Fire-resistant Fabrics Market

Fire-resistant Fabrics Market by Type (Treated and Inherent), Application (Apparel and Non-apparel), End-use Industry (Industrial, Defense & Public Safety Services, and Transport), Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The fire-resistant fabrics market is estimated to grow from USD 3.75 billion in 2024 to USD 5.65 billion by 2030, at a CAGR of 7.24%. The demand for fire-resistant fabrics is increasing due to the rising trend of heightened safety regulations and the expansion of high-risk industries such as the industrial sector, defense, public safety services, and transport, among others. As companies emphasize workforce safety and regulatory compliance, the demand for advanced fire-resistant fabrics is constantly growing in emerging as well as developed markets.

KEY TAKEAWAYS

-

BY TYPEThe fire-resistant fabrics market is segmented into treated and inherent fire-resistant fabrics. Among these, the treated fire-resistant fabric segment accounted for the larger market share, in terms of value, in 2024 and continues to dominate the market during the forecast period. Its cost-effectiveness, ease of processing, and broad application across diverse industrial sectors are the main factors driving this supremacy.

-

BY APPLICATIONThe fire-resistant fabrics market is segmented into apparel and non-apparel applications. Among these, the apparel segment accounted for the larger market share, in terms of value, in 2024 and will continue to dominate the market during the forecast period. This leadership is driven by strong demand from industries such as defense & public safety services, oil & gas, and electrical utilities, where flame-resistant protective clothing is mandated for worker safety.

-

BY END-USE INDUSTRYThe fire-resistant fabrics market is segmented into industrial, defense & public safety services, transport, and other end-use industries. The industrial sector, including construction, manufacturing, oil & gas, and metal production, is the largest end-user of fire-resistant fabrics. This supremacy is mainly led by the high-risk nature of manufacturing operations, where workers are routinely exposed to fires and extreme temperatures. Strict regulatory standards, rising focus on worker safety, and operational continuity further contribute to sustained demand for fire-resistant fabrics in this sector.

-

BY REGIONAsia Pacific is the largest market for fire-resistant fabrics and is projected to register the highest CAGR of 7.63% in terms of value during the forecast period. This growth is primarily fueled by the strict occupational safety regulations, high consciousness of workplace safety standards, and high demand from industrial sectors, defense & public safety services, and transport.

-

COMPETITIVE LANDSCAPELeading market participants focus on innovation, sustainable product offerings, and strategic partnerships, including collaborations, acquisitions, and product launches. Major players such asDuPont de Nemours, Inc., Teijin Limited, Indorama Ventures Public Company Limited, Syensqo SA/NV , and TenCate Protective Fabrics, are expanding their portfolio of fire-resisance fabrics to meet growing demand for high-performance, eco-friendly packaging solutions across apparel and non-apparel applications.

Fire-resistant fabrics are designed to resist fire initiation, slow the progress of flames, and mitigate the severity of burns, and thus play a valuable role in manufacturing, oil & gas, defense & public safety services, and transport. As regulatory standards become more stringent and workplace safety awareness spreads across the world, organizations are increasingly looking to deploy certified high-performance fire-resistant fabrics to ensure operational safety and compliance.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on consumers’ business emerges from changing safety standards and industry-specific disruptions. Fire-resistant fabric consumers include industrial apparel producers, defense & safety services, and transportation OEMs, which use these fabrics in protective clothing, seat covers, and interior applications. Shifts such as stricter occupational safety regulations, increased infrastructure development, and rising sustainability requirements influence the operational costs and compliance priorities of these end users. Changes in these downstream industries directly impact the demand, procurement volumes, and revenue patterns of fabric consumers, which subsequently affect the sales and growth prospects of fire-resistant fabric suppliers.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Stringent workplace safety regulations in developed countries

-

Increasing use of fire-resistant fabrics in oil & gas industry

Level

-

High cost of production and huge investment in R&D

-

Lack of safety regulations in developing regions

Level

-

Technological innovations in product development

Level

-

Fluctuating raw material costs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Stringent workplace safety regulations in developed countries

The market for fire-resistant fabrics has been significantly impacted by strict workplace safety standards in developed nations. These rules are intended to protect employees from the risks of fire-related incidents in diverse sectors, including construction, manufacturing, oil & gas, and defense & public safety services. Fire-resistant clothing has a very important function of keeping workers safe by protecting them with clothing that is resistant to heat and prevents burns. Safety policies in the workplace are enforced more strictly in developed economies than they are in developing economies. These policies aim to reduce the number of accidents and injuries in the workplace, including fire accidents. They generally set out conditions that employers must comply with, including the issuance of suitable PPE to workers.

