Military Sensors Market Size, Share, and Industry Growth Analysis Report by Platform (Airborne, Land, Naval, Munitions, Satellites), Application, Type, and Region (North America, Europe, Asia Pacific, Middle East & Africa, Rest of the World) - Global Forecast to 2026

Update: 10/23/2024

Military Sensors Market Size & Growth

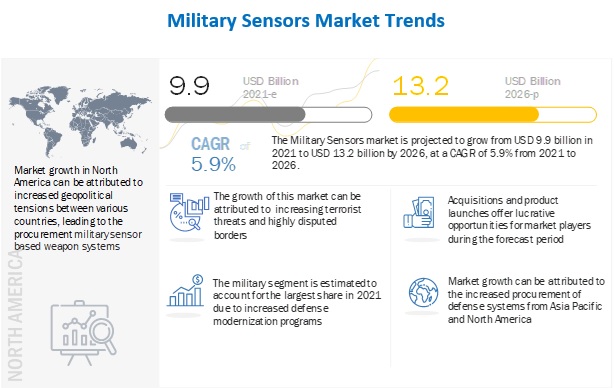

[256 Pages Report] The Global Military Sensors Market Size was valued at USD 9.9 Billion in 2021 and is estimated to reach USD 13.2 Billion by 2026, growing at a CAGR of 5.9% during the forecast period. The Military Sensors Industry is growing at a significant rate across the world, and a similar trend is expected to be observed during the forecast period. Increasing demand for battlespace awareness among defense forces, ongoing advancements in MEMS technology, increasing use of UAVs in modern warfare and increasing focus on weapon system reliability are fueling the growth of the military sensors market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Military Sensors Market

- Components and required raw materials used to manufacture military sensors were not available for ready production.

- The supply chain is experiencing transportation-related delays due to travel restrictions and shortage of workforce.

- Production/assembly lines were are also either running at lower capacities or are completely shut down.

Long-term market drivers for military sensors remain strong, and, before the pandemic, the market had started to show signs of recovery from the major market price reset. The COVID-19 pandemic has swept the world, with many industries trying to stay afloat. Governments and businesses involved with sensors are reacting differently to the new situation. Some product launches are moving forward, while some are not; some tests continue, and some are delayed; some companies still operate, and others have shuttered.

The spread of the COVID-19 pandemic has resulted in supply chain and logistical disruptions across North America. According to a survey published by the National Association of Manufacturers (NAM) in March 2020, ~80% of manufacturers expect that the pandemic will have a financial impact on their businesses. Some key companies in the region have closed their facilities and are mulling employee layoffs. The manufacturing sector, which employs ~13 million workers in the US, is also expected to be impacted by the pandemic, primarily for two reasons: firstly, a number of manufacturing jobs are onsite that eliminates the scope of working remotely. Secondly, slowed economic activities have the reduced demand for industrial products in the US and globally.

Military Sensors Market Trends

Driver: Increasing Demand for Battlespace Awareness Among Defense Forces

The battlespace situational awareness is essential for defense forces as it enables tracking of enemy movements and deciphering hidden information. It is also vital for detecting enemy threats in complex operational environments. Currently, the nature of challenges faced by defense forces worldwide has transformed significantly. Due to the increasingly networked digital and data-heavy battlespace, situational awareness has become critical to ensure the security of defense personnel. To enhance the capabilities of defense equipment, sensor systems such as Electro-Optics/Infrared (EO/IR) sensors and their data processors are increasingly deployed by military forces. EO/IR systems provide instantaneous and continuous coverage of the entire battlefield to defense forces by offering them full-motion videos and intuitive operator interfaces to acquire real-time situational awareness.

The defense forces across the globe are demanding military EO/IR systems to detect and track enemies. The EO/IR systems are used by defense forces to acquire persistent and panoramic surveillance of the covered areas as well as to issue timely warnings related to the potential threats and other information to defense forces for intelligence applications. EO/IR systems are integral for ISR and Intelligence, Surveillance, Target Acquisition, and Reconnaissance (ISTAR) capabilities of the modern military forces. Technological advancements in the optical and IR imaging sensors have resulted in enhancing the resolution and quality of images as well as improving their surveillance range. High specification gyro-stabilized EO/IR cameras have created an increased demand for specific target surveillance activities. EO/IR systems are also used in Close-in Weapon systems (CISW) such as Phalanx manufactured by The Raytheon Company. Although the Phalanx CISW primarily uses radars for target acquisition, the incorporation of the Forward-Looking Infrared (FLIR) feature enables these systems to identify the surface targets and low observable missiles flying in close to the Earth’s surface. Thus, increased surveillance applications of EO/IR systems have fueled the demand for military sensors in the defense sector.

Restraints: Lack of Accuracy and Operational Complexities in MEMS Inertial Navigation Sensors

The low accuracy characteristics of MEMS inertial navigation sensors restrict their performance and applicability in applications that require highly accurate information. However, alternative technologies such as Ring Laser Gyroscopes (RLGs) and Fiber Optic Gyros (FOGs) are comparatively more reliable than MEMS inertial navigation sensors as these provide highly accurate results. RLGs combine optical frequency generation and rotation sensing functions into a laser oscillator within a ring-shaped cavity. FOGs function on the principle of optical fibers being tuned to a single frequency of light, which is being propagated. An external force is applied to change the direction of the light, and hence, the frequency of the propagated light. RLGs and FOGs are complex navigation systems, which are difficult to manufacture due to their operational complexities. Furthermore, their maintenance and assembly require a technically skilled workforce and a controlled environment to eliminate any contamination from dust. These operational complexities in assembling and maintenance of RLGs and FOGs act as a restraint to the growth of the military sensors market across the globe.

Opportunities Demand for New Generation Air and Missile Defense Systems

The advent of new generation missiles such as nuclear-capable ballistic missiles and high-speed cruise missiles is a major threat to strategic installations and platforms such as military airbases and ships. Nuclear ballistic missiles are capable of destroying cities and harming civilians during wars or warlike situations. Various countries are developing advanced weapons capable of defeating high-end air defense systems such as the Medium Extended Air Defense System (MEADS), Patriot Advanced Capability (PAC-3), and S-400. Countries such as India, China, and Russia have developed hypersonic missiles with integrated navigation systems that can penetrate missile shields. For instance, in 2007, India and Russia jointly developed the BrahMos missile, which is capable of penetrating missile defense shields. These developments have led to the increasing requirement for new and advanced military navigation systems, thereby leading to the growth of the military sensors market.

