Composite Resin Market by Resin Type (Thermoset, Thermoplastic), Manufacturing Process (Layup, Filament Winding, Injection Molding, Pultrusion, Compression Molding, Resin Transfer Molding), Application and Region - Global Forecast to 2026

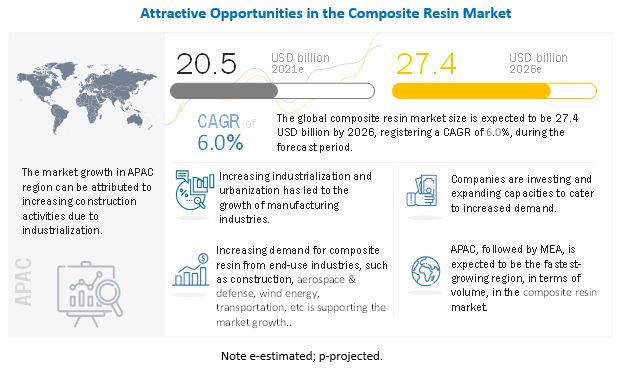

Composite Resin Market was valued at USD 20.5 billion in 2021 and is projected to reach USD 27.4 billion by 2026, growing at a cagr 6.0% from 2021 to 2026. The market is growing due to the rise in demand from various applications, globally. The market is expected to decline in 2020 due to COVID-19. However, the end of lockdown and recovery in the application sector will stimulate the demand during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on global Composite resin market

The composite resin market is expected to witness a decline in market in 2020 due to the COVID-19 pandemic. This deadly virus has adversely affected the entire globe, especially the APAC and European regions. To prevent the further spread of this virus, companies have shut down their operations and manufacturing facilities and government restricted the construction activities. This has led to a reduction in the consumption of composite resin across applications.

COVID-19 and pre–existing regulatory issues such as protracted permitting procedures have slowed down the production of end-use industries, reducing the demand for composite resin. However, the demand for composite resin is expected to recover in 2021. China was the first country affected by COVID-19, disrupting the global composite resin supply chain and resulting in reduced manufacturing activities across several end-use industries. However, various end-use industries have resumed manufacturing activities and are soon expected to recover from the impact, resulting in the rise in demand for composite resin.

Market dynamics of global composite resin market

Growing transportation industry to drive the market growth

The automotive & transportation industry is the rapidly growing consumer of composite resin. This is because of the use of composite resin in the manufacturing of automotive components. The automotive industry faces many challenges in terms of improving energy efficiency, reducing vehicle emissions, and increasing durability. Composites are seen as substitutes for aluminum and steel in the automotive & transportation sector that can reduce the weight of the vehicle by 30%–60%. Apart from providing lightweight structures, composites also provide excellent mechanical properties and longer durability. Composite resins such as thermoset and thermoplastic, which are used as a matrix in composites, offer improved performance properties that make the composites viable in such applications. The faster curing time, better finishing quality, and resistance against heat, temperature, and corrosion are the factors driving the demand for composites in the automotive & transportation industry.

Wind energy application to propel the market growth

The countries in North America and Europe have started generating electricity through renewable energy sources. Wind energy is one of the convenient ways of generating electricity through renewable sources. According to the Global Wind Energy Council (GWEC), in 2020, record growth was driven by a surge of installations in China and the US—the world’s two largest wind power markets, who together installed nearly 75% of the new installations in 2020 and account for over half of the world’s total wind power capacity. This has further increased the demand for composite resin in recent years. More such events are expected from emerging economies such as India, Brazil, and Indonesia in the next five years. These countries are utilizing their wind energy potential and increasing wind energy production to reduce the burden on non-renewable sources which will augment the demand for composite resins.

High processing and manufacturing cost to restrain the market growth

The use of composite resin has been rising significantly in aerospace, transportation, and other industries. However, the high costs related to the material and manufacturing limit its use. Therefore, it is necessary to use tools to accurately determine the costs in the early stages to reduce the cost associated with it. The machinery and tools required for its production are capital-intensive, leading to escalated costs. This high cost is a restraint for the OEMs in the supply chain to use composites, limiting the growth of composite resin.

Rising demand in the emerging markets

The use of composite resins is expanding across a variety of industrial bases, and demand for lightweight, cost-effective materials is driving the market growth. Rapid urbanization associated with economic growth and large investments in R&D activities are also expected to drive the demand for composite resins. The emerging economies are expected to boost the demand for these resins. These developing economies are driven by a strong industrial base and the presence of well-known manufacturers. Furthermore, in economies such as China and India, changes in living standards and growth in automobile & transportation, electrical & electronics, wind energy, and other industries are significantly boosting market demand.

The thermoplastic composite market registered the highest CAGR in terms of value during the forecast period

Thermoplastic resins such as PA, PE, PC, and PEEK exhibit properties that are superior to thermoset resins. Thermoplastic resins exhibiting properties such as high impact strength, better surface quality, high rigidity at elevated and sub-zero temperatures are useful in applications including aerospace & defense and transportation. Properties like high creep resistance under a severe environment and high rigidity at elevated temperatures are useful for wind energy applications.

Rail application requires resins having a high strength-to-weight ratio, better surface quality, and are flame retardant. Thermoplastic resins such as PP, PA, and PC exhibit these properties, due to which they are in high demand for rail application. Also, they have a curing time of less than a minute and a low cycle time, which makes it possible to manufacture thermoplastic composites on a large scale in a short time. These are the factors due to which the demand for the thermoplastic resin is increasing in various composites applications, including transportation, aerospace & defense, and electrical & electronics, driving the overall demand for composite resins

Unsaturated polyester resin of thermoset composite resin to dominate the composite resin market

The thermoset composite resin is segmented on the basis of types which include unsaturated polyester resin, epoxy resin, vinyl ester resin, and others. The unsaturated polyester resin is expected to dominate the market. Unsaturated polyester resin is a condensation product of unsaturated acids or anhydrides and diols with or without diacids. They need a catalyst which solidifies the resin during curing and accepts a wide range of fillers. Polyester resins do not expand with high temperature and exhibit good mechanical, electrical, and high heat resistance properties. A range of raw materials and processing techniques are available to achieve the desired properties in the formulated or processed polyester resin. These resins can be formulated and chemically tailored to provide properties and process compatibility. Moreover, they are priced lower as compared to resins like epoxy and vinyl ester and are also one of the cheapest resins used in composites. Due to these factors, unsaturated polyester resin segment dominated the composite resin market, in terms of volume, in 2020. High demand for polyester resin is observed in applications such as construction & infrastructure, transportation, electricals & electronics, wind energy, and marine. Therefore, market is witnessing significant growth in this segment and is projected to increase in future.