Restraints: High cost of production and huge investment in R&D

The high cost of production of fire-resistant fabrics is one of the major restraints that affect the growth of the market. The high cost of raw materials and advanced processes involved in the production of these fabrics increases the production cost. The complexity of the production technology and the high R&D costs put pressure on fire-resistant fabric manufacturers. Fluctuation in energy prices also has an impact on the cost of fire-resistant fabrics. Thus, increasing prices of raw materials, energy, weaving technology, and transportation have a direct and substantial impact on the cost of fire-resistant fabrics.

Opportunities: Technological innovations in product development

The current market is concentrated on fire-resistant fabrics that are cost-effective and meet the minimum standards or regulations mandated in a specific region. With the changing nature of end-use applications, customers demand more functions apart from fire resistance. Customers are becoming more focused on multifunctional fire-resistant protective clothing that serves more than one function. Generally, fire-resistant clothing is fire-resistant but may not provide adequate (or any) protection against mechanical hazards. However, industries such as oil & gas and chemicals may pose multiple hazards to workers. In such situations, workers and operators need multifunctional protective clothing. Changing environments in the defense sector also demand additional comfort in protective suits in terms of increased flexibility, reduced weight, and incorporation of cooling technologies such as phase-change materials (PCM) in suits.

Challenges: Fluctuating raw material costs

The volatile raw material prices are a major challenge to the industry players in the fire-resistant fabrics market. It has the potential to affect different facets of the industry, from the cost of production to pricing strategy, profitability, and competitiveness. This could result in increased manufacturing costs, which could eventually affect the end price of fire-resistant textiles. If raw material prices increase considerably, manufacturers may not be able to sustain competitive pricing, and demand for their products could decrease. Second, the volatility of raw material prices makes it difficult for firms to plan and budget. The volatility of raw material prices can affect long-term planning and strategic planning since companies may not be able to forecast and respond to sudden changes in raw material prices.

Fire-resistant Fabrics Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Inherently flame- and heat-resistant aramid fabrics for industrial FR workwear, oil and gas, transportation, and firefighter gear where protection must not wash out | Won’t melt or drip, maintains FR for life of the garment, and delivers long wear life versus FRT cotton due to superior durability and tear resistance |

|

Westex DH and UltraSoft fabrics for arc-flash and flash-fire garments with breathability and moisture management for comfort-critical daily wear | Certified to NFPA 2112/NFPA 70E with guaranteed flame resistance for the life of the garment and proven arc-flash performance in Westex programs |

|

Cellulosic-origin FR fibers used in multilayer firefighter, military, oil and gas, and metal industry PPE to add comfort and moisture management in blends | Layered systems with LENZING FR can reduce second/third-degree burns versus conventional garments while lowering heat stress through superior moisture transport |

|

Meta-aramid fibers for protective clothing across high-heat environments requiring materials that resist melting and sticking with >400°C heat resistance | High flame and chemical resistance with low thermal conductivity, enabling lighter garments via high tenacity while maintaining thermal protection |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The fire-resistant fabrics ecosystem comprises raw material suppliers, fabric manufacturers, distributors, and end users. Suppliers provide flame-retardant chemicals, fibers, yarns, and textile finishes to manufacturers, who process them through weaving, coating, and lamination technologies to produce fabrics with enhanced fire resistance, durability, and comfort. Distributors connect manufacturers with industrial safety, defense, oil & gas, transportation, and construction sectors, ensuring steady supply, quality standards, and regulatory compliance. End users utilize these fabrics in protective apparel, uniforms, furnishings, and automotive interiors, creating a connected value chain driven by safety regulations, technological innovation, and sustainability requirements.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Fire-Resistant Fabric Market, By Type

The inherent fire-resistant fabrics segment is projected to be the fastest-growing type in the global fire-resistant fabrics market in terms of value during the forecast period. The need for long-lasting, high-performing protective fabrics in sectors like emergency services, oil & gas, utilities, defense & public safety services, and aerospace is the main factor driving market growth. Unlike treated fabrics, inherent fire-resistant fabrics feature built-in flame resistance at the fiber level that does not deteriorate with time or repeated washings, making them a preferred choice for long-term use and critical safety applications. Because of their improved thermal stability, lightweight design, increased comfort, and longer lifespan, industries are gradually shifting to inherent fire-resistant fabrics.