Challenges: Cybersecurity Risks

Digitalization and system interconnection are the logical next steps in the defense industry. Instead of closed systems communicating one-on-one, the defense industry is transforming into an open ecosystem that is completely interconnected. Thus, military platforms are expected to use the capabilities of the Internet of Things (IoT) in the coming years. For instance, in military fighter jets, IoT-based sensors are expected to proactively identify the maintenance issues in aircraft, place orders for the replacement of faulty parts, and inform the ground maintenance crew during the flight about the same to ensure that everything is already in place and ready as and when the aircraft lands without affecting the overall operations of the airbase. This is done through thousands of sensors embedded in each military fighter jet that allows real-time data to be streamed to the ground crew. For instance, the Autonomic Logistics Information System (ALIS) of F-35 of Lockheed Martin uses sensors embedded in an aircraft to detect its performance, compare its parameters to standardized parameters, use sophisticated analytics to predict its maintenance requirements, and communicate with the maintenance staff to ensure that right aircraft parts are ready as and when required. ALIS serves as an information infrastructure for F-35 as it transmits information about the aircraft to the appropriate users on a globally distributed network of technicians.

Military Sensors Market Segmentation

Based on Type, the Gyroscope Sub-Segment of the Military Sensors Market is Projected to Witness the Highest CAGR During the Forecast Period

The introduction of MEMS-based gyroscopes has been a major point of innovation in the gyroscope technology. An increase in demand for high performance inertial navigation systems (INS) has fueled the growth of gyroscopes in military sensors market. The military aviation industry, which is one of the key consumers of inertial navigation systems, has been a major reason for the market growth and is expected to be a key driver for the global market. The increased adoption of drones and unmanned aerial vehicles (UAVs) in the defense sector will also play a major role in market growth. In June 2019, the US Missile Defense Agency (MDA) awarded a USD 4.4 million three-year contract to Vector Atomic (US) for the MDA Hypersonic Defense Component Technology program to design a micro-flatpack accelerometer-gyroscope sensor that will use hybrid integrated photonics. The company will develop and test a low size, weight, power, and cost (SWaP-C) navigation-grade gyroscope-accelerometer capable of navigating under severe acceleration, shock, and vibration characteristics of a hypersonic missile interceptor.

Based on Application, Electronic Warfare Segment Will Register the Highest Growth From 2021 to 2026

Significant technological advancements and integration of sensors and electronics in military equipment are resulting in a shift towards multilayered defense systems, which is expected to drive the electronic warfare segment in military sensors market during the forecast period. Adding to these factors, the increase in the use of UAV systems and the need for ground surveillance and communication jamming serve as opportunities for the electronic warfare segment. In March 2021, BAE Systems secured a USD 58 million contract to begin low-rate initial production of an electronic warfare system for F-15s to protect pilots from advanced threats coming over the electromagnetic spectrum. The contract scope includes multispectral sensors and countermeasures, signal processing, microelectronics and algorithms to deliver radar warning, situational awareness, geolocation, and self-protection capabilities.

Based on Platform, the Airborne Segment Will Register the Highest Growth From 2021 to 2026

Growing adoption of airborne sensors in the defense sector is boosting the growth of the airborne segment in military sensors market. One of the factors for high growth of the military sensors market for air-based platforms is the proliferation of UAVs. Countries across the world are investing in UAVs to increase surveillance. Various countries are also either adding new fighter aircraft fleets or are upgrading their existing fighter aircrafts with latest sensor technologies, which will play a major role in market growth for airborne military sensor market. The rapid evolution of geopolitical dynamics across the globe, coupled with increasing threats of terrorism, procurement plans of emerging economies, modernizations and political instability in few regions, will drive the demand for airborne military sensor market.

Military Sensors Market Regional Analysis

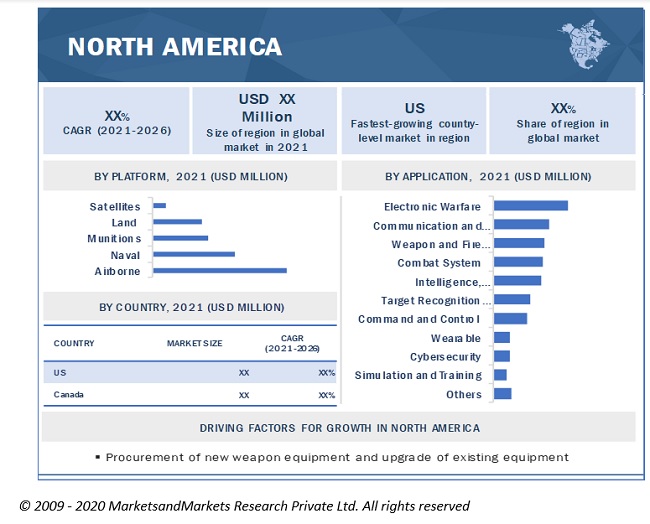

The North America Market is Projected to Contribute the Largest Share From 2021 to 2026 in the Military Sensors Industry

North America is projected to lead the military sensors market from 2021 to 2026. Significant investments in R&D activities for the development of advanced military power solutions by key players and increased demand for lightweight and energy-efficient sensors are some of the factors expected to fuel the growth of the military sensors market in this region. The US is expected to drive the growth of the North American military sensors market during the forecast period, owing to easy access to various innovative technologies and significant investments being made by manufacturers in the country for the development of improved health monitoring and warfare sensors. Several developments have taken place in the field of military sensors in the region. For instance, in March 2021, a cost-plus-fixed-fee modification contract was awarded to Honeywell International for integrating the Advanced Battle Management Systems (ABMS) with a wide range of sensors and sensing modalities.

To know about the assumptions considered for the study, download the pdf brochure

Top Military Sensors Companies - Key Market Players

Major manufacturers in this market are based in North America and Europe. The Military Sensors Companies are dominated by globally established players such as:

- Honeywell International (US)

- Raytheon Technologies (US)

- Lockheed Martin (US)

- Thales (France)

They are among the key manufacturers that secured military sensors contracts in the last few years. Major focus was given to the development of new products due to the changing requirements of sensor customers across the world.

Scope Of The Report

|

Report Metric |

Details |

|

Estimated Market Size |

$ 9.9 Billion in 2021 |

|

Projected Market Size |

$ 13.2 Billion |

|

Growth Rate (CAGR) |

5.9% |

|

Market Size Available for Years |

2018–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021-2026 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Type, By Application, By Platform |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Rest of the world |

|

Companies Covered |

Honeywell International Inc. (US), Raytheon Technologies Corporation (US), Lockheed Martin Corporation (US), Thales (France), and BAE Systems (UK), are some of the major suppliers of Military Sensors. (20 Companies) |

The study categorizes the military sensors market based on type, application, platform and region

By Type

- Imaging sensors

- Seismic sensors

- Acoustic sensors

- Magnetic sensors

- Pressure sensors

- Temperature sensors

- Torque sensors

- Speed-sensors

- Level sensors

- Flow sensors

- Force sensors

- AOA sensors

- Altimeter sensors

- Position or displacement sensors

- Accelerometers

- Gyroscopes

- GPS sensors

- Proximity sensors

By Platform

- Airborne

- Land

- Naval

- Satellite

- Munitions

By Application

- Intelligence, surveillance & reconnaissance (ISR)

- Communication & navigation

- Combat system

- Electronic warfare

- Target recognition system

- Command & control

- Weapon and fire control system

- Wearable

- Cybersecurity

- Simulation and training

- Engine and operations system

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Rest of the world

Recent Developments

- A cost-plus-fixed-fee modification contract was awarded to Honeywell International for integrating the Advanced Battle Management Systems (ABMS) with a wide range of sensors and sensing modalities.

