Enterprise Data Management Market by Component (Software (Data Security, Data Integration, Data Migration, and Data Quality) and Services) Deployment Mode, Organization Size, Industry Vertical, and Region - Global Forecast to 2025

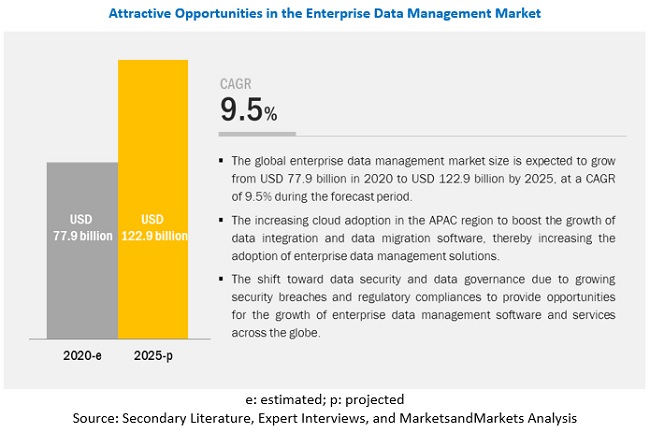

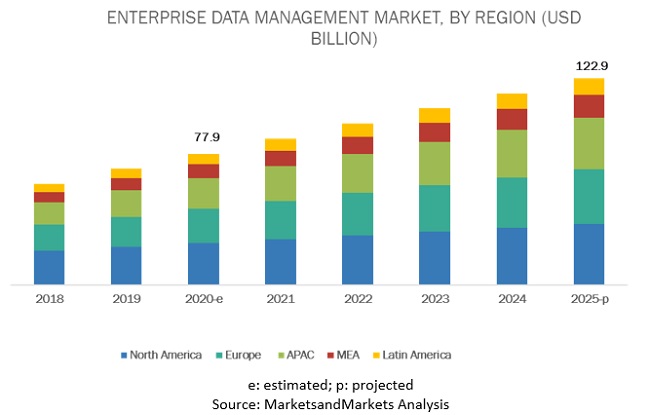

The global Enterprise Data Management Market size is expected to grow from $77.9 billion in 2020 to $122.9 billion by 2025, at a CAGR of 9.5% during the forecast period. Key growth factors for the market include the need to effectively manage the hierarchical master data generated across departments, adoption of Internet of Things (IoT) devices, and digitalization. Also, growing need to ensure regulatory compliance that is driven by the new regulations such as General Data Protection Regulation (GDPR), Act on the Protection of Personal Information (APPI) to drive the growth of enterprise data management market.

Software segment to hold a larger market size during the forecast period

The enterprise data management market, by component, covers software and services. The software segment outperforms the services segment and is anticipated to record a higher share during the forecast period due to the growing solutions adoption among Small and Medium-sized Enterprises (SMEs). Organizations are increasingly adopting effective enterprise data management solutions to fulfil the regulatory compliance, including data privacy needs and financial reporting. Improving the productivity across the organization by minimizing duplicate and inaccurate data is expected to drive the adoption of enterprise data management solutions.

Cloud deployment mode to grow at a higher CAGR during the forecast period

The growth of the cloud deployment mode can be attributed to the growing demand for low-cost storage resources and the on-demand scalability offered by the cloud. The integrated and fully deployed managed services of the cloud make enterprises rely on the cloud deployment mode. The cloud deployment mode is the best alternative for enterprise data management if enterprises want quick deployment of services, need to access the data at multiple locations, or expand their storage. Minimum support and maintenance cost required for cloud deployment compared to on-premises is further expected to drive the growth of this segment.

Asia Pacific to hold the highest CAGR during the forecast period

The global enterprise data management market covers five major geographic regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America. North America is expected to hold the largest market size during the forecast period. The increasing demand for risk management solutions and rise in the requirement of on-time authentic information is boosting the demand for enterprise data management solutions in the APAC region. The government’s focus on adopting big data strategies to predict or identify potential threats is also expected fuel the growth of enterprise data management across the region.

