Directed Energy Weapons Market by Technology (High Energy Lasers, High-power Radio Frequency, Electromagnetic Weapons, Sonic Weapons), Platform (Land, Airborne, Naval, Space), Application, Product, Range and Region - Global Forecast to 2027

Update: 10/22/2024

The Directed Energy Weapon Market is projected to grow from USD 5.3 Billion in 2022 to USD 12.9 Billion by 2027, at a CAGR of 19.6% from 2022 to 2027.

Extensive research into DEW sources and the concurrent advances in beam directing technology have pushed technology to the level where fully configured DEW systems are now being designed and tested for imminent deployment. Advances in material technology, information technology, and space-based capabilities of the 21st century are also providing the right environment for the growing demand for DEW systems. The US Air Force project on airborne laser (ABL) is a classic example of how DEW technology is transforming into a formidable weapon system with hitherto unthinkable military capabilities.

The Directed Energy Weapons Industry is diversified and competitive, with the majority of players in the North American and European regions. The market is dominated by companies based on their core competencies. Key players in this market include Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), The Boeing Company (US), L3Harris Technologies, Inc. (US), Raytheon Technologies Corporation (US), and BAE Systems plc (UK).

Directed Energy Weapons Market Forecast to 2027

To know about the assumptions considered for the study, Request for Free Sample Report

Directed energy weapon Market Dynamics:

Driver: Rising demand of DEW to conduct successful combat operations

The rapid development of high-energy laser weapons and the adoption of high-energy laser weapons to deal with the threat of Unmanned Aerial Vehicles (UAVs) has become one of the advanced directed energy technologies. In 2021, these weapons were increasingly being integrated into military platforms such as navy, airborne, mobile vehicles, and satellites. In recent decades, multiple defense manufacturers and integrators have been researching and developing laser weapons and are increasingly becoming more operational. In September 2020, Raytheon Technologies Corporation built and delivered a high-energy laser weapon system to the US Air Force for use in upcoming experiments and training activities overseas. In 2020, The Boeing Company declared the delivery of its first upgraded Compact Laser Weapon Systems to the US Department of Defense. In February 2021, SIGN4L signed an MoU with MBDA and CILAS to explore co-development in high-energy laser weapons systems as part of an advanced counter-unmanned aerial vehicle (C-UAV) strategy.

Restraint: Restrictions on anti-personnel lasers

DEWs are not authoritatively defined under international law, nor are they currently on the agenda of any existing multilateral mechanism. Several legal regimes would apply to directed energy weapons. The prospect of directed energy weapons raises questions for several bodies of international law, most notably those that place restrictions on the use of force. Some DEWs are classified as non-lethal or less-lethal weapons, with proponents setting them apart from lethal weapons. Low-energy laser weapon systems are one of the most controversial topics in defense, as they may be used for anti-personnel purposes. The use of blinding weapons was banned in 1995 by the UN decision (Protocol on Blinding Laser Weapons (1995), annexed to the Framework Convention on Prohibitions or Restrictions on the Use of Certain Conventional Weapons (CCW)). Thus, various DEW systems developed for military application in warfare have not been put into service. For instance, the Active Denial System developed by Raytheon Technologies Corporation was introduced to the US Army. Although the US DoD shipped the ADS to Afghanistan, deployment was halted due to humanitarian laws and other factors. The Joint Non-Lethal Weapons Directorate (JNLWD) of US is currently working on the deployment capability of the ADS without violating international laws.

Opportunity: R&D in advanced DEW technologies

Improved system reliability is a crucial factor in selecting a directed energy weapon by any country. The incorporation of advanced hardware units to help gather and distribute capability across various defense platforms like combat vehicles. These directed energy weapons are deployed in strategic locations to increase detection rates. State-of-the-art directed energy weapons with high accuracy have led countries with border disputes and regional threats to rely on these advanced directed energy weapons to assist in border protection. Thus, rising R&D in advanced directed energy weapons technologies provides a wide range of opportunities in defense sector applications.

Challenge: Integrating existing systems with new technologies

The integration between conventional and modern devices is difficult, which adversely affects the efficiency of directed energy devices. In some cases, new devices have different protocols that make these difficult to adopt. Integration of legacy systems with new technologies is time and effort-consuming and may distract an organization from its core business activities.

Based on technology, the high energy laser (HEL) segment register large share in base year

Based on technology, the directed energy weapon market has been segmented into high-power microwave (HPM), high energy laser (HEL), sonic weapons, and electromagnetic weapons. A laser is a device that emits light through a course of optical amplification based on the stimulated emission of electromagnetic radiation. A laser is different from other sources of light as it emits light that is coherent. Spatial coherence allows a laser to be focused on a tight spot, enabling applications such as directed energy weapon systems. A large amount of focused energy is delivered by high-energy lasers to a faraway target at the speed of light, thereby causing structural and incendiary damage. High-energy laser systems use photons, or light particles, to carry out military missions and civil defense. This directed energy technology enables the detection of threats, tracking during maneuvers, and positive visual identification to defeat a wide range of threats, including unmanned aerial systems, rockets, artillery, and mortars. In August 2022, Lockheed Martin Corporation delivered the high-energy laser to US Navy. The high energy laser weapon was installed on warships, which is a 60KW+ laser and is officially known as High Energy Laser Integrated Optical-Dazzler and Surveillance (HELIOS).

