Cryostat Market by Type (Closed-Cycle, Continuous-Flow, Bath, Multistage), System Component (Dewars, Transfer Tubes, Gas Flow Pumps, Temperature Controllers, High Vacuum Pumps, Microtome Blades), Cryogen, Application & Region - Global Forecast to 2027

Updated on : March 06, 2025

The Quantum Sensors Market is experiencing robust growth, driven by increasing demand for highly sensitive measurement technologies across various industries, including healthcare, telecommunications, and environmental monitoring. These sensors leverage the principles of quantum mechanics to provide unparalleled precision in detecting physical quantities such as magnetic fields, temperature, and pressure. Key trends influencing the market include advancements in quantum technology research, the miniaturization of sensor devices, and the rising adoption of quantum sensors in applications like navigation and geophysical exploration. As industries seek innovative solutions to enhance operational efficiency and accuracy, the future of the Quantum Sensors Market looks promising, with ongoing developments expected to expand their capabilities and applications.

Cryostat Market Size

The cryostat market size is projected to reach USD 2.8 billion by 2027 from USD 2.2 billion in 2022; growing at a CAGR of 4.9% from 2022 to 2027

A cryostat is a chamber that can maintain low temperatures. Medical laboratories and research centers use cryostats to preserve frozen tissue samples. A microtome, a sharp cutting tool mounted inside the cryostats, slices the tissues into pieces thin enough to be observed under a microscope. Cryostats have various applications in science, engineering, and medicine. The potential end users of cryostats include the healthcare, energy & power, aerospace, metallurgy, biotechnology, and forensic science industries.

The report covers the demand and supply sides of the cryostat industry . The supply-side market segmentation is based on types, cryogens, and system components. The demand-side market segmentation is based on applications and regions. The growth in this market can be attributed to the developments in various medical applications, such as Magnetic Resonance Imaging (MRI) and tissue sampling. In addition, increasing applications of cryogenics in energy & power and aerospace applications are expected to boost the market growth. The market for healthcare applications accounted for the largest share of the overall cryostat market in 2021.

To know about the assumptions considered for the study, Request for Free Sample Report

Cryostat Market Trends & Dynamics:

Driver : High demand for effective healthcare services in developing economies

Cryostats are widely used in various medical applications, such as Magnetic Resonance Imaging (MRI) machines and storing tissue specimens. Cryostats used in MRI machines are designed to hold a cryogen, especially helium, in a liquid state with minimal evaporation. Modern MRI cryostats have a mechanical refrigerator or cryocooler to re-condense the helium gas and return it to the bath to conserve it. Cryostats also are used to slice tissue with the help of a microtome and store the specimens for medical purposes. The advantage of the cryostat-cut frozen section is the preservation of cell density and tissue architecture. It is most important in diagnosing neurosurgical materials, especially in the case of diffusely infiltrating glioma. Cryostat sectioning offers two main advantages over standard histology microtome sectioning. First, the turnaround time from fixation to tissue section is much shorter. Second, protein antigenicity is better preserved; therefore, cryostat sections are well suited for immunofluorescence staining of multiple proteins in the same tissue section.

Developing economies are observing a high rate of urbanization and industrialization. With the rising standard of living in these developing countries, the demand for healthcare facilities is also increasing. For instance, over the past decade, the number of hospitals, clinics, and research centers offering various treatments has grown rapidly, with most of these facilities investing in advanced medical devices, such as mammography equipment, MRI machines, Computerized Tomography (CT) simulators, CT scanners, and Computerized Axial Tomography (CAT) scanners. Therefore, a rise in the demand for advanced medical equipment is expected to increase the consumption of cryostats by healthcare service providers and equipment manufacturers.

Restraint : High-input power consumption

Power consumption is one of the key criteria considered while designing cryostats. The input power consumption of a cryostat is largely dependent on the heating load and operating temperature. In general, the cooling capacity of a cryostat must be taken into consideration when comparing the overall performance. However, advancements in cryostats led to significant improvements in input power requirements, depending on the refrigerant used and the overall thermal efficiency of the system.

