Dispersing Agents Market by Type (Waterborne, Waterborne), Structure (Anionic, Nonionic, Hydrophobic, Hydrophilic, Cationic, Amphoteric), End-use Industry and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2027

Updated on : September 02, 2025

Dispersing Agents Market

The global dispersing agents market was valued at USD 7.1 billion in 2022 and is projected to reach USD 9.3 billion by 2027, growing at 5.5% cagr from 2022 to 2027. The market is growing at a rapid pace, globally. Asia Pacific is estimated to account for the largest market share, in terms of value, in 2021. This dominance is due to rising demand from end-use industries, especially in countries, such as China, India, and Japan. The dispersing agents market in Middle East & African region is projected to witness a steady growth rate, during the forecast period due to the increased infrastructure spending and low base effect.

The advantages offered in terms of economy and emission control have made dispersing agents important for any process or application in the industry. The dispersing agents used in the construction industry account for the maximum market share due to rapid advancement in infrastructure and modernization in different economies.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on Dispersing Agents Market

During the pandemic, the industries where dispersing agents are being used were shut down, too, resulting in the downfall of the demand in this market. The construction industry accounts for the largest market share in the worldwide dispersing agent market. Hence, expanding construction is expected to boost the market throughout the projected period. However, during COVID-19, the construction activities across the globe have been halted amid lockdown, which is expected to decrease the demand for dispersing agent during the forecast period. In addition, a decrease in investment in construction & infrastructure and a reduction in automobile sales have further hindered the growth of the market. Thus, hindering the dispersing agents market growth as these dispersing agents are used in the automotive coating.

Dispersing Agents Market Dynamics

Driver: Increasing oil drilling & exploration activities

The high-quality dispersing agents are used to undertake efficient and effective operations in the oil & gas industry. Also, the industry demands a bulk quantity to cater to increased demand in the energy sector. They are used in drilling fluids to prevent formation fluids from entering the well bore. The dispersing agents are chemicals that contain surfactants and/or solvent compounds that act to break petroleum oil into small droplets. In oil drilling, these droplets disperse into the water, where they are subjected to natural processes, such as waves and currents, which help to break them down further.

Restraint: Fluctuating costs of raw materials

The current global COVID-19 pandemic has widespread implications for manufacturing companies. From rising energy costs to unexpected fluctuations in raw material price levels, unforeseen obstacles are destabilizing supply chains and making it difficult for manufacturers to deliver quality products at low prices and earn profits. As the prices of raw materials fluctuate, it is up to manufacturers to either absorb additional costs, find new ways to mitigate the expenses, or pass price increases along to consumers who are already reluctant to spend. Price fluctuations leave no room for error when planning a project’s budget and have a lot of manufacturers walking a thin line between success and operating at a loss.

Opportunity: Growing demand in current & emerging end-use industries

Dispersing agents are used in a wide range of industries, such as paints & coatings, construction, water treatment, and oil & gas. The growing inclination toward waterborne systems and growth in the industrial sector has accelerated the usage of high-quality paints and coatings loaded with huge quantities of superior dispersing agents. The dispersing agents play a vital role in the pharmaceutical industry. They play a significant role in the preparation of different drug delivery systems. For the preparation of compounds, which are not entirely soluble in an aqueous medium, pharmaceutically tolerable dispersing agents are mainly used to enhance solubility.

Challenge: Harmful environmental impact of dispersing agents

Dispersing agents are chemicals that contain surfactants and/or solvent compounds that act to break petroleum oil into small droplets. Dispersing agents are among the quickest oil spill responses available to clean oil pollution. Oil spills are one of the major concerns for the oil & gas industry and a significant threat to the marine environment. Oil spills are caused during drilling or transportation of oil. Dispersing agents are used in oil spills to decrease the risk that the oil slick of reaching shores and affecting the surroundings like marshes and mangroves or encountering animals at the surface.

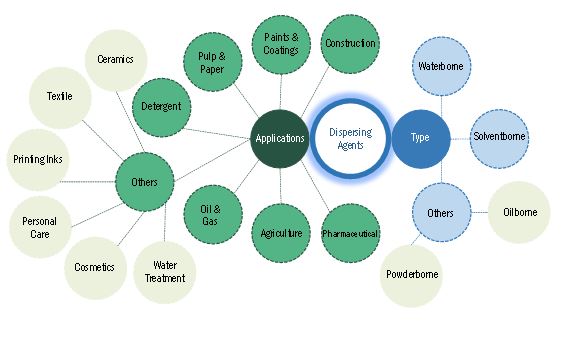

Dispersing Agents Market Ecosystem

Solventborne was the second-largest type of dispersing agents market, in terms of value, in 2021

Solvent-borne dispersing agents are popular, as they are used in diverse coating applications due to their high performance. Solvent-borne dispersing agents are primarily used in automotive coatings, general industrial coatings, and protective coatings. New high solid formulations (50–70% solids) successfully meet regulations with regard to VOC emissions. The main use of solvent-borne (excluding water) dispersing agents is to promote the formation of a durable film on the substrate.

Non-ionic was the second-largest dispersing agents structure in 2021 in terms of value

Non-ionic structured dispersing agents are non-ionic wetting, dispersing, and emulsifying agents suitable for textiles' scouring, bleaching, and finishing. These are mainly cleaning agents used on cotton, wool, and most synthetics and their blends to provide a uniformly prepared surface for dyeing. This structure plays an important role in the removal of excess oils and fiber lubricants from fiber surfaces prior to dyeing. Many fiber lubricants and carding oils contain a silica additive to improve the cohesiveness of the yarn. This can cause flow problems and blockages in equipment such as beams and package dyeing equipment.

