Fiber Cement Market by Material (Portland Cement, Application (Siding, Molding & Trim, Backer boards, Flooring, Roofing, Wall Partitions), End use (Residential, Non-residential) and Region - Global Forecast To 2025

Updated on : March 21, 2024

Fiber Cement Market

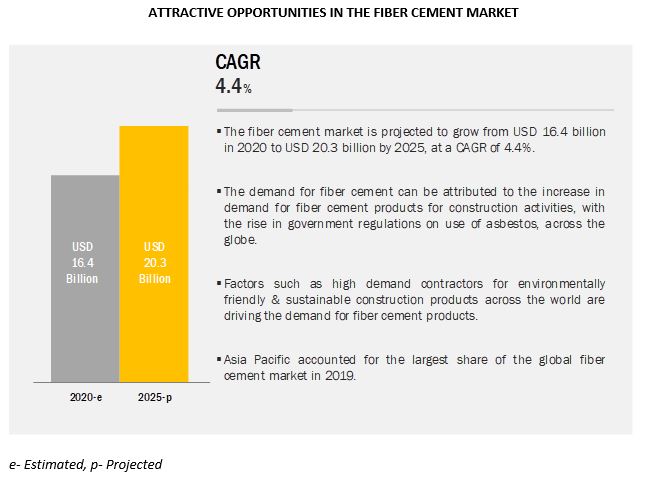

The global fiber cement market size was valued at USD 16.4 billion in 2020 and is projected to reach USD 20.3 billion by 2025, growing at 4.4% cagr from 2020 to 2025. The demand for fiber cement can be attributed to the increase in demand for fiber cement products for construction activities, with the rise in government regulations on use of asbestos, across the globe. Factors such as high demand contractors for environmentally friendly & sustainable construction products across the world are driving the demand for fiber cement products.

In terms of value and volume, the siding segment is projected to lead the fiber cement market from 2020 to 2025.

Based on the application, the siding segment is expected to be the largest market for fiber cement. Siding is the major application of fiber cement in both residential and non-residential constructions. In this application, fiber cement is applied to the exterior sides of the walls to protect them from the effects of extreme weather conditions. Fiber-cement siding also improves the aesthetic appeal of the buildings. Fiber-cement siding is affordable and most suitable for regions having extreme weather conditions.

In terms of volume, the Portland cement segment of the fiber cement market is projected to lead the market by 2025.

By material, the Portland cement is expected to dominate the fiber cement market, in terms of both value and volume. Portland cement is the most widely used type of cement, which is used for making concrete and mortar. The chief chemical components of Portland cement are calcium, silica, alumina, and iron. It is a reasonably priced material and is readily available, which makes it one of the widely used materials for construction globally.

In terms of value and volume, the non-resdential segment to lead the fiber cement market.

By end-use, the non-residential segment is projected to be the largest segment in the fiber cement market. The non-residential segment comprises industrial, commercial, and agricultural buildings of fiber cement. Fiber cement is commonly used in industrial buildings, such as factories, mills, and warehouses, owing to the enforcement of legislation by several governments, such as the UK, the US, and Canada, banning the use of asbestos at such workplaces.

To know about the assumptions considered for the study, download the pdf brochure

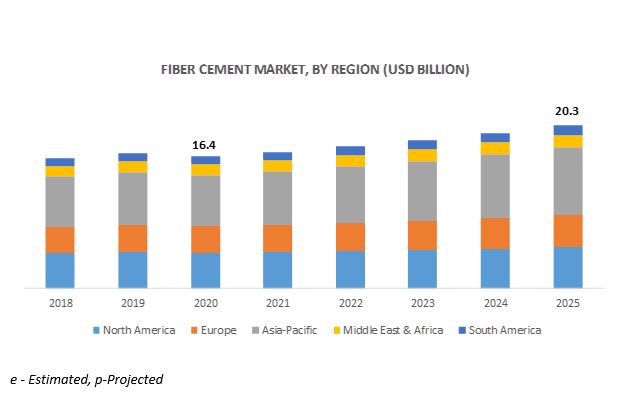

In terms of both value as well as volume, the Asia Pacific region is estimated to account for the highest share in the global fiber cement market during the forecast period.