To know about the assumptions considered for the study, download the pdf brochure

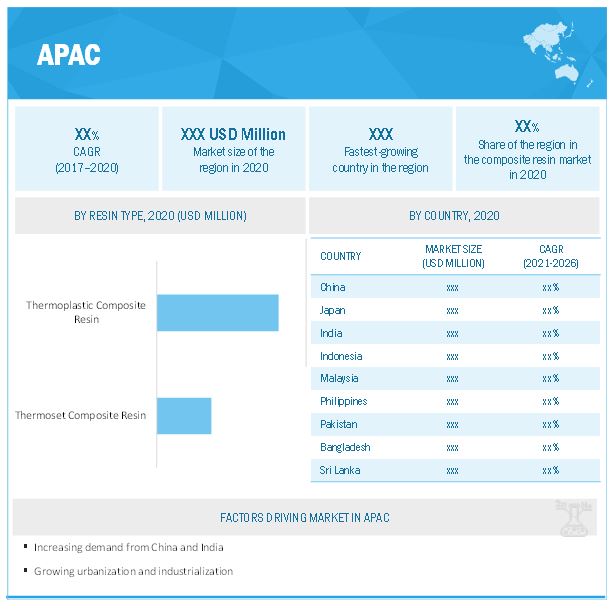

APAC held the largest market share in the Composite Resin market

APAC dominated the global composite resin market in 2020. This dominance is attributed to the rising demand from domestic industries in the region. The demand for composite resin is growing, especially, in APAC and Latin America. The markets in these regions are expected to register high growth in comparison to other regions.

Key Market Players

The key players in the global composite resin market are:

- Huntsman International LLC (US)

- Hexion, Inc (US)

- The Dow Chemical Company (US)

- Ashland Global Holdings, Inc (US)

- Sumitomo Bakelite Co., Ltd (Japan)

- Schott Bader Company Limited (England)

- Royal DSM N.V (Netherlands)

- BASF SE (Germany)

- Kukdo Chemical Co., Ltd. (South Korea)

- Polynt S.p.A (Italy)

- SABIC (Saudi Arabia)

- Arkema SA (France)

- Evonik Industries AG (Germany)

- Atul Ltd (India)

- Allnex Composites (Germany)

- Nan Ya Plastics Corporation (Taiwan)

- Showa Denko K.K (Japan)

- Swancor Holdings Co., Ltd (Taiwan)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the composite resin industry. The study includes an in-depth competitive analysis of these key players in the composite resin market, with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Years considered for the study |

2017–2020 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD million), Volume (Kilotons) |

|

Segments |

Resin Type, Manufacturing Process, Application and Region |

|

Regions |

Europe, North America, APAC, MEA, and Latin America |

|

Companies |

Huntsman International LLC (US), Hexion, Inc (US), The Dow Chemical Company (US), Ashland Global Holdings, Inc (US), Sumitomo Bakelite Co., Ltd, (Japan), Schott Bader Company Limited (England), Royal DSM N.V (Netherlands), BASF SE (Germany), Kukdo Chemical Co., Ltd. (South Korea), Polynt S.p.A (Italy), SABIC (Saudi Arabia), Arkema SA (France), Evonik Industries AG (Germany), Atul Ltd (India), Allnex Composites (Germany), Nan Ya Plastics Corporation (Taiwan), Showa Denko K.K (Japan), Swancor Holdings Co., Ltd (Taiwan). |

This research report categorizes the Composite resin market based on resin type, manufacturing process, application, and region.

By Resin Type:

- Thermoset Composite Resin

- Thermoplastic Composite Resin

By Manufacturing Process:

- Layup

- Filament Winding

- Injection Molding

- Pultrusion

- Compression Molding

- Resin Transfer Molding

- Others

By Application:

- Construction & Infrastructure

- Transportation

- Electrical & Electronics

- Pipes & Tanks

- Wind Energy

- Marine

- Aerospace & Defense

- Others

By Region:

- North America

- Europe

- APAC

- MEA

- Latin America

Recent Developments

- In September 2021, ALLNEX launched the new versatile super durable, CRYLCOAT 4478-0. This will provide outstanding weathering resistance, good hardness, excellent flow & smoothness, and excellent storage stability.

- In September 2021, BASF SE and Sanyo Chemical entered into a memorandum of understanding for collaboration on polyurethane dispersions.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the composite resin market?

High demand from application industries due to superior performance properties of composite resin has been driving the market.

Which is the fastest-growing region-level market for Composite resin?

APAC is the fastest-growing Composite resin market due to the presence of major composite resin manufacturers and the burgeoning growth of various end-use industries.

What are the factors contributing to the final price of composite resin?

Raw material and manufacturing process play a vital role in the costs. The type of manufacturing process contributes largely to the final pricing of Composite resin.

What are the challenges in the Composite resin market?

Market recovery from covid-19 is the major challenge in the composite resin market.

Which resin type of composite resin holds the largest market share?

Thermoset composite resin holds the largest share due to wide applications in construction & infrastructure, transportation, aerospace & defense, wind energy, and others.

How is the composite resin market aligned?

The market is growing at a significant pace. It is a potential market and many manufactures are planning business strategies to expand their business.

Who are the major manufacturers?

Huntsman International LLC (US), Hexion, Inc (US), The Dow Chemical Company (US), Ashland Global Holdings, Inc (US), Sumitomo Bakelite Co., Ltd, (Japan), Schott Bader Company Limited (England), Royal DSM N.V (Netherlands), BASF SE (Germany), Kukdo Chemical Co., Ltd. (South Korea), Polynt S.p.A (Italy), SABIC (Saudi Arabia), Arkema SA (France), Evonik Industries AG (Germany), Atul Ltd (India), Allnex Composites (Germany), Nan Ya Plastics Corporation (Taiwan), Showa Denko K.K (Japan), Swancor Holdings Co., Ltd (Taiwan) are a few of the key players in the Composite resin market.

What are the major applications for composite resin?

The major applications of composite resin include construction & infrastructure, transportation, electrical & electronics, pipes & tanks, wind energy, marine, aerospace & defense, and others.

What is the biggest restraint in the composite resin market?

