Flocculant & Coagulant Market by Type (Coagulant, Flocculant), End-Use Industry (Muncipal Water Treatment, Paper & Pulp, Textile, Oil & Gas, Mining), & Region( North America, Asia Paific, Europe , MEA, South America) - Global Forecast to 2028

Updated on : January 27, 2025

Flocculant & Coagulant Market

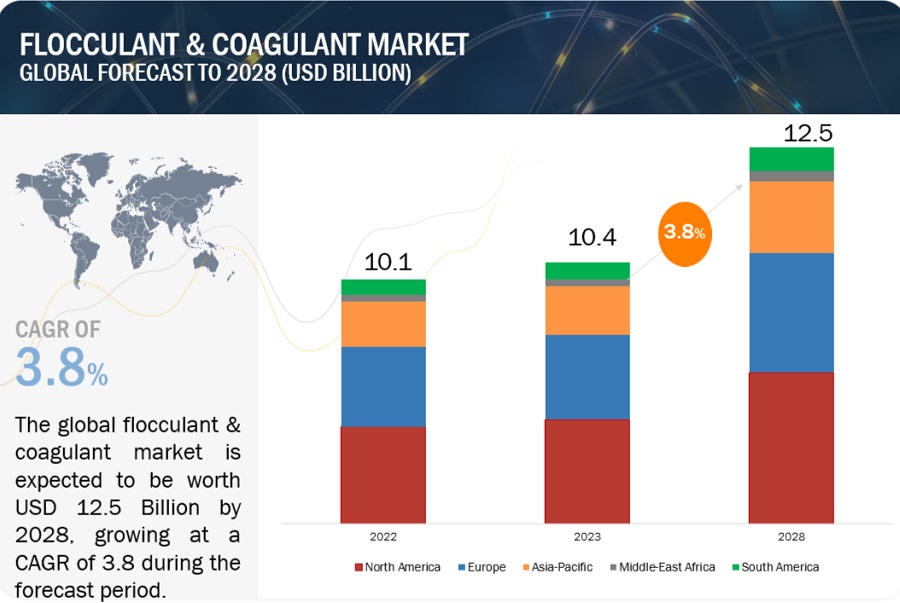

The global flocculant & coagulant market was valued at USD 10.4 billion in 2023 and is projected to reach USD 12.6 billion in 2028, growing at 3.8% cagr from 2023 to 2028. Flocculants and coagulants can be defined as chemical compounds used in the water treatment process to remove impurities, which may be of metallic, organic, or non-organic nature. Rapid growth is fueled by Implementation of stringent environmental regulations across the globe for wastewater treatment, limited availability and declining freshwater resource, and growth in mining and mineral processing.

Opportunities in the Flocculant & Coagulant Market

To know about the assumptions considered for the study, Request for Free Sample Report

Recession impact on Flocculant & Coagulant Market

During a recession, industries like construction, manufacturing, and mining may experience reduced activity, leading to decreased demand for water treatment chemicals. Companies may also cut costs, potentially affecting their investment in environmental compliance, including water treatment. Conversely, in some cases, there could be an increased need for efficient water treatment due to infrastructure maintenance and tighter regulatory controls during economic downturns. Overall, the impact depends on the severity and duration of the recession, industry-specific trends, and government policies concerning environmental standards and water management.

Flocculant and Coagulant Market Dynamics

Driver: Implementation of stringent environmental regulations across the globe for wastewater treatment

Stringent environmental regulations have emerged as a compelling driver of growth in the flocculants and coagulants market, significantly impacting industries worldwide. In today's business landscape, compliance with these regulations is not just a matter of legal obligation; it has evolved into a strategic imperative for companies aiming to sustain their operations and reputation. The regulatory bodies of the countries such as the U.S., China, Canada, India, and others have formulated various regulations for wastewater treatment and recovery & reuse of water generated from liquid waste to meet their water requirements for domestic as well as industrial usage. These governments have established certain manufacturing practices to maintain safety measures.

In Canada, over 150 billion liters of untreated wastewater is released into waterways every year, which is one of the major health, environmental, and economic issues in the country. The government of Canada established “Wastewater Systems Effluent Regulations” under the Fisheries Act in 2012. The aim of this regulation is to treat wastewater by secondary wastewater treatment and minimizing water wastage. The regulation mandates monitoring, record keeping, reporting, and toxicity testing of water. In April 2016, the Food Safety and Standards Authority of India (FSSAI) proposed some important amendments to the regulations regarding packaged drinking water. It has been stated that water utilized in packaged drinking water is subjected to specific purification treatments.

