Diaphragm Pumps Market by Mechanism (Air Operated and Electrically Operated), Operation (Single Acting and Double Acting), Discharge Pressure (Up to 80 Bar, 81 to 200 Bar & above 200 Bar), End User and Region - Global Trends & Forecast to 2027

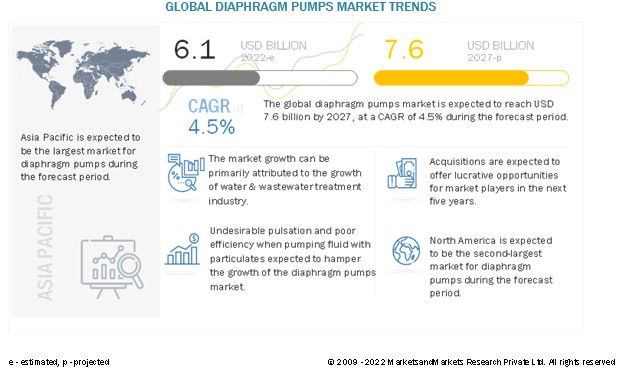

The global diaphragm pumps market is projected to reach USD 7.6 billion by 2027 from an estimated USD 6.1 billion in 2022, at a CAGR of 4.5% during the forecast period. The growth of water and wastewater treatment industry is a key driver for the market growth. Also, the spurt in oil & gas activities will also drive the demand for diaphragm pumps in the near future.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The pandemic has and continues to interfere with international trade, affecting various industries like oil & gas, chemicals and petrochemicals, power generation, automotive and transportation, and mining, amongst others. Many manufacturing facilities had to be closed, affecting the demand for diaphragm pumps across various end markets. It also led to supply chain disruptions on an unprecedented scale.

Diaphragm Pumps Market Dynamics

Driver: Spurt in oil & gas activities

Diaphragm pumps find applications within a wide performance range in the oil & gas industry, from exploration through processing and up to transportation to the consumer, encompassing the entire value chain of the industry. The pandemic-induced lockdowns drastically reduced the global demand for oil & gas as transportation, the main consumer of oil & gas, was brought to a standstill. However, the easing of lockdown measures and gradual resumption of transportation and other industrial activities led to a significant supply-demand gap for oil & gas. The International Energy Agency (IEA) has projected the total demand for oil in 2022 to increase by 2.1 mb/d compared to 2021. The Russian invasion of Ukraine has also led to a global oil supply shock due to the large-scale disruption of Russian oil production. Other producers, including the US and the Organization of Petroleum Exporting Countries (OPEC), may, as a result, work toward bolstering their exploration and production activities to offset the Russian shortfall. Hence, the post-pandemic economic rebound and growth, along with supply constraints due to the difficult geopolitical situation, will lead to an increase in exploration and production of oil & gas, which may drive the growth of the diaphragm pumps market during the forecast period.

Restraints: Poor efficiency when pumping fluids with particulates

Diaphragm pumps are widely utilized due to their ability to handle a wide variety of fluids like chemicals, volatile solvents, viscous fluids, shear sensitive foodstuffs, dirt water, abrasive slurry, smaller solids, creams, gels, and oil. Diaphragm pumps use check valves to maintain volumetric efficiency by preventing the bidirectional flow of fluid during the suction and pumping operation. Diaphragm pumps can handle a large number of smaller solids. However, the solution being pumped through a diaphragm metering pump needs to be clean and free from particulates. Particulate matter of larger size can get settled in the pump chamber or body and can block the diaphragms from moving, preventing the pump from operating. Also, these solid particulates can settle around the ball valve seats that can prevent the ball valves from re-seating properly, leading to poor performance, loss of efficiency and ability to meter accurately, and finally, loss of prime, which will stop the pump from working. Keeping the check valve clean leads to frequent maintenance operations on the pumps. Some operators may prefer using peristaltic pumps, which work well with high levels of particulate in the fluid being pumped. This may negatively impact the growth of the diaphragm pumps market during the forecast period.

Opportunities: Growth of pharmaceutical industry

The pharmaceutical industry utilizes pumps to process, mix, unload, and transfer liquids. The pharmaceutical industry deals with hazardous, often expensive materials, all of which must be pumped in a highly controlled and safe manner. In the critical pharmaceutical industry, diaphragm pumps are primarily used as sample loop pumps on top of reactors, as transfer pumps on many pharmaceutical skids, to pump products into filling lines and for transferring solvents. Diaphragm pumps are self-priming, dry-running, and have less wetted rotating parts, ensuring total product containment without abrasion or particle generation. As a result, they can easily handle different pharmaceutical liquids. Apart from this, many diaphragm pumps feature CIP (clean-in-place) and SIP (sterilization-in-place) capabilities, which make them the best choice for the pharmaceutical industry. The pandemic has put the global pharmaceutical industry into the spotlight and highlighted its importance. According to UN World Population Prospects (2020), the number of elderly people aged 65 or over worldwide is projected to double by 2050. Chronic conditions, as a result, are on the rise, and patients are often suffering from more than just one ailment. The growing middle class and increasing adoption of a sedentary lifestyle is further aggravating the problem. Hence, pharmaceutical products may see a spurt in demand, leading to rise in orders of diaphragm pumps required to manufacture these products.

Challenges: Decrease in coal mining activities

Diaphragm pumps, especially AODD pumps, are critical pieces of mining equipment and are always deployed in various mining locations around the globe. From coal mining to hard rock, these pumps are utilized in a wide array of applications to keep mining processes productive and safe. Diaphragm pumps are primarily used for dewatering in coal mining operations. Apart from dewatering, diaphragm pumps are also used to move fuels and lubricants to keep vehicles and heavy machinery running in coal mines. The coal mining industry, however, is experiencing a decline due to stringent emission regulations and global decarbonization targets. According to the IEA, production is estimated to diminish by a staggering 102 metric tons in the EU by 2024. The power sector in these regions is experiencing slow electricity demand growth and rapid expansion of renewable power sources like wind and solar PV. Countries are also switching toward utilizing gas instead of coal for power generation as it is less carbon-intensive. These factors may put a brake on coal mining activities, posing a challenge to the growth of the diaphragm pumps market

Market Map

To know about the assumptions considered for the study, download the pdf brochure

By Operation, reduced pulsation and smoother flow to drive demand for double acting diaphragm pumps.

