Fertility Test Market by Product (Ovulation Predictor Kits, Fertility Monitors (Urine, Saliva, Blood)), Mode of Purchase (OTC, Prescription, Online), Application (Female, Male), End User (Home care, Fertility clinics, hospitals) & Region - Global Forecast to 2025

Market Growth Outlook Summary

The global fertility test market growth forecasted to transform from $472 million in 2020 to $680 million by 2025, driven by a CAGR of 7.5%. Growth in this market is primarily driven by the increasing first-time pregnancy age in women, the declining fertility rate among men and women, the growing number of women suffering from disorders such as PCOS, the emergence of advanced ovulation monitors, and the increased awareness of fertility testing in both developed and developing countries.

Fertility Test Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Fertility Test Market Dynamics

Driver: Increasing first-time pregnancy age

Over the last few decades, the average age of first-time pregnancy has increased drastically across the globe, owing to the decline in first births among teenage women and the increase in first births among women over the age of 30. According to the OECD, the average age at which women give birth now stands at 30 or above; this trend is mostly being observed as women across the globe are showcasing a greater preference for postponing first-time pregnancies.

Listed below are some significant products launched in recent years:

- According to the OECD Family Database, the average mean age of first-time pregnancy across OECD-25 countries has increased from 29 to 30 during 2015–2019. Mexico is the only OECD-country having a mean average age of 28 or less.

- The rate of first-time pregnancies in young women (under the age of 20) stands at just 11.8 births per 1,000, which is in correlation with the increasing mean age of first-time pregnancies (Source: OECD).

- According to UNICEF, the average age of women at the birth of the first child in Canada has increased by ~1.5 years from 27.5 to 29 during 2005 to 2017.

- In the Netherlands, the average age of first-time mothers increased from 29.4 years in 2013 to 29.9 years in 2019 (Source: CBS, 2019).

Restraint: Lesser precision of ovulation prediction kits

Ovulation prediction kits measure the luteinizing hormone (LH) surge that precedes about 24–36 hours prior to ovulation. These kits, however, cannot accurately confirm ovulation. In conditions such as luteinized unruptured follicle syndrome (in which a woman’s egg fails to emerge from its follicle after the LH surge occurs), ovulation predictors fail to give accurate results. Also, urinary LH measurement is only predictive of the onset of ovulation and cannot determine the date of ovulation or anovulation, thereby only indicating a very small period (of only about two days) of the fertile window.

Ovulation monitors can only test LH and do not identify other important ovulation signs, such as whether the cervical mucus is conductive for fertilization. Also, these monitors do not work when certain fertility drugs, such as Pergonal or the hormone HCG (human chorionic gonadotropin), are present in the urine. Another major drawback of these kits is that they do not function for women in their 40s (specifically those approaching menopause) as they have increased levels of LH. These disadvantages of ovulation monitors limit their predictive capabilities and, thus, are restricting their adoption among end users.

Opportunity: Emerging nations to offer new growth avenues

Emerging markets such as China, India, Brazil, and Mexico are expected to offer significant growth opportunities to players operating in the fertility test industry. The demand for fertility and ovulation monitors in emerging countries is expected to grow significantly in the coming years due to the rising infertility rates, increasing prevalence of PCOS and obesity, growing fertility education, and easy availability of fertility monitors through e-commerce websites, pharmacies, and retail shops/drugstores. In addition, friendly regulatory policies and less competition among players in developing markets (as compared to developed markets) have encouraged companies to focus on emerging countries.

Challenge: High cost of fertility testing monitors

Price and brand recognition are two important criteria for the adoption of fertility testing kits and monitors across the globe. Being elective and non-reimbursable in nature, the price of a device is a prime determinant for its use. Although advanced branded fertility monitors possess high accuracy in identifying the fertility window, they are priced at a premium due to the high costs involved in maintaining brand loyalty, obtaining regulatory approvals, and incorporating the software in the systems. Owing to the high cost of these fertility monitors, a very limited number of patients in developing countries can afford them. This, in turn, is limiting the acceptance of these products, mainly in developing countries.

Based on the purchase mode, the OTC segment is expected to register significant growth in the fertility test industry during the forecast period.