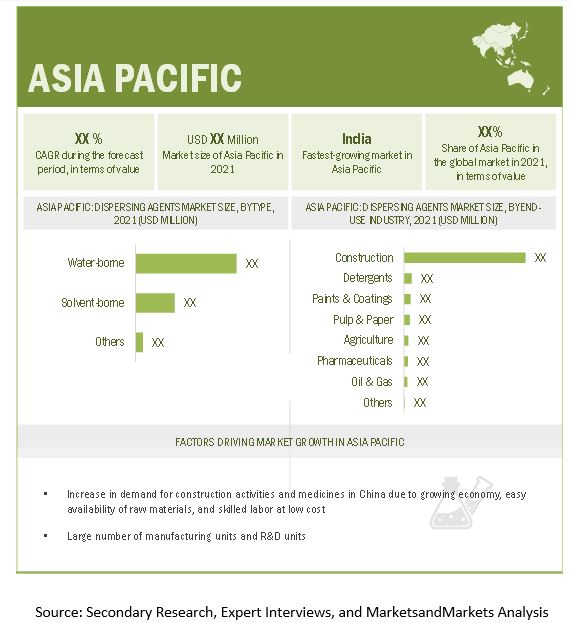

Asia Pacific to account for the largest share of the global dispersing agents market, in terms of value, in 2021

The Asia Pacific region is developing rapidly due to improving economic conditions and increasing population. These factors play an important role in driving the dispersing agents market; the developed countries of the Asia Pacific house the key global automakers. This region not only serves as a manufacturing hub but also has key R&D facilities. The construction industry in the emerging countries of the Asia Pacific is expected to grow because of the improving economic conditions as well as the booming manufacturing sector. According to the International Monetary Fund (IMF), China and India are among the fastest-growing economies in the world. India is expected to outpace China with the highest growth rate, thus driving the global economy. Due to the high growth rate in these countries, the dispersing agents market is also projected to grow rapidly.

Nippon Paper Industries Co., Ltd., Shubh Industries Pvt. Ltd., Shah Patil & Company, Harmony Additive Pvt. Ltd., Sanyo Chemical Industries Ltd., and Nicca Chemicals Co. Ltd. are some of the players in Asia Pacific

To know about the assumptions considered for the study, download the pdf brochure

Dispersing Agents Market Players

The key market players profiled in the report include BASF SE (Germany), Arkema SA (France), Altana AG (Germany), Solvay SA (Belgium), and Dow Inc. (US), Croda International Plc. (UK), Solvay SA (Belgium), LANXESS AG (Germany), Elementis Plc. (Germany), Nippon Paper Industries Co., Ltd. (Japan), Clariant AG (Switzerland) and others.

Dispersing Agents Market Report Scope

|

Report Metric |

Details |

| Market Size Value in 2022 | USD 7.1 billion |

| Revenue Forecast in 2027 | USD 9.3 billion |

| CAGR | 5.5% |

| Years considered for the study | 2017-2027 |

| Base Year Considered | 2021 |

| Forecast period | 2022–2027 |

| Units considered | Value (USD Million/Billion), Volume (Kiloton) |

| Segments covered | Type, Structure, End-use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa and South America |

| Companies profiled | BASF SE (Germany), Arkema SA (France), Altana AG (Germany), Solvay SA (Belgium), and Dow Inc. (US) and others Top 25 major players covered |

This report categorizes the global dispersing agents market based on type, structure, end-use industry, and region.

On the basis of type, the dispersing agents market has been segmented as follows:

- Waterborne

- Solventborne

- Others

On the basis of structure, the dispersing agents market has been segmented as follows:

- Anionic

- Non-ionic

- Hydrophobic

- Hydrophilic

- Cationic

- Amphoteric

On the basis of end-use industry, the dispersing agents market has been segmented as follows:

- Construction

- Paints & Coatings

- Pulp & Paper

- Detergents

- Oil & Gas

- Agriculture

- Pharmaceuticals

- Others

On the basis of region, the dispersing agents market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments:

- In October 2021, Clariant AG had launched a new dispersing agent product line, Licosperse, an eco-friendlier pigment preparation for polish applications. Licosperse pigment dispersing agents are readily incorporated in the base media for the effortless production of consistent color.

- In July 2021, Altana had launched two new wetting and dispersing additives in the DisperByk range, namely, DisperBYK-2018 & 2019, that stand out through maximum performance in respect of high viscosity reduction with simultaneous Newtonian flow behavior, outstanding pigment stability, and perfect optical properties.

- In September 2021, BASF and Sanyo Chemical signed an agreement of a Memorandum of Understanding for strategic collaboration of polyurethane dispersions (PUDs) development. The two parties aim to jointly develop and produce innovative products with strong sustainability contributions.

- In May 2021, Clariant AG had launched a new dispersing agent product line, Hostatint AU. it is an aqueous pigment dispersing agent, which expands the color choice for exterior and interior architectural coatings. It gives the North American and South American manufacturers the ability to offer the most expansive color palette possible.

Frequently Asked Questions (FAQs):

What is the current size and CAGR of the global dispersing agents market?

The dispersing agents market is estimated to grow from 6.7 billion in 2021 to 9.2 billion by 2027, at a CAGR of 5.5% between 2022 and 2027.

What are some of the regulatory bodies and mandates for dispersing agents?

EMSA 2010, EPA 2014 and Net environmental benefit analysis (NEBA) are some of the important mandates followed for dispersing agents market.

