Plasterboard Market by Type (Standard, Fire-Resistant, Sound-insulated, Moisture-Resistant, Thermal, Specialist, Impact-Resistant), Form (Tapered-Edged and Square-Edged), End-Use Sector, and Region - Global Forecast to 2021

The plasterboard market is projected to reach USD 23.85 Billion by 2021, at a CAGR of 5.7%. The base year considered for the study is 2015 and the market size is projected from 2016 to 2021.

The report aims at estimating the market size and future growth potential of the plasterboard market across different segments such as type, form, end-use sector, and region. The other objectives include providing detailed information regarding the main factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges). It also aims to study the individual growth trends, future prospects, and contribution of various segments to the total market. The study also analyzes opportunities in the market for stakeholders and details of competitive landscape for the market leaders. The study strategically profiles key players and comprehensively analyzes their core competencies.

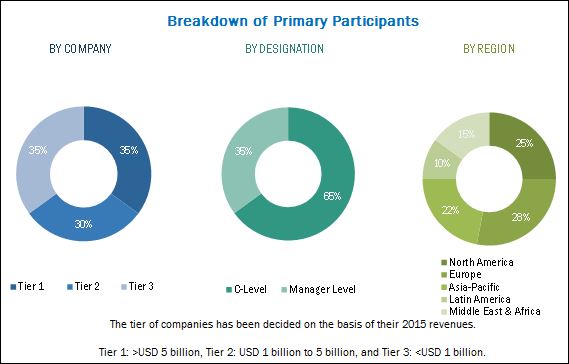

The research methodology used to estimate and forecast the plasterboards market begins with capturing data on key vendor revenues through secondary research and associations such as the European Commission (EC) the Environmental Protection Agency (EPA), the Gypsum Products Development Association (GPDA), the Association of the Wall and Ceiling Industry (AWCI), and the European Plaster and Plasterboard Manufacturers Association (EuroGypsum). The vendor offerings are also taken into consideration to determine the market segmentation. A bottom-up procedure was employed to arrive at the overall size of the global plasterboards market from the revenue of the key players. After arriving at the overall market size, the total market was split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. These data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Key Players in Plasterboard Market

The plasterboard value chain includes glass manufacturers such as Armstrong World Industries Inc. (U.S.), Etex Group (Belgium), Saint-Gobain S.A. (France), Gypsum Management and Supply, Inc. (U.S.), USG Corporation (U.S.), Georgia Pacific LLC (U.S.), Boral Limited (Australia), KNAUF Gips KG (Germany), Fletcher Building Limited (New Zealand), LafargeHolcim Ltd. (Switzerland), and National Gypsum Company (U.S.). Other players in the plasterboard market include Mada Gypsum Company (Saudi Arabia), Beijing New Building Material Group (China), Gypsemna (UAE), Gyprock (Australia), Siniat Ltd (U.K.), Ayhaco Gypsum Products (UAE), Ahlstrom Corporation (Finland), Tai Shah Gypsum Co. (China), Yoshino Gypsum Co., Ltd. (Japan), Tanzania Gypsum Limited (Tanzania), Atiskan Gypsum Products Co Inc. (Turkey), Jason Plasterboard Co. Ltd. (China), and Gyptec Iberica (Portugal).

Target Audience in Plasterboard Market

- Gypsum manufacturers

- Plasterboard manufacturers

- Plasterboard traders/distributers/suppliers

- Manufacturers of raw materials

- Architects & engineers

- Regulatory bodies

- Research organizations

- Association and industry bodies

- Interior designers

- End consumers

- Market research and consulting firms

Plasterboard Market Report Scope

The research report segments the plasterboard market into the following submarkets:

By Type:

- Standard

- Fire-resistant

- Sound-insulated

- Moisture-resistant

- Thermal

- Specialist

- Impact-resistant

- Triple low-e, gas-filled

By Form:

- Tapered-edged

- Square-edged

By End-Use Sector:

- Residential

- Non-residential

By Region:

- North America

- Europe

- Asia-Pacific

- Middle East & Africa

- Latin America

Plasterboard Market Report Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Plasterboard Market Geographic Analysis