- Honeywell International was awarded a USD 7.7 million contract for Inertial Navigation Kits for the US Army, which uses motion and rotation sensors to continuously calculate by dead reckoning the position, the orientation, and the velocity of a moving object without the need for external references.

- Raytheon designed the Pit Boss, an autonomous mission management sensor system for DARPA's Blackjack satellite constellation. It will network sensors together with a goal to provide persistent global coverage for many applications, including missile warning.

- Lockheed Martin was awarded a ceiling USD 485 million contract for Department of Defense and Foreign Military Sales (FMS) Sniper; Infrared Search and Track (IRST); and Low Altitude Navigation and Targeting Infrared for Night (LANTIRN) navigation pod (fixed wing) hardware production.

- German defense department contracted Thales with the development of the innovative suite of sensors that will equip the Future European Combat Air System.

- Kongsberg Gruppen received a contract from Ocean Infinity for supplying 5 HUGIN autonomous underwater vehicle systems. These autonomous underwater vehicle systems are fitted with the latest generation HISAS 1032 synthetic aperture sonars of Kongsberg Maritime

Frequently Asked Questions (FAQ):

Which Are the Major Companies in the Military Sensors Market? What Are Their Major Strategies to Strengthen Their Market Presence?

Some of the key players in the military sensors market are Honeywell International (US), Raytheon technology (US), Lockheed Martin (US), Thales (France), BAE Systems (UK), among others, are the key manufacturers that secured military sensor contracts in the last few years. Contracts was the key strategies adopted by these companies to strengthen their military sensors market presence.

What Are the Drivers and Opportunities for the Military Sensors Market?

The market for military sensors has grown substantially across the globe, and especially in Asia Pacific, where increase in fighter aircraft investments such as China, India, and South Korea, will offer several opportunities for sensor industry companies. The rising R&D activities to develop military sensors products are also expected to boost the growth of the market around the world.

Increasing demand for battlespace awareness among defense forces, ongoing advancements in MEMS technology, increasing use of UAVs in modern warfare and increasing focus on weapon system reliability are fueling the growth of the military sensors market.

Which Region is Expected to Grow at the Highest Rate in the Next Five Years?

The market in Asia Pacific is projected to grow at the highest CAGR of from 2021 to 2026, showcasing strong demand from military sensors in the region. India and China, with their strong defense expenditure and air force programmes, are recognized as the key users and adopters of military sensors in the region.

Which Type of Military Sensors is Expected to Significantly Lead in the Coming Years?

The growth on the gyroscope segment is attributed to the An increase in demand for high performance inertial navigation systems (INS) which are important in the modern military aviation industry. In terms of CAGR, the gyroscope segment will register the highest growth rate in the coming years i.e., in between 2021 to 2026. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 MARKETS COVERED

1.3.1 REGIONAL SCOPE

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 USD EXCHANGE RATES

1.6 LIMITATIONS

1.7 INCLUSIONS & EXCLUSIONS

1.8 MARKET STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 36)

2.1 RESEARCH DATA

FIGURE 2 REPORT PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.2.3 Primary details

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Increase in military spending of emerging countries

2.2.2.2 Growth of military expenditure on sensor-based autonomous defense systems

FIGURE 4 MILITARY EXPENDITURE, 2019-2020

2.2.2.3 Rising incidences of regional disputes, terrorism, and political conflicts

FIGURE 5 NUMBER OF TERRORIST ATTACKS IN 2019, BY COUNTRY

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 Major US defense contractors’ financial trend

2.3 MARKET SIZE ESTIMATION

2.3.1 MARKET DEFINITION & SCOPE

2.4 RESEARCH APPROACH & METHODOLOGY

2.4.1 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.2.1 COVID-19 impact on military sensors market

2.5 DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.6 ASSUMPTIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 9 INDUSTRY, BY PLATFORM, 2021 & 2026 (USD MILLION)

FIGURE 10 INDUSTRY, BY REGION

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 INTERNET OF THINGS TO OFFER SEVERAL UNTAPPED GROWTH OPPORTUNITIES

FIGURE 11 ATTRACTIVE GROWTH OPPORTUNITIES FROM 2021 TO 2026

4.2 BY APPLICATION

FIGURE 12 ELECTRONIC WARFARE SEGMENT PROJECTED TO LEAD, FROM 2021 TO 2026

4.3 BY TYPE

FIGURE 13 GYROSCOPE SEGMENT PROJECTED TO LEAD, FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 MILITARY SENSORS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for battlespace awareness among defense forces

5.2.1.2 Ongoing advancements in MEMS technology

5.2.1.3 Increasing use of UAVs in modern warfare

5.2.1.4 Increasing focus on weapon system reliability

5.2.2 RESTRAINTS

5.2.2.1 Lack of accuracy and operational complexities in MEMS inertial navigation sensors

5.2.2.2 Rules and regulations related to the transfer of weapons and their associated technologies

5.2.2.3 Declining defense budgets of several countries of North America and Europe

5.2.3 OPPORTUNITIES

5.2.3.1 Demand for new generation air and missile defense systems

5.2.3.2 Integration of anti-jamming capabilities with navigation systems

5.2.4 CHALLENGES

5.2.4.1 Cybersecurity risks

5.2.4.2 Complexity in the designs of military sensors

5.3 IMPACT OF COVID-19

FIGURE 15 IMPACT OF COVID-19

5.4 RANGES AND SCENARIOS

FIGURE 16 IMPACT OF COVID-19: 3 GLOBAL SCENARIOS

5.5 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS

5.6 TRENDS/DISRUPTION IMPACTING CUSTOMER BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR MILITARY SENSORS MANUFACTURERS

FIGURE 18 REVENUE SHIFT IN SATELLITE PAYLOAD MARKET

5.7 ECOSYSTEM

5.7.1 PROMINENT COMPANIES

5.7.2 PRIVATE AND SMALL ENTERPRISES

5.7.3 ECOSYSTEM

FIGURE 19 MARKET ECOSYSTEM MAP

FIGURE 20 MARKET ECOSYSTEM

TABLE 1 MILITARY SENSORS MARKET ECOSYSTEM

5.7.4 DEMAND-SIDE IMPACTS

5.7.4.1 Key developments from January 2020 to November 2020

TABLE 2 KEY DEVELOPMENTS, (DEMAND-SIDE IMPACTS) JANUARY 2020 TO DECEMBER 2020

5.7.5 SUPPLY-SIDE IMPACT

5.7.5.1 Key developments from January 2020 to December 2020

TABLE 3 KEY DEVELOPMENTS FOR SUPPLY-SIDE IMPACT, JANUARY 2020 TO DECEMBER 2020

5.8 AVERAGE SELLING PRICE

TABLE 4 AVERAGE SELLING PRICE TRENDS, BY RADAR, 2020 (USD MILLION)