The Clean Water Act (CWA) in the US, a cornerstone of environmental legislation, imposes stringent wastewater discharge standards, compelling industries to prioritize the removal of contaminants from their effluent streams. Similarly, within the European Union, the Water Framework Directive has set stringent quality criteria for surface waters. This has heightened the imperative for businesses operating in EU member states to adhere to these standards.

These regulations ensure that high-quality standards are maintained for drinking water and wastewater treatment and will increase the demand for flocculant & coagulant for water & wastewater treatment applications.

Restrain: Alternative water treatment technolgies

The emergence of alternative water treatment technologies, which are increasingly being recognized as more environmentally sustainable and cost-effective solutions restrains the growth of this market. Among these alternatives, membrane filtration systems stand out for their ability to offer precise control over contaminant removal without the necessity of chemical additives. This capability not only enhances the quality of treated water but also significantly reduces the reliance on traditional flocculants and coagulants. Additionally, ultraviolet (UV) disinfection systems have gained prominence for their eco-friendly approach to water treatment. By effectively eliminating pathogens without chemical intervention, UV disinfection not only addresses environmental concerns but also curtails the procurement and disposal costs associated with conventional treatment chemicals.

Membrane filtration technologies, including microfiltration, ultrafiltration, nanofiltration, and reverse osmosis, provide a tailored approach to removing impurities from water. They are prized for their ability to remove particles, microorganisms, and even dissolved solutes, making them highly versatile across industries. These systems are particularly attractive due to their minimal chemical use, reducing the environmental footprint and operational costs.

As industries increasingly prioritize both sustainability and cost-efficiency, the adoption of these innovative and environmentally conscious water treatment technologies can potentially restrain the growth of the traditional flocculants and coagulants market.

Opportunity: Emerging trend towards eco-friendly and biodegradable flocculant and coagulant

Developing eco-friendly and biodegradable flocculant and coagulant formulations in line with green chemistry principles offers substantial business opportunities, particularly in sectors like agriculture and textiles. In agriculture, where efficient water utilization is pivotal, sustainable water treatment solutions are increasingly sought after. These eco-friendly chemicals play a vital role in treating agricultural wastewater, ensuring that the water returned to natural ecosystems or reused in farming is devoid of harmful contaminants. The added advantage of biodegradability makes them even more appealing, reducing the long-term environmental impact and preserving soil and water quality.

Likewise, the textile industry, known for its heavy water usage, is recognizing the value of green chemistry in water treatment. Sustainable flocculants and coagulants are instrumental in treating wastewater generated during dyeing and finishing processes, aligning perfectly with the industry's heightened focus on sustainability and environmental stewardship. The biodegradable nature of these formulations further enhances their appeal, contributing to the reduction of the textile sector's ecological footprint.

With tightening regulatory standards and the growing emphasis on environmental responsibility, the demand for eco-conscious water treatment solutions is on an upward trajectory.

Challenge: Stringent environmental regulations pertaining to use on chemicals for the formulation of flocculant and coagulant

The increasing rigor of environmental regulations poses a substantial challenge for businesses operating within the flocculant and coagulant market. These regulatory measures, while essential for safeguarding the environment and public health, introduce complexities that necessitate careful management. These regulations often impose restrictions on the types of chemicals that can be incorporated into flocculant and coagulant formulations, especially if there's a potential for these chemicals to negatively impact aquatic ecosystems. Such limitations can limit flexibility in product development, compelling companies to seek out environmentally friendly alternatives. This transition requires significant investments in research and development to formulate compliant, yet effective, products. Furthermore, quantity limits on chemical usage, a common aspect of environmental regulations, directly influence the efficiency and efficacy of flocculants and coagulants in water treatment processes.

Compliance also entails meticulous documentation and reporting requirements. Companies must dedicate resources to maintain comprehensive records and robust monitoring systems to ensure they consistently meet environmental standards. These administrative responsibilities add complexity and costs to their operations. So, the stringent nature of environmental regulations significantly impacts the flocculant and coagulant market.

Flocculant and Coagulant Market Ecosystem

Flocculant is the second-fastest growing type in the flocculant & coagulant market during the forecast period.