The Asia Pacific region accounted for the largest market share in 2019. Factors such as improving global economy, growing construction sector, particularly in rapidly-growing countries such as China and India, huge foreign investments, and growing awareness about the ill-effects of using asbestos are expected to boost the market for fiber cement. In addition, stricter norms regarding the use of asbestos cement in the construction of residential and commercial buildings have made it mandatory for builders and related authorities to look for alternatives such as fiber cement. This, in turn, boosts the demand for fiber cement in the Asia Pacific market.

Fiber Cement Market Players

Key players, such as . James Hardie (Ireland), Toray Corporation (Japan), Etex Corporation (Belgium), and Nichiha Corporation (Japan) have adopted these strategies to strengthen their product portfolios, expand their market presence, and enhance their growth prospects in the fiber cement market.

James Hardie is one of the leading player engaged in the production of fiber cement siding and backerboard. It operates through three business units, namely, North America Fiber Cement, Asia Pacific Fiber Cement, and Europe Building Products. The company’s fiber cement building materials serve a wide range of internal & external applications, such as external siding, internal walls, ceilings, floors, soffits, fences, facade, cladding, decking, and roofing. James Hardie’s strong global presence, coupled with the attractive portfolio of fiber cement, makes it a global player in the fiber cement market. Its expertise in fiber cement building materials, and significant investments in its plants and market development programs have contributed toward its significant position in the market.

Recent Developments

- In August 2018, Nichiha Corporation invested USD 120 million to expand its manufacturing site in Macon-Bibb County (US) to widen its operations. This strategic initiative is expected to assist in growing the demand for the company’s products in the south-eastern region of the US.

- In April 2018, James Hardie Industries Plc. acquired Fermacell GmbH (Germany), a building material business, to strengthen its business. This strategic initiative is expected to spur the growth of its fiber cement business across Europe. Furthermore, it would also strengthen its geographical footprint and product portfolio.

- In March 2018, Toray Corporation acquired TenCate Advanced Composites Holding B.V., a subsidiary of Koninklijke Ten Cate B.V. (Netherlands), for USD 1.12 billion to enhance its fiber cement product portfolio and geographical reach.

Key Questions Addressed by the Report:

- What are the global trends in the fiber cement market? Would the market witness an increase or decline in the demand in the coming years?

- What is the estimated demand for different applications of fiber cement?

- Where will the strategic developments take the industry in the mid to long-term?

- What are the upcoming industry applications and trends for fiber cement?

- Who are the major players in the fiber cement market globally?

Frequently Asked Questions (FAQ):

What are the properties of fiber cement products?

Fiber cement is a building material used to cover the exterior materials used in the construction of residential and non-residential buildings. It is produced using three primary components, namely, Portland cement, silica, and cellulose fiber. Fiber cement products are known for their properties, such as high strength, durability, fire-proof, and resistance to deterioration from salt or UV rays.

What are the factors influencing the growth of the fiber cement market?

The growth of the fiber cement market is attributed to the increasing construction activities in the residential and non-residential sectors and government regulations pertaining to the use of asbestos. The increase in demand for durable building materials and the boost in infrastructure development is expected to create lucrative opportunities for the players operating in the fiber cement market. Furthermore, the growth of the market is attributed to the increase in the demand for energy-efficient buildings across the globe. Growing urbanization and industrialization in developing countries, increasing regulations on the usage of asbestos, and expanding construction industry are also contributing to the growth of the fiber cement market.

What are the factors contributing to the final price of fiber cement products?

Major factors contributing to the final price of fiber cement products are the type of raw materials used, the volume of the product required, manufacturing techniques, labor cost, energy cost, and role of the supply chain.

What are the different materials used in manufacturing fiber cement?

