Plant Factory Market by Growing System (Non-soil-based, Soil-based, Hybrid), Crop Type (Fruits, Vegetables, Flowers & Ornamentals, Other Crop Types), Facility Type (Greenhouses, Indoor Farms), Light Type and Region - Global Forecast to 2028

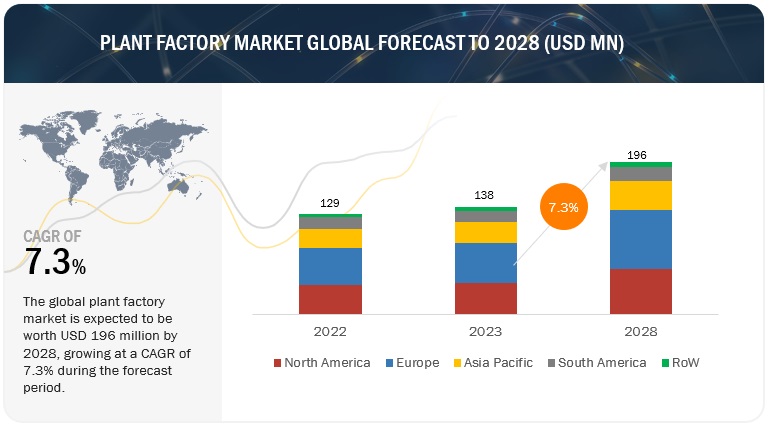

The global plant factory market size was valued at US$ 129 million in 2022 and is poised to grow from US$ 138 million in 2023 to US$ 196 million by 2028, growing at a CAGR of 7.3% in the forecast period (2023-2028). The demand for plant factory market has been steadily increasing over the years due to several factors. One of the main drivers is the growing global population and the need to produce more food in a sustainable manner. Plant factories offer a solution by using advanced technology to grow crops in a controlled environment, allowing for year-round production and higher yields. Additionally, plant factories are able to reduce the amount of water and land required for farming, making them an attractive option for countries facing water scarcity and limited arable land. Furthermore, consumers are increasingly demanding locally grown, pesticide-free produce, which can be provided by plant factories. As a result, the plant factory market is expected to continue growing in the coming years as the demand for sustainable, high-quality produce increases.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Plant Factory Market Dynamics

Driver: Higher yield as compared to traditional agriculture practices.

In order to increase food production, alternative farming techniques like vertical farming have emerged in response to rising food demand and decreasing cropland and fertile soils. These technologies are being used to achieve food self-sufficiency in countries that have suffered with domestic production and supply issues for a long time due to a lack of natural resources and favourable climatic conditions. Lack of arable land, lack of high-quality soil, and increased food demand have led to the development of novel techniques like vertical farming, which is gradually gaining acceptance in many countries. To maximise space, vertical farming involves producing food in stacks or layers. Its benefits include better area utilisation, reliable year-round crop production that is unaffected by weather, and low water and pesticide usage.

Hydroponic farming uses far less water than conventional farming because of the concentrated usage of water. Additionally, the plants only use 0.1% of the water that is available to them, with the remainder being returned to the environment through evapotranspiration. Conventional farming uses a lot of water, but much of it is wasted owing to insufficient irrigation, evaporation, and poor water management. Vertical farming enables efficient use of water, i.e., up to 95% less water compared to traditional farming methods. According to the Columbia University Earth Institute, vertical farmers use 70% to 95% less water than traditional farmers do in plant cultivation.

Restraint: High capital investments

High capital investments can be a significant barrier to entry for new businesses in the plant factory market. According to article by CoBANK 2022, the albatross of vertical farms is their high investment and operating expenses. The initial investment costs of real estate can increase as it gets closer to urban areas. Construction expenses for a single large-scale vertical farming plant could exceed USD100 million, according to estimates from the industry. It should be noted that technological costs tend to decline with time, and farms can relocate to cities with low property values or financial incentives from the local government. By necessity, improving plant growth in vertical farming necessitates significant technological and energy investment to control growing conditions like temperature, light, humidity, oxygen, and CO2 levels.

The high costs associated with building and maintaining these facilities can make it challenging for small or medium-sized businesses to compete with larger corporations. Furthermore, the initial investment required for setting up a plant factory can be significant, and the return on investment may not be realized for several years. This can be discouraging for investors who may prefer to invest in other sectors with a more immediate payoff. Additionally, the cost of technology and equipment required for plant factories can be high. This includes lighting systems, environmental control systems, and specialized equipment for hydroponic or aeroponic growing methods. As a result, companies that cannot afford to invest in the latest technology may struggle to compete with those that can. Overall, the high capital investment required to set up a plant factory can create barriers to entry for new players in the market, limiting competition and potentially leading to market consolidation.

Opportunity: Increased adoption of plant factories by restaurants and grocery stores amid the COVID-19 pandemic

The trend of adoption of indoor farming by restaurants and grocery stores is being fuelled by retailer acceptance and, eventually, public acceptance. Walmart, Kroger, and Albertsons are among the grocery stores that have agreements with indoor growers. Additionally, Publix, which is based in Lakeland, Florida, has introduced an on-site trailer farm from a nearby hydroponic grower. According to a survey conducted in 2021 by FMI, The Food Industry Association, 43% of consumers did not prefer produce grown indoors as opposed to outdoors. Members of Generation Z, who are quickly overtaking baby boomers as America's most influential demographic group, were most likely to prefer indoor sources.

However, many restaurants have advanced the idea of local food in recent years and now accept hyperlocal food, in which restaurants either produce their own produce or source some of it from nearby farms. While promoting sustainability and the local economy, they make an extra effort to provide the best quality ingredients. There are restaurants that source almost all their food locally, known as hyperlocal restaurants. Some restaurants have their own gardens where they produce the vegetables they use in their dishes. Orlando World Centre Marriott resort is also doing the same. In their restaurant, they built a vertical farm with a 4000 cubic feet space. It is a hydroponic system that will yearly produce 13,000 lbs. of other leafy greens, herbs, and micro-greens in addition to 1,10,000 heads of lettuce. That will be used to support the requirements for the hotel's banquets as well as the nine on-site lounges and restaurants. That is, there will be fresh produce and herbs accessible every day. 40 to 50 varieties of produce can be grown and incorporated into the restaurant menus- pick- to- plate within hours for providing maximum freshness.

Challenge: Tapping into the organic food market

According to the Organic Trade Association, in US Organic sales surpassed USD 63 billion between 2020 and 2021, growing by USD 1.4 billion (2%) overall over the year. Food sales, which account for more than 90% of organic sales, increased to USD 57.5 billion (an increase of about 2%), and non-food sales hit USD 6 billion (7 percent growth).