What are the major factors impacting market growth during the forecast period?

The market growth is primarily impacted due to rising need for energy is creating demand for the oil & gas industry. In addition, the increasing population has boosted the detergents, pharmaceuticals, and agricultural industries to satiate their daily basic requirements.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 DISPERSING AGENTS MARKET: INCLUSIONS AND EXCLUSIONS

1.2.2 DISPERSING AGENTS MARKET DEFINITION AND INCLUSIONS, BY TYPE

1.2.3 DISPERSING AGENTS MARKET DEFINITION AND INCLUSIONS, BY STRUCTURE

1.2.4 DISPERSING AGENTS MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

1.3 MARKET SCOPE

FIGURE 1 DISPERSING AGENTS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 UNITS CONSIDERED

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 2 DISPERSING AGENTS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Primary Interviews–Demand and Supply Sides

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE)

2.3 DATA TRIANGULATION

FIGURE 5 DISPERSING AGENTS MARKET: DATA TRIANGULATION

2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

2.4.1 SUPPLY SIDE

FIGURE 6 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

2.4.2 DEMAND SIDE

FIGURE 7 MARKET GROWTH PROJECTIONS FROM DEMAND SIDE: DRIVERS AND OPPORTUNITIES

2.5 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 1 DISPERSING AGENTS MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY (Page No. - 45)

FIGURE 8 WATERBORNE TYPE LED DISPERSING AGENTS MARKET

FIGURE 9 ANIONIC SEGMENT TO BE FASTEST-GROWING STRUCTURE DURING FORECAST PERIOD

FIGURE 10 CONSTRUCTION END-USE INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 11 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE OPPORTUNITIES IN DISPERSING AGENTS MARKET

FIGURE 12 GROWING CONSTRUCTION END-USE INDUSTRY TO DRIVE DISPERSING AGENTS MARKET DURING FORECAST PERIOD

4.2 DISPERSING AGENTS MARKET SIZE, BY REGION

FIGURE 13 ASIA PACIFIC TO BE LARGEST MARKET FOR DISPERSING AGENTS DURING FORECAST PERIOD

4.3 ASIA PACIFIC: DISPERSING AGENTS MARKET, BY END-USE INDUSTRY AND COUNTRY, 2021

FIGURE 14 CONSTRUCTION END-USE INDUSTRY AND CHINA ACCOUNTED FOR LARGEST SHARES

4.4 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE

FIGURE 15 ANIONIC TO BE LARGEST STRUCTURE IN DISPERSING AGENTS MARKET

4.5 DISPERSING AGENTS MARKET SIZE, TYPE VS. REGION

FIGURE 16 WATERBORNE TYPE LED DISPERSING AGENTS MARKET ACROSS REGIONS

4.6 DISPERSING AGENTS MARKET: MAJOR COUNTRIES

FIGURE 17 INDIA TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

5 MARKET OVERVIEW (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DISPERSING AGENTS MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing oil drilling & exploration activities

5.2.1.2 Rising cement production

FIGURE 19 GLOBAL CEMENT PRODUCTION (MILLION TON), 2010–2020

5.2.1.3 Growing demand for waterborne dispersing agents

FIGURE 20 GLOBAL VOC EMISSIONS, 2015–2019 (KILOTON)

5.2.1.4 Enhanced demand from paints & coatings industry

TABLE 2 TOP 10 GLOBAL PAINTS & COATINGS COMPANIES, 2021

5.2.2 RESTRAINTS

5.2.2.1 Fluctuating cost of raw materials

5.2.2.2 Lack of innovation in the industry

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand in current & emerging end-use industries

5.2.4 CHALLENGES

5.2.4.1 Harmful environmental impact of dispersing agents

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 21 DISPERSING AGENTS: PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF SUBSTITUTES

5.3.2 BARGAINING POWER OF SUPPLIERS

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 THREAT OF NEW ENTRANTS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 3 DISPERSING AGENTS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.4 KEY STAKEHOLDERS & BUYING CRITERIA

5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 22 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP-THREE APPLICATIONS

TABLE 4 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

5.4.2 BUYING CRITERIA

FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

5.5 MACROECONOMIC INDICATORS

5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

TABLE 6 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2019–2027 (USD BILLION)

5.6 IMPACT OF COVID-19

5.6.1 INTRODUCTION

5.6.2 COVID-19 HEALTH ASSESSMENT

FIGURE 24 COUNTRY-WISE SPREAD OF COVID-19

5.6.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2022

5.7 IMPACT OF COVID-19: CUSTOMER ANALYSIS

6 INDUSTRY TRENDS (Page No. - 66)

6.1 SUPPLY CHAIN ANALYSIS

FIGURE 26 DISPERSING AGENTS: SUPPLY CHAIN

6.1.1 RAW MATERIALS

6.1.2 MANUFACTURERS

6.1.3 DISTRIBUTION NETWORK

6.1.4 BUYERS

6.2 DISPERSING AGENTS MARKET: REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

FIGURE 27 MARKET SIZE UNDER REALISTIC, PESSIMISTIC, OPTIMISTIC, AND NON-COVID-19 SCENARIOS

TABLE 7 DISPERSING AGENTS MARKET FORECAST SCENARIO, 2019–2027 (USD MILLION)

6.2.1 NON-COVID-19 SCENARIO

6.2.2 OPTIMISTIC SCENARIO

6.2.3 PESSIMISTIC SCENARIO

6.2.4 REALISTIC SCENARIO

6.3 PRICING ANALYSIS

6.3.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY APPLICATION

FIGURE 28 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP-THREE APPLICATIONS