Materials used in the manufacturing of fiber cement are Portland cement, sand, cellulosic fiber, paints, and additives. These materials have their specific functions and importance in the final product. For instance, cellulosic fibrous material provides additional strength to fiber cement, while paints and additives improve the aesthetic appeal of the fiber-cement products.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Study Objectives

1.2 Market Definition

1.2.1 Exclusions

1.3 Market Scope

1.3.1 Years Considered

1.3.2 Regional Scope

1.4 Currency

1.5 Unit

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

3.1 Introduction

4 Premium Insights (Page No. - 29)

4.1 Asia Pacific to Hold Largest Share of Fiber Cement Market

4.2 Fiber Cement Market, By Application and Country

4.3 Fiber Cement Market, By Country

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Government Regulations On Use of Asbestos

5.2.1.2 Growing Demand for Fiber Cement Over Its Alternatives

5.2.1.3 Increasing Demand for Energy-Efficient Buildings

5.2.2 Restraints

5.2.2.1 High Installation Cost of Fiber Cement Products

5.2.3 Opportunities

5.2.3.1 Growing Urbanization and Population in Emerging Economies

5.2.3.2 Increasing Construction Activities and Infrastructure Development

5.2.4 Challenges

5.2.4.1 Volatile Raw Material Prices

6 Impact of Covid-19 On Fiber Cement Market (Page No. - 35)

7 Industry Trends (Page No. - 36)

7.1 Introduction

7.2 Porter’s Five Forces Analysis

7.2.1 Threat of New Entrants

7.2.2 Threat of Substitutes

7.2.3 Bargaining Power of Suppliers

7.2.4 Bargaining Power of Buyers

7.2.5 Intensity of Competitive Rivalry

7.3 Social and Environmental Risks Related to Fiber Cement

7.3.1 Social Risks

7.3.2 Environmental Risks

8 Fiber Cement Market, By Material (Page No. - 41)

8.1 Introduction

8.1.1 Fiber Cement Market, By Material

8.2 Portland Cement

8.3 Sand

8.4 Cellulosic Material (Fiber)

8.5 Others

9 Fiber Cement Market, By Application (Page No. - 44)

9.1 Introduction

9.1.1 Fiber Cement Market, By Application

9.2 Molding and Trim

9.3 Siding

9.4 Roofing

9.5 Wall Partitions

9.6 Flooring

9.7 Backer Boards

9.8 Others

10 Fiber Cement Market, By End Use (Page No. - 48)

10.1 Introduction

10.1.1 Fiber Cement Market, By End Use

10.2 Residential

10.3 Non-Residential

10.3.1 Industrial

10.3.2 Commercial

10.3.3 Agricultural

11 Fiber Cement Market, By Region (Page No. - 51)

11.1 Introduction

11.2 Asia Pacific

11.2.1 Asia Pacific: Fiber Cement Market, By Country

11.2.1.1 China Is Estimated to Be Largest Market in Asia Pacific for Fiber Cement

11.2.2 China

11.2.2.1 China Is Estimated to Hold Largest Market in Asia Pacific in 2025

11.2.3 Japan

11.2.3.1 Japan Is Estimated to Be Second-Largest Market in Asia Pacific in 2025

11.2.4 India

11.2.4.1 India Is Estimated to Be Fastest-Growing Market in Asia Pacific

11.2.5 Australia

11.2.5.1 Shift from Use of Asbestos to Drive Market for Fiber Cement in Australia

11.2.6 South Korea

11.2.6.1 South Korea to Be Third-Fastest Growing Market in Asia Pacific DuringForecast Period

11.2.7 Rest of Asia Pacific

11.2.7.1 Rest of Asia Pacific Provides Great Opportunity for Fiber Cement Players to Expand

11.3 Europe

11.3.1 Germany

11.3.1.1 Germany to Lead Fiber Cement Market in Europe By 2025

11.3.2 UK

11.3.2.1 UK to Be Second-Largest Market for Fiber Cement in Europe from 2020 to 2025

11.3.3 France

11.3.3.1 France to Be Fastest-Growing Market for Fiber Cement in Europe from 2020 to 2025

11.3.4 Russia

11.3.4.1 Significant Investments in Infrastructure Development Projects to Boost Fiber Cement Consumption in Russia

11.3.5 Rest of Europe

11.3.5.1 Increased Demand for Fiber Cement from Non-Residential Sector to Fuel Growth of Market in Rest of Europe from 2020 to 2025