- Further analysis of the plasterboard market for additional countries

Plasterboard Market Company Information

- Detailed analysis and profiling of additional market players

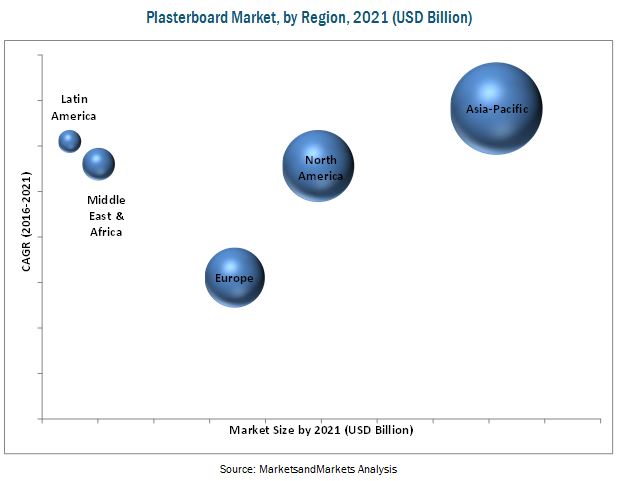

MarketsandMarkets projects that the plasterboard market size will grow from USD 18.07 Billion in 2016 to USD 23.85 Billion by 2021, at an estimated CAGR of 5.7% between 2016 and 2021. The plasterboards market is expected to witness high growth as a result of the recovery of the global economy, high growth in the Asia-Pacific region, and the emergence of environment-friendly construction techniques. Growth in modern retailing, rise in consumer income & employment, and increase in demand for new construction projects are some of the other factors influencing the growth of the plasterboards market.

This report is segmented on the basis of type, form, end-use sector, and region. The fire-resistant segment, by type, is projected to be the fastest-growing in the plasterboards market during the forecast period. The gradual shift of building contractors and consumers toward cost efficient, eco-friendly, and modern building techniques is creating growth opportunities for the plasterboard market.

On the basis of form, the tapered-edged segment is projected to grow at a higher rate in the forecast period as it is easy and quick to install as compared to the square-edged plasterboard. Developed countries have a higher demand for tapered-edged plasterboard compared to that of developing countries.

In 2015, the residential sector accounted for a larger share in the plasterboards market; this is projected to grow at a higher rate between 2016 and 2021. The growth of residential construction across the globe is also creating growth opportunities for the adoption of plasterboard. The residential segment is an emerging market for plasterboard products, where it is used for the construction of wall panels, ceilings, and partitions.

In 2015, the Asia-Pacific region accounted for the largest share and is projected to grow at the fastest rate in the plasterboards market from 2016 to 2021. Markets in developing countries such as China, India, Brazil, South Africa, and countries in the Middle East are projected to grow at a higher rate from 2016 to 2021, owing to the high population in these countries, along with expected new building constructions and renovation activities in the next ten years.

Poor acceptance of plasterboard among the end-users due to pre-defined mindsets about plasterboard is a constraint in the growth of plasterboard market. Furthermore, lack of awareness about the recyclability of plasterboard among end-users is hindering the market growth.

Key Plasterboard Market Industry Players

The global market for plasterboard is dominated by major players of the plasterboard industry, which include Armstrong World Industries Inc. (U.S.), Etex Group (Belgium), Saint-Gobain S.A. (France), Gypsum Management and Supply, Inc. (U.S.), USG Corporation (U.S.), Georgia Pacific LLC (U.S.), Boral Limited (Australia), KNAUF Gips KG (Germany), Fletcher Building Limited (New Zealand), LafargeHolcim Ltd. (Switzerland), and National Gypsum Company (U.S.). Other players in the plasterboard market include Mada Gypsum Company (Saudi Arabia), Beijing New Building Material Group (China), Gypsemna (UAE), Gyprock (Australia), Siniat Ltd (U.K.), Ayhaco Gypsum Products (UAE), Ahlstrom Corporation (Finland), Tai Shah Gypsum Co. (China), Yoshino Gypsum Co., Ltd. (Japan), Tanzania Gypsum Limited (Tanzania), Atiskan Gypsum Products Co Inc. (Turkey), Jason Plasterboard Co. Ltd. (China), and Gyptec Iberica (Portugal). These companies use various strategies such as mergers & acquisitions, expansions, new product launches, and partnerships, agreements, joint ventures, and collaborations to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Content

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Regional Scope

1.3.2 Periodization Considered

1.4 Currency Considered

1.5 Units Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 24)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.2 Factor Analysis

