Construction Composites Market by Fiber Type (Carbon, and Natural Fiber), Resin Type (Polyester, Vinyl Ester, Polyethylene and Polypropylene), Application (Industrial, Commercial, Housing and Civil) - Global Forecast to 2026

Updated on : September 03, 2025

Construction Composites Market

The construction composites market was valued at USD 4.75 billion in 2015 and is projected to reach USD 8.98 billion by 2026, growing at 6.0% cagr from 2016 to 2026. In this study, 2015 has been considered as the base year, while the forecast period is from 2016 to 2026.

Construction Composites Market Dynamics

Drivers

- Increasing use of composites in construction applications

- Long lifecycle and low maintenanace cost

- Rapid urbanization and economic growth in emerging economies

- Development of innovative products

Opportunities

- Growing demand for composites in civil applications in North Amwerica

- Increasing demand for pultruded profiles

Challenges

- Availability of low-cost substitutes

- High R&D costs

Increasing use of composites in construction applications

The construction industry in North America and Europe is growing steadily, as it recovers from the economic recession. With the increase in demand for high strength and corrosion-resistant construction materials in the housing and civil applications, the use of composites in the construction industry is witnessing significant growth. Composite decking & railing products are mostly used in the housing and commercial constructions, as they offer lower maintenance cost than timber decking & railing products. They also offer enhanced resistance to slippery & wet surfaces, scratches, fades, splinters, and rots in comparison to that of traditional materials.

MnM helped a key provider of building and construction solutions in understanding the impact of COVID 19 on the North America construction market

Client’s Problem Statement

One of the key suppliers of construction solutions in North America wanted to assess the impact of COVID 19 on the construction industry in North America across construction types such as new single family housing starts, new multi family housing starts, new commercial building starts and repair and renovation. They wanted to understand the strategies being undertaken by its competitors in reducing the effects of COVID 19.

MnM Approach

MnM started the research by analyzing the ‘essential’ versus ‘non-essential’ construction across countries in North America: US, Canada and Mexico. MnM provided a detailed analysis of the states within the countries that are most impacted. MnM segmented the states into ‘most construction restricted’, ‘shelter in place exempted’ and ‘least construction restricted’ and provided the analysis for each state. MnM also provided the Pre and Post COVID 19 estimates for new single family housing starts, new multi family housing starts, new commercial starts and repair and renovation. MnM also provided the key strategies being deployed by competitors to minimize the effects if COVID 19 across US, Canada and Mexico.

Revenue Impact (RI)

Our research findings and suggestions helped the client impact it's revenue by ~USD 5 Mn in the next 3 years across different housing and commercial unit starts and repair and renovation segments in North America

Objectives of the Construction Composites Market Study:

- To define, describe, and forecast the construction composites market on the basis of resin type, fiber type, application, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market shares and core competencies2

Note1: Micromarkets are the subsegments of the construction composite market included in the report

Note2: Core competencies of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market

In this report, market sizes have been derived from various research methodologies. In the secondary research process, different sources have been referred to, to identify and collect information for this study on the construction composites market. These secondary sources include annual reports, press releases, investor presentations of companies and associations (such as Composites World, Polymer Database, Factiva, D&B Hoovers, Manta, and others.) and white papers, certified publications, and articles from recognized authors. In the primary research process, sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The bottom-up approach has been used to estimate the market size, in terms of value. The top-down approach has also been implemented to validate the market size, in terms of value. With the data triangulation procedure and validation of data through primaries, exact values of the sizes of the overall parent market and individual markets have been determined and confirmed in this study.

The figure below illustrates the breakdown of profiles of primary interview participants.

To know about the assumptions considered for the study, download the pdf brochure

Key manufacturers of construction composites include Strongwell Corporation (US), Exel Composites (Finland), Trex Company Inc. (US), UPM Biocomposites (Finland), Bedford Reinforced Plastics (US) and many more. Further, the manufacturers of construction composites supply their products to various entities for industrial, commercial, housing and civil applications.