Based on Product, the directed energy weapons market is dominated by lethal products

Based on product, the directed energy weapon market has been segmented into two categories, namely lethal and non-lethal weapons. The lethal products focused on military applications include rail guns, electromagnetic bombs (e-bombs), plasma cannons (electrothermal accelerator), microwave guns, plasma grenades, navy laser cannons, gun-launched guided projectiles, automatic shotguns, and several others. Huge investments are being made in R&D as well as the demonstration and testing of lethal directed energy weapons.

Based on application, the directed energy weapons market is dominated by the military segment

The directed energy weapons market, based on application, has been segmented into two categories, namely, homeland security and military. One of the main features of directed energy weapon technology is the ability to customize the weapon by adjusting the amount of energy deposited upon targets. The directed energy weapons find extensive applications in homeland security as well as military markets. Amongst these two applications, the military is the major field where directed energy weapons are more functional. Directed energy weapons have been used in the military since the 1930s. Lethal-directed energy weapons are used in defense applications, while non-lethal-directed energy weapons are used in homeland security.

Based on platform, the naval platform of directed energy weapons market to dominate by the market

The directed energy weapons market has been segmented by platform into land, airborne, naval, and space. It is growing rapidly due to the need for these weapons, which have proven to be highly useful in national defense applications.

The naval segment is projected to account for the largest share in 2021. This growth can be attributed to the easy installation and low power consumption of high-energy laser weapons. Compared to conventional ordnance, they have next to zero time of flight, which allows for a longer decision time and a quicker reaction time.

The Asia Pacific region is projected to Grow at highest CAGR during the forecast period

China, India, Japan, Australia, South Korea, and Rest of Asia Pacific have been considered in the Asia Pacific directed energy weapons market. Rest of Asia Pacific includes New Zealand, Philippines, and Singapore. China and India are the leading manufacturers of directed energy weapons in this region.

The demand for the directed energy weapons market has increased in recent years due to rapid economic development, increasing security threats, and increased border disputes. The military spending of China, Japan, and India has been growing in recent years due to the increased possibility of being targeted by terrorist attacks.

Directed Energy Weapons Market by Region

To know about the assumptions considered for the study, download the pdf brochure

North America contributed the largest share, followed by Europe in 2022. The growth of the directed energy weapons market in various regions is primarily driven by cross-border disputes and terrorist attacks in different parts of the world, along with advancements in technologies, such as hy laser and high-power radio frequency technology, among others. The North American-directed energy weapons market includes the US and Canada. US contributed the largest share to the directed energy weapons market in 2022 due to the increased demand for high-energy laser systems and high-power microwave systems in the country on its military bases in overseas deployment. This region is expected to witness a significant increase in research & development activities, particularly in high-energy laser system technologies.

The directed energy weapons market in Europe includes UK, Germany, France, Russia, Italy, and Rest of Europe. This region contributed the second-largest share of 25.82% to the directed energy weapons market in 2022. Major drivers of the directed energy weapons market in Europe include the rise in advanced warfare techniques and technological advancements, such as high-energy laser technology in directed energy weapons in the region.

European countries have strong Air Forces, which are more inclined toward procuring directed energy weapons to strengthen their position. The Navy of these countries has been focusing on directed energy weapons for the last few years. They have made significant investments in developing directed energy weapons in naval applications. The growth of the directed energy weapons market in Europe is fueled by the recent terrorist attacks in different parts of Europe.

Key Market Players

The major players in the directed energy weapon companies are Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), and BAE Systems plc (UK). These players have adopted various growth strategies such as new product launches, new service launches, contracts, partnerships, agreements, collaborations, and expansions to further expand their presence in the directed energy weapon market.

Scope of the Report

|

Report Metric |

Details |

|

Estimated Market Size

|

USD 5.3 Billion in 2022

|

|

Projected Market Size

|

USD 12.9 Billion by 2027

|

|

Growth Rate

|

CAGR of 19.6%

|

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Platform, By Application, By Range, By Technology, By Product, and By Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), BAE Systems plc (UK), and The Boeing Company (US) |

|

Companies covered (Directed energy weapon market start-ups and directed energy weapon market ecosystem) |

Dynetics, Inc. (US), EaglePicher Technologies (US), Radiance Technologies, Inc. (US), Applied Research Associates, Inc. (US), BlueHalo (US), and others |

Directed Energy Weapons Market Highlights

This research report categorizes the directed energy weapon market based on platform, application, range, technology, product, and region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Application |

|

|

By Platform |

|

|

By Range |

|

|

By Product |

|

|

By Region |

|

Recent Developments

- In January 2023, L3Harris Technologies, Inc. was awarded a contract worth USD 40 million to provide 14 units of anti-drone weapon systems to bolster the security forces of Ukraine.

- In December 2022, Lockheed Martin Corporation and Rafael Advanced Defense Systems Ltd. jointly developed 100KW fiber class directed energy weapons for the IRON BEAM project.

Frequently Asked Questions (FAQ):

What is the current size of the Directed Energy Weapon Market?

The Directed Energy Weapon Market is projected to grow from USD 5.3 Billion in 2022 to USD 12.9 Billion by 2027, at a CAGR of 19.6% from 2022 to 2027.

Who are the winners in the Directed Energy Weapon Market?

Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), Thales Group (France), and BAE Systems plc (UK) are contributing major share in the market in 2021.

What are some of the technological advancements in the Market?

High Energy Microwaves, Laser Beam Energy, Army Directed Energy Weapons Solid-State Lasers to Counter Unmanned Aerial Vehicles

What are the factors driving the growth of the Market?

Increased demand in combat operations, modernization and investments in military platforms, rapid advancements in AI, big data analytics, and robotics.

What region holds the largest share of the Market in 2021?

North America registered the largest share of 44.8% in global directed energy weapon market in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased demand in combat operations- Modernization and investments in military platforms- Rapid advancements in AI, big data analytics, and robotics- Development of compact DEW for UAV platformsRESTRAINTS- Restrictions on anti-personnel lasers- Utilization of DEW for law enforcement missions- Possibility of high collateral damageOPPORTUNITIES- R&D in advanced DEW technologies- Complexities in weapon developmentCHALLENGES- Increased barriers in designing military DEW systems- Integrating existing systems with new technologies

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSESREVENUE SHIFT AND NEW REVENUE POCKETS FOR DIRECTED ENERGY WEAPON MANUFACTURERS

-

5.5 DIRECTED ENERGY WEAPONS MARKET ECOSYSTEMPROMINENT COMPANIESPRIVATE AND SMALL ENTERPRISESAPPLICATION

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 RECESSION IMPACT ANALYSISIMPACT OF RECESSION ON DIRECTED ENERGY WEAPONS MARKET

-

5.8 REGULATORY LANDSCAPENORTH AMERICAEUROPEASIA PACIFIC

- 5.9 TRADE ANALYSIS

- 5.10 AVERAGE SELLING PRICE TREND

-

5.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.12 KEY CONFERENCES AND EVENTS IN 2022–2023

- 6.1 INTRODUCTION

-

6.2 TECHNOLOGY TRENDSHIGH ENERGY MICROWAVESLASER BEAM ENERGYPARTICLE BEAM ENERGYACTIVE DENIAL SYSTEMS

- 6.3 TECHNOLOGY ANALYSIS

-

6.4 IMPACT OF MEGATRENDSARMY DIRECTED ENERGY WEAPONSSOLID-STATE LASERS TO COUNTER UNMANNED AERIAL VEHICLESDIRECTED ENERGY WEAPONS FOR SPACE AND SATELLITE SECURITY

- 6.5 INNOVATION AND PATENT REGISTRATIONS

-

6.6 USE CASE ANALYSIS: DIRECTED ENERGY WEAPONS MARKETTACTICAL HIGH ENERGY LASER BY NORTHROP GRUMMAN OFFERS VIABLE DEFENSE AGAINST THREATSTURKEY BECAME FIRST COUNTRY TO USE DIRECTED ENERGY WEAPONS IN COMBATGERMAN NAVY INTEGRATES HIGH ENERGY LASER ON FRIGATE AND SHOOTS DOWN DRONE

- 7.1 INTRODUCTION

-

7.2 HIGH ENERGY LASERSOLID-STATE LASER- Used in numerous military applicationsFIBER LASER- High efficiency, low maintenance, and reliableFREE ELECTRON LASER- Megawatt level output for strategic missile defenseCHEMICAL LASER- Provides precision with destructive capability at speed of lightLIQUID LASER- Better performance due to continuous cooling by liquid circulation

-

7.3 HIGH-POWER RADIO FREQUENCYNARROW-BAND MICROWAVE- Causes temporary and permanent damage to targetsULTRA-WIDEBAND MICROWAVE- Increased immunity to interference due to lower spectral power density

-

7.4 ELECTROMAGNETIC WEAPONSPARTICLE BEAM WEAPONS- Charged particle beam weapons- Neutral particle beam weaponsLASER-INDUCED PLASMA CHANNELS (LIPC)- Equally powerful as lightning during storms

-

7.5 SONIC WEAPONSFOCUSED BEAM OF SOUND TO DAMAGE TARGET

- 8.1 INTRODUCTION

-

8.2 HOMELAND SECURITYGROWING DEMAND IN MINING SECTOR OWING TO LONGER FLIGHT TIMERIOT CONTROL- Development of advanced, non-lethal weapons for riot controlAIRPORT PROTECTION- Safeguards airports from incoming missiles, mortars, anti-aircraft missiles, drones, and other threatsANTI-DRUG SMUGGLING- Helps control creative and new technologies from smuggling drugs across bordersCRITICAL INFRASTRUCTURE PROTECTION- Ground-based laser weapons protect critical infrastructure from terrorist attacksCHEMICAL, BIOLOGICAL, RADIOLOGICAL, NUCLEAR, AND EXPLOSIVES (CBRNE) DEFENSE- High-energy lasers to intercept ballistic and nuclear missiles

-

8.3 MILITARYBORDER PROTECTION- Demand for better intelligence, force modernization, and meeting equipment needsTACTICAL MISSILE DEFENSE- Defend against nuclear-armed ICBMs, shorter-ranged non-nuclear tactical, and theater missilesMARITIME PROTECTION- Defend sea-skimming cruise missilesMILITARY BASE PROTECTION- Strategic positioning to defend military bases against incoming threatsANTI-BALLISTIC MISSILE DEFENSE- High-performance tactical missile defense systems to influence military force deployment strategiesANTI-SATELLITE DEFENSE- High-energy beams to kill or destroy satellitesCOMMAND, CONTROL, AND INFORMATION WARFARE- High-power electromagnetic weapons to disable electronics of command and communication systemsBATTLEFIELD AIR INTERDICTION- Involves air attacks affecting ground combatCLOSE AIR SUPPORT (CAS)- High speed and range, accuracy, and limited collateral damage