TABLE 8 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP THREE APPLICATIONS USD/KG

6.3.2 AVERAGE SELLING PRICE, BY REGION

FIGURE 29 AVERAGE SELLING PRICE OF DISPERSING AGENTS, BY REGION (USD/KG)

TABLE 9 AVERAGE SELLING PRICE OF DISPERSING AGENTS, BY REGION (USD/KG)

6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

6.4.1 REVENUE SHIFTS & REVENUE POCKETS FOR DISPERSING AGENTS MARKET

FIGURE 30 REVENUE SHIFT FOR DISPERSING AGENTS MARKET

6.5 CONNECTED MARKETS: ECOSYSTEM

TABLE 10 DISPERSING AGENTS MARKET: ECOSYSTEM

FIGURE 31 DISPERSING AGENTS: ECOSYSTEM

6.6 TECHNOLOGY ANALYSIS

6.6.1 HIGH MOLAR VOLUME (HMV) POLYMER TECHNOLOGY

TABLE 11 ADVANTAGES OF HMV POLYMER TECHNOLOGY

6.6.2 RENEWABLE DISPERSANT TECHNOLOGY

6.6.3 CONTROLLED FREE-RADICAL POLYMERIZATION (CFRP) TECHNOLOGY

12 BENEFITS OF CFRP TECHNOLOGY

6.7 CASE STUDY ANALYSIS

6.7.1 CASE STUDY ON BASF SE

6.8 TRADE DATA STATISTICS

6.8.1 IMPORT SCENARIO OF DISPERSING AGENTS

FIGURE 32 IMPORTS OF DISPERSING AGENTS, BY KEY COUNTRY (2015–2020)

TABLE 13 IMPORTS OF DISPERSING AGENTS, BY REGION, 2015–2020 (USD MILLION)

6.8.2 EXPORT SCENARIO OF DISPERSING AGENTS

FIGURE 33 EXPORTS OF DISPERSING AGENTS, BY KEY COUNTRY (2015–2020)

TABLE 14 EXPORTS OF DISPERSING AGENTS, BY REGION, 2015–2020 (USD MILLION)

6.9 REGULATORY LANDSCAPE

6.9.1 REGULATIONS RELATED TO DISPERSING AGENTS

6.10 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 15 DISPERSING AGENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

6.11 PATENT ANALYSIS

6.11.1 APPROACH

6.11.2 DOCUMENT TYPE

TABLE 16 GRANTED PATENTS ACCOUNT FOR 5% OF ALL PATENTS BETWEEN 2011 AND 2021

FIGURE 34 PATENTS REGISTERED FOR DISPERSING AGENTS, 2011–2021

FIGURE 35 PATENT PUBLICATION TRENDS FOR DISPERSING AGENTS, 2011–2021

6.11.3 LEGAL STATUS OF PATENTS

FIGURE 36 LEGAL STATUS OF PATENTS FILED FOR DISPERSING AGENTS

6.11.4 JURISDICTION ANALYSIS

FIGURE 37 HIGHEST NUMBER OF PATENTS FILED BY COMPANIES IN CHINA

6.11.5 TOP APPLICANTS

FIGURE 38 GUANGXI UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2011 AND 2021

TABLE 17 LIST OF PATENTS BY SINOPEC

TABLE 18 LIST OF PATENTS BY BASF SE

TABLE 19 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

7 DISPERSING AGENTS MARKET, BY TYPE (Page No. - 86)

7.1 INTRODUCTION

FIGURE 39 WATERBORNE SEGMENT TO DOMINATE DISPERSING AGENTS MARKET BETWEEN 2022 AND 2027

TABLE 20 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 21 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 22 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 23 DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

7.2 WATERBORNE

7.2.1 NEED TO REDUCE VOC CONTENT DRIVING DEMAND FOR WATERBORNE DISPERSING AGENTS

TABLE 24 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 26 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 27 WATERBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.3 SOLVENTBORNE

7.3.1 HIGH PERFORMANCE AND FLEXIBILITY OF SOLVENTBORNE AGENTS TO DRIVE MARKET DEMAND

TABLE 28 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 30 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 31 SOLVENTBORNE DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

7.4 OTHERS

TABLE 32 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 34 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 35 OTHER DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

8 DISPERSING AGENTS MARKET, BY STRUCTURE (Page No. - 94)

8.1 INTRODUCTION

FIGURE 40 ANIONIC DISPERSANT TO DOMINATE OVERALL MARKET DURING FORECAST PERIOD

TABLE 36 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 37 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (USD MILLION)

TABLE 38 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (KILOTON)

TABLE 39 DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (KILOTON)

8.2 ANIONIC

8.2.1 LOW COST & EASY AVAILABILITY TO DRIVE DEMAND FOR ANIONIC STRUCTURED DISPERSING AGENTS

TABLE 40 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 42 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (KILOTON)

TABLE 43 ANIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (KILOTON)

8.3 NON-IONIC

8.3.1 LOW FOAMING AND SUPERIOR EMULSIFYING PROPERTIES DRIVE DEMAND FOR THIS SEGMENT

TABLE 44 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 46 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (KILOTON)

TABLE 47 NON-IONIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (KILOTON)

8.4 HYDROPHOBIC

8.4.1 CONSTRUCTION AND OTHER ARCHITECTURAL WORKS TO DRIVE DEMAND FOR HYDROPHOBIC STRUCTURED DISPERSING AGENTS

TABLE 48 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 50 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (KILOTON)