TABLE 5 AVERAGE SELLING PRICE TRENDS OF MILITARY SENSORS, 2020 (USD MILLION)

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 MILITARY SENSORS: PORTER’S FIVE FORCE ANALYSIS

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF SUPPLIERS

5.9.4 BARGAINING POWER OF BUYERS

5.9.5 DEGREE OF COMPETITION

5.10 REGULATORY LANDSCAPE

5.10.1 NORTH AMERICA

5.10.2 EUROPE

5.11 TRADE ANALYSIS

TABLE 7 COUNTRY-WISE IMPORT, NAVIGATIONAL INSTRUMENTS AND APPARATUS, 2018–2019 (USD THOUSAND)

TABLE 8 COUNTRY-WISE EXPORTS, NAVIGATIONAL INSTRUMENTS AND APPARATUS, 2018–2019 (USD THOUSAND)

TABLE 9 COUNTRY-WISE EXPORTS, RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, 2018–2019 (USD THOUSAND)

TABLE 10 COUNTRY-WISE IMPORTS, RADAR APPARATUS, RADIO NAVIGATIONAL AID APPARATUS, AND RADIO REMOTE CONTROL APPARATUS, 2018–2019 (USD THOUSAND)

6 INDUSTRY TRENDS (Page No. - 74)

6.1 INTRODUCTION

6.2 USE CASE ANALYSIS

6.2.1 ULTRA-RUGGED INERTIAL MEASUREMENT UNITS

6.2.2 NEXT-GENERATION DIGITAL CABIN PRESSURE CONTROL AND MONITORING SYSTEM FOR AIRCRAFT

6.2.3 TACTICAL UAS SENSOR DATA MANAGEMENT SOLUTION

6.3 TECHNOLOGY TRENDS

6.3.1 EMERGENCE OF WIRELESS SENSOR NETWORKS

6.3.2 MICROELECTROMECHANICAL SYSTEM (MEMS) SENSORS

6.3.3 NEXT-GENERATION SENSOR SYSTEMS

6.3.4 USE OF WIRELESS SENSORS IN MILITARY APPLICATIONS

6.4 INNOVATIONS AND PATENT REGISTRATIONS

TABLE 11 IMPORTANT INNOVATION & PATENT REGISTRATIONS, 2001-2021

7 MILITARY SENSORS MARKET, BY TYPE (Page No. - 79)

7.1 INTRODUCTION

FIGURE 21 SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 12 SIZE, BY TYPE, 2018–2020 (USD MILLION)

TABLE 13 SIZE, BY TYPE, 2021–2026 (USD MILLION)

7.2 IMAGING SENSORS

7.2.1 IMAGING SENSORS OFFER DAY-NIGHT WORKING CAPABILITY AND ABILITY TO PERFORM WELL IN EXTREME WEATHER CONDITIONS.

7.3 SEISMIC SENSORS

7.3.1 SEISMIC SENSORS OFFER PERIMETER PROTECTION AND INTRUSION DETECTION AGAINST ENEMY THREATS

7.4 ACOUSTIC SENSORS

7.4.1 ACOUSTIC SENSORS ARE DEPLOYED ON BATTLEFIELDS FOR TARGET ACQUISITION AND SURVEILLANCE APPLICATIONS

7.5 MAGNETIC SENSORS

7.5.1 MAGNETIC SENSORS DETECT MAGNETIC ANOMALIES GENERATED BY MOVEMENT OF ARMED TROOPS AND MILITARY VEHICLES ON BATTLEFIELD

7.6 PRESSURE SENSORS

7.6.1 INCREASING PROCUREMENT OF AIRCRAFT, MARINE, AND LAND VEHICLES IS EXPECTED TO DRIVE THE MARKET FOR PRESSURE SENSORS IN MILITARY SENSORS MARKET

7.7 TEMPERATURE SENSORS

7.7.1 HIGH DEMAND FOR FUEL, CABIN, CARGO TEMPERATURE, AND TURBINE INLET TEMPERATURE MONITORING IS EXPECTED TO DRIVE THE MARKET FOR TEMPERATURE SENSORS

7.8 TORQUE SENSORS

7.8.1 HIGH DEMAND FOR MEASURING TORQUES IN VARIOUS MILITARY APPLICATIONS IS EXPECTED TO DRIVE THE MARKET FOR TORQUE SENSORS

7.9 SPEED SENSORS

7.9.1 MILITARY SPEED SENSORS OFFER ABILITY TO OPERATE RELIABLY IN HARSH ENVIRONMENTS

7.10 LEVEL SENSORS

7.10.1 LIQUID LEVEL SENSORS DETECT LIQUID LEVELS WITHOUT FLUID CONTACT

7.11 FLOW SENSORS

7.11.1 THE DEMAND FOR PROCUREMENT OF FIXED WING AIRCRAFT WILL DRIVE THE FLOW SENSORS MARKET

7.12 FORCE SENSORS

7.12.1 FORCE SENSORS MEASURES THE SENSING FORCE ON DIFFERENT SYSTEMS IN A PLATFORM

7.13 AOA SENSORS

7.13.1 DEMAND FOR ANGLE-OF-ATTACK SENSORS INCREASES AS THEY CAPABLE OF PROVIDING MEASUREMENTS UNDER ALL ENVIRONMENTAL CONDITIONS

7.14 ALTIMETER SENSORS

7.14.1 GROWING DEMAND FOR UNMANNED AERIAL VEHICLES WILL FUEL GROWTH OF ALTIMETER SENSORS MARKET

7.15 POSITION OR DISPLACEMENT SENSORS

7.15.1 POSITION SENSORS CAN BE INTEGRATED INTO MILITARY VEHICLES, WEAPONS SYSTEMS, MATERIAL TEST LABS, AND RESEARCH AND DEVELOPMENT FACILITIES

7.16 ACCELEROMETERS

7.16.1 ACCELEROMETERS ARE USED FOR IN GUIDANCE SYSTEMS IN AIRBORNE, LAND, NAVAL, AND WEAPON SYSTEM PLATFORMS

7.17 GYROSCOPES

7.17.1 THE DEMAND FOR GYROSCOPES INCREASES AS THEY ARE WIDELY USED FOR NAVIGATION AND MEASUREMENT OF THE ANGULAR VELOCITY OF AIRCRAFT