Major Market Developments in Construction Composites Market

- In May 2016, Strongwell Corporation launched a new decking product Safplank. This new product offers various properties such as lightweight and prevention against degradation, making them useful in commercial and housing applications. This has helped the company to increase its product portfolio in the North American construction composites market.

- In March 2016, Exel Composites launched composite doorsill with the Belgian blue hardstone look designed for commercial and housing applications. The new product launch increased the product portfolio of the company and helped to increase its share in the construction composite market in Europe.

- In February 2016, Trex Company inc. expanded its reach in the Midwest U.S. This was done by the acquisition of Lumberyard Supply Co. by Amerhart, a company with Trex Company. This expansion has helped the company to increase its product reach thereby increasing its market share in the North American construction composite market.

Key Target Audience in Construction Composites Market

- Construction composites Manufacturers

- Construction composites Traders, Distributors, and Suppliers

- Raw Material Suppliers

- Governments and Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

Construction Composites Market Report Scope

The report forecasts revenue growth and provides an analysis of trends in each of the subsegments of the construction composites market. This research report categorizes the market based on the following:

On the Basis of Resin type

- Polyester

- Vinyl Ester

- Polyethylene

- Polypropylene

On the Basis of Fiber Reinforcement type,

- Glass fiber

- Natural fiber

On the Basis of Application,

- Industrial

- Commercial

- Housing

- Civil

On the Basis of Region,

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Each region has been further segmented into key countries in that region.

Critical questions which the report answers

- What are the upcoming trends for construction composites in developing nations?

- Which are the key players in the market and how intense is the competition?

Construction Composites Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies. The following customization options are available for the report:

Construction Composites Market Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Construction Composites Market Regional Analysis

- Further breakdown of the North American construction composites market

- Further breakdown of the European construction composite market

- Further breakdown of the Asia-Pacific region construction composites market

- Further breakdown of the Middle Eastern & African construction composite market

- Further breakdown of the Latin American construction composites market

Construction Composites Market Company Information

- Detailed analysis and profiles of additional market players

The construction composites market is estimated at USD 4.75 billion in 2015 and is projected to reach USD 8.98 billion by 2026, at a CAGR of 6.0% during the forecast period. The increase in the penetration of construction composites in the construction industry, the long life & low maintenance requirement, rapid urbanization & economic boom in the emerging countries and the development of innovative products, are key factors responsible for the growth of the construction composite market.

The construction composites market, by resin type is segmented into polyester, vinyl ester, polyethylene, polypropylene and other resins. The polypropylene resin construction composite market is expected to grow faster during the forecast period, as polypropylene resin based construction composites offer various thermal and mechanical properties, such as resistance to corrosive liquids, excellent electrical insulation and good performance at elevated temperatures, lower styrene emissions as compared to polyester resins, good adhesion strength to the different varieties of reinforcements, and so on.

Availability of low-cost substitutes is identified as the key challenge for the construction composites market growth. A wide variety of low-cost substitutes of composites are available in the market, including steel, aluminum, timber, and plywood for structure reinforcement. High prices of glass fiber and carbon fiber in comparison to traditional materials such as steel, timber, and concrete is preventing the mass adoption and utilization of FRP panels & sheets. There are many applications of FRP panels & sheets; however, they are not yet commercialized owing to its high cost. Raw material cost comprises a major share in the overall production and product cost. In addition, the industry requires large, capital-intensive equipment with long product development and qualification cycles. Therefore, manufacturers concentrate on small-volume, high price, and high-technology markets rather than high-volume, low-price, basic technology markets, which restricts the growth of the FRP panels & sheets market and its applications.