The double acting diaphragm pumps segment held the largest share of the diaphragm pumps market in 2021, and a similar trend is likely to continue in the near future. Double acting pumps incorporate two diaphragms and two sets of valves. The two diaphragms can be alternately driven by compressed air or electric motor. Although these pumps are larger in size and are more complicated than the single acting pumps, they are mostly preferred and are widely used in water & wastewater, mining, and power generation, among other industries. Hence, the market size of these pumps is relatively large.

By Mechanism, reduced operational costs and low pulsation expected to fuel the fastest growth of the electrically operated segment during 2022-2027.

The electrically operated segment of the diaphragm pumps market is expected to grow at the highest CAGR during the forecast period. Electrical diaphragm pumps are more efficient and have practically zero fluid leakage due to them being driven by efficient electric motors. Air compressors have low efficiency and their usage to drive diaphragm pumps leads to additional procurement and operational costs for the pump owners. Using electric motors to drive the pumps instead is cheaper, efficient and more sustainable alternative. New laws and regulations being introduced across various countries around the globe focus on decarbonization, supported by sustainability and efficiency. These factors are expected to lead to the fastest growth of the electrically operated segment in the near future.

By End User, the water & wastewater segment is expected to be the fastest growing segment during 2022-2027.

The water & wastewater segment is projected to grow at the highest CAGR during the forecast period. Diaphragm pumps are amongst the most commonly used equipment in the water & wastewater treatment sector. Such pumps are primarily used for fluid transfer as well as metering and dosing applications in the wastewater treatment processes. The relatively good solids handling capacity of these pumps makes them ideal for use in this industry. Governments around the world are introducing strict laws on the treatment of domestic and industrial wastewater before being released downstream. This wastewater may contain harmful pollutants that can harm the environment, animals, and humans if left untreated. Hence, there is going to be an increased requirement for industries and urban settlements to set up wastewater treatment plants in the near future, which may lead to a rapid growth of the diaphragm pumps market.

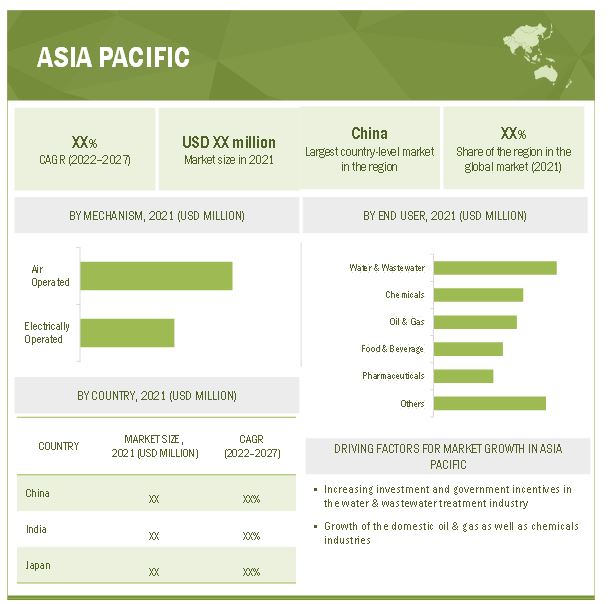

Asia Pacific is expected to lead the diaphragm pumps market globally, by value and volume, during the forecast period.

The sustained growth of the industrial and manufacturing sectors in the Asia Pacific region is driving the growth of the diaphragm pumps market. According to the International Monetary Fund (IMF), the region’s economy is projected to grow from 6.5% in FY 2021 to 5.7% in FY2022. Water & wastewater treatment, pharmaceuticals, chemicals, oil & gas, power generation, and mining are amongst the major end user of diaphragm pumps in this region. The growth of the industrial sector makes it necessary for the economies in this region to prudently manage and increase the existing power and fuel resources to ensure energy security. This, coupled with volatile geopolitical scenarios threatening the supply of oil & gas has led to an increase in domestic oil & gas exploration and production activity in the region. The water & wastewater treatment sector in the developing economies of this region has traditionally been underdeveloped and has huge growth potential. The pharmaceuticals industry in the region is also experiencing increasing investments leading to a growth in demand for diaphragm pumps.

Key Market Players

The major players in the global diaphragm pumps market are PSG (US), Ingersoll Rand Inc. (US), IDEX Corporation (US), Xylem, Inc. (US), Flowserve Corporation (US), Grundfos Holding A/S (Denmark), Kimray Inc. (US), LEWA GmbH (Germany), Tapflo AB (Denmark) and others.

Scope of the report

|

Report Metric |

Details |

|

Market Size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Mechanism, Operation, Discharge Pressure, and End User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

PSG (US), Ingersoll Rand Inc. (US), Flowserve Corporation (US), IDEX Corporation (US), Xylem, Inc. (US), Grundfos Holding A/S (Denmark), Kimray Inc. (US), Wanner Engineering Inc. (US), LEWA GmbH (Germany), Tapflo AB (Germany), Yamada Corporation (Japan), Verder International B.V. (Netherlands), SPX FLOW (US), URACA (Germany), SANDPIPER Pump (US), Dr. JESSBERGER GmbH (Germany), Wenzhou Kaixin Pump Co., Ltd. (China), Price Pump (US), Versamatic (US), SERFILCO (US), and others |

This research report categorizes the diaphragm pumps market based on mechanism, operation, discharge pressure, end user, and region.