7.18 GPS SENSORS

7.18.1 GPS ALLOWS LAND, SEA, AND AIRBORNE VEHICLES/USERS TO IMMEDIATELY DETERMINE THEIR THREE-DIMENSIONAL POSITION

7.19 PROXIMITY SENSORS

7.19.1 PROXIMITY SENSORS WILL BE HELPFUL IN SURVEILLANCE PURPOSE ON LAND AND AIRBORNE APPLICATIONS

7.20 OTHERS

8 MILITARY SENSORS MARKET, BY PLATFORM (Page No. - 91)

8.1 INTRODUCTION

FIGURE 22 SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 14 SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 15 SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

8.2 AIRBORNE

TABLE 16 AIRBORNE: MILITARY SENSOR MARKET SIZE, 2018–2020 (USD MILLION)

TABLE 17 AIRBORNE: MILITARY SENSOR MARKET SIZE, 2021–2026 (USD MILLION)

TABLE 18 AIRBORNE: MILITARY SENSOR MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 19 AIRBORNE: MILITARY SENSOR MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.2.1 FIGHTER AIRCRAFT

8.2.1.1 Increase in demand FOR fighter aircraft from countries such as US, India, and Japan is expected to drive military sensors market

8.2.2 HELICOPTERS

8.2.2.1 Increasing adoption of military helicopters for surveillance and combat operations is expected to drive the market

8.2.3 SPECIAL MISSION AIRCRAFT

8.2.3.1 Installation of advanced sensor systems in special mission aircraft to fuel the growth of military sensors market

8.2.4 UNMANNED AERIAL VEHICLES

8.2.4.1 High demand FOR UAVs from emerging countries such as India and China has led to market growth

8.3 LAND

TABLE 20 LAND: MILITARY SENSOR MARKET SIZE, 2018–2020 (USD MILLION)

TABLE 21 LAND: MILITARY SENSOR MARKET SIZE, 2021–2026 (USD MILLION)

TABLE 22 LAND: MILITARY SENSOR MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 23 LAND: MILITARY SENSOR MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.3.1 ARMORED GROUND VEHICLES

8.3.1.1 Reliable and agile navigation and situational awareness plays a crucial role in military missions

8.3.2 COMBAT SUPPORT VEHICLES

8.3.2.1 Increased demand for advanced combat support vehicles will drive market growth

8.3.3 UNMANNED GROUND VEHICLE (UGV)

8.3.3.1 Unmanned Ground Vehicles (UGVs) require sensors for navigation as well as to track and identify targets and engage them

8.3.4 OPERATING BASES

8.3.4.1 Operating bases use radars to detect intrusions and issue warnings of any incoming air or land attack

8.3.5 SOLDIERS SYSTEMS

8.3.5.1 Soldier systems is a network of sensors, wearables, and IoT devices that use cloud and edge computing to create a cohesive fighting force

8.4 NAVAL

TABLE 24 NAVAL: MILITARY SENSOR MARKET SIZE, 2018–2020 (USD MILLION)

TABLE 25 NAVAL: MILITARY SENSOR MARKET SIZE, 2021–2026 (USD MILLION)

TABLE 26 NAVAL: MILITARY SENSOR MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 27 NAVAL: MILITARY SENSOR MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4.1 COMBAT SHIPS

8.4.1.1 Combat ships are armed with powerful radars and advanced electronic warfare capabilities

8.4.2 COMBAT SUPPORT SHIPS

8.4.2.1 Powerful radars are installed on these ships to gather intelligence and warn intelligence officers about incoming attacks.

8.4.3 SUBMARINES

8.4.3.1 Submarines use electronic warfare sensors to block any kind of attack on their navigation and tracking systems

8.4.4 UNMANNED MARINE VEHICLES (UMVS)

8.4.4.1 Unmanned marine vehicles perform specified operations underwater without any human occupants by using an array of onboard sensors

8.5 SATELLITES

8.5.1 LEADING COUNTRIES ARE DEVELOPING SPACE-BASED RADAR SYSTEMS FOR SATELLITES TO ENHANCED SITUATIONAL AWARENESS IN THEIR REGION

TABLE 28 SATELLITE: MILITARY SENSORS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 29 SATELLITE: MILITARY SENSORS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 MUNITIONS

TABLE 30 MUNITIONS: MILITARY SENSORS MARKET SIZE, 2018–2020 (USD MILLION)

TABLE 31 MUNITIONS: MILITARY SENSORS MARKET SIZE, 2021–2026 (USD MILLION)

TABLE 32 MUNITIONS: MILITARY SENSORS MARKET SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 33 MUNITIONS: MILITARY SENSORS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6.1 ROCKETS & MISSILES

8.6.1.1 Sensors mounted on missiles are used for guidance as well as for the detection of targets

8.6.2 GUIDED AMMUNITION

8.6.2.1 Guided ammunition uses GPS sensors and thermal sensors to lock on to targets and hit them accurately

8.6.3 TORPEDOES

8.6.3.1 Torpedoes use sensors for reliable depth and altitude sensing

8.6.4 ARTILLERY SYSTEMS

8.6.4.1 The increased use of unmanned turret systems and autonomous target locating & tracking systems will drive market growth

9 MILITARY SENSORS MARKET, BY APPLICATION (Page No. - 107)

9.1 INTRODUCTION

FIGURE 23 SIZE, BY APPLICATION, 2021 TO 2026 (USD MILLION)

TABLE 34 SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 35 SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2 INTELLIGENCE, SURVEILLANCE & RECONNAISSANCE (ISR)

9.2.1 PROCUREMENT OF ADVANCED AND HIGH-TECH SURVEILLANCE & MONITORING SYSTEMS TO FUEL GROWTH OF THE ISR

9.3 COMMUNICATION & NAVIGATION

9.3.1 MILITARY SENSORS USED FOR COMMUNICATION & NAVIGATION APPLICATIONS ARE RADARS, GPS, ACCELEROMETERS, AND GYROSCOPES, AMONG OTHERS

9.4 COMBAT OPERATIONS

9.4.1 MILITARY SENSORS USED FOR COMBAT OPERATIONS INCLUDE RADAR WARNING RECEIVERS AND RADARS, WHICH ENABLE THE IDENTIFICATION OF THREATS DURING COMBAT OPERATIONS

9.5 ELECTRONIC WARFARE

9.5.1 LEADING COUNTRIES ARE INVESTING IN VARIOUS HIGH-TECH AND ADVANCED MILITARY SENSOR SOLUTIONS FOR COMBAT OPERATIONS

9.6 TARGET RECOGNITION

9.6.1 AUTOMATIC TARGET RECOGNITION (ATR USES AN ALGORITHM OR DEVICE TO RECOGNIZE TARGETS OR OTHER OBJECTS BASED ON DATA OBTAINED FROM SENSORS

9.7 COMMAND & CONTROL

9.7.1 MILITARY SENSORS ARE USED TO DETECT AND RESPOND TO ELECTRICAL OR PHYSICAL SIGNALS BOTH WITHIN AND OUTSIDE PLATFORMS