Organic farming is often associated with higher quality and better-tasting produce, which can be a significant selling point for consumers. Plant factories may struggle to replicate the taste and quality of organic produce, which could limit their appeal to certain consumers. Furthermore, organic farming is often supported by government regulations and subsidies, which can make it more financially attractive to farmers than other forms of agriculture. This can make it challenging for plant factories to compete with organic farms on price, as organic farms may be able to offer their products at lower prices due to government support.

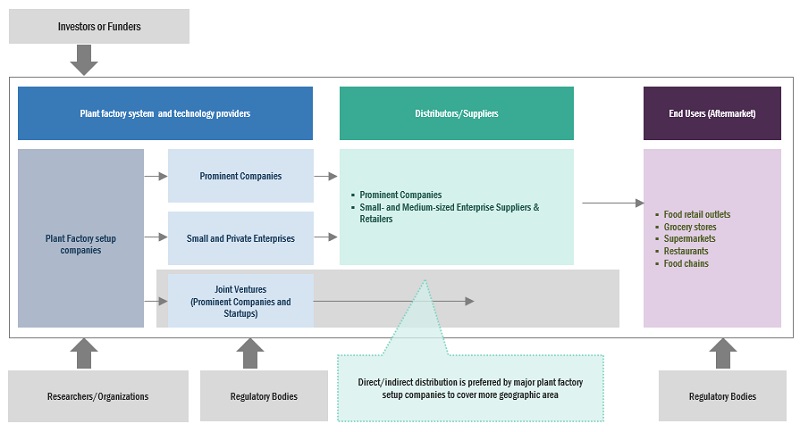

Plant Factory Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of plant factory. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include AeroFarms (US), Gotham Greens (US), BOWERY FARMING INC. (US), Oishii (US), Plenty Unlimited Inc. (US), MIRAI (Japan), Agricool (France), AppHarvest (US), CropOne (UAE) and BrightFarms (US).

Based on facility type, Indoor farms segment is estimated to account for the second largest market share of the plant factory market

Based on facility type, Indoor farms segment is estimated to account for the second largest market share. Indoor farming, also known as vertical farming, offers several advantages over traditional farming methods. One of the main benefits is the ability to grow crops year-round, regardless of weather conditions. This reduces the risk of crop failures due to extreme temperatures, drought, or pests. Additionally, indoor farming allows for precise control of growing conditions, such as temperature, humidity, and lighting, which can lead to higher crop yields and improved quality. Indoor farming also uses significantly less water than traditional farming methods, as water can be recycled and reused in a closed system.

Full artificial light segment of the plant factory market by light type is projected to witness the highest CAGR during the forecast period.

Based on light type, the full artificial light segment estimated to account for the highest growth rate. Full artificial light, or LED lighting, is a critical component of plant factories, which are indoor farms designed specifically for commercial crop production. LED lighting technology has advanced significantly in recent years, allowing for precise control over the light spectrum and intensity, making it possible to optimize plant growth and increase crop yields. This technology has been a major driver of the plant factory market, as it enables year-round crop production in a controlled indoor environment, independent of weather conditions and seasonal changes.

Based on crop type, Vegetables segment are anticipated to dominate the market.

Based on crop type, the market is segmented into the vegetables, fruits, flowers & ornamentals, other crop types. By providing an ideal growing environment, plant factories can produce vegetables that are more consistent in size, color, and taste, and are free from pesticides and other contaminants. Additionally, plant factories can use advanced technologies such as hydroponics and aeroponics to deliver nutrients directly to the roots of plants, reducing the need for fertilizers and improving the efficiency of nutrient uptake. The result is produce that is free from harmful chemical residues and other contaminants, promoting healthier and safer food for consumers.

The North America market is projected to contribute the second largest share for the plant factory market.

North America is home to a large number of plant factory companies, ranging from start-ups to established players, all focused on developing and scaling innovative solutions to meet the growing demand for fresh, high-quality produce. For instance, Plenty, a San Francisco-based vertical farming start-up that uses machine learning and robotics to optimize plant growth and reduce water usage. Plenty's plant factories are able to produce crops year-round, with up to 350 times more yield per square foot than traditional farming methods. The company has raised over USD 500 million in funding and has partnered with several major retailers and restaurants to provide locally grown produce. According to Agricultural Marketing Resource Centre 2021, greenhouse crops are the top 10 commodities in 42 states and the top five commodities grown in 27 states in the USA. Moreover, ten US states provide more than two-thirds of the nursery crop output grown in greenhouses, with California supplying around 20% of the total. In the United States, greenhouse farming is becoming more and more popular as a means of producing local, fresh vegetables without the need for cold weather.

Key Market Players

The key players in this include AeroFarms (US), Gotham Greens (US), BOWERY FARMING INC. (US), Oishii (US), Plenty Unlimited Inc. (US), MIRAI (Japan), Agricool (France), AppHarvest (US), CropOne (UAE) and BrightFarms (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Growing System (Soil-based, Non-soil-based, and Hybrid), Facility Type (Greenhouses, Indoor Farms, Other Facility Types), Light Type (Sunlight, Full Artificial Light), Crop Type (Vegetables, Fruits, Flowers & Ornamentals, other crop type), and Region |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

AeroFarms (US), Gotham Greens (US), BOWERY FARMING INC. (US), Oishii (US), Plenty Unlimited Inc. (US) |

This research report categorizes the plant factory market based on growing system, facility type, light type, crop type, and region.

Based on growing system, the plant factory market has been segmented as follows:

- Soil based

- Non-soil based

- Hybrid

Based on facility type, the plant factory market has been segmented as follows:

- Greenhouses

- Indoor farms

- Other facility types

Based on the light type, the plant factory market has been segmented as follows:

- Sunlight

- Full artificial light

Based on the crop type, the plant factory market has been segmented as follows:

- Vegetables

- Fruits

- Flowers & ornamentals

- Other crop type

Based on the region, the plant factory market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East & South Africa)

Recent Developments

- In Feb 2023, the Public Investment Fund (“PIF”) signed a joint venture agreement with AeroFarms, to establish a company in Riyadh to build and operate indoor vertical farms in Saudi Arabia and the wider Middle East and North Africa (MENA) region. The joint venture is anticipated to enable year-round, sustainable local sourcing of high-quality crops cultivated on AeroFarms' unique smart agriculture technology ("AgTech") platform, which helps address more general supply chain issues in the sector.