High processing and manufacturing cost is the major restraint of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 39)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 COMPOSITE RESIN MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 43)

FIGURE 2 COMPOSITE RESIN MARKET: RESEARCH DESIGN

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

2.2.2.1 Primary interviews – Top composite resin manufacturers

2.2.2.2 Breakdown of primary interviews

2.2.2.3 Key industry insights

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 COMPOSITE RESIN MARKET: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 COMPOSITE RESIN MARKET: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 COMPOSITE RESIN MARKET: DATA TRIANGULATION

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 6 THERMOSET COMPOSITE RESIN TYPE DOMINATED THE COMPOSITE RESIN MARKET IN 2020

FIGURE 7 LAYUP MANUFACTURING PROCESS LED THE COMPOSITE RESIN MARKET IN 2020

FIGURE 8 WIND ENERGY APPLICATION LED THE MARKET IN 2020

FIGURE 9 CHINA TO BE THE FASTEST-GROWING REGION IN THE COMPOSITE RESIN MARKET DURING THE FORECAST PERIOD

FIGURE 10 APAC LED THE COMPOSITE RESIN MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE COMPOSITE RESIN MARKET

FIGURE 11 HIGH DEMAND FROM END-USE INDUSTRIES TO DRIVE THE COMPOSITE RESIN MARKET

4.2 COMPOSITE RESIN MARKET, BY RESIN TYPE

FIGURE 12 THERMOSET COMPOSITE RESIN TYPE DOMINATED THE OVERALL MARKET

4.3 COMPOSITE RESIN MARKET, BY MANUFACTURING PROCESS

FIGURE 13 LAYUP MANUFACTURING PROCESS LED THE COMPOSITE RESIN MARKET

4.4 COMPOSITE RESIN MARKET, BY APPLICATION

FIGURE 14 CONSTRUCTION & INFRASTRUCTURE APPLICATIONS LED THE COMPOSITE RESIN MARKET

4.5 COMPOSITE RESIN MARKET, BY KEY COUNTRY

FIGURE 15 MARKET IN INDIA TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE COMPOSITE RESIN MARKET

5.2.1 DRIVERS

5.2.1.1 Growing automotive & transportation industry

FIGURE 17 GLOBAL ELECTRIC VEHICLE STOCK, BY REGION, 2010–2020

5.2.1.2 Growing demand for wind energy due to increasing focus on renewable sources of energy

5.2.1.3 Increase in demand for thermoplastic resin

5.2.2 RESTRAINTS

5.2.2.1 High processing and manufacturing cost

5.2.2.2 Recycling-related issues

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing demand from emerging economies

5.2.3.2 Increasing use of composite resins in the growing aerospace industry

TABLE 1 NUMBER OF NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION (2020–2039)

TABLE 2 SMALL, MEDIUM, AND LARGE DELIVERIES OF AIRCRAFT FROM 2019 TO 2038

5.2.4 CHALLENGES

5.2.4.1 Need for continuous improvement in product offering

5.2.4.2 Market recovery from COVID-19

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 18 PORTER’S FIVE FORCES ANALYSIS: COMPOSITE RESIN MARKET

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 BARGAINING POWER OF BUYERS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 COMPOSITE RESIN MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 TECHNOLOGY ANALYSIS

5.5 ECOSYSTEM: COMPOSITE RESIN MARKET

FIGURE 19 COMPOSITE RESIN MARKET: ECOSYSTEM

5.6 VALUE CHAIN ANALYSIS

FIGURE 20 COMPOSITE RESIN MARKET: VALUE CHAIN ANALYSIS

5.6.1 RAW MATERIAL SELECTION & MANUFACTURING

5.6.2 DISTRIBUTION & APPLICATIONS

5.7 SUPPLY CHAIN ANALYSIS

TABLE 4 COMPOSITE RESIN MARKET: SUPPLY CHAIN

5.8 IMPACT OF COVID-19

5.8.1 IMPACT OF COVID-19 ON THE AEROSPACE INDUSTRY

5.8.2 IMPACT OF COVID-19 ON THE AUTOMOTIVE INDUSTRY

5.9 PATENT ANALYSIS

5.9.1 INTRODUCTION

5.9.2 METHODOLOGY

5.9.3 DOCUMENT TYPE

TABLE 5 GRANTED PATENTS ARE 15% OF THE TOTAL COUNT IN THE LAST 10 YEARS

FIGURE 21 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE, 2010–2020

FIGURE 22 PUBLICATION TRENDS, 2010–2020

5.9.4 INSIGHTS

5.9.5 LEGAL STATUS OF PATENTS

FIGURE 23 PATENT JURISDICTION ANALYSIS, 2020

5.9.6 TOP APPLICANTS OF PATENTS

FIGURE 24 TOP APPLICANTS OF PATENTS

TABLE 6 LIST OF PATENTS BY KAO CORPORATION

TABLE 7 LIST OF PATENTS BY SEKISUI PLASTICS

TABLE 8 LIST OF PATENTS BY JSP CORPORATION

TABLE 9 TOP TEN PATENT OWNERS (US) DURING THE LAST 10 YEARS

5.10 COMPOSITE RESIN MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 10 COMPOSITE RESIN MARKET: CAGR (BY VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.10.1 OPTIMISTIC SCENARIO

5.10.2 PESSIMISTIC SCENARIO

5.10.3 REALISTIC SCENARIO

5.11 PRICING ANALYSIS

5.12 AVERAGE SELLING PRICE

TABLE 11 AVERAGE SELLING PRICE, BY TYPE

5.13 KEY MARKETS FOR IMPORTS/EXPORTS

5.13.1 EXPORT SCENARIO OF COMPOSITE RESIN

FIGURE 25 EXPORT OF UNSATURATED POLYALLYL ESTERS AND OTHER ESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID)

5.13.2 IMPORT SCENARIO OF COMPOSITE RESIN

FIGURE 26 IMPORT OF UNSATURATED POLYALLYL ESTERS AND OTHER ESTERS IN PRIMARY FORMS (EXCLUDING POLYCARBONATES, ALKYD RESINS, POLYETHYLENE TEREPHTHALATE, AND POLYLACTIC ACID)

5.14 TARIFFS AND REGULATIONS

TABLE 12 CURRENT STANDARD CODES FOR COMPOSITE RESINS

5.15 CASE STUDY: COMPOSITE RESIN

5.16 TRENDS AND DISRUPTIONS AFFECTING CUSTOMER’S BUSINESS

6 COMPOSITE RESIN MARKET, BY RESIN TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 27 COMPOSITE RESIN, BY TYPES

FIGURE 28 THERMOSET COMPOSITE RESIN TO BE THE LEADING RESIN TYPE

TABLE 13 COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 14 COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

6.2 THERMOSET COMPOSITE RESIN

6.2.1 SUPERIOR PROPERTIES OF THERMOSET COMPOSITE RESIN TO BOOST THE MARKET

FIGURE 29 APAC TO BE THE LEADING REGION IN THE THERMOSET RESIN TYPE

6.2.2 THERMOSET COMPOSITE RESIN MARKET, BY REGION

TABLE 15 THERMOSET COMPOSITE RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 16 THERMOSET COMPOSITE RESIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