9.8 WEAPONS AND FIRE CONTROL

9.8.1 RISING DEMAND FOR PRECISION WEAPON SYSTEMS TO FUEL THE GROWTH OF THE WEAPON AND FIRE CONTROL SEGMENT

9.9 WEARABLES

9.9.1 DEVELOPMENT OF NEW AND ADVANCED SENSOR SYSTEMS TO ENHANCE BATTLEFIELD CAPABILITIES OF SOLDIERS

9.10 CYBERSECURITY

9.10.1 INCREASING CYBERSECURITY ATTACKS TO FUEL GROWTH OF THE MILITARY SENSORS

9.11 SIMULATION AND TRAINING

9.11.1 INCREASING INVESTMENTS IN SIMULATION & TRAINING SECTOR BY DEFENSE FORCE ACROSS THE GLOBE WILL DRIVE SEGMENT GROWTH

9.12 ENGINES AND OPERATIONS SYSTEM

9.12.1 SENSORS HELP TO CUT FUEL CONSUMPTION AND HARMFUL EMISSIONS IN ENGINES AND OPERATION SYSTEMS

10 MILITARY SENSORS MARKET, BY REGION (Page No. - 115)

10.1 INTRODUCTION

TABLE 36 SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 37 SIZE, BY REGION, 2021–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 COVID-19 IMPACT ON NORTH AMERICA

10.2.2 PESTE ANALYSIS: NORTH AMERICA

FIGURE 24 NORTH AMERICA REGIONAL SNAPSHOT

TABLE 38 NORTH AMERICA REGIONAL SIZE BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 39 NORTH AMERICA REGIONAL SIZE BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 40 NORTH AMERICA REGIONAL SIZE BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 41 NORTH AMERICA REGIONAL SIZE BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 42 NORTH AMERICA REGIONAL SIZE BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 43 NORTH AMERICA REGIONAL SIZE BY COUNTRY, 2021–2026 (USD MILLION)

10.2.3 US

10.2.3.1 Presence of major players in this region will support the growth of military sensors market

TABLE 44 US REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 45 US REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 46 US REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 47 US REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.2.4 CANADA

10.2.4.1 Increase in adoption of electric sensor systems in airborne and naval platforms will support the market growth of military sensors

TABLE 48 CANADA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 49 CANADA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 50 CANADA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 51 CANADA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.3 EUROPE

10.3.1 COVID-19 IMPACT ON EUROPE

10.3.2 PESTLE ANALYSIS: EUROPE

FIGURE 25 EUROPE REGIONAL SNAPSHOT

TABLE 52 EUROPE REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 53 EUROPE REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 54 EUROPE REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 55 EUROPE REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 56 EUROPE REGIONAL SIZE MILITARY SENSORS MARKET, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 57 EUROPE REGIONAL SIZE MILITARY SENSORS MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.3 UK

10.3.3.1 The adoption of wearable technology for threat detection and information transfer will drive the military sensors market in UK

TABLE 58 UK REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 59 UK REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 60 UK REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 61 UK REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Increased demand for rugged sensor systems for the airborne defense industry will fuel the growth of the market in France.

TABLE 62 FRANCE REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 63 FRANCE REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 64 FRANCE REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 65 FRANCE REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.5 GERMANY

10.3.5.1 The increasing need for interoperability, control, and monitoring of borders to check the entry of illegal immigrants will fuel the growth of military sensor market

TABLE 66 GERMANY REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 67 GERMANY REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 68 GERMANY REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 69 GERMANY REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.6 ITALY

10.3.6.1 Increased demand for Intelligence, Surveillance, and Reconnaissance (ISR) missions in support of NATO operations will fuel the growth of military sensors market

TABLE 70 ITALY REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 71 ITALY REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 72 ITALY REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 73 ITALY REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.7 RUSSIA

10.3.7.1 Russia’s growing technological advances in electronic warfare to counter NATO’s radar and sensor systems will drive the growth of military sensor market

TABLE 74 RUSSIA REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 75 RUSSIA REGIONAL SIZE MILITARY SENSORS MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 76 RUSSIA REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 77 RUSSIA REGIONAL SIZE MILITARY SENSORS MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.3.8 REST OF EUROPE

TABLE 78 REST OF EUROPE REGIONAL SIZE MILITARY SENSOR MARKET, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 79 REST OF EUROPE REGIONAL SIZE MILITARY SENSOR MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 80 REST OF EUROPE REGIONAL SIZE MILITARY SENSOR MARKET, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 81 REST OF EUROPE REGIONAL SIZE MILITARY SENSOR MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 COVID-19 IMPACT ON ASIA PACIFIC

10.4.2 ASIA PACIFIC: PESTLE ANALYSIS

FIGURE 26 ASIA PACIFIC REGIONAL SNAPSHOT

TABLE 82 ASIA PACIFIC REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 83 ASIA PACIFIC REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 84 ASIA PACIFIC REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 85 ASIA PACIFIC REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 86 ASIA PACIFIC REGIONAL SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 87 ASIA PACIFIC REGIONAL SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.3 CHINA

10.4.3.1 Increasing defense spending on advanced electronic systems are contributing to the growth of the military sensors market

TABLE 88 CHINA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 89 CHINA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 90 CHINA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 91 CHINA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.4 INDIA

10.4.4.1 India’s plans to enhance its network-centric warfare technologies will drive the military sensors market in India

TABLE 92 INDIA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 93 INDIA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 94 INDIA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 95 INDIA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.5 JAPAN

10.4.5.1 Upgrade in surveillance and reconnaissance capabilities for defense against threats from China to drive the market of military sensors

TABLE 96 JAPAN REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 97 JAPAN REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 98 JAPAN REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 99 JAPAN REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.6 AUSTRALIA

10.4.6.1 Rising regional tensions, military modernization, and terrorism to drive the Australian military sensors market

TABLE 100 AUSTRALIA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 101 AUSTRALIA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 102 AUSTRALIA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 103 AUSTRALIA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.7 SOUTH KOREA

10.4.7.1 Increasing threat from North Korea’s electronic jammers and continuous infiltrations to fuel the growth of military sensors market

TABLE 104 SOUTH KOREA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 105 SOUTH KOREA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 106 SOUTH KOREA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 107 SOUTH KOREA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.4.8 REST OF ASIA PACIFIC

TABLE 108 REST OF ASIA PACIFIC REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 109 REST OF ASIA PACIFIC REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 110 REST OF ASIA PACIFIC REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 111 REST OF ASIA PACIFIC REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.5 MIDDLE EAST

10.5.1 COVID-19 IMPACT ON THE MIDDLE EAST & AFRICA

10.5.2 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

FIGURE 27 MIDDLE EAST REGIONAL SNAPSHOT

TABLE 112 MIDDLE EAST REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 113 MIDDLE EAST REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 114 MIDDLE EAST REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 115 MIDDLE EAST REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 116 MIDDLE EAST REGIONAL SIZE, BY COUNTRY, 2018–2020 (USD MILLION)