- In Feb 2023, Realty Income Corporation and Plenty Unlimited INC. announced that they have entered into a strategic real estate alliance to support the development of Plenty’s indoor vertical farms. Under the terms of the agreement, Realty Income will acquire and provide development funding for properties that will house Plenty’s indoor farms. These properties leased to Plenty under long-term net leases. The agreement provides for up to USD 1 billion of development opportunities.

- In April 2022, Bowery Farming announced a partnership with The Nature Conservancy (TNC) as part of its’ ‘Earth Month Rewild the Land initiative. With this partnership, Bowery is about to restore 50 acres in the U.S. to support conservation efforts in restoring ecosystem biodiversity and spotlight the rewilding movement, which returns retired farmland and other degraded land to Mother Nature.

- In Sept 2022, MIRAI Co., Ltd. concluded an agreement with ONNNA Greens AS, Norway for the cultivation equipment for a fully closed artificial light-type plant factory for the second expansion phase, in addition to the factory already in operation. This agreement will strengthen the company’s cooperation in the development of various labor-saving equipment.

- In December 2021, For the first operation of Gotham Greens on the West Coast, Gotham Greens, has opened the initial phase of its 10-acre hydroponic greenhouse near the University of California-Davis campus. With this national greenhouse expansion, Gotham Greens will have a network of high-tech hydroponic greenhouses spanning nine facilities in six states.

Frequently Asked Questions (FAQ):

How big is the plant factory market?

The plant factory market is projected to rise from its projected USD 138 million in 2023 to USD 196 million by 2028 at a compound annual growth rate (CAGR) of 7.3%.

Which players are involved in the manufacturing of plant factory market?

The key players in this market include AeroFarms (US), Gotham Greens (US), BOWERY FARMING INC. (US), Oishii (US), Plenty Unlimited Inc. (US), MIRAI (Japan), Agricool (France), AppHarvest (US), CropOne (UAE) and BrightFarms (US). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific and Europe. They also have manufacturing facilities along with strong distribution networks across these regions.

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the plant factory market?

On request, We will provide details on market size, key players, growth rate of this industry in the Oceania region. Also, you can let us know if there are any other countries of your interest.

What is the future growth potential of plant factory market?

The future growth potential of the plant factory market is significant, buoyed by a convergence of factors propelling innovation in agriculture. With increasing demand for locally sourced, fresh produce coupled with urbanization and the scarcity of arable land, plant factories offer a compelling solution. Technological advancements in automation, artificial intelligence, and environmental control systems are driving efficiency and productivity gains in these indoor farming facilities. Moreover, heightened awareness of climate change and its impact on traditional farming methods underscores the importance of resilient and sustainable agricultural practices, further boosting the appeal of plant factories.

What is the total CAGR expected to be recorded for the plant factory market during 2023-2028?

The CAGR is expected to record a CAGR of 7.3 % from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASING GLOBAL POPULATIONRAPID URBANIZATION

-

5.3 MARKET DYNAMICSDRIVERS- Higher yield compared to traditional agricultural practices- Low impact on external weather conditionsRESTRAINTS- High capital investments- Requirement of high-precision environmentOPPORTUNITIES- Increased adoption of plant factories by restaurants and grocery stores amid COVID-19 pandemic- Rising demand for floriculture and ornamental horticultureCHALLENGES- Tapping into organic food market- Risk of equipment failure and delay in learning curve among growers- Spread of waterborne diseases and algae in closed systems

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSPLANT FACTORY PROVIDERSPLANT FACTORY TECHNOLOGY PROVIDERSCONSULTING & MANAGEMENT SERVICESEND USERS

-

6.3 TECHNOLOGY ANALYSISAUTOMATION AND ROBOTICSDATA ANALYTICS AND MACHINE LEARNING

-

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSES

-

6.5 PATENT ANALYSIS

-

6.6 ECOSYSTEM/MARKET MAPDEMAND SIDESUPPLY SIDE

- 6.7 TRADE SCENARIO

-

6.8 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY FRAMEWORK- North America- Europe- Asia Pacific

-

6.9 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.11 CASE STUDY ANALYSISUSE CASE 1: GOODLEAF FARMS PROVIDED CANADIANS WITH FRESH, NUTRITIOUS, PESTICIDE-FREE BABY GREENS AND MICROGREENSUSE CASE 2: TOSHIBA LIGHTING & TECHNOLOGY CORPORATION HELPED SPREAD CO., LTD. ACHIEVE ENERGY SAVINGS AND REDUCE COSTSUSE CASE 3: SKY GREENS SAVED ON ELECTRICITY AND WATER BY USING NATURAL LIGHT SOURCES

- 6.12 KEY CONFERENCES & EVENTS IN 2023

- 7.1 INTRODUCTION

-

7.2 NON-SOIL-BASEDBETTER YIELD AND NECESSITY TO GROW CROPS IN SMALLER SPACES TO DRIVE MARKETHYDROPONICSAEROPONICSAQUAPONICS

-

7.3 SOIL-BASEDCLIMATE CHANGE AND INSUFFICIENT CROP PRODUCTIVITY TO DRIVE DEMAND FOR SOIL-BASED AGRICULTURE

-

7.4 HYBRIDHYBRID SYSTEMS TO OFFER DUAL ADVANTAGE FOR OPTIMUM PRODUCTION

- 8.1 INTRODUCTION

-

8.2 FRUITSYEAR-ROUND HARVEST, REDUCED WATER USAGE, AND MINIMAL DAMAGE POSSIBILITIES TO DRIVE MARKETBERRIES- Growing popularity of berries as healthy and delicious food to fuel production in plant factoriesOTHER FRUITS

-

8.3 VEGETABLESCONSISTENT NUTRIENT LEVELS, REDUCED PESTICIDE USE, AND LONGER SHELF LIFE TO DRIVE DEMANDTOMATO- Enhanced nutritive value and reduced negative environmental impact to drive demandLEAFY GREENS- Enhanced shelf-life, increased food safety, and security of supply to grow demand for leafy greensEGGPLANT- High sensitivity to external conditions to augment production of eggplants in plant factoriesHERBS & MICROGREENS- Need to retain peak flavor intensity of microgreens to drive production in plant factoriesOTHER VEGETABLES

