Oxidative Stress Assay Market by Product (Consumable, Instruments, Kits, Services), Test Type (Indirect, nucleic acid, Glutathione, ROS), Technology (ELISA, Chromatography), Diseases (CVD, Oncology) End User (Pharma & Biotech) & Region - Global Forecasts to 2025

Market Growth Outlook Summary

The global oxidative stress assay market growth forecasted to transform from USD 836 million in 2020 to USD 1,326 million by 2025, driven by a CAGR of 9.7%. Growth in the oxidative stress assay market is attributed to factors such as the biopharmaceutical industry and increasing public-sector funding for academic research. Other important factors aiding the growth of this market include technological advancements like HCS for drug discovery, increasing R&D expenditure in biotechnology and pharmaceutical industries, and government support for pharmaceutical and biotechnology industries.

![Oxidative Stress Assay Market Size, Share, Trends - [2020-2025] Oxidative Stress Assay Market](https://www.marketsandmarkets.com/Images/oxidative-stress-assay-market7.jpg)

To know about the assumptions considered for the study, Request for Free Sample Report

Oxidative Stress Assay Market Dynamics

Driver: Rapid growth in biopharmaceutical and biotechnology industry

The global biopharmaceuticals market was valued at ~USD 275 billion in 2018 and is estimated to grow at 12–13% annually (Source: 16th Annual Report and Survey of Biopharmaceutical Manufacturing, April 2019). Similarly, the global pharmaceutical market is expected to grow over USD 1.5 trillion by 2023 from the USD 1.2 trillion of 2018, at an annual growth rate of 3–6% (Source: The Global Use of Medicine in 2019 and Outlook to 2023).

A similar growth trend is observed in the biotechnology industry. For example, companies in biotech centers such in the US registered over USD 112 billion in revenue and had a total market capitalization of ~USD 700 billion in 2018. Currently, more than 130,000 people are employed by public biotechnology companies in the US (Source: biotecnika.org, January 2020). According to OECD estimates, in 2018, the total number of biotechnology companies that were active in the US was 2,470. In France, another major biotech market, this number was 2,083.

Oxidative stress assays are widely used in cell cultures used for biopharmaceutical production. Owing to this, biopharmaceutical and biotechnology companies are the largest end users of oxidative stress assays. Rapid growth in these industries is thus expected to drive the growth of the oxidative stress assays market..

Restraint: High cost of instruments

High-content screening and label-free detection technologies for oxidative stress assays offer many advantages over conventional technologies. These instruments are equipped with advanced features and functionalities and thus are priced at a premium. For instance, a confocal microscope used in HCS can cost up to USD 250,000. Thus, owing to their high cost, companies with smaller R&D budgets cannot afford these expensive instruments. On the other hand, pharmaceutical companies require many such systems, and hence their capital cost increases significantly. Furthermore, academic research laboratories find it difficult to invest in such systems as they have controlled budgets. Hence, the high costs associated with technological advancements may hinder the growth of the overall market.

Opportunity: Emerging Economies present significant growth opportunities

Emerging markets such as Brazil, Russia, India, China, and South Africa (BRICS) are expected to present significant opportunities for the growth of the oxidative stress assays market. This can mainly be attributed to increased R&D funding for various research organizations in these countries.

In China, R&D investments by public and private science and technology organizations increased by 12.5% between 2018 and 2019 to USD 322 billion (Source: National Bureau of Statistics); spending on basic research accounted for 6% of the total investments, while applied research and development accounted for 11.3% and 82.7%, respectively.

Emerging economies in Asia are experiencing rapid growth in healthcare expenditure. According to estimates from the World Bank, global healthcare spending increased from 1.995% of the GDP in 2013 to 2.274% of the GDP by 2018. Asian markets, especially China and India, have a large number of CROs that offer drug discovery services to serve the pharmaceutical and biotechnology industries. The global CRO market reached USD 39 billion in 2018 and is expected to exceed USD 44 billion by 2021, as patent expiration, proliferation of generic medications, and technological innovations like mHealth and big data influence product development. This will result in greater outsourcing of work to CROs (Source: Top 10 Contract Research Organisations to Watch in 2019). Growth in the CRO industry is expected to offer potential growth opportunities for oxidative stress assay manufacturers.