FIGURE 30 EPOXY RESIN IS PROJECTED TO BE THE FASTEST-GROWING THERMOSET COMPOSITE RESIN

6.2.3 THERMOSET COMPOSITE RESIN MARKET SIZE, BY TYPE

TABLE 17 THERMOSET COMPOSITE RESIN MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 18 THERMOSET COMPOSITE RESIN MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

6.2.3.1 Unsaturated polyester resin

6.2.3.2 Unsaturated polyester resin market, by region

TABLE 19 UNSATURATED POLYESTER RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 20 UNSATURATED POLYESTER RESIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.3.3 Epoxy resin

6.2.3.4 Epoxy resin market, by region

TABLE 21 EPOXY RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 22 EPOXY RESIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.3.5 Vinyl ester resin

6.2.3.6 Vinyl ester resin market, by region

TABLE 23 VINYL ESTER RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 24 VINYL ESTER RESIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.2.3.7 Other thermoset composite resins

6.2.3.8 Other thermoset composite resins market, by region

TABLE 25 OTHER THERMOSET COMPOSITE RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 26 OTHER THERMOSET COMPOSITE RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3 THERMOPLASTIC COMPOSITE RESIN

6.3.1 THERMOPLASTIC COMPOSITE MARKET TO GROW AT A FAST RATE DURING THE FORECAST PERIOD

FIGURE 31 APAC TO BE THE LEADING THERMOPLASTIC COMPOSITE RESIN MARKET

6.3.2 THERMOPLASTIC COMPOSITE RESIN MARKET, BY REGION

TABLE 27 THERMOPLASTIC COMPOSITE RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 28 THERMOPLASTIC COMPOSITE MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

FIGURE 32 PEEK TO BE THE FASTEST-GROWING THERMOPLASTIC COMPOSITE RESIN DURING THE FORECAST PERIOD

6.3.3 THERMOPLASTIC COMPOSITE RESIN MARKET, BY TYPE

TABLE 29 THERMOPLASTIC COMPOSITE RESIN MARKET SIZE, BY TYPE, 2019–2026 (KILOTON)

TABLE 30 THERMOPLASTIC COMPOSITE RESIN MARKET SIZE, BY TYPE, 2019–2026 (USD MILLION)

6.3.3.1 Polypropylene resin (PP)

6.3.3.2 Polypropylene resin market, by region

TABLE 31 POLYPROPYLENE RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 32 POLYPROPYLENE RESIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3.3 Polyether ether ketone resin (PEEK)

6.3.3.4 PEEK resin market, by region

TABLE 33 PEEK RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 34 PEEK RESIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

6.3.3.5 Other thermoplastic composite resins

6.3.3.6 Other thermoplastic resins market, by region

TABLE 35 OTHER THERMOPLASTIC RESINS MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 36 OTHER THERMOPLASTIC RESINS MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

7 COMPOSITE RESIN, BY MANUFACTURING PROCESS (Page No. - 97)

7.1 INTRODUCTION

FIGURE 33 LAYUP MANUFACTURING PROCESS TO ACCOUNT FOR THE LARGEST SHARE OF THE GLOBAL COMPOSITE RESIN MARKET

TABLE 37 COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (KILOTON)

TABLE 38 COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (USD MILLION)

7.2 LAYUP

7.2.1 LAYUP MANUFACTURING PROCESS TO HAVE THE HIGHEST SHARE IN THE COMPOSITE RESIN MARKET

FIGURE 34 NORTH AMERICA TO LEAD IN THE LAYUP MANUFACTURING PROCESS

7.2.2 COMPOSITE RESIN MARKET IN THE LAYUP MANUFACTURING PROCESS, BY REGION

TABLE 39 COMPOSITE RESIN MARKET SIZE IN THE LAYUP MANUFACTURING PROCESS, BY REGION, 2019–2026 (KILOTON)

TABLE 40 COMPOSITE RESIN MARKET SIZE IN THE LAYUP MANUFACTURING PROCESS, BY REGION, 2019–2026 (USD MILLION)

7.3 FILAMENT WINDING

7.3.1 TRANSPORTATION INDUSTRY TO AUGMENT THE DEMAND FOR FILAMENT WINDING MANUFACTURING PROCESS

FIGURE 35 APAC TO BE THE FASTEST-GROWING REGION IN THE FILAMENT WINDING MANUFACTURING PROCESS

7.3.2 COMPOSITE RESIN MARKET IN FILAMENT WINDING MANUFACTURING PROCESS, BY REGION

TABLE 41 COMPOSITE RESIN MARKET SIZE IN FILAMENT WINDING MANUFACTURING PROCESS, BY REGION, 2019–2026 (KILOTON)

TABLE 42 COMPOSITE RESIN SIZE IN FILAMENT WINDING MANUFACTURING PROCESS, BY REGION, 2019–2026 (USD MILLION)

7.4 INJECTION MOLDING

7.4.1 INJECTION MOLDING TO BE THE THIRD-LARGEST MANUFACTURING PROCESS

FIGURE 36 APAC TO LEAD THE COMPOSITE RESIN MARKET IN THE INJECTION MOLDING MANUFACTURING PROCESS

7.4.2 COMPOSITE RESIN MARKET IN INJECTION MOLDING MANUFACTURING PROCESS, BY REGION

TABLE 43 COMPOSITE RESIN MARKET SIZE IN INJECTION MOLDING MANUFACTURING PROCESS, BY REGION, 2019–2026 (KILOTON)

TABLE 44 COMPOSITE RESIN MARKET SIZE IN INJECTION MOLDING MANUFACTURING PROCESS, BY REGION, 2019–2026 (USD MILLION)

7.5 PULTRUSION

7.5.1 PULTRUSION PROCESS TO WITNESS THE HIGHEST GROWTH IN THE APAC REGION

FIGURE 37 APAC TO ACCOUNT FOR THE LARGEST SHARE IN THE PULTRUSION MANUFACTURING PROCESS

7.5.2 COMPOSITE RESIN MARKET IN PULTRUSION MANUFACTURING PROCESS, BY REGION

TABLE 45 COMPOSITE RESIN MARKET SIZE IN PULTRUSION MANUFACTURING PROCESS, BY REGION, 2019–2026 (KILOTON)

TABLE 46 COMPOSITE RESIN MARKET SIZE IN PULTRUSION MANUFACTURING PROCESS, BY REGION, 2019–2026 (USD MILLION)

7.6 COMPRESSION MOLDING

7.6.1 COMPRESSION MOLDING TO BE THE SECOND-LARGEST MANUFACTURING PROCESS

FIGURE 38 APAC TO LEAD THE COMPOSITE RESIN MARKET IN THE COMPRESSION MOLDING MANUFACTURING PROCESS

7.6.2 COMPOSITE RESIN MARKET IN THE COMPRESSION MOLDING MANUFACTURING PROCESS, BY REGION

TABLE 47 COMPOSITE RESIN MARKET SIZE IN THE COMPRESSION MOLDING MANUFACTURING PROCESS, BY REGION, 2019–2026 (KILOTON)