-

8.4 FLOWERS & ORNAMENTALSREQUIREMENT FOR COMPLETE CONTROL OVER NUTRITIONAL FLOW AND MONITOR PH LEVELS TO DRIVE MARKETPERENNIALS- Ease of production to drive market for perennials produced in plant factoriesANNUALS- Wider cultivation of ornamental annuals in indoor farms and greenhouses to boost marketBIENNIAL- Longer growth periods of biennials supplemented by secure environments to propel market

- 8.5 OTHER CROP TYPES

- 9.1 INTRODUCTION

-

9.2 GREENHOUSESNEED TO PRODUCE WIDER CROP VARIETIES AND PROVIDE HIGHER PROFITABILITY AND GROWTH PROSPECTS TO BOOST MARKET

-

9.3 INDOOR FARMSNEED TO FACILITATE MORE THAN THREE-FOLD YIELD THAN TRADITIONAL FARMING TO BOOST DEMAND

- 9.4 OTHER FACILITY TYPES

- 10.1 INTRODUCTION

-

10.2 FULL ARTIFICIAL LIGHTNEED FOR PRECISE CONTROL OF GROWING CONDITIONS AND YEAR-ROUND PRODUCTION OF CROPS TO DRIVE MARKET

-

10.3 SUNLIGHTNEED TO REDUCE ENERGY CONSUMPTION, DECREASE PRODUCTION COSTS, AND IMPROVE CROP QUALITY TO PROPEL MARKET

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Youth opting to live in cities and population of agricultural workers getting older to drive marketJAPAN- Advancements in automation and AI technologies and availability of limited space to propel marketSINGAPORE- Food security concerns, extensive R&D, and adoption of technical advancements to propel marketINDIA- Rising concerns about food security and growing population to drive demand for plant factoriesAUSTRALIA & NEW ZEALAND- Harsh climatic conditions, need to reduce reliance on imported products, and scarcity of fresh water to drive marketSOUTH KOREA- Favorable government legislation and investments by major playersTAIWAN- Limited agricultural land and destructive calamities to drive demand for plant factoriesREST OF ASIA PACIFIC

-

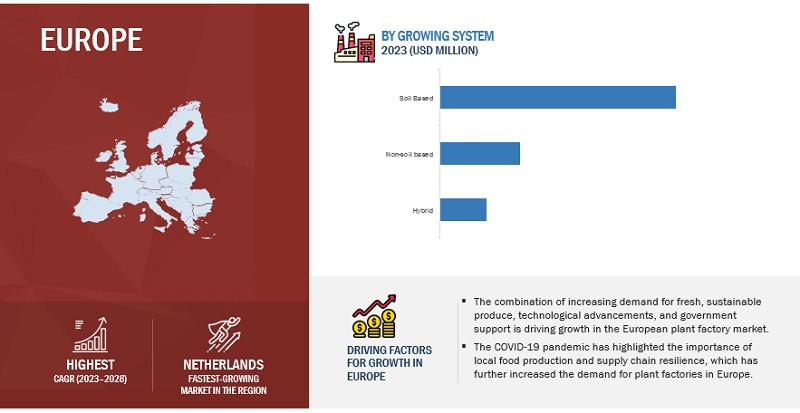

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISNETHERLANDS- Higher prices and increasing export volume of agricultural products to drive demand for efficient farmingSPAIN- Increasing investments and advanced setups to achieve higher volumes of products to drive marketITALY- Rising organic croplands and demand for out-of-season products to boost demand for plant factoriesUK- Shortage of agricultural workers and regulations and restrictions due to Brexit to propel marketFRANCE- Decline in agricultural land and continuous urbanization to lead to gradual adoption of modern farming techniquesTURKEY- Availability of alternative energy sources and growing interest in soilless crop cultivation to boost marketREST OF EUROPE

-

11.4 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Loss of favorable farmlands and need to boost overall crop productivity to drive demand for plant factoriesCANADA- Unfavorable weather conditions and awareness of modern farming techniques to drive marketMEXICO- Need to reduce carbon footprint and crop cultivation in water scarcity to drive demand for plant factories

-

11.5 `REST OF THE WORLDROW: RECESSION IMPACT ANALYSISAFRICA- Integration of technologies and government initiatives to augment agricultural sector to drive marketMIDDLE EAST- Lack of fresh water for agriculture and arable land to augment demand for CEA practices

- 11.6 SOUTH AMERICA

-

11.7 SOUTH AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Limited water resources and increasing population to drive adoption rate of plant factoriesARGENTINA- Surge in food consumption and necessity to establish reliable and secure food supply to drive demand for plant factoriesREST OF SOUTH AMERICA

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.5 PLANT FACTORY MARKET, EVALUATION QUADRANT FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.6 COMPETITIVE SCENARIODEALSOTHERS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSAEROFARMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGOTHAM GREENS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBOWERY FARMING INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewOISHII- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPLENTY UNLIMITED INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMIRAI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAGRICOOL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAPPHARVEST- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCROP ONE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRIGHTFARMS- Business overview- Products/Solutions/Services offered- MnM view

-

13.3 OTHER PLAYERSFARMINOVA PLANT FACTORY- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTAIKISHA LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewIRON OX, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVERTICAL HARVEST- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSMALLHOLD- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBADIA FARMSFARM.ONE INC.KALERA INC.SKY GREENSDREAM HARVEST

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

-

14.3 HYDROPONICS MARKETMARKET DEFINITIONMARKET OVERVIEWHYDROPONICS MARKET, BY TYPE- IntroductionHYDROPONICS MARKET, BY REGION- Introduction

-

14.4 INDOOR FARMING TECHNOLOGY MARKETMARKET DEFINITIONMARKET OVERVIEWINDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM- IntroductionINDOOR FARMING TECHNOLOGY MARKET, BY REGION- Introduction

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 US DOLLAR EXCHANGE RATES CONSIDERED, 2019–2022

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 3 PLANT FACTORY MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 4 YIELD OF CROPS: SOIL CULTIVATION VS. HYDROPONICS (LBS/ACRE)

- TABLE 5 KEY PATENTS PERTAINING TO PLANT FACTORY MARKET (CROPS & TECHNOLOGIES), 2022

- TABLE 6 PLANT FACTORY MARKET: ECOSYSTEM

- TABLE 7 IMPORT DATA OF FRUITS FOR KEY COUNTRIES, 2022 (VALUE)

- TABLE 8 EXPORT DATA OF FRUITS FOR KEY COUNTRIES, 2022 (VALUE)

- TABLE 9 IMPORT DATA OF OTHER VEGETABLES FOR KEY COUNTRIES, 2022 (VALUE)

- TABLE 10 EXPORT DATA OF OTHER VEGETABLES FOR KEY COUNTRIES, 2022 (VALUE)