Opportunity : Growing demand for cryostats for aerospace application

Aerospace applications for cryogenic technologies are growing, with a race between major countries to expand their space fleet. Advanced Adiabatic Demagnetization Refrigerators (AADRs) and others are used for cooling communication devices, satellite bodies, and X-ray spectrometers. Over the past decade, NASA has constantly been working on Cryogenic Fluid Management (CFM) technology, which is an integral part of the exploration systems for earth-to-orbit transportation, manned missions to the moon and mars, planetary exploration, and In-Situ Resource Utilization (ISRU). In 2000, Janis Research Company, LLC (US) received its second NASA Public Service Group Achievement Award for its performance on the FACET program, developing a cryostat to comply with the Shuttle Hitchhiker program and providing a platform for microgravity experimentation. In addition, research is taking place at the Spacecraft Component Thermal Research Group, Air Force Research Laboratory (AFRL), to increase the efficiency of space-qualified cryostats. Aerospace Fabrication & Materials performs testing of insulation systems using a Cryostat-200 developed by NASA’s Kennedy Space Center. It uses cryogenic boil-off calorimetry in a steady state method to measure the mass flow rate of the metering fluid. This steady state mass flow rate is measured across the entire spectrum of pressures from the hard vacuum to the standard atmosphere. The derived results include apparent thermal conductivity and heat flux.

Challenge : Tissue cracking and curling during cryostat tissue sectioning

In conventional cryostats, tissue is embedded in a frozen section by placing it face up on a tissue holder and covered with an embedding medium. The tissue holder or ‘chuck’ is set upon a freezing temperature bar. A heat sink is applied to the top of the tissue at the proper moment to speed the freezing process and flatten the surface of the tissue to create a flat plane. This system has many shortcomings, which can lead to considerable frustration. The system works adequately when a large volume of tissue is available and precise orientation is not an issue.

Cryostat Market Share

In system component segment, the dewar sub-segment is expected to hold the largest market share during the forecast period

Dewars are one of the key components of cryostats used for storing solid or liquid cryogens, which are hazardous. The capacity of dewars varies from 5 to 200 liters; the raw materials used for manufacturing dewars include stainless steel, glass, or aluminum with required safety standards. Dewar is an integral part of a cryostat from which liquid cryogen is drawn. A dewar usually consists of one or more reservoirs surrounded by a vacuum jacket that isolates these reservoirs from room temperature. These are made up of stainless steel, glass, or aluminum. Dewars made from stainless steel are considered the most reliable since stainless is rugged, has a relatively low thermal conductivity, and can easily be joined to other metals, such as copper and brass, by welding in an inert gas atmosphere or silver soldering. These storage vessels are portable, double-walled containers that are open-necked and non-pressurized. Only dewars that meet the prescribed safety standards should be used, and physical inspection should be carried out regularly to check the external surface integrity.

In application segment, aerospace application is expected to grow at higher CAGR during the forecast period

The market for the aerospace industry is expected to grow at the highest CAGR during the forecast period. The aerospace industry is an emerging application area for cryostats, where these are widely used for various advanced space and astronomy studies. In the aerospace industry, cryostats are used for cooling infrared sensors during various astronomical studies.

Some major studies conducted by various space agencies include space astronomy and planetary science. Space astronomy includes the study of star formation, planet detection, and black holes; planetary science comprises mineral distribution. Achieving longer-life cryostats with better life prediction is a key technology focus for the next few years. Since the beginning of space and satellite programs in 1957, cryostat technology has become progressive to a tremendous degree, providing a source of cryogenic cooling for several missions. There are a few companies in the ecosystem, such as Advanced Mechanical and Optical Systems (Belgium) and Redstone Aerospace (U.S.), which dedicatedly design and manufacture custom cryostats for space and terrestrial satellite applications.

To know about the assumptions considered for the study, download the pdf brochure

Cryostat Market Regional Analysis

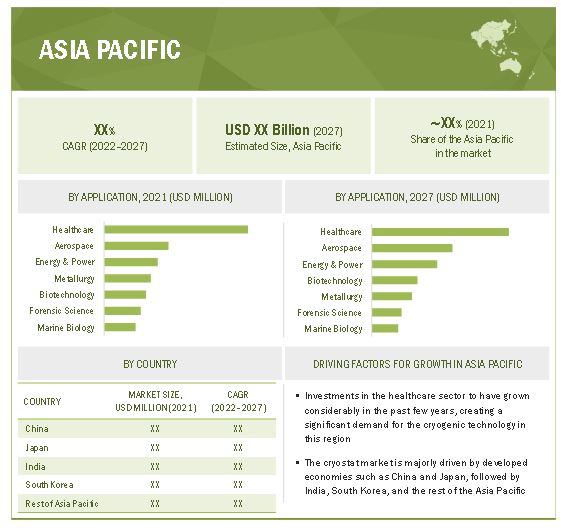

The cryostat market in APAC is expected to grow at highest CAGR during the forecast period (2022-2027)