By product, the consumables segment of Oxidative Stress Assay Market, is expected to grow at the highest CAGR during the forecast period.

On the basis of product, the market is segmented into consumables, instruments, and services. Consumables is the largest and fastest-growing segment, in 2020. This segment is also projected to register the highest CAGR from 2020 to 2025. The recurring requirement of consumables as compared to instruments is the key factor driving the growth of this segment.

By diseases type, cardiovascular diseases accounted for the largest share of the Oxidative Stress Assay Market in 2020

Based on disease type, the market is segmented into cardiovascular diseases, diabetes, cancer, respiratory diseases, and other diseases. The cardiovascular diseases segment accounted for the largest share of this market in 2020, primarily due to the high and growing prevalence of cardiovascular diseases across the globe.

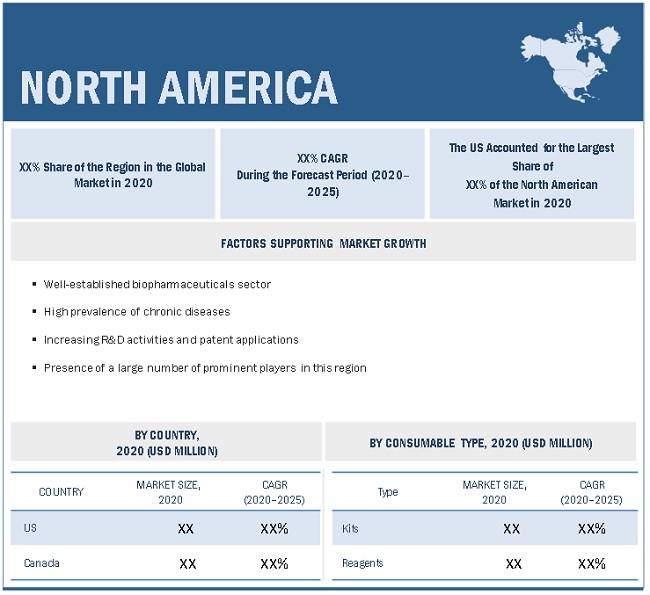

North America accounted for the largest share of the oxidative stress assay market in 2020, while the Asia Pacific market is expected to register the highest growth during the forecast period

The market is segmented into four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. North America accounted for the largest share of the global oxidative stress assay market in 2020. However, the Asia Pacific market is expected to register the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

The major players in the oxidative stress assay market are Merck KGaA (Germany), Thermo Fisher Scientific, Inc (US), and QIAGEN N.V. (Netherlands). These companies together accounted for a share of approximately 60% of the oxidative stress assay market in 2019. Other players in the market include Abcam, plc (UK), Enzo Biochem, Inc. (US), AMS Biotechnology (Europe), Ltd. (UK), BioVision, Inc. (US), Cell Biolabs, Inc. (US), Oxford Biomedical Research (US), Promega Corporation (US), Cayman Chemical (US), Eagle Biosciences, Inc. (US), Arbor Assays (US), Hycult Biotech (Netherlands), Callegari SRL (Italy), Kamiya Biomedical Company (US), MEGA TIP San.Tic.Ltd.Sti. (Turkey), ImmunoChemistry Technologies, LLC (US), Genox Corporation (US), and Toxys B.V. (Netherlands).

Scope of the Oxidative Stress Assay Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$836 million |

|

Projected Revenue Size by 2025 |

$1,326 million |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 9.7% |

|

Market Driver |

Rapid growth in biopharmaceutical and biotechnology industry |

|

Market Opportunity |

Emerging Economies present significant growth opportunities |

This research report categorizes the oxidative stress assay market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables

- Kits

- Reagents

- Instruments

- Services

By Test Type

- Antioxidant Capacity Assays

- Ascorbic Acid Assays

- Glutathione Assays

- Cell-based Exogenous Antioxidant Assays

- Indirect Assays

- Lipid-based Assays

- Nucleic Acid-based Assays

- Protein-based Assays

- Enzyme-based Assays

- Reactive Oxygen Species-based Assays

By Technology

- Enzyme-linked Immunosorbent Assay (ELISA)

- Flow Cytometry

- High-content Screening (HCS)

