Environmental Testing Market

Environmental Testing Market by Sample (Wastewater/Effluent, Soil & Sediments, Water, Air), Technology, Tested Material (Microbial Contamination, Organic Compounds, Inorganic Compounds, Residues, Solids), End User, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The environmental testing market is estimated to be valued at USD 7.43 billion in 2025 and is projected to reach USD 9.32 billion by 2030 at a CAGR of 4.6%. The environmental testing market is growing due to stricter regulations, rising pollution awareness, industrial expansion, and the emergence of new contaminants. Advances in rapid testing and sustainability reporting further drive demand, especially in developing regions.

KEY TAKEAWAYS

- North America accounted for a 33.8% share of the environmental testing market in 2024.

- Wastewater/effluent is the largest sample type in the environmental testing market with a share of 58.7% in 2025.

- By technology, the rapid testing segment is expected to dominate the market.

- By tested material, the organic compounds segment is expected to register the highest CAGR of 5.1%.

- By end user, the industrial sector is projected to grow at the fastest rate from 2025 to 2030.

- Companies such as SGS SA, Bureau Veritas SA, Intertek Group PLC, and ALS Limited were identified as some of the star players in the environmental testing market, given their strong market share and product footprint.

- Trabede, RKCT Laboratory Pvt. Ltd., SPL, and Element Materials Technology, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The environmental testing market is growing rapidly due to stricter global regulations, rising sustainability and ESG reporting requirements, and advances in testing technologies. Industries are conducting more frequent and complex testing to meet compliance standards and demonstrate environmental responsibility. The expansion of manufacturing, urbanization, and renewable energy projects further drives demand for water, air, soil, and waste testing. At the same time, digital tools such as IoT sensors and AI analytics are enabling real-time and predictive monitoring. As companies increasingly outsource testing to specialized labs like Eurofins, SGS, and Intertek, environmental testing is evolving from a compliance function into a core enabler of sustainable and transparent industrial operations.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Environmental testing providers are shifting from routine compliance testing toward advanced, data-driven, and digital monitoring services that help industries, utilities, and regulators achieve sustainability, transparency, and ESG compliance.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing need of cost saving and time-effective customized testing services

-

Active participation of government and regulatory bodies to monitor environmental conditions

Level

-

High capital investment for accurate and sensitive analytical testing

-

High setup and maintenance cost

Level

-

Increase in industrial activities in emerging markets

-

Introduction of innovative technologies

Level

-

Lack of basic supporting infrastructure

-

Shortage of skilled manpower

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Growing need of cost saving and time-effective customized testing services

Regulatory bodies demand regular testing of samples and inspection of the waste disposed of in the environment. Manufacturing industries and several organizations test these samples to safeguard the environment. Environmental testing is important for many different reasons. First of all, the company wants to know the longevity of its product and how to increase it to satisfy its customers fully. As a result, companies conduct regular third-party testing to stand by the regulatory requirements. Companies demand tests specific to their samples, meet their requirements, and provide time-efficient results. Hence, several analytical laboratories have identified the need for customized testing services and offer testing services per client requirements. This helps the companies manage their testing costs and save time. It also helps the clients obtain accurate data and analytical understandings, establishing a long-term relationship between analytical laboratories and companies. Environmental testing labs give manufacturers important information regarding their products and their performance in certain conditions. Considering these factors, the need for customized testing was observed in the market.

Restraint: High capital investment for accurate and sensitive analytical testing

Setting up any testing laboratory requires a lot of time and investment. Environmental testing is a highly regulated area, especially in the environmental testing lab; therefore, when setting up the lab, one must meet all the necessary government regulations defined by the local authorities. For example, to start and recognize water testing laboratories in India, the Central Pollution Control Board (CPCB) has set guidelines for the Recognition of Environmental Laboratories Under the Environment (Protection) Act 1986. Along with that, in terms of investment, several components need to be considered while setting up the lab. The major components are Infrastructural requirements, Laboratory Design and Furniture, and Laboratory equipment. While setting up the lab, a wide range of technologies needs to be considered, along with the requirement for skilled employees. All these components require an overall high investment.