Based on Mechanism:

- Air Operated

- Electrically Operated

Based on Operation:

- Single Acting

- Double Acting

Based on Discharge Pressure:

- Up to 80 Bar

- 81-200 Bar

- Above 200 Bar

Based on End User:

- Water & Wastewater

- Oil & Gas

- Chemicals

- Pharmaceuticals

- Food & Beverage

- Others (power generation, paint, mining, and pulp & paper)

Based on Region:

- North America

- Asia Pacific

- South America

- Europe

- Middle East & Africa

Recent Developments

- In March 2022, IDEX Corporation acquired Nexight LLC and its market-leading businesses – Envirosight, WinCan, MyTana, and Pipeline Renewal Technologies (PRT)

- In March 2022, Floweserve Corporation partnered with Gradiant to help and address the most challenging problems in water and wastewater treatment.

- In February 2022, Grundfos Holding A/S signed an agreement with the EKF Denmark’s Export Credit Agency enabling Grundfos to finance projects globally for private commercial and public customers with limited funds available.

- In June 2021, Ingersoll Rand Inc. acquired Tuthill Corporation’s Pump Group by USD 85 million. The employees and the brands of Pump Group joined Ingersoll Rand Precision and Science Technologies (PST) segment.

Frequently Asked Questions (FAQ):

What is the current size of the diaphragm pumps market?

The current market size of global diaphragm pumps market is USD 5.8 billion in 2021.

What are the major drivers for diaphragm pumps market?

Growth in water and wastewater treatment industry and spurt in oil & gas activities are the major drivers for the diaphragm pumps market.

Which is the fastest-growing region during the forecasted period in the diaphragm pumps market?

Asia Pacific is the fastest-growing region and its growth is driven by the growth of the wastewater treatment plants, pharmaceutical industries and increasing investments in chemical industries.

Which is the largest segment, by end user, during the forecasted period in diaphragm pumps market?

The water and wastewater segment held the largest share of diaphragm pumps market, by end user, during the forecast period, because of stringent regulations regarding wastewater treatment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.3 INCLUSIONS AND EXCLUSIONS

1.3.1 DIAPHRAGM PUMPS MARKET, BY MECHANISM

1.3.2 MARKET, BY OPERATION

1.3.3 MARKET, BY DISCHARGE PRESSURE

1.3.4 MARKET, BY END USER

1.3.5 MARKET, BY REGION

1.4 MARKET SCOPE

1.4.1 MARKET SEGMENTATION

1.4.2 REGIONAL SCOPE

1.5 YEARS CONSIDERED FOR THE STUDY

1.6 CURRENCY

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 33)

2.1 RESEARCH DATA

FIGURE 1 DIAPHRAGM PUMPS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Breakdown of primaries

2.2.2.2 Key data from primary sources

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 4 MAIN METRICS CONSIDERED WHILE ANALYZING AND ASSESSING DEMAND FOR DIAPHRAGM PUMPS

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 5 DIAPHRAGM PUMPS MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3.3 DEMAND-SIDE ANALYSIS

2.3.3.1 Regional analysis

2.3.3.2 Country analysis

2.3.3.3 Demand-side assumptions

2.3.3.4 Demand-side calculations

2.3.4 SUPPLY-SIDE ANALYSIS

FIGURE 7 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF DIAPHRAGM PUMPS

FIGURE 8 DIAPHRAGM PUMPS MARKET: SUPPLY-SIDE ANALYSIS

2.3.4.1 Supply-side calculations

2.3.4.2 Supply-side assumptions

2.3.5 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 1 DIAPHRAGM PUMPS MARKET SNAPSHOT

FIGURE 9 ASIA PACIFIC DOMINATED MARKET IN 2021

FIGURE 10 AIR OPERATED SEGMENT PROJECTED TO LEAD MARKET BETWEEN 2022 AND 2027

FIGURE 11 DOUBLE ACTING SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

FIGURE 12 UP TO 80 BAR SEGMENT EXPECTED TO DOMINATE MARKET DURING FORECAST PERIOD

FIGURE 13 WATER & WASTEWATER SEGMENT PROJECTED TO LEAD MARKET FROM 2022 TO 2027

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE OPPORTUNITIES IN DIAPHRAGM PUMPS MARKET

FIGURE 14 GROWTH OF WATER & WASTEWATER TREATMENT INDUSTRY AND INCREASED IN OIL & GAS ACTIVITIES EXPECTED TO DRIVE MARKET

4.2 MARKET, BY REGION

FIGURE 15 MARKET IN ASIA PACIFIC PROJECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 ASIA PACIFIC: MARKET, BY END USER AND COUNTRY, 2021

FIGURE 16 WATER & WASTEWATER SEGMENT AND CHINA HELD LARGEST SHARE OF MARKET IN ASIA PACIFIC

4.4 MARKET, BY MECHANISM

FIGURE 17 AIR OPERATED DIAPHRAGM PUMPS EXPECTED TO ACCOUNT FOR LARGER SHARE BY 2027

4.5 MARKET, BY OPERATION

FIGURE 18 DOUBLE ACTING SEGMENT PROJECTED TO DOMINATE MARKET

4.6 MARKET, BY DISCHARGE PRESSURE

FIGURE 19 UP TO 80 BAR SEGMENT EXPECTED TO HOLD LARGEST SHARE OF MARKET

4.7 MARKET, BY END USER

FIGURE 20 WATER & WASTEWATER SEGMENT TO DOMINATE MARKET

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 21 GLOBAL PROPAGATION OF COVID-19

FIGURE 22 PROPAGATION OF COVID-19 CASES IN SELECTED COUNTRIES

5.3 MARKET DYNAMICS

FIGURE 23 DIAPHRAGM PUMPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Growth of water & wastewater treatment industry