Flocculants are the second fastest-growing segment in the flocculant and coagulant market due to their expanding applications. These chemicals are in demand across various industries, including mining, oil and gas, and wastewater treatment, to effectively aggregate and settle suspended particles and impurities. As environmental regulations become more stringent, industries increasingly adopt flocculants to enhance water clarification processes and minimize environmental impact. Additionally, innovations in polymer-based flocculants have improved their efficiency, versatility, and cost-effectiveness, driving their adoption. This growth trend reflects the rising need for efficient solid-liquid separation techniques and the pursuit of sustainable water management practices across industries.

The pulp & paper is estimated to be the fastest growing end use industry in the flocculant & coagulant market during the forecast period.

The pulp & paper industry is the fastest-growing segment in the flocculant and coagulant market due to multiple factors. This industry relies heavily on water-intensive processes, generating significant wastewater challenges. Coagulants and flocculants are essential in effectively treating and purifying the copious amounts of water used. The rising demand for sustainable and eco-friendly paper production methods drives the adoption of these chemicals. Moreover, increasing environmental regulations regarding wastewater discharge and a growing emphasis on water recycling and resource efficiency further accelerate the utilization of flocculants and coagulants within the pulp and paper sector, contributing to its remarkable growth within the market.

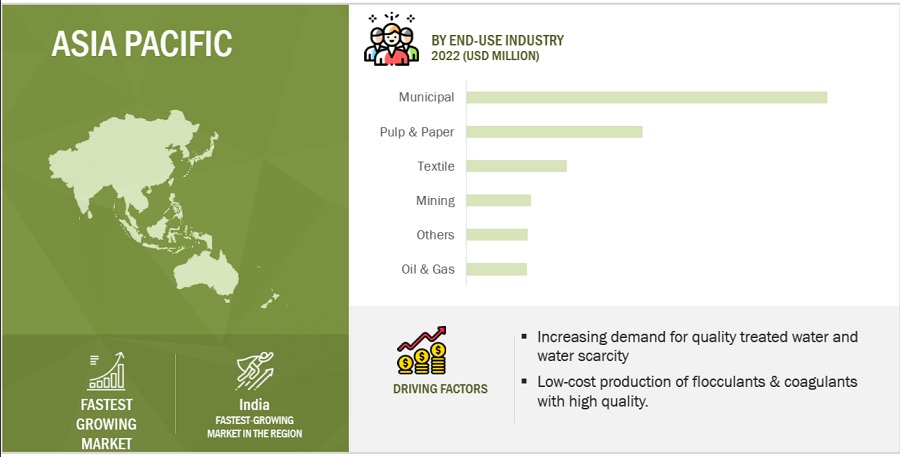

Based on region, Asia Pacific is projected to grow fastest in the flocculant & coagulant market during the forecast period.

The Asia Pacific region exhibits the fastest growth in the flocculant and coagulant market due to several key factors. Rapid industrialization and urbanization in countries like China and India have led to increased wastewater generation, necessitating efficient water treatment processes. Additionally, stringent environmental regulations aimed at improving water quality have stimulated demand for flocculants and coagulants. The expanding manufacturing, mining, and municipal sectors in the region also contribute to heightened usage. Additionally, heightened awareness of water scarcity issues and the pursuit of sustainable water management practices further fuel the adoption of these chemicals, making Asia Pacific the fastest-growing market for flocculants and coagulants.

Source: Secondary Research, Primary Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Flocculant and Coagulant Market Players

Kemira OYJ (Finland), BASF SE (Germany), Ecolab Inc. (U.S.), SNF Floerger (France), and Solenis LLC (U.S.). These players have established a strong foothold in the market by adopting strategies, such expansions, joint ventures, and merger & acquisitions.