- Label-free Detection

- Microscopy

- Chromatography

By Disease Type

- Cardiovascular Disease

- Diabetes

- Cancer

- Respiratory Diseases

- Other Diseases

By End User

- Clinical Laboratories

- Contract Research Organizations

- Pharmaceutical and Biotechnology Companies

- Academic Research Institutes

- Cosmetic Companies

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Rest of the World

Recent Developments:

- In 2020, Abcam plc (UK) Acquired Expedeon’s (Germany) Proteomics and Immunology business for enhancing its conjugation capability

- In 2018, Abcam plc (UK) had an agreement with QIAGEN (Suzhou) and signed a strategic MoU collaboration agreement to co-develop companion diagnostic (CDx) and in vitro diagnostic (IVD) reagents and kits for the Chinese market.

- In 2018, BioVision, Inc. (US) launched the nitrite Assay Kit (Griess Reagent)

- In 2020, Cayman Chemical (US) started building a USD 20-million research and development facility at its headquarters in the US.

Frequently Asked Questions (FAQ):

What is the projected market value of the global oxidative stress assay market?

The global market of oxidative stress assay is projected to reach USD 1,326 million.

What is the estimated growth rate (CAGR) of the global oxidative stress assay market for the next five years?

The global oxidative stress assay market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.7% from 2020 to 2025.

What are the major revenue pockets in the oxidative stress assay market currently?

The market is segmented into four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. North America accounted for the largest share of the global oxidative stress assay market in 2020. However, the Asia Pacific market is expected to register the highest CAGR during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKETS COVERED

FIGURE 1 OXIDATIVE STRESS ASSAY MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.3 KEY INDUSTRY INSIGHTS

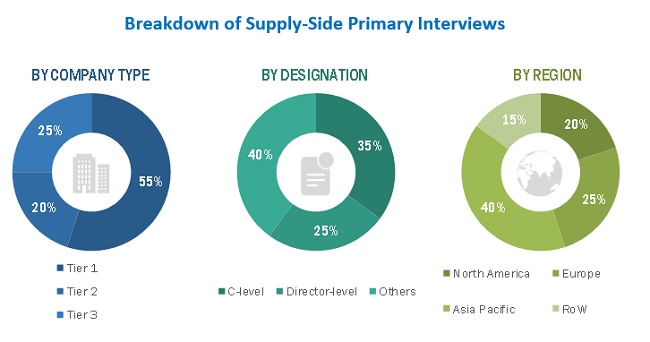

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

2.2.2 GROWTH FORECAST

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 6 OXIDATIVE STRESS ASSAYS MARKET, BY PRODUCT & SERVICE, 2020 VS. 2025 (USD MILLION)

FIGURE 7 MARKET, BY DISEASE TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 8 MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 9 MARKET, BY REGION, 2020 VS. 2025 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 OXIDATIVE STRESS ASSAY MARKET OVERVIEW

FIGURE 10 GROWING R&D EXPENDITURE IN PHARMACEUTICAL AND BIOPHARMACEUTICAL INDUSTRIES TO DRIVE MARKET GROWTH

4.2 NORTH AMERICA: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET (2020)

FIGURE 11 OXIDATIVE STRESS ASSAY KITS ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 12 ASIA PACIFIC COUNTRIES TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 OXIDATIVE STRESS ASSAYS MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 Rapid growth in the biopharmaceutical and biotechnology industries

5.2.1.2 Growing R&D expenditure in the pharmaceutical & biopharmaceutical industries

FIGURE 14 R&D SPENDING OF PHRMA MEMBER COMPANIES, 2005–2019 (USD BILLION)

5.2.1.3 Technological advancements such as high-content screening for drug discovery

5.2.1.4 Government funding for life science research

5.2.1.5 Emergence of label-free detection technologies

5.2.2 RESTRAINTS

5.2.2.1 High cost of instruments

5.2.2.2 Shortage of trained personnel for new and emerging technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies present significant growth opportunities

5.2.3.2 Applications of oxidative stress measurement in the cosmetic industry

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 1 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 DEGREE OF COMPETITION