The cryostat market in the Asia Pacific is expected to grow at the highest CAGR during the forecast period. Due to greater economic growth, the countries in this region are pushing themselves to develop and enhance healthcare and energy & power applications, creating prospects for the cryostat market. The cryostat market in the Asia Pacific is expected to grow at the highest rate during the forecast period. This market is majorly driven by developed economies such as China and Japan, followed by India, South Korea, and the rest of Asia Pacific. Investments in the healthcare and energy sectors have grown considerably in the past few years, creating a significant demand for cryogenic technology in the region. In addition, several countries in this region import natural gases, boosting the growth of the market for cryogenics in this region. Japan is the largest importer of LNG, along with several other developing nations in the region. These factors are driving the growth of the cryostat market in the Asia Pacific.

Some of the key players in this region that provide cryostats include Shenyang Pathtome Medical Instruments Co., Ltd. (China), Jinhua YIDI Medical Appliance Co., Ltd. (China), Amos Scientific Pty Ltd. (Australia), ATICO Medical Pvt. Ltd. (India), and Medimeas Instruments (India).

Key Market Players in Cryostat Market

The cryostat companies such as Leica Biosystems (Germany), Cryomech Inc. (US), Amos Scientific (Australia), MEDITE (Germany), Bright Instruments (UK), Dakewe Medical (China), Jinhua YIDI Medical Appliance Co., Ltd. (China), SLEE Medical GmbH (Germany), Advanced Research Systems (US), Lake Shore Cryotronics (US), Epredia (US), SM Scientific Instruments (India), Medimeas (India), Hacker Instruments & Industries (US), Boeckeler Instruments Inc. (US), Histo-line Laboratories (Italy), Lupetec (Brazil), SciLab Co. Ltd. (France), Cryofab, Inc. (US), Precision Cryogenics (US), attocube systems AG (Germany), AMETEK Scientific Instruments (US), Mirion Technologies (Georgia), BIOBASE (Germany), and Sipcon Instrument Industries (India).

Cryostat Market Report Scope :

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 2.8 Billion |

| Revenue Forecast in 2027 | USD 2.2 Billion |

| Growth Rate | 4.9% |

|

Market Size Available for Years |

2018–2027 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2027 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

|

|

Region Covered |

|

|

Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | High demand for effective healthcare services in developing economies |

| Key Market Opportunity | Growing demand for cryostats for aerospace application |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | In system component segment |

| Largest Application Market Share | Aerospace application |

In this report, the cryostat market has been segmented into the following categories:

Cryostat Market , By Type:

- Closed-Cycle Cryostats

- Continuous-flow Cryostats

- Bath Cryostats

- Multistage Cryostats

Cryostat Market , By System Component:

- Dewars

- Transfer Tubes

- Gas Flow Pumps

- Temperature Controllers

- High Vacuum Pumps

- Microtome Blades

By Cryogen:

- Helium

- Nitrogen

Cryostat Market , By Application:

- Healthcare

- Energy & Power

- Aerospace

- Metallurgy

- Biotechnology

- Forensic Science

- Marine Biology

Cryostat Market , By Region:

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments in Cryostat Industry

- In August 2020, Lake Shore Cryotronics announced the acquisition of Janis Research’s Laboratory Cryogenics business for low-temperature research. The acquisition of the Woburn, Massachusetts, based business enables Lake Shore to now offer Janis Research liquid nitrogen (LN2), liquid helium (LHe), and closed-cycle refrigerator (cryogen-free) cryostats, LHe and cryogen-free superconducting magnet systems, cryogenic and cryogen-free probe stations, and various lab cooling systems.

- In August 2020, AFCryo (CSA CSM), a division of Fabrum Solutions, and Cryomech (CSA CSM) collaborated to design and provide a liquid nitrogen generation system and helium recovery system for Victoria University of Wellington's (NZ) Nuclear Magnetic Resonance (NMR) lab. The helium recovery system reduces the need for helium shipments.

Frequently Asked Questions (FAQs):

Which are the major companies in the cryostat market? What are their major strategies to strengthen their market presence?