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 PLANT FACTORY MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CROP TYPES

- TABLE 18 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- TABLE 19 PLANT FACTORY MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023

- TABLE 20 PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 21 PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 22 NON-SOIL-BASED: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 23 NON-SOIL-BASED: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 24 NON-SOIL-BASED: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 NON-SOIL-BASED: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 SOIL-BASED: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 27 SOIL-BASED: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 HYBRID: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 HYBRID: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 PLANT FACTORY MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 31 PLANT FACTORY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 32 PLANT FACTORY MARKET, BY VEGETABLE TYPE, 2019–2022 (USD MILLION)

- TABLE 33 PLANT FACTORY MARKET, BY VEGETABLE TYPE, 2023–2028 (USD MILLION)

- TABLE 34 VEGETABLES: PLANT FACTORY MARKET, BY LEAFY GREENS TYPE, 2019–2022 (USD MILLION)

- TABLE 35 VEGETABLES: PLANT FACTORY MARKET, BY LEAFY GREENS TYPE, 2023–2028 (USD MILLION)

- TABLE 36 VEGETABLES: PLANT FACTORY MARKET, BY HERBS & MICROGREENS TYPE, 2019–2022 (USD MILLION)

- TABLE 37 VEGETABLES: PLANT FACTORY MARKET, BY HERBS & MICROGREENS TYPE, 2023–2028 (USD MILLION)

- TABLE 38 PLANT FACTORY MARKET, BY FRUIT TYPE, 2019–2022 (USD MILLION)

- TABLE 39 PLANT FACTORY MARKET, BY FRUIT TYPE, 2023–2028 (USD MILLION)

- TABLE 40 PLANT FACTORY MARKET, BY FLOWERS & ORNAMENTALS TYPE, 2019–2022 (USD MILLION)

- TABLE 41 PLANT FACTORY MARKET, BY FLOWERS & ORNAMENTALS TYPE, 2023–2028 (USD MILLION)

- TABLE 42 FRUITS: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 43 FRUITS: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 VEGETABLES: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 VEGETABLES: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 FLOWERS & ORNAMENTALS: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 47 FLOWERS & ORNAMENTALS: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 OTHER CROP TYPES: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 49 OTHER CROP TYPES: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 51 PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 52 GREENHOUSES: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 GREENHOUSES: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 INDOOR FARMS: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 55 INDOOR FARMS: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 OTHER FACILITY TYPES: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 OTHER FACILITY TYPES: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 PLANT FACTORY MARKET, BY LIGHT TYPE, 2019–2022 (USD MILLION)

- TABLE 59 PLANT FACTORY MARKET, BY LIGHT TYPE, 2023–2028 (USD MILLION)

- TABLE 60 FULL ARTIFICIAL LIGHT: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 61 FULL ARTIFICIAL LIGHT: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 SUNLIGHT: PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 63 SUNLIGHT: PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 PLANT FACTORY MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 PLANT FACTORY MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: PLANT FACTORY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 67 ASIA PACIFIC: PLANT FACTORY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: PLANT FACTORY MARKET, BY LIGHT TYPE, 2019–2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: PLANT FACTORY MARKET, BY LIGHT TYPE, 2023–2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: PLANT FACTORY MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: PLANT FACTORY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 78 CHINA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 79 CHINA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 80 CHINA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 81 CHINA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 82 JAPAN: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 83 JAPAN: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 84 JAPAN: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 85 JAPAN: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 SINGAPORE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 87 SINGAPORE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 88 SINGAPORE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 89 SINGAPORE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 INDIA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 91 INDIA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 92 INDIA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 93 INDIA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 94 AUSTRALIA & NEW ZEALAND: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 95 AUSTRALIA & NEW ZEALAND: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 96 AUSTRALIA & NEW ZEALAND: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 97 AUSTRALIA & NEW ZEALAND: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 98 SOUTH KOREA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 99 SOUTH KOREA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 102 TAIWAN: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 103 TAIWAN: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 104 TAIWAN: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 105 TAIWAN: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: PLANT FACTORY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 EUROPE: PLANT FACTORY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 113 EUROPE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 114 EUROPE: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 115 EUROPE: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 117 EUROPE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 118 EUROPE: PLANT FACTORY MARKET, BY LIGHT TYPE, 2019–2022 (USD MILLION)

- TABLE 119 EUROPE: PLANT FACTORY MARKET, BY LIGHT TYPE, 2023–2028 (USD MILLION)

- TABLE 120 EUROPE: PLANT FACTORY MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 121 EUROPE: PLANT FACTORY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 122 NETHERLANDS: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 123 NETHERLANDS: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 124 NETHERLANDS: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 125 NETHERLANDS: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 SPAIN: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 127 SPAIN: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 128 SPAIN: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 129 SPAIN: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 130 ITALY: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 131 ITALY: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 132 ITALY: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 133 ITALY: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 UK: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 135 UK: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 136 UK: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 137 UK: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 138 FRANCE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 139 FRANCE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 140 FRANCE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 141 FRANCE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 142 TURKEY: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 143 TURKEY: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 144 TURKEY: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 145 TURKEY: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 146 REST OF EUROPE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 147 REST OF EUROPE: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 149 REST OF EUROPE: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 NORTH AMERICA: PLANT FACTORY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 151 NORTH AMERICA: PLANT FACTORY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 152 NORTH AMERICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 153 NORTH AMERICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 155 NORTH AMERICA: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 156 NORTH AMERICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 157 NORTH AMERICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 158 NORTH AMERICA: PLANT FACTORY MARKET, BY LIGHT TYPE, 2019–2022 (USD MILLION)

- TABLE 159 NORTH AMERICA: PLANT FACTORY MARKET, BY LIGHT TYPE, 2023–2028 (USD MILLION)

- TABLE 160 NORTH AMERICA: PLANT FACTORY MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 161 NORTH AMERICA: PLANT FACTORY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 162 US: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 163 US: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 164 US: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 165 US: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 166 CANADA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 167 CANADA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 168 CANADA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 169 CANADA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 170 MEXICO: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 171 MEXICO: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 172 MEXICO: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 173 MEXICO: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 174 ROW: PLANT FACTORY MARKET, BY SUBREGION, 2019–2022 (USD MILLION)

- TABLE 175 ROW: PLANT FACTORY MARKET, BY SUBREGION, 2023–2028 (USD MILLION)