Enterprise Data Management Companies

The enterprise data management market comprises key solution providers, such as IBM Corporation (US), SAS Institute Inc. (US), Teradata Corporation (US), Oracle Corporation (US), SAP SE (Germany), Talend (US), Symantec (US), Cloudera, Inc. (US), Ataccama (Canada), Informatica (US), Mindtree Limited (India), Qlik (US), EnterWorks, Inc. (US), MapR (US), GoldenSource Corporation (US), Amazon Web Services, Inc. (US), MuleSoft, LLC. (US), Micro Focus International plc (UK), Zaloni, Inc. (US), and Actian (US).

The study includes an in-depth competitive analysis of the key players in the enterprise data management market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

Component, Deployment Mode, Organization size, Industry Vertical, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

List of Companies in Enterprise Data Management |

IBM Corporation (US), SAS Institute Inc. (US), Teradata Corporation (US), Oracle Corporation (US), SAP SE (Germany), Talend (US), Symantec (US), Cloudera, Inc. (US), Ataccama (Canada), Informatica (US), Mindtree Limited (India), Qlik (US), EnterWorks, Inc. (US), MapR (US), GoldenSource Corporation (US), Amazon Web Services, Inc. (US), MuleSoft, LLC. (US), Micro Focus International plc (UK), Zaloni, Inc. (US), and Actian (US) |

This research report categorizes the enterprise data management market based on component, deployment mode, organization size, industry vertical, and region.

Based on components, the enterprise data management market has the following segments:

-

Software

- Data Security

- Master Data Management

- Data Integration

- Data Migration

- Data Warehousing

- Data Governance

- Data Quality

- Others (Data Stewardship, Data Synchronization, and Metadata Management)

-

Services

- Managed Services

- Professional Services

- Professional Services

- Consulting

- Deployment and Integration

- Support and Maintenance

Based on industry vertical, the enterprise data management market has the following segments:

- Healthcare and Life science

- Banking, Financial Services and Insurance (BFSI)

- Telecom and Information Technology (IT)

- Retail and Consumer goods

- Media and Entertainment

- Manufacturing

- Energy and Utilities

- Transportation and Logistics

- Government and Defense

- Others (travel and hospitality, education, research, and real estate)

Based on deployment mode, the enterprise data management market has the following segments

- Cloud

- On-premises

Based on organization size, thee data management market has the following segments:

- Small and Medium-sized Enterprises

- Large enterprises

Based on regions, the enterprise data management market has the following segments:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Singapore

- Rest of APAC

-

MEA

- Middle East

- South Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2019, IBM Corporation launched the IBM Cloud Integration platform. This platform provides hybrid cloud offerings to assist businesses in migrating, integrating, and managing applications in both the cloud and on-premises environments, which will reduce the integration cost and time by 1/3.

- In October 2019, Teradata announced an update for Teradata Vantage platform by including Vantage Customer Experience (CX) and Vantage Analyst into the platform. Through this platform, Vantage CX delivered real-time personalized experiences of customers and Vantage analyst empowered business analysts in performing Machine Learning (ML) and advanced analytics. This enhancement helped organizations focus on customer retention and growth.

- In September 2019, Oracle extended its data management portfolio by announcing new innovations. These innovations include expansions in Autonomous Database Capabilities, expansion in Exadata Portfolio, and acceleration in Database Software Innovation, enabling database accessibility to developers, and automating the protection of customer data.

Key Questions addressed by the report:

- What are the opportunities in the enterprise data management market?

- What is the competitive landscape in the market?

- What are the emerging technologies impacting the overall market?

- What are the key use cases existing in the market?

- What are the key trends and dynamics existing in the market?

Frequently Asked Questions (FAQ):

What is enterprise data management?