2.2.1 Introduction

2.2.2 Demand-Side Analysis

2.2.2.1 Rising Population

2.2.2.1.1 Increase in Middle-Class Population

2.2.2.2 Developing Economies, GDP (PPP), 2013

2.2.3 Supply-Side Analysis

2.2.3.1 Regulations

2.2.3.2 Research & Development

2.3 Market Size Estimation

2.4 Data Triangulation

2.5 Market Share Estimation

2.6 Research Assumptions & Limitations

2.6.1 Assumptions Made for This Study

2.6.2 Limitations of the Research Study

3 Executive Summary (Page No. - 36)

4 Premium Insights (Page No. - 40)

4.1 Developed Economies to Witness A Relatively Higher Demand for Plasterboard

4.2 Plasterboard Market, By Form

4.3 Plasterboards Market, By Type

4.5 China Accounted for the Largest Share in the Asia-Pacific Region in 2015

4.6 Plasterboard Market: Geographic Snapshot

4.7 Plasterboards Market, By End-Use Sector

5 Market Overview (Page No. - 46)

5.1 Introduction

5.2 Evolution of Plasterboard Market

5.3 Plasterboards Market Segmentation

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Rapid Urbanization Requires Large Number of New Construction Projects

5.4.1.2 Rise in Preference for Dry Construction Techniques Over Wet Construction Methods

5.4.1.3 Ease of Installation and Replacement Increases Preference Among End Users Toward Plasterboard

5.4.1.4 Technological Advancements in Extrusion and Processing

5.4.2 Restraints

5.4.2.1 Economic Downturn in Key Regions May Impact the Plasterboard Market Negatively

5.4.2.2 Saturated Markets Have Low Demand for New Construction

5.4.3 Opportunity

5.4.3.1 Rise in New Construction Projects in the Emerging Economies

5.4.4 Challenges

5.4.4.1 Lack of Awareness About the Recyclability of Plasterboard Among End Users

5.4.4.2 Lack of Availability of Plasterboard Waste Disposal Plants

5.4.4.3 Poor Acceptance of Plasterboard Construction Among End Users

5.4.4.4 Environmental and Government Regulations Imposed on Plasterboard Disposal

6 Plasterboard Market, By Form (Page No. - 56)

6.1 Introduction

6.2 Tapered-Edged

6.3 Square-Edged

7 Plasterboard Market, By Type (Page No. - 59)

7.1 Introduction

7.2 Standard Plasterboard

7.3 Fire-Resistant Plasterboard

7.4 Sound-Insulated Plasterboard

7.5 Thermal Plasterboard

7.6 Moisture-Resistant Plasterboard

7.7 Impact-Resistant Plasterboard

7.8 Specialist Plasterboard

8 Plasterboards Market, By End-Use Sector (Page No. - 64)

8.1 Introduction

8.2 Residential

8.3 Non-Residential

9 Macroeconomic Factors: an Overview (Page No. - 68)

9.1 Introduction

9.2 Trends & Forecast of the Construction Industry and GDP

9.2.1 Trends of Residential & Non-Residential Construction Industries in North America

9.2.2 U.K. & Germany to Spend the Largest Amount for Growth of the Construction Industry in Europe

9.2.3 China & India to Spend the Largest Amount on the Construction Industry in Asia-Pacific

9.2.4 Saudi Arabia to Spend the Largest Amount on the Construction Industry in the Middle East & Africa

9.2.5 Brazil to Spend the Largest Amount for Construction Industry in Latin America

10 Plasterboard Market, By Region (Page No. - 72)

10.1 Introduction

10.2 Asia-Pacific

10.2.1 Asia-Pacific: Plasterboard Market, By Country

10.2.2 Asia-Pacific: Market, By Type

10.2.3 Asia-Pacific: Market, By Form

10.2.4 Asia-Pacific: Market, By End-Use Sector

10.2.5 China

10.2.5.1 China: Plasterboard Market, By Type

10.2.5.2 China: Market, By End-Use Sector

10.2.6 Japan

10.2.6.1 Japan: Plasterboard Market, By Type

10.2.6.2 Japan: Market, By End-Use Sector

10.2.7 Australia

