Data Center Rack Market

Data Center Rack Market by Rack Type (Open Frame, Enclosed), Type (Server Racks, Network Racks), Rack Height (42U & Below, 43U up to 52U), Rack Width (19 Inch, 23 Inch), Data Center Type (Enterprise, Colocation, Hyperscale) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global data center rack market is projected to grow from USD 5.17 billion in 2025 to USD 9.42 billion by 2030, at a CAGR of 12.7%, driven by the rapid expansion of hyperscale, colocation, and edge data centers. Growth is fueled by rising demand for AI-ready infrastructure, cloud-native deployments, and high-density compute environments. Cloud service providers and hyperscalers are deploying modular rack systems that support liquid cooling, direct-to-chip cooling, and rack power densities exceeding 1MW, enabling efficient hosting of GPU-intensive workloads and HPC clusters.

KEY TAKEAWAYS

-

BY OFFERINGThe solutions segment dominates the market as enterprises and service providers deploy high-density, modular, and energy-efficient rack systems to optimize performance, cooling, and power management in large-scale data centers. Meanwhile, the services segment is projected to grow at the highest CAGR, driven by rising demand for integration, installation, and maintenance support that ensures seamless deployment and operational scalability of modern rack infrastructures.

-

BY DATA CENTER TYPEHyperscale data centers are driving the fastest growth in the rack market, fueled by massive expansion in cloud computing, AI workloads, and the need for high-density modular racks with advanced cooling and power capabilities. While on-premises and enterprise data centers continue to adopt modern rack systems for improved efficiency and space utilization, their growth remains moderate compared to hyperscale deployments.

-

BY VERTICALThe BFSI sector holds the largest market share due to its critical need for secure, high-performance, and compliance-ready infrastructure. With the rise of digital banking, fintech platforms, and real-time payment systems, financial institutions rely on advanced rack systems to manage vast volumes of transactional and customer data. Regulatory demands for uptime, data security, and operational continuity further accelerate rack investments.

-

BY REGIONAsia Pacific is projected to grow at the fastest rate (CAGR 17.1%), driven by rapid digital transformation, cloud adoption, and the expansion of hyperscale and colocation data centers. Demand from BFSI, e-commerce, and IT sectors is fueling investments in high-density, energy-efficient, and modular rack solutions. Government-backed smart city initiatives and data infrastructure programs are further accelerating the deployment of racks across the region.

-

COMPETITIVE LANDSCAPEKey players, including Schneider Electric, HPE, IBM, Eaton, and Rittal, are driving innovation in modular rack designs, energy-efficient solutions, and scalable infrastructure. Schneider Electric leads in integrated power and cooling solutions; HPE and IBM offer high-performance racks for enterprise and hyperscale environments; Eaton focuses on advanced power management and reliability; and Rittal specializes in flexible modular racks tailored for diverse deployment needs. Ongoing product development, strategic partnerships, and regional expansion are intensifying competition and fueling market growth.

The data center rack market is expanding rapidly as enterprises and service providers scale their infrastructure to support cloud adoption, AI-driven workloads, and the growing demand for digital services. Hyperscale and colocation operators are increasingly deploying high-density racks to optimize space, cooling, and energy efficiency. At the same time, growing reliance on third-party data centers is accelerating demand for flexible and modular rack designs. This evolution is driving continuous innovation, with vendors introducing advanced solutions tailored to complex and large-scale deployments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The data center rack market is undergoing significant disruption, driven by evolving customer requirements and technological advancements. Buyers are increasingly focused on high-density racks capable of supporting power-intensive applications such as artificial intelligence, big data, and edge computing, leading to a shift away from traditional, lower-capacity racks. Additionally, sustainability concerns are driving demand for energy-efficient, modular rack solutions that align with environmental goals and lower operational costs. The expansion of hyperscale and colocation data centers has further influenced purchasing behavior, with an emphasis on scalability, rapid deployment, and compatibility with advanced cooling and cable management systems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for data generation and storage needs from cloud computing, AI, and IoT

-

Adoption of modular and edge data centers

Level

-

Space and power limitations in legacy data centers

-

High initial setup cost associated with advanced rack infrastructure

Level

-

Innovations in thermal management and smart rack technologies

-

Rising adoption of AI & ML workload, requiring optimized rack infrastructure

Level

-

Integration with legacy infrastructure and backward compatibility

-

Ensuring physical security and compliance with data protection regulations

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increasing demand for data generation and storage needs from cloud computing, AI, and IoT

The exponential surge in data generation—driven by cloud computing, AI/ML workloads, and IoT ecosystems—is accelerating the deployment of hyperscale and edge data centers. This is fueling demand for modular, high-density rack systems that support advanced thermal management, high-power density configurations, and optimized cable management. Enterprises are prioritizing scalable, customizable, and space-efficient rack architectures to reduce TCO, improve energy efficiency, and support complex, compute-intensive workloads.