Enterprise data management can be defined as a process of accurately defining, sourcing, integrating, storing, and effectively retrieving and reconciling massive amounts of enterprise-wide data.

Most of the business personnel involved in making strategic decisions rely on the enterprise data produced inside the organization. However, a majority of their time is taken up in the search, transformation, processing, and extraction of the suitable data to construct the necessary business models and implement them strategically. Making crucial business data easily available and in a structured form can result in increased efficiency and reduced costs of data management. The enterprise data management solutions also help in sourcing data from different databases and data marts. They help migrate, integrate, and eliminate noise and redundancy in data along with properly archiving it to extract meaningful business insights for business decisions. These solutions can also incorporate an organization’s existing templates, formats, policies, or standards, improve data integrity, and enforce best data governance practices. By automating data management and facilitating exchanges among multiple heterogeneous systems used across the data life cycle, enterprise data management solutions provide users with timely access to the latest data qualified to make crucial business decisions.

What is the market size and current trends driving the enterprise data management market?

The global enterprise data management market size is expected to grow from USD 77.9 billion in 2020 to USD 122.9 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 9.5% during the forecast period. Key growth factors for the market include the need to effectively manage the hierarchical master data generated across departments, adoption of Internet of Things (IoT) devices, and digitalization. Also, growing need to ensure regulatory compliance that is driven by the new regulations such as General Data Protection Regulation (GDPR), Act on the Protection of Personal Information (APPI) to drive the growth of enterprise data management market.

Who are the top vendors in the enterprise data management market?

The major vendors operating in the enterprise data management market include IBM, SAS, Teradata, Oracle, SAP, and Talend. These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

What are the regulations impacting the enterprise data management market?

Some of the regulations that are impacting enterprise data management market are General Data Protection Regulation (GDPR), Payment Card Industry Data Security Standard (PCI DSS), The International Organization for Standardization (ISO) 27001, California Consumer Privacy Act (CCPA), Health Insurance Portability and Accountability Act (HIPAA), Health Information Technology for Economic and Clinical Health (HITECH) Act, Basel Committee on Banking Supervision (BCBS) 239 Compliance, Sarbanes- Oxley (SOX) Act of 2002, and Personal Data Protection Act 2012 (PDPA). These regulations also help maintain data quality and prevent fraudulent activities by ensuring data transparency among defined entities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.3.3 Years Considered for the Study

1.4 Currency Considered

1.5 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

2.5 Assumptions for the Study

2.6 Limitations of the Study

3 Executive Summary (Page No. - 32)

4 Premium Insights (Page No. - 37)

4.1 Attractive Opportunities in the Enterprise Data Management Market

4.2 Market Top 3 Industry Verticals

4.3 Market By Region

4.4 Market in North America, By Software and Industry Vertical

5 Market Overview and Industry Trends (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increased Adoption of Columnar Databases and Massively Parallel Processing Architectures