Flocculant and Coagulant Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 10.4 billion |

|

Revenue Forecast in 2028 |

USD 12.6 billion |

|

CAGR |

3.8% |

|

Years considered for the study |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Volume (Kiloton) and Value (USD Million/Billion) |

|

Segments |

By Type, End-use Industry, and Region |

|

Regions |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies |

Kemira OYJ (Finland), BASF SE (Germany), Ecolab Inc. (U.S.), SNF Floerger (France), and Solenis LLC (U.S.). |

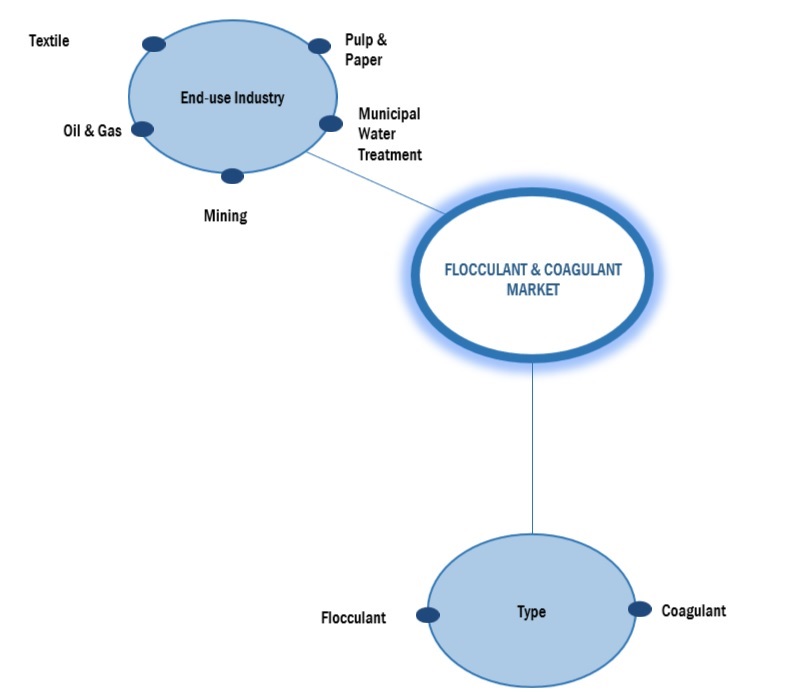

The study categorizes the flocculant & coagulant market based on type, end-use industry, and region at the region and global level.

Flocculant and Coagulant Market by Type:

- Coagulant

- Flocculant

Flocculant and Coagulant Market by End-use Industry:

- Muncipal water treatment

- Pulp & paper

- Textile

- Oil & gas

- Mining

- Others

Flocculant and Coagulant Market by Region:

- North America

- Asia Paific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In July 2023, Solenis, a specialty chemical manufacturer, successfully acquired Diversey Holdings, expanding its global presence across 130 countries. This all-cash transaction, valued at USD 4.6 billion, enhances Solenis' capabilities in hygiene and cleaning solutions, fostering growth and sustainability across various industries.

- In Febrauary 2023, Feralco, acquired the remaining 50% share capital of Feracid, a key producer of high purity iron salts for water treatment. Feracid's production unit, with a 60,000-ton capacity, is situated in Pont-de-Claix, France, providing essential access to hydrochloric acid as a raw material.

- In June 2021, Kemira successfully completed a USD 80 million investment in its Alabama manufacturing site, establishing state-of-the-art production units for emulsion polymers and biobased acrylamide monomers. This expansion strengthens Kemira's presence in the energy market in the Americas, aligning with its strategic growth focus. The enhanced capacity addresses growing demand for polyacrylamide polymers, particularly in water-intensive applications like the oil and gas industry.

- In November 2022, SNF announced a substantial investment of USD 300 million in the US. This investment aims to expand their production capabilities significantly. Specifically, SNF plans to add 30,000 metric tons per year of powder-grade Polyacrylamide (PAM) production capacity and increase Acrylamide production by 100,000 metric tons at their facility located in Plaquemine, Louisiana.

Frequently Asked Questions (FAQ):

What is the current size of the global flocculant & coagulant market?

Global flocculant & coagulant market size is estimated to reach USD 12.5 billion by 2028 from USD 10.1 billion in 2022, at a CAGR of 3.8% during the forecast period.

Who are the winners in the global flocculant & coagulant market?

Kemira OYJ, BASF SE, Ecolab Inc., SNF Floerger, and Solenis LLC fall under the winner’s category. They have the potential to broaden their product portfolio and compete with other key market players. Such advantages give these companies an edge over other companies.

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use expansions, joint ventures, and mergers & acquisitions as important growth tactics.

What is the recession on flocculant & coagulant manufacturers?

Companies may focus more on cost-cutting measures and short-term survival strategies rather than long-term investments. Recessions might bring about shifts in consumer preferences and market demands.

What are some of the drivers in the market?

