Enteral Feeding Formulas Market by Product (Polymeric, Elemental, Disease-specific), Stage (Adults, Pediatrics), Application (Oncology, Gastroenterology, Neurology, Hypermetabolism), End User (Hospitals, LTCF, Home care) & Region - Global Forecast to 2027

Market Growth Outlook Summary

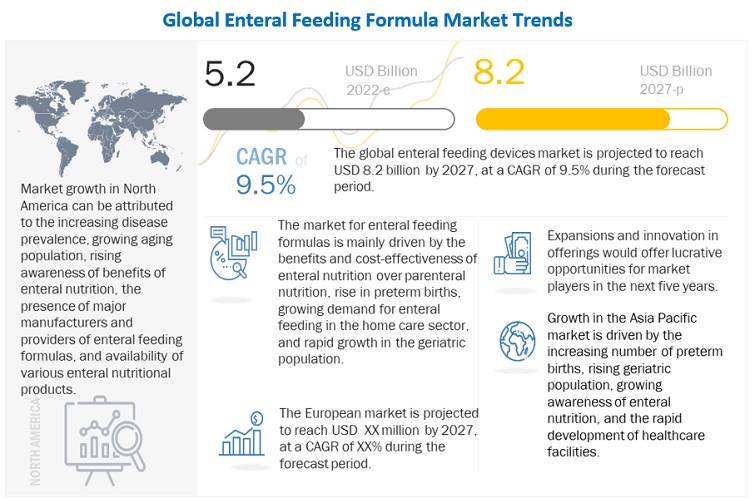

The global enteral feeding formulas market growth forecasted to transform from $5.2 billion in 2022 to $8.2 billion by 2027, driven by a CAGR of 9.5%. Enteral feeding uses the gastrointestinal route, wherein the formula is fed either through a tube or orally. Tube feeding is the most prevalent term associated with enteral nutrition/feeding. Food and nutrition provided through a tube serve as an alternative to a traditional diet or solid food intake. Enteral feeding is largely doctor-prescribed, performed with the help of medical professionals, particularly for chronically ill patients. Different enteral formulas have been commercialized to administer nutrients through enteral formulas. Factors such as rising healthcare expenditure; a surge in the number of preterm births worldwide; growing aging population in need for enteral feeding; rising prevalence of chronic diseases such as diabetes, cancer, gastrointestinal diseases, and neurological disorders; growing awareness of enteral nutrition benefits; and rapid improvements in healthcare facilities in emerging countries are expected to further drive the market during the forecast period. Moreover, the shift from parenteral nutrition to enteral nutrition due to cost effectiveness and nutritional benefits and growing adoption for enteral feeding formulas in long term care facilities are also expected to drive the market in the coming years. However, patient safety risks; insufficient or lack of reimbursements in some developing and underdeveloped countries and a dearth of trained physicians across the globe pose significant challenges for the growth of this market.

Enteral Feeding Formulas Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Enteral Feeding Formulas Market Dynamics

Driver: Benefits and cost-effectiveness of enteral over parenteral nutrition

Enteral feeding delivers artificial nutrients or medication through the gastrointestinal tract (including the esophagus, stomach, and small & large intestine). Parenteral feeding uses central or peripheral veins to deliver nutrients or medication intravenously into the bloodstream with a catheter. Enteral nutrition is associated with fewer complications than parenteral nutrition—a major factor driving market growth. The American Society for Parenteral and Enteral Nutrition (ASPEN) guidelines highlighted enteral nutrition as the preferred feeding route over parenteral nutrition in critically ill patients who require nutrition support therapy. Also, the cost of enteral nutrition is lower as compared to parenteral nutrition. The cost of enteral nutrition per day per person is 40% that of parenteral nutrition. Such cost benefits and affordability of enteral nutrition have impacted a significant increase in the enteral feeding formulas market.

Restraint: Lack of patient Awareness

A recent study on patients with dementia observed that using feeding tubes (FTs) in patients with advanced dementia does not yield positive health outcomes and can have a negative effect. However, during the study, it was observed that there are significant gaps in knowledge among the doctors about the indications for FTs, with only 17.9% answering that there is no indication for the use of FTs in these patients with dementia. The results of this study demonstrate large gaps in knowledge among doctors on enteral feeding for patients with advanced dementia. It was also observed that despite the availability of numerous verified clinical practice guidelines focusing on enteral feeding of critically ill patients, a wide gap remains between the guideline recommendations and actual nutrition performances. Underfeeding is also a global problem. There is a current need for hospital departments to strengthen standardization and systematic EN training, provide ICU full-time nutritionists, and distribute medical resources and personnel rationally to provide minimum restraints for the market growth.

Opportunity: Emergence of new products and innovation

In the last 25 years, the number and variety of enteral formulas available for use have increased dramatically. There are over 1,000 enteral formulas now available and companies are launching new products to cater to a wider range of clients. One such example is Abbott, which in 2019 launched PediaSure Harvest product and Ensure Harvest, a new blend of real-food ingredients from sources such as mango, spinach, carrot, pumpkin and banana, to fulfil the demand for nourishing food blend formulas for tube fed patients.

Furthermore, a recent study indicated the need for high-protein enteral nutrition formulas to cater to the energy demands of the critically ill, which indicates an opportunity in this market. Further innovation is also a possibility given the expanding knowledge of disease physiopathology, composition, and functionality of food ingredients. These opportunities present strong growth potential for companies.