5.2.1.2 Need for On-Time Qualified Information

5.2.1.3 Increase in Regulatory Compliance and Regulations

5.2.1.4 Increased Need for Risk Management

5.2.2 Restraints

5.2.2.1 Presence of Data Silos

5.2.2.2 Data Quality and Data Address Validation Issues

5.2.3 Opportunities

5.2.3.1 Deployment of Data Maturity Model

5.2.3.2 Deploying Specific Tools and Technologies to Increase Data Access and Data Convergence

5.2.4 Challenges

5.2.4.1 Conflicts Regarding Ownership of Data

5.2.4.2 Inconsistent Business Semantics

5.2.4.3 Aligning Enterprise Data Management Strategy With Strategic Organizational Initiatives

5.3 Industry Trends

5.3.1 Value Chain Analysis

5.4 Regulatory Implications

5.4.1 General Data Protection Regulation

5.4.2 The International Organization for Standardization 27001

5.4.3 Payment Card Industry Data Security Standard

5.4.4 Basel Committee on Banking Supervision 239 Compliance

5.4.5 California Consumer Privacy Act

5.4.6 Health Insurance Portability and Accountability Act of 1996

5.4.7 Health Information Technology for Economic and Clinical Health Act

5.4.8 Sarbanes-Oxley Act of 2002

5.4.9 Personal Data Protection Act

5.4.10 Case Study

5.4.10.1 Case Study#1: Unification of Data

5.4.10.2 Case Study#2: Holistic View of Enterprise Data

5.4.10.3 Case Study #3: Consumer Data Consolidation for Easy Access

5.4.10.4 Case Study #4: Comply With Regulations and Government Norms

5.4.10.5 Case Study #5: Streamline Data Management Practices

5.4.11 Data Type

5.4.11.1 Transactional Data

5.4.11.2 Analytical Data

5.4.11.3 Master Data

6 Enterprise Data Management Market, By Component (Page No. - 50)

6.1 Introduction

6.2 Software

6.2.1 Data Security

6.2.1.1 Data Security: Market Drivers

6.2.2 Master Data Management

6.2.2.1 Master Data Management: Market Drivers

6.2.3 Data Integration

6.2.3.1 Data Integration: Market Drivers

6.2.4 Data Migration

6.2.4.1 Data Migration: Enterprise Data Management Market Drivers

6.2.5 Data Warehousing

6.2.5.1 Data Warehousing: Market Drivers

6.2.6 Data Governance

6.2.6.1 Data Governance: Market Drivers

6.2.7 Data Quality

6.2.7.1 Data Quality: Market Drivers

6.2.8 Others

6.3 Services

6.3.1 Managed Services

6.3.1.1 Managed Services: Market Drivers

6.3.2 Professional Services

6.3.2.1 Consulting

6.3.2.1.1 Consulting: Market Drivers

6.3.2.2 Deployment and Integration

6.3.2.2.1 Deployment and Integration: Market Drivers

6.3.2.3 Support and Maintenance

6.3.2.3.1 Support and Maintenance: Market Drivers

7 Enterprise Data Management Market, By Deployment Mode (Page No. - 69)

7.1 Introduction

7.2 On-Premises

7.2.1 On-Premises: Market Drivers

7.3 Cloud

7.3.1 Cloud: Market Drivers

8 Enterprise Data Management Market, By Organization Size (Page No. - 73)

8.1 Introduction

8.2 Large Enterprises

8.2.1 Large Enterprises: Market Drivers

8.3 Small and Medium-Sized Enterprises

8.3.1 Small and Medium-Sized Enterprises: Market Drivers

9 Enterprise Data Management Market, By Industry Vertical (Page No. - 77)

9.1 Introduction

9.2 Healthcare and Life Sciences

9.2.1 Use Cases in Healthcare and Life Sciences

9.2.2 Healthcare and Life Sciences: Market Drivers

9.3 Banking, Financial Services, and Insurance

9.3.1 Use Cases in Banking, Financial Services, and Insurance

9.3.2 Banking, Financial Services, and Insurance: Market Drivers

9.4 Telecom and Information Technology

9.4.1 Use Cases in Telecom and Information Technology

9.4.2 Telecom and Information Technology: Enterprise Data Management Market Drivers

9.5 Retail and Consumer Goods

9.5.1 Use Cases in Retail and Consumer Goods Sector

9.5.2 Retail and Consumer Goods: Market Drivers

9.6 Media and Entertainment

