Agricultural Testing Market by Sample (Soil, Water, Seed, Compost, Manure, Biosolids, Plant Tissue), Application (Saftey Testing, Quality Assurance), Technology (Conventional, Rapid) and Region ( North America, Europe, APAC, Row) - Global Forecast to 2028

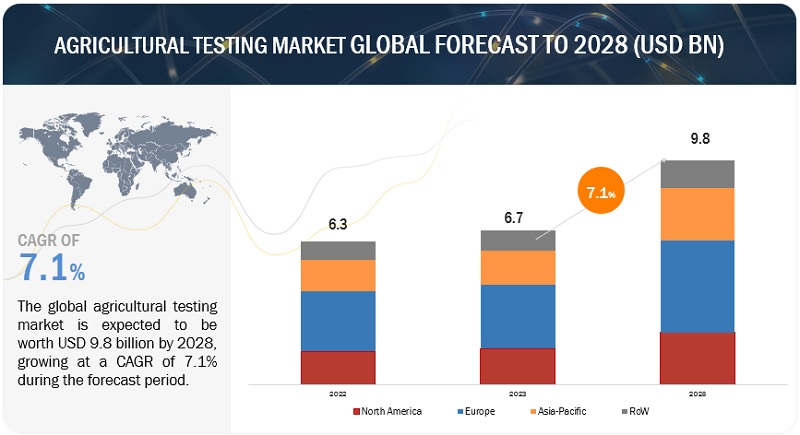

[254 Pages Report] According to MarketsandMarkets, the agricultural testing market is projected to reach USD 9.8 billion by 2028 from USD 6.7 billion by 2023, at a CAGR of 7.1% during the forecast period in terms of value. The agricultural testing market refers to the industry involved in analyzing various agricultural products, such as soil, water, compost, biosolids, manure and seeds, to determine their quality, composition, and presence of contaminants. This type of testing is crucial for ensuring food safety, optimizing crop production, and maintaining environmental sustainability in the agriculture sector. With the growing global population and rising concerns about foodborne illnesses, there is a greater emphasis on ensuring the safety and quality of agricultural products. Testing helps identifying contaminants, pesticides, heavy metals, and pathogens, enabling proactive measures to be taken to maintain food safety standards. The development of advanced testing methods and technologies has improved the efficiency and accuracy of agricultural testing. These advancements include the use of remote sensing, DNA testing, and rapid diagnostic techniques, which have streamlined the testing process and reduced turnaround times.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Stringent safety and quality regulations for agricultural commodities

Stringent safety and quality regulations for agriculture commodities refer to the rules and standards set by regulatory bodies and governments to ensure that agricultural products meet specific safety and quality criteria. These regulations are put in place to protect public health, prevent the spread of diseases, and maintain the overall quality of agricultural commodities. The driver for the agriculture testing market is the need to comply with these regulations. Agricultural producers, processors, and exporters are required to demonstrate that their products meet the established safety and quality standards before they can be sold in domestic or international markets. This creates a demand for agriculture testing services and drives the growth of the agriculture testing market.

In order to curb instances of illnesses, food regulatory authorities focus on the framework and implementation of strict safety and quality regulations for food, feed, and agricultural products and commodities. This has driven the growth of the testing, inspection, and certification markets. Regulatory bodies such as the United States Department of Agriculture (USDA) and European Food Safety Authority (EFSA) are introducing guidelines for testing, inspection, and sampling services for safety and quality assurance. Similar guidelines are adopted by other countries, worldwide, with slight variations and exceptions in laws. For instance, in 2020, the USDA released new guidelines for the production of hemp, a crop that has recently been legalized in the United States. The guidelines set strict limits on the levels of THC (tetrahydrocannabinol), the psychoactive component in hemp, that is allowed in the crop. The guidelines also require testing of hemp crops to ensure that they meet these limits before they can be sold. Also, the European Union (EU) has established regulations for the safety and quality of agricultural products that are sold within the EU. In 2021, the EU announced new regulations for organic farming, which will take effect in 2022. The regulations include stricter rules for the use of pesticides and fertilizers, as well as requirements for animal welfare and soil conservation.

Restraint: Lack of coordination between market stakeholders and supporting infrastructure in developing economies, and improper enforcement of regulatory laws

The lack of coordination between market stakeholders and supporting infrastructure in developing economies, combined with improper enforcement of regulatory laws, can create significant barriers to the growth of the agriculture testing market. For example, in 2020, the World Bank published a report on the challenges facing the agricultural sector in sub-Saharan Africa. The report identified a lack of coordination between governments, farmers, and other stakeholders as a key challenge, which can limit the adoption of new technologies and practices, including agriculture testing services.

In addition, inadequate regulatory law enforcement can undermine the credibility of testing services, making it difficult for companies to gain the trust of farmers and consumers. This can limit the demand for testing services, particularly in developing economies where there may be a lack of awareness about the importance of food safety. According to a report by the Food and Agriculture Organization of the United Nations (FAO), only 21% of developing countries have the necessary regulatory frameworks in place to ensure the safety of food and agricultural products. This highlights the need for greater investment in regulatory infrastructure and improved law enforcement to support the growth of the agriculture testing market.

Thus, the lack of coordination between market stakeholders and supporting infrastructure in developing economies, combined with poor regulatory law enforcement, can create significant challenges for companies operating in the agriculture testing market. However, by working closely with governments, farmers, and other stakeholders, and investing in regulatory infrastructure, companies can overcome these challenges and tap into the significant growth potential of the market.

Opportunity: Technological advancements in the testing industry

The focus on reducing lead time, sample utilization, cost of testing, and drawbacks associated with several technologies has resulted in the development of new technologies such as spectrometry and chromatography. Increased adoption of these technologies is an opportunity for medium- and small-scale laboratories to expand their service offerings and compete with large market players in the industry, as these technologies offer higher sensitivity, accuracy in results, reliability, and multi-contaminant and non-targeted screening with low turnaround time, among other benefits.