- 9.1 INTRODUCTION

-

9.2 LANDARMORED VEHICLES- Combat vehicles- Combat support vehicles- Unmanned armored ground vehiclesHANDHELD- Compact, lightweight, and energy-efficient weaponsWEAPON SYSTEMS- Launch systems- Defense systems

-

9.3 AIRBORNEHELICOPTERS- Low cost of engagement and easy installationFIGHTER AIRCRAFT- Developed by major market playersSPECIAL MISSION AIRCRAFT- Offers high precision strike abilityTACTICAL UAVS- Low equipment size, weight, and power consumption

-

9.4 NAVALCOMBAT SHIPS- Fast, maneuverable, and long enduranceSUBMARINES- Ability to penetrate below-water surfaces without attenuationUNMANNED SURFACE VEHICLES- Used for MCM, ISR, and ASW

-

9.5 SPACESATELLITES- Assist in strategic and tactical missionsSPACE-BASED INTERCEPTORS- Low reaction time and high attack speedEARTH TO SPACE WEAPONS- Suitable for space security and preparedness

- 10.1 INTRODUCTION

-

10.2 LETHAL WEAPONSRAIL GUNS- Cause damage to targets by firing projectile with high speed, mass, and kinetic energyELECTROMAGNETIC BOMBS- Ability to destroy electronic systemsPLASMA CANNON- Uses plasma discharge instead of chemical propellantsMICROWAVE GUNS- Generate very high power levels of repeated short pulses and very little heatNAVY LASER CANNON- Counters surface craft and UAVsGUN LAUNCHED GUIDED PROJECTILE- Next-generation, low drag system

-

10.3 NON-LETHAL WEAPONSPULSED ENERGY PROJECTILE- Can be used for riot controlACTIVE DENIAL SYSTEMS (ADS)- Fires high-powered beam of 95 GHz waves at targetsDAZZLERS- Uses intense directed radiation to disable targets temporarilySONIC GUNS- Fire extremely high-power sound waves to damage or destroy eardrumsTASER GUNS- Disrupts voluntary control of musclesSTUN GUNS- Not preferred by law enforcement agents

- 11.1 INTRODUCTION

-

11.2 LESS THAN 1 KMSOLID-STATE LASERS OFFER BETTER PERFORMANCE IN LESS THAN 1 KM RANGE

-

11.3 MORE THAN 1 KMOFFERS DEFENSE AGAINST MULTIPLE THREATS

- 12.1 INTRODUCTION

-

12.2 REGIONAL RECESSION IMPACT ANALYSISSMALL AND MEDIUM-SIZED BUSINESSES IN DEFENSE MARKETRUSSIA-UKRAINE EFFECT

-

12.3 NORTH AMERICAPESTLE ANALYSIS: NORTH AMERICAUS- Strong focus on development and procurement of modern military weapon systemsCANADA- Increased R&D investments

-

12.4 EUROPEPESTLE ANALYSIS: EUROPERUSSIA- Constant focus on strengthening military power with advanced weapon systemsFRANCE- Presence of key players with strong product innovation and development capabilitiesGERMANY- High demand for lethal and non-lethal weapons to improve capabilities of military platformUK- Market expansion through significant investment in military system development programsITALY- High investment by key players in R&DREST OF EUROPE- Significant improvement and strengthening of military capabilities

-

12.5 ASIA PACIFICASIA PACIFIC: PESTLE ANALYSISCHINA- Increasing investment to strengthen militaryINDIA- Increasing procurement and development of advanced military platforms and systems to tackle border disputesJAPAN- Rising focus on innovation of high-end indigenous military technologiesSOUTH KOREA- Boost to military capabilities with development of lethal and non-lethal weapons systemsAUSTRALIA- Supportive government programs to modernize military weaponsREST OF ASIA PACIFIC- Deployment of technologically advanced military platforms on battlefields

-

12.6 REST OF THE WORLDPESTLE ANALYSIS: REST OF THE WORLDISRAEL- Presence of major defense playersTURKEY- Increasing number of terror attacks led to procurement of modern weapon systems

- 13.1 INTRODUCTION

-

13.2 COMPANY OVERVIEWKEY DEVELOPMENTS/STRATEGIES OF LEADING PLAYERS IN DIRECTED ENERGY WEAPONS MARKET

- 13.3 RANKING ANALYSIS OF KEY PLAYERS IN DIRECTED ENERGY WEAPONS MARKET, 2021

- 13.4 REVENUE ANALYSIS, 2021

- 13.5 MARKET SHARE ANALYSIS, 2021

-

13.6 COMPETITIVE EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

13.7 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.8 COMPETITIVE BENCHMARKING