Limited availability and declining freshwater resources. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Implementation of stringent environmental regulations regarding wastewater treatment- Declining availability of freshwater resources- Growth in mining and mineral processingRESTRAINTS- Availability of alternative water treatment technologies- High cost of using flocculants and coagulantsOPPORTUNITIES- Emerging trend towards eco–friendly and biodegradable flocculants and coagulants- Rapid industrialization and urbanization in emerging economiesCHALLENGES- Stringent environmental regulations pertaining to use of chemicals for formulation of flocculants and coagulants

-

5.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

5.4 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.5 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEPUBLICATION TRENDSINSIGHTSJURISDICTION ANALYSISTOP 10 COMPANIES/APPLICANTSTOP 10 PATENT OWNERS IN LAST 10 YEARS

-

5.6 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE BASED ON REGIONAVERAGE SELLING PRICE BASED ON BY END-USE INDUSTRYAVERAGE SELLING PRICE BASED ON TYPE

-

5.7 ECOSYSTEM/MARKET MAP

-

5.8 TECHNOLOGY ANALYSISADVANCED POLYMER–BASED FLOCCULANTSNAN0–FLOCCULANTSBIODEGRADABLE COAGULANTS AND FLOCCULANTS

-

5.9 TRADE ANALYSISIMPORT–EXPORT SCENARIO OF WATER TREATMENT CHEMICALS

-

5.10 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS

-

5.11 TARIFF & REGULATORY LANDSCAPENORTH AMERICA- Clean Water Act (CWA)- Safe Drinking Water Act (SDWA)ASIA PACIFIC- Environmental Protection Law (EPL)- Water Resources Law- Water Pollution Prevention and Control Law- Water Prevention and Control of Pollution ActEUROPE- Urban Wastewater Treatment Directive- Drinking Water Directive- Water Framework DirectiveREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA- Quality- Service

-

5.14 CASE STUDY ANALYSISSNF GROUPKEMIRA

-

5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.1 INTRODUCTION

-

6.2 COAGULANTINORGANIC COAGULANTS WIDELY USED FOR COST–EFFECTIVE TREATMENT OF RAW WATER WITH LOW TURBIDITYORGANIC COAGULANT- Polyamine- PolyDADMACINORGANIC COAGULANT- Aluminum sulfate- Polyaluminum chloride- Ferric chloride- Polyaluminum sulfate- Ferric sulfate- Others

-

6.3 FLOCCULANTANIONIC FLOCCULANTS TO DOMINATE MARKET DURING FORECAST PERIODANIONIC FLOCCULANTCATIONIC FLOCCULANTNON–IONIC FLOCCULANTAMPHOTERIC FLOCCULANT

- 7.1 INTRODUCTION

-

7.2 MUNICIPALHIGH DEMAND IN MUNICIPAL WATER TREATMENT SYSTEMS DUE TO INCREASING NEED FOR TREATED WATER

-

7.3 PULP & PAPERFLOCCULANTS AND COAGULANTS USED TO OPTIMIZE WATER CONSUMPTION

-

7.4 TEXTILENATURAL COAGULANTS INCREASINGLY PREFERRED IN TEXTILE SECTOR

-

7.5 OIL & GASSTRINGENT ENVIRONMENTAL REGULATION TO BOOST USE OF COAGULANTS AND FLOCCULANTS

-

7.6 MININGCOAGULANTS AND FLOCCULANTS WIDELY USED TO ENABLE EFFICIENT SEPARATION OF SOLIDS FROM WATER

- 7.7 OTHERS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICAUS- Adoption of advanced water treatment technologies to increase demand for flocculants and coagulantsCANADA- Increasing governmental support for wastewater treatment to boost market growthMEXICO- Expanding industrial sector to drive demand

-

8.3 ASIA PACIFICCHINA- China to lead flocculant & coagulant market in Asia PacificINDIA- Government regulatory policies to drive demandJAPAN- Technological advancements in water treatment techniques to support market growthSOUTH KOREA- Government regulations to reuse wastewater to propel marketINDONESIA- Growing water treatment infrastructure to drive marketAUSTRALIA & NEW ZEALAND- Increasingly stringent regulatory policies to fuel demandREST OF ASIA PACIFIC

