Data Center Security Market by Application Solutions (Logical Security Solutions and Physical Security Solutions), Service (Consulting, Integration and Deployment, and Managed Services), Data Center Type, Vertical, and Region - Global Forecast to 2021

[140 Pages Report] The data center security market is expected to grow from USD 6.32 billion in 2016 to USD 12.91 billion by 2021, at a high Compound Annual Growth Rate (CAGR) of 15.36%. For the purpose of report, 2015 has been considered as the historical year and 2016 as the base year for performing market estimation and forecasting. The growing data center security threats and increased data traffic over the networks have paved way for adoption of data center security solutions by various organizations. Data center security includes solutions for access control, compliance, data protection, and security consulting services. Data center security is undergoing technological advancements and is experiencing significant adoption. Hence, it is expected to experience an exponential growth in the coming years. The market is broadly segmented by application solution, service, data center type, industry vertical, and region. The global data center security market is segmented across five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America.

Market Dynamics

Drivers

- Virtualization and cloud computing

- Increasing data traffic and need for secured connectivity

- Increased number of sophisticated attacks

Restraints

- Limited IT budgets, availability of low-cost substitutes, and piracy

Opportunities

- Requirement for more data centers

- Micro-segmentation for enhanced data center security

- Integrating logical and physical security solutions

Challenges

- Continuous innovations in data centers

Increasing data traffic and need for secured connectivity to drive growth of data center cooling market

After big data, analytics and other technological modules, data traffic is growing exponentially. Heavy use of social media, increasing need for connectivity, and high penetration of internet for business and personal use in the last few years have greatly affected the demand for advanced and efficient network and cyber security solutions and services. Further, the increasing adoption trend of technologies such as BYOD has boosted the requirement for efficient and advanced network security and network analytics solutions. Due to the increasing trend of BYOD, mobile data traffic grew by 70% in 2014, from 1.5 exabytes per month in 2013 to 2.5 exabytes per month in 2014. Rising needs for higher speed connectivity is further fueling this market.

Major Market Developments

- In March 2016, HPE unveiled new security solutions that help enterprises with enhanced secured environment for their business

- In February 2016, IBM announced the acquisition of Resilient Systems to strengthen its incident response capabilities

- In February 2016, Cisco expanded its partnership with NATOs Communications and Information Agency, to provide security services and products to 28 NATO member nations including CISCOs customers

Objectives of the Study:

The main objective of this report is to define, describe, and forecast the global data center security market on the basis of application solutions, services, data center types, industry verticals, and regions. The report provides detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). The report aims to strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the total market. The report attempts to forecast the market size with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), Middle East & Africa (MEA), and Latin America. The report strategically profiles key players and comprehensively analyzes their core competencies. This report also tracks and analyzes competitive developments such as joint ventures, mergers & acquisitions, new product developments, and Research & Development (R&D) activities in the data center rack server market.

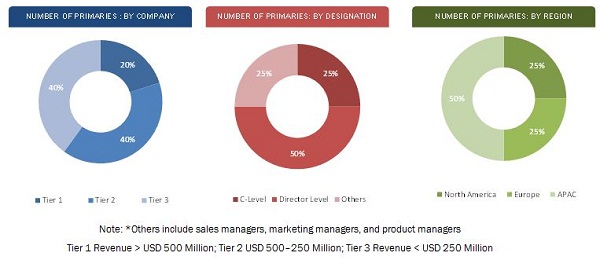

The research methodology used to estimate the market size includes the following details: the key players in the market were identified through secondary research and their market shares in respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources. Top-down and bottom-up approaches were used to estimate and validate the size of the global data center security market and to estimate the size of various other dependent submarkets in the overall data center security market. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The data center security ecosystem comprises supply side, intermediates, and demand side. The supply side vendors include hardware suppliers and equipment manufacturers, software suppliers, cloud providers, and professional services. The top vendors include Hewlett Packard Enterprises, International Business Machines (IBM) Corporation, CISCO Systems, Fortinet, and Honeywell International, among others. The intermediate includes system integrators and value-added service providers and distributors. The system integrators are responsible for the integration of data center security resources and cloud resources. The demand side includes the end users of data center security solutions, such as BFSI, IT & telecom, government & defense, healthcare, media and entertainment, and others.