The agricultural testing industry is experiencing technological innovations as major players are offering faster and more accurate technologies such as liquid chromatography (LC), high-performance liquid chromatography (HPLC), and inductively coupled plasma mass spectrometry (ICP-MS) for testing the safety and quality of various agricultural samples. These methods are used in the detection of almost all targets to be tested, including pathogens, pesticides, toxins, and heavy metals, among others. One company that has made significant advancements in this area is AgroCares. In 2019, AgroCares launched the AgroCares Scanner, a handheld device that can analyze soil and crop samples on-site, providing real-time nutrient measurements. The device uses near-infrared spectroscopy to assess nutrient levels in the samples, eliminating the need for laboratory testing and reducing the time required to get results. Also, in 2021, the company Purigen Biosystems announced the launch of its new automated DNA extraction system, which is designed to help researchers and testing labs quickly and efficiently extract DNA from complex samples, including those from plants and other agricultural sources. The system uses a proprietary microfluidic technology to isolate and purify DNA and can process up to 96 samples at a time. Also in 2021, the company Eurofins announced the launch of its new "AgroSeq" DNA testing service, which is designed to help agricultural companies and researchers quickly and accurately identify and track genetic traits in crops and livestock. The service uses high-throughput sequencing technology to analyze DNA samples and provide detailed information about genetic variation, which can be used to improve breeding programs, monitor food safety, and more.

Thus, technological advancements in the testing industry are driving innovation and efficiency in the agriculture testing market and creating new opportunities for growth and expansion.

Challenge: The high cost of agriculture testing

The cost constraints associated with agricultural testing pose a significant challenge, particularly for small-scale farmers or those operating in developing regions. The expenses related to laboratory equipment, reagents, and specialized testing services can limit the widespread adoption of testing practices.

Some agricultural tests require specialized expertise or external laboratory services, which can be expensive. Farmers may need to send samples to external laboratories, incurring additional costs for sample transportation and analysis fees. These costs can discourage farmers from conducting comprehensive testing or limit their ability to test multiple parameters. In 2019, a study conducted in Uganda examined the cost-effectiveness of soil testing and its impact on fertilizer use. The research found that the high costs associated with specialized soil testing services were a significant barrier for small-scale farmers. The study emphasized the importance of developing affordable and accessible testing services tailored to the needs and financial capabilities of farmers in developing regions.

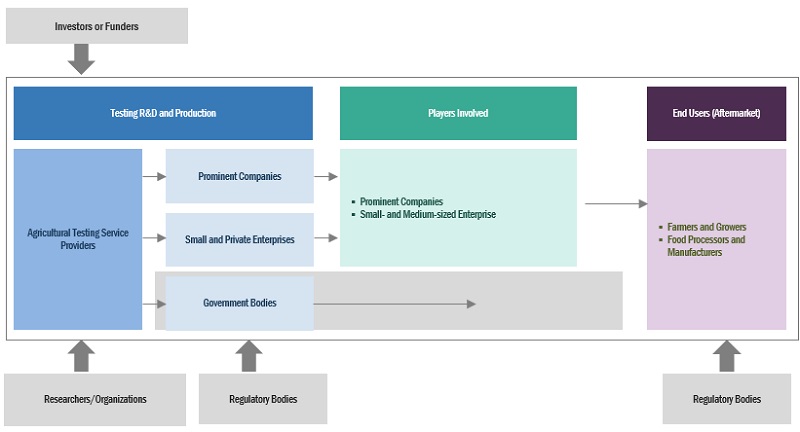

Agricultural Testing Market Ecosystem

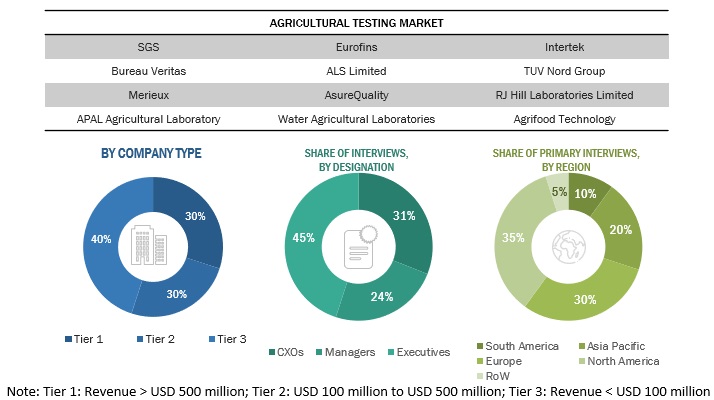

Prominent companies in this market include well-established, financially stable service provider of agriculture testing. These companies have been operating in the market for several years and possess a diversified service portfolio, state-of-the-art laboratory & technologies, and strong global sales and marketing networks. Prominent companies in this market include SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), Bureau Veritas (France), ALS Limited (Australia), TUV Nord Group (Germany), Merieux (US), AsureQuality (New Zealand), RJ Hill Laboratories Limited (New Zealand), SCS Global (US), Agrifood Technology (Australia), APAL Agricultural Laboratory (Australia), Agvise Laboratories (US), LGC Limited (UK) and Water Agricultural Laboratories (US).

By sample, water is projected to have the fastest growing rate during the forecast period.