Restraint: Space and power limitations in legacy data centers

Aging data centers face space and power constraints, making it challenging to accommodate modern, high-density servers and networking equipment. Key issues include inadequate power distribution units (PDUs), outdated cooling systems, and non-standard rack dimensions. These limitations are prompting a shift toward greenfield deployments and next-gen data center designs optimized for scalability and energy efficiency.

Opportunity: Innovations in thermal management and smart rack technologies

Vendors are introducing AI-ready, IoT-enabled rack systems equipped with liquid cooling, high-efficiency airflow designs, and real-time environmental monitoring capabilities. Solutions like Delta Electronics’ 1,400A busbar-enabled racks and Vertiv’s VR Rack exemplify how intelligent rack infrastructure can extend hardware lifespan, reduce energy consumption, and enable predictive maintenance. These innovations are critical for hyperscale, colocation, and edge deployments where space optimization and thermal efficiency are paramount.

Challenge: Integration with legacy infrastructure and backward compatibility

Integration with Legacy Systems: Backward compatibility remains a major hurdle due to non-standard form factors, incompatible power & cooling requirements, and custom retrofitting needs. Vendors like Rittal (VX IT) and Vertiv are addressing this with adaptive rack solutions that support mixed environments, enabling phased upgrades while preserving existing infrastructure investments.

Data Center Rack Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

AWC partnered with Rittal to deliver secure, scalable, and modular IT enclosures for a leading tissue manufacturer. | Customizable plug-and-play systems to meet evolving operational needs | Accelerated deployment and simplified procurement | Improved operational efficiency and reduced downtime | Enabled AWC’s expansion into IT infrastructure, unlocking new revenue streams and long-term business growth |

|

SAGA and Vertiv rapidly upgraded a Serbian telecom’s data center using Vertiv VR Racks and Geist PDUs, with seamless DCIM integration. | Optimized space utilization and real-time power monitoring | Minimized downtime through proactive infrastructure management | Scalable architecture for future growth | Enhanced resilience, cost-efficiency, and competitive positioning |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The data center rack market encompasses the design, manufacturing, and deployment of physical racks, cabinets, and enclosures used to house IT equipment, including servers, storage devices, and networking components. This market includes vendors offering solutions for rack-level power distribution, cooling, security, and monitoring. As data centers evolve to support growing demand for cloud, AI, and big data, the need for efficient, scalable, and secure rack solutions continues to rise. The market is driven by trends in hyperscale computing, colocation services, and the increasing need for infrastructure security.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Data Center Rack Market, By Offering

The solutions segment is projected to dominate the data center rack market, driven by the increasing demand for high-performance, scalable, and energy-efficient rack infrastructure. This includes advanced rack systems, enclosures, and integrated power and cooling management; support for high-density workloads such as AI, big data, and cloud-native applications; and modular and customizable designs that address diverse deployment needs across hyperscale, colocation, and enterprise environments.

Data Center Rack Market, By Type

The server rack segment dominates the market, as it forms the backbone of compute-intensive workloads across enterprises, hyperscale data centers, and colocation facilities. Server racks enable efficient housing of servers while supporting power and cooling optimization. Key drivers include increasing adoption of AI, HPC, and big data applications, the growing need for scalable, modular rack systems, and enhanced cooling & airflow management in high-density environments. These advantages are positioning server racks as a critical component for modernizing infrastructure and meeting the demands of next-generation workloads.

Data Center Rack Market, By Data Center Type

The on-premises/enterprise segment continues to hold a significant share due to the widespread presence of enterprise-owned data centers across various verticals, including BFSI, healthcare, and manufacturing. The need for secure, compliant, and scalable rack solutions, as well as support for mission-critical workloads and disaster recovery, and seamless integration with legacy infrastructure, are key drivers in this market.

Data Center Rack Market, By Rack Height

The 42U and below rack segment continues to hold the largest market share owing to its flexibility, cost-effectiveness, and suitability for enterprise and edge data centers. These racks are widely used for small to mid-scale deployments. Key drivers include compatibility with legacy infrastructure and existing layouts, cost-efficient deployment for enterprise and edge facilities, and growing adoption in modular and compact data center designs. These benefits are enabling enterprises to optimize limited space, ensure seamless upgrades, and improve infrastructure efficiency in both traditional and edge environments.