Target Audience

- Telecom Operators

- IT Services Provides

- System Integrators

- Consulting Services providers

- Cloud Services Providers

- Data Center Vendors

- Colocation Providers

- Internet Service Providers (ISPs)

Report Scope

The data center security market report is broadly segmented into the following:

Global Data Center Security Market, by Application Solution

- Physical Security Solutions

- Logical Security Solutions

Global Data Center Security Market, by Service

- Consulting

- Integration and Deployment

- Managed Services

Global Data Center Security Market, by Data Center Type

- Mid-Sized Data Centers

- Enterprise Data Centers

- Large Data Center

Global NAC Market, by Vertical

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Government and Defense

- Healthcare

- Media and Entertainment

- Others

Global NAC Market, by Region

- North America

- Europe

- APAC

- MEA

- Latin America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the regions according to the feasibility

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The data center security market is estimated to grow from USD 5.61 billion in 2016 to USD 12.91 billion by 2021, at a high Compound Annual Growth Rate (CAGR) of 15.36% during the forecast period. Network security is gaining a significant importance among the corporates due to the increasing number of untrusted devices accessing their networks. Hence, the adoption of NAC in various industries is increasing, which is one of the major growth factors of the market.

The report provides detailed insights into the global data center security market, which is segmented by application solution, service, data center type, vertical, and region. By application solution, logical security solution holds higher market share than physical security solution. However, physical security solution is expected to show great growth opportunities within the next five years. The evolution of data center security solutions has observed a dramatic change. Earlier, the security solutions were generic in nature but today, with the advent of technology, advanced analytics and proactive tools have emerged that provide higher degree of data center security. Growing investment in data center security across the world and the increasing adoption of these solutions is further fueling the growth of the market.

The data center security market by data center type includes mid-sized data center, enterprise data center, and large data center. With the increasing adoption of the security solutions in large data centers, adoption of security solutions is also growing in mid-sized and enterprise data centers.

Data center security is considered crucial as it needs to address the network security as well as physical security of a data center. The data center security market is booming and during the forecast period, it is expected that adoption rate will increase and contribute to the high growth of this market. The report provides detailed insights into the global data center security market. The market has been segmented into many industry verticals, namely, Banking, Financial, and Insurance Services (BFSI), IT & telecom, government & defense, healthcare, media & entertainment, and others where BFSI holds the largest market share, and government and defense accounts for the highest CAGR.

Increasing data traffic and need for secured connectivity to drive growth in the data center rack server market

BFSI

Financial institutions, banks, insurance companies, and financial markets across the globe are closely monitored by regulatory agencies and are made to put a strong focus on adherence to guidelines and compliances of respective authorities. The BFSI sector uses data centers for storing and securing its customers crucial and personal data, which is at high risk of cyber threats and data vulnerabilities. The major challenges faced by the BFSI sector are hacking and intrusions. High adoption rate of new technologies has become an obligatory requirement for financial institutions that are strongly focusing on combating hacking. Banks and financial institutes across the globe have started using stronger access controls, IDS/IPS, IDS firewalls, two-factor authentication, encryption, and other controls and protocols to guard valuable asset information.

IT and Telecom

Telecom and IT companies across the globe frequently use data centers to store their crucial business data and customers personal data. Most of the telecom and IT companies highly depend on data centers for the smooth running of business operations. Therefore, telecom and IT companies around the world are aggressively adopting advance security solutions and services to protect their crucial data from cyberattacks and hackers and to strengthen their capability against unplanned threats and cyber-attacks.

Government and Defense

Governments and public sectors across the globe are putting high emphasis on data center security and data privacy. These sectors are experiencing a high usage and dependence on IT and telecommunication infrastructures to increase efficiency and reliability of the data stored on the servers. Governments and public organizations are increasingly using data center security measures to protect the data from attacks by intruders and hackers, as well as to strengthen their flexibility against natural corrosion and unplanned threats such as equipment shutdowns and user errors.

Critical questions the report answers:

- Where will all these developments take the industry in the mid to long term?

- What are the upcoming industry applications for data center security?

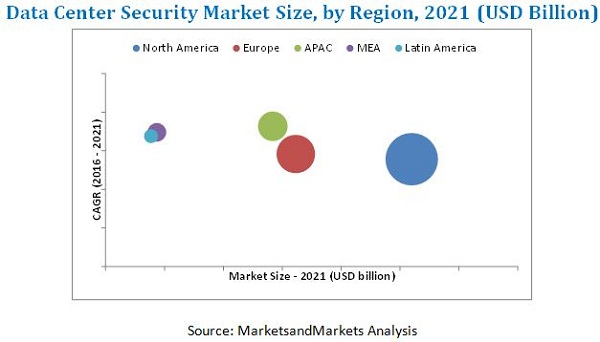

The report covers all the major aspects of the data center security market and provides an in-depth analysis across the regions of North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA), and Latin America. The market in North America is expected to hold the largest share of the market. The APAC region is projected to have great opportunities in this market and would grow at the highest CAGR by 2021 due to the presence of various developing countries, such as China, India, and the Philippines.