Challenge: Insufficient reimbursements for enteral nutrition

Enteral nutrition therapy is reimbursed in developed countries such as US, Canada, Germany, France, the UK, and Japan. However, reimbursements for enteral feeding in developing countries across the Asia Pacific, Latin America, and the Middle East are insufficient. This poses a significant challenge to the widespread adoption of enteral feeding in developing countries. Furthermore, decreasing federal funding and subsequent reimbursement cuts for home healthcare services over the next five years are expected to add to the challenges faced by players in the market.

By Stage, Pediatrics segment of enteral feeding formulas industry, registered the highest CAGR, Rise in chronic diseases for pediatrics driving market growth for pediatric patients

Based on stage, the enteral feeding formulas market is segmented into adult patients (18 years and over) and pediatric & infant patients (neonates under one month, infants between one month and two years of age, children of 2–12 years, and adolescents of 12–16 years). In 2021, the pediatrics stage accounted for higher CAGR. This can be attributed to because of the growing preterm birth rate and chronic condition in pediatrics.

By Product, Disease specific segment of enteral feeding formulas industry, registered the highest CAGR, Increased incidence of diabetes patients inducing market growth

Based on product, the global enteral feeding formulas market is segmented into standard (polymeric), peptide-based (elemental/semi-elemental), disease-specific, and other formulas. The disease specific segment registered the fastest CAGR because of Disease-specific formulas are formulated to meet the nutritional requirements of specific patient populations and increased incidence of diabetic pateints is inducting market growth for diabetic disease specific formulas.

By Application, Gastrointestinal diseases segment of enteral feeding formulas industry, registered the highest CAGR, Increasing incidence of gastrointestinal diseases to drive the adoption of enteral feeding formulas

Based on applications, the enteral feeding formulas market is segmented into oncology, gastrointestinal diseases, diabetes, neurological disorders, and other applications. The other applications segment includes psychiatric disorders and diseases of the heart, kidney, lung, and liver and hypermetabolism. The gastrointestinal diseased application segment registered the highest CAGR. The reaseason can be attributed to the rising incidence of gastrointestinal diseases and disorders.

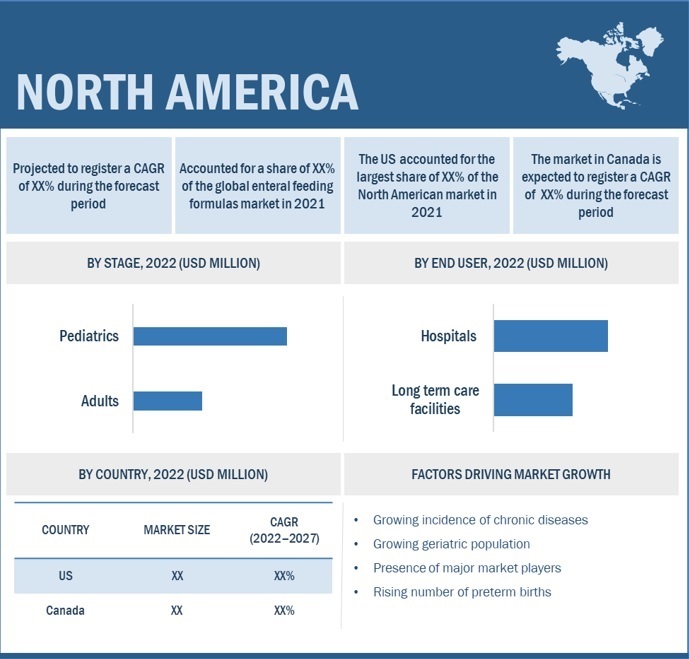

North America is expected to account for the largest share of the enteral feeding formulas industry

To know about the assumptions considered for the study, download the pdf brochure

North America, comprising the US and Canada, held the largest share of the enteral feeding formulas market in 2021. The enteral feeding formulas market is well-established across North America. Growth in this market is backed by the increasing prevalence of chronic diseases in North America, the presence of many well-equipped hospitals, and the gradual shift from parenteral to enteral nutrition.

Prominent players in this market include Abbott (US), Nestlé S.A. (Switzerland), Danone S.A. (France), Fresenius Kabi (Germany), B. Braun Melsungen AG (Germany), Otsuka Holding Co. Ltd. (Japan), Nutritional Medicinals, LLC (US), Kate Farms (US), Medtrition Inc. (US), Victus, Inc. (US), Global Health Products, Inc. (US), Meiji Holdings Co., Ltd. (Japan), Reckitt Benckiser Group PLC. (UK), Hormel Foods Corporation (US), DermaRite Industries, LLC. (US), Medline Industries, LP. (US), Real Food Blends (US), and Ajinomoto Cambrooke, Inc. (US).

Scope of the Enteral Feeding Formulas Industry

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$5.2 billion |

|

Projected Revenue by 2027 |

$8.2 billion |

|

Revenue Rate |

Poised to grow a a CAGR of 9.5% |

|

Growth Driver |

Benefits and cost-effectiveness of enteral over parenteral nutrition |

|

Growth Opportunity |

Emergence of new products and innovation |

This report categorizes the Enteral Feeding Formulas Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Standard Formula

- Disease specific

- Diabetic Formula

- Renal Formula

- Hepatic Formula

- Pulmonary Formula

- Other Disease Specific Formula

- Peptide based formula

- Other Formula

By Stage

- Adults

- Pediatric

By End User

- Hospitals

- Long Term Care facilities

- Nursing Homes

- Assisted Living Facilities

- Home Care Agencies & Hospices

By Application

- Oncology

- Gastrointestinal Diseases

- Neurological Disorders

- Diabetes

- Other Applications

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC

- Latin America

- Middle East & Africa

Recent Developments of Enteral Feeding Formulas Industry

- In February 2022, Nestlé (Switzerland) agreed to purchase a majority stake in Orgain, a leader in plant-based nutrition. This acquisition would complement Nestlé Health Science’s existing portfolio of nutrition products.