9.6.1 Use Cases in Media and Entertainment Sector

9.6.2 Media and Entertainment: Market Drivers

9.7 Manufacturing

9.7.1 Use Cases in Manufacturing Sector

9.7.2 Manufacturing: Market Drivers

9.8 Energy and Utilities

9.8.1 Use Cases in Energy and Utilities Sector

9.8.2 Energy and Utilities: Market Drivers

9.9 Transportation and Logistics

9.9.1 Use Cases in Transportation and Logistics Sector

9.9.2 Transportation and Logistics: Market Drivers

9.10 Government and Defense

9.10.1 Use Cases in Government and Defense Sector

9.10.2 Government and Defense: Market Drivers

9.11 Others

9.11.1 Use Cases in Others Sector

10 Enterprise Data Management Market, By Region (Page No. - 95)

10.1 Introduction

10.2 North America

10.2.1 North America: Market Drivers

10.2.2 United States

10.2.3 Canada

10.3 Europe

10.3.1 Europe: Enterprise Data Management Market Drivers

10.3.2 United Kingdom

10.3.3 Germany

10.3.4 France

10.3.5 Rest of Europe

10.4 Asia Pacific

10.4.1 Asia Pacific: Market Drivers

10.4.2 China

10.4.3 Japan

10.4.4 Singapore

10.4.5 Rest of Asia Pacific

10.5 Middle East and Africa

10.5.1 Middle East and Africa: Enterprise Data Management Market Drivers

10.5.2 Middle East

10.5.3 South Africa

10.6 Latin America

10.6.1 Latin America: Market Drivers

10.6.2 Brazil

10.6.3 Mexico

10.6.4 Rest of Latin America

11 Competitive Landscape (Page No. - 131)

11.1 Microquadrant Overview

11.2 Competitive Leadership Mapping

11.2.1 Visionary Leaders

11.2.2 Innovators

11.2.3 Dynamic Differentiators

11.2.4 Emerging Companies

12 Company Profiles (Page No. - 133)

12.1 Introduction

12.2 IBM

(Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and Right-To-Win)*

12.3 SAS Institute

12.4 Teradata

12.5 Oracle

12.6 SAP SE

12.7 Talend

12.8 Symantec

12.9 Cloudera

12.10 Ataccama

12.11 Informatica

12.12 Mindtree

12.13 Qlik

12.14 Enterworks

12.15 MapR

12.16 Goldensource

12.17 Aws

12.18 MuleSoft

12.19 Micro Focus

12.20 Zaloni

12.21 Actian

*Details on Business Overview, Solutions and Services Offered, Recent Developments, SWOT Analysis, and Right-To-Win Might Not be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 180)

13.1 Industry Excerpts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (105 Tables)

Table 1 United States Dollar Exchange Rate, 2015–2018

Table 2 Factor Analysis

Table 3 Global Market Size and Growth Rate, 2018–2025 (USD Million, Y-O-Y %)

Table 4 Enterprise Data Management Market Size, By Component, 2018–2025 (USD Million)

Table 5 Software: Market Size By Type, 2018–2025 (USD Million)

Table 6 Software: Market Size By Region, 2018–2025 (USD Million)

Table 7 Data Security Software Market Size, By Region, 2018–2025 (USD Million)

Table 8 Master Data Management Software Market Size, By Region, 2018–2025 (USD Million)

Table 9 Data Integration Software Market Size, By Region, 2018–2025 (USD Million)

Table 10 Data Migration Software Market Size, By Region, 2018–2025 (USD Million)

Table 11 Data Warehousing Software Market Size, By Region, 2018–2025 (USD Million)

Table 12 Data Governance Software Market Size, By Region, 2018–2025 (USD Million)

Table 13 Data Quality Software Market Size, By Region, 2018–2025 (USD Million)

Table 14 Others Software Market Size, By Region, 2018–2025 (USD Million)

Table 15 Services: Enterprise Data Management Market Size, By Type, 2018–2025 (USD Million)

Table 16 Services: Market Size By Region, 2018–2025 (USD Million)

Table 17 Managed Services Market Size, By Region, 2018–2025 (USD Million)

Table 18 Professional Services: Market Size By Type, 2018–2025 (USD Million)

Table 19 Professional Services: Market Size By Region, 2018–2025 (USD Million)

