Cryogenic Pump Market by Orientation, Design (Submersible, Non-Submersible), Type, Cryogen (Nitrogen, Argon, Oxygen, LNG, Helium, Hydrogen), End User (Energy & Power, Chemicals, Metallurgy, Healthcare & Pharmaceuticals) & Region - Global forecast to 2027

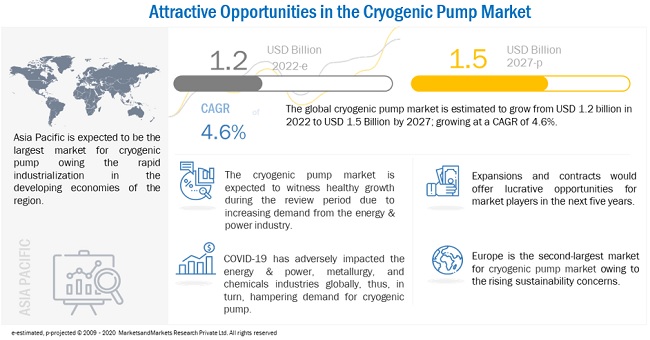

[224 Pages Report] The global cryogenic pump market is expected to grow from an estimated is projected USD 1.2 billion in 2022 to USD 1.5 billion by 2027, at a CAGR of 4.6% during the forecast period. The primary driver to the cryogenic pump market is the increasing demand for cryogenic gases from the energy & power industry, especially the oil & gas sector.

To know about the assumptions considered for the study, Request for Free Sample Report

Cryogenic Pump Market Dynamics

Driver: High demand for industrial gases from energy & power industry

The oil industry is a major consumer of cryogenic gases. In oil & gas refining and other downstream processes, industrial gases such as nitrogen, hydrogen, oxygen, and carbon dioxide are consumed for chemical synthesis. In addition, nitrogen and carbon dioxide are effectively used as injection fluids for enhanced oil recovery (EOR) and are widely used in oil field processes for gas cycling, reservoir pressure maintenance, and gas lift.

Due to the forecast increase in demand for oil and gas, oilfield operators are focusing on increasing their production from the existing assets or engaging in exploration and consequent production activities. Cryogenic pumps are required in these oilfields to handle liquified industrial gases and convert them to useful gaseous forms. Thus, growing oil production from existing mature wells through EOR and from newly drilled wells across the world is expected to drive the growth of the cryogenic pump market.

Restraint: Volatile raw material prices and competition from gray market players

Cryogenic pumps are made from materials such as stainless steel, bronze, carbon steel, and specialized alloys. Over the years, the prices of iron and other ores have been rising rapidly, due to which there has been a steady increase in stainless steel and other metal prices globally. The largest steel producer and exporter—China—has witnessed volatility in processed metal prices, affecting many industries. The manufacturing of cryogenic pumps requires high-quality raw materials, such as stainless steel. The increase in the cost of raw materials has led to intense competitive pricing among key manufacturers of cryogenic pumps. The rise in the prices of cryogenic pumps has also led to the growing preference for small-scale manufacturers in the unorganized market in countries such as China and India. Hence, volatility in metal prices has become a restraint for the market. Apart from the major raw material providers, the presence of several local suppliers who offer raw materials of international standards at competitive prices provides manufacturers with a choice of procurement. This interruption by the unorganized gray market players consequently hinders the growth of the market.

Opportunities: Evolving cryogenic electronics applications

Cryogenic gases are widely used for semiconductor manufacturing and testing procedures. Liquid nitrogen is used extensively as a coolant to remove heat from the manufacturing process. When electronics are given cryogenic treatment, gaps within the structure of their metallic components can be reduced. Cryogenics also improves the reliability of electronics by improving their thermal and electrical conductivity and lowering the operating power.

Cryogenic electronics (low-temperature electronics or cold electronics) can be based on semiconductive devices, superconductive devices, or a combination of the two. Applications of cryogenic electronics are increasing. For instance, power-conversion circuits can be applied to superconducting power generation, management, and distribution applications. Also, with increased investments in the renewable energy space, the need for cryogenic signal-processing systems or sensors will increase for instrumentation in wind tunnels. In addition, increasing applications of cryogenic electronics in research studies, superconducting magnet systems, low-temperature detector systems, and infrared array systems are likely to bring opportunities for the cryogenic pump market.

Challenges: Cryogen leakage from equipment leading to hazards and greenhouse emissions

Leakage and loss of cryogens is amng the major challenges faced by cryogenic pump manufacturers. The risk of cryogen leakage and the threat of greenhouse emissions are directly proportional to the number of modular cryogenic processing plants rise. i.e, as the number of plants increases the risk of leakage and emission also increases. Despite regular maintenance, cryogenic pumps are bound to face issue, which might lead to leakage and loss of cryogens. These cryogens are not environment friendly, and if released in a closed area, they can lead to oxygen deficiency in the region.

Prolonged exposure to cryogen can cause frostbite and damage to the lungs. 38% of leakage accidents are observed to take place during maintenance, while the rest happen during the normal course of work. In order to avoid such instances, the cryogenic pump designers, manufacturers and operators are expected to be provided with proper leak detection equipment to detect leakages and emissions while the pump is operating, thus enabling them to take counteractive measures to control the leakage.

The centrifugal segment is expected to be the largest segment of the cryogenic pump market, by type, during the forecast period

The cryogenic pump market, by type, is segmented into centrifugal and positive displacements. The centrifugal segment is expected to hold the largest size of the market for cryogenic pump during the forecast period. Owing to the relatively superior operational efficiency of the centrifugal pumps, the market by type is dominated by it.