FIGURE 24 ESTIMATED PROPORTIONS OF HOUSEHOLD WASTEWATER SAFELY TREATED, BY REGION, 2020

5.3.1.2 Spurt in oil & gas activities

FIGURE 25 OIL DEMAND FORECAST, 2010 TO 2026

TABLE 2 WORLD NATURAL GAS CONSUMPTION BY REGION, 2020-2050 (TRILLION CUBIC FEET)

5.3.2 RESTRAINTS

5.3.2.1 Undesirable effects of pulsation

TABLE 3 SOLUTIONS TO MITIGATE PROBLEM OF PULSATION AND ITS LIMITATIONS

5.3.2.2 Poor efficiency when pumping fluids with particulates

5.3.3 OPPORTUNITIES

5.3.3.1 Growth of pharmaceutical industry

FIGURE 26 PHARMACEUTICAL INDUSTRY R&D SPENDING (2010–2024)

5.3.4 CHALLENGES

5.3.4.1 Decrease in coal mining activity

FIGURE 27 SHARE OF UNABATED COAL-FIRED POWER GENERATION IN NET-ZERO SCENARIO, 2010–2050

5.4 COVID-19 IMPACT

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIAPHRAGM PUMP PROVIDERS

FIGURE 28 REVENUE SHIFT FOR DIAPHRAGM PUMP PROVIDERS

5.6 MARKET MAP

FIGURE 29 DIAPHRAGM PUMPS MARKET MAP: MARKET

TABLE 4 MARKET: ROLE IN ECOSYSTEM

5.7 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS: DIAPHRAGM PUMPS MARKET

5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.7.2 COMPONENT MANUFACTURERS

5.7.3 DIAPHRAGM PUMP MANUFACTURERS/ASSEMBLERS

5.7.4 DISTRIBUTORS (BUYERS)/END USERS

5.7.5 POST-SALES SERVICES

5.8 TECHNOLOGY ANALYSIS

5.8.1 IOT-CONNECTED DIAPHRAGM PUMPS

5.8.2 SMART ELECTRIC DIAPHRAGM PUMPS

5.9 PRICING ANALYSIS

5.9.1 AVERAGE SELLING PRICES OF DIAPHRAGM PUMPS, BY DISCHARGE PRESSURE

TABLE 5 AVERAGE SELLING PRICES OF DIAPHRAGM PUMPS, 2021

TABLE 6 AVERAGE SELLING PRICES OF DIAPHRAGM OF KEY PLAYERS, BY DISCHARGE PRESSURE (2021)

FIGURE 31 AVERAGE SELLING PRICES OF KEY PLAYERS, BY POWER RANGE

5.10 KEY CONFERENCES & EVENTS, 2022-2024

TABLE 7 DIAPHRAGM PUMPS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.11 TARIFFS, CODES & REGULATIONS

5.11.1 TARIFFS RELATED TO DIAPHRAGM PUMPS

TABLE 8 IMPORT TARIFFS FOR HS 8413 LIQUID PUMPS IN 2019

5.12 TRADE ANALYSIS

5.12.1 TRADE ANALYSIS FOR PUMPS

5.12.2 EXPORT SCENARIO

TABLE 9 EXPORT SCENARIO FOR HS CODE: 841319, BY COUNTRY, 2019–2021 (USD)

5.12.3 IMPORT SCENARIO

TABLE 10 IMPORT SCENARIO FOR HS CODE: 841319, BY COUNTRY, 2019–2021 (USD)

5.12.4 TRADE ANALYSIS FOR PUMPS AND LIQUID ELEVATORS

5.12.5 EXPORT SCENARIO

TABLE 11 EXPORT SCENARIO FOR HS CODE: 841381, BY COUNTRY, 2019–2021 (USD)

5.12.6 IMPORT SCENARIO

TABLE 12 IMPORT SCENARIO FOR HS CODE: 841381, BY COUNTRY, 2019–2021 (USD)

5.12.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12.8 CODES AND REGULATIONS RELATED TO DIAPHRAGM PUMPS

TABLE 17 DIAPHRAGM PUMPS: CODES AND REGULATIONS

5.13 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 18 DIAPHRAGM PUMPS: INNOVATIONS AND PATENT REGISTRATIONS, MAY 2018–JANUARY 2022

5.14 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS FOR DIAPHRAGM PUMPS MARKET

TABLE 19 DIAPHRAGM PUMPS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.14.1 THREAT OF SUBSTITUTES

5.14.2 BARGAINING POWER OF SUPPLIERS

5.14.3 BARGAINING POWER OF BUYERS

5.14.4 THREAT OF NEW ENTRANTS

5.14.5 INTENSITY OF COMPETITIVE RIVALRY

5.15 KEY STAKEHOLDERS & BUYING CRITERIA

5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 33 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 20 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

5.16 BUYING CRITERIA

FIGURE 34 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 END USERS

TABLE 21 KEY BUYING CRITERIA FOR TOP 3 END USERS

5.17 CASE STUDY ANALYSIS

5.17.1 A NORTH AMERICAN FOOD COMPANY PRODUCING CHOCOLATES IMPROVED FOOD SAFETY BY DEPLOYING SANDPIPER FDA COMPLIANT PUMPS

5.17.1.1 Problem Statement: June 2020

5.17.1.2 Solution

5.17.2 INDOCHEM, A LEADER IN SOLVENT PRODUCTION, OPTIMIZES PRODUCTION RATES AND AIR CONSUMPTION IN SOLVENT MANUFACTURING BY USING AODD PUMP FROM WILDEN

5.17.2.1 Problem Statement: May 2019

5.17.2.2 Solution

5.17.3 A MAJOR KRAFT PULP MILL PRODUCING PULP AND PAPER SAFELY EMPTIES SUMP OF HAZARDOUS WASTEWATER WITH SANDPIPER AODD PUMP