The demand for water testing in the agricultural sector has increased as farmers and regulatory bodies recognize its significance in maintaining productivity, profitability, and sustainability in agricultural practices. Water is a crucial resource for agriculture, especially in irrigation systems. The quality of water used for irrigation can directly impact crop health and productivity. Testing water for parameters such as pH, salinity, nutrient levels, heavy metals, and microbial contaminants helps farmers determine its suitability for irrigation. High-quality water is essential to avoid damaging crops, soil, and irrigation equipment. Additionally, agricultural practices often involve the use of pesticides, herbicides, and other chemicals to control pests, diseases, and weeds. Runoff from fields can contaminate water sources with these residues. Water testing allows farmers to monitor the presence and concentration of such substances, ensuring compliance with regulations and minimizing potential health risks associated with contaminated water supplies.

By application, safety testing is projected to have fastest growing rate during the forecast period.

products are subject to various national and international regulations, standards, and guidelines. Safety testing is necessary to comply with these regulations and ensure that products meet the specified safety criteria. Non-compliance can result in product recalls, legal consequences, damage to reputation, and loss of market access. By conducting safety testing, agricultural businesses can demonstrate their commitment to meeting regulatory requirements and providing safe products to consumers. Also, agricultural products are often traded internationally, and different countries have specific safety standards and import regulations. Exporting agricultural products requires compliance with the safety requirements of the destination market. Safety testing is necessary to ensure that products meet these standards and avoid potential trade barriers or rejections. Exporters must provide evidence of safety testing to demonstrate the suitability of their products for international markets.

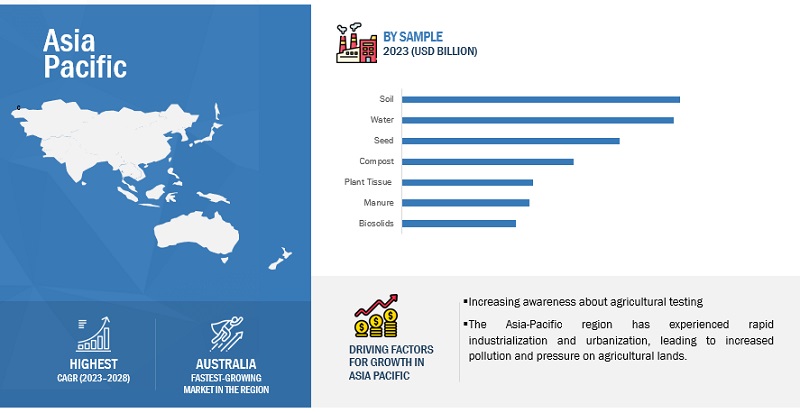

Asia Pacific is expected to have the fastest growing rate during the forecast period.

The Asia-Pacific region is home to a significant portion of the global population, including countries like China and India, which have the world's largest populations. This densely populated region requires extensive agricultural production to meet the growing food demand. As a result, there is a greater need for agricultural testing to ensure the safety, quality, and productivity of agricultural products. The Asia-Pacific region has experienced rapid industrialization and urbanization, leading to increased pollution and pressure on agricultural lands. This has raised concerns about the impact of industrial activities and urban expansion on agricultural productivity and safety. Agricultural testing helps identify and mitigate potential contamination risks, ensuring the safety and sustainability of agricultural practices in the face of urban development.

Key Market Players

The key players covered in the study include SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), Bureau Veritas (France), ALS Limited (Australia), TUV Nord Group (Germany), Merieux (US), AsureQuality (New Zealand), RJ Hill Laboratories Limited (New Zealand), SCS Global (US), Agrifood Technology (Australia), APAL Agricultural Laboratory (Australia), Agvise Laboratories (US), LGC Limited (UK) and Water Agricultural Laboratories (US). These companies have been focusing on expanding their market presence, enhancing their solutions, and partnering with many channel partners and technology companies to cater to consumers across the globe. The deep roots of these players in the market and their robust offerings are among the major factors that have helped them achieve major sales and revenues in the global agricultural testing market.

Scope of the Report

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD) |

|

Segments covered |

By Sample, By Application, By Technology, By Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies studied |

|

Report Scope

Agricultural Testing Market:

By Sample

- Soil

- Water

- Seed

- Compost

- Manure

- Biosoilds

- Plant Tissue

By Application

- Safety Testing

- Quality Assurance

By Technology

- Conventional

- Rapid

By Region

- North America

- Europe

- Asia Pacific

- RoW

Recent Developments

- In January 2022, SGS announced a collaboration with Transmute, a blockchain technology company, to develop supply chain solutions using blockchain technology. The collaboration will focus on developing a platform that provides transparency and traceability across supply chains.

- In April 2023, Eurofins acquired Inlabtech AG, a Swiss manufacturer of microbiological testing equipment. The company acquired Inlabtech AG to expand its testing equipment.

- In May 2021, Intertek acquired SAI Global Assurance, and this will strengthen Intertek’s Assurance offering by providing additional scale, enhanced geographic coverage and new capabilities. In addition to management systems certifications, SAI Global Assurance has a particularly strong position in the Food, Agriculture and QSR end-markets, as well as a good presence in environmental & sustainability audits. The benefit from this is ensuring a stronger market position in Australia, the USA, Canada, the UK and China, and an expanded service capability in attractive end-markets.

Frequently Asked Questions (FAQ):

Which are the major companies in the agriculture testing market? What are their major strategies to strengthen their market presence?

The key players studied in the report include SGS (Switzerland), Eurofins (Luxembourg), Intertek (UK), Bureau Veritas (France), ALS Limited (Australia), TUV Nord Group (Germany), Merieux (US), AsureQuality (New Zealand), RJ Hill Laboratories Limited (New Zealand), SCS Global (US), Agrifood Technology (Australia), APAL Agricultural Laboratory (Australia), Agvise Laboratories (US), LGC Limited (UK) and Water Agricultural Laboratories (US). These companies have been focusing on expanding their market presence, enhancing their solutions, and partnering with many channel partners and technology companies to cater to consumers across the globe. The deep roots of these players in the market and their robust offerings are among the major factors that have helped them achieve major sales and revenues in the global agricultural testing market.