Table 20 Consulting Market Size, By Region, 2018–2025 (USD Million)

Table 21 Deployment and Integration Market Size, By Region, 2018–2025 (USD Million)

Table 22 Support and Maintenance Market Size, By Region, 2018–2025 (USD Million)

Table 23 Enterprise Data Management Market Size, By Deployment Mode, 2018–2025 (USD Million)

Table 24 On-Premises: Market Size By Region, 2018–2025 (USD Million)

Table 25 Cloud: Market Size By Region, 2018–2025 (USD Million)

Table 26 Market Size By Organization Size, 2018–2025 (USD Million)

Table 27 Large Enterprises: Market Size By Region, 2018–2025 (USD Million)

Table 28 Small and Medium-Sized Enterprises: Market Size By Region, 2018–2025 (USD Million)

Table 29 Enterprise Data Management Market Size, By Industry Vertical, 2018–2025 (USD Million)

Table 30 Healthcare and Life Sciences: Market Size By Region, 2018–2025 (USD Million)

Table 31 Banking, Financial Services, and Insurance: Market Size By Region, 2018–2025 (USD Million)

Table 32 Telecom and Information Technology: Market Size By Region, 2018–2025 (USD Million)

Table 33 Retail and Consumer Goods: Market Size By Region, 2018–2025 (USD Million)

Table 34 Media and Entertainment: Market Size By Region, 2018–2025 (USD Million)

Table 35 Manufacturing: Enterprise Data Management Market Size, By Region, 2018–2025 (USD Million)

Table 36 Energy and Utilities: Market Size By Region, 2018–2025 (USD Million)

Table 37 Transportation and Logistics: Market Size By Region, 2018–2025 (USD Million)

Table 38 Government and Defense: Market Size By Region, 2018–2025 (USD Million)

Table 39 Others: Market Size By Region, 2018–2025 (USD Million)

Table 40 Enterprise Data Management Market Size, By Region, 2018–2025 (USD Million)

Table 41 North America: Enterprise Data Management Market Size, By Component, 2018–2025 (USD Million)

Table 42 North America: Market Size By Software , 2018–2025 (USD Million)

Table 43 North America: Market Size By Service, 2018–2025 (USD Million)

Table 44 North America: Market Size By Professional Service, 2018–2025 (USD Million)

Table 45 North America: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 46 North America: Market Size By Organization Size, 2018–2025 (USD Million)

Table 47 North America: Market Size By Industry Vertical, 2018–2025 (USD Million)

Table 48 North America: Market Size By Country, 2018–2025 (USD Million)

Table 49 United States: Market Size By Component, 2018–2025 (USD Million)

Table 50 United States: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 51 Canada: Enterprise Data Management Market Size, By Component, 2018–2024 (USD Million)

Table 52 Canada: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 53 Europe: Market Size By Component, 2018–2025 (USD Million)

Table 54 Europe: Market Size By Software , 2018–2025 (USD Million)

Table 55 Europe: Market Size By Service, 2018–2025 (USD Million)

Table 56 Europe: Market Size By Professional Service, 2018–2025 (USD Million)

Table 57 Europe: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 58 Europe: Market Size By Organization Size, 2018–2025 (USD Million)

Table 59 Europe: Market Size By Industry Vertical, 2018–2025 (USD Million)

Table 60 Europe: Market Size By Country, 2018–2025 (USD Million)

Table 61 United Kingdom: Enterprise Data Management Market Size, By Component, 2018–2025 (USD Million)

Table 62 United Kingdom: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 63 Germany: Market Size By Component, 2018–2025 (USD Million)

Table 64 Germany: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 65 France: Market Size By Component, 2018–2025 (USD Million)

Table 66 France: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 67 Asia Pacific: Enterprise Data Management Market Size, By Component, 2018–2024 (USD Million)

Table 68 Asia Pacific: Market Size By Software, 2018–2025 (USD Million)