5.17.3.1 Problem Statement: June 2020

5.17.3.2 Solution

5.17.4 A LARGE SODA BOTTLING SYRUP PLANT SAVED USD 26,806 AND RESOLVED MULTIPLE CHALLENGES WITH THE HELP OF ARO SD20S FDA COMPLIANT DIAPHRAGM PUMP

5.17.4.1 Problem Statement: March 2019

5.17.4.2 Solution

6 DIAPHRAGM PUMPS MARKET, BY MECHANISM (Page No. - 93)

6.1 INTRODUCTION

FIGURE 35 DIAPHRAGM PUMPS MARKET, BY MECHANISM, 2021

TABLE 22 MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

6.2 AIR OPERATED

6.2.1 GROWING FOOD & BEVERAGE, CHEMICALS, AND PHARMACEUTICALS INDUSTRIES LIKELY TO FUEL DEMAND FOR AIR OPERATED DIAPHRAGM PUMPS

TABLE 23 AIR OPERATED MARKET, BY REGION, 2020–2027 (USD MILLION)

6.3 ELECTRICALLY OPERATED

6.3.1 REDUCED OPERATIONAL COSTS AND LOW PULSATION EXPECTED TO DRIVE THIS SEGMENT

TABLE 24 ELECTRICALLY OPERATED MARKET, BY REGION, 2020–2027 (USD MILLION)

7 DIAPHRAGM PUMPS MARKET, BY OPERATION (Page No. - 97)

7.1 INTRODUCTION

FIGURE 36 DIAPHRAGM PUMPS MARKET, BY OPERATION, 2021

TABLE 25 MARKET, BY OPERATION, 2020–2027 (USD MILLION)

7.2 SINGLE ACTING

7.2.1 PORTABILITY AND EASE OF OPERATION LIKELY TO FUEL DEMAND FOR SINGLE ACTING DIAPHRAGM PUMPS

TABLE 26 SINGLE ACTING MARKET, BY REGION, 2020–2027 (USD MILLION)

7.3 DOUBLE ACTING

7.3.1 REDUCED PULSATION AND SMOOTHER FLOW TO DRIVE DEMAND FOR DOUBLE ACTING DIAPHRAGM PUMPS

TABLE 27 DOUBLE ACTING MARKET, BY REGION, 2020–2027 (USD MILLION)

8 DIAPHRAGM PUMPS MARKET, BY DISCHARGE PRESSURE (Page No. - 101)

8.1 INTRODUCTION

FIGURE 37 MARKET, BY DISCHARGE PRESSURE, 2021

TABLE 28 MARKET, BY DISCHARGE PRESSURE, 2020–2027 (USD MILLION)

TABLE 29 MARKET, BY DISCHARGE PRESSURE, 2020–2027 (USD MILLION)

TABLE 31 UP TO 80 BAR: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

8.3 81-200 BAR

8.3.1 GROWTH OF CHEMICALS INDUSTRY EXPECTED TO DRIVE DEMAND FOR 81–200 BAR DIAPHRAGM PUMPS

TABLE 32 81-200 BAR: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 33 81-200 BAR: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

8.4 ABOVE 200 BAR

8.4.1 ABOVE 200 BAR DIAPHRAGM PUMPS CAN HANDLE CHEMICALLY AGGRESSIVE FLUIDS WITH HIGH SOLID CONTENT

TABLE 34 ABOVE 200 BAR: MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 ABOVE 200 BAR: MARKET, BY REGION, 2020–2027 (THOUSAND UNITS)

9 DIAPHRAGM PUMPS MARKET, BY END USER (Page No. - 107)

9.1 INTRODUCTION

FIGURE 38 MARKET, BY END USER, 2021

TABLE 36 MARKET, BY END USER, 2020–2027 (USD MILLION)

9.2 WATER & WASTEWATER

9.2.1 STRINGENT REGULATIONS REGARDING WASTEWATER TREATMENT LIKELY TO BOOST DEMAND FOR DIAPHRAGM PUMPS

TABLE 37 MARKET FOR WATER & WASTEWATER INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.3 OIL & GAS

9.3.1 INCREASING OIL & GAS ACTIVITIES EXPECTED TO DRIVE MARKET

TABLE 38 MARKET FOR OIL & GAS INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.4 CHEMICALS

9.4.1 INCREASING INVESTMENTS IN CHEMICALS INDUSTRY TO DRIVE THE DEMAND FOR DIAPHRAGM PUMPS

TABLE 39 MARKET FOR CHEMICAL INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.5 PHARMACEUTICALS

9.5.1 DEVELOPMENT OF PHARMACEUTICALS INDUSTRY IN ASIA PACIFIC LIKELY TO FUEL DEMAND FOR DIAPHRAGM PUMPS

TABLE 40 MARKET FOR PHARMACEUTICAL INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.6 FOOD & BEVERAGE

9.6.1 GROWING DEMAND FOR PROCESSED FOOD & BEVERAGES EXPECTED TO BOOST MARKET

TABLE 41MARKET FOR FOOD & BEVERAGE INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

9.7 OTHER INDUSTRIES

9.7.1 GROWTH IN POWER GENERATION AND MINING ACTIVITIES LIKELY TO DRIVE MARKET

TABLE 42 MARKET FOR OTHER INDUSTRIES, BY REGION, 2020–2027 (USD MILLION)

10 DIAPHRAGM PUMPS MARKET, BY REGION (Page No. - 114)

10.1 INTRODUCTION

FIGURE 39 MARKET, BY REGION, 2021 (%)

FIGURE 40 MARKET IN ASIA PACIFIC EXPECTED TO GROW AT HIGHEST CAGR FROM 2022 TO 2027

TABLE 43 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC MARKET SNAPSHOT

10.2.1 BY MECHANISM

TABLE 44 ASIA PACIFIC: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.2.2 BY OPERATION

TABLE 45 ASIA PACIFIC: MARKET, BY OPERATION, 2020–2027 (USD MILLION)