- TABLE 176 ROW: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 177 ROW: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 178 ROW: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 179 ROW: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 180 ROW: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 181 ROW: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 182 ROW: PLANT FACTORY MARKET, BY LIGHT TYPE, 2019–2022 (USD MILLION)

- TABLE 183 ROW: PLANT FACTORY MARKET, BY LIGHT TYPE, 2023–2028 (USD MILLION)

- TABLE 184 ROW: PLANT FACTORY MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 185 ROW: PLANT FACTORY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 186 AFRICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 187 AFRICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 188 AFRICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 189 AFRICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 190 MIDDLE EAST: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 191 MIDDLE EAST: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 192 MIDDLE EAST: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 193 MIDDLE EAST: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 194 SOUTH AMERICA: PLANT FACTORY MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 195 SOUTH AMERICA: PLANT FACTORY MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 196 SOUTH AMERICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 197 SOUTH AMERICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 198 SOUTH AMERICA: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 199 SOUTH AMERICA: PLANT FACTORY MARKET, BY NON-SOIL-BASED GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 200 SOUTH AMERICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 201 SOUTH AMERICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 202 SOUTH AMERICA: PLANT FACTORY MARKET, BY LIGHT TYPE, 2019–2022 (USD MILLION)

- TABLE 203 SOUTH AMERICA: PLANT FACTORY MARKET, BY LIGHT TYPE, 2023–2028 (USD MILLION)

- TABLE 204 SOUTH AMERICA: PLANT FACTORY MARKET, BY CROP TYPE, 2019–2022 (USD MILLION)

- TABLE 205 SOUTH AMERICA: PLANT FACTORY MARKET, BY CROP TYPE, 2023–2028 (USD MILLION)

- TABLE 206 BRAZIL: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 207 BRAZIL: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 208 BRAZIL: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 209 BRAZIL: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 210 ARGENTINA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 211 ARGENTINA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 212 ARGENTINA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 213 ARGENTINA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2019–2022 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023–2028 (USD MILLION)

- TABLE 216 REST OF SOUTH AMERICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2019–2022 (USD MILLION)

- TABLE 217 REST OF SOUTH AMERICA: PLANT FACTORY MARKET, BY FACILITY TYPE, 2023–2028 (USD MILLION)

- TABLE 218 PLANT FACTORY MARKET: DEGREE OF COMPETITION (FRAGMENTED)

- TABLE 219 STRATEGIES ADOPTED BY KEY PLANT FACTORY MANUFACTURERS

- TABLE 220 CROP TYPE: COMPANY FOOTPRINT

- TABLE 221 FACILITY TYPE: COMPANY FOOTPRINT

- TABLE 222 REGION: COMPANY FOOTPRINT

- TABLE 223 OVERALL COMPANY FOOTPRINT

- TABLE 224 PLANT FACTORY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 225 PLANT FACTORY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 226 PLANT FACTORY MARKET: DEALS, 2018–2023

- TABLE 227 PLANT FACTORY MARKET: OTHERS, 2018–2023

- TABLE 228 AEROFARMS: BUSINESS OVERVIEW

- TABLE 229 AEROFARMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 AEROFARMS: NEW PRODUCT LAUNCHES

- TABLE 231 AEROFARMS: PLANT FACTORY MARKET: DEALS

- TABLE 232 AEROFARMS: PLANT FACTORY MARKET: OTHERS

- TABLE 233 GOTHAM GREENS: BUSINESS OVERVIEW

- TABLE 234 GOTHAM GREENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 GOTHAM GREENS: PLANT FACTORY MARKET: OTHERS

- TABLE 236 BOWERY FARMING INC.: BUSINESS OVERVIEW

- TABLE 237 BOWERY FARMING INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BOWERY FARMING INC.: PLANT FACTORY MARKET: DEALS

- TABLE 239 BOWERY FARMING INC.: PLANT FACTORY MARKET: OTHERS

- TABLE 240 OISHII: BUSINESS OVERVIEW

- TABLE 241 OISHII: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 PLENTY UNLIMITED INC.: BUSINESS OVERVIEW

- TABLE 243 PLENTY UNLIMITED INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 PLENTY UNLIMITED INC.: PLANT FACTORY MARKET: DEALS

- TABLE 245 PLENTY UNLIMITED INC.: PLANT FACTORY MARKET: OTHERS

- TABLE 246 MIRAI: BUSINESS OVERVIEW

- TABLE 247 MIRAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 MIRAI: PLANT FACTORY MARKET: DEALS

- TABLE 249 AGRICOOL: BUSINESS OVERVIEW

- TABLE 250 AGRICOOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 APPHARVEST: BUSINESS OVERVIEW

- TABLE 252 APPHARVEST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 APPHARVEST: PLANT FACTORY MARKET: DEALS

- TABLE 254 APPHARVEST: PLANT FACTORY MARKET: OTHERS

- TABLE 255 CROP ONE: BUSINESS OVERVIEW

- TABLE 256 CROP ONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 CROP ONE: PLANT FACTORY MARKET: DEALS

- TABLE 258 CROP ONE: PLANT FACTORY MARKET: OTHERS

- TABLE 259 BRIGHTFARMS: BUSINESS OVERVIEW

- TABLE 260 BRIGHTFARMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 BRIGHTFARMS: PLANT FACTORY MARKET: OTHERS

- TABLE 262 FARMINOVA PLANT FACTORY: BUSINESS OVERVIEW

- TABLE 263 FARMINOVA PLANT FACTORY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 TAIKISHA LTD.: BUSINESS OVERVIEW

- TABLE 265 TAIKISHA LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 TAIKISHA LTD.: PLANT FACTORY MARKET: OTHERS

- TABLE 267 IRON OX, INC.: BUSINESS OVERVIEW

- TABLE 268 IRON OX, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 IRON OX, INC.: PLANT FACTORY MARKET: OTHERS

- TABLE 270 VERTICAL HARVEST: BUSINESS OVERVIEW

- TABLE 271 VERTICAL HARVEST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 272 SMALLHOLD: BUSINESS OVERVIEW

- TABLE 273 SMALLHOLD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 HYDROPONICS MARKET, BY TYPE, 2019–2021 (USD MILLION)

- TABLE 275 HYDROPONICS MARKET, BY TYPE, 2022–2027 (USD MILLION)

- TABLE 276 HYDROPONIC TYPES MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 277 HYDROPONIC TYPES MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 278 HYDROPONIC INPUTS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 279 HYDROPONIC INPUTS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 280 HYDROPONIC CROP MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 281 HYDROPONIC CROP MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 282 INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2015–2018 (USD MILLION)