TABLE 48 COMPOSITE RESIN MARKET SIZE IN THE COMPRESSION MOLDING MANUFACTURING PROCESS, BY REGION, 2019–2026 (USD MILLION)

7.7 RESIN TRANSFER MOLDING

7.7.1 RESIN TRANSFER MOLDING TO BE THE FASTEST-GROWING MANUFACTURING PROCESS

FIGURE 39 APAC TO DOMINATE THE COMPOSITE RESIN MARKET IN THE RESIN TRANSFER MOLDING MANUFACTURING PROCESS

7.7.2 COMPOSITE RESIN MARKET IN RTM MANUFACTURING PROCESS, BY REGION

TABLE 49 COMPOSITE RESIN MARKET SIZE IN RTM MANUFACTURING PROCESS, BY REGION, 2019–2026 (KILOTON)

TABLE 50 COMPOSITE RESIN MARKET SIZE IN RTM MANUFACTURING PROCESS, BY REGION, 2019–2026 (USD MILLION)

7.8 OTHERS

7.8.1 COMPOSITE RESIN MARKET IN OTHER MANUFACTURING PROCESSES, BY REGION

TABLE 51 COMPOSITE RESIN MARKET SIZE IN OTHER MANUFACTURING PROCESSES, BY REGION, 2019–2026 (KILOTON)

TABLE 52 COMPOSITE RESIN MARKET SIZE IN OTHER MANUFACTURING PROCESSES, BY REGION, 2019–2026 (USD MILLION)

8 COMPOSITE RESIN MARKET, BY APPLICATION (Page No. - 111)

8.1 INTRODUCTION

FIGURE 40 WIND ENERGY APPLICATION PROJECTED TO ACCOUNT FOR THE LARGEST SHARE IN THE GLOBAL COMPOSITE RESIN MARKET

8.2 COMPOSITE RESIN MARKET, BY APPLICATION

TABLE 53 COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 54 COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

8.3 CONSTRUCTION & INFRASTRUCTURE

8.3.1 APAC TO BE THE FASTEST-GROWING REGION IN THE CONSTRUCTION & INFRASTRUCTURE APPLICATION SEGMENT

FIGURE 41 APAC REGION TO LEAD THE CONSTRUCTION & INFRASTRUCTURE APPLICATION SEGMENT

8.3.2 COMPOSITE RESIN MARKET IN CONSTRUCTION & INFRASTRUCTURE APPLICATION, BY REGION

TABLE 55 COMPOSITE RESIN MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 56 COMPOSITE RESIN MARKET SIZE IN CONSTRUCTION & INFRASTRUCTURE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.4 TRANSPORTATION

8.4.1 INCREASING GROWTH OF AUTOMOTIVE & TRANSPORTATION INDUSTRY IN APAC TO PROPEL THE DEMAND FOR COMPOSITE RESIN

8.4.2 AUTOMOTIVE & HEAVY VEHICLES

8.4.3 RAILS

FIGURE 42 LATIN AMERICA TO BE THE SECOND-FASTEST-GROWING REGION IN THE TRANSPORTATION APPLICATION AFTER APAC

8.4.4 COMPOSITE RESIN MARKET IN TRANSPORTATION APPLICATION, BY REGION

TABLE 57 COMPOSITE RESIN MARKET SIZE IN TRANSPORTATION APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 58 COMPOSITE RESIN MARKET SIZE IN TRANSPORTATION APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.5 ELECTRICALS & ELECTRONICS

8.5.1 INCREASING USE OF COMPOSITES IN ELECTRICALS & ELECTRONICS SEGMENT TO DRIVE THE MARKET GROWTH OF COMPOSITE RESIN

FIGURE 43 APAC REGION TO HAVE THE LARGEST SHARE IN THE ELECTRICALS & ELECTRONICS APPLICATION SEGMENT

8.5.2 COMPOSITE RESIN MARKET IN ELECTRICALS & ELECTRONICS APPLICATION, BY REGION

TABLE 59 COMPOSITE RESIN MARKET SIZE IN ELECTRICALS & ELECTRONICS APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 60 COMPOSITE RESIN MARKET SIZE IN ELECTRICALS & ELECTRONICS APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.6 PIPES & TANKS

8.6.1 LIGHTWEIGHT PROPERTIES OF COMPOSITES TO BOOST THE DEMAND FOR COMPOSITE RESINS IN THE PIPES & TANKS APPLICATION SEGMENT

FIGURE 44 PIPES & TANKS APPLICATION SEGMENT TO OBSERVE GROWTH IN APAC

8.6.2 COMPOSITE RESIN MARKET IN PIPES & TANKS APPLICATION, BY REGION

TABLE 61 COMPOSITE RESIN MARKET SIZE IN PIPES & TANKS APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 62 COMPOSITE RESIN MARKET SIZE IN PIPES & TANKS APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.7 WIND ENERGY

8.7.1 GROWING WIND ENERGY INDUSTRY TO AUGMENT THE DEMAND FOR COMPOSITE RESINS

FIGURE 45 APAC TO BE THE FASTEST-GROWING REGION IN THE WIND ENERGY APPLICATION SEGMENT

8.7.2 COMPOSITE RESIN MARKET IN WIND ENERGY APPLICATION, BY REGION

TABLE 63 COMPOSITE RESIN MARKET SIZE IN WIND ENERGY APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 64 COMPOSITE RESIN MARKET SIZE IN WIND ENERGY APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.8 MARINE

8.8.1 MARINE APPLICATION TO WITNESS RAPID GROWTH IN THE COMPOSITE RESIN MARKET

FIGURE 46 MARINE APPLICATION SEGMENT TO WITNESS GROWTH IN THE APAC REGION

8.8.2 COMPOSITE RESIN MARKET IN MARINE APPLICATION, BY REGION

TABLE 65 COMPOSITE RESIN MARKET SIZE IN MARINE APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 66 COMPOSITE RESIN MARKET SIZE IN MARINE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.9 AEROSPACE & DEFENSE

8.9.1 NORTH AMERICA TO HAVE THE LARGEST MARKET SIZE IN THE AEROSPACE & DEFENSE APPLICATION

FIGURE 47 NORTH AMERICA TO HAVE THE LARGEST SHARE IN THE AEROSPACE & DEFENSE APPLICATION SEGMENT

8.9.2 COMPOSITE RESIN MARKET IN AEROSPACE & DEFENSE APPLICATION, BY REGION

TABLE 67 COMPOSITE RESIN MARKET SIZE IN AEROSPACE & DEFENSE APPLICATION, BY REGION, 2019–2026 (KILOTON)