The LNG segment is expected to be the fastest-growing segment of the market, by cryogen, during the forecast period

The cryogenic pump market, by cryogen, is segmented into nitrogen, argon, oxygen, LNG, helium, hydrogen, and other cryogens. Other cryogenic gases include nitrous oxide, ethylene, and carbon dioxide. The high growth rate of the LNG segment can be attributed to the rising demand for LNG, owing to the transition towards adoption of cleaner energy by various economies of the world

Asia Pacific is expected to dominate the global cryogenic pump market

The Asia Pacific region is estimated to be the largest market for the cryogenic pump market, followed by Europe. The Asia Pacific region is also projected to be the fastest-growing market during the forecast period. The growth of the Asia Pacific market for cryogenic pump is primarily driven by the development of metallurgy and energy & power industries in India and China.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

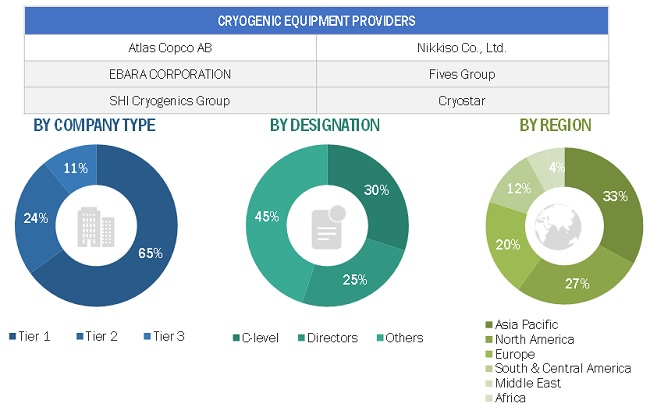

The major players in the cryogenic pump market are Atlas Copco AB (Sweden), EBARA CORPORATION (Japan), SHI Cryogenic Group (Japan), Nikkiso Co., Ltd. (Japan) and Fives Group (France). Between 2018 and 2021, the companies adopted growth strategies such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures to capture a larger share of the market.

Scope of the Report

|

Report Attributes |

Details |

|

Market size value in 2022: |

USD 1.2 Billion |

|

Projected to reach 2027: |

USD 1.5 Billion |

|

CAGR: |

4.6% |

|

Base Year Considered: |

2021 |

|

Forecast Period: |

2022-2027 |

|

Largest Market: |

Asia Pacific |

|

Region Covered: |

North America, Europe, Asia Pacific, Middle East, Africa and South America |

|

Segments Covered: |

Orientation, Design, Type, Cryogen, End User and Region |

|

Companies Covered: |

AB (Sweden), Ebara Corporation (Japan), SHI Cryogenics Group (Japan), Nikkiso C., Ltd. (Japan), Fives Group (France), Cryostar (France), TRILLIUM FLOW TECHNOLOGIES (Scotland), Gemmecotti Srl (Italy), PHPK Technologies (US), Barber-Nichols (US), Sulzer Ltd (Switzerland), Technex Limited (China), Vanzetti Engineering S.p.A. (Italy), HSR AG (Liechtenstein), Xinxiang Chengde Energy Technology Equipment Co.,Ltd. (China), Ruhrpumpen Group (Mexico), OPTIMEX (France), SEHWA TECH, INC. (South Korea), CS&P Technologies (US), CryoVation LLC. (US), PBS Velká Bíteš (Czech Republic), KRYTEM Cryogenic Systems (Germany), Trillium US (US), Sing Swee Bee Enterprise Pte Ltd. (Singapore), and EOSgen-technologies (France) |

This research report categorizes the cryogenic pump market by Orientation, Design, Type, Cryogen, End User and Region.

On the basis of by Orientation:

- Horizontal

- Vertical

On the basis of by Design:

- Submersible

- Non-Submersible

On the basis of by Type:

- Centrifugal

- Positive displacement

On the basis of by Cryogen:

- Nitrogen

- Oxygen

- Argon

- LNG

- Helium

- Hydrogen

- Other Cryogens

On the basis of by end user:

- Metallurgy

- Energy & Power

- Chemicals

- Electronics

- Healthcare & Pharmaceuticals

- Others

On the basis of Region:

- North America

- South America

- Europe

- Asia Pacific

- Middle East

- Africa

Recent Developments

- In April 2022, TRILLIUM FLOW TECHNOLOGIES acquired Termomeccanica Pompe, an Italian manufacturer of highly engineered vertical turbine and split case pumps.

- In April 2022, Cyostar had been contracted to provide 15 NeoVP vertical pumps to be installed in an ASU in China.

- In November 2021, Elliot Group inaugurated a new state-of-the-art cryogenic pump testing facility in Jeannette, pennsylvania, US.

- In November 2021, Fives Group was contracted to provide its cryomec pumps for installation in a major industrial gas complex in Jubail industrial city, Saudi Arabia.

Frequently Asked Questions (FAQ):

What is the current size of the cryogenic pump market?

The current market size of global market is USD 1.2 billion in 2021.

What is the major drivers?

The factors driving the growth for market are the high demand for industrial gases from the energy & power industry and growing demand for cryogenic pump across the entire LNG value chain .

Which is the fastest-growing region during the forecasted period?

Asia Pacific region is expected to grow at the highest CAGR during the forecast period because of the increased adoption of LNG, owing to the sustainability concerns.