- TABLE 283 INDOOR FARMING TECHNOLOGY MARKET, BY GROWING SYSTEM, 2019–2026 (USD MILLION)

- TABLE 284 INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2015–2018 (USD MILLION)

- TABLE 285 INDOOR FARMING TECHNOLOGY MARKET, BY REGION, 2019–2026 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 PLANT FACTORY MARKET: GEOGRAPHIC SCOPE

- FIGURE 3 PLANT FACTORY MARKET: RESEARCH DESIGN

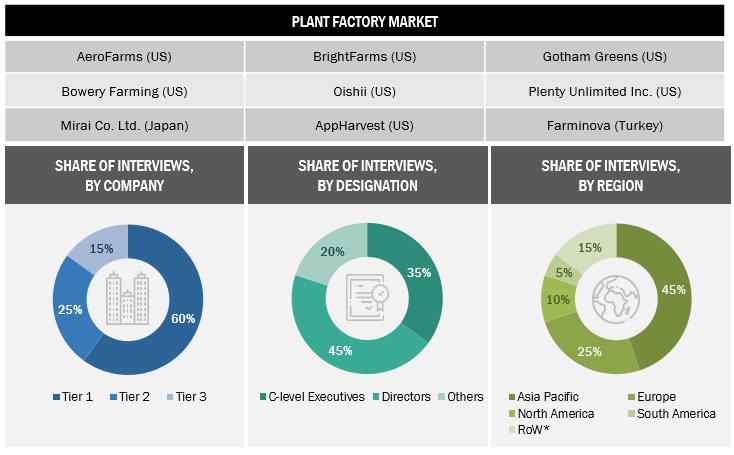

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 PLANT FACTORY MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 6 PLANT FACTORY MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 PLANT FACTORY MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 8 PLANT FACTORY MARKET SIZE ESTIMATION, BY CROP TYPE (SUPPLY SIDE)

- FIGURE 9 DATA TRIANGULATION AND MARKET BREAKUP

- FIGURE 10 ASSUMPTIONS

- FIGURE 11 RECESSION INDICATORS AND IMPACT ON PLANT FACTORY MARKET

- FIGURE 12 GLOBAL PLANT FACTORY MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 13 PLANT FACTORY MARKET SIZE, BY FACILITY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 PLANT FACTORY MARKET SIZE, BY GROWING SYSTEM, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 PLANT FACTORY MARKET SIZE, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 PLANT FACTORY MARKET SIZE, BY LIGHT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 PLANT FACTORY MARKET SHARE, BY REGION, 2022

- FIGURE 18 RISING POPULATION AND CONCERNS OVER FOOD SECURITY TO DRIVE GROWTH OF PLANT FACTORY MARKET

- FIGURE 19 VEGETABLES SEGMENT AND CHINA TO ACCOUNT FOR LARGEST MARKET SHARES IN 2022

- FIGURE 20 NETHERLANDS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 EUROPE TO DOMINATE PLANT FACTORY MARKET BY GROWING SYSTEM, 2023 VS. 2028

- FIGURE 22 VEGETABLES SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 23 GREENHOUSE SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- FIGURE 24 WORLD POPULATION BY GROUP OF ECONOMIES

- FIGURE 25 WORLD POPULATION, 1950–2021

- FIGURE 26 POPULATION GROWTH TREND, 1950–2050

- FIGURE 27 NUMBER OF PEOPLE LIVING IN URBAN AND RURAL AREAS GLOBALLY

- FIGURE 28 URBAN POPULATION BY GROUP OF ECONOMIES (PERCENTAGE OF TOTAL POPULATION)

- FIGURE 29 DRIVER, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PLANT FACTORY MARKET

- FIGURE 30 BREAKEVEN COST OF PRODUCTION TO GROW AND DELIVER GREENS (DOLLARS PER POUND)

- FIGURE 31 ELECTRICITY PRICES PAID BY INDUSTRIAL SECTOR (CENTS PER KILOWATT-HOUR)

- FIGURE 32 INDIA: FRUITS & VEGETABLES, FLORICULTURE EXPORTS

- FIGURE 33 CANADA: ORNAMENTAL SALES AND RESALES BY SUB-SECTOR (MILLIONS OF CANADIAN DOLLARS)

- FIGURE 34 GLOBAL ORGANIC AGRICULTURAL LAND, 2019

- FIGURE 35 ORGANIC FOOD SALES IN US AND EUROPEAN UNION

- FIGURE 36 COUNTRIES WITH HIGHEST PER CAPITA CONSUMPTION OF ORGANIC FOOD IN 2019

- FIGURE 37 PLANT FACTORY MARKET: VALUE CHAIN ANALYSIS

- FIGURE 38 PLANT FACTORY MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

- FIGURE 39 PATENTS GRANTED FOR PLANT FACTORY MARKET, 2012–2022

- FIGURE 40 REGIONAL ANALYSIS OF PATENTS GRANTED FOR PLANT FACTORY MARKET, 2012–2022

- FIGURE 41 PLANT FACTORY MARKET: ECOSYSTEM/MARKET MAP

- FIGURE 42 FRUITS: IMPORT VALUE BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 43 FRUITS: EXPORT VALUE BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 44 OTHER VEGETABLES: IMPORT VALUE BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 45 OTHER VEGETABLES: EXPORT VALUE BY KEY COUNTRY, 2018–2022 (USD THOUSAND)

- FIGURE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CROP TYPES

- FIGURE 47 KEY CRITERIA FOR SELECTING SUPPLIERS/VENDORS

- FIGURE 48 PLANT FACTORY MARKET, BY GROWING SYSTEM, 2023 VS. 2028 (USD MILLION)

- FIGURE 49 PLANT FACTORY MARKET, BY CROP TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 50 PLANT FACTORY MARKET, BY FACILITY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 51 PLANT FACTORY MARKET, BY LIGHT TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 52 ASIA PACIFIC PLANT FACTORY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 53 EUROPEAN PLANT FACTORY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 54 EUROPE: PLANT FACTORY MARKET SNAPSHOT

- FIGURE 55 NORTH AMERICAN PLANT FACTORY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 56 ROW PLANT FACTORY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 57 SOUTH AMERICAN PLANT FACTORY MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 58 PLANT FACTORY MARKET: COMPANY EVALUATION QUADRANT, 2022 (KEY PLAYERS)

- FIGURE 59 PLANT FACTORY MARKET: COMPANY EVALUATION QUADRANT, 2022 (STARTUP/SME)

- FIGURE 60 TAIKISHA LTD: COMPANY SNAPSHOT

The study involved four major activities in estimating the current size of the plant factory market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, and investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

The plant factory market includes several stakeholders in the supply chain, including raw material suppliers, technology and service providers, plant factory setup companies, and regulatory organizations. The demand side of the market is characterized by the presence of food retail outlets, grocery stores, food suppliers & vendors, and processed food manufacturing companies. Key technology and service providers and suppliers of raw materials characterize the supply side.