TABLE 68 COMPOSITE RESIN MARKET SIZE IN AEROSPACE & DEFENSE APPLICATION, BY REGION, 2019–2026 (USD MILLION)

8.10 OTHER APPLICATIONS

8.10.1 APAC TO BE THE LEADING REGION IN THE OTHER APPLICATIONS OF COMPOSITE RESIN

8.10.2 COMPOSITE RESIN MARKET SIZE IN OTHER APPLICATIONS, BY REGION

TABLE 69 COMPOSITE RESIN MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (KILOTON)

TABLE 70 COMPOSITE RESIN MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

9 COMPOSITE RESIN MARKET, BY REGION (Page No. - 129)

9.1 INTRODUCTION

FIGURE 48 CHINA TO BE THE FASTEST-GROWING COMPOSITE RESIN MARKET DURING THE FORECAST PERIOD

TABLE 71 COMPOSITE RESIN MARKET SIZE, BY REGION, 2019–2026 (KILOTON)

TABLE 72 COMPOSITE RESIN MARKET SIZE, BY REGION, 2019–2026 (USD MILLION)

9.2 NORTH AMERICA

FIGURE 49 NORTH AMERICA: COMPOSITE RESIN MARKET SNAPSHOT

9.2.1 NORTH AMERICA: COMPOSITE RESIN MARKET, BY RESIN TYPE

TABLE 73 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 74 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.2.2 NORTH AMERICA: COMPOSITE RESIN MARKET, BY MANUFACTURING PROCESS

TABLE 75 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (KILOTON)

TABLE 76 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (USD MILLION)

9.2.3 NORTH AMERICA: COMPOSITE RESIN MARKET, BY APPLICATION

TABLE 77 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 78 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.4 NORTH AMERICA: COMPOSITE RESIN MARKET, BY COUNTRY

TABLE 79 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 80 NORTH AMERICA: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4.1 US

9.2.4.1.1 Well-built ecosystem of wind energy sector is driving the demand for composite resins in the US

TABLE 81 US: NEW WIND ENERGY INSTALLATIONS, 2010–2019 (MW)

TABLE 82 US: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 83 US: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.2.4.2 Canada

9.2.4.2.1 Growing focus on construction & infrastructure in the country is driving the composite resins market

TABLE 84 CANADA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 85 CANADA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3 APAC

FIGURE 50 APAC: COMPOSITE RESIN MARKET SNAPSHOT

9.3.1 APAC: COMPOSITE RESIN MARKET, BY RESIN TYPE

TABLE 86 APAC: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 87 APAC: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.2 APAC: COMPOSITE RESIN MARKET, BY MANUFACTURING PROCESS

TABLE 88 APAC: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (KILOTON)

TABLE 89 APAC: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (USD MILLION)

9.3.3 APAC: COMPOSITE RESIN MARKET, BY APPLICATION

TABLE 90 APAC: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 91 APAC: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.4 APAC: COMPOSITE RESIN MARKET, BY COUNTRY

TABLE 92 APAC: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 93 APAC: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4.1 China

9.3.4.1.1 Largest composite resins market in APAC region

TABLE 94 CHINA: NEW WIND ENERGY INSTALLATIONS, 2010–2020 (MW)

TABLE 95 CHINA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 96 CHINA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.2 Japan

9.3.4.2.1 Immense opportunities in construction & infrastructure, electrical & electronics, and automotive & transportation sectors

TABLE 97 JAPAN: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 98 JAPAN: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.3 India

9.3.4.3.1 Vast population making it the most promising market

TABLE 99 INDIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 100 INDIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.4 Indonesia

9.3.4.4.1 Growing government initiative for manufacturing fuel-efficient vehicles to drive the market

TABLE 101 INDONESIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 102 INDONESIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.5 Malaysia

9.3.4.5.1 Potential to become the regional hub for composite resins

TABLE 103 MALAYSIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 104 MALAYSIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.6 Philippines

9.3.4.6.1 High growth potential in the wind energy sector

TABLE 105 PHILIPPINES: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 106 PHILIPPINES: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (MILLION)

9.3.4.7 Pakistan

9.3.4.7.1 Growing penetration of composite technology in various end-use industries

TABLE 107 PAKISTAN: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 108 PAKISTAN: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.8 Bangladesh

9.3.4.8.1 Increasing consumption of composite resins in the construction & infrastructure industry

TABLE 109 BANGLADESH: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 110 BANGLADESH: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.9 Sri Lanka

9.3.4.9.1 Growing economy, coupled with increasing middle-class population, is propelling the growth of the market

TABLE 111 SRI LANKA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 112 SRI LANKA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.3.4.10 Rest of APAC

TABLE 113 REST OF APAC: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 114 REST OF APAC: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.4 EUROPE

FIGURE 51 EUROPE: COMPOSITE RESIN MARKET SNAPSHOT

9.4.1 EUROPE: COMPOSITE RESIN MARKET, BY RESIN TYPE

TABLE 115 EUROPE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 116 EUROPE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.4.2 EUROPE: COMPOSITE RESIN MARKET, BY MANUFACTURING PROCESS

TABLE 117 EUROPE: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (KILOTON)

TABLE 118 EUROPE: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (USD MILLION)

9.4.3 EUROPE: COMPOSITE RESIN MARKET, BY APPLICATION

TABLE 119 EUROPE: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 120 EUROPE: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.4 EUROPE: COMPOSITE RESIN MARKET, BY COUNTRY

TABLE 121 EUROPE: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 122 EUROPE: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4.1 Germany

9.4.4.1.1 Growing automotive industry to propel the market growth

TABLE 123 GERMANY: NEW WIND ENERGY INSTALLATIONS, 2010–2019 (MW)

TABLE 124 GERMANY: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 125 GERMANY: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.4.4.2 France

9.4.4.2.1 Increasing demand for composite resins in aerospace applications to drive the market growth

TABLE 126 FRANCE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 127 FRANCE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.4.4.3 UK

9.4.4.3.1 Transportation industry to boost the market growth

TABLE 128 UK: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 129 UK: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.4.4.4 Turkey

9.4.4.4.1 Wind energy applications to propel the market growth

TABLE 130 TURKEY: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 131 TURKEY: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.4.4.5 Russia

9.4.4.5.1 Increasing aerospace applications to drive the market growth

TABLE 132 RUSSIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 133 RUSSIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.4.4.6 Rest of Europe

TABLE 134 REST OF EUROPE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 135 REST OF EUROPE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 LATIN AMERICA: COMPOSITE RESIN MARKET, BY RESIN TYPE