Based on the mode of purchase, the fertility test market is segmented into direct/prescription, OTC, and online products. The OTC segment had the largest market share and was growing rapidly in 2020. The high growth of this segment is attributed to the inclination of patients towards self-monitoring of healthcare conditions, increasing initiatives by market players to spread awareness about fertility, and the rising preference for confidentiality and accessibility of test results.

Based on application, the female fertility testing segment is expected to account for the largest share of the fertility test industry.

The fertility test market is divided into two segments based on application: female fertility testing and male fertility testing. Female fertility testing accounted for a larger market share in 2020, owing to declining female fertility rates, the availability of a wide range of fertility testing options for females, an increase in gynaecological issues in women (such as PCOD/PCOS), and the high cost of IVF procedures.

The ovulation prediction kits segment is expected to account for the largest share in the fertility test industry during the forecast period.

Based on products, the fertility test market is segmented into ovulation prediction kits, fertility monitors, and male fertility testing products. A large share is attributed to the ovulation prediction kits segment due to the increasing use of these kits, their easy over-the-counter availability and low cost, and their higher accuracy than natural fertility testing techniques such as calendar methods and cervical mucus monitoring.

The home care settings segment is expected to register the highest CAGR in the fertility test industry during the forecast period.

Based on end-users, the fertility test market has been segmented based on end-user categories—home care settings, hospitals, fertility clinics, and other end users. This segment's large share and rapid growth can be attributed to patients' preference for self-monitoring of healthcare conditions, easy access to fertility and ovulation monitors on e-commerce websites, the availability of user-friendly and easy-to-handle devices, and the growing preference for test result confidentiality.

North America dominated the global fertility test industry.

North America, comprising the US and Canada, accounted for the largest share of the fertility test market. The large share of this region can primarily be attributed to factors such as the high prevalence of infertility, increasing awareness about fertility testing among women, the rising age of first-time pregnancies in women, and the easy availability of ovulation and fertility monitors through e-commerce websites.

The Asia Pacific region is expected to grow at the highest CAGR in the fertility test industry during the forecast period.

Growth in the Asia Pacific region is primarily due to the growing number of women suffering from lifestyle disorders, increasing funding and investments towards the development of fertility and ovulation monitors, and the growing focus of both international and domestic players on the Asia Pacific fertility test market.

Swiss Precision Diagnostics (Switzerland), Church & Dwight (US), Prestige Brands Holdings (US), bioZhena (US), Fairhaven Health (US), Fertility Focus (UK), Geratherm Medical (Germany), Hilin Life Products (US), UEBE Medical (Germany), AdvaCare Pharma (US), AVA (Switzerland), Babystart (UK), Valley Electronics (Germany), Sensiia (UK), and Mira Care (US), among others, are some of the major players operating in the global fertility test market.

Scope of the Fertility Test Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2020 |

$472 Million |

|

Projected Revenue Size by 2025 |

$680 Million |

|

Industry Growth Rate |

Poised to grow at a CAGR of 7.5% |

|

Market Driver |

Increasing first-time pregnancy age |

|

Market Opportunity |

Emerging nations to offer new growth avenues |

This report has segmented the fertility test market to forecast revenue and analyze trends in each of the following submarkets:

By Application

- Female Fertility Products

- Male Fertility Products

By Mode of Purchase

- Direct/Prescription-based products

- OTC-based products

- Online Products

By Product

- Ovulation Prediction Kits

- Fertility Monitors

- Male Fertility Testing Products

By End User

- Home Care Settings

- Hospitals and Fertility Clinics

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments of Fertility Test Industry

- February 2021, Fertility Focus partnered with ExSeed Health, a home-based sperm testing company. Under this partnership, both companies would together provide solutions to couples planning a pregnancy.

- May 2019, Fertility Focus (UK) launched an updated version of OvuSense App— OvuSense App v.2—with features such as increased flexibility in data viewing (three different ways), more choices for logging events than most of the apps, and increased accuracy in terms of monitoring cycles.

- January 2017, NFI Consumer Healthcare (US), a division of Gregory Pharmaceutical Holdings (US), completed the acquisition of the e.p.t OTC pregnancy.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global fertility test market?

The global fertility test market boasts a total revenue value of $680 million by 2025.