What are the drivers and opportunities for the agriculture testing market?

Stringent government regulations and standards require farmers and agricultural businesses to comply with testing requirements, opening avenues for testing service providers. Additionally, the expansion of export-oriented agriculture creates opportunities for agricultural testing to meet the strict quality and safety standards of international markets.

Which region is expected to hold the highest market share?

The market in Europe will dominate the market share in 2023, showcasing strong demand from agriculture testing services in the region. Europe has robust regulatory frameworks and strict quality standards for agricultural products. These regulations aim to ensure food safety, traceability, and environmental sustainability. Agricultural testing is essential to comply with these regulations and meet the stringent requirements, driving the demand for testing services in the region. Additionally, Europe has a strong focus on organic and sustainable agricultural practices. Organic certification requires strict compliance with specific production and testing standards. The demand for organic products, along with sustainable agriculture initiatives, drives the need for testing services to verify adherence to these standards and ensure the integrity of organic claims.

Which are the key technology trends prevailing in the agriculture testing market?

The agricultural testing industry is experiencing technological innovations as major players are offering faster and more accurate technologies such as liquid chromatography (LC), high-performance liquid chromatography (HPLC), and inductively coupled plasma mass spectrometry (ICP-MS) for testing the safety and quality of various agricultural samples. These methods are used in the detection of almost all targets to be tested, including pathogens, pesticides, toxins, and heavy metals, among others. One company that has made significant advancements in this area is AgroCares. In 2019, AgroCares launched the AgroCares Scanner, a handheld device that can analyze soil and crop samples on-site, providing real-time nutrient measurements. The device uses near-infrared spectroscopy to assess nutrient levels in the samples, eliminating the need for laboratory testing and reducing the time required to get results.

What is the total CAGR expected to be recorded for the agriculture testing market during 2023-2028?

The CAGR is expected to record a CAGR of 7.1% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINTRODUCTIONINCREASE IN ORGANIC AGRICULTURAL FARM AREASCLIMATE CHANGE AND INCREASE IN ABIOTIC STRESS ON PLANTS

-

5.3 MARKET DYNAMICSDRIVERS- Stringent safety and quality regulations for agricultural commodities- Increase in outbreaks of foodborne illnesses- Growth in industrialization and resulting disposal of untreated industrial waste into environmentRESTRAINTS- Improper enforcement of regulations in developing economiesOPPORTUNITIES- Technological advancements in testing industry- Expansion of agricultural exportsCHALLENGES- High cost of agricultural testing- Limited awareness about importance of food safety

- 6.1 INTRODUCTION

-

6.2 VALUE CHAIN ANALYSISRESEARCH AND DEVELOPMENTINPUTAGRICULTURAL TESTINGDISTRIBUTIONMARKETING AND SALESPOST-SALES SERVICES

-

6.3 SUPPLY CHAIN ANALYSISUPSTREAM PROCESS- R&D- Sample collectionMIDSTREAM PROCESS- Transportation- Testing of sampleDOWNSTREAM PROCESS- Final result- DistributionTRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

6.4 TECHNOLOGY ANALYSISINTEGRATION OF ROBOTICS, COMPUTER VISION, AND MACHINE LEARNING FOR WEED AND PEST DETECTIONBIOSENSORS

-

6.5 PATENT ANALYSIS

-

6.6 MARKET MAPMANUFACTURERSSERVICE PROVIDERSTECHNOLOGY PROVIDERSGOVERNMENT AUTHORITIES

- 6.7 KEY CONFERENCES AND EVENTS IN 2023

-

6.8 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.9 REGULATIONSINTRODUCTIONNORTH AMERICA- Environmental Protection Agency (EPA)- Canadian Food Inspection Agency (CFIA)EUROPEASIA PACIFIC- China- India- JapanREST OF THE WORLD- Brazil- Argentina

-

6.10 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTS

-

6.11 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.12 CASE STUDIESENHANCING CROP YIELD AND QUALITY THROUGH ADVANCED AGRICULTURAL TESTING: CASE STUDY WITH AGSOURCESUPPORTING SUSTAINABLE AGRICULTURE THROUGH ACCURATE AND RELIABLE TESTING: CASE STUDY WITH SGS

- 7.1 INTRODUCTION

-

7.2 SOILSTRINGENT SOIL POLLUTION REGULATIONS TO DRIVE GROWTH

-

7.3 WATERINCREASING AWARENESS OF IMPACT OF WATER POLLUTION ON CROP HEALTH TO PROPEL GROWTH

-

7.4 SEEDSINCREASING ADOPTION AND COMMERCIALIZATION OF GENETICALLY MODIFIED SEEDS TO FUEL GROWTH

-

7.5 COMPOSTGROWING EMPHASIS ON SOIL HEALTH AND SUSTAINABLE AGRICULTURE PRACTICES TO DRIVE GROWTH

-

7.6 MANUREECONOMICALLY OPTIMUM CROP PRODUCTION WITH MINIMUM ENVIRONMENTAL IMPACT TO DRIVE GROWTH

-

7.7 BIOSOLIDSNEED FOR EFFECTIVE NUTRIENT MANAGEMENT, ENVIRONMENTAL SUSTAINABILITY, AND REGULATORY COMPLIANCE TO DRIVE GROWTH

-

7.8 PLANT TISSUEPLANT TISSUE TESTING PROVIDES CRUCIAL INSIGHTS INTO CROP NUTRITION

- 8.1 INTRODUCTION

-

8.2 SAFETY TESTINGTOXINS- Growing focus on identifying and mitigating toxin-related risks to drive growthPATHOGENS- Growing need to ensure food safety and prevent foodborne illnesses to drive growthHEAVY METALS- Risks posed by heavy metals in agricultural produce to drive growthPESTICIDES- Focus on minimizing pesticide poisoning to boost growthOTHER TARGETS

