This research study involved the extensive use of both primary and secondary sources. It involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study involved the wide use of secondary sources, directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, white papers, and companies’ house documents. Secondary research was undertaken to identify and collect information for this extensive, technical, market-oriented, and commercial study of the dental equipment market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various supply side and demand side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the dental equipment market. Primary sources from the demand side included hospitals, clinics, researchers, lab technicians, purchase managers etc, and stakeholders in corporate & government bodies.

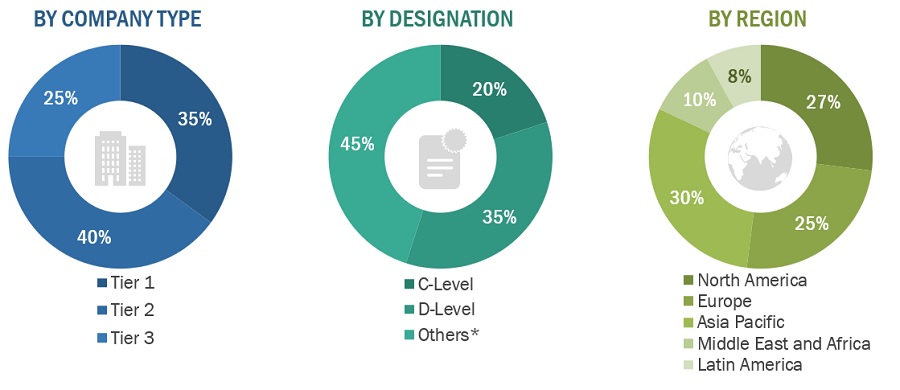

Breakdown of Primary Interviews

A breakdown of the primary respondents for dental equipment market (supply side) market is provided below:

Note 1: Companies are classified into tiers based on their total revenue. As of 2023: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Other primaries include sales managers, marketing managers, and product managers.

To know about the assumptions considered for the study, download the pdf brochure

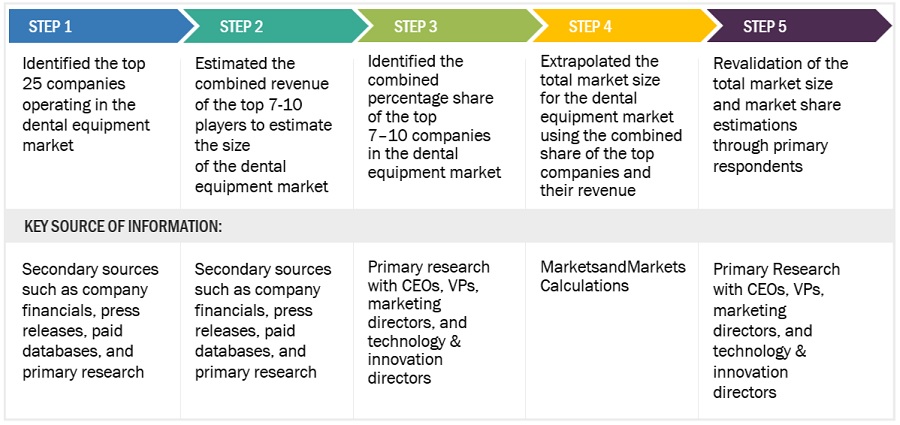

Market Size Estimation

The market size for dental equipment market was calculated using data from four different sources, as will be discussed below. Each technique concluded and a weighted average of the four ways was calculated based on the number of assumptions each approach made. The market size for dental equipment market was calculated using data from four distinct sources, as will be discussed below:

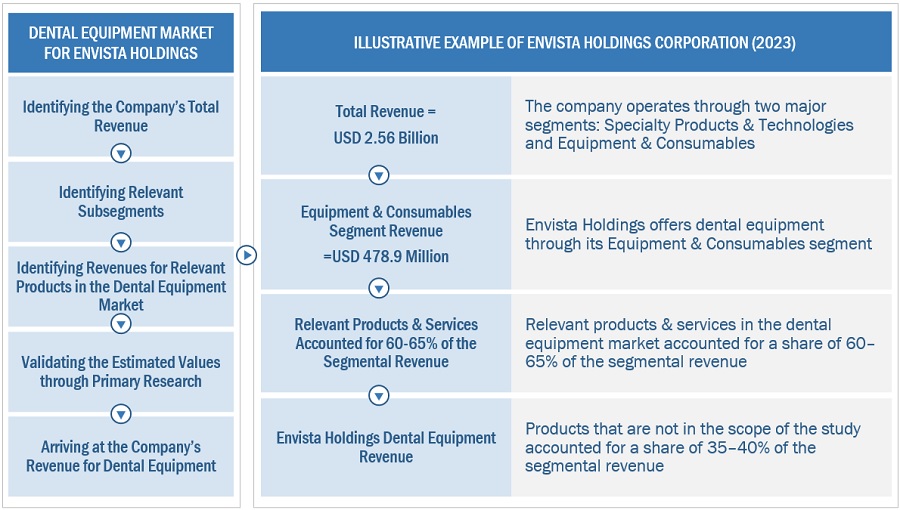

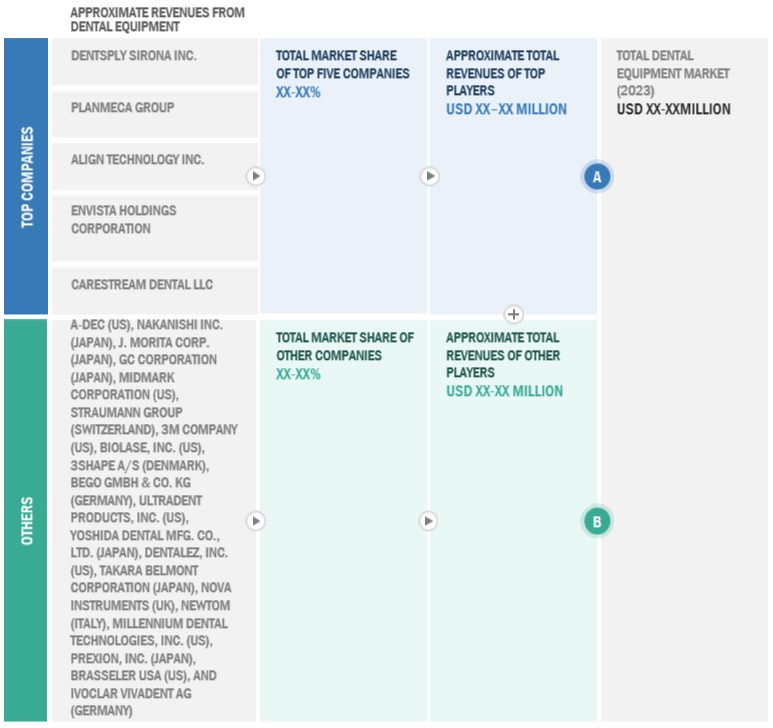

Dental Equipment Market: Supply-Side Analysis - Revenue Share Analysis

Dental Equipment Market: Revenue Share Analysis Illustration Of Envista Holdings Corporation

To know about the assumptions considered for the study, Request for Free Sample Report

Dental Equipment Market: Supply Side Analysis: Dental Equipment Market (2023)

Data Triangulation

The entire market was split up into several segments when the market size was determined. Data triangulation and market breakdown processes were used where necessary to complete the entire market engineering process and arrive at the precise statistics for all segments.

Approach to derive the market size and estimate market growth.

Using secondary data from both paid and unpaid sources, the market rankings for the major players were determined following a thorough analysis of their sales of dental equipments. Due to data restrictions, the revenue share in certain cases was determined after a thorough analysis of the product portfolio of big corporations and their individual sales performance. This information was verified at each stage by in-depth interviews with professionals in the field.

Market Definition

Dental equipment encompasses the tools and instruments used to diagnose and treat a range of dental diseases and disorders. These supplies are utilized by dentists, dental hygienists, and dental laboratories. The category includes a variety of dental equipment, such as diagnostic tools and therapeutic instruments.

Key Stakeholders

-

Manufacturers and distributors of medical devices

-

Dental equipment manufacturers

-

Contract manufacturers of dental equipment

-

Distributors of dental equipment

-

Research and consulting firms

-

Raw material suppliers of dental equipment

-

Dental hospitals and clinics

-

Dental laboratories and associations

-

Dental practitioners

-

Dental laboratory technicians

-

Healthcare institutions

-

Diagnostic laboratories

-

Hospitals and clinics

-

Academic institutions

-

Research institutions

-

Government associations

-

Market research and consulting firms

-

Venture capitalists and investors

Objectives of the Study

-

To define, describe, and forecast the dental equipment market based on by type, end user, and region

-

To provide detailed information about the major factors influencing the market growth (such as drivers, restraints, challenges, and opportunities)

-

To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall dental equipment market

-

To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

-

To forecast the size of the dental equipment market in North America, Europe, the Asia Pacific, Latin America, Middle East & Africa and GCC Countries

-

To profile the key players and comprehensively analyze their market shares and core competencies in the dental equipment market

-

To track and analyze competitive developments such as partnerships, expansions, acquisitions, collaborations, service launches, agreements, and other developments in the dental equipment market

-

To benchmark players within the dental equipment market using the Company Evaluation Quadrant framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and service offerings

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

-

Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

-

Further breakdown of the Rest of Europe Dental Equipment Market into Denmark, Norway, and others

-

Further breakdown of the Rest of Asia Pacific Dental Equipment Market into Vietnam, New Zealand, and others

MnM Analyst

Sep, 2023

Hi Ivan,

The growth of the European dental manufacturing market is attributed to a number of factors, including:

1. Increasing geriatric population: The aging population in Europe is leading to an increase in the prevalence of dental diseases, such as cavities, gum disease, and tooth loss. This is driving the demand for dental implants, crowns, bridges, and other restorative devices.

2. Growing awareness about oral health: There is a growing awareness about the importance of oral health among the general population in Europe. This is leading to an increase in the demand for preventive dental care, such as dental cleanings and checkups.

3. Advances in dental technology: There have been significant advances in dental technology in recent years. This has led to the development of new dental products and services, such as 3D printing, laser dentistry, and digital imaging. These new technologies are making it possible to provide more accurate and efficient dental care.

4. Increased disposable income: The rising disposable income of consumers in Europe is making it possible for them to afford more expensive dental care. This is driving the demand for high-end dental products and services.

The European dental manufacturing market is highly competitive. Some of the major players in the market include:

1. 3M

2. Dentsply Sirona

3. Straumann

4. Danaher

5. Henry Schein

6. Zimmer Biomet

7. Planmeca

8. Ivoclar Vivadent

9. GC Corporation

10. Biolase Inc.

These companies are investing heavily in research and development to develop new products and services that meet the needs of consumers. They are also expanding their geographic presence to tap into new markets.

The European dental manufacturing market is expected to continue to grow in the coming years. The growth of the market will be driven by the factors mentioned above, as well as by the increasing demand for dental care in emerging markets, such as China and India..

Ivan

Sep, 2023

WHAT IS EUROPE OF GLOBAL DENTAL MANUFACTURING MARKET.