TABLE 51 HYDROPHOBIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (KILOTON)

8.5 HYDROPHILIC

8.5.1 INSTITUTIONAL CLEANING TO DRIVE DEMAND FOR HYDROPHILIC STRUCTURED DISPERSING AGENTS

TABLE 52 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 53 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 54 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (KILOTON)

TABLE 55 HYDROPHILIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (KILOTON)

8.6 CATIONIC

8.6.1 NON-MIXABILITY WITH ANIONIC DISPERSING AGENTS TO POSITIVELY AFFECT CATIONIC DISPERSING AGENT SEGMENT

TABLE 56 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 58 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (KILOTON)

TABLE 59 CATIONIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (KILOTON)

8.7 AMPHOTERIC

8.7.1 GROWING DEMAND FOR PERSONAL CARE PRODUCTS TO DRIVE DEMAND FOR AMPHOTERIC SEGMENT

TABLE 60 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (USD MILLION)

TABLE 62 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2017–2020 (KILOTON)

TABLE 63 AMPHOTERIC: DISPERSING AGENTS MARKET, BY REGION, 2021–2027 (KILOTON)

9 DISPERSING AGENTS MARKET, BY END-USE INDUSTRY (Page No. - 107)

9.1 INTRODUCTION

FIGURE 41 PHARMACEUTICALS PROJECTED TO BE FASTEST-GROWING END-USE INDUSTRY OF DISPERSING AGENTS MARKET

TABLE 64 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 65 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 66 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 67 DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

9.2 CONSTRUCTION

9.2.1 RISING GLOBAL CONSTRUCTION ACTIVITIES DRIVING DEMAND FOR DISPERSING AGENTS

TABLE 68 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2021–2027 (USD MILLION)

TABLE 70 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2017–2020 (KILOTON)

TABLE 71 DISPERSING AGENTS MARKET SIZE IN CONSTRUCTION, BY REGION, 2021–2027 (KILOTON)

9.3 PAINTS & COATINGS

9.3.1 RISING GLOBAL MOTOR VEHICLE PRODUCTION DRIVES DEMAND FOR DISPERSING AGENTS IN PAINTS & COATINGS INDUSTRY

TABLE 72 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2021–2027 (USD MILLION)

TABLE 74 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS, BY REGION, 2017–2020 (KILOTON)

TABLE 75 DISPERSING AGENTS MARKET SIZE IN PAINTS & COATINGS END-USE INDUSTRY, BY REGION, 2021–2027 (KILOTON)

9.4 PULP & PAPER

9.4.1 INCREASING CONSUMER DEMAND AND QUALITY STANDARDS DRIVE DEMAND FOR PULP & PAPER INDUSTRY

TABLE 76 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2021–2027 (USD MILLION)

TABLE 78 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2017–2020 (KILOTON)

TABLE 79 DISPERSING AGENTS MARKET SIZE IN PULP & PAPER, BY REGION, 2021–2027 (KILOTON)

9.5 DETERGENTS

9.5.1 DEMAND FOR GERM-FREE, DIRT-FREE, AND HYGIENIC WORKSPACE TO PROPEL DETERGENTS SEGMENT

TABLE 80 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2021–2027 (USD MILLION)

TABLE 82 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2017–2020 (KILOTON)

TABLE 83 DISPERSING AGENTS MARKET SIZE IN DETERGENTS, BY REGION, 2021–2027 (KILOTON)

9.6 OIL & GAS

9.6.1 DEMAND FOR AUTOMOTIVE LUBRICANTS DRIVES MARKET FOR DISPERSING AGENTS IN OIL & GAS INDUSTRY

TABLE 84 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2021–2027 (USD MILLION)

TABLE 86 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2017–2020 (KILOTON)

TABLE 87 DISPERSING AGENTS MARKET SIZE IN OIL & GAS, BY REGION, 2021–2027 (KILOTON)

9.7 AGRICULTURE

9.7.1 CLIMATIC CHANGES AND NEED FOR AGROCHEMICALS DRIVING DEMAND FOR DISPERSING AGENTS IN THIS SEGMENT

TABLE 88 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2021–2027 (USD MILLION)

TABLE 90 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2017–2020 (KILOTON)

TABLE 91 DISPERSING AGENTS MARKET SIZE IN AGRICULTURE, BY REGION, 2021–2027 (KILOTON)

9.8 PHARMACEUTICALS

9.8.1 RISING GLOBAL PHARMACEUTICALS PRODUCTION DRIVING DEMAND FOR DISPERSING AGENTS

TABLE 92 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2021–2027 (USD MILLION)

TABLE 94 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2017–2020 (KILOTON)

TABLE 95 DISPERSING AGENTS MARKET SIZE IN PHARMACEUTICALS, BY REGION, 2021–2027 (KILOTON)

9.9 OTHERS

9.9.1 INNOVATIONS IN PERSONAL CARE INDUSTRY TO DRIVE MARKET

TABLE 96 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

TABLE 97 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

TABLE 98 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2017–2020 (KILOTON)

TABLE 99 DISPERSING AGENTS MARKET SIZE IN OTHERS END-USE INDUSTRIES, BY REGION, 2021–2027 (KILOTON)

10 REGIONAL ANALYSIS (Page No. - 125)

10.1 INTRODUCTION

FIGURE 42 ASIA PACIFIC TO BE FASTEST-GROWING DISPERSING AGENTS MARKET BETWEEN 2022 AND 2027

TABLE 100 DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 101 DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