-

8.3 QUALITY ASSURANCEQUALITY ASSURANCE APPLICATIONS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- 9.1 INTRODUCTION

-

9.2 CONVENTIONAL TECHNOLOGIESAGAR CULTURING- Agar culturing provides platform for isolating and identifying microorganisms present in soil, water, and plant samples

-

9.3 RAPID TECHNOLOGIESSPECTROMETRY AND CHROMATOGRAPHY- Ability to provide accurate and reliable analysis to drive growthPOLYMERASE CHAIN REACTION- Rapid and accurate detection capabilities to boost growthENZYME-LINKED IMMUNOSORBENT ASSAY- High sensitivity and specificity to propel growth

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Significant contribution of agriculture sector to GDP to drive market growthCANADA- Growing and diverse nature of primary agriculture activities in Canada to drive demand for agricultural testing servicesMEXICO- Growing agricultural export to boost demand for agricultural testing services

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Environmental protection and food safety regulations in Germany to support growthUK- Government initiatives to boost adoption of agricultural testing services in coming yearsFRANCE- Growing environmental sustainability initiatives to fuel market in FranceITALY- Growing popularity of organic farming to boost marketSPAIN- Degraded soil quality to boost market for agricultural testing in SpainREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISCHINA- Expanding agricultural sector and increasing focus on food safety to drive marketJAPAN- Increased focus on safety and quality standards to fuel growthINDIA- Record-breaking wheat and rice harvests in India and increased exports to boost demand for agricultural testing servicesAUSTRALIA- Biodiversity laws and increased agricultural imports to support marketREST OF ASIA PACIFIC

-

10.5 REST OF THE WORLD (ROW)REST OF THE WORLD: RECESSION IMPACT ANALYSISBRAZIL- Pest management and good quality produce to serve as driving factors for market growthARGENTINA- Strong focus on agricultural research and innovation to propel growthOTHER ROW COUNTRIES

- 11.1 OVERVIEW

- 11.2 MARKET SHARE ANALYSIS, 2022

- 11.3 KEY PLAYER STRATEGIES

- 11.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

-

11.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSSAMPLE FOOTPRINT

-

11.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

-

11.7 COMPETITIVE SCENARIODEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSSGS- Business overview- Services offered- Recent developments- MnM viewEUROFINS- Business overview- Services offered- Recent developments- MnM viewINTERTEK- Business overview- Services offered- Recent developments- MnM viewBUREAU VERITAS- Business overview- Services offered- MnM viewALS LIMITED- Business overview- Services offered- MnM viewTÜV NORD GROUP- Business overview- Services offered- MnM viewMÉRIEUX- Business overview- Services offered- MnM viewASUREQUALITY- Business overview- Services offered- MnM viewRJ HILL LABORATORIES LIMITED- Business overview- Services offered- MnM viewSCS GLOBAL- Business overview- Services offered- MnM viewAGRIFOOD TECHNOLOGY- Business overview- Services offered- MnM viewAPAL AGRICULTURAL LABORATORY- Business overview- Services offered- MnM viewAGVISE LABORATORIES- Business overview- Services offered- MnM viewLGC LIMITED- Business overview- Services offered- MnM viewWATERS AGRICULTURAL LABORATORIES- Business overview- Services offered- MnM view

-

12.2 OTHER PLAYERSADVANCED ANALYTICAL TESTING LABORATORY- Business overview- Services offered- MnM viewELEMENTS MATERIAL TECHNOLOGY- Business overview- Services offered- MnM viewAMERICAN ENVIRONMENTAL TESTING LABORATORY, LLC.- Business overview- Services offered- MnM viewTRACE GENOMICS- Business overview- Services offered- MnM viewPACE ANALYTICAL- Business overview- Services offered- MnM viewAGROSMARTCITY ANALYSTSALPHA ANALYTICAL, INC.AGROCARESSOURCE MOLECULAR

- 13.1 INTRODUCTION

-

13.2 ENVIRONMENTAL TESTING MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWENVIRONMENTAL TESTING MARKET, BY TARGET TESTEDENVIRONMENTAL TESTING MARKET, BY REGION

-

13.3 FOOD SAFETY TESTING MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWFOOD SAFETY TESTING MARKET, BY TARGET TESTEDFOOD SAFETY TESTING MARKET, BY REGION

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2021

- TABLE 2 AGRICULTURAL TESTING MARKET SHARE SNAPSHOT, 2023 VS. 2028 (USD MILLION)

- TABLE 3 KEY PATENTS FOR AGRICULTURAL TESTING MARKET, 2022–2023

- TABLE 4 AGRICULTURAL TESTING MARKET: ECOSYSTEM

- TABLE 5 AGRICULTURAL TESTING MARKET: LIST OF CONFERENCES AND EVENTS, 2023

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 AGRICULTURAL TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SERVICES (%)

- TABLE 12 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- TABLE 13 CASE STUDY 1: IMPROVED QUALITY AND SAFETY OF AGRICULTURAL PRODUCTS THROUGH ADVANCED TESTING

- TABLE 14 CASE STUDY 2: HELPING A COFFEE PRODUCER ENSURE PRODUCT QUALITY AND SAFETY WITH COMPREHENSIVE TESTING SERVICES

- TABLE 15 AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 16 AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 17 SOIL: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 18 SOIL: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 WATER: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 20 WATER: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 SEEDS: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 22 SEEDS: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 COMPOST: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 24 COMPOST: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 MANURE: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 26 MANURE: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 BIOSOLIDS: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 BIOSOLIDS: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 PLANT TISSUE: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 PLANT TISSUE: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 32 AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 33 SAFETY TESTING: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 SAFETY TESTING: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 SAFETY TESTING: AGRICULTURAL TESTING MARKET, BY TARGET, 2018–2022 (USD MILLION)