The major companies in cryostat market are – Leica Biosystems (Germany), Cryomech Inc. (US), Amos Scientific (Australia), MEDITE (Germany), Bright Instruments (UK), Dakewe Medical (China), Jinhua YIDI Medical Appliance Co., Ltd. (China), SLEE Medical GmbH (Germany), Advanced Research Systems (US), Lake Shore Cryotronics (US), Epredia (US), SM Scientific Instruments (India), Medimeas (India), Hacker Instruments & Industries (US), Boeckeler Instruments Inc. (US), Histo-line Laboratories (Italy), Lupetec (Brazil), SciLab Co. Ltd. (France), Cryofab, Inc. (US), Precision Cryogenics (US), attocube systems AG (Germany), AMETEK Scientific Instruments (US), Mirion Technologies (Georgia), BIOBASE (Germany), and Sipcon Instrument Industries (India). The major strategies adopted by these players are product launches, collaborations, agreements and acquisitions.

Which is the potential market for cryostat in terms of region?

North America is the largest market for cryostat. North America, being one of the fastest-growing markets for technology solutions, provides attractive opportunities for players offering cryostat; as a result, many companies are expanding their footprint in this region. US, Canada and Mexico are among the key hubs in North America that occupy the maximum share of the market of the region.

Which application segment is expected to drive the growth of the cryostat market in the next 5 years?

Aerospace application segment among all others is expected to grow at the highest CAGR in coming years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKET COVERED

FIGURE 1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC ANALYSIS

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DATA

FIGURE 2 CRYOSTAT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.1.2 Key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE) —BOTTOM-UP ESTIMATION OF CRYOSTAT MARKET BY GEOGRAPHY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET SHARE ESTIMATION

2.4 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 34)

FIGURE 7 DEWAR SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 8 HEALTHCARE APPLICATION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

FIGURE 9 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 37)

4.1 GROWTH OPPORTUNITIES IN CRYOSTAT MARKET

FIGURE 10 ASIA PACIFIC TO EMERGE AS LUCRATIVE GROWTH AVENUE FOR CRYOSTAT MARKET

4.2 CRYOSTAT MARKET, BY TYPE

FIGURE 11 BATH CRYOSTATS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

4.3 MARKET, BY CRYOGEN

FIGURE 12 NITROGEN SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET IN ASIA PACIFIC, BY APPLICATION & COUNTRY

FIGURE 13 HEALTHCARE APPLICATION AND CHINA TO ACCOUNT FOR LARGEST SHARES IN ASIA PACIFIC IN 2027

4.5 MARKET, BY COUNTRY

FIGURE 14 CRYOSTAT MARKET TO RECORD HIGHEST CAGR IN INDIA DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 40)

5.1 INTRODUCTION

5.2 EVOLUTION

FIGURE 15 EVOLUTION OF CRYOSTATS

5.3 MARKET DYNAMICS

FIGURE 16 CRYOSTAT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 High demand for effective healthcare services in developing economies

5.3.1.2 Increase in production of liquefied natural gas

FIGURE 17 CRYOSTAT MARKET DRIVERS: IMPACT ANALYSIS

5.3.2 RESTRAINTS

5.3.2.1 High-input power consumption

TABLE 1 VARIATION IN POWER CONSUMPTION BY CRYOSTATS MANUFACTURED BY LEICA BIOSYSTEMS (GERMANY)

FIGURE 18 CRYOSTAT MARKET RESTRAINTS: IMPACT ANALYSIS

5.3.3 OPPORTUNITIES

5.3.3.1 Growing demand for cryostats for aerospace application

5.3.3.2 Increasing use of natural gas pipelines

FIGURE 19 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.3.4 CHALLENGES

5.3.4.1 Tissue cracking and curling during cryostat tissue sectioning

5.3.4.2 Leakage of cryogen gases

FIGURE 20 CRYOSTAT MARKET CHALLENGES: IMPACT ANALYSIS

5.4 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN ANALYSIS: CRYOSTAT MARKET

5.5 MARKET MAP/ECOSYSTEM

TABLE 2 CRYOSTAT MARKET: ECOSYSTEM

FIGURE 22 KEY PLAYERS IN CRYOSTAT MARKET

5.6 REGULATORY LANDSCAPE

TABLE 3 CRYOSTAT MARKET: REGULATORY LANDSCAPE

6 CRYOSTAT MARKET, BY TYPE (Page No. - 49)

6.1 INTRODUCTION

FIGURE 23 CRYOSTAT MARKET, BY TYPE

FIGURE 24 CONTINUOUS-FLOW CRYOSTATS SEGMENT TO HOLD LARGEST SHARE OF CRYOSTAT MARKET DURING FORECAST PERIOD

TABLE 4 MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 5 MARKET, BY TYPE, 2022–2027 (USD MILLION)

6.2 CLOSED-CYCLE CRYOSTATS

6.2.1 HELIUM CRYOGEN IN CLOSED-CYCLE CRYOSTATS TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 6 CLOSED-CYCLE CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2018–2021 (USD MILLION)