- In September 2021, Abbott (US) launched plant-based proteins and organic food ingredient enteral formulas for tube feeding.

Frequently Asked Questions (FAQ):

How big is the global enteral feeding formulas market?

Global enteral feeding formulas market revenue was estimated at $5.2 billion in 2022 and is projected to reach $8.2 billion by 2027, with a robust growth rate of 9.5% CAGR from 2022 to 2027.

Which major factors are influencing global growth of enteral feeding formulas market?

Factors such as rising healthcare expenditure; a surge in the number of preterm births worldwide; growing aging population in need for enteral feeding; rising prevalence of chronic diseases such as diabetes, cancer, gastrointestinal diseases, and neurological disorders; growing awareness of enteral nutrition benefits; and rapid improvements in healthcare facilities in emerging countries are expected to further drive the market during the forecast period. Moreover, the shift from parenteral nutrition to enteral nutrition due to cost effectiveness and nutritional benefits and growing adoption for enteral feeding formulas in long term care facilities are also expected to drive the market in the coming years.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES

1.2 ENTERAL FEEDING FORMULAS INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 GLOBAL MARKET

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 3 ENTERAL FEEDING FORMULAS MARKET: BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ENTERAL FEEDING FORMULAS

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2021

FIGURE 6 AVERAGE MARKET SIZE ESTIMATION, 2021

2.3 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 7 MARKET: CAGR PROJECTIONS, 2022–2027

FIGURE 8 MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION METHODOLOGY

2.5 INSIGHTS FROM PRIMARIES

FIGURE 11 MARKET VALIDATION FROM PRIMARY EXPERTS

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 12 ENTERAL FEEDING FORMULAS INDUSTRY, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 13 MARKET, BY STAGE, 2022 VS. 2027 (USD MILLION)

FIGURE 14 MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 15 MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 16 GEOGRAPHIC ANALYSIS: ENTERAL FEEDING FORMULAS INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ENTERAL FEEDING FORMULAS MARKET OVERVIEW

FIGURE 17 INCREASING PREVALENCE OF CHRONIC DISEASES AND SHIFT FROM PARENTERAL NUTRITION TO ENTERAL NUTRITION TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: MARKET, BY TYPE (2022)

FIGURE 18 STANDARD FORMULAS TO DOMINATE APAC MARKET IN 2022

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 19 MARKET IN CHINA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

4.4 MARKET, BY REGION, 2020–2027

FIGURE 20 NORTH AMERICA WILL CONTINUE TO DOMINATE ENTERAL FEEDING FORMULAS INDUSTRY TILL 2027

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 ENTERAL FEEDING FORMULAS INDUSTRY DYNAMICS

FIGURE 21 ENTERAL FEEDING FORMULAS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Benefits and cost-effectiveness of enteral over parenteral nutrition

5.2.1.2 Rising preterm births fueling demand for enteral feeding formulas

FIGURE 22 US: TOTAL NUMBER OF PRETERM BIRTHS, 2010–2020

5.2.1.3 Growing demand for enteral feeding in home care

5.2.1.4 Rapid growth in geriatric population and disease prevalence

FIGURE 23 ESTIMATED DIABETIC POPULATION, BY REGION, 2019 VS. 2030 VS. 2040

FIGURE 24 GLOBAL CANCER INCIDENCE, 2015–2040

FIGURE 25 US: NUMBER OF PEOPLE WITH CHRONIC CONDITIONS, 1995–2030 (MILLION INDIVIDUALS)

TABLE 1 DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 Complications associated with enteral feeding

TABLE 2 COMPLICATIONS ASSOCIATED WITH ENTERAL FEEDING

5.2.2.2 Lack of patient awareness

TABLE 3 RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of new products and innovation

5.2.3.2 High growth opportunities in emerging countries

TABLE 4 OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Insufficient reimbursements for enteral nutrition

5.2.4.2 Dearth of skilled professionals

TABLE 5 CHALLENGES: IMPACT ANALYSIS

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT FROM NEW ENTRANTS

5.3.2 THREAT FROM SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 COMPETITIVE RIVALRY

5.4 REGULATORY SCENARIO

5.4.1 REGULATORY ANALYSIS

5.5 VALUE CHAIN ANALYSIS

FIGURE 26 MARKET: VALUE CHAIN ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 27 MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM MARKET MAP

FIGURE 28 MARKET: ECOSYSTEM MARKET MAP

5.8 PRICING ANALYSIS

TABLE 7 AVERAGE PRICE OF ENTERAL FEEDING FORMULAS, IN USD (2021)

TABLE 8 AVERAGE SELLING PRICES OF ENTERAL FEEDING FORMULAS, 2017–2021 (USD)

5.9 PATENT ANALYSIS

FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR ENTERAL FEEDING FORMULA PATENTS (JANUARY 2011–OCTOBER 2021)

TABLE 9 INDICATIVE LIST OF PATENTS IN MARKET

5.10 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 MARKET: LIST OF CONFERENCES AND EVENTS