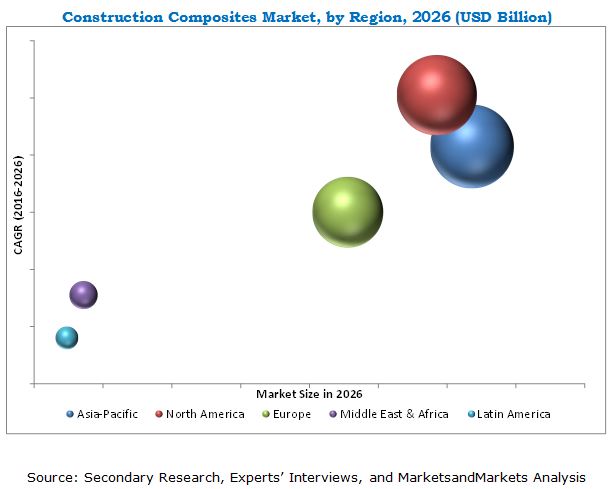

North America is expected to be the fastest-growing market for construction composites during the next five years. The factors that contribute to this growth are, the increasing urbanization and industrialization, coupled with long life & the low maintenance requirement. This has resulted in the high demand for construction composites in existing applications such as civil, commercial and industrial. Thus, these growing application industries are expected to drive the construction composites market in the North American region.

Construction composite market by resin type is segmented into polyester, vinyl ester, polyethylene, polypropylene and other resins.

Polyester resin

Unsaturated polyester resin is a condensed product of unsaturated acids or anhydrides and diols with or without diacids. They need a catalyst that solidifies the resin during curing and accepts a wide range of fillers. Polyester resin do not expand with high temperature and exhibit good mechanical, electrical, and heat resistance properties. It is a thermoset resin which allows convenient impregnation of reinforcing fiber. It has long process cycle and takes significant time to complete the process.

Vinyl ester

Vinyl ester resin has better corrosion resistance and mechanical properties at elevated temperature, however they are expensive than polyester. It display greater toughness properties, such as inter laminar shear and impact strength. Vinyl ester also offers enhanced strength and better impact and thermal shock resistance than polyester resin, making it a suitable composite resin for construction applications that are prone to continuous mechanical stress.

Polyethylene

High density polyethylene is used as resin matrix with natural fiber to produce composites of high tensile strength and flexibility. Polyethylene-based natural fiber composites have good mechanical properties, high dimensional stability, and can be used to produce complex shapes. It can be extruded to high dimensional tolerances and are tough and stable products. Wood plastics composites are generally reinforced with polyethylene for use in the commercial and residential applications.

Critical questions the report answers:

- What are the upcoming hot bets for construction composites market?

- How market dynamics is with regards to development of new composite parts used in construction applications?

Construction Composites Market Players

Companies such as, Advanced Environmental Recycling Technologies, Inc. (U.S.), Bedford Reinforced Plastics (U.S.), Diversified Structural Composites (U.S.), Exel Composites Oyj (Finland), Hughes Brothers, Inc. (U.S.), Jamco Corporation (Japan), Schoeck International (Germany), Strongwell Corporation (U.S.), Trex Company, Inc. (U.S.) and UPM Biocomposites (Finland) and others are the leading market players in the global construction composites market. They have been adopting various organic and inorganic growth strategies such as agreements, new product developments and expansions to enhance their shares in the global construction composite market.

Frequently Asked Questions (FAQ):

What is the Construction Composites Market growth?

Growth of Construction Composites Market - Growing at a CAGR of 6.00%, from 2016 to 2026.

Who leading market players in Construction Composites industry?

Some of the key global players prevailing in the construction composites market are Advanced Environmental Recycling Technologies, Inc. (U.S.), Bedford Reinforced Plastics (U.S.), Diversified Structural Composites (U.S.), Exel Composites Oyj (Finland), Hughes Brothers, Inc. (U.S.), Jamco Corporation (Japan), Schoeck International (Germany), Strongwell Corporation (U.S.), Trex Company, Inc. (U.S.) and UPM Biocomposites (Finland).

How big is the Construction Composites Market?

The construction composites market is projected to reach USD 8.98 Billion by 2026.

Which segments are covered in Construction Composites Market report?