TABLE 102 DISPERSING AGENTS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 103 DISPERSING AGENTS MARKET SIZE, BY REGION, 2021–2027 (KILOTON)

10.2 ASIA PACIFIC

FIGURE 43 ASIA PACIFIC: DISPERSING AGENTS MARKET SNAPSHOT

10.2.1 ASIA PACIFIC: DISPERSING AGENTS MARKET, BY TYPE

TABLE 104 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 107 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

10.2.2 ASIA PACIFIC DISPERSING AGENTS MARKET, BY STRUCTURE

TABLE 108 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 109 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (KILOTON)

TABLE 111 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (KILOTON)

10.2.3 ASIA PACIFIC DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

TABLE 112 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 113 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 115 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.2.4 ASIA PACIFIC DISPERSING AGENTS MARKET, BY COUNTRY

TABLE 116 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 117 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 118 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 119 ASIA PACIFIC: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

10.2.4.1 China

10.2.4.1.1 Consecutive increase in industrial output to drive market

TABLE 120 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 121 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 122 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 123 CHINA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.2.4.2 JAPAN

10.2.4.2.1 Manufacturing and exporting of surfactants supporting market growth

TABLE 124 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 125 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 126 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 127 JAPAN: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.2.4.3 India

10.2.4.3.1 Improving economic conditions and government initiatives to support market growth

TABLE 128 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 129 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 130 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 131 INDIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.2.4.4 South Korea

10.2.4.4.1 Presence of technologically advanced vehicle manufacturers to support market growth

TABLE 132 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 133 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 134 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 135 SOUTH KOREA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.3 EUROPE

FIGURE 44 EUROPE: DISPERSING AGENTS MARKET SNAPSHOT

10.3.1 EUROPE DISPERSING AGENTS MARKET, BY TYPE

TABLE 136 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 137 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 138 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 139 EUROPE: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

10.3.2 EUROPE DISPERSING AGENTS MARKET, BY STRUCTURE

TABLE 140 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 141 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (USD MILLION)

TABLE 142 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (KILOTON)

TABLE 143 EUROPE: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (KILOTON)

10.3.3 EUROPE DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

TABLE 144 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 145 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 146 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 147 EUROPE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.3.4 EUROPE DISPERSING AGENTS MARKET, BY COUNTRY

TABLE 148 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 149 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 150 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 151 EUROPE: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

10.3.4.1 Germany

10.3.4.1.1 Investments from residential and non-profit institutions to favor market growth

TABLE 152 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 153 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 154 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 155 GERMANY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.3.4.2 France

10.3.4.2.1 Government regulations and tax reductions in construction industry to drive market

TABLE 156 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 157 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 158 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 159 FRANCE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.3.4.3 UK

10.3.4.3.1 Investments in construction & pharmaceuticals industry to lead to market growth

TABLE 160 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 161 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 162 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 163 UK: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.3.4.4 Italy

10.3.4.4.1 Presence of domestic car manufacturers to drive market

TABLE 164 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 165 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 166 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 167 ITALY: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.4 NORTH AMERICA

FIGURE 45 NORTH AMERICA: DISPERSING AGENTS MARKET SNAPSHOT

10.4.1 NORTH AMERICA DISPERSING AGENTS MARKET, BY TYPE

TABLE 168 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 169 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 170 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 171 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

10.4.2 NORTH AMERICA DISPERSING AGENTS MARKET, BY STRUCTURE

TABLE 172 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 173 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (USD MILLION)

TABLE 174 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (KILOTON)

TABLE 175 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (KILOTON)

10.4.3 NORTH AMERICA DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

TABLE 176 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 177 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 178 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 179 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.4.4 NORTH AMERICA DISPERSING AGENTS MARKET, BY COUNTRY

TABLE 180 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 181 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 182 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 183 NORTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

10.4.4.1 US

10.4.4.1.1 Increased private construction to drive market

TABLE 184 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 185 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 186 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 187 US: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.4.4.2 Canada

10.4.4.2.1 Development of residential, commercial, and infrastructure to boost market

TABLE 188 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 189 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 190 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 191 CANADA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.4.4.3 Mexico

10.4.4.3.1 Investments from pharma players to drive market

TABLE 192 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 193 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 194 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 195 MEXICO: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY TYPE

TABLE 196 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 199 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

10.5.2 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY STRUCTURE

TABLE 200 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (KILOTON)

TABLE 203 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027(KILOTON)

10.5.3 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

TABLE 204 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 205 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 206 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 207 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.5.4 MIDDLE EAST & AFRICA DISPERSING AGENTS MARKET, BY COUNTRY

TABLE 208 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 209 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 210 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 211 MIDDLE EAST & AFRICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

10.5.4.1 Saudi Arabia

10.5.4.1.1 Investments from residential and non-profit institutions to favor market growth

TABLE 212 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 213 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 214 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 215 SAUDI ARABIA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.5.4.2 UAE

10.5.4.2.1 Increased oil recovery activities to drive demand for dispersing agents

TABLE 216 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 217 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 218 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 219 UAE: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.5.4.3 South Africa

10.5.4.3.1 Substantial demand for dispersing agents witnessed in building projects

TABLE 220 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 221 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 222 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 223 SOUTH AFRICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.6 SOUTH AMERICA

10.6.1 SOUTH AMERICA DISPERSING AGENTS MARKET, BY TYPE

TABLE 224 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 225 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 226 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2017–2020 (KILOTON)

TABLE 227 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY TYPE, 2021–2027 (KILOTON)

10.6.2 SOUTH AMERICA DISPERSING AGENTS MARKET, BY STRUCTURE

TABLE 228 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (USD MILLION)