Due to high prices, limited IT budgets, and high initial investment costs, organizations may find it difficult to adopt new and genuine solutions and services. Though the investments involved are huge, the enterprises are slowly getting aware of the importance and benefits of these security solutions, such as help in the smooth running of the business operations. Therefore, it is expected to strengthen its footprints in not only large enterprises but also in small and mid-sized enterprises.

Various vendors are coming up with innovative data center security solutions and products due to the emerging virtualization and cloud computing which is increasing the demands for advance, proactive, and efficient virtual security solutions. Cisco Systems is one of the dominant players in providing data center security solutions and services due to its decades of experience in networking, communication and data center security. Cisco focuses highly on developing new security related products, solutions, and services, which help the company to deliver a comprehensive portfolio for data center logical security. The company provides an innovative security solution, application centric infrastructure, which is effective in micro segmentation of data centers. This solution provides enhanced security for east-west traffic within the data center. The other major vendors providing data center security solutions and services are Hewlett Packard Enterprises, International Business Machines (IBM) Corporation, Fortinet, Honeywell International, Schneider Electric SE, McAfee, Dell, and Robert Bosch Gmbh among others. These players adopted various strategies such as new product launches, partnerships, collaborations, and expansions to become competitive in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered in the Report

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 28)

4.1 Attractive Market Opportunities in the Market

4.2 Market By Product Type

4.3 Market Share of Data Center Security and Top Three Regions

4.4 Data Center Security Market Size: By Region

4.5 Lifecycle Analysis, By Region

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Application Solution

5.2.2 By Service

5.2.3 By Data Center Type

5.2.4 By Region

5.2.5 By Vertical

5.3 Evolution

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Virtualization and Cloud Computing

5.4.1.2 Increasing Data Traffic and Need for Secured Connectivity

5.4.1.3 Increased Number of Sophisticated Attacks

5.4.2 Restraints

5.4.2.1 Limited IT Budgets, Availability of Low-Cost Substitutes, and Piracy

5.4.3 Opportunities

5.4.3.1 Requirement for More Data Centers

5.4.3.2 Micro-Segmentation for Enhanced Data Center Security

5.4.3.3 Integrating Physical and Logical Security Solutions

5.4.4 Challenges

5.4.4.1 Continuous Innovations in Data Centers

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Strategic Benchmarking

6.3.1 Innovation and Product Enhancements

6.3.2 Collaborations, Partnerships, and Acquisitions

6.4 Technology Trends and Standards

6.4.1 Introduction

6.4.2 Standards and Guidelines for Data Center Security

6.4.2.1 Canadian Standards Association

6.4.2.2 Underwriters Laboratory

6.4.2.3 Iso/Iec 27001- Information Security Management

6.4.2.4 Made in U.S. (For the U.S. Region)

7 Market Analysis, By Application Solution (Page No. - 44)

7.1 Introduction

7.2 Logical Security Solutions

7.2.1 Threat and Application Security

7.2.1.1 Threat and Application Security Solution, By Technology

7.2.1.1.1 Intrusion Prevention Security/Intrusion Detection Security

7.2.1.1.2 Firewall

7.2.1.1.3 Virtualization Security Solutions

7.2.1.1.4 Unified Threat Management

7.2.1.1.5 Others

7.2.2 Compliance Management

7.2.3 Data Protection

7.3 Physical Security Solutions

7.3.1 Video Surveillance Solution

7.3.2 Monitoring and Management

7.3.3 Access Control

8 Data Center Security Market Analysis, By Service (Page No. - 52)

8.1 Introduction

8.2 Consulting

8.3 Integration and Deployment

8.4 Managed Services

9 Market Analysis, By Data Center Type (Page No. - 56)

9.1 Introduction

9.2 Mid-Sized Data Center

9.3 Enterprise Data Center

9.4 Large Data Center

10 Data Center Security Market Analysis, By Vertical (Page No. - 60)

10.1 Introduction

10.2 BFSI

10.3 IT and Telecom

10.4 Government and Defense

10.5 Healthcare

10.6 Media and Entertainment

10.7 Others

11 Geographic Analysis (Page No. - 66)

11.1 Introduction

11.2 North America

11.3 Europe

11.4 Asia-Pacific

11.5 Middle East and Africa

11.6 Latin America

12 Competitive Landscape (Page No. - 86)

12.1 Overview

12.2 Competitive Situations and Trends

12.2.1 New Product/Technology Launches

12.2.2 Partnerships and Collaborations

12.2.3 Mergers and Acquisitions

13 Company Profiles (Page No. - 91)

13.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

13.2 Hewlett Packard Enterprise Co.

13.3 International Business Machines Corporation

13.4 Cisco Systems, Inc.

13.5 Fortinet, Inc.

13.6 Check Point Software Technologies Ltd.

13.7 Honeywell International, Inc.

13.8 Schneider Electric SE

13.9 Mcafee, Inc. (Subsidiary of Intel Corp.)

13.10 Dell, Inc.

13.11 Robert Bosch GmbH

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 127)