10.2.3 BY DISCHARGE PRESSURE

TABLE 46 ASIA PACIFIC: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (USD MILLION)

TABLE 47 ASIA PACIFIC: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (THOUSAND UNITS)

10.2.4 BY END USER

TABLE 48 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 49 ASIA PACIFIC: DIAPHRAGM PUMPS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.5.1 China

10.2.5.1.1 New wastewater treatment plants and increasing investments in chemicals industry drive market in China

TABLE 50 CHINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.5.2 India

10.2.5.2.1 Growth of pharmaceuticals sector will boost market in the country

TABLE 51 INDIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.5.3 Japan

10.2.5.3.1 Increased LNG terminals expected to fuel growth of market in Japan

TABLE 52 JAPAN: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.5.4 Australia

10.2.5.4.1 Government policies for mining and water & wastewater treatment will drive diaphragm pumps market in Australia

TABLE 53 AUSTRALIA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.2.5.5 Rest of Asia Pacific

TABLE 54 REST OF ASIA PACIFIC: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

10.3.1 BY MECHANISM

TABLE 55 NORTH AMERICA: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.3.2 BY OPERATION

TABLE 56 NORTH AMERICA: MARKET, BY OPERATION, 2020–2027 (USD MILLION)

10.3.3 BY DISCHARGE PRESSURE

TABLE 57 NORTH AMERICA: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (THOUSAND UNITS)

10.3.4 BY END USER

TABLE 59 NORTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 60 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.5.1 US

10.3.5.1.1 Growth of manufacturing sector to drive demand for diaphragm pumps in the US

TABLE 61 US: DIAPHRAGM PUMPS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5.2 Canada

10.3.5.2.1 Increased investments in oil and gas projects expected to boost demand for diaphragm pumps

TABLE 62 CANADA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.3.5.3 Mexico

10.3.5.3.1 Presence of energy resources and infrastructure likely to boost the market

TABLE 63 MEXICO: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4 EUROPE

10.4.1 BY MECHANISM

TABLE 64 EUROPE: DIAPHRAGM PUMPS MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.4.2 BY OPERATION

TABLE 65 EUROPE: MARKET, BY OPERATION, 2020–2027 (USD MILLION)

10.4.3 BY DISCHARGE PRESSURE

TABLE 66 EUROPE: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (THOUSAND UNITS)

10.4.4 BY END USER

TABLE 68 EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 69 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.5.1 Germany

10.4.5.1.1 Growth in wastewater treatment facilities in Germany expected to drive demand for diaphragm pumps

TABLE 70 GERMANY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.5.2 Italy

10.4.5.2.1 Sewage and wastewater treatment projects likely to boost diaphragm pumps market

TABLE 71 ITALY: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.5.3 UK

10.4.5.3.1 Stringent regulations associated with wastewater treatment boost diaphragm pumps market in UK

TABLE 72 UK: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.5.4 France

10.4.5.4.1 Growth of pharmaceutical industry likely to boost market for diaphragm pumps

TABLE 73 FRANCE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.4.5.5 Rest of Europe

10.4.5.5.1 Investments in wastewater treatment industry will drive market

TABLE 74 REST OF EUROPE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY MECHANISM

TABLE 75 MIDDLE EAST & AFRICA: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.5.2 BY OPERATION

TABLE 76 MIDDLE EAST & AFRICA: MARKET, BY OPERATION, 2020–2027 (USD MILLION)

10.5.3 BY DISCHARGE PRESSURE

TABLE 77 MIDDLE EAST & AFRICA: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (USD MILLION)

TABLE 78 MIDDLE EAST & AFRICA: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (THOUSAND UNITS)

10.5.4 BY END USER

TABLE 79 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 80 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.5.1 UAE

10.5.5.1.1 Investment in oil & gas industry to drive demand for diaphragm pumps

TABLE 81 UAE: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.5.2 Saudi Arabia

10.5.5.2.1 Investments in oil & gas production activities likely to boost market

TABLE 82 SAUDI ARABIA: DIAPHRAGM PUMPS MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.5.3 South Africa

10.5.5.3.1 Lack of sewage facilities and power generation sector drive demand for diaphragm pumps

TABLE 83 SOUTH AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.5.5.4 Rest of Middle East & Africa

10.5.5.4.1 Growth in manufacturing and construction and increased oil & gas activities likely to boost market

TABLE 84 REST OF MIDDLE EAST & AFRICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6 SOUTH AMERICA

10.6.1 BY MECHANISM

TABLE 85 SOUTH AMERICA: MARKET, BY MECHANISM, 2020–2027 (USD MILLION)

10.6.2 BY OPERATION

TABLE 86 SOUTH AMERICA: MARKET, BY OPERATION, 2020–2027 (USD MILLION)

10.6.3 BY DISCHARGE PRESSURE

TABLE 87 SOUTH AMERICA: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (USD MILLION)

TABLE 88 SOUTH AMERICA: MARKET, BY DISCHARGE PRESSURE, 2020–2027 (THOUSAND UNITS)

10.6.4 BY END USER

TABLE 89 SOUTH AMERICA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 90 SOUTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.5.1 Brazil

10.6.5.1.1 Investment in oil & gas industry will drive demand for diaphragm pumps

TABLE 91 BRAZIL: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.5.2 Argentina

10.6.5.2.1 Growth of mining and construction industry likely to boost market

TABLE 92 ARGENTINA: MARKET, BY END USER, 2020–2027 (USD MILLION)

10.6.5.3 Rest of South America

10.6.5.3.1 Growth of pharmaceutical and water & wastewater industries will boost market

TABLE 93 REST OF SOUTH AMERICA: DIAPHRAGM PUMPS MARKET, BY END USER, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 145)