TABLE 7 CLOSED-CYCLE CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2022–2027 (USD MILLION)

TABLE 8 CLOSED-CYCLE CRYOSTATS: MARKET, BY CRYOGEN, 2018–2021 (USD MILLION)

TABLE 9 CLOSED-CYCLE CRYOSTATS: MARKET, BY CRYOGEN, 2022–2027 (USD MILLION)

TABLE 10 CLOSED-CYCLE CRYOSTATS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 11 CLOSED-CYCLE CRYOSTATS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.3 CONTINUOUS-FLOW CRYOSTATS

6.3.1 CONTINUOUS-FLOW CRYOSTATS TO HOLD LARGEST MARKET SHARE

TABLE 12 CONTINUOUS-FLOW CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2018–2021 (USD MILLION)

TABLE 13 CONTINUOUS-FLOW CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2022–2027 (USD MILLION)

TABLE 14 CONTINUOUS-FLOW CRYOSTATS: MARKET, BY CRYOGEN, 2018–2021 (USD MILLION)

TABLE 15 CONTINUOUS-FLOW CRYOSTATS: MARKET, BY CRYOGEN, 2022–2027 (USD MILLION)

TABLE 16 CONTINUOUS-FLOW CRYOSTATS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 17 CONTINUOUS-FLOW CRYOSTATS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.4 BATH CRYOSTATS

6.4.1 BATH CRYOSTATS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 18 BATH CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2018–2021 (USD MILLION)

TABLE 19 BATH CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2022–2027 (USD MILLION)

TABLE 20 BATH CRYOSTATS: MARKET, BY CRYOGEN, 2018–2021 (USD MILLION)

TABLE 21 BATH CRYOSTATS: MARKET, BY CRYOGEN, 2022–2027 (USD MILLION)

TABLE 22 BATH CRYOSTATS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 23 BATH CRYOSTATS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

6.5 MULTISTAGE CRYOSTATS

6.5.1 MULTISTAGE CRYOSTATS TO GROW SIGNIFICANTLY IN ENERGY & POWER APPLICATION

TABLE 24 MULTISTAGE CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2018–2021 (USD MILLION)

TABLE 25 MULTISTAGE CRYOSTATS: MARKET, BY SYSTEM COMPONENT, 2022–2027 (USD MILLION)

TABLE 26 MULTISTAGE CRYOSTATS: MARKET, BY CRYOGEN, 2018–2021 (USD MILLION)

TABLE 27 MULTISTAGE CRYOSTATS: MARKET, BY CRYOGEN, 2022–2027 (USD MILLION)

TABLE 28 MULTISTAGE CRYOSTATS: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 29 MULTISTAGE CRYOSTATS: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7 CRYOSTAT MARKET, BY SYSTEM COMPONENT (Page No. - 62)

7.1 INTRODUCTION

FIGURE 25 CRYOSTAT MARKET, BY SYSTEM COMPONENT

FIGURE 26 MICROTOME BLADE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 30 MARKET, BY SYSTEM COMPONENT, 2018–2021 (USD MILLION)

TABLE 31 MARKET, BY SYSTEM COMPONENT, 2022–2027 (USD MILLION)

7.2 DEWARS

7.2.1 DEWARS TO HOLD MAXIMUM MARKET SHARE

TABLE 32 DEWARS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 33 DEWARS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.3 TRANSFER TUBES

7.3.1 TRANSFER TUBES TO PLAY SIGNIFICANT ROLE IN CIRCULATING LIQUID CRYOGEN

TABLE 34 TRANSFER TUBES: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 TRANSFER TUBES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.4 GAS FLOW PUMPS

7.4.1 CONTINUOUS-FLOW CRYOSTATS TO HOLD MAXIMUM SHARE OF GAS FLOW PUMPS INDUSTRY

TABLE 36 GAS FLOW PUMPS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 GAS FLOW PUMPS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.5 TEMPERATURE CONTROLLERS

7.5.1 TEMPERATURE CONTROLLER SYSTEM COMPONENT IS AT NASCENT STAGE

TABLE 38 TEMPERATURE CONTROLLERS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 39 TEMPERATURE CONTROLLERS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.6 HIGH VACUUM PUMPS

7.6.1 HIGH VACUUM PUMPS TO BE USED TO DECREASE PRESSURE IN VACUUM SPACE

TABLE 40 HIGH VACUUM PUMPS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 41 HIGH VACUUM PUMPS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.7 MICROTOME BLADES