Which is the fastest-growing segment, by end-user during the forecasted period?

The energy & power segment is estimated to have the largest market share during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 CRYOGENIC PUMP MARKET: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 CRYOGENIC PUMP MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 1 CRYOGENIC PUMP MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 IDEAL DEMAND-SIDE ANALYSIS

2.4.1 DEMAND-SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR CRYOGENIC PUMPS

2.4.2 ASSUMPTIONS FOR DEMAND-SIDE ANALYSIS

2.5 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF MARKET

FIGURE 7 MARKET: SUPPLY-SIDE ANALYSIS

2.5.1 CALCULATIONS FOR SUPPLY SIDE

2.5.2 ASSUMPTIONS FOR SUPPLY SIDE

FIGURE 8 MARKET SHARE ANALYSIS, 2021

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 47)

TABLE 1 CRYOGENIC PUMP MARKET SHARES

FIGURE 9 NON-SUBMERSIBLE PUMPS ARE EXPECTED TO DOMINATE MARKET, BY DESIGN, DURING FORECAST PERIOD

FIGURE 10 CENTRIFUGAL SEGMENT IS EXPECTED TO DOMINATE MARKET, BY TYPE, DURING FORECAST PERIOD

FIGURE 11 NITROGEN IS EXPECTED TO DOMINATE MARKET, BY CRYOGEN, DURING FORECAST PERIOD

FIGURE 12 ENERGY & POWER IS EXPECTED TO HOLD LARGEST SIZE OF MARKET, BY END USER, DURING FORECAST PERIOD

FIGURE 13 ASIA PACIFIC DOMINATED MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN CRYOGENIC PUMP MARKET

FIGURE 14 INCREASING ADOPTION OF EOR METHOD TO INCREASE OIL & GAS PRODUCTION IS EXPECTED TO DRIVE MARKET FROM 2022 TO 2027

4.2 MARKET, BY DESIGN

FIGURE 15 NON-SUBMERSIBLE SEGMENT DOMINATED MARKET, BY DESIGN, IN 2021

4.3 MARKET, BY TYPE

FIGURE 16 CENTRIFUGAL SEGMENT DOMINATED MARKET, BY TYPE, IN 2021

4.4 MARKET, BY CRYOGEN

FIGURE 17 NITROGEN SEGMENT DOMINATED MARKET, BY CRYOGEN, IN 2021

4.5 MARKET, BY END USER

FIGURE 18 ENERGY & POWER SEGMENT DOMINATED MARKET, BY END USER, IN 2021

4.6 MARKET IN ASIA PACIFIC, BY TYPE & COUNTRY

FIGURE 19 CENTRIFUGAL TYPE PUMPS & CHINA DOMINATED MARKET IN ASIA PACIFIC, BY APPLICATION & COUNTRY, IN 2021

4.7 MARKET, BY REGION

FIGURE 20 ASIA PACIFIC TO WITNESS HIGHEST CAGR OF MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 21 COVID-19 GLOBAL PROPAGATION

FIGURE 22 COVID-19 PROPAGATION IN SELECT COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 23 COMPARISON OF GDP FOR SELECT G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 24 CRYOGENIC PUMP MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 High demand for industrial gases from energy & power industry

FIGURE 25 GLOBAL OIL DEMAND, 2019–2026

TABLE 2 GLOBAL OIL DEMAND (OECD VS. NON-OECD), 2019–2026

5.4.1.2 Growing demand for cryogenic pumps across entire LNG value chain

5.4.2 RESTRAINTS

5.4.2.1 High CAPEX and OPEX costs associated with cryogenic plants

5.4.2.2 Volatile raw material prices and interference of gray market players

FIGURE 26 IRON ORE PRICE, 2021–2022

5.4.3 OPPORTUNITIES

5.4.3.1 Evolving cryogenic electronics applications

5.4.3.2 Rising adoption of cryogenic energy storage systems

5.4.4 CHALLENGES

5.4.4.1 Cryogen leakage from equipment leading to hazards and greenhouse emissions

5.5 COVID-19 IMPACT

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET

FIGURE 27 REVENUE SHIFT OF CRYOGENIC PUMP PROVIDERS

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 28 CRYOGENIC PUMP MARKET: SUPPLY CHAIN ANALYSIS

5.7.1 CRYOGENIC PUMP RAW MATERIAL SUPPLIERS

5.7.2 CRYOGENIC PUMP MANUFACTURERS

5.7.3 INDUSTRIAL GAS MANUFACTURERS

5.7.4 END USERS

TABLE 3 MARKET: SUPPLY CHAIN PARTICIPANTS

5.8 MARKET MAP

FIGURE 29 CRYOGENIC PUMP: MARKET MAP

5.9 KEY CONFERENCES & EVENTS TO BE HELD DURING 2022–2023

TABLE 4 MARKET: LIST OF CONFERENCES & EVENTS

5.10 MARKET: REGULATIONS

5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 7 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 30 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 8 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 BARGAINING POWER OF SUPPLIERS

5.11.3 BARGAINING POWER OF BUYERS

5.11.4 THREAT OF SUBSTITUTES

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS & BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR 3 OTHERS

TABLE 9 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR 3 OTHERS (%)