10.2.7.1 Australia: Plasterboard Market, By Type

10.2.7.2 Australia: Market, By End-Use Sector

10.2.8 India

10.2.8.1 India: Plasterboard Market, By Type

10.2.8.2 India: Market, By End-Use Sector

10.2.9 South Korea

10.2.9.1 South Korea: Plasterboard Market, By Type

10.2.9.2 South Korea: Market, By End-Use Sector

10.2.10 Indonesia

10.2.10.1 Indonesia: Plasterboard Market, By Type

10.2.10.2 Indonesia: Market, By End-Use Sector

10.2.11 Thailand

10.2.11.1 Thailand: Plasterboard Market, By Type

10.2.11.2 Thailand: Market, By End-Use Sector

10.2.12 Rest of Asia-Pacific

10.2.12.1 Rest of Asia-Pacific: Plasterboard Market, By Type

10.2.12.2 Rest of Asia-Pacific: Market, By End-Use Sector

10.3 North America

10.3.1 North America: Plasterboard Market, By Country

10.3.2 North America: Market, By Type

10.3.3 North America: Market, By Form

10.3.4 North America: Market, By End-Use Sector

10.3.5 U.S.

10.3.5.1 U.S.: Plasterboard Market, By Type

10.3.5.2 U.S.: Market, By End-Use Sector

10.3.6 Canada

10.3.6.1 Canada: Plasterboard Market, By Type

10.3.6.2 Canada: Market, By End-Use Sector

10.3.7 Mexico

10.3.7.1 Mexico: Plasterboard Market, By Type

10.3.7.2 Mexico: Market, By End-Use Sector

10.4 Europe

10.4.1 Europe: Plasterboard Market, By Country

10.4.2 Europe: Market, By Type

10.4.3 Europe: Market Size, By Form

10.4.4 Europe: Market Size, By End-Use Sector

10.4.5 Germany

10.4.5.1 Germany: Plasterboard Market, By Type

10.4.5.2 Germany: Market, By End-Use Sector

10.4.6 U.K.

10.4.6.1 U.K.: Plasterboard Market, By Type

10.4.6.2 U.K.: Market, By End-Use Sector

10.4.7 France

10.4.7.1 France: Plasterboard Market, By Type

10.4.7.2 France: Market, By End-Use Sector

10.4.8 Russia

10.4.8.1 Russia: Plasterboard Market, By Type

10.4.8.2 Russia: Market, By End-Use Sector

10.4.9 Spain

10.4.9.1 Spain: Plasterboard Market, By Type

10.4.9.2 Spain: Market, By End-Use Sector

10.4.10 Italy

10.4.10.1 Italy: Plasterboard Market, By Type

10.4.10.2 Italy: Market, By End-Use Sector

10.4.11 Rest of Europe

10.4.11.1 Rest of Europe: Plasterboard Market, By Type

10.4.11.2 Rest of Europe: Market, By End-Use Sector

10.5 Middle East & Africa (Mea)

10.5.1 Middle East & Africa: Plasterboard Market, By Country

10.5.2 Middle East & Africa: Market, By Type

10.5.3 Middle East & Africa: Market, By Form

10.5.4 Middle East & Africa: Market, By End-Use Sector

10.5.5 Turkey

10.5.5.1 Turkey: Plasterboard Market, By Type

10.5.5.2 Turkey: Market, By End-Use Sector

10.5.6 Saudi Arabia

10.5.6.1 Saudi Arabia: Plasterboard Market, By Type

10.5.6.2 Saudi Arabia: Market, By End-Use Sector

10.5.7 South Africa

10.5.7.1 South Africa: Plasterboard Market, By Type

10.5.7.2 South Africa: Market, By End-Use Sector

10.5.8 Rest of Middle East & Africa

10.5.8.1 Rest of Middle East & Africa: Plasterboard Market, By Type

10.5.8.2 Rest of Middle East & Africa: Market, By End-Use Sector

10.6 Latin America

10.6.1 Latin America: Plasterboard Market, By Country

10.6.2 Latin America: Market, By Type

10.6.3 Latin America: Market, By Form

10.6.4 Latin America: Market, By Form

10.6.5 Latin America: Market, By End-Use Sector

10.6.6 Latin America: Market, By End-Use Sector

10.6.7 Brazil

10.6.7.1 Brazil: Plasterboard Market, By Type

10.6.7.2 Brazil: Market, By End-Use Sector

10.6.8 Argentina

10.6.8.1 Argentina: Plasterboard Market, By Type

10.6.8.2 Argentina: Market, By End-Use Sector

10.6.9 Rest of Latin America

10.6.9.1 Rest of Latin America: Plasterboard Market, By Type