7.7.1 MICROTOME BLADES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 42 MICROTOME BLADES: CRYOSTAT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 43 MICROTOME BLADES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

7.8 OTHER SYSTEM COMPONENTS

TABLE 44 OTHER SYSTEM COMPONENTS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 45 OTHER SYSTEM COMPONENTS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8 CRYOSTAT MARKET, BY CRYOGEN (Page No. - 72)

8.1 INTRODUCTION

FIGURE 27 CRYOSTAT MARKET, BY CRYOGEN

FIGURE 28 HELIUM SEGMENT TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 46 MARKET, BY CRYOGEN, 2018–2021 (USD MILLION)

TABLE 47 MARKET, BY CRYOGEN, 2022–2027 (USD MILLION)

8.2 HELIUM

8.2.1 HELIUM TO HOLD LARGEST MARKET SHARE IN 2021

TABLE 48 HELIUM CRYOGEN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 49 HELIUM CRYOGEN: MARKET, BY TYPE, 2022–2027 (USD MILLION)

8.3 NITROGEN

8.3.1 NITROGEN CRYOGEN MARKET TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

TABLE 50 NITROGEN CRYOGEN: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 51 NITROGEN CRYOGEN: CMARKET, BY TYPE, 2022–2027 (USD MILLION)

8.4 OTHER CRYOGENS

TABLE 52 OTHER CRYOGENS: CRYOSTAT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 53 OTHER CRYOGENS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

9 CRYOSTAT MARKET, BY APPLICATION (Page No. - 77)

9.1 INTRODUCTION

FIGURE 29 CRYOSTAT MARKET, BY APPLICATION

FIGURE 30 HEALTHCARE APPLICATION TO HAVE LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 54 MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 55 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 56 MARKET, 2018–2021 (THOUSAND UNITS)

TABLE 57 MARKET, 2022–2027 (THOUSAND UNITS)

9.2 HEALTHCARE

9.2.1 HEALTHCARE APPLICATION TO HOLD LARGEST MARKET SHARE IN 2021

9.2.2 MRI

9.2.3 FROZEN TISSUE SECTIONING

9.2.4 EXPLORATORY SURGERIES

9.2.5 OTHERS

TABLE 58 HEALTHCARE: MARKET, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 59 HEALTHCARE: MARKET, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 60 HEALTHCARE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 61 HEALTHCARE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 62 HEALTHCARE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ENERGY & POWER

9.3.1 ENERGY & POWER APPLICATION TO GROW SIGNIFICANTLY DURING FORECAST PERIOD

TABLE 64 ENERGY & POWER: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 65 ENERGY & POWER: CRYOSTAT MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 66 ENERGY & POWER: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 ENERGY & POWER: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 AEROSPACE

9.4.1 AEROSPACE APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 68 AEROSPACE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 69 AEROSPACE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 70 AEROSPACE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 AEROSPACE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 METALLURGY

9.5.1 HELIUM CRYOGEN MOSTLY USED IN METALLURGY APPLICATION

TABLE 72 METALLURGY: CRYOSTAT MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 73 METALLURGY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 74 METALLURGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 METALLURGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 BIOTECHNOLOGY

9.6.1 AGRICULTURAL RESEARCH TO HOLD LARGEST MARKET SHARE IN BIOTECHNOLOGY APPLICATION

9.6.2 VETERINARY STUDIES

9.6.3 AGRICULTURAL RESEARCH

9.6.4 BIOCHEMISTRY

TABLE 76 BIOTECHNOLOGY: CRYOSTAT MARKET, BY SUB-APPLICATION, 2018–2021 (USD MILLION)

TABLE 77 BIOTECHNOLOGY: MARKET, BY SUB-APPLICATION, 2022–2027 (USD MILLION)

TABLE 78 BIOTECHNOLOGY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 79 BIOTECHNOLOGY: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 80 BIOTECHNOLOGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 81 BIOTECHNOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 FORENSIC SCIENCE

9.7.1 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN FORENSIC SCIENCE APPLICATION

TABLE 82 FORENSIC SCIENCE: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 83 FORENSIC SCIENCE: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 84 FORENSIC SCIENCE: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 85 FORENSIC SCIENCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MARINE BIOLOGY

9.8.1 CRYOSTAT MARKET IN MARINE BIOLOGY APPLICATION AT NASCENT STAGE

TABLE 86 MARINE BIOLOGY: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 87 MARINE BIOLOGY: ARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 88 MARINE BIOLOGY: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 89 MARINE BIOLOGY: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER APPLICATIONS