Opportunity:Increase in industrial activities in emerging markets

Developing regions such as Africa and Asia have experienced increased industrialization in the past few years. Especially in Asia, China, Japan, and India have made considerable progress in industrial development. Hong Kong, Korea, and Taiwan have become major textiles and other goods exporters. To promote manufacturing growth, countries have initiated multiple campaigns, such as “Make in India” by the Indian government and “Made in China 2025” by the Chinese government. With the help of such initiatives, these countries were not only able to push their industrial growth but also create awareness about the importance of industrialization for economy among their citizens. These aggressive strategies led Asia to industrial development. In addition to the increase in industrialization in such regions, the government also tries to increase awareness among the people regarding environmental pollution and degradation. This has resulted in implementing numerous environmental protection acts, the key opportunity for the environmental testing market. Because of the increase in pollution and environmental contamination, several amendments and new environmental safety standards are expected to be set up mainly in developing economies, such as Asia Pacific, in the next five years. The progressive development of new testing methods for testing samples of contaminants such as pesticide residues, heavy metals, and organic chemicals is expected to play an important role in promoting the growth of the environmental testing market.

Challenge: Lack of basic supporting infrastructure

Testing & certification practices in several developing countries lack organization, sophistication, and technology. The lack of basic supporting infrastructure for setting up testing laboratories is a major challenge to the growth of the environmental testing market. Testing services in some developing regions also face the challenge of obtaining samples from manufacturing companies, as they are fragmented and dominated by small enterprises. Lack of funding (as well as the expansion of illegal/unplanned urban colonies) is a common cause of the inadequate provision of essential environmental services in urban India. While the infrastructure for providing environmental services is more than enough in developed nations, investing capital in developing countries like India is important to improve the infrastructure. According to an article published by the Indian Council for Research on International Economic Relations, the analysis of the gaps in India's environmental infrastructure services indicates that lack of capital is the biggest barrier to the provision of these services, followed by inadequate management systems (problem of attitude noted by Supreme Court Committee on Municipal Waste Management in India). To ensure the provision of the infrastructure and effective collection and management, international investment could be attracted (together with domestic private capital) to this sector.

Environmental Testing Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

The company performs asbestos testing for services and other contaminants testing for soil using highly sensitive Scanning Electron Microscopy (SEM), Transmission Electron Microscopy (TEM), and Polarized Light Microscopy (PLM) instruments. | Provides precise, scientifically rigorous data about soil contamination, |

|

Provides comprehensive air quality testing services, including ambient and industrial air monitoring, using both active and passive sampling methods | This testing helps detect an ultrarace level of hazardous compounds in various air. The samples can be tested for ambient air, metals, dust fall measurement, or soil vapor. |

|

Physical, chemical, and microbiological testing are performed for samples like drinking water, groundwater, process water, cooling tower water, wastewater, etc. | Their services help in early pollution detection, assessing treatment efficiency, and evaluating water quality for various purposes, from industrial discharge to environmental protection. |

|

The company supports testing for various types of water, such as marine potable water quality testing, cooling water conditioning and control, microbiology services, water content testing for the petroleum industry, sea water analysis, water activity testing, and drinking water quality testing. | Precise and accurate results, regulatory expertise, and comprehensive risk management. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The environmental testing market ecosystem connects testing service providers, industrial end users, regulatory bodies, and research institutes in a highly interdependent and compliance-driven landscape. Leading service providers such as Eurofins, Intertek, TÜV SÜD, ALS, SGS, and Mérieux NutriSciences deliver comprehensive testing solutions across water, air, soil, and waste to ensure environmental safety and regulatory adherence. Major end-user companies including Conagra, Nestlé, Unilever, Kellogg’s, and BASF rely on these services to maintain sustainability standards, minimize environmental impact, and support ESG reporting. Oversight from regulatory authorities such as the EPA, ISO, EFSA, FDA, and the European Environment Agency ensures alignment with global environmental and safety standards. In parallel, research and academic institutes such as Universidade de São Paulo, University of Massachusetts, and Centre for Science and Environment (CSE) play a vital role in advancing testing technologies and environmental science. Together, these stakeholders drive innovation, regulatory compliance, and the development of sustainable testing frameworks that safeguard ecosystems and public health.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Environmental Testing Market, By Sample

The market for environmental testing is dominated by the wastewater/effluent segment. The wastewater/effluent segment is growing because industrialization, urbanization, and stricter discharge regulations are increasing the need to monitor and treat wastewater before it enters the environment. Rising public health concerns, tighter government standards, and sustainability initiatives push industries to regularly test effluents for pollutants like heavy metals, organic compounds, and nutrients. Additionally, advances in rapid and automated wastewater testing technologies make monitoring more efficient, supporting the segment’s growth.