TABLE 117 MIDDLE EAST REGIONAL SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

10.5.3 ISRAEL

10.5.3.1 Increasing counterterrorism activities and rising border tensions with neighbors are driving the military sensors market

TABLE 118 ISRAEL REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 119 ISRAEL REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 120 ISRAEL REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 121 ISRAEL REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.4 SAUDI ARABIA

10.5.4.1 Regular MRO activities and upgrades of sensor technologies in airborne and naval platforms will boost demand for military sensors market

TABLE 122 SAUDI ARABIA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 123 SAUDI ARABIA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 124 SAUDI ARABIA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 125 SAUDI ARABIA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.5 UAE

10.5.5.1 Tensions in the neighboring states will drive the growth of military sensors market

TABLE 126 UAE REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 127 UAE REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 128 UAE REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 129 UAE REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.5.6 REST OF MIDDLE EAST

TABLE 130 REST OF MIDDLE EAST REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 131 REST OF MIDDLE EAST REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 132 REST OF MIDDLE EAST REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 133 REST OF MIDDLE EAST REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.6 REST OF THE WORLD (ROW)

10.6.1 COVID-19 IMPACT ON LATIN AMERICA

10.6.2 PESTLE ANALYSIS: LATIN AMERICA

TABLE 134 REST OF THE WORLD REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 135 REST OF THE WORLD REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 136 REST OF THE WORLD REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 137 REST OF THE WORLD REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 138 REST OF THE WORLD REGIONAL SIZE, BY REGION, 2018–2020 (USD MILLION)

TABLE 139 REST OF THE WORLD REGIONAL SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6.3 LATIN AMERICA

10.6.3.1 Growing adoption of advanced military computers and surveillance equipment by Brazilian defense forces is expected to drive the growth of the military sensors market

TABLE 140 LATIN AMERICA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 141 LATIN AMERICA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 142 LATIN AMERICA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 143 LATIN AMERICA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.6.4 AFRICA

10.6.4.1 Increasing demand for air defense systems and ongoing military modernization in Africa to drive the growth of the market

TABLE 144 AFRICA REGIONAL SIZE, BY PLATFORM, 2018–2020 (USD MILLION)

TABLE 145 AFRICA REGIONAL SIZE, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 146 AFRICA REGIONAL SIZE, BY APPLICATION, 2018–2020 (USD MILLION)

TABLE 147 AFRICA REGIONAL SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 182)

11.1 INTRODUCTION

11.2 COMPETITIVE OVERVIEW

TABLE 148 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE MILITARY SENSORS MARKET BETWEEN 2018 AND 2021

FIGURE 28 MARKET EVALUATION FRAMEWORK: CONTRACTS IS A KEY STRATEGY ADOPTED BY MARKET PLAYERS

11.2.1 COMPETITIVE LEADERSHIP MAPPING

11.2.1.1 Star

11.2.1.2 Emerging leader

11.2.1.3 Pervasive

11.2.1.4 Participant

FIGURE 29 COMPETITIVE LEADERSHIP MAPPING, 2020

11.2.2 COMPETITIVE LEADERSHIP MAPPING (STARTUPS/SMES)

11.2.2.1 Progressive companies

11.2.2.2 Responsive companies

11.2.2.3 Dynamic companies

11.2.2.4 Starting blocks

FIGURE 30 COMPETITIVE LEADERSHIP MAPPING, (STARTUPS/SME) 2020

11.3 MARKET SHARE OF KEY PLAYERS, 2020

FIGURE 31 MARKET SHARE ANALYSIS OF TOP PLAYERS IN THE MILITARY

SENSORS, 2020 187

11.4 MILITARY SENSORS MARKET: DEGREE OF COMPETITION

11.5 RANKING AND REVENUE ANALYSIS OF KEY PLAYERS, 2020

FIGURE 32 RANKING OF TOP PLAYERS IN THE MILITARY SENSORS MARKET, 2020

FIGURE 33 REVENUE ANALYSIS OF MILITARY SENSORS MARKET PLAYERS, 2016-2020

11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 149 COMPETITIVE LEADERSHIP