-

13.9 COMPETITIVE SCENARIOSMARKET EVALUATION FRAMEWORKPRODUCT LAUNCHES

- 14.1 INTRODUCTION

-

14.2 KEY PLAYERSLOCKHEED MARTIN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewRAYTHEON TECHNOLOGIES CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewNORTHROP GRUMMAN CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHALES GROUP- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBAE SYSTEMS PLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTHE BOEING COMPANY- Business overview- Products/Services/Solutions offered- Recent developmentsTEXTRON, INC.- Business overview- Products/Services/Solutions offeredRHEINMETALL AG- Business overview- Products/Services/Solutions offered- Recent developmentsL3HARRIS TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsRAFAEL ADVANCED DEFENSE SYSTEMS LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsMOOG, INC.- Business overview- Products/Services/Solutions Offered- Recent developmentsQINETIQ LIMITED- Business overview- Products/Services/Solutions offered- Recent developmentsHONEYWELL INTERNATIONAL INC.- Business overview- Products/Services/Solutions offeredELBIT SYSTEMS LTD.- Business overview- Products/Services/Solutions offered- Recent developmentsLEONARDO SPA- Business overview- Products/Services/Solutions offered- Recent developments

-

14.3 OTHER PLAYERSDYNETICS, INC.EAGLEPICHER TECHNOLOGIESRADIANCE TECHNOLOGIES, INC.APPLIED RESEARCH ASSOCIATES, INC.BLUEHALOROKETSAN ASGENERAL ATOMICSMBDAEPIRUS, INC.AQWEST LLC

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 DIRECTED ENERGY WEAPONS MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES

- TABLE 3 DIRECTED ENERGY WEAPONS MARKET ECOSYSTEM

- TABLE 4 DIRECTED ENERGY WEAPONS: PORTER’S FIVE FORCE ANALYSIS

- TABLE 5 ELECTRICAL MACHINES AND APPARATUS: COUNTRY-WISE IMPORTS, 2020–2021 (USD THOUSAND)

- TABLE 6 ELECTRICAL MACHINES AND APPARATUS: COUNTRY-WISE EXPORTS, 2020–2021 (USD THOUSAND)

- TABLE 7 DIRECTED ENERGY WEAPONS MARKET: AVERAGE SELLING PRICE TREND

- TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE TECHNOLOGY TYPES (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 10 DIRECTED ENERGY WEAPONS MARKET: CONFERENCES AND EVENTS

- TABLE 11 IMPORTANT INNOVATION AND PATENT REGISTRATIONS, 2007–2022

- TABLE 12 DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 13 DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 14 DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 15 DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 16 DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 17 DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 18 DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 19 DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 20 DIRECTED ENERGY WEAPONS MARKET, BY RANGE, 2019–2021 (USD MILLION)

- TABLE 21 DIRECTED ENERGY WEAPONS MARKET, BY RANGE, 2022–2027 (USD MILLION)

- TABLE 22 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 23 DIRECTED ENERGY WEAPONS MARKET, BY REGION, 2019–2021 (USD MILLION)

- TABLE 24 DIRECTED ENERGY WEAPONS MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 25 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 26 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 27 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 28 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 29 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 30 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 31 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 32 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 33 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 34 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 35 US: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 36 US: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 37 US: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 38 US: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 39 US: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 40 US: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 41 US: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 42 US: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 43 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 44 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 45 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 46 CANADA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 47 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 48 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 49 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 50 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 51 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 52 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 53 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 54 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 55 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 56 EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 57 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 58 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 59 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 60 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 61 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 62 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 63 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 64 RUSSIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 65 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 66 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 67 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 68 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 69 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 70 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 71 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 72 FRANCE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 73 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 74 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 75 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 76 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 77 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 78 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 79 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 80 GERMANY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 81 UK: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 82 UK: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 83 UK: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 84 UK: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 85 UK: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 86 UK: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 87 UK: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 88 UK: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 89 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 90 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 91 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 92 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 93 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 94 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 95 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 96 ITALY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 97 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 98 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 99 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 100 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 101 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 102 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 103 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 104 REST OF EUROPE: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 112 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 113 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 114 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 115 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 116 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 117 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 118 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 119 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 120 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 121 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 122 CHINA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 123 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 124 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 125 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 126 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 127 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 128 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 129 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 130 INDIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 131 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 132 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 133 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 134 JAPAN: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 135 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 136 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 137 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 138 SOUTH KOREA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 139 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 140 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 141 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 142 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 143 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 144 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 145 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 146 AUSTRALIA: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 150 REST OF ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 151 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 152 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 153 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 154 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 155 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 156 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 157 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 158 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 159 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2019–2021 (USD MILLION)

- TABLE 160 REST OF THE WORLD: DIRECTED ENERGY WEAPONS MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

- TABLE 161 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 162 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 163 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 164 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 165 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 166 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 167 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 168 ISRAEL: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 169 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2019–2021 (USD MILLION)

- TABLE 170 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PLATFORM, 2022–2027 (USD MILLION)

- TABLE 171 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2019–2021 (USD MILLION)

- TABLE 172 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

- TABLE 173 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2019–2021 (USD MILLION)

- TABLE 174 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

- TABLE 175 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2019–2021 (USD MILLION)

- TABLE 176 TURKEY: DIRECTED ENERGY WEAPONS MARKET, BY TECHNOLOGY, 2022–2027 (USD MILLION)

- TABLE 177 DIRECTED ENERGY WEAPONS MARKET: DEGREE OF COMPETITION

- TABLE 178 COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 179 COMPANY PRODUCT FOOTPRINT