By Fiber Type (Carbon, and Natural Fiber), Resin Type (Polyester, Vinyl Ester, Polyethylene and Polypropylene) & Application (Industrial, Commercial, Housing and Civil).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Significant Opportunities in the Construction Composites Market

4.2 Construction Composite Market, By Resin Type

4.3 Construction Composites Market, By Application and Region

4.4 Construction Composite Market Share, By Country

4.5 Construction Composites Market, By Fiber Type

4.6 Construction Composite Market, By Application

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Resin Type

5.2.2 By Fiber Type

5.2.3 By Application

5.2.4 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Use of Composites in Construction Applications

5.3.1.2 Long Lifecycle and Low Maintenance Cost

5.3.1.3 Rapid Urbanization and Economic Growth in Emerging Economies

5.3.1.4 Development of Innovative Products

5.3.2 Restraints

5.3.2.1 High Initial Production and Installation Costs of Composites

5.3.2.2 Recyclability Issues

5.3.3 Opportunities

5.3.3.1 Growing Demand for Composites in Civil Applications in North America

5.3.3.2 Increasing Demand for Pultruded Profiles

5.3.4 Challenges

5.3.4.1 Availability of Low-Cost Substitutes

5.3.4.2 High R&D Costs

5.4 Porter’s Five Forces Analysis

5.4.1 Threat of New Entrants

5.4.2 Threat of Substitutes

5.4.3 Bargaining Power of Buyers

5.4.4 Bargaining Power of Suppliers

5.4.5 Intensity of Competitive Rivalry

5.5 Cost Structure Analysis

6 Macroeconomic Overview (Page No. - 49)

6.1 Introduction

6.2 Trends and Forecast of GDP

6.3 Per Capita GDP vs Per Capita Construction Composites Demand

6.4 Trends and Forecast of the Construction Industry and Its Impact on the Construction Composites Market

6.4.1 Trends and Forecast of the Construction Industry in North America

6.4.1.1 Trends of Residential and Non-Residential Construction Industries in North America

6.4.2 Trends and Forecast of the Construction Industry in Europe

6.4.2.1 Construction Industry Trend in Europe

6.4.2.2 Trends of Residential and Non-Residential Construction Industries in Europe

6.4.3 Trends and Forecast of the Construction Industry in Asia-Pacific

6.4.3.1 Construction Industry Trend in Asia-Pacific

6.4.4 Trends and Forecast of Construction Industry in ME&A

6.4.5 Trends and Forecast of Construction Industry in Latin America

7 Construction Composites Market, By Resin Type (Page No. - 60)

7.1 Introduction

7.2 Polyester Resin

7.3 Vinyl Ester

7.4 Polyethylene

7.5 Polypropylene

7.6 Others

7.6.1 Phenolic Resin

7.6.2 Polyurethane Resin

7.6.3 Epoxy Resin

8 Construction Composites Market, By Fiber Type (Page No. - 71)

8.1 Introduction

8.2 Glass Fiber

8.2.1 Glass Fiber Construction Composites Market, By Region

8.3 Natural Fiber

8.3.1 Wood Fiber Composites

8.3.2 Non-Wood Fiber Composites

8.3.3 Natural Fiber Construction Composite Market, By Region

8.4 Others

8.4.1 Carbon Fiber

8.4.2 Basalt Fiber

8.4.3 Other Fiber-Based Construction Composites Market, By Region

9 Construction Composites Market, By Application (Page No. - 79)

9.1 Introduction

9.2 Industrial

9.2.1 Water-Treatment Plants

9.2.2 Oil & Gas

9.2.3 Chemical

9.2.4 Power Generation

9.3 Commercial

9.3.1 Hotels & Resorts

9.3.2 Marine

9.3.3 ATC Towers

9.3.4 Parking Structures

9.4 Housing

9.4.1 FRP Window and Door

9.4.2 Composite Decking and Railing

9.5 Civil

9.5.1 Highways