5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 30 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR ENTERAL FEEDING PRODUCTS

5.12 KEY BUYING CRITERIA FOR END USERS

FIGURE 31 MARKET: BUYING CRITERIA OF END USERS

6 ENTERAL FEEDING FORMULAS MARKET, BY STAGE (Page No. - 78)

6.1 INTRODUCTION

TABLE 11 ENTERAL FEEDING FORMULAS INDUSTRY, BY STAGE, 2020–2027 (USD MILLION)

6.2 ADULTS

6.2.1 INCREASED PREVALENCE OF CHRONIC DISEASES AND NEUROLOGICAL DISORDERS IN ADULT PATIENTS TO INCREASE MARKET SHARE

TABLE 12 MARKET FOR ADULTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 NORTH AMERICA: MARKET FOR ADULTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 EUROPE: MARKET FOR ADULTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 15 ASIA PACIFIC: MARKET FOR ADULTS, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 PEDIATRICS

6.3.1 GROWING DISEASE PREVALENCE IN PEDIATRIC PATIENTS DRIVING MARKET GROWTH

TABLE 16 ENTERAL FEEDING FORMULAS INDUSTRY FOR PEDIATRICS, BY REGION, 2020–2027 (USD MILLION)

TABLE 17 NORTH AMERICA: MARKET FOR PEDIATRICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 18 EUROPE: MARKET FOR PEDIATRICS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 ASIA PACIFIC: MARKET FOR PEDIATRICS, BY COUNTRY, 2020–2027 (USD MILLION)

7 ENTERAL FEEDING FORMULAS MARKET, BY PRODUCT (Page No. - 85)

7.1 INTRODUCTION

TABLE 20 ENTERAL FEEDING FORMULAS INDUSTRY, BY PRODUCT, 2020–2027 (USD MILLION)

7.2 STANDARD FORMULAS

7.2.1 EASE OF ACCESSIBILITY AND COST-EFFECTIVENESS WILL INCREASE MARKET GROWTH

TABLE 21 STANDARD ENTERAL-FEEDING FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 22 NORTH AMERICA: STANDARD ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 23 EUROPE: STANDARD ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 24 ASIA PACIFIC: STANDARD ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 DISEASE-SPECIFIC FORMULAS

TABLE 25 DISEASE-SPECIFIC ENTERAL-FEEDING FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 26 DISEASE-SPECIFIC ENTERAL-FEEDING FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 NORTH AMERICA: DISEASE-SPECIFIC ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 EUROPE: DISEASE-SPECIFIC ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 29 ASIA PACIFIC: DISEASE-SPECIFIC ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.1 DIABETIC FORMULAS

7.3.1.1 Increased incidence of diabetes patients driving market growth

TABLE 30 DIABETIC FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: DIABETIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 32 EUROPE: DIABETIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 ASIA PACIFIC: DIABETIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.2 RENAL FORMULAS

7.3.2.1 Rise in patient population for chronic kidney disease to contribute to market growth

TABLE 34 RENAL FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 35 NORTH AMERICA: RENAL FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 36 EUROPE: RENAL FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 37 ASIA PACIFIC: RENAL FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.3 HEPATIC FORMULAS

7.3.3.1 Rise in obesity and alcohol consumption drive demand for hepatic formulas

TABLE 38 HEPATIC FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: HEPATIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 EUROPE: HEPATIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 41 ASIA PACIFIC: HEPATIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.4 PULMONARY FORMULAS

7.3.4.1 Rising disease prevalence to drive demand growth

TABLE 42 PULMONARY FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: PULMONARY FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: PULMONARY FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: PULMONARY FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3.5 OTHER DISEASE-SPECIFIC FORMULAS

TABLE 46 OTHER DISEASE-SPECIFIC FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: OTHER DISEASE-SPECIFIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: OTHER DISEASE-SPECIFIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: OTHER DISEASE-SPECIFIC FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 PEPTIDE-BASED FORMULAS

7.4.1 BENEFITS OF PEPTIDE-BASED FORMULAS OVER OTHER SEGMENTS POSITIVELY IMPACTING MARKET GROWTH

TABLE 50 PEPTIDE-BASED ENTERAL-FEEDING FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: PEPTIDE-BASED ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: PEPTIDE-BASED ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: PEPTIDE-BASED ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 OTHER FORMULAS

TABLE 54 OTHER ENTERAL-FEEDING FORMULAS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: OTHER ENTERAL-FEEDING FORMULAS MARKET, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: OTHER ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: OTHER ENTERAL-FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 ENTERAL FEEDING FORMULAS MARKET, BY APPLICATION (Page No. - 104)

8.1 INTRODUCTION

TABLE 58 ENTERAL FEEDING FORMULAS INDUSTRY, BY APPLICATION, 2020–2027 (USD MILLION)

8.2 ONCOLOGY

8.2.1 GROWING INCIDENCE OF CANCER TO INCREASE MARKET SHARE

TABLE 59 NUMBER OF NEW CANCER PATIENTS IN AMERICA

TABLE 60 MARKET FOR ONCOLOGY, BY REGION, 2020–2027 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 EUROPE: MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 GASTROENTEROLOGY

8.3.1 INCREASING INCIDENCE OF GASTROINTESTINAL DISEASES TO DRIVE ADOPTION OF ENTERAL FEEDING FORMULAS

TABLE 64 INDICATIVE LIST OF DIGESTIVE DISEASES & DISORDERS REQUIRING ENTERAL FEEDING

TABLE 65 ENTERAL FEEDING FORMULAS INDUSTRY FOR GASTROENTEROLOGY, BY REGION, 2020–2027 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 68 ASIA PACIFIC: MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 NEUROLOGY