5.12.2 BUYING CRITERIA

FIGURE 32 KEY BUYING CRITERIA FOR 3 OTHERS

TABLE 10 KEY BUYING CRITERIA FOR 3 OTHERS

5.13 INNOVATIONS & PATENT REGISTRATION

5.14 TECHNOLOGY ANALYSIS

TABLE 11 MARKET: REGULATIONS

5.15 PRICING ANALYSIS

5.15.1 AVERAGE SELLING PRICES OF TYPES OF CRYOGENIC PUMPS, BY DESIGN

TABLE 12 CRYOGENIC PUMP: AVERAGE SELLING PRICES, BY DESIGN (USD)

5.16 CASE STUDY ANALYSIS

5.16.1 FIVES GROUP’S IMPACTFUL SOLUTION TO HELP INDONESIAN CLIENT’S ASU PLANT MISHAP

6 CRYOGENIC PUMP MARKET, BY ORIENTATION (Page No. - 79)

6.1 INTRODUCTION

TABLE 13 CRYOGENIC PUMP: COMPANY FOOTPRINT, BY ORIENTATION

6.2 HORIZONTAL

6.3 VERTICAL

7 CRYOGENIC PUMP MARKET, BY DESIGN (Page No. - 82)

7.1 INTRODUCTION

FIGURE 33 MARKET, BY DESIGN, 2021

TABLE 14 MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 15 MARKET, BY DESIGN, 2020–2027 (USD MILLION)

7.2 SUBMERSIBLE

7.2.1 SUSTAINABILITY GOALS OF VARIOUS ECONOMIES TO DRIVE MARKET

TABLE 16 SUBMERSIBLE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 SUBMERSIBLE: MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 NON-SUBMERSIBLE

7.3.1 INCREASING INVESTMENTS IN OIL & GAS SECTOR TO DRIVE DEMAND FOR NON-SUBMERSIBLE PUMPS

TABLE 18 NON-SUBMERSIBLE: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 19 NON-SUBMERSIBLE: MARKET, BY REGION, 2020–2027 (USD MILLION)

8 CRYOGENIC PUMP MARKET, BY TYPE (Page No. - 86)

8.1 INTRODUCTION

FIGURE 34 MARKET, BY TYPE, 2021

TABLE 20 MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 21 MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.2 CENTRIFUGAL

8.2.1 GROWTH OF FOOD & BEVERAGES, HEALTHCARE, AND ELECTRONICS INDUSTRIES TO DRIVE MARKET

TABLE 22 CENTRIFUGAL: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 CENTRIFUGAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3 POSITIVE DISPLACEMENT

8.3.1 HIGHER OPERATIONAL EFFICIENCY AND VERSATILITY ARE EXPECTED TO DRIVE MARKET

TABLE 24 POSITIVE DISPLACEMENT: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 POSITIVE DISPLACEMENT: MARKET, BY REGION, 2020–2027 (USD MILLION)

9 CRYOGENIC PUMP MARKET, BY CRYOGEN (Page No. - 90)

9.1 INTRODUCTION

FIGURE 35 MARKET SHARE, BY CRYOGEN, 2021

TABLE 26 MARKET, BY CRYOGEN, 2016–2019 (USD MILLION)

TABLE 27 MARKET, BY CRYOGEN, 2020–2027 (USD MILLION)

9.2 NITROGEN

9.2.1 INCREASING DEMAND FROM OIL & GAS SECTOR CREATES HIGH DEMAND FOR NITROGEN-BASED CRYOGENIC PUMPS

TABLE 28 NITROGEN: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 NITROGEN: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.3 ARGON

9.3.1 DEMAND FOR ARGON-HANDLING CRYOGENIC PUMPS INCREASES WITH DEMAND FOR ELECTRONICS

TABLE 30 ARGON: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 ARGON: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 OXYGEN

9.4.1 INCREASING STEEL AND IRON PRODUCTION CREATES HIGH DEMAND FOR OXYGEN-RELATED CRYOGENIC PUMPS

TABLE 32 OXYGEN: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 OXYGEN: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.5 LNG

9.5.1 RISING DEMAND FOR CLEANER ENERGY SOURCES CREATES DEMAND FOR LNG INFRASTRUCTURE

TABLE 34 LNG: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 LNG: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.6 HYDROGEN

9.6.1 RISING DEMAND FOR HYDROGEN FUEL CELLS IS EXPECTED TO FUEL GROWTH OF HYDROGEN PUMPS

TABLE 36 HYDROGEN: MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 37 HYDROGEN: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

9.7 HELIUM

9.7.1 RAPID INDUSTRIALIZATION TO FUEL MARKET GROWTH

TABLE 38 HELIUM: MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 39 HELIUM: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

9.8 OTHER CRYOGENS

TABLE 40 OTHER CRYOGENS: MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 41 OTHER CRYOGENS: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

10 CRYOGENIC PUMP MARKET, BY END USER (Page No. - 100)

10.1 INTRODUCTION

FIGURE 36 MARKET, BY END USER, 2021

TABLE 42 MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 43 MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2 METALLURGY

10.2.1 FAVOURABLE GOVERNMENT POLICIES BENEFITTING MANUFACTURING AND INDUSTRIAL SECTORS TO DRIVE MARKET

TABLE 44 METALLURGY: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 45 METALLURGY: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.3 ENERGY & POWER

10.3.1 GROWING ENERGY AND OIL DEMANDS AND GROWTH OF LNG MARKET TO FUEL MARKET GROWTH

TABLE 46 ENERGY & POWER: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 47 ENERGY & POWER: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.4 CHEMICALS

10.4.1 CHEMICAL COMPANIES TRANSITION TOWARD SUSTAINABILITY AND DECARBONIZATION GOALS TO FUEL MARKET GROWTH

TABLE 48 CHEMICALS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 49 CHEMICALS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.5 ELECTRONICS