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 15 DIRECT DISTRIBUTION STRATEGY PREFERRED BY PROMINENT COMPANIES

5.5 VALUE CHAIN ANALYSIS

FIGURE 16 MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASE

5.6 ECOSYSTEM ANALYSIS OF THE MARKET

FIGURE 17 ECOSYSTEM ANALYSIS

5.7 COVID-19 IMPACT ANALYSIS

6 OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE (Page No. - 58)

6.1 INTRODUCTION

TABLE 2 OXIDATIVE STRESS ASSAYS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

6.2 CONSUMABLES

TABLE 3 OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 4 OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.1 KITS

6.2.1.1 Kits accounted for the largest share of the market

TABLE 5 OXIDATIVE STRESS ASSAY KITS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.2.2 REAGENTS

6.2.2.1 Antibodies are the most widely used reagents in oxidative stress assays

TABLE 6 OXIDATIVE STRESS ASSAY REAGENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.3 INSTRUMENTS

6.3.1 INSTRUMENTS SEGMENT TO WITNESS LOWER GROWTH THAN THE CONSUMABLES SEGMENT

TABLE 7 OXIDATIVE STRESS ASSAY INSTRUMENTS MARKET, BY REGION, 2018–2025 (USD MILLION)

6.4 SERVICES

6.4.1 SERVICES SEGMENT TO ACCOUNT FOR A LOW SHARE OF THE MARKET DURING THE FORECAST PERIOD

TABLE 8 OXIDATIVE STRESS ASSAY SERVICES MARKET, BY REGION, 2018–2025 (USD MILLION)

7 OXIDATIVE STRESS ASSAY MARKET, BY TECHNOLOGY (Page No. - 63)

7.1 INTRODUCTION

TABLE 9 OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

7.2 ELISA

7.2.1 ELISA SEGMENT TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

TABLE 10 MARKET FOR ELISA, BY REGION, 2018–2025 (USD MILLION)

7.3 FLOW CYTOMETRY

7.3.1 FLOW CYTOMETRY IS USEFUL FOR THE MEASUREMENT OF CELLULAR OXIDATIVE STRESS

TABLE 11 MARKET FOR FLOW CYTOMETRY, BY REGION, 2018–2025 (USD MILLION)

7.4 CHROMATOGRAPHY

7.4.1 GAS CHROMATOGRAPHY IS THE PREFERRED METHOD FOR THE ANALYSIS OF HNE

TABLE 12 MARKET FOR CHROMATOGRAPHY, BY REGION, 2018–2025 (USD MILLION)

7.5 MICROSCOPY

7.5.1 DIGITAL MICROSCOPES WITH ADVANCED FEATURES ARE USED TO EVALUATE OXIDATIVE STRESS

TABLE 13 MARKET FOR MICROSCOPY, BY REGION, 2018–2025 (USD MILLION)

7.6 HIGH-CONTENT SCREENING

7.6.1 HCS IS AN EMERGING TECHNOLOGY IN THE MARKET

TABLE 14 MARKET FOR HIGH-CONTENT SCREENING, BY REGION, 2018–2025 (USD MILLION)

7.7 LABEL-FREE DETECTION

7.7.1 LABEL-FREE DETECTION SEGMENT TO WITNESS THE HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 15 MARKET FOR LABEL-FREE DETECTION, BY REGION, 2018–2025 (USD MILLION)

8 OXIDATIVE STRESS ASSAY MARKET, BY TEST TYPE (Page No. - 70)

8.1 INTRODUCTION

TABLE 16 OXIDATIVE STRESS ASSAYS MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

8.2 INDIRECT ASSAYS

TABLE 17 MARKET FOR INDIRECT ASSAYS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 18 MARKET FOR INDIRECT ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.2.1 PROTEIN-BASED ASSAYS

8.2.1.1 Protein-based assays accounted for the largest share of the indirect assays market

TABLE 19 MARKET FOR PROTEIN-BASED ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.2.2 LIPID-BASED ASSAYS

8.2.2.1 The most commonly used lipid peroxidation assays are MDA assays

TABLE 20 MARKET FOR LIPID-BASED ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.2.3 NUCLEIC ACID-BASED ASSAYS

8.2.3.1 Nucleic acid-based assays accounted for the lowest share of the indirect assays market

TABLE 21 MARKET FOR NUCLEIC ACID-BASED ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.3 ANTIOXIDANT CAPACITY ASSAYS