11.1 KEY PLAYERS STRATEGIES

TABLE 94 OVERVIEW OF KEY STRATEGIES DEPLOYED BY TOP PLAYERS, AUGUST 2018–MARCH 2022

11.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS

TABLE 95 DIAPHRAGM PUMPS MARKET: DEGREE OF COMPETITION

FIGURE 43 MARKET SHARE ANALYSIS, 2021

11.3 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 44 TOP PLAYERS IN MARKET FROM 2016 TO 2020

11.4 COMPANY EVALUATION QUADRANT

11.4.1 STAR

11.4.2 PERVASIVE

11.4.3 EMERGING LEADER

11.4.4 PARTICIPANT

FIGURE 45 COMPETITIVE LEADERSHIP MAPPING: DIAPHRAGM PUMPS MARKET, 2021

11.5 START-UP/SME EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 46 DIAPHRAGM PUMPS MARKET: START-UP/SME EVALUATION QUADRANT, 2021

11.5.5 COMPETITIVE BENCHMARKING

TABLE 96 DIAPHRAGM PUMPS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 97 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

11.6 DIAPHRAGM PUMPS: COMPANY FOOTPRINT

TABLE 98 BY MECHANISM: COMPANY FOOTPRINT

TABLE 99 BY END USER: COMPANY FOOTPRINT

TABLE 100 BY REGION: COMPANY FOOTPRINT

TABLE 101 COMPANY FOOTPRINT

11.7 COMPETITIVE SCENARIO

TABLE 102 MARKET: PRODUCT LAUNCHES, NOVEMBER 2020– JANUARY 2021

TABLE 103 MARKET: DEALS, JUNE 2021– MARCH 2022

TABLE 104 MARKET: OTHERS, MARCH 2018– NOVEMBER 2021

12 COMPANY PROFILES (Page No. - 161)

12.1 KEY PLAYERS

Business overview, Products offered, Recent developments, Deals, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats

12.1.1 INGERSOLL RAND INC.

TABLE 105 INGERSOLL RAND INC.: BUSINESS OVERVIEW

FIGURE 47 INGERSOLL RAND INC.: COMPANY SNAPSHOT (2020)

TABLE 106 INGERSOLL RAND INC.: PRODUCTS OFFERED

TABLE 107 INGERSOLL RAND INC.: DEALS

TABLE 108 INGERSOLL RAND INC.: OTHERS

12.1.2 PSG

TABLE 109 PSG: BUSINESS OVERVIEW

FIGURE 48 PSG: COMPANY SNAPSHOT (2021)

TABLE 110 PSG: PRODUCTS OFFERED

TABLE 111 PSG: PRODUCT LAUNCHES

TABLE 112 PSG: DEALS

TABLE 113 PSG: OTHERS

12.1.3 IDEX CORPORATION

TABLE 114 IDEX CORPORATION: BUSINESS OVERVIEW

FIGURE 49 IDEX CORPORATION: COMPANY SNAPSHOT (2021)

TABLE 115 IDEX CORPORATION: PRODUCTS OFFERED

TABLE 116 IDEX CORPORATION: DEALS

12.1.4 FLOWSERVE CORPORATION

TABLE 117 FLOWSERVE CORPORATION: BUSINESS OVERVIEW

FIGURE 50 FLOWSERVE CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 118 FLOWSERVE CORPORATION: PRODUCTS OFFERED

TABLE 119 FLOWSERVE CORPORATION: PRODUCT LAUNCHES

TABLE 120 FLOWSERVE CORPORATION: DEALS

TABLE 121 FLOWSERVE CORPORATION: OTHERS

12.1.5 XYLEM, INC.

TABLE 122 XYLEM, INC.: BUSINESS OVERVIEW

FIGURE 51 XYLEM, INC.: COMPANY SNAPSHOT (2021)

TABLE 123 XYLEM, INC.: PRODUCTS OFFERED

TABLE 124 XYLEM, INC.: DEALS

TABLE 125 XYLEM, INC.: OTHERS

12.1.6 YAMADA CORPORATION

TABLE 126 YAMADA CORPORATION: BUSINESS OVERVIEW

FIGURE 52 YAMADA CORPORATION: COMPANY SNAPSHOT (2020)

TABLE 127 YAMADA CORPORATION: PRODUCTS OFFERED

TABLE 128 YAMADA CORPORATION: PRODUCT LAUNCHES

12.1.7 LEWA GMBH

TABLE 129 LEWA GMBH: BUSINESS OVERVIEW

TABLE 130 LEWA GMBH: PRODUCTS OFFERED

TABLE 131 LEWA GMBH: PRODUCT LAUNCHES

TABLE 132 LEWA GMBH: DEALS

TABLE 133 LEWA GMBH: OTHERS

12.1.8 VERDER INTERNATIONAL B.V.

TABLE 134 VERDER INTERNATIONAL B.V.: BUSINESS OVERVIEW

TABLE 135 VERDER INTERNATIONAL B.V.: PRODUCTS OFFERED

TABLE 136 VERDER INTERNATIONAL B.V.: PRODUCT LAUNCHES

TABLE 137 VERDER INTERNATIONAL B.V.: DEALS

12.1.9 GRUNDFOS HOLDING A/S

TABLE 138 GRUNDFOS HOLDING A/S: BUSINESS OVERVIEW

FIGURE 53 GRUNDFOS HOLDING A/S: COMPANY SNAPSHOT (2021)

TABLE 139 GRUNDFOS HOLDING A/S: PRODUCTS OFFERED

TABLE 140 GRUNDFOS HOLDING A/S: DEALS

12.1.10 TAPFLO AB

TABLE 141 TAPFLO AB: COMPANY OVERVIEW

TABLE 142 TAPFLO AB: PRODUCTS OFFERED

TABLE 143 TAPFLO AB: PRODUCT LAUNCHES

12.1.11 URACA

TABLE 144 URACA: COMPANY OVERVIEW

TABLE 145 URACA: PRODUCTS OFFERED

TABLE 146 URACA: DEALS

12.1.12 SPX FLOW

TABLE 147 SPX FLOW: COMPANY OVERVIEW

FIGURE 54 SPX FLOW: COMPANY SNAPSHOT (2021)