10.6.9.2 Rest of Latin America: Market, By End-Use Sector

11 Competitive Landscape (Page No. - 150)

11.1 Overview

11.2 Market Share of Key Players

11.2.1 Market Share of Key Players

11.2.1.1 Saint Gobain S.A.

11.2.1.2 USG Corporation

11.2.1.3 ETEX Group

11.2.1.4 Armstrong World Industries, Inc.

11.3 Competitive Situations & Trends

11.3.1 Expansions & Divestitures Have Fueled the Growth of the Plasterboard Market, 2015–2016

11.3.2 Mergers & Acquisitions Were the Key Strategies Adopted By Major Players in the Plasterboards Market

11.4 Mergers & Acquisitions

11.5 Expansions & Investments

11.6 Partnerships, Agreements, Joint Ventures, and Strategic Alliances

11.7 New Product Launches

12 Company Profiles (Page No. - 159)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

12.1 Saint- Gobain S.A.

12.2 USG Corporation

12.3 ETEX Group

12.4 Armstrong World Industries, Inc.

12.5 Boral Limited

12.6 Fletcher Building Limited

12.7 Gypsum Management and Supply, Inc.

12.8 Lafargeholcim Ltd

12.9 Georgia Pacific LLC

12.10 Knauf GIPS Kg

12.11 National Gypsum Company

12.12 Mada Gypsum Company

12.13 Beijing New Building Material Group

12.14 Gypsemna

12.15 Gyprock

12.16 Siniat Ltd

12.17 Ayhaco Gypsum Products

12.18 Ahlstrom Corporation

12.19 TAI Shan Gypsum

12.20 Yoshino Gypsum Co, Ltd.

12.21 Tanzania Gypsum Limited

12.22 Atiskan Gypsum Products Co.Inc

12.23 Jason Plasterboard Co.Ltd.

12.24 Gyptec Iberica

*Details on Business overview, Products offered, Recent Developments, SWOT analysis, MNM view might not be captured in case of unlisted companies.

13 Appendix (Page No. - 193)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (163 Tables)

Table 1 Asia-Pacific: Urbanization Trend, 1990–2050

Table 2 Plasterboard Market Size, By Form, 2014–2021 (USD Billion)

Table 3 Plasterboards Market Size, By Form, 2014–2021 (Billion Square Meters)

Table 4 Plasterboard Market Size, By Type, 2014–2021 (USD Billion)

Table 5 Plasterboards Market Size, By Type, 2014–2021 (Billion Square Meters)

Table 6 Plasterboard Market Size, By End-Use Sector, 2014–2021 (USD Billion)

Table 7 Plasterboards Market Size, By End-Use Sector, 2014–2021 (Billion Square Meters)

Table 8 North America: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 9 North America: GDP, By Country, 2014–2021 (USD Billion)

Table 10 Europe: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 11 Europe: GDP, By Country, 2014–2021 (USD Billion)

Table 12 Asia-Pacific: Contribution to Construction Industry , By Country, 2014–2021 (USD Billion)

Table 13 Asia-Pacific: GDP, By Country, 2014–2021 (USD Billion)

Table 14 Middle East & Africa: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 15 Middle East & Africa: GDP, By Country, 2014–2021 (USD Billion)

Table 16 South America: Contribution to Construction Industry, By Country, 2014–2021 (USD Billion)

Table 17 Latin America: GDP, By Country, 2014–2021 (USD Billion)

Table 18 Plasterboard Market Size, By Region, 2014–2021 (USD Million)

Table 19 Plasterboards Market Size, By Region, 2014–2021 (Million Square Meters)

Table 20 Asia-Pacific: Plasterboard Market Size, By Country, 2014–2021 (USD Million)

Table 21 Asia-Pacific: Market Size, By Country, 2014–2021 (Million Square Meters)

Table 22 Asia-Pacific: Market Size, By Type, 2014–2021 (USD Million)

Table 23 Asia-Pacific: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 24 Asia-Pacific: Market Size, By Form, 2014–2021 (USD Million)

Table 25 Asia-Pacific: Market Size, By Form, 2014–2021 (Million Square Meters)