Data Center Rack Market, By Data Center Size

The large data center segment holds the largest market share due to significant rack deployments in hyperscale and colocation facilities. These environments require scalable, high-density, and energy-efficient racks to support massive workloads. Key drivers include the expansion of hyperscale and cloud service provider facilities, the rising demand for modular and energy-optimized rack systems, and the ability to manage large-scale AI, IoT, and big data workloads. These factors are driving large data centers to adopt advanced rack solutions that enhance scalability, improve operational efficiency, and reduce the total cost of ownership.

Data Center Rack Market, By Vertical

The BFSI sector is expected to lead vertical adoption due to its need for secure, high-performance, and compliance-ready infrastructure, as well as the management of sensitive transactional data and real-time analytics, and support for digital banking, fintech platforms, and AI-driven fraud detection. BFSI organizations are prioritizing modular, energy-efficient, and space-optimized rack systems, as well as infrastructure that ensures uninterrupted operations and regulatory compliance, and scalable solutions that align with their digital transformation and cloud migration strategies.

REGION

Asia Pacific is expected to grow at the highest CAGR in market during the forecast period

North America is projected to dominate the data center rack market, driven by strong cloud adoption across the enterprise and public sectors, the rapid integration of AI, machine learning, and IoT workloads, and the aggressive expansion of hyperscale and colocation data centers. Major hyperscalers are investing heavily in infrastructure. For example, Apple’s USD 100 billion U.S. investment plan, including the Maiden, North Carolina data center expansion, underscores the demand for high-density, scalable rack systems, advanced thermal management, and energy-efficient enclosures to support next-gen compute environments.

Data Center Rack Market: COMPANY EVALUATION MATRIX

In the data center rack market matrix, Schneider Electric (Star) has a substantial presence due to its comprehensive portfolio of high-density, energy-efficient, and modular rack solutions, strong global presence, and continuous innovation in power and thermal management. IBM (Emerging Leader) is gaining traction with scalable, AI-ready rack systems and enterprise-focused solutions, while steadily expanding its capabilities in hybrid and cloud data center environments. Both companies are leveraging technological advancements and strategic partnerships to address evolving customer demands and strengthen their market positions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.46 Billion |

| Market Forecast in 2030 (Value) | USD 9.42 Billion |

| Growth Rate | 12.7% |

| Years Considered | 2020–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million/Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Data Center Rack Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Provider (US) |

|

|

| Leading Provider (EU) |

|

|

RECENT DEVELOPMENTS

- April 2025 : Legrand acquired Computer Room Solutions, a Sydney-based vendor with nearly 20 years of experience in server racks, security caging, and uninterruptible power supply (UPS) systems. This strengthens Legrand’s data center hardware portfolio and regional footprint in Asia-Pacific, enhancing its ability to serve edge, colocation, and enterprise deployments.

- March 2025 : A three-way partnership between Schneider Electric, ETAP, and NVIDIA integrates digital twin technology with NVIDIA Omniverse to enable chip-level dynamic power modeling (up to 132kW rack densities) and improve real-time operational efficiency for AI factories and high-density environments. This builds on Schneider’s liquid-cooled reference design (December 2024) and the launch of its microgrid + data center R&D lab in Massachusetts (March 2025), reinforcing its leadership in AI-optimized, sustainable infrastructure.

- March 2025 : Eaton announced the acquisition of Fiberbond Corporation, a specialist in pre-integrated modular power enclosures for multi-tenant data centers. Expected to close in Q3 2025, Projected to generate USD 110M in adjusted EBITDA for 2025. Enhances Eaton’s capabilities in modular power delivery, reducing deployment time and costs, and expanding its presence in the colocation and hyperscale segments.

- February 2025 : Vertiv, in partnership with Oxigen, launched its largest and most energy-efficient facility in Sant Cugat del Vallès, Spain, with a 6,000m² Tier III facility (including a 3,000m² clean room) that supports 800 racks and is powered by 100% renewable energy. This demonstrates Vertiv’s leadership in AI-scalable, sustainable, and modular data center infrastructure.

- January 2025 : Fujitsu, in collaboration with Supermicro and Nidec, has launched a subscription-based service to enhance data center energy efficiency that combines liquid-cooling control software, GPU servers, and advanced cooling systems. The initial deployment was at Tatebayashi Data Center, with a commercial launch in Japan (Q1 FY2025).