What is the estimated growth rate (CAGR) of the global fertility test market?

The global fertility test market has an estimated compound annual growth rate (CAGR) of 7.5% and a revenue size in the region of $472 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 OBJECTIVES OF THE STUDY

1.2 FERTILITY TEST INDUSTRY DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY USED FOR THE STUDY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 28)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Indicative list of secondary sources

2.1.2 PRIMARY DATA

FIGURE 2 PRIMARY SOURCES

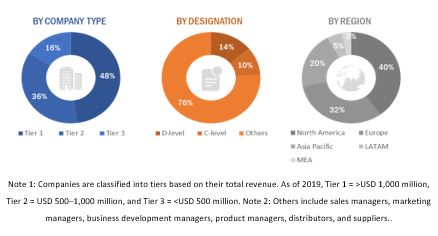

FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET ESTIMATION METHODOLOGY

FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

2.2.1 PRODUCT-BASED MARKET ESTIMATION

2.2.2 VOLUME-BASED MARKET ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: FERTILITY TEST MARKET

FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.2.3 PRIMARY RESEARCH VALIDATION

2.3 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION METHODOLOGY

2.4 RESEARCH ASSUMPTIONS

2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 38)

FIGURE 8 FERTILITY TEST MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GLOBAL MARKET, BY MODE OF PURCHASE, 2020 VS. 2025 (USD MILLION)

FIGURE 10 GLOBAL MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 11 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 12 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 42)

4.1 FERTILITY TEST MARKET OVERVIEW

FIGURE 13 INCREASING FIRST-TIME PREGNANCY AGE TO DRIVE MARKET GROWTH

4.2 GLOBAL FERTILITY TEST INDUSTRY, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 14 OVULATION PREDICTION KITS SEGMENT TO DOMINATE THE MARKET IN 2025

4.3 APAC MARKET SHARE, BY COUNTRY AND APPLICATION (2020)

FIGURE 15 FEMALE FERTILITY TESTING SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2020

4.4 GLOBAL MARKET SHARE, BY END USER, 2020 VS. 2025

FIGURE 16 HOME CARE SETTINGS ARE THE LARGEST END USERS OF FERTILITY TESTING PRODUCTS

4.5 GLOBAL FERTILITY TEST INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 17 CHINA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 47)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 MARKET DYNAMICS: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing first-time pregnancy age

5.2.1.2 Declining fertility rates across the globe

FIGURE 19 DECLINE IN FERTILITY RATE IN THE US, 2008–2018

5.2.1.3 Growing population of women of reproductive age

5.2.1.4 Launch of advanced, easy-to-use fertility testing devices with high accuracy

5.2.1.5 Increasing awareness of fertility testing

5.2.1.6 Growing number of gynecological and reproductive issues in women and men

5.2.2 RESTRAINTS

5.2.2.1 Lesser precision of ovulation prediction kits

5.2.2.2 Unproven accuracy of urine-based ovulation monitors in PCOS/PCOD patients

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of combined kits for dual testing of pregnancy and ovulation

5.2.3.2 Emerging nations to offer new growth avenues

5.2.3.3 Online sales of fertility testing devices

5.2.3.4 High cost and low accuracy of IVF treatment

TABLE 1 COST OF IVF ACROSS VARIOUS COUNTRIES

5.2.4 CHALLENGES

5.2.4.1 High cost of fertility testing monitors

5.3 ECOSYSTEM COVERAGE: PARENT MARKET (IN VITRO DIAGNOSTICS)

5.4 REGULATORY ANALYSIS

5.4.1 US

TABLE 2 US FDA: CLASSIFICATION OF IN VITRO DIAGNOSTIC DEVICES

FIGURE 20 US: REGULATORY PROCESS FOR IVD DEVICES

5.4.2 CANADA

TABLE 3 CANADA: CLASSIFICATION OF IN VITRO DIAGNOSTIC DEVICES

FIGURE 21 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

5.4.3 EUROPE

TABLE 4 EUROPE: CLASSIFICATION OF IN VITRO DIAGNOSTIC DEVICES

FIGURE 22 EUROPE: REGULATORY PROCESS FOR IVD DEVICES

5.4.4 JAPAN

TABLE 5 CLASSIFICATION OF IVD REAGENTS IN JAPAN

5.4.5 CHINA

TABLE 6 CHINA: CLASSIFICATION OF MEDICAL DEVICES

TABLE 7 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION PROCESS

5.4.6 INDIA

FIGURE 23 INDIA: REGULATORY PROCESS FOR IVD DEVICES

5.5 VALUE CHAIN ANALYSIS

5.6 PRICING TREND ANALYSIS

TABLE 8 AVERAGE PRICE OF FERTILITY TESTING PRODUCTS, BY COUNTRY, 2020 (USD)