Fire-Resistant Fabric Market, By Application

The apparel application held the largest share of the global fire-resistant fabrics market in terms of value due to the increasing demand for protective gear in high-risk industries such as industrial production, defense, firefighting, oil & gas, and utilities. Fire-resistant apparel is critical in environments where workers are exposed to heat, flames, arc flashes, and molten metal splashes. Increasing regulatory enforcement of occupational safety standards by organizations such as OSHA, NFPA, and ISO has significantly influenced the adoption of flame-retardant clothing, especially in North America, Europe, and the Asia Pacific.

Fire-Resistant Fabric Market, By End-Use

The industrial sector held the largest share of the global fire-resistant fabrics market, in terms of value, in 2024. This is mainly due to the high risk of operation in the industry, where open flames and high temperatures heavily raise the risk of accidents and workforce injuries. Industries such as oil & gas, metal processing, chemicals, electrical utility, and manufacturing that operate in conditions where fire risk, arc flash, and high temperature are the real concerns, which make flame-resistant apparel and protective equipment crucial. The rising number of industrial accidents has compelled the governing agencies of major economies to introduce regulations for the application of certified fire-retardant fabrics, further bolstering the demand.

REGION

Asia Pacific to be largest & fastest-growing region in global fire-resistat fabrics market during forecast period

Asia Pacific was the largest market for fire-resistant fabrics, in terms of value, in 2024, boosted by high demand in industrial, defense & public safety services, and transport industries. The dominance of the region is largely due to industrialization, workplace safety laws, and the rise of manufacturing and infrastructure development. China held the largest market share within the region due to its massive capacity for production, growing investment in protective clothing, and government regulations for fire safety compliance in oil & gas, construction, railways, and public infrastructure industries.

Fire-resistant Fabrics Market: COMPANY EVALUATION MATRIX

In the fire-resistant fabrics market, DuPont leads with a strong global footprint and a pioneering portfolio of advanced flame-retardant fibers and fabrics, including Nomex, Kevlar, and Tychem. The company’s focus on thermal protection, durability, and comfort, combined with its commitment to sustainability and innovation, has positioned it as a trusted partner across critical industries such as industrial safety, defense, firefighting, and oil & gas. DuPont’s continuous R&D advancements in meta-aramid and para-aramid technologies, along with its efforts to develop lightweight, breathable, and recyclable protective fabrics, enable superior performance while meeting stringent international safety standards. Its strategic collaborations with apparel manufacturers, OEMs, and safety gear providers strengthen its market reach and application diversity.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- DuPont de Nemours, Inc. (US)

- Teijin Limited (Japan)

- Indorama Ventures Public Company Limited (Thailand)

- Syensqo SA/NV (Belgium)

- TenCate Protective Fabrics (Netherlands)

- Lenzing AG (Austria)

- PBI Performance Products, Inc. (US)

- Kaneka Corporation (Japan)

- Gun Ei Chemical Industry Co., Ltd. (Japan)

- W. L. Gore & Associates, Inc. (US)

- Milliken & Company (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size Value in 2024 | USD 3.75 Billion |

| Revenue Forecast in 2030 | USD 5.65 Billion |

| Growth Rate | CAGR of 7.25% from 2025-2030 |

| Actual data | 2020-2030 |

| Base year | 2024 |

| Forecast period | 2025-2030 |

| Units considered | Value (USD Million), Volume (Million Sq. Meter) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered | By Type: Treated, and Inherent By Application: Apparel, and Non-apparel By End-Use: Industrial, Defense & Public Safety Services, Transportation, and Other End-Use Industries |

| Regional Scope | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

WHAT IS IN IT FOR YOU: Fire-resistant Fabrics Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Europe-based Fire-Resistant Fabrics Manufacturer |

|

|

| Asia Pacific-based Fire-Resistant Fabrics Manufacturer |

|

|

RECENT DEVELOPMENTS

- July 2024 : PBI Performance Products, Inc. and TenCate Protective Fabrics formed a partnership to launch PBI Peak5, an ultra-lightweight fire-resistant outer shell fabric specifically designed for firefighters

- May 2024 : Milliken & Company, a global leader in diversified manufacturing, collaborated with NASA to develop and produce flame-resistant intimate apparel fabric for the upcoming Artemis missions.