Environmental Testing Market, By End User

Industries dominate the environmental testing market because they are the largest generators of pollutants and are strictly regulated to monitor emissions, effluents, and waste. Manufacturing, chemical, energy, and food sectors must regularly test air, water, and soil to meet compliance standards and avoid penalties. Moreover, growing ESG commitments and sustainability goals drive companies to conduct frequent testing for transparency and certification. Their high testing volumes, continuous operations, and legal accountability make industries the leading end users in the market.

REGION

Asia Pacific is estimated to be the fastest region in environmental testing market

Infrastructure developments, such as construction and energy-related projects, industrial development, growth in awareness regarding environmental pollution, and sustainable transformation of environmental policies primarily drive the Asia Pacific market. Another factor could be the increasing death toll in the region due to the unhealthy environment in India and China. Countries like Japan are growing due to the increase in laws related to environmental concerns globally. Since it is important to test and certify the products before importing that they are abiding by the country’s law, these mandates of certification and testing are creating a high demand for environmental testing in Japan.Agriculture is one of the prime industrial sectors in several countries in the region, further driving the market growth. While many countries have successfully adopted farm mechanization techniques used for crop production, harvest, and post-harvest operations, such as packaging and marketing, to help improve product quality, many countries have yet to adopt such mechanized technologies in an all-inclusive manner. Although the region has successfully implemented positive changes in its agricultural methodologies, yields remain stunted, mainly due to the deteriorating soil and water quality, increased use of fertilizers to maintain increasing yields, and the extensive use of chemical pesticides. This drives the need to adopt quality analysis technologies.

Environmental Testing Market: COMPANY EVALUATION MATRIX

In the environmental testing market matrixSGS SA (Switzerland), is a global leader in environmental testing markeSGS SA provides comprehensive environmental testing services that cover a wide range of analyses, including quality control, safety testing, and compliance with regulatory standards. The company operates through the following business segments: connectivity & products, health & nutrition, industries & environment, natural resources and knowledge service. Under the subsegment industries & environment, the company offers sampling and testing services for air, soil, water, waste, sustainability services, hygiene solutions, and auditing solutions. SGS, with its vast network of over 2,700 offices across 119 countries and a workforce of nearly 100,000 employees, has been a trusted leader in testing, inspection, and certification for over 145 years. Mérieux NutriSciences (US) is an emerging player in the market.Mérieux NutriSciences is one of the global leaders specializing in food safety, quality, and sustainability. With over 100 accredited laboratories across 25 countries, the company offers tailored solutions such as laboratory testing, food safety management, environmental footprinting, packaging, and regulatory compliance. Mérieux NutriSciences also provides digital solutions, training, and consumer research. Recent initiatives include strategic acquisitions, such as the food testing business of Bureau Veritas, to strengthen its position globally.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 7.14 Billion |

| Revenue Forecast in 2030 | USD 9.32 Billion |

| Growth Rate | CAGR of 4.6% from 2025-2030 |

| Actual data | 2020–2030 |

| Base year | 2024 |

| Forecast period | 2025–2030 |

| Units considered | Value (USD Million), Volume (No.of Tested Samples) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By sample : Wastewater/effluent, soil & sediment, water, air, others • By Technology :Rapid and Conventional • By Tested Material: Microbial contamination, Organic compounds, Inorganic compounds, Residues, Solids • By End-users: Industries, Agriculture and irrigation sector, Government institutes, Research and academic institution, Forestry and geology, Healthcare sector |

| Regions Covered | North America, Europe, Asia Pacific, South America, Row |

WHAT IS IN IT FOR YOU: Environmental Testing Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| US-based Environmental testing service providers | · Competitive profiling of 20+ regional and global players (financials, product mix, pricing strategies) | · Identified white spaces for modular and cost-effective automation |

| Agro chemical input Manufacturers (End-Users of Environmental testing service providers) | Segmentation of environmental testing services by tested material (microbial contamination, organic compounds, inorganic compounds, residues, solids), | Identifies high-margin material types (organic compounds like PFAS command premiums) versus commodity testing (routine microbial screening) |

| Contract Environmental Service Providers | · Mapping of CMOs offering environmental service providers globally and regionally ( specialization, certifications). | · Benchmark industry players, identify gaps in scale and specialization. |

RECENT DEVELOPMENTS

- January 2025 : SGS SA (Switzerland) announced the acquisition of Aster Global Environmental Solutions, Inc., one of the prominent companies in the validation and verification of greenhouse gas emissions, forestry, ecosystem, and corporate social responsibility services. The deal complemented SGS’s Impact Now for sustainability platform and Strategy 27, reinforcing the company’s commitment to meeting escalating global demands for reliable environmental disclosures.