5.7 PORTER’S FIVE FORCES ANALYSIS

5.7.1 OVERVIEW

TABLE 9 GLOBAL MARKET: PORTER’S FIVE FORCES ANALYSIS

5.7.2 THREAT OF NEW ENTRANTS

FIGURE 24 THREAT OF NEW ENTRANTS

5.7.3 THREAT OF SUBSTITUTES

FIGURE 25 THREAT OF SUBSTITUTES

5.7.4 BARGAINING POWER OF SUPPLIERS

FIGURE 26 BARGAINING POWER OF SUPPLIERS

5.7.5 BARGAINING POWER OF BUYERS

FIGURE 27 BARGAINING POWER OF BUYERS

5.7.6 DEGREE OF COMPETITION

FIGURE 28 DEGREE OF COMPETITION

5.8 NUMBER OF PATIENTS UTILIZING SPECIFIC FERTILITY TECHNIQUES WORLDWIDE (AS OF 2019)

TABLE 10 NUMBER OF PATIENTS UTILIZING SPECIFIC FERTILITY TECHNIQUES WORLDWIDE (AS OF 2019)

5.9 COVID-19 IMPACT

6 FERTILITY TEST MARKET, BY PRODUCT (Page No. - 69)

6.1 INTRODUCTION

TABLE 11 GLOBAL FERTILITY TEST INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 OVULATION PREDICTION KITS

6.2.1 LOW COST AND EASY AVAILABILITY OF OVULATION PREDICTION KITS TO DRIVE THEIR ADOPTION

TABLE 12 OVULATION PREDICTION KITS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 13 OVULATION PREDICTION KITS MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 14 OVULATION PREDICTION KITS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 15 OVULATION PREDICTION KITS MARKET, BY END USER, 2018–2025 (USD MILLION)

6.3 FERTILITY MONITORS

TABLE 16 FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 17 FERTILITY MONITORS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 18 FERTILITY MONITORS MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 19 FERTILITY MONITORS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 20 FERTILITY MONITORS MARKET, BY END USER, 2018–2025 (USD MILLION)

6.3.1 URINE-BASED FERTILITY MONITORS

6.3.1.1 Lower user-interpretation errors and fast and accurate results are advantages offered by urine-based monitors

TABLE 21 URINE-BASED FERTILITY MONITORS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 22 URINE-BASED FERTILITY MONITORS MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 23 URINE-BASED FERTILITY MONITORS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 24 URINE-BASED FERTILITY MONITORS MARKET, BY END USER, 2018–2025 (USD MILLION)

6.3.2 SALIVA-BASED FERTILITY MONITORS

6.3.2.1 Saliva-based monitors offer cost-effectiveness and better hygiene

TABLE 25 SALIVA-BASED FERTILITY MONITORS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 26 SALIVA-BASED FERTILITY MONITORS MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 27 SALIVA-BASED FERTILITY MONITORS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 28 SALIVA-BASED FERTILITY MONITORS MARKET, BY END USER, 2018–2025 (USD MILLION)

6.3.3 BLOOD-BASED FERTILITY MONITORS

6.3.3.1 Cost-effectiveness of blood-based monitors is expected to drive their adoption

TABLE 29 BLOOD-BASED FERTILITY MONITORS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 30 BLOOD-BASED FERTILITY MONITORS MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 31 BLOOD-BASED FERTILITY MONITORS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 32 BLOOD-BASED FERTILITY MONITORS MARKET, BY END USER, 2018–2025 (USD MILLION)