10.5.1 GROWTH IN SEMICONDUCTOR AND CONSUMER ELECTRONICS SECTORS TO DRIVE MARKET

TABLE 50 ELECTRONICS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 51 ELECTRONICS: MARKET, BY REGION, 2020–2027 (USD MILLION)

10.6 HEALTHCARE & PHARMACEUTICALS

10.6.1 ABSENCE OF ALTERNATIVE MEDICAL GASES TO FUEL MARKET GROWTH

TABLE 52 HEALTHCARE & PHARMACEUTICALS: MARKET, BY REGION, 2016–2019 (USD THOUSAND)

TABLE 53 HEALTHCARE & PHARMACEUTICALS: MARKET, BY REGION, 2020–2027 (USD THOUSAND)

10.7 OTHERS

TABLE 54 OTHERS: MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 55 OTHERS: MARKET, BY REGION, 2020–2027 (USD MILLION)

11 CRYOGENIC PUMP MARKET, BY REGION (Page No. - 110)

11.1 INTRODUCTION

FIGURE 37 REGIONAL SNAPSHOT: MARKET IN ASIA PACIFIC IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 38 MARKET SHARE (VALUE), BY REGION, 2021

TABLE 56 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 57 MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 58 MARKET, BY REGION, 2016–2019 (THOUSAND UNITS)

TABLE 59 MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

11.2 ASIA PACIFIC

FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

11.2.1 BY DESIGN

TABLE 60 ASIA PACIFIC: MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 61 ASIA PACIFIC: MARKET, BY DESIGN, 2020–2027 (USD MILLION)

11.2.2 BY TYPE

TABLE 62 ASIA PACIFIC: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET, BY TYPE, 2020–2027 (USD MILLION)

11.2.3 BY CRYOGEN

TABLE 64 ASIA PACIFIC: MARKET, BY CRYOGEN, 2016–2019 (USD MILLION)

TABLE 65 ASIA PACIFIC: MARKET, BY CRYOGEN, 2020–2027 (USD MILLION)

11.2.4 BY END USER

TABLE 66 ASIA PACIFIC: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 67 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.5 BY COUNTRY

TABLE 68 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 69 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.2.5.1 China

11.2.5.1.1 LNG infrastructure projects offer lucrative growth opportunities in China

TABLE 70 CHINA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 71 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.5.2 India

11.2.5.2.1 Investments in space missions are likely to bring opportunities for cryogenic pumps during forecast period

TABLE 72 INDIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 73 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.5.3 Australia

11.2.5.3.1 Increasing government investments in energy & power and metallurgy industries to drive demand

TABLE 74 AUSTRALIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 75 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.5.4 Japan

11.2.5.4.1 Import and utilization of LNG to drive market for cryogenic pumps

TABLE 76 JAPAN: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 77 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.5.5 Malaysia

11.2.5.5.1 Upstream production activities concerned with natural gas are expected to drive market growth

TABLE 78 MALAYSIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 79 MALAYSIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.2.5.6 Rest of Asia Pacific

TABLE 80 REST OF ASIA PACIFIC: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 81 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3 EUROPE

FIGURE 40 EUROPE: MARKET SNAPSHOT

11.3.1 BY DESIGN

TABLE 82 EUROPE: MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY DESIGN, 2020–2027 (USD MILLION)

11.3.2 BY TYPE

TABLE 84 EUROPE: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY TYPE, 2020–2027 (USD MILLION)

11.3.3 BY CRYOGEN

TABLE 86 EUROPE: MARKET, BY CRYOGEN, 2016–2019 (USD MILLION)

TABLE 87 EUROPE: MARKET, BY CRYOGEN, 2020–2027 (USD MILLION)

11.3.4 BY END USER

TABLE 88 EUROPE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 89 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.5 Y COUNTRY

TABLE 90 EUROPE: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 91 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.3.5.1 Russia

11.3.5.1.1 LNG and gas production infrastructure projects to fuel growth of market in Russia

TABLE 92 RUSSIA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 93 RUSSIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.5.2 UK

11.3.5.2.1 Investments in cryogenic energy storage systems to fuel demand for cryogenic pumps

TABLE 94 UK: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 95 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.5.3 Germany

11.3.5.3.1 Increasing government investments in healthcare and chemical industries to drive demand for cryogenic pumps

TABLE 96 GERMANY: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.5.4 France

11.3.5.4.1 France’s commitment to net-zero emissions to boost market

TABLE 98 FRANCE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 99 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.3.5.5 Rest of Europe

TABLE 100 REST OF EUROPE: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4 NORTH AMERICA

11.4.1 BY DESIGN

TABLE 102 NORTH AMERICA: MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 103 NORTH AMERICA: MARKET, BY DESIGN, 2020–2027 (USD MILLION)

11.4.2 BY TYPE

TABLE 104 NORTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

11.4.3 BY CRYOGEN

TABLE 106 NORTH AMERICA: MARKET, BY CRYOGEN, 2016–2019 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY CRYOGEN, 2020–2027 (USD MILLION)

11.4.4 BY END USER

TABLE 108 NORTH AMERICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.5 BY COUNTRY

TABLE 110 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.4.5.1 US

11.4.5.1.1 Growth of natural gas generation and concerned exports to fuel market growth

TABLE 112 US: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 113 US: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.5.2 Canada