8.4.1 HIGH BURDEN OF NEUROLOGICAL DISORDERS TO FUEL DEMAND FOR CLINICAL NUTRITION THERAPIES

TABLE 69 MARKET FOR NEUROLOGY, BY REGION, 2020–2027 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET FOR NEUROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 71 EUROPE: MARKET FOR NEUROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET FOR NEUROLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 DIABETES

8.5.1 USE OF ENTERAL FEEDING SYSTEMS IN DIABETICS HELPS PREVENT HYPERGLYCEMIA AND ASSOCIATED COMPLICATIONS

TABLE 73 MARKET FOR DIABETES, BY REGION, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET FOR DIABETES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET FOR DIABETES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: MARKET FOR DIABETES, BY COUNTRY, 2020–2027 (USD MILLION)

8.6 OTHER APPLICATIONS

TABLE 77 MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 80 ASIA PACIFIC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 ENTERAL FEEDING FORMULAS MARKET, BY END USER (Page No. - 117)

9.1 INTRODUCTION

TABLE 81 ENTERAL FEEDING FORMULAS INDUSTRY, BY END USER, 2020–2027 (USD MILLION)

9.2 HOSPITALS

9.2.1 GROWING CHRONIC AND INFECTIOUS DISEASE PREVALENCE DRIVES MARKET GROWTH

TABLE 82 MARKET FOR HOSPITALS, BY REGION, 2020–2027 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET FOR HOSPITALS, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 LONG-TERM CARE FACILITIES

TABLE 86 MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

TABLE 87 MARKET FOR LONG-TERM CARE FACILITIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 89 EUROPE: MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 90 ASIA PACIFIC: MARKET FOR LONG-TERM CARE FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.1 NURSING HOMES

9.3.1.1 Need for nursing care in above-65 age group to drive market growth

TABLE 91 MARKET FOR NURSING HOMES, BY REGION, 2020–2027 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET FOR NURSING HOMES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 93 EUROPE: MARKET FOR NURSING HOMES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 94 ASIA PACIFIC: MARKET FOR NURSING HOMES, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.2 ASSISTED LIVING FACILITIES

9.3.2.1 Growth in chronic disease prevalence to support market growth

TABLE 95 ENTERAL FEEDING FORMULAS INDUSTRY FOR ASSISTED LIVING FACILITIES, BY REGION, 2020–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MARKET FOR ASSISTED LIVING FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 EUROPE: MARKET FOR ASSISTED LIVING FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 98 ASIA PACIFIC: MARKET FOR ASSISTED LIVING FACILITIES, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.3 HOME CARE AGENCIES & HOSPICES

9.3.3.1 Limitations associated with home care to hamper market growth

TABLE 99 MARKET FOR HOME CARE AGENCIES & HOSPICES, BY REGION, 2020–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: MARKET FOR HOME CARE AGENCIES & HOSPICES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 101 EUROPE: MARKET FOR HOME CARE AGENCIES & HOSPICES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 102 ASIA PACIFIC: MARKET FOR HOME CARE AGENCIES & HOSPICES, BY COUNTRY, 2020–2027 (USD MILLION)

10 ENTERAL FEEDING FORMULAS MARKET, BY REGION (Page No. - 128)

10.1 INTRODUCTION

TABLE 103 ENTERAL FEEDING FORMULAS INDUSTRY, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: ENTERAL FEEDING FORMULAS MARKET SNAPSHOT, 2021

TABLE 104 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 110 NORTH AMERICA: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Advanced healthcare system and availability of reimbursement for enteral nutrition to increase market growth

TABLE 111 US: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 112 US: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 113 US: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 US: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 115 US: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 116 US: MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing incidence of chronic diseases such as diabetes and cancer supports market growth

TABLE 117 CANADA: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 118 CANADA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 119 CANADA: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 CANADA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 121 CANADA: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 122 CANADA: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 123 EUROPE: ENTERAL FEEDING FORMULAS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 124 EUROPE: MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 125 EUROPE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 126 EUROPE: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 127 EUROPE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 129 EUROPE: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.3.1 UK

10.3.1.1 High incidence of target diseases to drive UK enteral feeding formulas market

TABLE 130 MACROINDICATORS FOR MARKET IN UK

TABLE 131 UK: MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 132 UK: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 133 UK: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 UK: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 135 UK: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 136 UK: MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Germany to overtake UK and dominate European market by 2027

TABLE 137 MACROINDICATORS FOR MARKET IN GERMANY

TABLE 138 GERMANY: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 139 GERMANY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 140 GERMANY: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 141 GERMANY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 142 GERMANY: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 143 GERMANY: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Well-established healthcare system and strong government support contribute to market growth

TABLE 144 MACROINDICATORS FOR MARKET IN FRANCE

TABLE 145 FRANCE: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 146 FRANCE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 147 FRANCE: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 FRANCE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 149 FRANCE: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 150 FRANCE: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Market growth attributed to growing geriatric population and need for nursing homes in Italy

TABLE 151 MACROINDICATORS FOR MARKET IN ITALY

TABLE 152 ITALY: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 153 ITALY: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 154 ITALY: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 ITALY: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 156 ITALY: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 157 ITALY: MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Significant increase in patients opting for enteral nutrition to support market growth