Table of Contents

Methodology

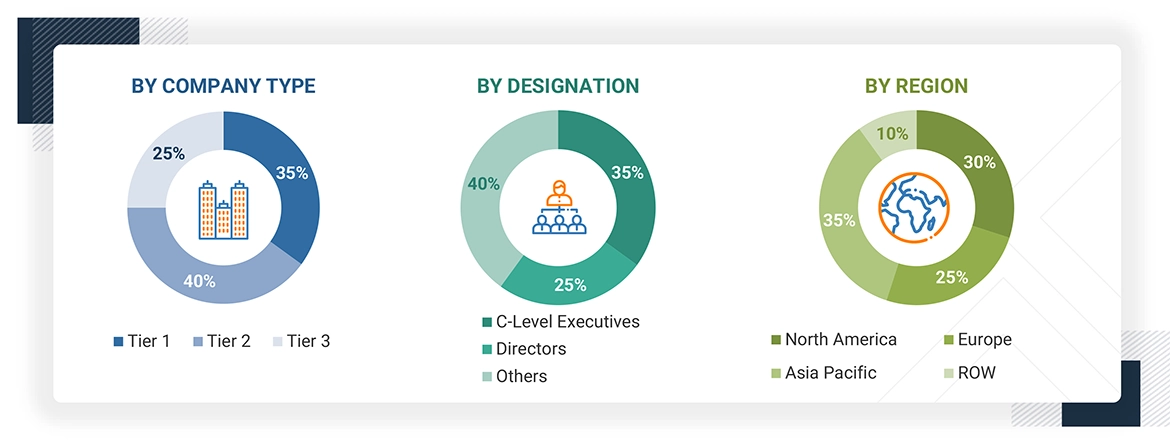

This research study on the data center rack market involved extensive secondary sources, directories, several journals, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information useful for this technical, market-oriented, and commercial study of the data center rack market. Primary sources were industry experts from core and related industries, preferred system developers, service providers, resellers, partners, and organizations related to the various segments of the industry’s value chain. In-depth interviews were conducted with different primary respondents, including key industry participants and subject-matter experts, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

These included key industry participants, subject-matter experts, C-level executives of key companies, and industry consultants. Primary sources were mainly industry experts from the core and related industries, preferred Data center rack providers, third-party service providers, consulting service providers, end users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information and assess growth prospects. The following figure highlights the market research methodology applied to make the Data center rack market report.

Secondary Research

The market size of companies offering data center rack solutions and services was determined based on secondary data available through paid and unpaid sources. It was also evaluated by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

Various sources were considered in the secondary process to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals and related magazines. Data center rack spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain the key information related to the industry’s value chain and supply chain to identify key players, market classification, and segmentation according to offerings of major players and key developments from market and technology-oriented perspectives.

Primary Research

In the primary research process, various sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing data center rack solutions and services. The primary sources from the demand side included end users, such as Chief Information Officers (CIOs), consultants, service professionals, technicians and technologists, and managers at public and investor-owned utilities.

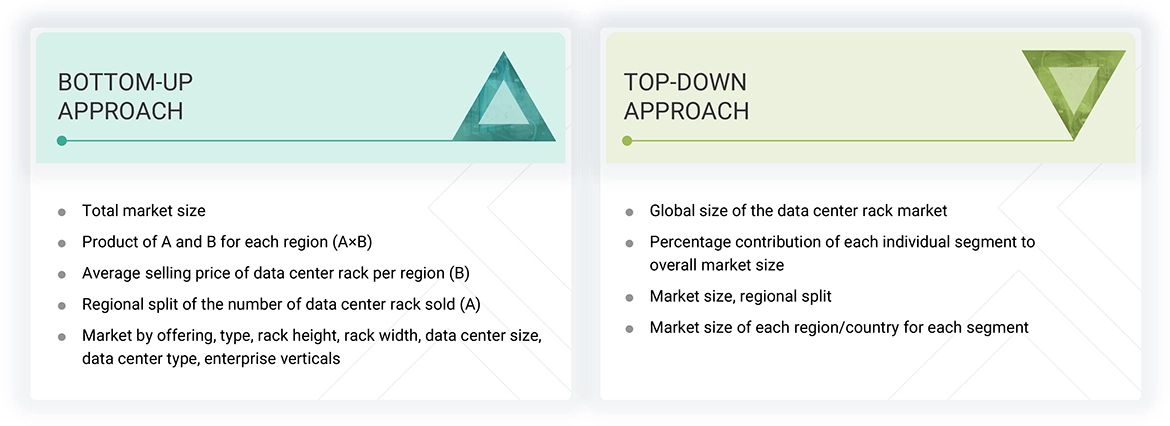

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform market estimation and market forecasting for the overall market segments and subsegments listed in the report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and identify the segmentation, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Note 1: Tier 1 companies have revenues greater than USD 10 billion; tier 2 companies’ revenues range between

USD 1 and 10 billion; and tier 3 companies’ revenues range between USD 500 million and 1 billion.