11.4.5.2.1 Export of LNG to fuel growth of market in Canada

TABLE 114 CANADA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 115 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.4.5.3 Mexico

11.4.5.3.1 Development of shale reserves creates opportunities for market in Mexico

TABLE 116 MEXICO: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 117 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5 MIDDLE EAST

11.5.1 BY DESIGN

TABLE 118 MIDDLE EAST: MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 119 MIDDLE EAST: MARKET, BY DESIGN, 2020–2027 (USD MILLION)

11.5.2 BY TYPE

TABLE 120 MIDDLE EAST: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 121 MIDDLE EAST: MARKET, BY TYPE, 2020–2027 (USD MILLION)

11.5.3 BY CRYOGEN

TABLE 122 MIDDLE EAST: MARKET, BY CRYOGEN, 2016–2019 (USD MILLION)

TABLE 123 MIDDLE EAST: MARKET, BY CRYOGEN, 2020–2027 (USD MILLION)

11.5.4 BY END USER

TABLE 124 MIDDLE EAST: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 125 MIDDLE EAST: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.5.5 BY COUNTRY

TABLE 126 MIDDLE EAST: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 127 MIDDLE EAST: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.5.5.1 Saudi Arabia

11.5.5.1.1 LNG and gas production infrastructure projects to fuel growth of market in Saudi Arabia

TABLE 128 SAUDI ARABIA: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 129 SAUDI ARABIA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.5.5.2 UAE

11.5.5.2.1 Investments in cryogenic energy storage systems to fuel demand for cryogenic pumps

TABLE 130 UAE: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 131 UAE: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.5.5.3 Qatar

11.5.5.3.1 Increasing government investments in healthcare and chemical industries to drive demand for cryogenic pumps

TABLE 132 QATAR: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 133 QATAR: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.5.5.4 Rest of Middle East

TABLE 134 REST OF MIDDLE EAST: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 135 REST OF MIDDLE EAST: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.6 AFRICA

11.6.1 BY DESIGN

TABLE 136 AFRICA: MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 137 AFRICA: MARKET, BY DESIGN, 2020–2027 (USD MILLION)

11.6.2 BY TYPE

TABLE 138 AFRICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 AFRICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

11.6.3 BY CRYOGEN

TABLE 140 AFRICA: MARKET, BY CRYOGEN, 2016–2019 (USD MILLION)

TABLE 141 AFRICA: MARKET, BY CRYOGEN, 2020–2027 (USD MILLION)

11.6.4 BY END USER

TABLE 142 AFRICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 143 AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.6.5 BY COUNTRY

TABLE 144 AFRICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 145 AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.6.5.1 South Africa

11.6.5.1.1 Industrial growth in South Africa is expected to drive market

TABLE 146 SOUTH AFRICA: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 147 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.6.5.2 Nigeria

11.6.5.2.1 Increasing demand for LNG and nitrogen in oil & gas and shipping industries is favoring market growth

TABLE 148 NIGERIA: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 149 NIGERIA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.6.5.3 Algeria

11.6.5.3.1 Upcoming offshore projects are likely to drive demand for cryogenic pumps in Algeria

TABLE 150 ALGERIA: MARKET IN, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 151 ALGERIA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.6.5.4 Rest of Africa

TABLE 152 REST OF AFRICA: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 153 REST OF AFRICA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.7 SOUTH AMERICA

11.7.1 BY DESIGN

TABLE 154 SOUTH AMERICA: MARKET, BY DESIGN, 2016–2019 (USD MILLION)

TABLE 155 SOUTH AMERICA: MARKET, BY DESIGN, 2020–2027 (USD MILLION)

11.7.2 BY TYPE

TABLE 156 SOUTH AMERICA: MARKET, BY TYPE, 2016–2019 (USD MILLION)

TABLE 157 SOUTH AMERICA: MARKET, BY TYPE, 2020–2027 (USD MILLION)

11.7.3 BY CRYOGEN

TABLE 158 SOUTH AMERICA: MARKET, BY CRYOGEN, 2016–2019 (USD MILLION)

TABLE 159 SOUTH AMERICA: MARKET, BY CRYOGEN, 2020–2027 (USD MILLION)

11.7.4 BY END USER

TABLE 160 SOUTH AMERICA: MARKET, BY END USER, 2016–2019 (USD MILLION)

TABLE 161 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

11.7.5 BY COUNTRY

TABLE 162 SOUTH AMERICA: MARKET, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 163 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

11.7.5.1 Brazil

11.7.5.1.1 Oil & gas industry in Brazil is expected to drive market

TABLE 164 BRAZIL: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 165 BRAZIL: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.7.5.2 Argentina

11.7.5.2.1 Reviving oil & gas sector in Argentina is likely to bring opportunities for market

TABLE 166 ARGENTINA: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 167 ARGENTINA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.7.5.3 Venezuela

11.7.5.3.1 Low industrial growth and recession in Venezuela are affecting market

TABLE 168 VENEZUELA: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 169 VENEZUELA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

11.7.5.4 Rest of South America

TABLE 170 REST OF SOUTH AMERICA: MARKET, BY END USER, 2016–2019 (USD THOUSAND)

TABLE 171 REST OF SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD THOUSAND)