TABLE 158 SPAIN: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 159 SPAIN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 160 SPAIN: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 SPAIN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 162 SPAIN: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 163 SPAIN: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 164 ROE: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 165 ROE: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 166 ROE: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 ROE: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 168 ROE: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 169 ROE: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 33 ASIA PACIFIC: ENTERAL FEEDING FORMULAS MARKET SNAPSHOT

TABLE 170 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 173 ASIA PACIFIC: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 175 ASIA PACIFIC: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 176 ASIA PACIFIC: MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Rising geriatric population to drive market growth in Japan

TABLE 177 JAPAN: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 178 JAPAN: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 179 JAPAN: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 180 JAPAN: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 181 JAPAN: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 182 JAPAN: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Growing investment in healthcare infrastructure development to drive adoption of enteral feeding formulas

TABLE 183 CHINA: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 184 CHINA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 185 CHINA: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 186 CHINA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 187 CHINA: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 188 CHINA: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increasing incidence of preterm births and cancer cases to drive market growth in India

TABLE 189 INDIA: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 190 INDIA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 191 INDIA: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 INDIA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 193 INDIA: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 194 INDIA: MARKET FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 195 ROAPAC: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 196 ROAPAC: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 197 ROAPAC: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 198 ROAPAC: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 199 ROAPAC: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 200 ROAPAC: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 ECONOMIC DEVELOPMENT, INCREASING HEALTHCARE ACCESS, AND GROWING DISEASE PREVALENCE TO DRIVE MARKET GROWTH

TABLE 201 LATIN AMERICA: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 202 LATIN AMERICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 203 LATIN AMERICA: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 204 LATIN AMERICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 206 LATIN AMERICA: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 IMPROVING HEALTHCARE INFRASTRUCTURE AND HEALTH INSURANCE PENETRATION TO SUPPORT MARKET GROWTH

TABLE 207 MIDDLE EAST AND AFRICA: ENTERAL FEEDING FORMULAS MARKET, BY STAGE, 2020–2027 (USD MILLION)

TABLE 208 MIDDLE EAST AND AFRICA: MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 209 MIDDLE EAST AND AFRICA: DISEASE-SPECIFIC FORMULAS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 210 MIDDLE EAST AND AFRICA: MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 211 MIDDLE EAST AND AFRICA: MARKET, BY END USER, 2020–2027 USD MILLION)

TABLE 212 MIDDLE EAST AND AFRICA: ENTERAL FEEDING FORMULAS INDUSTRY FOR LONG-TERM CARE FACILITIES, BY TYPE, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 181)

11.1 OVERVIEW

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 34 KEY PLAYER STRATEGIES IN ENTERAL FEEDING FORMULAS MARKET, 2019–2022

11.3 MARKET SHARE ANALYSIS

FIGURE 35 ENTERAL FEEDING FORMULAS INDUSTRY: MARKET SHARE ANALYSIS, 2021 (TOP FIVE PLAYERS)

TABLE 213 ENTERAL FEEDING FORMULAS INDUSTRY: DEGREE OF COMPETITION

11.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 36 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN MARKET

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 37 MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 COMPETITIVE BENCHMARKING

11.6.1 COMPANY FOOTPRINT ANALYSIS

FIGURE 38 COMPANY FOOTPRINT ANALYSIS

11.6.2 COMPANY PRODUCT FOOTPRINT

TABLE 214 PRODUCT PORTFOLIO ANALYSIS

11.6.3 COMPANY REGIONAL FOOTPRINT

TABLE 215 REGIONAL REVENUE MIX

11.6.3.1 COMPETITIVE BENCHMARKING

TABLE 216 MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 217 MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (START-UPS/SMES)

11.7 COMPETITIVE SCENARIO AND TRENDS

TABLE 218 PRODUCT LAUNCHES & APPROVALS, JANUARY 2019–JULY 2022

TABLE 219 DEALS, JANUARY 2019–JULY 2022

TABLE 220 OTHER DEVELOPMENTS, JANUARY 2019–JULY 2022

12 COMPANY PROFILES (Page No. - 193)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 ABBOTT

TABLE 221 ABBOTT: BUSINESS OVERVIEW

FIGURE 39 ABBOTT: COMPANY SNAPSHOT (2021)

12.1.2 NESTLÉ

TABLE 222 NESTLÉ: BUSINESS OVERVIEW

FIGURE 40 NESTLÉ: COMPANY SNAPSHOT (2021)

12.1.3 DANONE S.A.

TABLE 223 DANONE: BUSINESS OVERVIEW

FIGURE 41 DANONE: COMPANY SNAPSHOT (2021)

12.1.4 FRESENIUS KABI

TABLE 224 FRESENIUS KABI: BUSINESS OVERVIEW

FIGURE 42 FRESENIUS KABI: COMPANY SNAPSHOT (2021)

12.1.5 B. BRAUN MELSUNGEN AG

TABLE 225 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 43 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

12.1.6 OTSUKA HOLDINGS CO., LTD.

TABLE 226 OTSUKA HOLDINGS CO., LTD.: BUSINESS OVERVIEW

FIGURE 44 OTSUKA HOLDINGS CO., LTD.: COMPANY SNAPSHOT (2021)