TABLE 136 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 137 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.5.2 LATIN AMERICA: COMPOSITE RESIN MARKET, BY MANUFACTURING PROCESS

TABLE 138 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (KILOTON)

TABLE 139 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (USD MILLION)

9.5.3 LATIN AMERICA: COMPOSITE RESIN MARKET, BY APPLICATION

TABLE 140 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 141 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.4 LATIN AMERICA: COMPOSITE RESIN MARKET, BY COUNTRY

TABLE 142 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 143 LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4.1 Brazil

9.5.4.1.1 Fastest developing market in Latin America

TABLE 144 BRAZIL: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 145 BRAZIL: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.5.4.2 Mexico

9.5.4.2.1 Growing industrial framework to drive the market

TABLE 146 MEXICO: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 147 MEXICO: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.5.4.3 Rest of Latin America

TABLE 148 REST OF LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 149 REST OF LATIN AMERICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET, BY RESIN TYPE

TABLE 150 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 151 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.2 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET, BY MANUFACTURING PROCESS

TABLE 152 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (KILOTON)

TABLE 153 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY MANUFACTURING PROCESS, 2019–2026 (USD MILLION)

9.6.3 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET, BY APPLICATION

TABLE 154 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (KILOTON)

TABLE 155 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY APPLICATION, 2019–2026 (USD MILLION)

9.6.4 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET, BY COUNTRY

TABLE 156 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (KILOTON)

TABLE 157 MIDDLE EAST & AFRICA: COMPOSITE RESIN MARKET SIZE, BY COUNTRY, 2019–2026 (USD MILLION)

9.6.4.1 UAE

9.6.4.1.1 Growing spending on construction & infrastructure is driving the market

TABLE 158 UAE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 159 UAE: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.2 Saudi Arabia

9.6.4.2.1 Largest composite resins market in the Middle East & Africa

TABLE 160 SAUDI ARABIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 161 SAUDI ARABIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.3 South Africa

9.6.4.3.1 Fast-growing market in the Middle East & Africa

TABLE 162 SOUTH AFRICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 163 SOUTH AFRICA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.4 Egypt

9.6.4.4.1 Lucrative growth in the construction & infrastructure application

TABLE 164 EGYPT: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 165 EGYPT: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.5 Nigeria

9.6.4.5.1 Significant demand for composite resins in the pipes & tanks application

TABLE 166 NIGERIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 167 NIGERIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.6 Ethiopia

9.6.4.6.1 Country’s fast-growing and vibrant economy is driving the market

TABLE 168 ETHIOPIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 169 ETHIOPIA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.7 Kenya

9.6.4.7.1 Significant demand for composite resins in construction application

TABLE 170 KENYA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 171 KENYA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.8 Israel

9.6.4.8.1 Potential country for the composite resins market in the Middle East region

TABLE 172 ISRAEL: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 173 ISRAEL: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.9 Jordan

9.6.4.9.1 Increasing penetration in pipes & tanks application to augment the market growth

TABLE 174 JORDAN: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 175 JORDAN: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

9.6.4.10 Rest of MEA

TABLE 176 REST OF MEA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (KILOTON)

TABLE 177 REST OF MEA: COMPOSITE RESIN MARKET SIZE, BY RESIN TYPE, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 181)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS

FIGURE 52 SHARES OF TOP COMPANIES IN THE COMPOSITE RESIN MARKET

TABLE 178 DEGREE OF COMPETITION: FRAGMENTED

10.3 MARKET RANKING

FIGURE 53 RANKING OF TOP FIVE PLAYERS IN THE COMPOSITE RESIN MARKET

10.4 MARKET EVALUATION FRAMEWORK

TABLE 179 COMPOSITE RESIN MARKET: NEW PRODUCT LAUNCHES/ DEVELOPMENTS, 2016-2021

TABLE 180 COMPOSITE RESIN MARKET: OTHER DEALS, 2016-2021

10.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

10.6 COMPANY EVALUATION MATRIX

FIGURE 54 COMPANY PRODUCT FOOTPRINT

FIGURE 55 COMPANY APPLICATION FOOTPRINT

FIGURE 56 COMPANY RESIN TYPE FOOTPRINT

FIGURE 57 COMPANY REGION FOOTPRINT

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 PARTICIPANTS

10.6.4 EMERGING LEADERS

FIGURE 58 COMPOSITE RESIN MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 59 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 60 BUSINESS STRATEGY EXCELLENCE

10.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 61 COMPOSITE RESIN MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2020