TABLE 150 COMPANY PLATFORM FOOTPRINT

TABLE 151 COMPANY REGION FOOTPRINT

11.7 COMPETITIVE SCENARIO

11.7.1 MARKET EVALUATION FRAMEWORK

11.7.2 PRODUCT LAUNCHES AND DEVELOPMENTS

TABLE 152 PRODUCT LAUNCHES AND DEVELOPMENTS, 2017–2021

11.7.3 CONTRACTS

TABLE 153 CONTRACTS, 2017–2021

11.7.4 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS/EXPANSIONS

TABLE 154 ACQUISITIONS/PARTNERSHIPS/JOINT VENTURES/AGREEMENTS/ EXPANSIONS, 2017–2021

12 COMPANY PROFILES (Page No. - 199)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 INTRODUCTION

12.2 KEY PLAYERS

12.2.1 HONEYWELL INTERNATIONAL INC.

TABLE 155 HONEYWELL INTERNATIONAL INC: BUSINESS OVERVIEW

FIGURE 34 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 156 HONEYWELL INTERNATIONAL INC: PRODUCT LAUNCHES

TABLE 157 HONEYWELL INTERNATIONAL INC: DEALS

12.2.2 TE CONNECTIVITY LTD.

TABLE 158 TE CONNECTIVITY: BUSINESS OVERVIEW

FIGURE 35 TE CONNECTIVITY LTD.: COMPANY SNAPSHOT

TABLE 159 PRODUCTS/SERVICES/SOLUTIONS OFFERED

TABLE 160 TE CONNECTIVITY: PRODUCT LAUNCHES

TABLE 161 TE CONNECTIVITY: DEALS

12.2.3 RAYTHEON TECHNOLOGIES

TABLE 162 RAYTHEON TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 36 RAYTHEON: COMPANY SNAPSHOT

TABLE 163 RAYTHEON TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 164 RAYTHEON TECHNOLOGIES: DEALS

12.2.4 LOCKHEED MARTIN

TABLE 165 LOCKHEED MARTIN: BUSINESS OVERVIEW

FIGURE 37 LOCKHEED MARTIN: COMPANY SNAPSHOT

TABLE 166 LOCKHEED MARTIN: PRODUCT LAUNCHES

TABLE 167 LOCKHEED MARTIN: DEALS

12.2.5 THALES

TABLE 168 THALES: BUSINESS OVERVIEW

FIGURE 38 THALES: COMPANY SNAPSHOT

TABLE 169 THALES: PRODUCT LAUNCHES

TABLE 170 THALES: DEALS

12.2.6 KONGSBERG GRUPPEN

TABLE 171 KONGSBERG GRUPPEN: BUSINESS OVERVIEW

FIGURE 39 KONGSBERG GRUPPEN: COMPANY SNAPSHOT

TABLE 172 KONGSBERG GRUPPEN: PRODUCT LAUNCHES

TABLE 173 KONGSBERG GRUPPEN: DEALS

12.2.7 ULTRA ELECTRONICS

TABLE 174 ULTRA ELECTRONICS: BUSINESS OVERVIEW

FIGURE 40 ULTRA ELECTRONICS: COMPANY SNAPSHOT

TABLE 175 ULTRA ELECTRONICS: DEALS

12.2.8 GENERAL ELECTRIC COMPANY

TABLE 176 GENERAL ELECTRIC COMPANY: BUSINESS OVERVIEW

FIGURE 41 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

TABLE 177 GENERAL ELECTRIC COMPANY: PRODUCT LAUNCHES

TABLE 178 GENERAL ELECTRIC COMPANY: DEALS

12.2.9 BAE SYSTEMS PLC

TABLE 179 BAE SYSTEMS: BUSINESS OVERVIEW

FIGURE 42 BAE SYSTEMS PLC: COMPANY SNAPSHOT

TABLE 180 BAE SYSTEMS: PRODUCT LAUNCHES

TABLE 181 BAE SYSTEMS: DEALS

12.2.10 CRANE AEROSPACE & ELECTRONICS, INC.

TABLE 182 CRANE AEROSPACE & ELECTRONICS, INC.: BUSINESS OVERVIEW

FIGURE 43 CRANE AEROSPACE & ELECTRONICS, INC.: COMPANY SNAPSHOT

TABLE 183 CRANE AEROSPACE & ELECTRONICS, INC.: DEALS

12.2.11 MICROFLOWN AVISA B.V.

TABLE 184 MICROFLOWN TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 185 MICROFLOWN TECHNOLOGIES: PRODUCT LAUNCHES

12.2.12 VECTORNAV TECHNOLOGIES, LLC

TABLE 186 VECTORNAV TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 187 VECTORNAV TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 188 VECTORNAV TECHNOLOGIES: DEALS

12.2.13 VIOOA IMAGING TECHNOLOGY

TABLE 189 VIOOA IMAGING: BUSINESS OVERVIEW

TABLE 190 VIOOA IMAGING TECH: PRODUCT LAUNCHES

12.2.14 AEROSONIC

TABLE 191 AEROSONIC: BUSINESS OVERVIEW

TABLE 192 AEROSONIC: PRODUCT LAUNCHES

12.2.15 UNITED AIRCRAFT TECHNOLOGIES

TABLE 193 UNITED AIRCRAFT TECHNOLOGIES: BUSINESS OVERVIEW

TABLE 194 UNITED AIRCRAFT TECHNOLOGIES: PRODUCT LAUNCHES

TABLE 195 UNITED AIRCRAFT TECHNOLOGIES: DEALS

12.2.16 ROCKWEST SOLUTIONS

TABLE 196 ROCKWEST SOLUTIONS: BUSINESS OVERVIEW

TABLE 197 ROCKWEST SOLUTIONS: PRODUCT LAUNCHES

12.2.17 STELLAR TECHNOLOGY

TABLE 198 STELLAR TECHNOLOGY: BUSINESS OVERVIEW

12.2.18 LORD SENSING

TABLE 199 LORD SENSING: BUSINESS OVERVIEW

TABLE 200 LORD SENSING: PRODUCT LAUNCHES

12.3 OTHER PLAYERS

12.3.1 EMCORE TECHNOLOGIES

12.3.2 AMPHENOL CORPORATION

12.3.3 TRIMBLE CORPORATION

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 249)

13.1 DISCUSSION GUIDE

FIGURE 44 MARKET SEGMENTATION

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

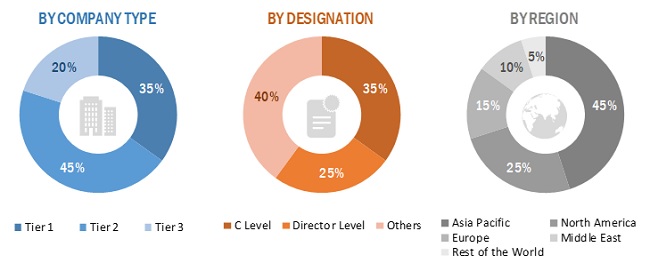

The study involved four major activities in estimating the current size of the Military Sensors Market. Exhaustive secondary research was done to collect information on the Military Sensors market, its adjacent markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both demand- and supply-side analyses were carried out to estimate the overall size of the market. Thereafter, market breakdown and data triangulation procedures were used to estimate the sizes of different segments and subsegments of the Military Sensors Market.

Secondary Research

The market share of companies in the Military Sensors market was determined using secondary data made available through paid and unpaid sources, and by analyzing the product portfolio of major companies operating in the market. These companies were rated based on the performance and quality of their products. These data points were further validated by primary sources.

Secondary sources referred to for this research study on the Military Sensors market included Hoovers, Bloomberg Businessweek, SIPRI, and Factiva to identify and collect information relevant to the military sensors market and budget spending of various countries; corporate filings such as annual reports, investor presentations, and financial statements; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the Military Sensors market, which was further validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information about the current scenario of the Military Sensors market through secondary research. Several primary interviews were conducted with market experts from both, demand- and supply-side across 5 major regions, namely, North America, Europe, Asia Pacific (APAC), Latin America, the Middle East, and Africa. Primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both, top-down and bottom-up approaches were used to estimate and validate the Military Sensors market size. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following steps:

- Key players in the industry and markets were identified through secondary research, and their market share was determined through primary and secondary research. This included an extensive study of annual and financial reports of top market players and interviews of CEOs, directors, and marketing executives.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics for market segments and subsegments, the data triangulation and market breakdown procedures explained below were implemented, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides.

Report Objectives

- To analyze the military sensors market and provide projections for it from 2021 to 2026

- To define, describe, and forecast the size of the military sensors market based on type, application, platform and region.

- To forecast the size of various segments of the market with respect to four major regions, namely, North America, Europe, Asia Pacific, Middle East, and Rest of the World, along with the major countries in each of these regions

- To understand the market structure by identifying its various segments and subsegments

- To identify and analyze key drivers, restraints, opportunities, and challenges that influence the growth of the military sensors market.

- To strategically analyze the micro-markets with respect to individual growth trends, prospects, and their contributions to the overall market.

- To analyze the opportunities in the market for stakeholders by identifying key market trends

- To analyze competitive developments such as contracts, acquisitions, expansions, new product launches, and partnerships & agreements in the market

- To provide a detailed competitive landscape of the military sensors market, along with an analysis of the business and corporate strategies adopted by leading players

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Military Sensors Market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Military Sensors Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Sensors Market