- January 2025 : Eurofins Scientific (Luxembuorg) acquired American Environmental Testing Laboratory, LLC, marking a major milestone. This acquisition expanded Eurofins’ footprint in the U.S. and strengthened its presence in the environmental testing market, enhancing capabilities to deliver comprehensive testing services and further innovation in the sector.

- November 2024 : Bureau Veritas (France) acquired Versatec Energy B.V., a specialized technical advisory company with expertise in the offshore and onshore energy industry. The acquisition strengthened Bureau Veritas' position in the renewables sector, particularly offshore wind, and expanded its service offerings in areas like oil & gas, nuclear, and low-carbon energy such as hydrogen and carbon capture. Versatec's 40 years of experience in health, safety, operational excellence, and technical compliance bolstered Bureau Veritas’ capabilities.

- October 2024 : TÜV Italia, the Italian branch of TÜV SÜD (Germany), acquired Eurotest Laboratori Srl., enhancing their presence in north-eastern Italy. Eurotest specializes in safety and compliance testing across various sectors, including environmental and reliability tests. This further enhanced TÜV SÜD's service portfolio and competitive edge in the environmental testing market.

- August 2024 : ALS (Australia) acquired Wessling Group, an independent testing organization specializing in environmental, pharmaceutical, and food testing, with a strong footprint across 26 sites in Germany, France, Switzerland, and Romania. The acquisition marks a further step in ALS’ strategic growth agenda and establishes a significant presence in Germany and France, Europe’s largest TIC markets, complementing its existing global reach.

Table of Contents

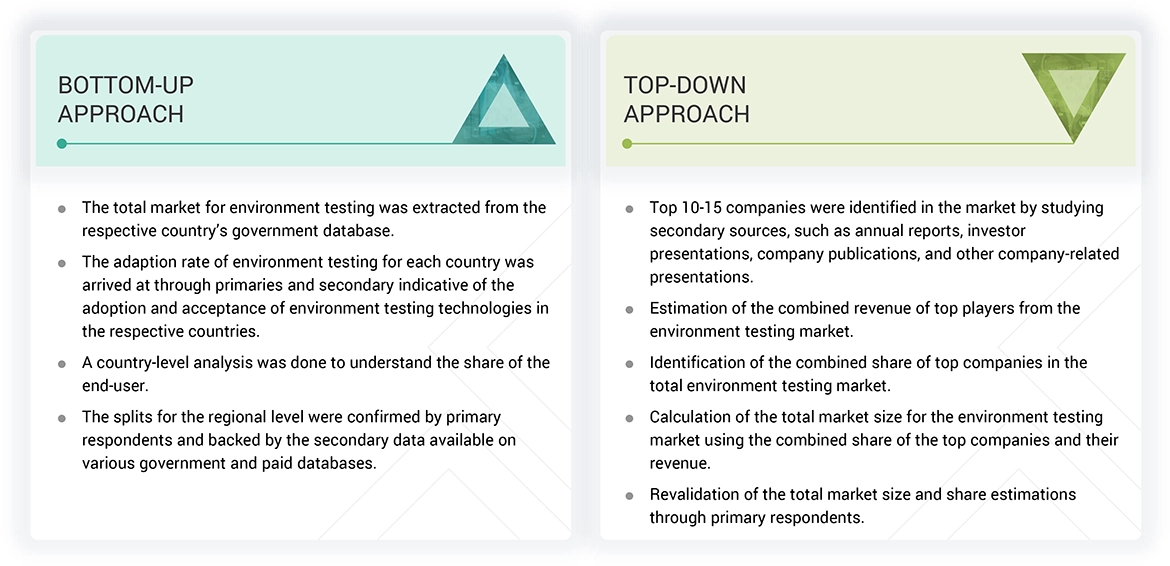

Methodology

The study involved two major approaches in estimating the current size of the environment testing market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, food journals, certified publications, articles from recognized authors, directories, and databases were referred to identify and collect information.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