11.4 North America

11.4.1 US

11.4.1.1 US to Be Largest Market for Fiber Cement in North America from 2020 to 2025

11.4.2 Canada

11.4.2.1 Canada to Be Second-Fastest Growing Market for Fiber Cement in North America from 2020 to 2025

11.4.3 Mexico

11.4.3.1 Mexico to Be Fastest-Growing Market for Fiber Cement in North America from 2020 to 2025

11.5 Middle East & Africa

11.5.1 UAE

11.5.1.1 UAE Is Expected to Be Second-Fastest Growing Country in Middle Eastern & African Market for Fiber Cement

11.5.2 Saudi Arabia

11.5.2.1 Saudi Arabia Is Expected to Be Fastest-Growing Market for Fiber Cement in Middle East & Africa

11.5.3 South Africa

11.5.3.1 Growth in Construction Activities to Boost Fiber Cement Market in South Africa

11.5.4 Turkey

11.5.4.1 Turkey to Dominate Fiber Cement Market in Middle East & Africa in 2025

11.5.5 Rest of Middle East & Africa

11.5.5.1 Rest of Middle East & Africa Is Projected to Have High Potential for Growth in Fiber Cement Market

11.6 South America

11.6.1 Brazil

11.6.1.1 Brazil to Lead Fiber Cement Market in South America ThroughoutForecast Period

11.6.2 Argentina

11.6.2.1 Increased Investments in Construction Projects to Drive Growth of Fiber Cement Market in Argentina

11.6.3 Rest ofSouth America

11.6.3.1 Significant Investments in Residential and Infrastructure Construction Projects to Fuel Market Growth in Rest ofSouth America