9.5.2 Bridges

9.5.3 Tunneling

9.5.4 Structural Strengthening and Monument Restorations

10 Regional Analysis (Page No. - 91)

10.1 Introduction

10.2 North America

10.2.1 Construction Composites Market Size in North America, By Country

10.2.1.1 U.S.

10.2.1.2 Canada

10.2.2 Construction Composites Market Size in North America, By Resin Type

10.2.3 Construction Composite Market Size in North America, By Application

10.3 Europe

10.3.1 Construction Composites Market Size in Europe, By Country

10.3.1.1 Germany

10.3.1.2 U.K.

10.3.1.3 France

10.3.1.4 Italy

10.3.1.5 Spain

10.3.1.6 Netherlands

10.3.2 Construction Composites Market Size in Europe, By Resin Type

10.3.3 Construction Composite Market Size in Europe, By Application

10.4 Asia-Pacific

10.4.1 Construction Composites Market Size in Asia-Pacific, By Country

10.4.1.1 China

10.4.1.2 Japan

10.4.1.3 India

10.4.1.4 Australia & New Zealand

10.4.1.5 South Korea

10.4.2 Construction Composites Market Size in Asia-Pacific, By Resin Type

10.4.3 Construction Composite Market Size in Asia-Pacific, By Application

10.5 ME&A

10.5.1 Construction Composites Market Size in ME&A, By Country

10.5.1.1 UAE

10.5.1.2 Qatar

10.5.1.3 Saudi Arabia

10.5.1.4 South Africa

10.5.2 Construction Composites Market Size in ME&A, By Resin Type

10.5.3 Construction Composite Market Size in ME&A, By Application

10.6 Latin America

10.6.1 Construction Composites Market Size in Latin America, By Country

10.6.1.1 Brazil

10.6.1.2 Mexico

10.6.2 Construction Composites Market Size in Latin America, By Resin Type

10.6.3 Construction Composite Market Size in Latin America, By Application

11 Competitive Landscape (Page No. - 117)

11.1 Overview

11.2 Competitive Situation and Trends

11.3 Market Share Estimation

11.3.1 Strongwell Corporation

11.3.2 Exel Composites

11.3.3 Jiangsu Juiding New Material Co. Ltd.

11.3.4 Trex Company, Inc.

11.3.5 UPM Biocomposites

11.3.6 Weyerhauser Company

11.4 Recent Developments

11.4.1 Agreements

11.4.2 Expansions

11.4.3 New Product Launches

12 Company Profiles (Page No. - 126)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Strongwell Corporation

12.2 Exel Composites

12.3 Trex Company, Inc.

12.4 UPM Biocomposites

12.5 Bedford Reinforced Plastics

12.6 Advanced Environmental Recycling Technologies, Inc. (AERT)

12.7 Hughes Brothers, Inc.

12.8 Diversified Structural Composites

12.9 Schoeck International

12.10 Jiangsu Jiuding New Material Co., Ltd.

12.11 Other Key Players

12.11.1 Faigle Kunstsoffe GmbH

12.11.2 Fibergrate Composite Structure, Inc.

12.11.3 Fiberon LLC

12.11.4 Pultron Composites

12.11.5 Fibrolux GmbH

12.11.6 Sireg S.P.A.

12.11.7 Tamko Building Products, Inc.

12.11.8 Timbertech

12.11.9 Nantong Wuzhou Composite Material Co., Ltd.

12.11.10 Nantong Rell Construction Material Co., Ltd.

12.11.11 Zhengzhou Yalong Pultrex Composite Materials Co., Ltd.

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 147)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (79 Tables)

Table 1 Construction Composites Market Size, 2014–2026

Table 2 Construction Composite Market, By Resin Type

Table 3 Construction Composites Market, By Fiber Type

Table 4 Construction Composite Market, By Application

Table 5 Construction Composites Market, By Region

Table 6 Impact Analysis of Drivers

Table 7 Cost Structure of Construction Composites

Table 8 Trends and Forecast of GDP, USD Billion (2015–2021)