-

8.4 EUROPEGERMANY- Germany to lead flocculant & coagulant market in EuropeFRANCE- Municipal water treatment to be largest consumer during forecast periodITALY- Utilization of advanced treatment procedures and chemicals to boost demandUK- Growing end–use industries and government initiatives to support market growthRUSSIA- Strong energy sector to drive demand for flocculants & coagulantsSPAIN- Government focus on water and wastewater treatment to drive marketBENELUX- Stringent environmental regulations to propel market growthNORDIC- Implementation of infrastructure projects to drive marketREST OF EUROPE

-

8.5 MIDDLE EAST & AFRICASAUDI ARABIA- Oil & gas sector to fuel demand for flocculants & coagulantsSOUTH AFRICA- Prominent mining industry to fuel demandUAE- Government investments in wastewater treatment to drive marketREST OF MIDDLE EAST & AFRICA

-

8.6 SOUTH AMERICABRAZIL- Brazil to lead market in South AmericaARGENTINA- Growing pulp & paper industry to support market growthCHILE- Mining to be fastest–growing end user during forecast periodREST OF SOUTH AMERICA

- 9.1 OVERVIEW

- 9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 9.3 RANKING ANALYSIS OF KEY MARKET PLAYERS

- 9.4 MARKET SHARE ANALYSIS

- 9.5 REVENUE ANALYSIS OF TOP PLAYERS

- 9.6 MARKET EVALUATION FRAMEWORK

-

9.7 COMPANY EVALUATION MATRIX, 2022 (TIER 1 COMPANIES)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

9.8 START–UPS AND SMALL AND MEDIUM–SIZED ENTERPRISES (SMES) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

9.9 COMPETITIVE SCENARIO & TRENDSDEALSOTHER DEVELOPMENTS

-

10.1 KEY PLAYERSKEMIRA OYJ- Business overview- Products offered- Recent developments- MnM viewBASF SE- Business overview- Products offered- MnM viewECOLOAB INC.- Business overview- Products offered- Recent developments- MnM viewSNF FLOERGER- Business overview- Products offered- Recent developments- MnM viewSOLENIS LLC- Business overview- Products offered- Recent developments- MnM viewSOLVAY- Business overview- Products offered- MnM viewKURITA WATER INDUSTRIES LTD.- Business overview- Products offered- Recent developments- MnM viewBUCKMAN LABORATORIES, INC.- Business overview- Products offered- Recent developments- MnM viewFERALCO AB- Business overview- Products offered- Recent developments- MnM viewIXOM- Business overview- Products offered- Recent developments- MnM view

-

10.2 OTHER PLAYERSAKKIM KIMYAARIES CHEMICAL INC.BAUMINAS AQUASCHEMIFLOCCHEMTRADE LOGISTICSDEW SPECIALTY CHEMICALS (P) LTD.DONAU CHEMIE AGGEO SPECIALTY CHEMICALS INC.HOLLAND COMPANY INC.KRONOS ECOCHEMTIDAL VISIONJAYEM ENGINEERSSHANDONG SHUIHENG CHEMICAL CO., LTD.USALCO LLCYIXING BLUWAT CHEMICALS CO., LTD.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 FLOCCULANT & COAGULANT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 PATENT BY ECOLAB USA INC.

- TABLE 3 PATENT BY NALCO COMPANY LLC

- TABLE 4 TOP 10 PATENT OWNERS

- TABLE 5 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- TABLE 6 AVERAGE SELLING PRICE, BY TYPE (USD/KG)

- TABLE 7 FLOCULANT & COAGULANT MARKET: ROLE IN ECOSYSTEM

- TABLE 8 IMPORT TRADE DATA OF TOP 20 COUNTRIES, 2020–2022 (USD THOUSAND)

- TABLE 9 EXPORT TRADE DATA OF TOP 20 COUNTRIES, 2020–2022 (USD THOUSAND)

- TABLE 10 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 11 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 FLOCULANT & COAGULANT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 FLOCCULANT & COAGULANT MARKET SIZE, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 14 FLOCCULANT & COAGULANT MARKET SIZE, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 15 FLOCCULANT & COAGULANT MARKET SIZE, BY TYPE, 2020–2022 (KILOTON)

- TABLE 16 FLOCCULANT & COAGULANT MARKET SIZE, BY TYPE, 2023–2028 (KILOTON)

- TABLE 17 FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 18 FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 19 FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 20 FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 21 FLOCCULANT & COAGULANT MARKET SIZE, BY REGION, 2020–2022 (USD MILLION)