Table 69 Asia Pacific: Market Size By Service, 2018–2025 (USD Million)

Table 70 Asia Pacific: Market Size By Professional Service, 2018–2025 (USD Million)

Table 71 Asia Pacific: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 72 Asia Pacific: Market Size By Organization Size, 2018–2025 (USD Million)

Table 73 Asia Pacific: Market Size By Industry Vertical, 2018–2025 (USD Million)

Table 74 Asia Pacific: Market Size By Country, 2018–2024 (USD Million)

Table 75 China: Enterprise Data Management Market Size, By Component, 2018–2025 (USD Million)

Table 76 China: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 77 Japan: Market Size By Component, 2018–2025 (USD Million)

Table 78 Japan: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 79 Singapore: Market Siz By Component, 2018–2025 (USD Million)

Table 80 Singapore: Market Size, By Deployment Mode, 2018–2025 (USD Million)

Table 81 Middle East and Africa: Enterprise Data Management Market Size, By Component, 2018–2024 (USD Million)

Table 82 Middle East and Africa: Market Size By Software, 2018–2025 (USD Million)

Table 83 Middle East and Africa: Market Size By Service, 2018–2025 (USD Million)

Table 84 Middle East and Africa: Market Size By Professional Service, 2018–2025 (USD Million)

Table 85 Middle East and Africa: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 86 Middle East and Africa: Market Size By Organization Size, 2018–2025 (USD Million)

Table 87 Middle East and Africa: Market Size By Industry Vertical, 2018–2025 (USD Million)

Table 88 Middle East and Africa: Market Size By Country, 2018–2025 (USD Million)

Table 89 Middle East: Enterprise Data Management Market Size, By Component, 2018–2025 (USD Million)

Table 90 Middle East: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 91 South Africa: Market Size By Component, 2018–2025 (USD Million)

Table 92 South Africa: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 93 Latin America: Enterprise Data Management Market Size, By Component, 2018–2025 (USD Million)

Table 94 Latin America: Market Size By Software, 2018–2025 (USD Million)

Table 95 Latin America: Market Size By Service, 2018–2025 (USD Million)

Table 96 Latin America: Market Size By Professional Service, 2018–2024 (USD Million)

Table 97 Latin America: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 98 Latin America: Market Size By Organization Size, 2018–2025 (USD Million)

Table 99 Latin America: Market Size By Industry Vertical, 2018–2024 (USD Million)

Table 100 Latin America: Enterprise Data Management Market Size, By Country, 2018–2025 (USD Million)

Table 101 Brazil: Market Size By Component, 2018–2025 (USD Million)

Table 102 Brazil: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 103 Mexico: Market Size By Component, 2018–2025 (USD Million)

Table 104 Mexico: Market Size By Deployment Mode, 2018–2025 (USD Million)

Table 105 Evaluation Criteria

List of Figures (44 Figures)

Figure 1 Enterprise Data Management Market: Research Design

Figure 2 Market Size Estimation Methodology, Approach 1 (Supply Side): Revenue of Products/Solutions/Services of Enterprise Data Management Market

Figure 3 Market Size Estimation Methodology—Approach 1— Bottom-Up (Supply Side): Collective Revenue of All Products/Solutions/Services of Enterprise Data Management Market

Figure 4 Market Size Estimation Methodology—Approach 2—Bottom-Up (Demand Side): Products/Solutions/Services Sold and Their Average Selling Price

Figure 5 Enterprise Data Management Market, By Component

Figure 6 Market By Software

Figure 7 Market By Service

Figure 8 Market By Professional Service

Figure 9 Market By Deployment Mode

Figure 10 Market By Organization Size

Figure 11 Market By Industry Vertical

Figure 12 Enterprise Data Management Market, By Region

Figure 13 Need to Ensure Regulatory Compliance and Improve Data Quality, and High Inclination of Enterprises Toward Achieving Data-Driven Decision –Making to Drive Market Growth