Table 9 Per Capita GDP vs Per Capita Construction Composites Demand, 2015

Table 10 Contribution of the Construction Industry to the GDP of North America, USD Billion (2014–2021)

Table 11 Contribution of the Construction Industry to the GDP of Europe, USD Billion (2014–2021)

Table 12 Contribution of the Construction Industry to the GDP of Asia-Pacific, USD Billion (2014–2021)

Table 13 Contribution of Construction Industry to GDP in ME&A, USD Billion (2014–2021)

Table 14 Contribution of Construction Industry to GDP in Latin America, USD Billion (2014–2021)

Table 15 Construction Composites Market Size, By Resin Type, 2014–2026 (USD Million)

Table 16 Construction Composite Market Size, By Resin Type, 2014–2026 (Kiloton)

Table 17 Polyester-Based Construction Composite Market Size, By Region, 2014–2026 (USD Million)

Table 18 Polyester-Based Market Size, By Region, 2014–2026 (Kiloton)

Table 19 Vinyl Ester-Based Construction Composites Market Size, By Region, 2014–2026 (USD Million)

Table 20 Vinyl Ester-Based Market Size, By Region, 2014–2026 (Kiloton)

Table 21 Polyethylene-Based Construction Composite Market Size, By Region, 2014–2026 (USD Million)

Table 22 Polyethylene-Based Market Size, By Region, 2014–2026 (Kiloton)

Table 23 Polypropylene-Based Construction Composites Market Size, By Region, 2014–2026 (USD Million)

Table 24 Polypropylene-Based Market Size, By Region, 2014–2026 (Kiloton)

Table 25 Other Resin-Based Construction Composite Market Size, By Region, 2014–2026 (USD Million)

Table 26 Other Resin-Based Market Size, By Region, 2014–2026 (Kiloton)

Table 27 Construction Composites Market Size, By Fiber Type, 2014–2026 (USD Million)

Table 28 Construction Composite Market Size, By Fiber Type, 2014–2026 (Kiloton)

Table 29 Glass Fiber Construction Composites Market Size, By Region, 2014–2026 (USD Million)

Table 30 Glass Fiber Construction Composite Market Size, By Region, 2014–2026 (Kiloton)

Table 31 Natural Fiber Construction Composites Market Size, By Region, 2014–2026 (USD Million)

Table 32 Natural Fiber Construction Composite Market Size, By Region, 2014–2026 (Kiloton)

Table 33 Other Fiber-Based Construction Composites Market Size, By Region, 2014–2026 (USD Million)

Table 34 Other Fiber-Based Construction Composite Market Size, By Region, 2014–2026 (Kiloton)

Table 35 Construction Composites Market Size, By Application, 2014–2026 (USD Million)

Table 36 Market Size, By Region, 2014–2026 (Kiloton)

Table 37 Market Size in Industrial Application, By Region, 2014–2026 (USD Million)

Table 38 Market Size in Industrial Application, By Region, 2014–2026 (Kiloton)

Table 39 Market Size in Commercial Application, By Region, 2014–2026 (USD Million)

Table 40 Market Size in Commercial Application, By Region, 2014–2026 (Kiloton)

Table 41 Market Size in Housing Application, By Region, 2014–2026 (USD Million)

Table 42 Market Size in Housing Application, By Region, 2014–2026 (Kiloton)

Table 43 Market Size in Civil Application, By Region, 2014–2026 (USD Million)

Table 44 Market Size in Civil Application, By Region, 2014–2026 (Kiloton)

Table 45 Market Size, By Region, 2014–2026 (USD Million)

Table 46 Market Size, By Region, 2014–2026 (Kiloton)

Table 47 North America: Construction Composites Market Size, By Country, 2014–2026 (USD Million)

Table 48 North America: Market Size, By Country, 2014–2026 (Kiloton)

Table 49 North America: Market Size, By Resin Type, 2014–2026 (USD Million)