- TABLE 22 FLOCCULANT & COAGULANT MARKET SIZE, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 FLOCCULANT & COAGULANT MARKET SIZE, BY REGION, 2020–2022 (KILOTON)

- TABLE 24 FLOCCULANT & COAGULANT MARKET SIZE, BY REGION, 2023–2028 (KILOTON)

- TABLE 25 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 26 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 27 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 28 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 29 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 32 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 33 US: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 34 US: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 35 US: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 36 US: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 37 CANADA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 38 CANADA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 39 CANADA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 40 CANADA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 41 MEXICO: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 42 MEXICO: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 43 MEXICO: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 44 MEXICO: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 45 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 46 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 48 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 49 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 52 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 53 CHINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 54 CHINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 55 CHINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 56 CHINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 57 INDIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 58 INDIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 59 INDIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 60 INDIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 61 JAPAN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 62 JAPAN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 JAPAN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 64 JAPAN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 65 SOUTH KOREA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 66 SOUTH KOREA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 67 SOUTH KOREA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 68 SOUTH KOREA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 69 INDONESIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 70 INDONESIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 71 INDONESIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 72 INDONESIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 73 AUSTRALIA & NEW ZEALAND: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 74 AUSTRALIA & NEW ZEALAND: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 75 AUSTRALIA & NEW ZEALAND: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 76 AUSTRALIA & NEW ZEALAND: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 77 REST OF ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 78 REST OF ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 79 REST OF ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 80 REST OF ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 81 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 82 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 84 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 85 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 86 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 88 EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 89 GERMANY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 90 GERMANY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 91 GERMANY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 92 GERMANY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 93 FRANCE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 94 FRANCE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 95 FRANCE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 96 FRANCE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 97 ITALY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 98 ITALY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 99 ITALY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 100 ITALY: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 101 UK: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 102 UK: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 103 UK: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 104 UK: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 105 RUSSIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 106 RUSSIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 RUSSIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 108 RUSSIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 109 SPAIN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 110 SPAIN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 111 SPAIN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 112 SPAIN: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 113 BENELUX: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 114 BENELUX: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 115 BENELUX: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 116 BENELUX: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 117 NORDIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 118 NORDIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 NORDIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 120 NORDIC: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 121 REST OF EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 122 REST OF EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 124 REST OF EUROPE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 132 MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 133 SAUDI ARABIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 134 SAUDI ARABIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 135 SAUDI ARABIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 136 SAUDI ARABIA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 137 SOUTH AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 138 SOUTH AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 SOUTH AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 140 SOUTH AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 141 UAE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 142 UAE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 143 UAE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 144 UAE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 149 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 150 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 151 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2020–2022 (KILOTON)

- TABLE 152 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 153 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 154 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 155 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 156 SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 157 BRAZIL: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 158 BRAZIL: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 159 BRAZIL: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 160 BRAZIL: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 161 ARGENTINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 162 ARGENTINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 163 ARGENTINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 164 ARGENTINA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 165 CHILE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 166 CHILE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 167 CHILE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 168 CHILE: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 169 REST OF SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 170 REST OF SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2020–2022 (KILOTON)

- TABLE 172 REST OF SOUTH AMERICA: FLOCCULANT & COAGULANT MARKET SIZE, BY END–USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 173 FLOCCULANT & COAGULANT MARKET: DEGREE OF COMPETITION

- TABLE 174 FLOCCULANT & COAGULANT MARKET: REVENUE ANALYSIS (USD BILLION)

- TABLE 175 STRATEGIC DEVELOPMENTS, BY KEY COMPANIES

- TABLE 176 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 177 COMPANY REGION FOOTPRINT