TABLE 22 MARKET FOR ANTIOXIDANT CAPACITY ASSAYS, BY TYPE, 2018–2025 (USD MILLION)

TABLE 23 MARKET FOR ANTIOXIDANT CAPACITY ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.3.1 GLUTATHIONE ASSAYS

8.3.1.1 Glutathione assays accounted for the largest share of the antioxidant capacity assays market

TABLE 24 MARKET FOR GLUTATHIONE ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.3.2 ASCORBIC ACID ASSAYS

8.3.2.1 Ascorbic acid assay kits are based on FRASC chemistry

TABLE 25 MARKET FOR ASCORBIC ACID ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.3.3 CELL-BASED EXOGENOUS ANTIOXIDANT ASSAYS

8.3.3.1 These assays are used for measuring the activity of an exogenous antioxidant compound within adherent cells

TABLE 26 MARKET FOR CELL-BASED EXOGENOUS ANTIOXIDANT ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.4 ENZYME-BASED ASSAYS

8.4.1 CATALASE ACTIVITY ASSAYS AND SOD ASSAYS ARE THE TWO TYPES OF ENZYME-BASED ASSAYS AVAILABLE IN THE MARKET

TABLE 27 MARKET FOR ENZYME-BASED ASSAYS, BY REGION, 2018–2025 (USD MILLION)

8.5 REACTIVE OXYGEN SPECIES-BASED ASSAYS

8.5.1 ROS ASSAY KITS MEASURE THE ACTIVITY OF HYDROXYL, PEROXYL, AND OTHER REACTIVE OXYGEN SPECIES

TABLE 28 MARKET FOR REACTIVE OXYGEN SPECIES-BASED ASSAYS, BY REGION, 2018–2025 (USD MILLION)

9 OXIDATIVE STRESS ASSAY MARKET, BY DISEASE TYPE (Page No. - 80)

9.1 INTRODUCTION

TABLE 29 OXIDATIVE STRESS ASSAYS MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

9.2 CARDIOVASCULAR DISEASES

9.2.1 HIGH PREVALENCE OF CARDIOVASCULAR DISEASES WILL DRIVE MARKET GROWTH

TABLE 30 MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2018–2025 (USD MILLION)

9.3 CANCER

9.3.1 RISING INCIDENCE OF CANCER TO DRIVE MARKET GROWTH

FIGURE 18 WORLDWIDE ESTIMATED NUMBER OF NEW CANCER CASES IN FEMALES (ALL AGE GROUPS), 2020

FIGURE 19 WORLDWIDE ESTIMATED NUMBER OF NEW CANCER CASES IN MALES (ALL AGE GROUPS), 2020

TABLE 31 MARKET FOR CANCER, BY REGION, 2018–2025 (USD MILLION)

9.4 DIABETES

9.4.1 HIGH AND GROWING PREVALENCE OF DIABETES TO BOOST MARKET GROWTH

TABLE 32 MARKET FOR DIABETES, BY REGION, 2018–2025 (USD MILLION)

9.5 RESPIRATORY DISEASES

9.5.1 RISING PREVALENCE OF COPD TO BOOST MARKET GROWTH

TABLE 33 MARKET FOR RESPIRATORY DISEASES, BY REGION, 2018–2025 (USD MILLION)

9.6 OTHER DISEASES

TABLE 34 MARKET FOR OTHER DISEASES, BY REGION, 2018–2025 (USD MILLION)

10 OXIDATIVE STRESS ASSAY MARKET, BY END USER (Page No. - 87)

10.1 INTRODUCTION

TABLE 35 OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES

10.2.1 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES ARE THE LARGEST END USERS OF OXIDATIVE STRESS ASSAYS

TABLE 36 MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY REGION, 2018–2025 (USD MILLION)

10.3 ACADEMIC RESEARCH INSTITUTES

10.3.1 STRENGTHENING OF DRUG DISCOVERY RESEARCH PROGRAMS TO DRIVE MARKET GROWTH

FIGURE 20 PUBLIC-SECTOR RESEARCH FUNDING IS DRIVING THE GROWTH OF THE ACADEMIC RESEARCH INSTITUTES SEGMENT (2018–2020)