6.3.4 OTHER FERTILITY MONITORS

TABLE 33 OTHER FERTILITY MONITORS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 34 OTHER FERTILITY MONITORS MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 35 OTHER FERTILITY MONITORS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 36 OTHER FERTILITY MONITORS MARKET, BY END USER, 2018–2025 (USD MILLION)

6.4 MALE FERTILITY TESTING PRODUCTS

6.4.1 MALE FERTILITY TESTING PRODUCTS TO ACCOUNT FOR THE LOWEST SHARE OF THE MARKET

TABLE 37 MALE FERTILITY TESTING PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

TABLE 38 MALE FERTILITY TESTING PRODUCTS MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 39 MALE FERTILITY TESTING PRODUCTS MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 40 MALE FERTILITY TESTING PRODUCTS MARKET, BY END USER, 2018–2025 (USD MILLION)

7 FERTILITY TEST MARKET, BY MODE OF PURCHASE (Page No. - 84)

7.1 INTRODUCTION

TABLE 41 FERTILITY TEST INDUSTRY, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

7.2 DIRECT/PRESCRIPTION PRODUCTS

7.2.1 AVAILABILITY OF INSURANCE COVERAGE FOR PRESCRIPTION REFILLS WILL DRIVE THE GROWTH OF THIS SEGMENT

TABLE 42 DIRECT/PRESCRIPTION PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.3 OTC PRODUCTS

7.3.1 TREND OF SELF-MONITORING AND REMOTE ACCESS WILL BOOST THE GROWTH OF THIS SEGMENT

TABLE 43 OTC PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

7.4 ONLINE PRODUCTS

7.4.1 INCREASING NUMBER OF E-PHARMACY PLATFORMS BOOSTING THE GROWTH OF THIS SEGMENT

TABLE 44 ONLINE PRODUCTS MARKET, BY REGION, 2018–2025 (USD MILLION)

8 FERTILITY TEST MARKET, BY APPLICATION (Page No. - 89)

8.1 INTRODUCTION

TABLE 45 FERTILITY TEST INDUSTRY, BY APPLICATION, 2018–2025 (USD MILLION)

8.2 FEMALE FERTILITY TESTING

8.2.1 RISING PREVALENCE OF PCOD/PCOS WILL BOOST THE GROWTH OF THIS SEGMENT

TABLE 46 GLOBAL BURDEN OF PCOS, 2019 (PER MILLION)

TABLE 47 GLOBAL MARKET FOR FEMALE FERTILITY TESTING APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

8.3 MALE FERTILITY TESTING

8.3.1 GROWING ADOPTION OF ADVANCED FERTILITY DEVICES TO AID THE GROWTH OF THIS SEGMENT

TABLE 48 FERTILITY TESTING MARKET FOR MALE FERTILITY TESTING APPLICATIONS, BY REGION, 2018–2025 (USD MILLION)

9 FERTILITY TEST MARKET, BY END USER (Page No. - 94)

9.1 INTRODUCTION

TABLE 49 GLOBAL FERTILITY TEST INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

9.2 HOME CARE SETTINGS

9.2.1 EASY ACCESS TO FERTILITY TESTING PRODUCTS THROUGH E-COMMERCE WEBSITES WILL STIMULATE THE GROWTH OF THIS SEGMENT

TABLE 50 FERTILITY TESTING MARKET FOR HOME CARE SETTINGS, BY REGION, 2018–2025 (USD MILLION)

9.3 HOSPITALS AND FERTILITY CENTERS

9.3.1 INCREASING NUMBER OF FERTILITY CENTERS TO BOOST THE GROWTH OF THIS SEGMENT

TABLE 51 GLOBAL MARKET FOR HOSPITALS AND FERTILITY CENTERS, BY REGION, 2018–2025 (USD MILLION)

9.4 OTHER END USERS

TABLE 52 FERTILITY TESTING MARKET FOR OTHER END USERS, BY REGION, 2018–2025 (USD MILLION)

10 FERTILITY TEST MARKET, BY REGION (Page No. - 98)

10.1 INTRODUCTION

TABLE 53 GLOBAL FERTILITY TEST INDUSTRY, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: FERTILITY TEST MARKET SNAPSHOT

TABLE 54 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 56 NORTH AMERICA: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