12 COMPETITIVE LANDSCAPE (Page No. - 170)

12.1 OVERVIEW

FIGURE 41 KEY DEVELOPMENTS IN MARKET, 2018–2021

12.2 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

TABLE 172 MARKET: DEGREE OF COMPETITION

FIGURE 42 SHARE ANALYSIS OF TOP PLAYERS IN MARKET, 2021

12.3 MARKET EVALUATION FRAMEWORK

TABLE 173 MARKET EVALUATION FRAMEWORK, 2018–2022

12.4 SEGMENTAL REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 43 SEGMENTAL REVENUE ANALYSIS, 2017–2021

12.5 RECENT DEVELOPMENTS

12.5.1 DEALS

TABLE 174 MARKET: DEALS, JANUARY 2021–APRIL 2022

12.5.2 OTHERS

TABLE 175 MARKET: OTHERS, MARCH 2021–MARCH 2022

12.6 COMPANY EVALUATION QUADRANT

12.6.1 STAR

12.6.2 EMERGING LEADER

12.6.3 PERVASIVE

12.6.4 PARTICIPANT

FIGURE 44 MARKET: COMPANY EVALUATION QUADRANT, 2021

TABLE 176 COMPANY REGION FOOTPRINT

13 COMPANY PROFILES (Page No. - 179)

13.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 ATLAS COPCO AB

TABLE 177 ATLAS COPCO AB: BUSINESS OVERVIEW

FIGURE 45 ATLAS COPCO AB: COMPANY SNAPSHOT

TABLE 178 ATLAS COPCO AB: PRODUCTS OFFERED

TABLE 179 ATLAS COPCO AB: DEALS

TABLE 180 ATLAS COPCO AB: OTHERS

13.1.2 EBARA CORPORATION

TABLE 181 EBARA CORPORATION: BUSINESS OVERVIEW

FIGURE 46 EBARA CORPORATION: COMPANY SNAPSHOT

TABLE 182 EBARA CORPORATION: PRODUCTS OFFERED

TABLE 183 EBARA CORPORATION: DEALS

13.1.3 SHI CRYOGENICS GROUP

TABLE 184 SHI CRYOGENICS GROUP: BUSINESS OVERVIEW

FIGURE 47 SHI CRYOGENICS GROUP: COMPANY SNAPSHOT

TABLE 185 SHI CRYOGENICS GROUP: PRODUCTS OFFERED

13.1.4 NIKKISO CO., LTD.

TABLE 186 NIKKISO CO., LTD.: BUSINESS OVERVIEW

FIGURE 48 NIKKISO CO., LTD.: COMPANY SNAPSHOT

TABLE 187 NIKKISO CO., LTD.: PRODUCTS OFFERED

TABLE 188 NIKKISO CO., LTD.: OTHERS

13.1.5 FIVES GROUP

TABLE 189 FIVES GROUP: BUSINESS OVERVIEW

TABLE 190 FIVES GROUP: PRODUCTS

TABLE 191 FIVES GROUP: DEALS

TABLE 192 FIVES GROUP: OTHERS

13.1.6 SULZER LTD

TABLE 193 SULZER LTD: BUSINESS OVERVIEW

FIGURE 49 SULZER LTD: COMPANY SNAPSHOT

TABLE 194 SULZER LTD: PRODUCTS

TABLE 195 SULZER LTD: OTHERS

13.1.7 CRYOSTAR

TABLE 196 CRYOSTAR: BUSINESS OVERVIEW

TABLE 197 CRYOSTAR: PRODUCTS OFFERED

TABLE 198 CRYOSTAR: DEALS

TABLE 199 CRYOSTAR: PRODUCT LAUNCH

13.1.8 RUHRPUMPEN GROUP

TABLE 200 RUHRPUMPEN GROUP: BUSINESS OVERVIEW

TABLE 201 RUHRPUMPEN GROUP: PRODUCTS

TABLE 202 RUHRPUMPEN GROUP: OTHERS

13.1.9 TRILLIUM FLOW TECHNOLOGIES

TABLE 203 TRILLIUM FLOW TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 204 TRILLIUM FLOW TECHNOLOGIES: PRODUCTS

TABLE 205 TRILLIUM FLOW TECHNOLOGIES: DEALS

13.1.10 PHPK TECHNOLOGIES

TABLE 206 PHPK TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 207 PHPK TECHNOLOGIES: PRODUCTS OFFERED

13.1.11 GEMMECOTTI SRL

TABLE 208 GEMMECOTTI SRL: BUSINESS OVERVIEW

TABLE 209 GEMMECOTTI SRL: PRODUCTS OFFERED

13.1.12 TECHNEX LIMITED

TABLE 210 TECHNEX LIMITED: BUSINESS OVERVIEW

TABLE 211 TECHNEX LIMITED: PRODUCTS OFFERED

13.1.13 BARBER-NICHOLS

TABLE 212 BARBER-NICHOLS: BUSINESS OVERVIEW

TABLE 213 BARBER-NICHOLS: PRODUCTS OFFERED

TABLE 214 BARBER-NICHOLS: DEALS

TABLE 215 BARBER-NICHOLS: OTHERS

13.1.14 HSR AG

TABLE 216 HSR AG: BUSINESS OVERVIEW

TABLE 217 HSR AG: PRODUCTS OFFERED

TABLE 218 HSR AG: DEALS

13.1.15 VANZETTI ENGINEERING S.P.A.

TABLE 219 VANZETTI ENGINEERING S.P.A.: BUSINESS OVERVIEW

TABLE 220 VANZETTI ENGINEERING S.P.A.: PRODUCTS

TABLE 221 VANZETTI ENGINEERING S.P.A.: DEALS

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13.2 OTHER PLAYERS

13.2.1 SEHWA TECH, INC.

13.2.2 CRYOVATION LLC.

13.2.3 OPTIMEX

13.2.4 CS&P TECHNOLOGIES

13.2.5 PBS VELKÁ BÍTEŠ

14 APPENDIX (Page No. - 216)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

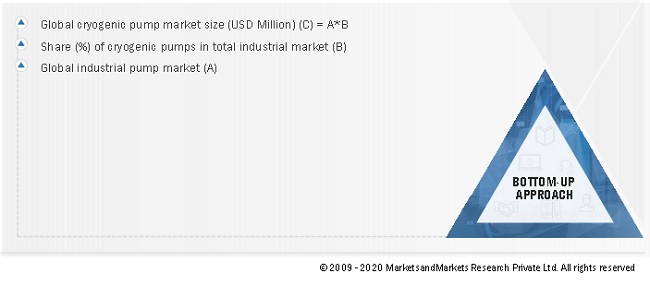

This study involved four major activities in estimating the current size of the cryogenic pump market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as water and wastewater management data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and water & environment journal to identify and collect information useful for a technical, market-oriented, and commercial study of the cryogenic pump market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The cryogenic pump market comprises several stakeholders such as companies related to the industry, component manufacturing companies for cryogenic pump, government & research organizations, organizations, forums, alliances & associations, cryogenic pump providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by increased investment in the residential, commercial, and industrial sector. The supply side is characterized by investments & expansion and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global cryogenic pump market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global cryogenic pump Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the market.

Objectives of the Study

- To define and describe the cryogenic pump market, based on orientation, design, type, cryogen, end user and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each segment/subsegment of the market with respect to individual growth trends, future expansions, and their contributions to the overall market