TABLE 37 MARKET FOR ACADEMIC RESEARCH INSTITUTES, BY REGION, 2018–2025 (USD MILLION)

10.4 CLINICAL LABORATORIES

10.4.1 OXIDATIVE STRESS ASSAYS ARE USED IN PRECLINICAL BIOLOGICAL TESTING

TABLE 38 MARKET FOR CLINICAL LABORATORIES, BY REGION, 2018–2025 (USD MILLION)

10.5 CONTRACT RESEARCH ORGANIZATIONS

10.5.1 OUTSOURCING OF PHARMACEUTICAL R&D ACTIVITIES TO DRIVE MARKET GROWTH

TABLE 39 MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2018–2025 (USD MILLION)

10.6 COSMETIC INDUSTRY

10.6.1 ADOPTION OF OXIDATIVE STRESS ASSAYS IS EXPECTED TO INCREASE IN THE COSMETIC INDUSTRY

TABLE 40 MARKET FOR COSMETIC INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

11 OXIDATIVE STRESS ASSAY MARKET, BY REGION (Page No. - 93)

11.1 INTRODUCTION

TABLE 41 OXIDATIVE STRESS ASSAYS MARKET, BY REGION, 2018–2025 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: MARKET SNAPSHOT

TABLE 42 NORTH AMERICA: OXIDATIVE STRESS ASSAYS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 47 NORTH AMERICA: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.1 US

11.2.1.1 The US is the largest market for oxidative stress assays

TABLE 51 US: OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 52 US: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 US: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 54 US: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 55 US: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 56 US: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 US: ASSAYS MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 58 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Increasing biopharmaceutical industry to drive market growth in Canada

TABLE 59 CANADA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 60 CANADA: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 61 CANADA: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 62 CANADA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 63 CANADA: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 64 CANADA: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 65 CANADA: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 66 CANADA: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3 EUROPE

TABLE 67 EUROPE: OXIDATIVE STRESS ASSAY MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 68 EUROPE: OXIDATIVE STRESS ASSAYS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 EUROPE: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 71 EUROPE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 72 EUROPE: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 73 EUROPE: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Germany is the largest market for oxidative stress assay products in Europe

TABLE 76 GERMANY: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 77 GERMANY: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 GERMANY: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 79 GERMANY: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 80 GERMANY: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 81 GERMANY: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 83 GERMANY: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.2 UK

11.3.2.1 High burden of CVD in the UK to drive the adoption of oxidative stress assay products

TABLE 84 UK: OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 85 UK: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 UK: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 87 UK: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 88 UK: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 89 UK: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 UK: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 91 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.3 FRANCE

11.3.3.1 Rising prevalence of COPD in France to drive market growth

TABLE 92 FRANCE: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 93 FRANCE: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 94 FRANCE: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 96 FRANCE: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 97 FRANCE: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 FRANCE: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 99 FRANCE: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Sluggish growth in the Italian healthcare sector to hamper market growth

TABLE 100 ITALY: OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 101 ITALY: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 102 ITALY: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 103 ITALY: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 104 ITALY: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 105 ITALY: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 106 ITALY: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 107 ITALY: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Rising prevalence of chronic diseases to support market growth

TABLE 108 SPAIN: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 109 SPAIN: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 SPAIN: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 111 SPAIN: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 112 SPAIN: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 113 SPAIN: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 SPAIN: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 115 SPAIN: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 116 ROE: OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 117 ROE: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 ROE: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 119 ROE: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 120 ROE: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 121 ROE: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 122 ROE: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 123 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4 ASIA PACIFIC

TABLE 124 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 125 ASIA PACIFIC: OXIDATIVE STRESS ASSAYS MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 126 ASIA PACIFIC: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 127 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 128 ASIA PACIFIC: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 129 ASIA PACIFIC: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 130 ASIA PACIFIC: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 131 ASIA PACIFIC: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 132 ASIA PACIFIC: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Japan is the largest market for oxidative stress assays in the APAC

TABLE 133 JAPAN: OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 134 JAPAN: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 135 JAPAN: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 136 JAPAN: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 137 JAPAN: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 138 JAPAN: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 139 JAPAN: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 140 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.2 CHINA