- TABLE 36 SAFETY TESTING: AGRICULTURAL TESTING MARKET, BY TARGET, 2023–2028 (USD MILLION)

- TABLE 37 TOXINS: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 38 TOXINS: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 PATHOGENS: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 PATHOGENS: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 HEAVY METALS: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 HEAVY METALS: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 PESTICIDES: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 PESTICIDES: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 OTHER TARGETS: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 OTHER TARGETS: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 QUALITY ASSURANCE: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 QUALITY ASSURANCE: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 AGRICULTURAL TESTING MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

- TABLE 50 AGRICULTURAL TESTING MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 51 CONVENTIONAL TECHNOLOGIES: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 52 CONVENTIONAL TECHNOLOGIES: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 RAPID TECHNOLOGIES: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 RAPID TECHNOLOGIES: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 RAPID TECHNOLOGIES: AGRICULTURAL TESTING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 56 RAPID TECHNOLOGIES: AGRICULTURAL TESTING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 57 SPECTROMETRY AND CHROMATOGRAPHY: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 SPECTROMETRY AND CHROMATOGRAPHY: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 POLYMERASE CHAIN REACTION: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 60 POLYMERASE CHAIN REACTION: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 61 ENZYME-LINKED IMMUNOSORBENT ASSAY: AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 ENZYME-LINKED IMMUNOSORBENT ASSAY: AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 AGRICULTURAL TESTING MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 64 AGRICULTURAL TESTING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 66 NORTH AMERICA: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 68 NORTH AMERICA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 70 NORTH AMERICA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 US: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 72 US: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 73 US: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 74 US: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 76 CANADA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 78 CANADA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 79 MEXICO: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 80 MEXICO: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 81 MEXICO: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 82 MEXICO: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 84 EUROPE: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 86 EUROPE: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 88 EUROPE: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 GERMANY: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 90 GERMANY: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 91 GERMANY: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 92 GERMANY: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 UK: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 94 UK: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 95 UK: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 96 UK: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 97 FRANCE: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 98 FRANCE: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 99 FRANCE: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 100 FRANCE: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 101 ITALY: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 102 ITALY: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 103 ITALY: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 104 ITALY: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 SPAIN: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 106 SPAIN: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 107 SPAIN: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 108 SPAIN: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 REST OF EUROPE: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 110 REST OF EUROPE: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 111 REST OF EUROPE: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 115 ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 CHINA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 120 CHINA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 121 CHINA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 122 CHINA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 123 JAPAN: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 124 JAPAN: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 125 JAPAN: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 126 JAPAN: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 127 INDIA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 128 INDIA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 129 INDIA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 130 INDIA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 131 AUSTRALIA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 132 AUSTRALIA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 133 AUSTRALIA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 134 AUSTRALIA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 138 REST OF ASIA PACIFIC: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 REST OF THE WORLD: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 140 REST OF THE WORLD: AGRICULTURAL TESTING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 REST OF THE WORLD: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 142 REST OF THE WORLD: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 143 REST OF THE WORLD: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 144 REST OF THE WORLD: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 145 BRAZIL: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 146 BRAZIL: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 147 BRAZIL: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 148 BRAZIL: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 149 ARGENTINA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 150 ARGENTINA: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 151 ARGENTINA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 152 ARGENTINA: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 OTHER ROW COUNTRIES: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2018–2022 (USD MILLION)

- TABLE 154 OTHER ROW COUNTRIES: AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023–2028 (USD MILLION)

- TABLE 155 OTHER ROW COUNTRIES: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 156 OTHER ROW COUNTRIES: AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 AGRICULTURAL TESTING MARKET: DEGREE OF COMPETITION

- TABLE 158 COMPANY FOOTPRINT, BY SAMPLE

- TABLE 159 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 160 COMPANY FOOTPRINT, BY REGION

- TABLE 161 OVERALL COMPANY FOOTPRINT

- TABLE 162 AGRICULTURAL TESTING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 163 AGRICULTURAL TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UP/SMES