Table 50 North America: Market Size, By Resin Type, 2014–2026 (Kiloton)

Table 51 North America: Market Size, By Application, 2014–2026 (USD Million)

Table 52 North America: Market Size, By Application, 2014–2026 (Kiloton)

Table 53 Europe: Construction Composite Market Size, By Country, 2014–2026 (USD Million)

Table 54 Europe: Market Size, By Country, 2014–2026 (Kiloton)

Table 55 Europe: Market Size, By Resin Type, 2014–2026 (USD Million)

Table 56 Europe: Market Size, By Resin Type, 2014–2026 (Kiloton)

Table 57 Europe: Market Size, By Application, 2014–2026 (USD Million)

Table 58 Europe: Market Size, By Application, 2014–2026 (Kiloton)

Table 59 Asia-Pacific: Construction Composites Market Size, By Country, 2014–2026 (USD Million)

Table 60 Asia-Pacific: Market Size, By Country, 2014–2026 (Kiloton)

Table 61 Asia-Pacific: Market Size, By Resin Type, 2014–2026 (USD Million)

Table 62 Asia-Pacific: Market Size, By Resin Type, 2014–2026 (Kiloton)

Table 63 Asia-Pacific: Market Size, By Application, 2014–2026 (USD Million)

Table 64 Asia-Pacific: Market Size, By Application, 2014–2026 (Kiloton)

Table 65 ME&A: Construction Composite Market Size, By Country, 2014–2026 (USD Million)

Table 66 ME&A: Market Size, By Country, 2014–2026 (Kiloton)

Table 67 ME&A: Market Size, By Resin Type, 2014–2026 (USD Million)

Table 68 ME&A: Market Size, By Resin Type, 2014–2026 (Kiloton)

Table 69 ME&A: Market Size, By Application, 2014–2026 (USD Million)

Table 70 ME&A: Market Size, By Application, 2014–2026 (Kiloton)

Table 71 Latin America: Construction Composites Market Size, By Country, 2014–2026 (USD Million)

Table 72 Latin America: Market Size, By Country, 2014–2021 (Kiloton)

Table 73 Latin America: Market Size, By Resin Type, 2014–2026 (USD Million)

Table 74 Latin America: Market Size, By Resin Type, 2014–2026 (Kiloton)

Table 75 Latin America: Market Size, By Application, 2014–2026 (USD Million)

Table 76 Latin America: Market Size, By Application, 2014–2026 (Kiloton)

Table 77 Agreements, 2011–2016

Table 78 Expansions, 2011–2016

Table 79 New Product Launches, 2011–2016

List of Figures (63 Figures)

Figure 1 Construction Composites: Market Segmentation

Figure 2 Years Considered for the Study

Figure 3 Construction Composites Market: Research Design

Figure 4 Key Data From Secondary Sources

Figure 5 Key Data From Primary Sources

Figure 6 Key Industry Insights

Figure 7 Breakdown of Primary Interviews

Figure 8 Bottom-Up Approach

Figure 9 Top-Down Approach

Figure 10 Data Triangulation

Figure 11 Assumptions

Figure 12 Polyester Resin is Expected to Drive the Construction Composites Market, 2016-2021

Figure 13 Natural Fiber is Projected to Register the Highest CAGR in the Construction Composite Market, 2016-2021

Figure 14 Industrial Application to Dominate the Construction Composites Market, 2016-2021

Figure 15 Asia-Pacific Dominated the Construction Composite Market in 2015

Figure 16 Attractive Opportunities in the Construction Composites Market

Figure 17 Polyethylene to Be the Fastest-Growing Resin Type in the Construction Composite Market

Figure 18 Asia-Pacific Dominated the Construction Composites Market in 2015

Figure 19 U.S. Accounted for A Major Share of the Construction Composite Market

Figure 20 Natural Fiber to Register the Highest CAGR in the Construction Composites Market, 2016-2021