12.1.7 NUTRITIONAL MEDICINALS, LLC

TABLE 227 NUTRITIONAL MEDICINALS, LLC: BUSINESS OVERVIEW

12.1.8 KATE FARMS

TABLE 228 KATE FARMS: BUSINESS OVERVIEW

12.1.9 MEDTRITION INC.

TABLE 229 MEDTRITION INC.: BUSINESS OVERVIEW

12.1.10 VICTUS, INC.

TABLE 230 VICTUS, INC.: BUSINESS OVERVIEW

12.1.11 GLOBAL HEALTH PRODUCTS, INC.

TABLE 231 GLOBAL HEALTH PRODUCTS, INC.: BUSINESS OVERVIEW

12.1.12 MEIJI HOLDINGS

TABLE 232 MEIJI HOLDINGS CO., LTD.: BUSINESS OVERVIEW

FIGURE 45 MEIJI HOLDINGS CO., LTD.: COMPANY SNAPSHOT (2021)

12.1.13 RECKITT BENCKISER GROUP

TABLE 233 RECKITT BENCKISER GROUP: BUSINESS OVERVIEW

FIGURE 46 RECKITT BENCKISER GROUP: COMPANY SNAPSHOT (2021)

12.2 OTHER COMPANIES

12.2.1 HORMEL FOODS CORPORATION

12.2.2 DERMARITE INDUSTRIES

12.2.3 MEDLINE INDUSTRIES, LP

12.2.4 REAL FOOD BLENDS

12.2.5 AJINOMOTO CAMBROOKE, INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 226)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the enteral feeding formulas market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side and demand side are detailed below.

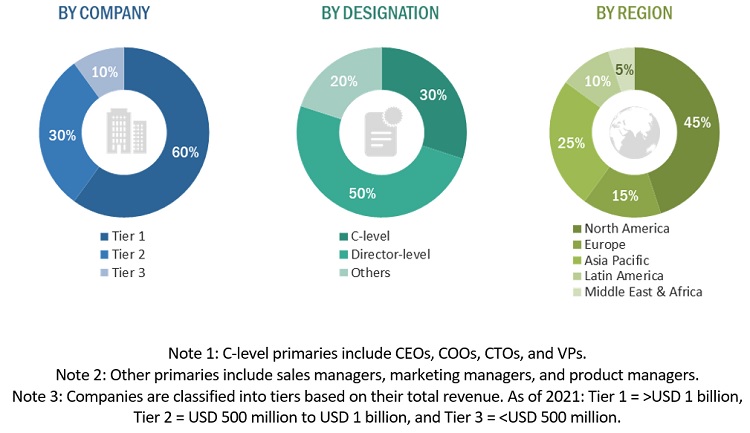

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the enteral feeding formulas market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in this report’s market engineering process.

Objectives of the Study

- To validate the segmentation defined through the assessment of the product portfolios of the leading players in the market

- To understand key industry trends and issues defining the growth objectives of market players

- To gather both demand- and supply-side validation of the key factors affecting market growth, including market drivers, restraints, opportunities, and challenges

- To validate assumptions for the market sizing and forecasting model used for this market study

- To understand the market positions of the leading players in the enteral feeding formulas market and their shares/rankings

- To understand the ongoing pricing trends in the market and future expectations

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the RoE enteral feeding formulas market into Sweden, Russia, Austria, Finland, and others

- Further breakdown of the Southeast Asian enteral feeding formulas market into Singapore, Vietnam, and others

- Further breakdown of the RoLATAM enteral feeding formulas market into Argentina, Colombia, Chile, and others

- Further breakdown of the Benelux enteral feeding formulas market into Belgium, the Netherlands, and Luxembourg

Competitive Landscape Assessment

- Market share analysis for the APAC region, which provides market shares of the top 3–5 key players in the enteral feeding formulas market

- Competitive leadership mapping for established players in the US

Market outlook for the top 10 companies in tube feeding market

The global tube feeding market is expected to grow in the coming years, driven by factors such as increasing prevalence of chronic conditions that require tube feeding, advancements in medical technologies, and increasing awareness about the benefits of tube feeding. Here is a market outlook for the top 10 companies in the tube feeding market

Abbott Laboratories: Abbott Laboratories is a leading player in the tube feeding market, with a wide range of products for both adults and children. The company's nutrition business, which includes tube feeding products, generated $8.7 billion in sales in 2020.

Nestle Health Science: Nestle Health Science is a subsidiary of Nestle that focuses on nutrition and medical products. The company has a strong presence in the tube feeding market, with products such as Peptamen and Compleat.

Danone S.A.: Danone S.A. is a multinational food products company that is active in the tube feeding market through its medical nutrition division. The company's tube feeding products include Nutrison and Nutrini.

B. Braun Melsungen AG: B. Braun is a German medical technology and pharmaceutical company that produces a range of tube feeding products, including pumps, tubes, and enteral nutrition formulas.

Fresenius Kabi AG: Fresenius Kabi is a global healthcare company that produces a range of products for clinical nutrition and infusion therapy, including tube feeding formulas and pumps.

Mead Johnson Nutrition Company: Mead Johnson is a subsidiary of Reckitt Benckiser Group that produces infant and children's nutrition products, including tube feeding formulas.

Meiji Holdings Co., Ltd.: Meiji Holdings is a Japanese company that produces a range of products in the healthcare and nutrition sectors, including tube feeding formulas.

Vygon Group: Vygon Group is a French company that produces a range of medical products, including tube feeding sets and pumps.

Mlnlycke Health Care AB: Mlnlycke Health Care is a Swedish company that produces a range of medical products, including tube feeding sets and pumps.