14.1 Insight of Industry Experts

14.2 Recent Developments

14.2.1 New Product Launches

14.2.2 Agreements, Partnerships, Collaborations, and Joint Ventures

14.3 Discussion Guide

14.4 Knowledge Store: Marketsandmarkets Subscription Portal

14.5 Introducing RT: Real-Time Market Intelligence

14.6 Available Customizations

14.7 Related Reports

List of Tables (66 Tables)

Table 1 Global Data Center Security Market: Assumptions

Table 2 Market Size and Growth Rate, 20142021 (USD Billion, Y-O-Y %)

Table 3 Market Size, By Application Solution, 20142021 (USD Billion)

Table 4 Market Size, By Logical Security Solution, 20142021 (USD Million)

Table 5 Threat and Application Security Solution: Market Size, By Region, 20142021 (USD Million)

Table 6 Threat and Application Security Solution: Market Size, By Technology, 20142021 (USD Million)

Table 7 Compliance Management Solution: Market Size, By Region, 20142021 (USD Million)

Table 8 Data Protection Solution: Market Size, By Region, 20142021 (USD Million)

Table 9 Data Center Security Market Size, By Physical Security Solution, 20142021 (USD Million)

Table 10 Video Surveillance Solution: Market Size, By Region, 20142021 (USD Million)

Table 11 Monitoring and Management Solution: Market Size, By Region, 20142021 (USD Million)

Table 12 Access Control Solution: Market Size, By Region, 20142021 (USD Million)

Table 13 Market Size, By Service, 20142021 (USD Million)

Table 14 Consulting Service: Market Size, By Region, 20142021 (USD Million)

Table 15 Integration and Deployment Service: Market Size, By Region, 20142021 (USD Million)

Table 16 Managed Service: Market Size, By Region, 20142021 (USD Million)

Table 17 Market Size, By Data Center Type, 20142021 (USD Billion)

Table 18 Mid-Sized Data Center: Market Size, By Region, 20142021 (USD Million)

Table 19 Enterprise Data Center: Market Size, By Region, 20142021 (USD Million)

Table 20 Large Data Center: Market Size, By Region, 20142021 (USD Million)

Table 21 Data Center Security Market Size, By Vertical, 20142021 (USD Billion)

Table 22 BFSI: Market, By Region, 20142021 (USD Billion)

Table 23 IT and Telecom: Market Size, By Region, 20142021 (USD Billion)

Table 24 Government and Defense: Market Size, By Region, 20142021 (USD Billion)

Table 25 Healthcare: Market Size, By Region, 20142021 (USD Million)

Table 26 Media and Entertainment: Market Size, By Region, 20142021 (USD Million)

Table 27 Others: Market Size, By Region, 20142021 (USD Million)

Table 28 Data Center Security Market Size, By Region, 20142021 (USD Billion)

Table 29 North America: Market Size, 20142021 (USD Billion)

Table 30 North America: Market Size, By Application Solution, 20142021 (USD Billion)

Table 31 North America: Market Size, By Logical Security Solution, 20142021 (USD Billion)

Table 32 North America: Market Size, By Physical Security Solution, 20142021 (USD Million)

Table 33 North America: Market Size, By Service, 20142021 (USD Million)

Table 34 North America: Market Size, By Data Center Type, 20142021 (USD Billion)

Table 35 North America: Market Size, By Vertical, 20142021 (USD Billion)

Table 36 Europe: Data Center Security Market Size, 20142021 (USD Billion)

Table 37 Europe: Market Size, By Application Solution, 20142021 (USD Billion)

Table 38 Europe: Market Size, By Logical Security Solution, 20142021 (USD Billion)

Table 39 Europe: Market Size, By Physical Security Solution, 20142021 (USD Million)

Table 40 Europe: Market Size, By Service, 20142021 (USD Million)

Table 41 Europe: Market Size, By Data Center Type, 20142021 (USD Million)

Table 42 Europe: Market Size, By Vertical, 20142021 (USD Billion)

Table 43 Asia-Pacific: Market Size, 20142021 (USD Billion)

Table 44 Asia-Pacific: Market Size, By Application Solution, 20142021 (USD Billion)