12 Competitive Landscape (Page No. - 102)

12.1 Overview

12.2 Competitive Scenario

12.2.1 Mergers & Acquisitions

12.2.2 Expansions &Investments

12.3 Market Share Analysis

13 Competitive Evaluation Matrix (Page No. - 105)

13.1 Overview

13.1.1 Star

13.1.2 Emerging Leaders

13.1.3 Pervasive

13.1.4 Emerging Companies

13.1.5 Strength ofProduct Portfolio

13.1.6 Business Strategy Excellence

14 Company Profiles (Page No. - 108)

14.1 James Hardie Industries PLC

14.1.1 Business Overview

14.1.2 Financial Assessment

14.1.3 Operational Assessment

14.1.4 Products Offered

14.1.5 SWOT Analysis

14.1.6 Recent Developments

14.1.7 Winning Imperatives

14.1.8 Current Focus and Strategies

14.1.9 Threat from Competition

14.1.10 Right to Win

14.2.1 Business Overview

14.2.2 Financial Assessment

14.2.3 Operational Assessment

14.2.4 Products Offered

14.2.5 Recent Developments

14.2.6 SWOT Analysis

14.2.7 Winning Imperatives

14.2.8 Current Focus and Strategies

14.2.9 Threat from Competition

14.2.10 Right to Win

14.3 EvonikIndustries

14.3.1 Business Overview

14.3.2 Financial Assessment

14.3.3 Operational Assessment

14.3.4 Products Offered

14.3.5 SWOT Analysis

14.3.6 Winning Imperatives

14.3.7 Current Focus and Strategies

14.3.8 Threat from Competition

14.3.9 Right to Win

14.4 Toray Industries

14.4.1 Business Overview

14.4.2 Financial Overview

14.4.3 Operational Assessment

14.4.4 Products Offered

14.4.5 Recent Developments

14.4.6 SWOT Analysis

14.4.7 Winning Imperatives

14.4.8 Current Focus and Strategies

14.4.9 Threat from Competition

14.4.10 Right to Win

14.5 CSR Limited

14.5.1 Business Overview

14.5.2 Operational Assessment

14.5.3 Products Offered

14.5.4 Right to Win

14.6 Nichiha Corporation

14.6.1 Business Overview

14.6.2 Operational Assessment

14.6.3 List ofNichiha’s Group Companies and Their Business Activities

14.6.4 List ofNichiha’s Affiliated Companies (Subsidiaries)

14.6.5 Products Offered

14.6.6 Recent Developments

14.6.7 Right to Win

14.7 Cembrit Group A/S

14.7.1 Business Overview

14.7.2 Operational Assessment

14.7.3 Products Offered

14.7.4 Right to Win

14.8 The Siam Cement Public Company Limited

14.8.1 Business Overview

14.8.2 Operational Assessment

14.8.3 Products Offered

14.8.4 Right to Win

14.9 Plycem Corporation

14.9.1 Business Overview

14.9.2 Products Offered

14.9.3 Right to Win

14.1 Beijing Hocreboard Building Materials Co. Ltd

14.10.1 Business Overview

14.10.2 Operational Assessment

14.10.3 Products Offered

14.10.4 Right to Win

14.11 Other Players

14.11.1 Zhejiang Headerboard Building Materials Co., Ltd.

14.11.2 Zhejiang Hailong New Building Materials Co., Ltd.

14.11.3 Swisspearl

14.11.4 Allura

14.11.5 LatoOjsc

14.11.6 Everest

14.11.7 Shera Public Company Limited

14.11.8 CoverworldUK

14.11.9 TepeBetopan A.S.

14.11.10 Jiahua Special Cement Co., Ltd.

15 Appendix (Page No. - 138)

15.1 Discussion Guide

15.2 Knowledge Store: Marketsandmarkets Subscription Portal

15.3 Available Customizations

15.4 Related Reports

15.5 Author Details

List of Tables (131 Tables)

Table 1 Fiber Cement Market Size, By Material, 2018–2025 (Million Square Meter)

Table 2 Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 3 Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 4 Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 5 Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 6 Fiber Cement Market Size, By Region, 2018–2025 (USD Million)

Table 7 Fiber Cement Market Size, By Region, 2018–2025 (Million Square Meter)

Table 8 Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 9 Fiber Cement Market Size, By Application, 2018–2025 (Million Square Feet)

Table 10 Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 11 Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 12 Asia Pacific: Fiber Cement Market Size, By Country, 2018–2025 (USD Million)

Table 13 Asia Pacific: Fiber Cement Market Size, By Country, 2018–2025 (Million Square Meter)

Table 14 Asia Pacific: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 15 Asia Pacific: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 16 Asia Pacific: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 17 Asia Pacific: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 18 China: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 19 China: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 20 China: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 21 China: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 22 Japan: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 23 Japan: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 24 Japan: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 25 Japan: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 26 India: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 27 India: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 28 India: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 29 India: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 30 Australia: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 31 Australia: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 32 Australia: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 33 Australia: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 34 South Korea: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 35 South Korea: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 36 South Korea: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 37 South Korea: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 38 Rest of Asia Pacific: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 39 Rest of Asia Pacific: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 40 Rest of Asia Pacific: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 41 Rest of Asia Pacific: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 42 Europe: Fiber Cement Market Size, By Country, 2018–2025 (USD Million)

Table 43 Europe: Fiber Cement Market Size, By Country, 2018–2025 (Million Square Meter)

Table 44 Europe: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 45 Europe: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 46 Europe: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 47 Europe: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 48 Germany: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 49 Germany: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 50 Germany: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 51 Germany: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 52 UK: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 53 UK: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 54 UK: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 55 UK: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 56 France: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 57 France: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 58 France: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 59 France: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 60 Russia: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 61 Russia: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 62 Russia: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 63 Russia: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 64 Rest of Europe: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 65 Rest of Europe: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 66 Rest of Europe: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 67 Rest of Europe: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 68 North America: Fiber Cement Market Size, By Country, 2018–2025 (USD Million)

Table 69 North America: Fiber Cement Market Size, By Country, 2018–2025 (Million Square Meter)