Figure 14 Banking, Financial Services, and Insurance Industry Vertical to Hold the Largest Market Size During the Forecast Period

Figure 15 North America to Hold the Highest Market Share in 2020

Figure 16 Data Security Segment and Banking, Financial Services, and Insurance Industry Vertical to Account for the Highest Market Shares in 2020

Figure 17 Drivers, Restraints, Opportunities, and Challenges: Enterprise Data Management Market

Figure 18 Value Chain Analysis

Figure 19 Services Segment to Register a Higher CAGR During the Forecast Period

Figure 20 Data Quality Segment to Grow at the Highest CAGR During the Forecast Period

Figure 21 Managed Services Segment to Grow at a Higher CAGR During the Forecast Period

Figure 22 Support and Maintenance Segment to Grow at the Highest CAGR During the Forecast Period

Figure 23 Cloud Deployment Mode to Register a Higher CAGR During the Forecast Period

Figure 24 Small and Medium-Sized Enterprises Segment to Register a Higher CAGR During the Forecast Period

Figure 25 Manufacturing Industry Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 26 North America to Account for the Largest Market Size During the Forecast Period

Figure 27 Singapore to Register the Highest CAGR During the Forecast Period

Figure 28 Asia Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 29 North America: Market Snapshot

Figure 30 Asia Pacific: Market Snapshot

Figure 31 Enterprise Data Management Market (Global), Competitive Leadership Mapping, 2020

Figure 32 IBM: Company Snapshot

Figure 33 SWOT Analysis: IBM

Figure 34 SAS Institute: Company Snapshot

Figure 35 SWOT Analysis: SAS Institute

Figure 36 Teradata: Company Snapshot

Figure 37 SWOT Analysis: Teradata

Figure 38 Oracle: Company Snapshot

Figure 39 SWOT Analysis: Oracle

Figure 40 SAP SE: Company Snapshot

Figure 41 SWOT Analysis: SAP SE

Figure 42 Talend: Company Snapshot

Figure 43 Symantec: Company Snapshot

Figure 44 Cloudera: Company Snapshot

The study involved four major activities in estimating the current market size for enterprise data management market and services. An exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate the findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers and Bloomberg BusinessWeek have been referred to, for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases.

Primary Research

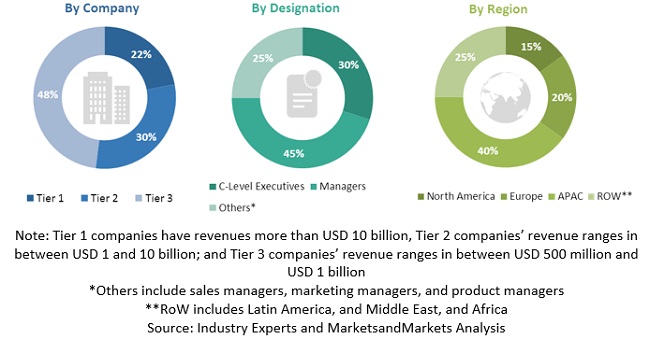

Various primary sources from both the supply and demand sides of the enterprise data management market ecosystem were interviewed to obtain qualitative and quantitative information for the study. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the enterprise data management market, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The breakup of profiles of primary respondents as follows:

Market Size Estimation

For making market estimations and forecasting the enterprise data management market, and the other dependent submarkets, top-down, and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global enterprise data management market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market have been identified through extensive secondary research.

- The market size, in terms of value, has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using the study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets through percentage splits of the market segmentation.

Report Objectives

- To describe and forecast the global enterprise data management market by component (software and services), deployment mode, organization size, industry vertical, and region

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information regarding major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for the major players

- To profile the key players of the enterprise data management market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships, and collaborations, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Enterprise Data Management Market

What could be the estimated enterprise data management market size for entertainment, and specifically for mobile gaming industry?