- TABLE 180 COMPANY APPLICATION FOOTPRINT

- TABLE 181 COMPANY REGION FOOTPRINT

- TABLE 182 DIRECTED ENERGY WEAPONS MARKET: PRODUCT LAUNCHES, SEPTEMBER 2020–SEPTEMBER 2022

- TABLE 183 DIRECTED ENERGY WEAPONS MARKET: DEALS, NOVEMBER 2018–MAY 2020

- TABLE 184 DIRECTED ENERGY WEAPONS MARKET: OTHER DEVELOPMENTS, SEPTEMBER 2018–JANUARY 2023

- TABLE 185 LOCKHEED MARTIN CORPORATION: BUSINESS OVERVIEW

- TABLE 186 LOCKHEED MARTIN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 187 LOCKHEED MARTIN CORPORATION: DEALS

- TABLE 188 RAYTHEON TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- TABLE 189 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 190 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCT LAUNCHES

- TABLE 191 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- TABLE 192 RAYTHEON TECHNOLOGIES CORPORATION: OTHERS

- TABLE 193 NORTHROP GRUMMAN CORPORATION: BUSINESS OVERVIEW

- TABLE 194 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 195 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 196 NORTHROP GRUMMAN CORPORATION: DEALS

- TABLE 197 NORTHROP GRUMMAN CORPORATION: OTHERS

- TABLE 198 THALES GROUP: BUSINESS OVERVIEW

- TABLE 199 THALES GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 200 THALES GROUP: DEALS

- TABLE 201 BAE SYSTEMS PLC: BUSINESS OVERVIEW

- TABLE 202 BAE SYSTEMS PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 203 BAE SYSTEMS PLC: PRODUCT LAUNCHES

- TABLE 204 BAE SYSTEMS PLC: DEALS

- TABLE 205 BAE SYSTEMS PLC: OTHERS

- TABLE 206 THE BOEING COMPANY: BUSINESS OVERVIEW

- TABLE 207 THE BOEING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 208 THE BOEING COMPANY: PRODUCT LAUNCHES

- TABLE 209 THE BOEING COMPANY: DEALS

- TABLE 210 TEXTRON, INC.: BUSINESS OVERVIEW

- TABLE 211 TEXTRON, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 212 RHEINMETALL AG: BUSINESS OVERVIEW

- TABLE 213 RHEINMETALL AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 214 RHEINMETALL AG: PRODUCT LAUNCHES

- TABLE 215 RHEINMETALL AG: DEALS

- TABLE 216 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 217 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 218 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 219 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 220 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 221 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: DEALS

- TABLE 222 MOOG, INC.: BUSINESS OVERVIEW

- TABLE 223 MOOG, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 224 MOOG, INC.: OTHERS

- TABLE 225 QINETIQ LIMITED: BUSINESS OVERVIEW

- TABLE 226 QINETIQ LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 227 QINETIQ LIMITED: DEALS

- TABLE 228 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

- TABLE 229 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 230 ELBIT SYSTEMS LTD.: BUSINESS OVERVIEW

- TABLE 231 ELBIT SYSTEMS LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 232 ELBIT SYSTEMS LTD.: DEALS

- TABLE 233 LEONARDO SPA: BUSINESS OVERVIEW

- TABLE 234 LEONARDO SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 235 LEONARDO SPA: DEALS

- TABLE 236 DYNETICS, INC.: COMPANY OVERVIEW

- TABLE 237 EAGLEPICHER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 238 RADIANCE TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 239 APPLIED RESEARCH ASSOCIATES, INC.: COMPANY OVERVIEW

- TABLE 240 BLUEHALO: COMPANY OVERVIEW

- TABLE 241 ROKETSAN AS: COMPANY OVERVIEW

- TABLE 242 GENERAL ATOMICS: COMPANY OVERVIEW

- TABLE 243 MBDA: COMPANY OVERVIEW

- TABLE 244 EPIRUS, INC.: COMPANY OVERVIEW

- TABLE 245 AQWEST LLC: COMPANY OVERVIEW

- FIGURE 1 DIRECTED ENERGY WEAPONS MARKET SEGMENTATION

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 DIRECTED ENERGY WEAPONS MARKET: RESEARCH DESIGN

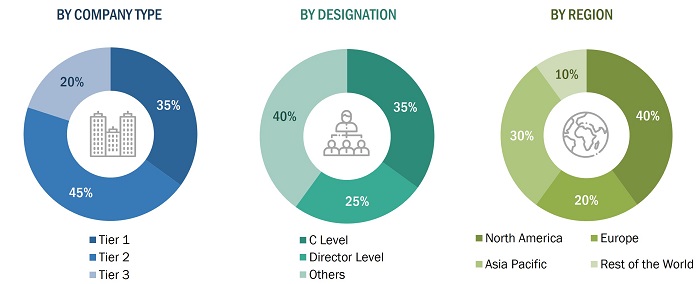

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RECESSION IMPACT ON REVENUE OF KEY PLAYERS

- FIGURE 6 MILITARY EXPENDITURE, 2019–2021

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ASSUMPTIONS FOR RESEARCH STUDY