Table 70 North America: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 71 North America: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 72 North America: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 73 North America: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 74 US: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 75 US: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 76 US: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 77 US: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 78 Canada: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 79 Canada: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 80 Canada: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 81 Canada: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 82 Mexico: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 83 Mexico: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 84 Mexico: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 85 Mexico: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 86 Middle East & Africa: Fiber Cement Market Size, By Country, 2018–2025 (USD Million)

Table 87 Middle East & Africa: Fiber Cement Market Size, By Country, 2018–2025 (Million Square Meter)

Table 88 Middle East & Africa: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 89 Middle East & Africa: Fiber Cement Market Size, By Type, 2018–2025 (Million Square Meter)

Table 90 Middle East & Africa: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 91 Middle East & Africa: Fiber Cement Market Size, By Material, 2018–2025 (Million Square Meter)

Table 92 UAE: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 93 UAE: Fiber Cement Market Size, By Type, 2018–2025 (Million Square Meter)

Table 94 UAE: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 95 UAE: Fiber Cement Market Size, By Material, 2018–2025 (Million Square Meter)

Table 96 Saudi Arabia: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 97 Saudi Arabia: Fiber Cement Market Size, By Type, 2018–2025 (Million Square Meter)

Table 98 Saudi Arabia: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 99 Saudi Arabia: Fiber Cement Market Size, By Material, 2018–2025 (Million Square Meter)

Table 100 South Africa: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 101 South Africa: Fiber Cement Market Size, By Type, 2018–2025 (Million Square Meter)

Table 102 South Africa: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 103 South Africa: Fiber Cement Market Size, By Material, 2018–2025 (Million Square Meter)

Table 104 Turkey: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 105 Turkey: Fiber Cement Market Size, By Type, 2018–2025 (Million Square Meter)

Table 106 Turkey: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 107 Turkey: Fiber Cement Market Size, By Material, 2018–2025 (Million Square Meter)

Table 108 Rest of Middle East & Africa: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 109 Rest of Middle East & Africa: Fiber Cement Market Size, By Type, 2018–2025 (Million Square Meter)

Table 110 Rest of Middle East & Africa: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 111 Rest of Middle East & Africa: Fiber Cement Market Size, By Material, 2018–2025 (Million Square Meter)

Table 112 South America: Fiber Cement Market Size, By Country, 2018–2025 (USD Million)

Table 113 South America: Fiber Cement Market Size, By Country, 2018–2025 (Million Square Meter)

Table 114 South America: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 115 South America: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 116 South America: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 117 South America: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 118 Brazil: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 119 Brazil: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 120 Brazil: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 121 Brazil: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 122 Argentina: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 123 Argentina: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 124 Argentina: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 125 Argentina: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 126 Rest of South America: Fiber Cement Market Size, By Application, 2018–2025 (USD Million)

Table 127 Rest of South America: Fiber Cement Market Size, By Application, 2018–2025 (Million Square Meter)

Table 128 Rest of South America: Fiber Cement Market Size, By End Use, 2018–2025 (USD Million)

Table 129 Rest of South America: Fiber Cement Market Size, By End Use, 2018–2025 (Million Square Meter)

Table 130 Mergers & Acquisitions

Table 131 Expansions & Investments

List of Figures(35 Figures)

Figure 1 Fiber Cement Market Segmentation

Figure 2 Fiber Cement Market, By Region

Figure 3 Approach 1 (Based On Parent Market)

Figure 4 Approach 2 (Based On Regional Market Size)

Figure 5 Fiber Cement Market: Data Triangulation

Figure 6 Key Market Insights

Figure 7 List ofStakeholders Involved and Breakdown ofPrimary Interviews

Figure 8 Siding to Be Largest Segment ofFiber Cement Market in Terms ofValue, in 2019

Figure 9 Non-Residential to Be Largest Segment ofFiber Cement Market During Forecast Period

Figure 10 APAC Dominated Fiber Cement Market in 2019

Figure 11 Asia Pacific to Offer Attractive Opportunities in Fiber Cement Market During Forecast Period