TABLE 148 SPX FLOW: PRODUCTS OFFERED

TABLE 149 SPX FLOW: DEALS

TABLE 150 SPX FLOW: OTHERS

12.1.13 KIMRAY, INC.

TABLE 151 KIMRAY, INC.: COMPANY OVERVIEW

TABLE 152 KIMRAY, INC.: PRODUCTS OFFERED

TABLE 153 KIMRAY, INC.: DEALS

TABLE 154 KIMRAY, INC.: OTHERS

12.1.14 SANDPIPER PUMP

TABLE 155 SANDPIPER PUMP: COMPANY OVERVIEW

TABLE 156 SANDPIPER PUMP: PRODUCTS OFFERED

12.1.15 WANNER ENGINEERING, INC.

TABLE 157 WANNER ENGINEERING, INC: COMPANY OVERVIEW

TABLE 158 WANNER ENGINEERING, INC: PRODUCTS OFFERED

TABLE 159 WANNER ENGINEERING, INC.: PRODUCT LAUNCHES

12.2 OTHER PLAYERS

12.2.1 DR. JESSBERGER GMBH

12.2.2 PRICE PUMP

12.2.3 WENZHOU KAIXIN PUMP CO., LTD

12.2.4 SERFILCO

12.2.5 VERSAMATIC

*Details on Business overview, Products offered, Recent developments, Deals, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 212)

13.1 INSIGHTS FROM INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

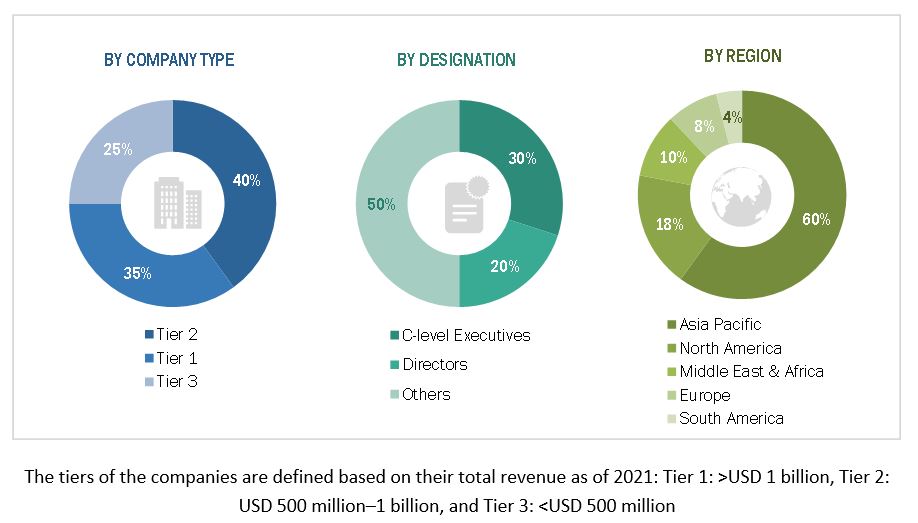

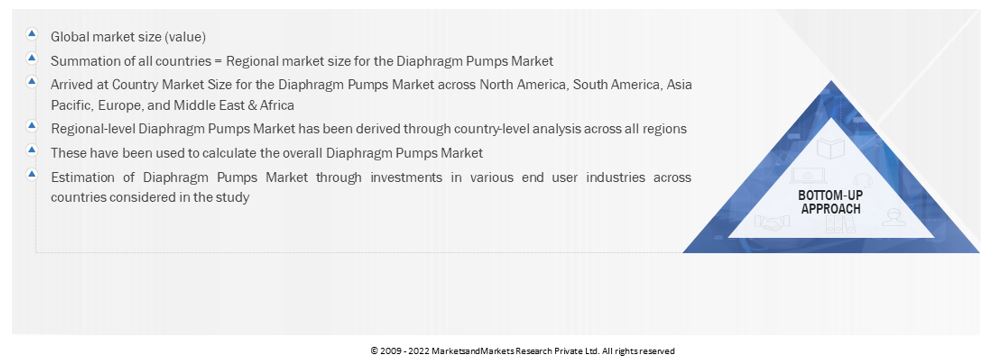

This study involved four major activities in estimating the current size of the diaphragm pumps market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

The research study on the diaphragm pumps market involved the extensive use of directories, secondary sources, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, International Monetary Fund, United Nations Conference on Trade and Development, US Energy Information Administration, British Pump Manufacturers’ Association, US Environmental Protection Agency, International Federation of Pharmaceutical Manufacturers & Association, UN Comtrade Database and BP Statistical Review of World Energy, to identify and collect information useful for this technical, market-oriented, and commercial study. The other secondary sources included white papers, certified publications, articles by recognized authors, annual reports, press releases & investor presentations of companies, manufacturer associations, trade directories, and databases.

Primary Research

Primary sources included several industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, standard and certification agencies of companies, and organizations related to all the segments of this industry’s value chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. In the canvassing of primaries, various departments within organizations, such as sales, engineering, operations, and administration were covered to provide a holistic viewpoint in our report The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global diaphragm pumps market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the diaphragm pumps market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The market’s value chain and size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Diaphragm Pumps Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained below, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the diaphragm pumps market by mechanism, operation, discharge pressure, end user, and region based on market size and volume

- To forecast the market size, in terms of value and volume, for five key regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To provide detailed information about the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze competitive developments, such as sales contracts, agreements, investments, expansions, new product launches, mergers, partnerships, joint ventures, collaborations, and acquisitions, in the diaphragm pumps market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Diaphragm Pumps Market

Interested in finding out the available customizations by company information and subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market of diaphragm pumps market.