10.2.1 US

10.2.1.1 High incidence of PCOD/PCOS will boost the growth of this market

TABLE 60 US: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 61 US: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Decreasing fertility rate and the increasing mean age of first-time pregnancies driving the market

TABLE 62 CANADA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 63 CANADA: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3 EUROPE

TABLE 64 EUROPE: FERTILITY TEST INDUSTRY, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 66 EUROPE: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Increasing fertility concerns and awareness to drive market growth in Germany

TABLE 70 GERMANY: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 71 GERMANY: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.2 UK

10.3.2.1 Government initiatives and promotion of lab-based testing will stimulate market growth

TABLE 72 UK: FERTILITY TEST MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 73 UK: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increasing reforms for the management of POC tests to drive market growth in France

TABLE 74 FRANCE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 75 FRANCE: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Decreasing fertility rates to drive the adoption of fertility testing devices in Italy

TABLE 76 ITALY: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 77 ITALY: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Growing awareness of fertility testing products among women to drive market growth

TABLE 78 SPAIN: FERTILITY TEST INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 79 SPAIN: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 80 ROE: FERTILITY TEST MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 81 ROE: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 82 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 83 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 84 ASIA PACIFIC: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 85 ASIA PACIFIC: MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 86 ASIA PACIFIC: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 87 ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Increasing average age of first-time pregnancies to drive market growth

TABLE 88 JAPAN: FERTILITY TEST INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 89 JAPAN: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.2 CHINA

10.4.2.1 China dominated the Asia Pacific market in 2020

TABLE 90 CHINA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 91 CHINA: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Increasing prevalence of PCOD/PCOS to drive market growth in India

TABLE 92 INDIA: FERTILITY TEST MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 93 INDIA: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.4 AUSTRALIA

10.4.4.1 Supportive government initiatives and rising investments to drive market growth

TABLE 94 AUSTRALIA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 95 AUSTRALIA: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.5 SOUTH KOREA

10.4.5.1 Supportive government initiatives expected to positively impact market growth

TABLE 96 SOUTH KOREA: FERTILITY TEST INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 97 SOUTH KOREA: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 98 ROAPAC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 99 ROAPAC: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.5 LATIN AMERICA

TABLE 100 LATAM: FERTILITY TEST MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 LATAM: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 102 LATAM: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 103 LATAM: MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 104 LATAM: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 105 LATAM: MARKET, BY END USER, 2018–2025 (USD MILLION)

10.5.1 BRAZIL

10.5.1.1 Shrinking population concerns will drive market growth

TABLE 106 BRAZIL: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 107 BRAZIL: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.5.2 MEXICO

10.5.2.1 Increasing population to drive market growth in Mexico

TABLE 108 MEXICO: FERTILITY TEST INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 109 MEXICO: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.5.3 REST OF LATIN AMERICA

TABLE 110 ROLATAM: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 111 ROLATAM: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 UNFAVORABLE REIMBURSEMENT POLICIES ARE EXPECTED TO RESTRAIN MARKET GROWTH IN MEA

TABLE 112 MEA: FERTILITY TEST MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 113 MEA: FERTILITY MONITORS MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 114 MEA: MARKET, BY MODE OF PURCHASE, 2018–2025 (USD MILLION)

TABLE 115 MEA: MARKET, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 116 MEA: MARKET, BY END USER, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 134)

11.1 OVERVIEW

11.2 KEY STRATEGIES

11.3 GLOBAL MARKET SHARE ANALYSIS (2019)

TABLE 117 GLOBAL FERTILITY TEST INDUSTRY: DEGREE OF COMPETITION

FIGURE 31 SWISS PRECISION DIAGNOSTICS HELD THE LEADING POSITION IN THE GLOBAL MARKET IN 2020

11.4 COMPETITIVE LEADERSHIP MAPPING

11.5 VENDOR INCLUSION CRITERIA

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 32 GLOBAL FERTILITY TEST INDUSTRY: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2019

11.6 COMPETITIVE LEADERSHIP MAPPING: EMERGING COMPANIES/SMES/START-UPS (2019)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 33 FERTILITY TEST MARKET: GLOBAL COMPETITIVE LEADERSHIP MAPPING, 2019 (SME/START-UPS)