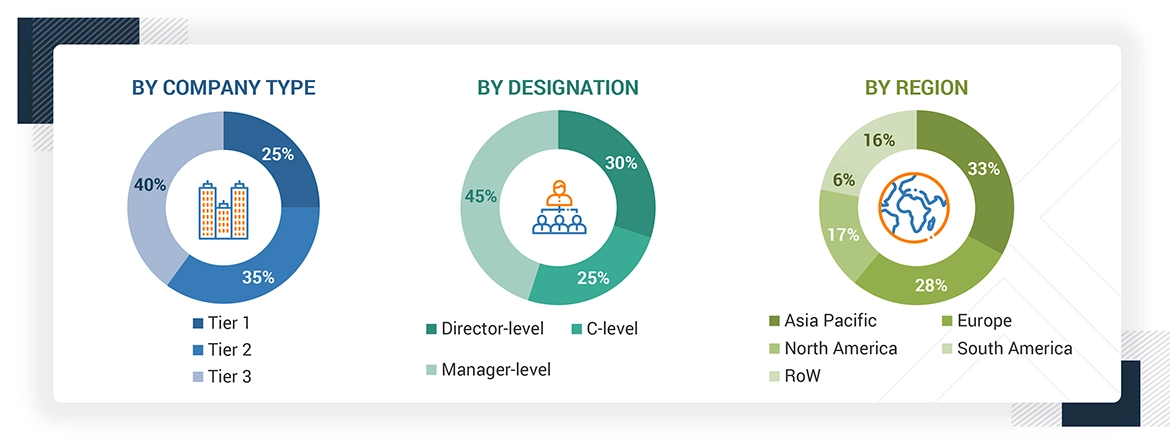

Extensive primary research was conducted after obtaining information regarding the environmental testing market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, South America, and the Rest of the World. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to environmental testing samples, tested material, technology, end-users and region. Stakeholders from the demand side, such as food associations, dealers, distributors, and government agencies, were interviewed to understand the demand side perspective on the suppliers, products, and their current usage of environmental testing and the outlook of their business, which will affect the overall market.

Note: The three tiers of the companies are defined based on their total revenues in 2022 or 2023, as per

the availability of financial data: Tier 1: Revenue > USD 1 billion; Tier 2: USD 100 million = Revenue = USD

1 billion; Tier 3: Revenue USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

SGS SA (Switzerland) |

Regional Sales Manager |

|

Eurofins Scientific (Luxembourg) |

Senior Vice President |

|

TUV SUD (Germany) |

General Manager |

|

Intertek Group Plc (UK) |

Director of Business Development |

|

Bureau Veritas (France) |

Product Specialist |

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the environmental testing market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the overall markets were identified through extensive secondary research.

- All shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from leaders, such as CXOs, directors, and marketing executives.

Environmental Testing Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall environmental testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

The environmental testing market is focused on analyzing and monitoring environmental factors such as air, water, soil, and waste to detect pollutants, hazardous substances, and contaminants. It plays a critical role in ensuring environmental safety, public health, and compliance with environmental regulations. The market involves testing materials like water (drinking, wastewater, and groundwater), soil, air, and industrial waste for harmful substances such as heavy metals, chemicals, pathogens, and volatile organic compounds (VOCs). The demand for environmental testing is driven by the need for strict regulatory compliance, especially from agencies like the EPA, WHO, and EEA, and growing concerns about pollution, climate change, and environmental sustainability.

Stakeholders

- Supply side: Reagent manufacturers & suppliers, diagnostic instruments and kits manufacturers/suppliers, R&D institutes and laboratories, environmental testing service providers, third-party testing & certification laboratories, associations, regulatory bodies, and other industry-related bodies, importers, exporters, & traders, end users.

- Demand side: Industries, agriculture & irrigation sector, government institutes, research and academic institutions, forestry & geology, and healthcare sector that are actively involved in the R&D phase to innovate environmental testing methods.

- Regulatory side: Concerned government authorities, commercial research & development (R&D) institutions, and other regulatory bodies.

- Associations and industry bodies such as the United States Department of Agriculture (USDA), the International Organization for Standardization (ISO), the European Food Safety Authority (EFSA), the Food Safety and Standards Authority of India (FSSAI)

Report Objectives

MARKET INTELLIGENCE

- Determining and projecting the size of the environmental testing market based on sample, tested material, technology, end users, and region from 2025 to 2030

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across the key regions

- Analyzing the demand-side factors based on the following:

- Impact of macro and microeconomic factors on the market

- Shifts in demand patterns across different subsegments and regions

This research report categorizes the environmental testing market based on sample, tested material, technology, end users, and region.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis as per Feasibility

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe environmental testing market into key countries.

- Further breakdown of the Rest of Asia Pacific environmental testing market into key countries.

- Further breakdown of the Rest of South America environmental testing market into key countries.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Key Questions Addressed by the Report

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Environmental Testing Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Environmental Testing Market

User

Feb, 2020

I can see that the report discusses about the various technologies in the industry of environmental testing, I have a keen interest towards the future technological aspects and their impact of technological innovations on the testing market, kindly let me know if such details are available or not?.