TABLE 229 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (USD MILLION)

TABLE 230 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2017–2020 (KILOTON)

TABLE 231 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY STRUCTURE, 2021–2027 (KILOTON)

10.6.3 SOUTH AMERICA DISPERSING AGENTS MARKET, BY END-USE INDUSTRY

TABLE 232 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 233 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 234 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 235 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

10.6.4 SOUTH AMERICA DISPERSING AGENTS MARKET, BY COUNTRY

TABLE 236 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 237 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

TABLE 238 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 239 SOUTH AMERICA: DISPERSING AGENTS MARKET SIZE, BY COUNTRY, 2021–2027 (KILOTON)

10.6.4.1 Brazil

10.6.4.1.1 Rising exploration activities and discovery of new oilfields to drive market

TABLE 240 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 241 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

TABLE 242 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (KILOTON)

TABLE 243 BRAZIL: DISPERSING AGENTS MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (KILOTON)

11 COMPETITIVE LANDSCAPE (Page No. - 200)

11.1 INTRODUCTION

11.2 STRATEGIES ADOPTED BY KEY PLAYERS

TABLE 244 STRATEGIES ADOPTED BY MANUFACTURERS IN DISPERSING AGENTS MARKET

11.3 MARKET SHARE ANALYSIS

11.3.1 RANKING OF KEY MARKET PLAYERS, 2021

FIGURE 46 RANKING OF TOP FIVE PLAYERS IN DISPERSING AGENTS MARKET, 2021

11.3.2 MARKET SHARE OF KEY PLAYERS

TABLE 245 DISPERSING AGENTS MARKET: DEGREE OF COMPETITION

FIGURE 47 BASF SE LEADING PLAYER IN DISPERSING AGENTS MARKET IN 2021

11.3.2.1 BASF SE

11.3.2.2 Arkema SA

11.3.2.3 Altana AG

11.3.2.4 Solvay SA

11.3.2.5 Dow Inc.

11.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

FIGURE 48 REVENUE ANALYSIS OF KEY COMPANIES IN PAST FIVE YEARS

11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

FIGURE 49 DISPERSING AGENTS MARKET: OVERALL COMPANY FOOTPRINT

TABLE 246 DISPERSING AGENTS MARKET: END-USE INDUSTRY FOOTPRINT

TABLE 247 DISPERSING AGENTS MARKET: TYPE FOOTPRINT

TABLE 248 DISPERSING AGENTS MARKET: REGION FOOTPRINT

11.5 COMPANY EVALUATION MATRIX (TIER 1)

11.5.1 STAR

11.5.2 EMERGING LEADERS

FIGURE 50 COMPANY EVALUATION QUADRANT FOR DISPERSING AGENTS MARKET (TIER 1)

11.6 COMPETITIVE BENCHMARKING

TABLE 249 DISPERSING AGENTS MARKET: DETAILED LIST OF KEY START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES)

TABLE 250 DISPERSING AGENTS MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

11.7 START-UPS/ SMES EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 STARTING BLOCKS

FIGURE 51 START-UP/SME EVALUATION QUADRANT FOR DISPERSING AGENTS MARKET

11.8 COMPETITIVE SITUATION AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 251 DISPERSING AGENTS MARKET: PRODUCT LAUNCHES, 2018–2021

11.8.2 DEALS

TABLE 252 DISPERSING AGENTS MARKET: DEALS (2018–2021)

11.8.3 OTHER DEVELOPMENTS

TABLE 253 DISPERSING AGENTS MARKET: EXPANSIONS, INVESTMENTS, AND INNOVATIONS (2018–2021)