- May 2023 : Indorama Ventures Public Company Limited renamed Trevira GmbH as Indorama Ventures Fibers Germany GmbH as part of its global brand alignment strategy aimed at establishing a unified corporate identity across its 147 sites in 35 countries.

- February 2022 : DuPont Personal Protection, a subsidiary of DuPont de Nemours, Inc., formed a partnership with Bulwark, the world’s largest flame-resistant (FR) apparel brand

- February 2021 : Teijin Limited launched a new fire-resistant fabric named Tenax. This is a woven carbon fiber fabric coated with a thermoplastic polymer and is completely impregnated.

Table of Contents

Methodology

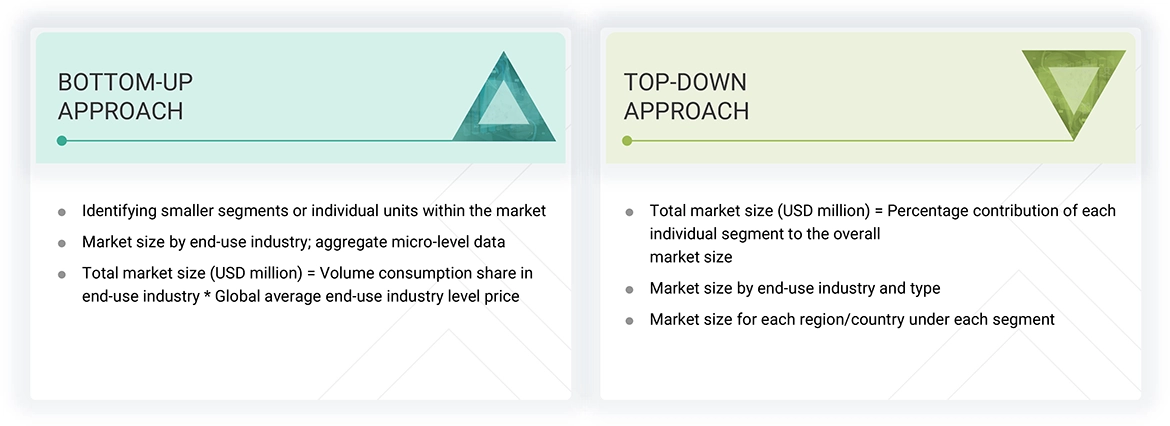

The study involved four major activities in estimating the market size for fire-resistant fabrics. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

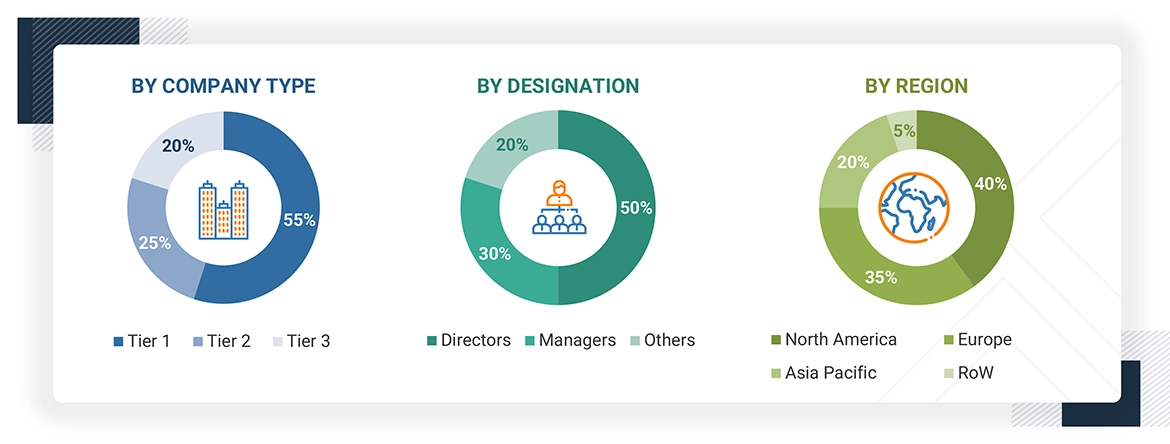

Secondary sources used in this study included annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites such as Factiva, ICIS, Bloomberg, and others. The findings of this study were verified through primary research by conducting extensive interviews with key officials such as CEOs, VPs, directors, and other executives. The breakdown of the profiles of the primary interviewees is illustrated in the figure below.