11 COMPANY PROFILES (Page No. - 199)

(Business Overview, Products Offered, Recent Developments, Deals, and MnM View)*

11.1 KEY COMPANIES

11.1.1 HUNTSMAN INTERNATIONAL LLC

TABLE 181 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

FIGURE 62 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

TABLE 182 HUNTSMAN INTERNATIONAL LLC: DEALS

11.1.2 HEXION, INC.

TABLE 183 HEXION, INC.: COMPANY OVERVIEW

FIGURE 63 HEXION, INC.: COMPANY SNAPSHOT

TABLE 184 HEXION, INC.: DEALS

11.1.3 THE DOW CHEMICAL COMPANY

TABLE 185 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

FIGURE 64 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

11.1.4 ASHLAND GLOBAL HOLDINGS, INC.

TABLE 186 ASHLAND GLOBAL HOLDINGS, INC.: COMPANY OVERVIEW

FIGURE 65 ASHLAND GLOBAL HOLDINGS, INC.: COMPANY SNAPSHOT

11.1.5 SUMITOMO BAKELITE CO., LTD.

TABLE 187 SUMITOMO BAKELITE CO., LTD.: COMPANY OVERVIEW

FIGURE 66 SUMITOMO BAKELITE CO., LTD.: COMPANY SNAPSHOT

11.1.6 SCHOTT BADER COMPANY LIMITED

TABLE 188 SCHOTT BADER COMPANY LIMITED: COMPANY OVERVIEW

FIGURE 67 SCHOTT BADER COMPANY LIMITED: COMPANY SNAPSHOT

11.1.7 ROYAL DSM N.V.

TABLE 189 ROYAL DSM N.V.: COMPANY OVERVIEW

11.1.8 BASF SE

TABLE 190 BASF SE: COMPANY OVERVIEW

FIGURE 69 BASF SE: COMPANY SNAPSHOT

11.1.9 KUKDO CHEMICAL CO., LTD.

TABLE 191 KUKDO CHEMICAL CO., LTD.: COMPANY OVERVIEW

FIGURE 70 KUKDO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

11.1.10 POLYNT S.P.A

TABLE 192 POLYNT S.P.A: COMPANY OVERVIEW

FIGURE 71 POLYNT S.P.A: COMPANY SNAPSHOT

11.1.11 SABIC

TABLE 193 SABIC: COMPANY OVERVIEW

FIGURE 72 SABIC: COMPANY SNAPSHOT

11.1.12 ARKEMA

TABLE 194 ARKEMA: COMPANY OVERVIEW

FIGURE 73 ARKEMA: COMPANY SNAPSHOT

TABLE 195 ARKEMA: PRODUCT LAUNCHES

TABLE 196 ARKEMA: DEALS

11.1.13 EVONIK INDUSTRIES AG

TABLE 197 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

FIGURE 74 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

TABLE 198 EVONIK INDUSTRIES AG: PRODUCT LAUNCHES

TABLE 199 EVONIK INDUSTRIES AG: DEALS

11.2 REGIONAL COMPANIES

11.2.1 POLIYA

TABLE 200 POLIYA: COMPANY OVERVIEW

11.2.2 ATUL LTD

TABLE 201 ATUL LTD: COMPANY OVERVIEW

FIGURE 75 ATUL LTD: COMPANY SNAPSHOT

11.2.3 ALLNEX COMPOSITES

TABLE 202 ALLNEX COMPOSITES: COMPANY OVERVIEW

TABLE 203 ALLNEX GMBH: PRODUCT LAUNCHES

TABLE 204 ALLNEX GMBH: DEALS

11.2.4 NAN YA PLASTICS CORPORATION

TABLE 205 NAN YA PLASTICS CORPORATION: COMPANY OVERVIEW

FIGURE 76 NAN YA PLASTICS CORPORATION: COMPANY SNAPSHOT

11.2.5 CHEMREX CORPORATION SDN. BHD.

TABLE 206 CHEMREX CORPORATION: COMPANY OVERVIEW

11.2.6 SHOWA DENKO K.K

TABLE 207 SHOWA DENKO K.K: COMPANY OVERVIEW

FIGURE 77 SHOWA DENKO K.K: COMPANY SNAPSHOT

TABLE 208 SHOWA DENKO K.K: PRODUCT LAUNCHES

TABLE 209 SHOWA DENKO K.K: DEALS

11.2.7 HITECH RESINS

TABLE 210 HITECH RESINS: COMPANY OVERVIEW

11.2.8 INDUSTRIAL CHEMICALS & RESINS CO.

TABLE 211 INDUSTRIAL CHEMICALS & RESINS CO.: COMPANY OVERVIEW

11.2.9 POLYCHEM MIDDLE EAST

TABLE 212 POLYCHEM MIDDLE EAST: COMPANY OVERVIEW

11.2.10 ORGI CHEMIE FZC LLC

TABLE 213 ORGI CHEMIE FZC LLC: COMPANY OVERVIEW

11.2.11 SAUDI INDUSTRIAL RESINS LIMITED

TABLE 214 SAUDI INDUSTRIAL RESINS LIMITED: COMPANY OVERVIEW

11.2.12 ETERNAL RESIN COMPANY LIMITED

TABLE 215 ETERNAL RESIN COMPANY LIMITED: COMPANY OVERVIEW

11.2.13 SHOWA HIGHPOLYMER SINGAPORE PTE LTD

TABLE 216 SHOWA HIGHPOLYMER SINGAPORE: COMPANY OVERVIEW

11.2.14 SWANCOR HOLDINGS CO., LTD

TABLE 217 SWANCOR HOLDINGS CO., LTD: COMPANY OVERVIEW

FIGURE 78 SWANCOR HOLDINGS CO., LTD: COMPANY SNAPSHOT

11.2.15 LUXCHEM POLYMER INDUSTRIES SDN BHD

TABLE 218 LUXCHEM POLYMER INDUSTRIES SDN BHD: COMPANY OVERVIEW

11.2.16 SYNRESINS LIMITED

TABLE 219 SYNRESINS LIMITED: COMPANY OVERVIEW

11.2.17 SINO POLYMER CO., LTD.

TABLE 220 SINO POLYMER CO., LTD.: COMPANY OVERVIEW

11.2.18 NCS RESINS (PTY) LTD

TABLE 221 NCS RESINS (PTY) LTD: COMPANY OVERVIEW

11.2.19 EAGLE CHEMICALS

TABLE 222 EAGLE CHEMICALS: COMPANY OVERVIEW

11.2.20 NIMIR RESINS LIMITED

TABLE 223 NIMIR RESINS LIMITED: COMPANY OVERVIEW

FIGURE 79 NIMIR RESINS LIMITED: COMPANY SNAPSHOT

* Business Overview, Products Offered, Recent Developments, Deals, and MnM View might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 306)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

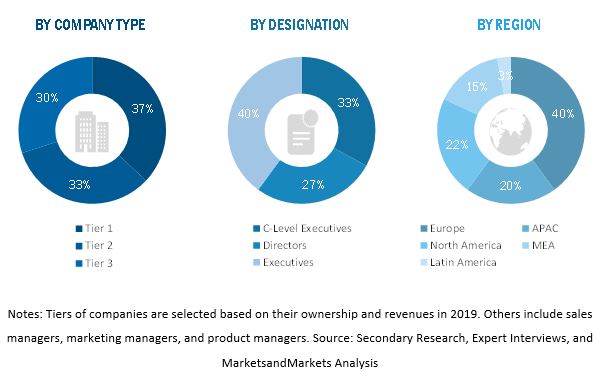

The study involves two major activities in estimating the current size of the composite resin market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases, and investor presentations of companies; certified publications; articles from recognized authors; gold & silver standard websites; and various databases were referred to for identifying and collecting information for this study.

Secondary research was mainly conducted to obtain key information about the supply chain of the industry, the total pool of players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology & innovation directors, and related key executives from various leading companies and organizations operating in the composite resin market. Primary sources from the demand side included procurement managers and experts from end-use industries.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total Composite resin market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall Composite resin market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the highways, bridges & buildings, marine structures & waterfronts and other applications.

Report Objectives

- To analyze and forecast the global Composite resin market size, in terms of volume and value

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the market segmentation and forecast the market size based on resin type, manufacturing process, and application.

- To analyze and forecast the market size based on five main regions, namely, Asia Pacific (APAC), Europe, North America, Middle East & Africa (MEA), and Latin America.

- To analyze the market with respect to individual growth trends, prospects, and contribution of submarkets to the total market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To analyze competitive developments such as expansions, partnership, agreement, new product/technology launch, joint venture, contract, and merger & acquisition in the market

- To profile key players and comprehensively analyze their market share and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC composite resin market

- Further breakdown of Rest of European Composite resin market

- Further breakdown of Rest of North American Composite resin market

- Further breakdown of Rest of MEA Composite resin market

- Further breakdown of Rest of Latin American Composite resin market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Composite Resin Market