Avanos Medical, Inc.: Avanos Medical is a US-based medical device company that produces a range of products for clinical nutrition and infusion therapy, including tube feeding formulas and pumps.

Overall, the top 10 companies in the tube feeding market are expected to continue to grow in the coming years, driven by factors such as increasing prevalence of chronic conditions that require tube feeding, advancements in medical technologies, and increasing awareness about the benefits of tube feeding.

Hypothetic challenges of tube feeding business in future

There are several hypothetical challenges that could arise in the tube feeding business in the future. Here are some potential challenges and specific examples

Cost: One of the biggest challenges in the tube feeding business could be the cost of the products. Tube feeding can be expensive, and insurance coverage can be limited, which could make it difficult for patients to afford the products they need. For example, in the United States, Medicare and Medicaid only cover tube feeding supplies for certain conditions and situations, which could limit access for some patients.

Supply chain disruptions: The COVID-19 pandemic highlighted the vulnerability of supply chains, and disruptions could also impact the tube feeding business. Disruptions could include shortages of raw materials, delays in manufacturing or shipping, or other issues that could limit the availability of tube feeding products. For example, in early 2021, severe winter weather in Texas led to disruptions in the production and distribution of tube feeding supplies.

Competition: The tube feeding market is relatively small, but it is still competitive. As new products and technologies are developed, companies may need to invest in research and development to stay ahead of the competition. For example, in recent years, there has been a trend towards the development of more advanced tube feeding formulas that are tailored to specific patient needs.

Regulatory challenges: The tube feeding business is subject to a range of regulations and standards, and compliance with these regulations can be complex and time-consuming. Regulatory challenges could include changes in regulations or guidelines that impact the development, manufacturing, or marketing of tube feeding products. For example, in 2020, the US Food and Drug Administration (FDA) issued new guidance on the labeling of tube feeding products, which could impact manufacturers and distributors.

Ethics: There are ethical considerations associated with tube feeding, particularly in cases where patients are unable to make decisions for themselves. For example, some patients may not want to receive tube feeding, but may be unable to communicate their wishes. In these cases, healthcare providers and caregivers may need to make decisions on behalf of the patient, which can be emotionally and ethically challenging.

Overall, the tube feeding business will likely face a range of challenges in the future, and companies in the industry will need to be prepared to adapt and respond to these challenges in order to continue to provide essential products and services to patients in need.

Industries that will get impacted heavily by tube feeding market in future

The tube feeding market is primarily focused on the healthcare industry, specifically on patients who require tube feeding as a medical intervention. However, there are other industries that could be impacted by the tube feeding market in the future, such as the food and beverage industry and the agriculture industry.

In the food and beverage industry, the tube feeding market could impact the demand for certain types of food and nutrition products. For example, as tube feeding formulas become more advanced and are tailored to specific patient needs, there may be a decrease in demand for certain types of food products that are commonly used for tube feeding, such as pureed foods.

In the agriculture industry, the tube feeding market could impact the demand for certain types of crops and livestock. For example, as the demand for tube feeding formulas and supplements increases, there may be a corresponding increase in the demand for certain types of ingredients, such as soy or whey protein, that are commonly used in these products.

Overall, while the tube feeding market is primarily focused on the healthcare industry and the needs of patients who require tube feeding, there may be ripple effects in other industries as well, particularly in areas related to nutrition and agriculture.

Future use cases of tube feeding market along with insights on adaption, market potential, risk

The tube feeding market is likely to continue to evolve and expand in the coming years, with new use cases emerging as medical technology advances. Here are a few potential future use cases for the tube feeding market, along with commentary on their adaption, market potential, and risk

Tube feeding for older adults: As the global population ages, there is an increasing need for healthcare solutions that address the unique needs of older adults. Tube feeding is one such solution, as it can help older adults who are unable to eat enough food to maintain their health. The market potential for tube feeding in older adults is high, given the growing number of older adults worldwide. However, there are also risks associated with tube feeding in this population, such as the risk of aspiration pneumonia.

Tube feeding for sports nutrition: Some athletes and bodybuilders use tube feeding as a way to quickly and efficiently consume large amounts of nutrients. While this use case is not yet mainstream, it has the potential to grow in popularity, particularly among professional athletes and bodybuilders. The market potential for tube feeding in sports nutrition is relatively small compared to other use cases, but it could still represent a niche market. The main risk associated with this use case is the potential for misuse or abuse of tube feeding.

Tube feeding for weight loss: Some people use tube feeding as a way to lose weight quickly. This use case is controversial and has not yet gained widespread acceptance in the medical community. The market potential for tube feeding in weight loss is uncertain, as it is not clear how many people would be willing to use this method of weight loss. The main risk associated with this use case is the potential for misuse or abuse of tube feeding, as well as the risk of nutrient deficiencies.

Tube feeding for cancer patients: Cancer patients who are undergoing treatment often experience difficulty eating, which can lead to malnutrition and other complications. Tube feeding can help these patients get the nutrients they need to maintain their health. The market potential for tube feeding in cancer patients is high, given the large number of people who are diagnosed with cancer each year. The main risk associated with this use case is the potential for complications, such as infection or blockage of the feeding tube.

Overall, the future use cases for the tube feeding market are likely to vary in their adaption, market potential, and risk. While some use cases, such as tube feeding for cancer patients, are likely to become more common and widely accepted, others may face significant barriers to adoption or may be considered controversial or risky.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Enteral Feeding Formulas Market