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders

- To forecast the growth of the market with respect to six main regions: North America, Europe, Asia Pacific, Middle East, Africa and South America.

- To strategically profile key players and comprehensively analyze their respective market share and core competencies*

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, new product launches, contracts & agreements, and joint ventures & collaborations in the cryogenic pump market

Gas Liquefaction & Its impact on Cryogenic Pump Market

The process of converting gases, such as natural gas or air, into liquids by cooling and compressing them is known as gas liquefaction. Many industrial applications rely on this process, including the production and transportation of liquefied natural gas (LNG) and other cryogenic liquids. Cryogenic pumps, which are used to compress and move cryogenic liquids at extremely low temperatures, are an essential component in gas liquefaction systems. Cryogenic pumps can handle gaseous and liquid gases and liquids, making them extremely versatile in gas liquefaction applications.

The demand for cryogenic pumps is directly tied to the growth of the gas liquefaction market. As the demand for LNG and other cryogenic liquids continues to increase, so does the demand for cryogenic pumps. The cryogenic pump market is expected to grow alongside the gas liquefaction market, driven by factors such as increasing demand for energy, rising industrialization, and a growing need for clean fuels.

By extending the reach of Gas Liquefaction companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Increased demand for cryogenic pumps: As the demand for liquefied natural gas (LNG) and other cryogenic liquids continues to rise, the demand for cryogenic pumps will also increase.

- Technological advancements: As the demand for cryogenic pumps increases, manufacturers will invest in research and development to improve their designs and increase their efficiency.

- Geographic expansion: The growth of gas liquefaction and the cryogenic pump market is not limited to a specific region.

- Increasing competition: The growth of gas liquefaction and the cryogenic pump market will lead to increased competition among manufacturers.

The top players in the Gas Liquefaction Market are Air Products and Chemicals, Inc, Linde plc, TechnipFMC plc, Royal Dutch Shell plc, Mitsubishi Heavy Industries, Ltd. , General Electric Company, Chart Industries, Inc. , Gazprom, Total SE, ExxonMobil Corporation.

Some of the key industries that are going to get impacted because in the future because of Gas Liquefaction are

- Energy industry: The gas liquefaction market is primarily driven by the energy industry, as LNG is becoming an increasingly popular source of energy due to its cleaner burning properties.

- Transportation industry: LNG is being increasingly used as a fuel for transportation, especially in the shipping industry.

- Chemical industry: Natural gas is used as a feedstock in the production of many chemicals. As demand for LNG grows, so does the availability of natural gas, which may have an impact on the chemical industry by making natural gas more accessible and cost-effective.

- Construction industry: Gas liquefaction has implications for the construction industry, especially as it relates to the development of LNG infrastructure, such as LNG terminals and storage tanks.

- Agriculture industry: Natural gas can be used as a source of nitrogen for fertilizer production, which is essential for the agriculture industry.

Speak to our analyst today to know more about, "Gas Liquefaction Market"

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cryogenic Pump Market

The contents of the Cryogenic Pump Market report will be updated including the sales revenues for the year 2021 onwards to 2030, considering 2021 sales revenues of key top OEMs as the base year for estimation, their performance in 2021 and investments data of each of the top key players as the base year for estimating the 2021 revenues and forecast the market to 2030 with market share analysis of key players will be provided for the year 2021.The updated version of the report will cover Semiconductor & Electronics as well as Aerospace (which includes applications in space technologies as well) from an end-user perspective showing you the market size, CAGR and forecast to 2026 from a regional and country level perspective. The updated report will consider 2020 to be the base year, 2021 will be estimated with a forecast to 2026. The report will also deliver a quantified COVID 19 Impact analysis from a regional perspective depicting optimistic, pessimistic and realistic scenarios of recovery.

Interested in the crucial market acquisition strategies and policies applied by the companies of the cryogenic pump market for the period of 2022-2030.