Table 26 Asia-Pacific: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 27 Asia-Pacific: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 28 China: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 29 China: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 30 China: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 31 China: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 32 Japan: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 33 Japan: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 34 Japan: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 35 Japan: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 36 Australia: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 37 Australia: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 38 Australia: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 39 Australia: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 40 India: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 41 India: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 42 India: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 43 India: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 44 South Korea: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 45 South Korea: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 46 South Korea: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 47 South Korea: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 48 Indonesia: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 49 Indonesia: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 50 Indonesia: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 51 Indonesia: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 52 Thailand: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 53 Thailand: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 54 Thailand: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 55 Thailand: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 56 Rest of Asia-Pacific: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 57 Rest of Asia-Pacific: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 58 Rest of Asia-Pacific: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 59 Rest of Asia-Pacific: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 60 North America: Plasterboard Market Size, By Country, 2014–2021(USD Million)

Table 61 North America: Market Size, By Country, 2014–2021(Million Square Meters)

Table 62 North America: Market Size, By Type, 2014–2021 (USD Million)

Table 63 North America: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 64 North America: Market Size, By Form, 2014–2021 (USD Million)

Table 65 North America: Market Size, By Form, 2014–2021 (Million Square Meters)

Table 66 North America: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 67 North America: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 68 U.S.: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 69 U.S.: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 70 U.S.: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 71 U.S.: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 72 Canada: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 73 Canada: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 74 Canada: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 75 Canada: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 76 Mexico: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 77 Mexico: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 78 Mexico: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 79 Mexico: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 80 Europe: Plasterboards Market Size, By Country, 2014–2021 (USD Million)

Table 81 Europe: Market Size, By Country, 2014–2021 (Million Square Meters)

Table 82 Europe: Market Size, By Type, 2014–2021 (USD Million)

Table 83 Europe: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 84 Europe: Market Size, By Form, 2014–2021 (USD Million)

Table 85 Europe: Market Size, By Form, 2014–2021 (Million Square Meters)

Table 86 Europe: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 87 Europe: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 88 Germany: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 89 Germany: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 90 Germany: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 91 Germany: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 92 U.K.: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 93 U.K.: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 94 U.K.: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 95 U.K.: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 96 France: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 97 France: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 98 France: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 99 France: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 100 Russia: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 101 Russia: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 102 Russia: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 103 Russia: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 104 Spain: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 105 Spain: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 106 Spain: arket Size, By End-Use Sector, 2014–2021 (USD Million)

Table 107 Spain: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 108 Italy: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 109 Italy: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 110 Italy: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 111 Italy: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 112 Rest of Europe: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 113 Rest of Europe: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 114 Rest of Europe: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 115 Rest of Europe: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 116 Middle East & Africa: Plasterboards Market Size, By Country, 2014–2021 (USD Million)

Table 117 Middle East & Africa: Market Size, By Country, 2014–2021 (Million Square Meters)

Table 118 Middle East & Africa: Market Size, By Type, 2014–2021 (USD Million)

Table 119 Middle East & Africa: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 120 Middle East & Africa: Market Size, By Form, 2014–2021 (USD Million)

Table 121 Middle East & Africa: Market Size, By Form, 2014–2021 (Million Square Meters)

Table 122 Middle East & Africa: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 123 Middle East & Africa: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 124 Turkey: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 125 Turkey: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 126 Turkey: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 127 Turkey: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 128 Saudi Arabia: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 129 Saudi Arabia: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 130 Saudi Arabia: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 131 Saudi Arabia: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 132 South Africa: Market Size, By Type, 2014–2021 (USD Million)

Table 133 South Africa: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 134 South Africa: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 135 South Africa: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 136 Rest of Middle East & Africa: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 137 Rest of Middle East & Africa: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 138 Rest of Middle East & Africa: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 139 Rest of Middle East & Africa: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 140 Latin America: Plasterboard Market Size, By Country, 2014–2021 (USD Million)

Table 141 Latin America: Market Size, By Country, 2014–2021 (Million Square Meters)

Table 142 Latin America: Market Size, By Type, 2014–2021 (USD Million)

Table 143 Latin America: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 144 Latin America: Market Size, By Form, 2014–2021 (USD Million)

Table 145 Latin America: Market Size, By Form, 2014–2021 (Million Square Meters)

Table 146 Latin America: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 147 Latin America: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 148 Brazil: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 149 Brazil: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 150 Brazil: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 151 Brazil: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 152 Argentina: Plasterboards Market Size, By Type, 2014–2021 (USD Million)

Table 153 Argentina: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 154 Argentina: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 155 Argentina: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 156 Rest of Latin America: Plasterboard Market Size, By Type, 2014–2021 (USD Million)