11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

TABLE 118 PRODUCT FOOTPRINT OF COMPANIES

TABLE 119 APPLICATION FOOTPRINT OF COMPANIES

TABLE 120 REGIONAL FOOTPRINT OF COMPANIES

11.8 COMPETITIVE SCENARIO

11.8.1 PRODUCT LAUNCHES, ENHANCEMENTS, AND APPROVALS

TABLE 121 GLOBAL MARKET: PRODUCT LAUNCHES, ENHANCEMENTS, AND APPROVALS, 2017–2020

11.8.2 EXPANSIONS

TABLE 122 GLOBAL MARKET: EXPANSIONS, 2017–2020

11.8.3 OTHER STRATEGIES

TABLE 123 GLOBAL FERTILITY TEST INDUSTRY: OTHER STRATEGIES, 2017–2020

12 COMPANY PROFILES (Page No. - 146)

12.1 KEY PLAYERS

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.1.1 SWISS PRECISION DIAGNOSTICS

TABLE 124 SWISS PRECISION DIAGNOSTICS: BUSINESS OVERVIEW

TABLE 125 SWISS PRECISION DIAGNOSTICS: PRODUCTS OFFERED

TABLE 126 FERTILITY TEST MARKET: PRODUCT LAUNCHES, JANUARY 2017 TO DECEMBER 2020

12.1.2 CHURCH & DWIGHT

TABLE 127 CHURCH & DWIGHT: BUSINESS OVERVIEW

FIGURE 34 CHURCH & DWIGHT: COMPANY SNAPSHOT (2020)

TABLE 128 CHURCH & DWIGHT: PRODUCTS OFFERED

12.1.3 PRESTIGE BRANDS HOLDINGS

TABLE 129 PRESTIGE BRANDS HOLDINGS: BUSINESS OVERVIEW

TABLE 130 PRESTIGE BRANDS HOLDINGS: PRODUCTS OFFERED

TABLE 131 FERTILITY TESTS MARKET: DEALS, JANUARY 2017 TO DECEMBER 2020

12.1.4 BIOZHENA

TABLE 132 BIOZHENA: BUSINESS OVERVIEW

TABLE 133 BIOZHENA: PRODUCTS OFFERED

12.1.5 FAIRHAVEN HEALTH

TABLE 134 FAIRHAVEN HEALTH: BUSINESS OVERVIEW

TABLE 135 FAIRHAVEN HEALTH: PRODUCTS OFFERED

12.1.6 FERTILITY FOCUS

TABLE 136 FERTILITY FOCUS: BUSINESS OVERVIEW

TABLE 137 FERTILITY FOCUS: PRODUCTS OFFERED

TABLE 138 GLOBAL MARKET: PRODUCT LAUNCHES, JANUARY 2016 TO DECEMBER 2020

TABLE 139 GLOBAL MARKET: DEALS, JANUARY 2016 TO DECEMBER 2020

12.1.7 GERATHERM MEDICAL

TABLE 140 GERATHERM MEDICAL: BUSINESS OVERVIEW

FIGURE 35 GERATHERM MEDICAL: COMPANY SNAPSHOT (2019)