Figure 21 Industrial Application to Account for the Largest Market Share, 2016-2021

Figure 22 Drivers, Restraints, Opportunities, and Challenges of the Construction Composite Market

Figure 23 Porter’s Five Forces Analysis of the Construction Composites Market

Figure 24 Cost Structure of Construction Composites

Figure 25 Trends and Forecast of GDP, USD Billion (2016–2021)

Figure 26 Per Capita GDP vs Per Capita Construction Composites Demand

Figure 27 Trends and Forecast of the Construction Industry in North America

Figure 28 Trends of Residential and Non-Residential Construction Industries in North America

Figure 29 Trends and Forecast of the Construction Industry in Europe

Figure 30 Trends of Residential and Non-Residential Construction Industries in Europe

Figure 31 Trends and Forecast of the Construction Industry in Asia-Pacific

Figure 32 Construction Industry in Saudi Arabia Contributes the Maximum to the GDP in ME&A, USD Billion, 2015 vs 2021

Figure 33 Construction Industry in Brazil Contributes the Maximum to the GDP in Latin America, USD Billion, 2015 vs 2021.

Figure 34 Polyester Resin-Based Construction Composites Dominates the Market, 2016-2021

Figure 35 Polyester Resin Dominated the Construction Composites Market in Asia-Pacific, 2016-2021

Figure 36 North America Dominates the Vinyl Ester-Based Construction Composite Market, 2016-2021

Figure 37 Asia-Pacific to Lead the Other Resin-Based Construction Composites Market, 2016-2021

Figure 38 Natural Fiber to Be the Fastest-Growing Fiber Type in the Construction Composite Market, 2016-2021

Figure 39 Asia-Pacific is Projected to Register the Highest CAGR in the Glass Fiber Construction Composites Market, 2016-2021

Figure 40 North America Accounts for the Largest Share of the Natural Fiber-Based Construction Composite Market, 2016-2021

Figure 41 Industrial Application to Dominate the Construction Composites Market, 2016-2021

Figure 42 Asia-Pacific Dominates the Construction Composite Market in Industrial Application, 2016-2021

Figure 43 North America Accounts for the Major Share of the Construction Composites Market in Commercial Application

Figure 44 The Market in North America to Register the Highest Growth Rate in Housing Application, 2016-2021

Figure 45 North America is the Largest Construction Composite Market in Civil Application, 2016-2021

Figure 46 China and U.S. to Drive the Construction Composites Market Between 2016 and 2021

Figure 47 North America Construction Composite Market Snapshot: U.S. is the Most Lucrative Market

Figure 48 Europe Construction Composites Market Snapshot: Germany is the Most Lucrative Market

Figure 49 Asia-Pacific Construction Composite Market Snapshot: China is the Largest Construction Composites Market

Figure 50 ME&A Construction Composites Market Snapshot: Saudi Arabia is the Most Lucrative Market

Figure 51 Latin America Construction Composite Market Snapshot: Mexico is the Most Lucrative Market, 2016-2021

Figure 52 Agreements are the Most Preferred Growth Strategy Adopted By Major Players, 2011-2016

Figure 53 Market Development Matrix: Maximum Number of Developments Were Witnessed in 2013

Figure 54 Growth Strategies Adopted By Market Players in the Construction Composites Market, 2011–2016

Figure 55 Strongwell Corporation: the Largest Pultruded Company in the Construction Composite Market

Figure 56 Trex Company, Inc.: the Largest Natural Fiber Composite Company in the Construction Composites Market

Figure 57 Strongwell Corporation: SWOT Analysis

Figure 58 Exel Composites: Company Snapshot

Figure 59 Exel Composites: SWOT Analysis

Figure 60 Trex Company, Inc.: Company Snapshot

Figure 61 Trex Company, Inc.: SWOT Analysis

Figure 62 UPM Biocomposites: Company Snapshot

Figure 63 AERT: Company Snapshot

Growth opportunities and latent adjacency in Construction Composites Market