- FIGURE 11 HIGH ENERGY LASER SEGMENT TO HOLD HIGHEST MARKET SHARE IN 2022

- FIGURE 12 MILITARY SEGMENT TO LEAD MARKET FROM 2022 TO 2027

- FIGURE 13 AIRBORNE SEGMENT TO RECORD HIGHEST GROWTH BY 2027

- FIGURE 14 INCREASING TERRORIST THREATS AND HIGHLY DISPUTED BORDERS TO DRIVE MARKET

- FIGURE 15 HIGH ENERGY LASER SEGMENT EXPECTED TO LEAD DIRECTED ENERGY WEAPONS MARKET FROM 2022 TO 2027

- FIGURE 16 NAVAL SEGMENT PROJECTED TO GAIN MAJOR MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 LETHAL WEAPONS SEGMENT TO ACCOUNT FOR MOST SIGNIFICANT MARKET SHARE FROM 2022 TO 2027

- FIGURE 18 NORTH AMERICA LED MARKET IN 2022

- FIGURE 19 DIRECTED ENERGY WEAPONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIRECTED ENERGY WEAPON MANUFACTURERS

- FIGURE 22 MARKET ECOSYSTEM MAP: DIRECTED ENERGY WEAPONS MARKET

- FIGURE 23 FIVE FORCES ANALYSIS FOR DIRECTED ENERGY WEAPONS MARKET

- FIGURE 24 FACTORS IMPACTING DIRECTED ENERGY WEAPONS MARKET

- FIGURE 25 SCENARIO ANALYSIS OF DIRECTED ENERGY WEAPONS MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE TECHNOLOGIES

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 28 HIGH ENERGY LASER SEGMENT PROJECTED TO LEAD DIRECTED ENERGY WEAPONS MARKET DURING FORECAST PERIOD

- FIGURE 29 MILITARY SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 30 NAVAL SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- FIGURE 31 LETHAL WEAPONS SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 32 MORE THAN 1 KM SEGMENT PROJECTED TO LEAD DURING FORECAST PERIOD

- FIGURE 33 REGIONAL SNAPSHOT: GROWTH RATE ANALYSIS, 2022–2027

- FIGURE 34 NORTH AMERICA: DIRECTED ENERGY WEAPONS MARKET SNAPSHOT

- FIGURE 35 EUROPE: DIRECTED ENERGY WEAPONS MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: DIRECTED ENERGY WEAPONS MARKET SNAPSHOT

- FIGURE 37 RANKING OF KEY PLAYERS IN DIRECTED ENERGY WEAPONS MARKET, 2021

- FIGURE 38 REVENUE ANALYSIS OF KEY COMPANIES IN DIRECTED ENERGY WEAPONS MARKET, 2018-2021

- FIGURE 39 DIRECTED ENERGY WEAPONS MARKET SHARE ANALYSIS OF KEY COMPANIES, 2021

- FIGURE 40 MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 41 DIRECTED ENERGY WEAPONS MARKET (STARTUP/SME) COMPETITIVE LEADERSHIP MAPPING, 2021

- FIGURE 42 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- FIGURE 44 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 THALES GROUP: COMPANY SNAPSHOT

- FIGURE 46 BAE SYSTEMS PLC: COMPANY SNAPSHOT

- FIGURE 47 THE BOEING COMPANY: COMPANY SNAPSHOT

- FIGURE 48 TEXTRON, INC.: COMPANY SNAPSHOT

- FIGURE 49 RHEINMETALL AG: COMPANY SNAPSHOT

- FIGURE 50 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- FIGURE 51 RAFAEL ADVANCED DEFENSE SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 52 MOOG, INC.: COMPANY SNAPSHOT

- FIGURE 53 QINETIQ LIMITED: COMPANY SNAPSHOT

- FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 55 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- FIGURE 56 LEONARDO SPA: COMPANY SNAPSHOT

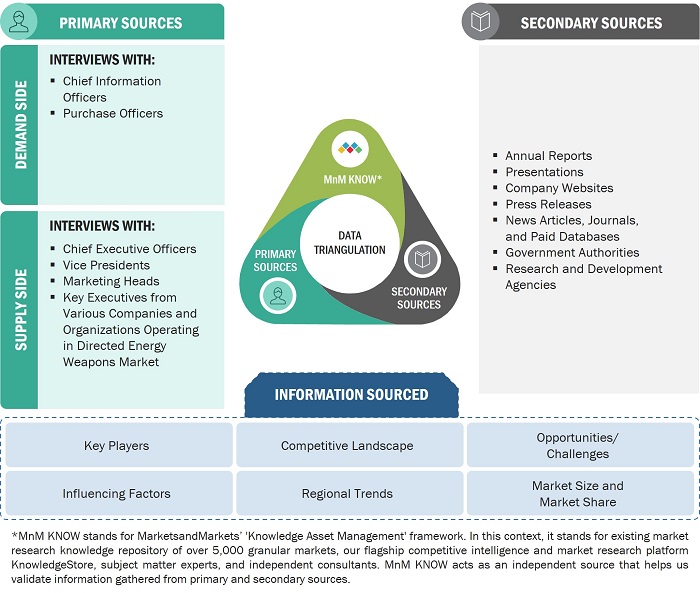

This research study on the directed energy weapon market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts as well as service providers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews with various primary respondents, including key industry participants, subject matter experts (SMEs), industry consultants, and C-level executives, were conducted to obtain and verify critical qualitative and quantitative information pertaining to the directed energy weapon market as well as assess its growth prospects.