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the food & beverage sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in the plant factory market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the plant factory market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details.

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent markets—the hydroponics market and Indoor farming technology market—were considered to validate further the market details of plant factory.

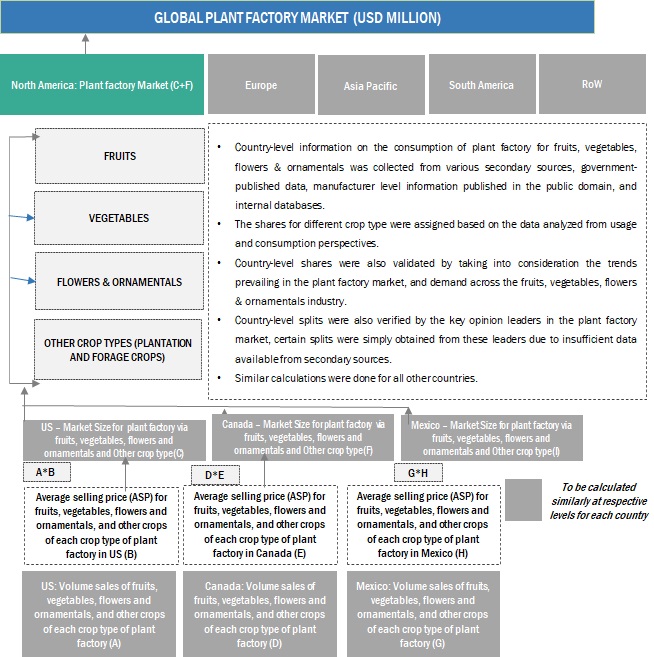

Bottom-up approach:

- The market size was analyzed based on the share of each crop type of plant factory and growing system at regional and country levels. Thus, the global market was estimated with a bottom-up approach at the country level.

- Other factors include demand for crops produced through different growing systems across various facility types; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

All macroeconomic and microeconomic factors affecting the plant factory market were considered while estimating the market size.

All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global plant factory market Size: Bottom Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. The approach was employed to determine the overall size of the plant factory market in particular regions. Its share in the plant factory market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

To know about the assumptions considered for the study, Request for Free Sample Report

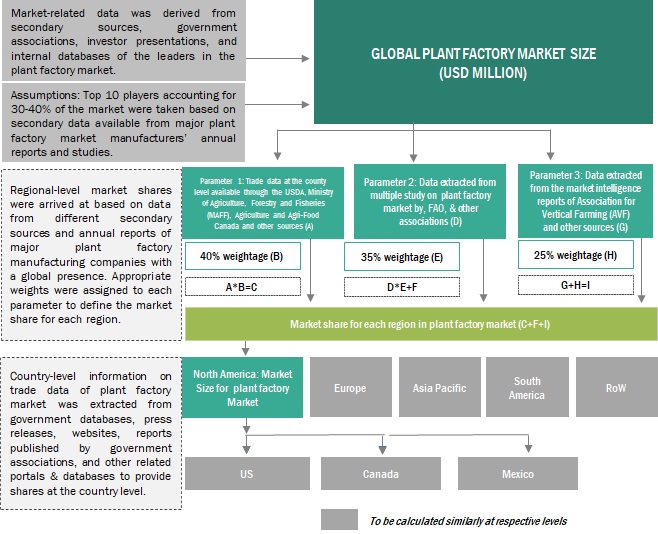

Global Plant Factory Market Size: Top Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research.

The top-down approach used to triangulate the data obtained through this study is explained in the next section:

- In the global plant factory market, related secondary sources such as US Department of Agriculture (USDA), Food and Drug Administration (FDA), Ministry of Agriculture, Forestry and Fisheries (MAFF), Association for Vertical Farming (AVF) and Annual Reports of all major players were considered to arrive at the global market size.

- The global number for plant factory was arrived upon after giving certain weightage factors for the data obtained from these secondary and primary sources.

- With the data triangulation procedure and data validation through primaries (from both supply and demand sides), the shares and sizes of the regional markets and individual markets were determined and confirmed.

- Data on company revenues, area harvested, product launches, and global regulations for plant factory in the last four years was used to arrive at the country-wise market size. CAGR estimation of type and application segments was used and then validated from primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to estimate the overall plant factory market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

According to Ministry of Economy, Trade and Industry (METI), the plant factory is a facility that aids the consistent production of high-quality vegetables all year long by artificially regulating the cultivation environment (such as light, temperature, humidity, carbon dioxide concentration, and culture solution), and enables farmers to plan production.

A plant factory is a commercial plant-growing facility that helps facilitate the constant production of crops throughout the year. It uses high-tech automated processes to produce yields, including monitoring of aspects such as light, moisture, carbon dioxide, and temperature. Plant factories are conducive to economies of scale as they enable cost, quality, and quantity control against the required harvest time.

They can be further categorized by growing systems, facility types, light types, and crop types. The advent of Controlled Environment Agriculture (CEA) as an alternative to conventional agricultural methods has provided lucrative opportunities for producing a higher yield of better quality.

Key Stakeholders

- Government regulatory authorities and research bodies

- Original Device Manufacturers (ODMs), Original Equipment Manufacturers (OEMs), and technology solution providers

- Artificial intelligence and machine learning system providers

- Importers & exporters, traders, distributors, and suppliers of plant factory

- Grow media, crop protection chemical, and fertilizer manufacturers and raw material suppliers

- Horticulture lighting, irrigation, and remote sensing equipment manufacturers

- Organic certification agencies

Report Objectives

Market Intelligence

- Determining and projecting the size of the Plant Factory market based on growing system, facility type, light type, crop type, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro- and micro-economic factors on the market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the Plant Factory market

Competitive Intelligence

- Identifying and profiling the key market players in the Plant Factory market

- Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations and technology in the Plant Factory market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe plant factory market, by key country

- Further breakdown of the Rest of Asia Pacific plant factory market, by key country

Segmentation Analysis

- Market segmentation analysis of other types of plant factory

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Plant Factory Market