11.4.2.1 China is the fastest-growing market for oxidative stress assays

TABLE 141 CHINA: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 142 CHINA: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 143 CHINA: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 144 CHINA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 145 CHINA: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 146 CHINA: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 147 CHINA: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 148 CHINA: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Rising prevalence of chronic diseases to propel market growth

TABLE 149 INDIA: OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 150 INDIA: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 151 INDIA: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 152 INDIA: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 153 INDIA: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 154 INDIA: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 155 INDIA: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 156 INDIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11.4.4 REST OF ASIA PACIFIC

TABLE 157 ROAPAC: MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 158 ROAPAC: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 159 ROAPAC: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 160 ROAPAC: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 161 ROAPAC: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 ROAPAC: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 163 ROAPAC: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 164 ROAPAC: OXIDATIVE STRESS ASSAYS MARKET, BY END USER, 2018–2025 (USD MILLION)

11.5 REST OF THE WORLD

TABLE 165 ROW: OXIDATIVE STRESS ASSAY MARKET, BY PRODUCT & SERVICE, 2018–2025 (USD MILLION)

TABLE 166 ROW: OXIDATIVE STRESS ASSAY CONSUMABLES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 167 ROW: OXIDATIVE STRESS ASSAYS MARKET, BY TECHNOLOGY, 2018–2025 (USD MILLION)

TABLE 168 ROW: MARKET, BY TEST TYPE, 2018–2025 (USD MILLION)

TABLE 169 ROW: OXIDATIVE STRESS ANTIOXIDANT CAPACITY ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 170 ROW: OXIDATIVE STRESS INDIRECT ASSAYS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 171 ROW: MARKET, BY DISEASE TYPE, 2018–2025 (USD MILLION)

TABLE 172 ROW: MARKET, BY END USER, 2018–2025 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 144)

12.1 OVERVIEW

FIGURE 22 KEY PLAYERS ADOPTED ORGANIC AS WELL AS INORGANIC GROWTH STRATEGIES BETWEEN JANUARY 2017 AND DECEMBER 2020

FIGURE 23 MARKET EVOLUTION FRAMEWORK

12.2 MARKET SHARE ANALYSIS

12.2.1 INTRODUCTION

FIGURE 24 MARKET SHARE ANALYSIS, BY KEY PLAYER, 2019

12.3 COMPANY EVALUATION MATRIX

12.3.1 STARS

12.3.2 EMERGING LEADERS

12.3.3 PERVASIVE PLAYERS

12.3.4 PARTICIPANTS

FIGURE 25 OXIDATIVE STRESS ASSAY MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

12.4 COMPETITIVE SITUATIONS AND TRENDS

12.4.1 KEY PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS (2017–2020)

TABLE 173 MARKET: KEY PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS (2017–2020)

12.4.2 KEY PRODUCT LAUNCHES (2017–2020)

TABLE 174 MARKET: KEY PRODUCT LAUNCHES (2017–2020)

12.4.3 KEY ACQUISITIONS (2017–2020)

TABLE 175 MARKET: KEY ACQUISITIONS (2017–2020)

12.4.4 KEY EXPANSIONS (2017–2020)

TABLE 176 MARKET: KEY EXPANSIONS (2017–2020)

13 COMPANY PROFILES (Page No. - 151)

13.1 MAJOR PLAYERS

(Business overview, Products offered, Recent developments, MNM view)*

13.1.1 ABCAM PLC

TABLE 177 ABCAM PLC: BUSINESS OVERVIEW

FIGURE 26 ABCAM PLC: COMPANY SNAPSHOT (2019)

TABLE 178 ABCAM PLC: PRODUCTS OFFERED

13.1.2 ENZO BIOCHEM, INC.

TABLE 179 ENZO BIOCHEM, INC.: BUSINESS OVERVIEW

FIGURE 27 ENZO BIOCHEM, INC.: COMPANY SNAPSHOT (2019)

TABLE 180 ENZO BIOCHEM, INC.: PRODUCTS OFFERED

13.1.3 MERCK KGAA

TABLE 181 MERCK KGAA: BUSINESS OVERVIEW

FIGURE 28 MERCK KGAA: COMPANY SNAPSHOT (2019)