TABLE 90 OTHER APPLICATIONS: MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 91 OTHER APPLICATIONS: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 92 OTHER APPLICATIONS: MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 CRYOSTAT MARKET, BY REGION (Page No. - 95)

10.1 INTRODUCTION

FIGURE 31 CRYOSTAT MARKET, BY GEOGRAPHY

FIGURE 32 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 94 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 95 CMARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 33 SNAPSHOT: CRYOSTAT MARKET IN NORTH AMERICA, 2021

TABLE 96 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increased demand for cryostats and presence of research companies to drive market in US

10.2.2 CANADA

10.2.2.1 Canada held second-largest share of cryostat market in North America in 2021

10.2.3 MEXICO

10.2.3.1 Development in infrastructure and favorable labor rates to drive cryostat market

10.3 EUROPE

FIGURE 34 SNAPSHOT: CRYOSTAT MARKET IN EUROPE, 2021

TABLE 100 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 103 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 Cryostat market to witness significant growth due to major developments

10.3.2 GERMANY

10.3.2.1 Germany to be largest cryostat market for adopting cryogenics

10.3.3 FRANCE

10.3.3.1 Cryostat market in France to exhibit fastest growth rate due to prosperity in medical industry

10.3.4 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 35 SNAPSHOT: MARKET IN ASIA PACIFIC, 2021

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: CRYOSTAT MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 Increasing investments in industries to drive cryostat market in China

10.4.2 JAPAN

10.4.2.1 Being a developed economy, Japan to become a potential market for cryostats

10.4.3 INDIA

10.4.3.1 Demand for cooling infrared sensors from various industries to fuel cmarket in India

10.4.4 SOUTH KOREA

10.4.4.1 Due to demand from various industries, market to witness remarkable development in South Korea

10.4.5 REST OF ASIA PACIFIC

10.5 ROW

FIGURE 36 SOUTH AMERICA TO HOLD LARGEST MARKET SHARE IN ROW DURING FORECAST PERIOD

TABLE 108 ROW: CRYOSTAT MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 109 ROW: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 110 ROW: MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 111 ROW: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 111)

11.1 OVERVIEW

TABLE 112 KEY DEVELOPMENTS UNDERTAKEN BY LEADING PLAYERS IN CRYOSTAT MARKET

11.2 MARKET SHARE AND RANKING ANALYSIS

TABLE 113 DEGREE OF COMPETITION

FIGURE 37 RANKING ANALYSIS OF TOP FIVE PLAYERS IN CRYOSTAT MARKET

11.3 COMPETITIVE BENCHMARKING

TABLE 114 COMPANY FOOTPRINT (14 COMPANIES)

TABLE 115 APPLICATION FOOTPRINT (14 COMPANIES)

TABLE 116 REGIONAL FOOTPRINT (14 COMPANIES)