12 COMPANY PROFILES (Page No. - 217)

(Business overview, Products offered, Recent developments & MnM View)*

12.1 MAJOR PLAYERS

12.1.1 ALTANA AG

FIGURE 52 ALTANA AG: COMPANY SNAPSHOT

TABLE 254 ALTANA AG: BUSINESS OVERVIEW

12.1.2 ARKEMA SA

FIGURE 53 ARKEMA SA: COMPANY SNAPSHOT

TABLE 255 ARKEMA SA: BUSINESS OVERVIEW

12.1.3 BASF SE

FIGURE 54 BASF SE: COMPANY SNAPSHOT

TABLE 256 BASF SE: BUSINESS OVERVIEW

12.1.4 CRODA INTERNATIONAL PLC

FIGURE 55 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

TABLE 257 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

12.1.5 SOLVAY SA

FIGURE 56 SOLVAY SA: COMPANY SNAPSHOT

TABLE 258 SOLVAY SA: BUSINESS OVERVIEW

12.1.6 ELEMENTIS PLC

FIGURE 57 ELEMENTIS PLC: COMPANY SNAPSHOT

TABLE 259 ELEMENTIS PLC: BUSINESS OVERVIEW

12.1.7 LANXESS AG

FIGURE 58 LANXESS AG: COMPANY SNAPSHOT

TABLE 260 LANXESS AG: BUSINESS OVERVIEW

12.1.8 DOW INC.

FIGURE 59 DOW INC.: COMPANY SNAPSHOT

TABLE 261 DOW INC.: BUSINESS OVERVIEW

12.1.9 NIPPON PAPER INDUSTRIES CO., LTD.

FIGURE 60 NIPPON PAPER INDUSTRIES CO., LTD.: COMPANY SNAPSHOT

TABLE 262 NIPPON PAPER INDUSTRIES CO., LTD.: BUSINESS OVERVIEW

12.1.10 CLARIANT AG

FIGURE 61 CLARIANT AG: COMPANY SNAPSHOT

TABLE 263 CLARIANT AG: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

12.2 OTHER PLAYERS

12.2.1 SAINT-GOBAIN SA

TABLE 264 SAINT-GOBAIN SA: BUSINESS OVERVIEW

12.2.2 EVONIK INDUSTRIES AG

TABLE 265 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

12.2.3 SHUBH INDUSTRIES PVT. LTD.

TABLE 266 SHUBH INDUSTRIES PVT. LTD.: BUSINESS OVERVIEW

12.2.4 KING INDUSTRIES, INC.

TABLE 267 KING INDUSTRIES, INC.: BUSINESS OVERVIEW

12.2.5 LUBRIZOL CORPORATION

TABLE 268 LUBRIZOL CORPORATION: BUSINESS OVERVIEW

12.2.6 RUDOLF GMBH

TABLE 269 RUDOLF GMBH: BUSINESS OVERVIEW

12.2.7 UNIQCHEM GMBH

TABLE 270 UNIQCHEM GMBH: BUSINESS OVERVIEW

12.2.8 SHAH PATIL & COMPANY

TABLE 271 SHAH PATIL & COMPANY: BUSINESS OVERVIEW

12.2.9 HARMONY ADDITIVE PVT. LTD.

TABLE 272 HARMONY ADDITIVE PVT. LTD.: BUSINESS OVERVIEW

12.2.10 FINE ORGANICS

TABLE 273 FINE ORGANICS: BUSINESS OVERVIEW

12.2.11 SANYO CHEMICAL INDUSTRIES LTD.

TABLE 274 SANYO CHEMICAL INDUSTRIES LTD.: BUSINESS OVERVIEW

12.2.12 ARXADA AG

TABLE 275 ARXADA AG: BUSINESS OVERVIEW

12.2.13 ANGUS CHEMICAL COMPANY

TABLE 276 ANGUS CHEMICAL COMPANY: BUSINESS OVERVIEW

12.2.14 ASHLAND GLOBAL HOLDINGS INC.

TABLE 277 ASHLAND GLOBAL HOLDINGS INC.: BUSINESS OVERVIEW

12.2.15 NICCA CHEMICAL CO. LTD.

TABLE 278 NICCA CHEMICAL CO. LTD.: BUSINESS OVERVIEW

13 ADJACENT & RELATED MARKETS (Page No. - 262)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 PAINTS & COATINGS MARKET

13.3.1 MARKET DEFINITION

13.3.2 MARKET OVERVIEW

13.4 PAINTS & COATINGS MARKET, BY REGION

TABLE 279 PAINTS & COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 280 PAINTS & COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 281 PAINTS & COATINGS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 282 PAINTS & COATINGS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

13.4.1 ASIA PACIFIC

13.4.1.1 By country

TABLE 283 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 284 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 285 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 286 ASIA PACIFIC: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

13.4.2 EUROPE

13.4.2.1 By country

TABLE 287 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 288 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 289 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 290 EUROPE: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

13.4.3 NORTH AMERICA

13.4.3.1 By country

TABLE 291 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 292 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 293 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 294 NORTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

13.4.4 MIDDLE EAST & AFRICA

13.4.4.1 By country

TABLE 295 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 296 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 297 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 298 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

13.4.5 SOUTH AMERICA

13.4.5.1 By country

TABLE 299 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 300 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 301 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 302 SOUTH AMERICA: PAINTS & COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

14 APPENDIX (Page No. - 272)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

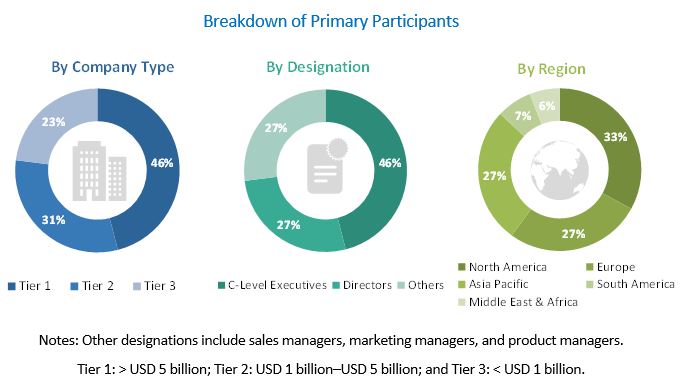

The study involved four major activities in estimating the market size for the dispersing agents market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Post that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. Findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives.

Primary Research

The dispersing agents market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of construction, paints & coatings, detergents, pharmaceutical and other industries. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the dispersing agents market.

- Extensive secondary and primary research has been carried out to understand the global market scenario for various type of dispersing agents.

- Several primary interviews have been conducted with key opinion leaders related to dispersing agents manufacturing and development.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the construction, pharmaceuticals & paints & coatings industry among others.

Report Objectives

- To analyze and forecast the size of the dispersing agents market in terms of value and volume

- To provide detailed information regarding key factors, such as drivers, restraints, challenges, and opportunities influencing the growth of the market

- To define, describe, and segment the dispersing agents market based on type, structure and end-use industry.

- To forecast the size of the market segments for regions such as Asia Pacific, North America, Europe, Middle East & Africa and South America.

- To strategically analyze the segmented markets with respect to individual growth trends, prospects, and contribution to the overall market

- To identify and analyze opportunities for stakeholders in the market

- To strategically profile key players and comprehensively analyze their core competencies

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional type

Company Information

- Detailed analysis and profiles of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dispersing Agents Market