Table 45 Asia-Pacific Data Center Security Market Size, By Logical Security Solution, 20142021 (USD Billion)

Table 46 Asia-Pacific: Market Size, By Physical Security Solution, 20142021 (USD Million)

Table 47 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 48 Asia-Pacific: Market Size, By Data Center Type, 20142021 (USD Million)

Table 49 Asia-Pacific: Market Size, By Vertical, 20142021 (USD Billion)

Table 50 Middle East and Africa: Market Size, 20142021 (USD Million)

Table 51 Middle East and Africa: Market Size, By Application Solution, 20142021 (USD Million)

Table 52 Middle East and Africa: Market Size, By Logical Security Solution, 20142021 (USD Million)

Table 53 Middle East and Africa: Market Size, By Physical Security Solution, 20142021 (USD Million)

Table 54 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 55 Middle East and Africa: Market Size, By Data Center Type, 20142021 (USD Million)

Table 56 Middle East and Africa: Data Center Security Market Size, By Vertical, 20142021 (USD Million)

Table 57 Latin America: Market Size, 20142021 (USD Million)

Table 58 Latin America: Market Size, By Application Solution, 20142021 (USD Million)

Table 59 Latin America Market Size, By Logical Security Solution, 20142021 (USD Million)

Table 60 Latin America: Market Size, By Physical Security Solution, 20142021 (USD Million)

Table 61 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 62 Latin America: Market Size, By Data Center Type, 20142021 (USD Million)

Table 63 Latin America: Data Center Security Market Size, By Vertical, 20142021 (USD Million)

Table 64 New Product/Technology Launches, 2016

Table 65 Partnerships and Collaborations, 2015-2016

Table 66 Mergers and Acquisitions, 2013-2016

List of Figures (43 Figures)

Figure 1 Data Center Security Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Total Data Center Security Market

Figure 7 Market By Application Solution: Physical Security Solutions is Expected to Grow at the Highest Rate During the Forecast Period

Figure 8 Top Segments in Terms of Market Share in the Market

Figure 9 North America is Expected to Hold the Largest Market Share in 2016

Figure 10 Growth Trend of the Data Center Security Market

Figure 11 Data Center Security Service Market is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 12 Logical Security Solution and North America Region are Expected to Have the Largest Market Share in 2016

Figure 13 Asia-Pacific is Expected to Register the Highest Growth in the Data Center Security Market

Figure 14 Geographic Lifecycle Analysis, 2016: Asia-Pacific is Expected to Have High Growth in the Coming Years

Figure 15 Data Center Security Market By Application Solution

Figure 16 Market By Service Type

Figure 17 Market: By Data Center Type

Figure 18 Market: By Region

Figure 19 Market: By Vertical

Figure 20 Evolution of Data Center Security

Figure 21 Data Center Security Market: Drivers, Restraints, Opportunities, Challenges

Figure 22 Value Chain Analysis: Major Value Addition During the Design & Development, and Testing Phase

Figure 23 Strategic Benchmarking: Innovations and Product Enhancements

Figure 24 Strategic Benchmarking: Collaborations, Partnerships, and Acquisitions

Figure 25 Geographic Snapshot (20162021): North America is Expected to Have the Largest Market Share in 2016

Figure 26 North America Market Snapshot

Figure 27 Asia-Pacific Market Snapshot

Figure 28 Companies Adoption of Organic and Inorganic Strategies

Figure 29 New Product Launch Was the Key Strategy Used By the Major Market Players From 2013 to 2015

Figure 30 Battle for Market Share: New Product Launches, Partnership and Collaboration, and Acquisitions

Figure 31 Geographic Revenues of Top 5 Market Players

Figure 32 Hewlett Packard Enterprise Co.: Company Snapshot

Figure 33 Hewlett Packard Enterprise Co : SWOT Analysis

Figure 34 International Business Machines Corporation: Company Snapshot

Figure 35 International Business Machines Corporation: SWOT Analysis

Figure 36 Cisco Systems, Inc. : Company Snapshot

Figure 37 Cisco, Inc. : SWOT Analysis

Figure 38 Fortinet, Inc. : Company Snapshot

Figure 39 Fortinet, Inc. : SWOT Analysis

Figure 40 Check Point Software Technologies Ltd.: Company Snapshot

Figure 41 Check Point Software Technologies Ltd.: SWOT Analysis

Figure 42 Honeywell International, Inc.: Company Snapshot

Figure 43 Schneider Electric SE: Company Snapshot

Growth opportunities and latent adjacency in Data Center Security Market

Need data on physical protection, surveillance, intrusion detection, relating to datacenters.