11.4 COMPETITIVE SCENARIO AND TRENDS

11.4.1 DEALS

TABLE 117 DEALS, AUGUST 2020

12 COMPANY PROFILES (Page No. - 117)

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) *

12.1 KEY PLAYERS

12.1.1 LEICA BIOSYSTEMS

TABLE 118 LEICA BIOSYSTEMS: BUSINESS OVERVIEW

12.1.2 CRYOMECH INC

TABLE 119 CRYOMECH INC: BUSINESS OVERVIEW

TABLE 120 CRYOMECH INC: DEALS

12.1.3 AMOS SCIENTIFIC

TABLE 121 AMOS SCIENTIFIC: BUSINESS OVERVIEW

12.1.4 MEDITE

TABLE 122 MEDITE: BUSINESS OVERVIEW

12.1.5 RIGHT INSTRUMENTS

TABLE 123 BRIGHT INSTRUMENT: BUSINESS OVERVIEW

12.1.6 DAKEWE MEDICAL

TABLE 124 DAKEWE MEDICAL: BUSINESS OVERVIEW

12.1.7 JINHUA YIDI MEDICAL APPLIANCE CO., LTD.

TABLE 125 JINHUA YIDI MEDICAL APPLIANCE CO., LTD.: BUSINESS OVERVIEW

12.1.8 SLEE MEDICAL GMBH

TABLE 126 SLEE MEDICAL GMBH: BUSINESS OVERVIEW

12.1.9 ADVANCED RESEARCH SYSTEMS

TABLE 127 ADVANCED RESEARCH SYSTEMS: BUSINESS OVERVIEW

12.1.10 LAKE SHORE CRYOTRONICS

TABLE 128 LAKE SHORE CRYOTRONICS: BUSINESS OVERVIEW

TABLE 129 LAKE SHORE CRYOTRONICS: DEALS

12.2 OTHER KEY PLAYERS

12.2.1 EPREDIA

12.2.2 SM SCIENTIFIC INSTRUMENTS

12.2.3 MEDIMEAS INSTRUMENTS

12.2.4 HACKER INSTRUMENTS & INDUSTRIES

12.2.5 BOECKELER INSTRUMENTS INC.

12.2.6 HISTO-LINE LABORATORIES

12.2.7 LUPETEC

12.2.8 SCILAB CO. LTD.

12.2.9 CRYOFAB, INC.

12.2.10 PRECISION CRYOGENICS

12.2.11 ATTOCUBE SYSTEMS AG

12.2.12 AMETEK SCIENTIFIC INSTRUMENTS

12.2.13 MIRION TECHNOLOGIES

12.2.14 BIOBASE

12.2.15 SIPCON INSTRUMENT INDUSTRIES

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 138)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 QUESTIONNAIRE FOR CRYOSTAT MARKET

13.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 CUSTOMIZATION OPTIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

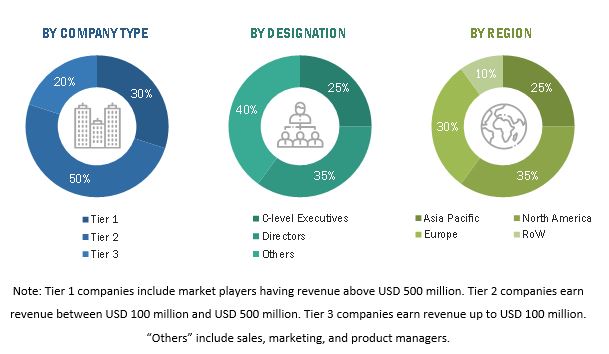

This research study extensively uses secondary sources, directories, and databases (such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the cryostat market. In-depth interviews have been conducted with various primary respondents, including industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, key industry participants, subject matter experts, C-level executives of key market players, and industry consultants among other experts, to obtain and verify critical qualitative and quantitative information and assess the future market prospects. The following figure shows the market research methodology applied in this report on the cryostat market. Key players in the cryostat market have been identified through secondary research, and their market ranking analysis has been determined through primary and secondary research. This research includes the study of the annual reports of the market players to identify the top players in the cryostat market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information relevant to this study on the cryostat market. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the cryostat market was obtained from the secondary data made available through paid and unpaid sources. It was determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research was used to gather key information about the industry’s supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources were interviewed to obtain qualitative and quantitative information related to the market across four main regions: Asia Pacific, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, technology directors, and other key executives from major companies and organizations operating in the cryostat market or related markets.

After the completion of market engineering, primary research was conducted to gather information and verify and validate critical numbers obtained from other sources. Primary research was also conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most of the primary interviews were conducted with the supply side of the market. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used extensively in the market engineering process. Several data triangulation methods were also used to perform market forecasting and market estimation for the overall market segments and subsegments in the report. Multiple qualitative and quantitative analyses were performed on the market engineering process to gain key insights throughout the report.

Secondary research was used to identify the key players in the cryostat market. The revenues of those key players were determined through both primary and secondary research. The revenues were identified geographically as well as market segment-wise, using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights into the key players and the cryostat market. All the market shares were estimated using secondary and primary research. This data was consolidated, supplemented with detailed inputs and analysis from MarketsandMarkets, and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation was employed to complete the market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both the top-down and bottom-up approaches.

Study Objectives

- To define, describe, and forecast the global cryostat market based on types, system components, cryogens, applications, and geographies

- To provide the market statistics with detailed classifications along with the respective market size

- To strategically analyze the micromarkets1 with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and detail the competitive landscape of the market leaders

- To forecast the size of the market segments with respect to four main geographies: North America, Europe, Asia Pacific, and the rest of the world

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To track and analyze the competitive developments, such as joint ventures, mergers and acquisitions, new product launches, and R&D activities in the cryostat market

- To map the competitive intelligence based on the company profiles, key player strategies, and game-changing developments such as product developments, collaborations, and acquisitions

Report Scope

The report covers the demand- and supply-side segmentation of the cryostat market. The supply-side market segmentation includes the type, system component, and cryogen, whereas the demand-side market segmentation includes application, and region.

The following years are considered:

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on the specific requirements of companies. The following customization options are available for the report:

Company Information

- Market size based on different subsegments of the cryostat market

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cryostat Market