- TABLE 164 AGRICULTURAL TESTING: DEALS

- TABLE 165 AGRICULTURAL TESTING: OTHER DEVELOPMENTS

- TABLE 166 SGS: BUSINESS OVERVIEW

- TABLE 167 SGS: SERVICE OFFERINGS

- TABLE 168 SGS: DEALS

- TABLE 169 SGS: OTHER DEVELOPMENTS

- TABLE 170 EUROFINS: BUSINESS OVERVIEW

- TABLE 171 EUROFINS: SERVICE OFFERINGS

- TABLE 172 EUROFINS: DEALS

- TABLE 173 EUROFINS: OTHER DEVELOPMENTS

- TABLE 174 INTERTEK: BUSINESS OVERVIEW

- TABLE 175 INTERTEK: SERVICE OFFERINGS

- TABLE 176 INTERTEK: DEALS

- TABLE 177 BUREAU VERITAS: BUSINESS OVERVIEW

- TABLE 178 BUREAU VERITAS: SERVICE OFFERINGS

- TABLE 179 ALS LIMITED: BUSINESS OVERVIEW

- TABLE 180 ALS LIMITED: SERVICE OFFERINGS

- TABLE 181 TÜV NORD GROUP: BUSINESS OVERVIEW

- TABLE 182 TÜV NORD GROUP: SERVICE OFFERINGS

- TABLE 183 MÉRIEUX: BUSINESS OVERVIEW

- TABLE 184 MÉRIEUX: SERVICE OFFERINGS

- TABLE 185 ASUREQUALITY: BUSINESS OVERVIEW

- TABLE 186 ASUREQUALITY: SERVICE OFFERINGS

- TABLE 187 RJ HILL LABORATORIES LIMITED: BUSINESS OVERVIEW

- TABLE 188 RJ LABORATORIES LIMITED: SERVICE OFFERINGS

- TABLE 189 SCS GLOBAL: BUSINESS OVERVIEW

- TABLE 190 SCS GLOBAL: SERVICE OFFERINGS

- TABLE 191 AGRIFOOD TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 192 AGRIFOOD TECHNOLOGY: SERVICE OFFERINGS

- TABLE 193 APAL AGRICULTURAL LABORATORY: BUSINESS OVERVIEW

- TABLE 194 APAL AGRICULTURAL LABORATORY: SERVICE OFFERINGS

- TABLE 195 AGVISE LABORATORIES: BUSINESS OVERVIEW

- TABLE 196 AGVISE LABORATORIES: SERVICE OFFERINGS

- TABLE 197 LGC LIMITED: BUSINESS OVERVIEW

- TABLE 198 LGC LIMITED: SERVICE OFFERINGS

- TABLE 199 WATERS AGRICULTURAL LABORATORIES: BUSINESS OVERVIEW

- TABLE 200 WATERS AGRICULTURAL LABORATORIES: SERVICE OFFERINGS

- TABLE 201 ADVANCED ANALYTICAL TESTING LABORATORY: BUSINESS OVERVIEW

- TABLE 202 ADVANCED ANALYTICAL TESTING LABORATORY: SERVICE OFFERINGS

- TABLE 203 ELEMENTS MATERIAL TECHNOLOGY: BUSINESS OVERVIEW

- TABLE 204 ELEMENTS MATERIAL TECHNOLOGY: SERVICE OFFERINGS

- TABLE 205 AMERICAN ENVIRONMENTAL TESTING LABORATORY, LLC.: BUSINESS OVERVIEW

- TABLE 206 AMERICAN ENVIRONMENTAL TESTING LABORATORY, LLC.: SERVICE OFFERINGS

- TABLE 207 TRACE GENOMICS: BUSINESS OVERVIEW

- TABLE 208 TRACE GENOMICS: SERVICE OFFERINGS

- TABLE 209 PACE ANALYTICAL: BUSINESS OVERVIEW

- TABLE 210 PACE ANALYTICAL: SERVICE OFFERINGS

- TABLE 211 ENVIRONMENTAL TESTING MARKET FOR ORGANIC COMPOUNDS, BY SAMPLE, 2018–2021 (USD MILLION)

- TABLE 212 ENVIRONMENTAL TESTING MARKET FOR ORGANIC COMPOUNDS, BY SAMPLE, 2022–2027 (USD MILLION)

- TABLE 213 ENVIRONMENTAL TESTING MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 214 ENVIRONMENTAL TESTING MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 215 FOOD SAFETY TESTING MARKET, BY TARGET TESTED, 2017–2021 (USD MILLION)

- TABLE 216 FOOD SAFETY TESTING MARKET, BY REGION, 2017–2021 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 AGRICULTURAL TESTING MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 AGRICULTURAL TESTING MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 AGRICULTURAL TESTING MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 AGRICULTURAL TESTING MARKET: MARKET SIZE ESTIMATION (SUPPLY SIDE)

- FIGURE 7 AGRICULTURAL TESTING MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 WORLD INFLATION RATE, 2011–2021

- FIGURE 11 GLOBAL GDP, 2011–2021

- FIGURE 12 AGRICULTURAL TESTING MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 13 AGRICULTURAL TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF AGRICULTURAL TESTING MARKET

- FIGURE 17 STRINGENT SAFETY AND QUALITY REGULATIONS FOR AGRICULTURAL COMMODITIES TO DRIVE MARKET

- FIGURE 18 PATHOGEN TESTING TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 SPECTROMETRY AND CHROMATOGRAPHY SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 20 QUALITY ASSURANCE SEGMENT TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN AGRICULTURAL TESTING MARKET IN 2023

- FIGURE 21 US ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 22 GROWTH OF ORGANIC AGRICULTURAL LAND, 1999–2019

- FIGURE 23 AGRICULTURAL TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 AGRICULTURAL TESTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS: AGRICULTURAL TESTING MARKET

- FIGURE 26 REVENUE SHIFT FOR AGRICULTURAL TESTING SERVICES

- FIGURE 27 PATENTS GRANTED FOR AGRICULTURAL TESTING MARKET, 2012–2022

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED FOR AGRICULTURAL TESTING MARKET, 2012–2022

- FIGURE 29 AGRICULTURAL TESTING: MARKET MAP

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR SERVICES

- FIGURE 31 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR

- FIGURE 32 AGRICULTURAL TESTING MARKET, BY SAMPLE, 2023 VS. 2028

- FIGURE 33 AGRICULTURAL TESTING MARKET, BY APPLICATION, 2023 VS. 2028

- FIGURE 34 AGRICULTURAL TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028

- FIGURE 35 AGRICULTURAL TESTING MARKET, BY REGION, 2023 VS. 2028

- FIGURE 36 AUSTRALIA TO REGISTER HIGHEST GROWTH RATE IN AGRICULTURAL TESTING MARKET DURING FORECAST PERIOD

- FIGURE 37 INFLATION: COUNTRY-LEVEL DATA (2018–2021)

- FIGURE 38 NORTH AMERICA: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 39 EUROPE: AGRICULTURAL TESTING MARKET SNAPSHOT

- FIGURE 40 EUROPE: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 41 EUROPE: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 42 ASIA PACIFIC: AGRICULTURAL TESTING MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: INFLATION RATES, BY KEY COUNTRY, 2017–2021