Figure 12 China Held Largest Share of Fiber Cement Market in 2019

Figure 13 India to Register Highest CAGR in Fiber Cement Market from 2020 to 2025

Figure 14 Fiber Cement Market Dynamics

Figure 15 Portland Cement to Continue to Lead Fiber Cement Market During Forecast Period

Figure 16 Molding & Trim to Be Fastest-Growing Segment for Fiber Cement During Forecast Period

Figure 17 Residential Segment to Dominate Fiber Cement Market By 2025

Figure 18 India Is Projected to Be Fastest-Growing Country-Level Market, 2020–2025

Figure 19 Australia Building and Construction Activity 2018

Figure 20 Companies Adopted Acquisitions as Key Growth Strategy Between 2016 and 2020

Figure 21 Competitive Leadership Mapping, 2020

Figure 22 Product Portfolio Analysis of Top Players in Fiber Cement Market

Figure 23 Business Strategy Excellence of Top Players in Fiber Cement Market

Figure 24 James Hardie Industries PLC: Company Snapshot

Figure 25 James Hardie Industries PLC: SWOT Analysis

Figure 26 ETEX Group: Company Snapshot

Figure 27 ETEX Group: SWOT Analysis

Figure 28 Evonik Industries: Company Snapshot

Figure 29 Evonik Industries: SWOT Analysis

Figure 30 Toray Industries: Company Snapshot

Figure 31 Toray Industries: SWOT Analysis

Figure 32 CSR Limited: Company Snapshot

Figure 33 Nichiha Corporation: Company Snapshot

Figure 34 Cembrit Group A/S: Company Snapshot

Figure 35 The Siam Cement Public Company Limited: Company Snapshot

The study involved four major activities for estimating the current global size of the fiber cement market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of fiber cement through primary research. Both the top-down and bottom-up approaches were employed to estimate the overall size of the fiber cement market. After that, market breakdown and data triangulation procedures were used to determine the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, to identify and collect information for this study on the fiber cement market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

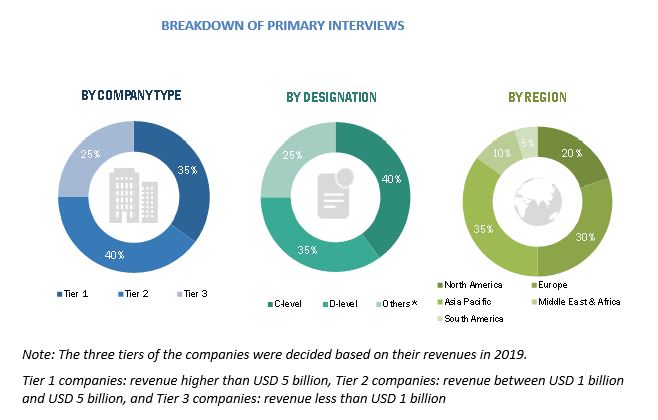

Various primary sources from both the supply and demand sides of the fiber cement market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the fiber cement industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the global size of the fiber cement market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the fiber cement market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Research Objectives

- To define, analyze, and project the size of the fiber cement market in terms of value and volume based on material, application, end-use, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments, expansions, and acquisitions, in the fiber cement market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Fiber Cement Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast Units |

Value (USD) and Volume (Million Square Meter) |

|

Segments covered |

Material, Application, End-use, and Region |

|

Geographic covered |

North America, Asia Pacific, Europe, Middle East & Africa, and South America |

|

Companies covered |

This research report categorizes the fiber cement market based on material, application, end-use, and region.

Based on material:

- Portland cement

- Sand

- Cellulosic material (fiber)

- Others (paints and additives)

Based on the application:

- Molding & trim

- Siding

- Roofing

- Wall partitions

- Flooring

- Backer board

- Others (ceilings, countertops, and interior wall cladding)

Based on the end-use:

- Residential

- Non-residential

Based on the region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

-

South America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the fiber cement report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the linerless labels market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Fiber Cement Market