TABLE 182 MERCK KGAA: PRODUCTS OFFERED

13.1.4 QIAGEN N.V.

TABLE 183 QIAGEN N.V.: BUSINESS OVERVIEW

FIGURE 29 QIAGEN N.V.: COMPANY SNAPSHOT (2019)

TABLE 184 QIAGEN N.V.: PRODUCTS OFFERED

13.1.5 THERMO FISHER SCIENTIFIC, INC.

TABLE 185 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 30 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2019)

TABLE 186 THERMO FISHER SCIENTIFIC, INC.: PRODUCTS OFFERED

13.1.6 AMS BIOTECHNOLOGY (EUROPE) LTD.

TABLE 187 AMS BIOTECHNOLOGY (EUROPE), LTD.: BUSINESS OVERVIEW

TABLE 188 AMS BIOTECHNOLOGY (EUROPE) LTD.: PRODUCTS OFFERED

13.1.7 BIOVISION, INC.

TABLE 189 BIOVISION, INC.: BUSINESS OVERVIEW

TABLE 190 BIOVISION, INC.: PRODUCTS OFFERED

13.1.8 CELL BIOLABS, INC.

TABLE 191 CELL BIOLABS, INC.: BUSINESS OVERVIEW

TABLE 192 CELL BIOLABS, INC.: PRODUCTS OFFERED

13.1.9 OXFORD BIOMEDICAL RESEARCH

TABLE 193 OXFORD BIOMEDICAL RESEARCH: BUSINESS OVERVIEW

TABLE 194 OXFORD BIOMEDICAL RESEARCH: PRODUCTS OFFERED

13.1.10 CAYMAN CHEMICAL

TABLE 195 CAYMAN CHEMICAL: BUSINESS OVERVIEW

TABLE 196 CAYMAN CHEMICAL: PRODUCTS OFFERED

13.2 OTHER PLAYERS

13.2.1 EAGLE BIOSCIENCES, INC.

TABLE 197 EAGLE BIOSCIENCES, INC.: BUSINESS OVERVIEW

TABLE 198 EAGLE BIOSCIENCES, INC.: PRODUCTS OFFERED

13.2.2 ARBOR ASSAYS

TABLE 199 ARBOR ASSAYS.: BUSINESS OVERVIEW

TABLE 200 ARBOR ASSAYS: PRODUCTS OFFERED

13.2.3 HYCULT BIOTECH

TABLE 201 HYCULT BIOTECH: BUSINESS OVERVIEW

TABLE 202 HYCULT BIOTECH: PRODUCTS OFFERED

13.2.4 KAMIYA BIOMEDICAL COMPANY

TABLE 203 KAMIYA BIOMEDICAL COMPANY: BUSINESS OVERVIEW

TABLE 204 KAMIYA BIOMEDICAL COMPANY: PRODUCTS OFFERED

13.2.5 MEGA TIP SAN.TIC.LTD.STI.

TABLE 205 MEGA TIP SAN.TIC.LTD.STI.: BUSINESS OVERVIEW

TABLE 206 MEGA TIP SAN.TIC.LTD.STI.: PRODUCTS OFFERED

13.2.6 PROMEGA CORPORATION

13.2.7 CALLEGARI SRL

13.2.8 IMMUNOCHEMISTRY TECHNOLOGIES, LLC

13.2.9 GENOX CORPORATION

13.2.10 TOXYS B.V.

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 182)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for oxidative stress assay. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, so as to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information as well as assess future prospects.

Primary research was conducted to identify segmentation types; industry trends; key players; and key market dynamics such as drivers, opportunities, challenges, industry trends, and strategies adopted by key players.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the oxidative stress assay market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and to arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the fluoroscopy industry.

Report Objectives

- To define, describe, and measure the oxidative stress assay market by test type, product, technology, disease type, end user and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, and growth opportunities)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the oxidative stress assay market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in North America, Europe, Asia Pacific (APAC), and Rest of the World

- To strategically analyze the market structure and profile key players and their core competencies3 in the oxidative stress assay market

- To track and analyze competitive developments such as product launches, expansions, acquisitions, and partnerships & collaborations in the oxidative stress assay market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present oxidative stress assay market report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company (Top 3 companies)

Company Information

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Oxidative Stress Assay Market