Table 157 Rest of Latin America: Market Size, By Type, 2014–2021 (Million Square Meters)

Table 158 Rest of Latin America: Market Size, By End-Use Sector, 2014–2021 (USD Million)

Table 159 Rest of Latin America: Market Size, By End-Use Sector, 2014–2021 (Million Square Meters)

Table 160 Mergers & Acquisitions, 2011–2016

Table 161 Expansions & Investments, 2011–2016

Table 162 Partnerships, Agreements, Joint Ventures, and Strategic Alliances 2011–2016

Table 163 New Product Launches, 2011–2016

List of Figures (47 Figures)

Figure 1 Market Segmentation

Figure 2 Plasterboard Market, By Region

Figure 3 Plasterboards Market: Research Design

Figure 4 Breakdown of Primaries

Figure 5 Global Population is Projected to Reach ~9.5 Billion By 2050

Figure 6 Market Size Estimation Methodology: Bottom-Up Approach

Figure 7 Market Size Estimation Methodology: Top-Down Approach

Figure 8 Plaster Board: Data Triangulation

Figure 9 Standard Plasterboard is Projected to Dominate the Market Through 2021

Figure 10 Tapered-Edged is Estimated to Account for the Largest Share in the Plasterboard Market Through 2021

Figure 11 The Residential Sector is Projected to Dominate the Plasterboards Market Through 2021

Figure 12 Asia-Pacific Dominated the Plasterboard Market in 2015

Figure 13 Emerging Economies Offer Attractive Opportunities in the Plasterboards Market

Figure 14 Tapered-Edged Segment to Lead the Market for Plasterboard Through 2021

Figure 15 Fire-Resistant Plasterboard to Grow at the Highest Rate During the Forecast Period

Figure 16 Standard Plasterboard Captured the Largest Share in the Asia-Pacific Market in 2015

Figure 17 Market in China is Projected to Grow at the Highest Rate From 2016 to 2021

Figure 18 Residential Sector to Have A Relatively Larger Share Through 2021

Figure 19 Evolution of Plasterboard Market

Figure 20 Plasterboards Market Segmentation

Figure 21 Growing Market for Building Construction is the Key Driver for Plasterboard Market

Figure 22 Global GDP Growth

Figure 23 World GDP Growth

Figure 24 Impact Analysis of the Short-, Mid-, and Long-Term Market Drivers and Restraints of the Plasterboards Market

Figure 25 Tapered-Edged to Account for A Larger Market Share, in Terms of Value, From 2016 to 2021

Figure 26 Standard Segment is Estimated to Account for the Largest Share Through 2021

Figure 27 Residential Segment is Estimated to Account for the Largest Share Through 2021

Figure 28 Geographic Snapshot (2016–2021): the Market in China is Projected to Grow at the Highest Rate, in Terms of Value

Figure 29 Asia-Pacific Plasterboard Market Snapshot: China is Projected to Be the Fastest-Growing Market Between 2016 & 2021

Figure 30 North American Plasterboards Market Snapshot: the U.S. is Projected to Be the Fastest-Growing Market Between 2016 & 2021

Figure 31 European Plasterboard Market Snapshot: Germany is Projected to Be the Fastest-Growing Market From 2016 to 2021

Figure 32 Companies Adopted Mergers & Acquisitions as the Key Growth Strategies Between 2011 and 2016

Figure 33 Plasterboard Market, By Shares of Key Players, 2015

Figure 34 2014 Was the Most Active Year for the Companies in the Plasterboards Market, in Terms of Number of Developments

Figure 35 Saint-Gobain S.A.: Business Overview

Figure 36 Saint Gobain S.A.: SWOT Analysis

Figure 37 USG Corporation: Business Overview

Figure 38 USG Corporation: SWOT Analysis

Figure 39 ETEX Group: Business Overview

Figure 40 ETEX Group: SWOT Analysis

Figure 41 Armstrong World Industries: Company Snapshot

Figure 42 Armstrong World Industries Inc.: SWOT Analysis

Figure 43 Boral Limited: Company Snapshot

Figure 44 Boral Limited: SWOT Analysis

Figure 45 Fletcher Building: Company Snapshot

Figure 46 Gypsum Management and Supply, Inc.: Company Snapshot

Figure 47 Lafargeholcim Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Plasterboard Market