Secondary Research

Secondary sources referred for this research study included financial statements of companies offering directed energy weapons based on different technology, application, platform, product, and range, along with information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the market that was validated by primary respondents.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as chief X officers (CXOs), vice presidents (VPs), and directors from business development, marketing, and product development/innovation teams; related key executives from the market participants, such as Georgia Aerospace Systems, DRDO, and Individual Industry Expert.

Extensive primary research was conducted after obtaining information about the current scenario of the directed energy weapons market through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across 4 regions, namely, North America, Europe, Asia Pacific, and Rest of the World. This primary data was collected through questionnaires, emails, and telephonic interviews.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products, market breakdowns, market size estimations, market size forecasting, and data triangulation. Primary research also helped analyze the technology, application, product, platform, range, and distribution channel segments of the market for four key regions. Stakeholders from the demand side, such as CXOs, production managers, and maintenance engineers, were interviewed to understand the perspective of buyers on product suppliers and service providers, along with their current usage. It also helped in understanding the future outlook of their businesses that will affect the overall directed energy weapon market.

To know about the assumptions considered for the study, download the pdf brochure

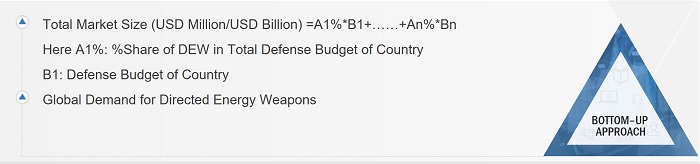

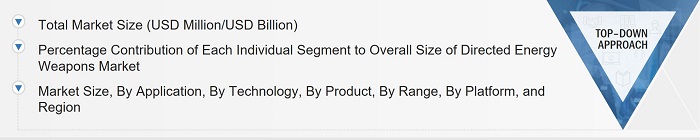

Market Size Estimation

The bottom-up approach was employed to arrive at the overall size of the directed energy weapons market from the revenues of key players and their shares in the market. Calculations based on the revenues of key players identified in the market led to the overall market size. The bottom-up approach was also implemented for data extracted from secondary research to validate the market segment revenues obtained. The market shares were then estimated for each company to verify the revenue shares used earlier in the bottom-up approach. With the data triangulation procedure and validation of data through primaries, the overall parent market size and each individual market size were determined and confirmed in this study.

The research methodology used to estimate the market size also includes the following details:

- Key players in the industry and markets have been identified through secondary research, and their market value is determined through primary and secondary research. These include a study of the annual and financial reports of top market players and extensive interviews with leaders, including CEOs, directors, and marketing executives.

- All the percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

- All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to procure the final quantitative and qualitative data.

This data has been consolidated, added with detailed inputs and analysis by MarketsandMarkets, and presented in this report.

Market Size Estimation Methodology: Bottom-Up Approach

Market Size Estimation Methodology: Top- Down Approach

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

The following figure indicates the market breakdown structure and data triangulation procedure implemented in the market engineering process for developing this report.

Similarities Between Sonic Weapons and Laser Weapons as Directed Energy Weapons

Directed energy weapons are weapons that use concentrated energy, such as lasers or sound waves, to disable or destroy a target. Sonic weapons use high-intensity sound waves to incapacitate or disorient a target, while laser weapons use concentrated beams of light to disable or destroy a target.

Both types of weapons are considered directed energy weapons because they focus a specific type of energy onto a target in a concentrated manner. This allows them to be highly effective in their intended purpose, whether it be disabling a target's electronics or physically damaging a target.

Potential Future Applications of Sonic Weapons and Laser Weapons

Sonic weapons have been used for crowd control and non-lethal applications, and their effectiveness in these areas may make them a popular choice for law enforcement and military organizations. However, the use of sonic weapons has also raised concerns about their potential for misuse and human rights violations.

Laser weapons, on the other hand, have been developed primarily for military applications, such as anti-aircraft defense and anti-missile defense. As the technology behind laser weapons continues to improve, it is possible that they will become more widely used in military operations.

The future of sonic weapons and laser weapons in the directed energy weapons market will likely depend on a variety of factors, including technological advancements, changing military needs, and evolving ethical and legal considerations.

Report Objectives

- To define, describe, segment, and forecast the size of the directed energy weapons (DEW) market based on application, technology, product, platform, and range, along with a regional analysis

- To forecast the size of different segments of the market with respect to four key regions, namely, North America, Europe, Asia Pacific, and the Rest of the World, along with their key countries

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the market

- To identify technology trends currently prevailing in the market

- To provide an overview of the tariff and regulatory landscape with respect to directed energy weapons across different regions

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for the stakeholders by identifying key market trends

- To analyze the impact of the recession on the market and its stakeholders

- To profile the leading market players and comprehensively analyze their market share and core competencies2

- To analyze the degree of competition in the market by identifying key growth strategies, such as new product launches, collaborations & expansions, contracts, partnerships, and agreements, adopted by the leading market players

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the directed energy weapons market, along with a ranking analysis, market share analysis, and revenue analysis of the key players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Directed Energy Weapons Market

New start company based on material science. I am assessing market opportunities in directed energy as a subsystem supplier of optical and high voltage components.