- FIGURE 44 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 45 REST OF THE WORLD: INFLATION RATES, BY KEY COUNTRY, 2018–2021

- FIGURE 46 REST OF THE WORLD: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 47 AGRICULTURAL TESTING MARKET: SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 48 AGRICULTURAL TESTING MARKET: COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 49 AGRICULTURAL TESTING MARKET: COMPANY EVALUATION QUADRANT, 2022 (START-UP/SME)

- FIGURE 50 SGS: COMPANY SNAPSHOT

- FIGURE 51 EUROFINS: COMPANY SNAPSHOT

- FIGURE 52 INTERTEK: COMPANY SNAPSHOT

- FIGURE 53 BUREAU VERITAS: COMPANY SNAPSHOT

- FIGURE 54 ALS LIMITED: COMPANY SNAPSHOT

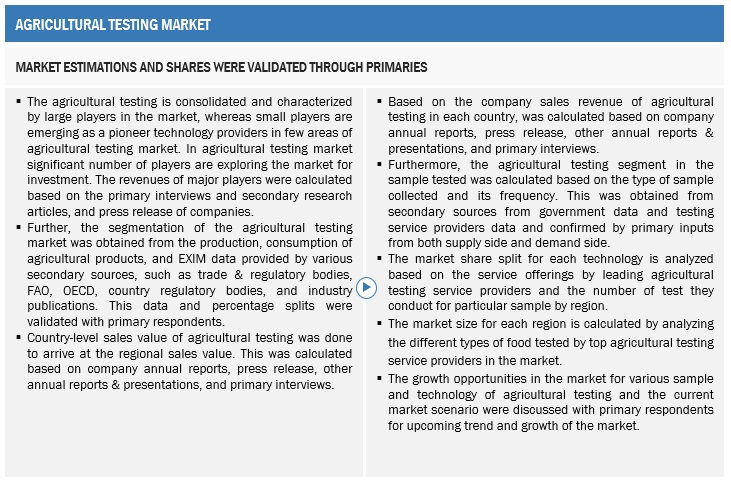

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the agricultural testing market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), CropLife Europe, U.S. Environment Protection Agency, Plant Protection Association of India, International Association for the Plant Protection Sciences, Organization for Economic Co-operation & Developments (OECD), were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The agricultural testing market comprises several stakeholders, including agricultural testing service providers and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviewees from the supply side include research institutions involved in R&D to introduce technology, agricultural testing providers, and technology providers. Primary sources from the demand-side include key opinion leaders, executives, vice presidents, and CEOs of food manufacturers and growers through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the agricultural testing market. These approaches have also been used extensively to determine the size of the various sub-segments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and market have been identified through extensive secondary research.

- The agricultural testing value chain and market size in terms of value have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the agricultural testing market were considered while estimating the market size.

- All the possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for this study.

Market size estimation: Bottom-up approach

- In the bottom-up approach, agricultural testing for application, sample testing, technology, and region were added up to arrive at the global and regional market size and CAGR.

- The bottom-up procedure has been employed to arrive at the overall size of the agricultural testing market from the revenues of key players (companies) and their product share in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: top-down approach

For the calculation of each type of specific market segment, the most appropriate, immediate parent and peer market sizes were used for implementing the top-down procedure.

Secondary reports from various sources like company revenues, associations, and regulatory bodies were considered. Further, appropriate weightage was assigned to the data derived from each parameter to arrive at the final shares for each region. The regional demand-supply trends, presence of labs, and regulatory scenario were also analyzed to further validate the shares arrived at. These shares were then confirmed with primary respondents from across regions.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall agricultural testing market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Agricultural testing refers to the process of analyzing various agricultural products, such as soil, water, crops, and livestock, to evaluate their quality, composition, and safety. The agriculture testing market refers to the industry that analyses soil, water, plant, and animal samples to assess their quality, composition, and potential contaminants. This includes testing of water, soil, compost, manure, biosolids and plant tissue. The agricultural testing market is an important service industry that plays a vital role in ensuring the safety and quality of agriculture sector as well as the environmental concerns. The aim of agricultural testing is to identify potential issues that may impact the productivity, profitability, and sustainability of agricultural operations. This can include testing for nutrient deficiencies or excesses, disease or pest infestations, chemical contaminants, and other factors that may affect the health and yield of crops and livestock. Agricultural testing is used by farmers, agricultural researchers, and regulatory agencies to ensure that agricultural products are safe, of high quality, and meet regulatory standards.

Key Stakeholders

- Agricultural & farming industry

- Farmers

- R&D institutes & laboratories

- Agricultural testing service providers and third-party testing & certification laboratories

- Agricultural testing equipment/ technology manufacturers

- Regulatory bodies

- The Food and Drug Administration (FDA), the European Food Safety Authority (EFSA), Food Standards Australia New Zealand (FSANZ), the Food Safety Commission of Japan, the Agri-Food & Veterinary Authority of Singapore (AVA) (Singapore), and the Canadian Food Inspection Agency

- Government agencies and NGOs

- Component suppliers

- Reagent manufacturers & suppliers

- Diagnostic instrument & kit manufacturers/suppliers

Report Objectives

Market Intelligence

- Determining and projecting the size of the global agricultural testing market, with respect to based on sample, application, technology and regional markets, over a five-year period, ranging from 2023 to 2028

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework for major countries related to the agricultural testing market.

- Analyzing the micro markets, with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key players in the global agricultural testing market

- Providing a comparative analysis of market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions

- Analyzing the value chain and products across the key regions and their impact on the prominent market players

- Providing insights on key product innovations and investments in the global agricultural testing market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of European agricultural testing market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Agricultural Testing Market