Primary Research

The fire-resistant fabrics market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by key opinion leaders in various applications for the fire-resistant fabrics market. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Breakdown of Primary Participants

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2023/2024, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

| COMPANY NAME | DESIGNATION | |

|---|---|---|

| DuPont de Nemours, Inc. | Senior Manager | |

| Teijin Limited | Innovation Manager | |

| Indorama Ventures Public Company Limited | Vice President | |

| Syensqo SA/NV | Production Supervisor | |

| TenCate Protective Fabrics | Sales Manager | |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fire-resistant fabrics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the fire-resistant fabrics industry.

Market Definition

According to Comité International de la Rayonne et des Fibres Synthétiques (CIRFS), “Fire-resistant fabrics are materials that do not burn when exposed to fire due to their chemical structure.

Fire-resistant fabrics are used as the last-level protection barrier in case of direct exposure to fire. They do not catch fire or melt when exposed to fire. This type of fabric can have inherent fire resistance properties or be treated to make it fire resistant. Fire-resistant fabrics are also used to manufacture personal protective equipment (PPE) to safeguard personnel working in harsh, high-temperature environments.

Stakeholders

- Transfection products manufacturing companies

- Pharmaceutical & Biopharmaceutical Companies

- Chemical Companies

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Contract Development and Manufacturing Organizations (CDMOs)

- Research Institutes and Universities

- Venture Capitalists & Investors

- Government Associations

Report Objectives

- To define, describe, and forecast the fire-resistant fabrics market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the market growth

- To estimate and forecast the market size by type, application, end-use industry, and region

- To forecast the size of the market with respect to five main regions (along with key countries of each region): Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To analyze competitive developments, such as product launches, acquisitions, partnerships, and expansions

- To strategically profile the key players and comprehensively analyze their core competencies

Key Questions Addressed by the Report

Who are the major players in the fire-resistant fabrics market?

DuPont de Nemours, Inc. (US), Teijin Limited (Japan), Indorama Ventures Public Company Limited (Thailand), Syensqo SA/NV (Belgium), TenCate Protective Fabrics (Netherlands), Lenzing AG (Austria), PBI Performance Products, Inc. (US), Kaneka Corporation (Japan), Gun Ei Chemical Industry Co., Ltd. (Japan), W. L. Gore & Associates, Inc. (US), and Milliken & Company (US).

What are the drivers and opportunities for the fire-resistant fabrics market?

Major drivers include stringent workplace safety regulations in developed countries, increased use in the oil & gas industry, and growing urbanization & infrastructure development. Technological innovations in product development are expected to create new opportunities.

Which strategies are the key players focusing on in the fire-resistant fabrics market?

Key strategies include product launches, partnerships, collaborations, mergers & acquisitions, agreements, and expansions to enhance global presence.

What is the expected growth rate of the fire-resistant fabrics market between 2025 and 2030?

The market is projected to grow at a CAGR of 7.24% in terms of value during the forecast period.

Which major factors are expected to restrain the growth of the fire-resistant fabrics market?

High production costs, significant R&D investment requirements, and lack of safety regulations in developing regions are expected to restrain market growth.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Fire-resistant Fabrics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Fire-resistant Fabrics Market

Enric

Jul, 2015

Interested in Aramid Fibre market.

Edson

Aug, 2019

flame retardant yarn Market.

Lee

Dec, 2018

Interested in market size, competition in Industrial setting (oil and gas, chemical, petrochemical, and mining) in GCC /Middle east region for Fire resistant clothing market..

Victor

Oct, 2016

Interested in Singapore, Indonesia, Thailand, Malaysia and Vietnam country level information..