TABLE 141 EXCHANGE RATES: EUR TO USD

TABLE 142 GERATHERM MEDICAL: PRODUCTS OFFERED

12.1.8 HILIN LIFE PRODUCTS

TABLE 143 HILIN LIFE PRODUCTS: BUSINESS OVERVIEW

TABLE 144 HILIN LIFE PRODUCTS: PRODUCTS OFFERED

12.1.9 UEBE MEDICAL

TABLE 145 UEBE MEDICAL: BUSINESS OVERVIEW

TABLE 146 UEBE MEDICAL: PRODUCTS OFFERED

12.1.10 ADVACARE PHARMA

TABLE 147 ADVACARE PHARMA: BUSINESS OVERVIEW

TABLE 148 ADVACARE PHARMA: PRODUCTS OFFERED

12.1.11 AVA

TABLE 149 AVA: BUSINESS OVERVIEW

TABLE 150 AVA: PRODUCTS OFFERED

TABLE 151 GLOBAL MARKET: PRODUCT LAUNCHES, JANUARY 2017 TO DECEMBER 2020

TABLE 152 GLOBAL MARKET: DEALS, JANUARY 2017 TO DECEMBER 2020

12.1.12 BABYSTART (SNOWDEN HEALTHCARE)

TABLE 153 BABYSTART: BUSINESS OVERVIEW

TABLE 154 BABYSTART: PRODUCTS OFFERED

12.1.13 VALLEY ELECTRONICS

TABLE 155 VALLEY ELECTRONICS: BUSINESS OVERVIEW

TABLE 156 VALLEY ELECTRONICS: PRODUCTS OFFERED

12.1.14 SENSIIA

TABLE 157 SENSIIA: BUSINESS OVERVIEW

TABLE 158 SENSIIA: PRODUCTS OFFERED

TABLE 159 FERTILITY TEST MARKET: DEALS, JANUARY 2017 TO DECEMBER 2020

12.1.15 MIRA CARE

TABLE 160 MIRA CARE: BUSINESS OVERVIEW

TABLE 161 MIRA CARE: PRODUCTS OFFERED

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

12.2 OTHER COMPANIES

12.2.1 EXSEED HEALTH

12.2.2 TEMPDROP

12.2.3 PREGMATE

12.2.4 MEDICAL ELECTRONIC SYSTEMS

12.2.5 SWIM COUNT (SUBSIDIARY OF MOTILTYCOUNT APS)

13 APPENDIX (Page No. - 174)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, fundamental market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B), white papers, annual reports, companies house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the fertility test market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

Primary research was conducted after acquiring extensive knowledge about the global fertility test market scenario through secondary research. Primary interviews were conducted with market experts from both the demand-side (such as hospitals, fertility clinics, research universities, academic institutions, and government institutions, among others) and supply-side respondents (such as presidents, CEOs, vice presidents, directors, general managers, heads of business units, and senior managers) across five major geographies, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East, and Africa. Approximately 30% of the primary interviews were conducted with stakeholders from the demand side, while those from the supply side accounted for the remaining 70%. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

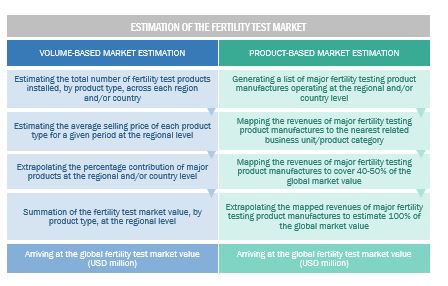

Market Estimation Methodology

A detailed market estimation approach was followed to estimate and validate the size of the global fertility test market and other dependent submarkets.

- The key players in the global fertility test market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology includes the study of the annual and quarterly financial reports of the top market players as well as interviews with industry experts for key insights on the global fertility test market.

- All percentage shares, splits, and breakdowns were determined by using secondary sources and verified through primary sources.

- All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The above-mentioned data was consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After deriving the overall fertility test market value data from the market size estimation process, the total market value data was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments, data triangulation and market breakdown procedures were employed wherever applicable. The data was triangulated by studying various qualitative and quantitative variables as well as by analyzing regional trends for both the demand- and supply-side macroindicators.

Report Objectives

- To define, describe, and forecast the fertility test market based on product, application, mode of purchase, and end user

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall fertility test market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To estimate the size & growth potential of the market segments and subsegments with respect to five key regions—North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa—and key countries

- To profile the key players in the market and comprehensively analyze their global revenue shares and core competencies

- To track and analyze competitive developments, such as product launches and approvals, partnerships, agreements, collaborations, and acquisitions in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the global fertility test market report:

Product analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company information

- Detailed analysis and profiling of additional market players (up to five)

Geographic analysis

- Further breakdown of the Rest of Europe fertility test market into Belgium, Austria, Denmark, Greece, Poland, and Russia, among other countries

- Further breakdown of the Rest of Asia Pacific fertility test market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

- Further breakdown of the Rest of Latin America fertility test market into Argentina and Colombia, among other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fertility Test Market

Which of the segments Fertility Test Market is expected to grow at a highest CAGR during the forecast period?

What are the major revenue growth boosting factors for the Fertility Test Market?

How the technological advancements are boosting the global growth of Fertility Test Market?