Note 2: Others include sales, marketing, and product managers.

Source: Secondary Literature, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the data center rack market. The first approach involved estimating the market size by the summation of the companies’ revenue generated through the sale of services.

The research methodology used to estimate the market size included the following.

- Primary and secondary research was conducted to assess the revenue contributions of major market participants in each country, with secondary research identifying these participants.

- Critical insights were obtained by conducting in-depth interviews with industry professionals, including directors, CEOs, VPs, and marketing executives, and by reading the annual and financial reports of the top firms in the market.

- Primary sources were used to verify all percentage splits and breakups, calculated using secondary sources.

Data Center Rack Market : Top-Down and Bottom-Up Approach

Data Triangulation

Once the overall market size was determined, the market was divided into segments and subsegments using the previously described market size estimation procedures. When required, market breakdown and data triangulation procedures were employed to complete the market engineering process and specify the exact figures for every market segment and subsegment. The data was triangulated by examining several variables and patterns from the government entities’ supply and demand sides.

Market Definition

Considering the views of various sources and associations, MarketsandMarkets defines “a data center rack as a steel and electronic framework designed to house servers, networking devices, cables, and other data center computing equipment. This physical structure provides equipment placement and orchestration within a data center facility.”

Stakeholders

- Rack Manufacturers

- Colocation Providers

- Telecom Operators

- IT Infrastructure Providers

- System Integrators

- Network Operators

- Component Providers

- Consultants & Data Center Designers

- Data Center Operators

- Channel Partners & Distributors

- Internet Service Providers (ISPs)

- Regulatory Bodies / Standards Organizations

Report Objectives

- To define, describe, and forecast the data center rack market in terms of value

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To forecast the market by offering (solutions, services), type, rack height, rack width, data center size, data center type, on-premises/enterprise verticals, and region

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To profile the key market players, including top vendors and startups; provide a comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials; and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as mergers & acquisitions (M&A), product launches/enhancements, agreements, partnerships, collaborations, expansions, and R&D activities, in the market

Available Customizations

MarketsandMarkets provides customizations based on the company’s unique requirements using market data. The following customization options are available for the report.

Product Analysis

- The product matrix provides a detailed comparison of each company’s portfolio.

Geographic Analysis as per Feasibility

- Further breakup of the data center rack market

Company Information

- Detailed analysis and profiling of five additional market players

Key Questions Addressed by the Report

What is the projected market value of the Data Center Rack Market?

The global Data Center Rack Market was crossed $4.4 billion in 2022 and is anticipated to rise over $6.6 billion by 2027, at a CAGR of 8.7%.

What are the key trends of Data Center Rack Market?

Below are the key trends in Data Center Rack Market:

- Increasing demand for higher density racks

- Growth of edge computing

- Increasing focus on energy efficiency

- Growing adoption of hybrid cloud

- Increasing focus on security and compliance

Which region has the highest market share in the Data Center Rack Market?

North America region has the highest market share in the data center rack market

Which are the leading vendors in the Data center Rack Market?

The major vendors in data center rack market includes Schneider Electric (France), HPE (US), Rittal (Germany), IBM (US), Cisco (US), Fujitsu (Japan), Eaton (Ireland), Dell (US), Vertiv (US), and AGC Network (India).

What are the Key Opportunities in the Data Center Rack Market?

Data center rack providers are increasingly working towards developing enhanced servers that can withstand harsh environments and have applications in various industries, including military, oil and gas, shipping, aeronautics, and others. Companies have started offering customized rack enclosures specifically designed for hyperscale data centers, hence increasing the deployment.

What are the regulations or industry standards that will impact the Data Center Rack Market?

The Data center rack market is impacted by various standards, including ISO 9001 Quality Management, ISO/IEC 27000 Standards, CSA controls, and Distributed Management Task Force (DMTF)-Cloud Infrastructure Management Interface (CIMI). Moreover, many major Data center rack solutions adhere to other industry and regional regulation, including but not limited to PCI DSS, European Union Agency for Cybersecurity (ENISA) Information Assurance Framework, Federal Risk and Authorization Management Program (FedRAMP), HIPAA, and many others.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Data Center Rack Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free Customisation

Growth opportunities and latent adjacency in Data Center Rack Market