- TABLE 178 DEALS, 2019—2023

- TABLE 179 OTHER DEVELOPMENTS, 2019–2023

- TABLE 180 KEMIRA OYJ: COMPANY OVERVIEW

- TABLE 181 KEMIRA OYJ: PRODUCT OFFERINGS

- TABLE 182 KEMIRA OYJ: DEALS

- TABLE 183 KEMIRA OYJ: OTHER DEVELOPMENTS

- TABLE 184 BASF SE: COMPANY OVERVIEW

- TABLE 185 BASF SE: PRODUCT OFFERINGS

- TABLE 186 ECOLAB INC.: COMPANY OVERVIEW

- TABLE 187 ECOLAB INC.: PRODUCT OFFERINGS

- TABLE 188 ECOLAB INC.: OTHER DEVELOPMENTS

- TABLE 189 SNF FLOERGER: COMPANY OVERVIEW

- TABLE 190 SNF FLOERGER: PRODUCT OFFERINGS

- TABLE 191 SNF FLOERGER: DEALS

- TABLE 192 SNF FLOERGER: OTHER DEVELOPMENTS

- TABLE 193 SOLENIS LLC: COMPANY OVERVIEW

- TABLE 194 SOLENIS LLC: PRODUCT OFFERINGS

- TABLE 195 SOLENIS LLC: DEALS

- TABLE 196 SOLENIS LLC: OTHER DEVELOPMENTS

- TABLE 197 SOLVAY: COMPANY OVERVIEW

- TABLE 198 SOLVAY: PRODUCT OFFERINGS

- TABLE 199 KURITA WATER INDUSTRIES LTD.: COMPANY OVERVIEW

- TABLE 200 KURITA WATER INDUSTRIES LTD.: PRODUCT OFFERINGS

- TABLE 201 KURITA WATER INDUSTRIES LTD.: DEALS

- TABLE 202 KURITA WATER INDUSTRIES LTD.: OTHER DEVELOPMENTS

- TABLE 203 BUCKMAN LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 204 BUCKMAN LABORATORIES, INC.: PRODUCT OFFERINGS

- TABLE 205 BUCKMAN LABORATORIES, INC.: OTHER DEVELOPMENTS

- TABLE 206 FERALCO AB: COMPANY OVERVIEW

- TABLE 207 FERALCO AB: PRODUCT OFFERINGS

- TABLE 208 FERALCO AB: DEALS

- TABLE 209 IXOM: COMPANY OVERVIEW

- TABLE 210 IXOM: PRODUCT OFFERINGS

- TABLE 211 IXOM: DEALS

- FIGURE 1 FLOCCULANT & COAGULANT MARKET: RESEARCH DESIGN

- FIGURE 2 FLOCCULANT & COAGULANT MARKET SIZE ESTIMATION

- FIGURE 3 TOP–DOWN APPROACH

- FIGURE 4 BOTTOM–UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: BOTTOM–UP APPROACH (DEMAND SIDE)

- FIGURE 6 FLOCCULANT & COAGULANT MARKET: DATA TRIANGULATION

- FIGURE 7 MUNICIPAL WATER TREATMENT TO BE LARGEST END–USE INDUSTRY BETWEEN 2023 AND 2028

- FIGURE 8 COAGULANTS TO LEAD FLOCCULANT & COAGULANT MARKET BETWEEN 2023 AND 2028

- FIGURE 9 NORTH AMERICA TO LEAD FLOCCULANT & COAGULANT MARKET, 2023–2028

- FIGURE 10 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FLOCCULANT & COAGULANT MARKET DURING FORECAST PERIOD

- FIGURE 11 ORGANIC COAGULANT TO BE FASTEST–GROWING SEGMENT

- FIGURE 12 MUNICIPAL WATER TREATMENT TO ACCOUNT FOR LARGEST MARKET SHARE

- FIGURE 13 CHINA TO LEAD FLOCCULANT & COAGULANT MARKET IN ASIA PACIFIC

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN FLOCCULANT & COAGULANT MARKET

- FIGURE 16 OVERVIEW OF VALUE CHAIN OF FLOCCULANT & COAGULANT MARKET

- FIGURE 17 FLOCCULANT & COAGULANT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 18 PATENTS REGISTERED FROM 2012 TO 2022

- FIGURE 19 NUMBER OF PATENTS YEAR–WISE FROM 2012 TO 2022

- FIGURE 20 US REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 21 NALCO CHEMICAL CO. REGISTERED MAXIMUM NUMBER OF PATENTS

- FIGURE 22 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- FIGURE 23 FLOCULANT & COAGULANT MARKET: ECOSYSTEM MAPPING

- FIGURE 24 SUPPLIER SELECTION CRITERION

- FIGURE 25 NEW REVENUE POCKETS IN FLOCCULANT & COAGULANT MARKET

- FIGURE 26 ORGANIC COAGULANT TO BE FASTEST–GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 27 MUNICIPAL TO BE LARGEST END–USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 28 INDIA TO REGISTER HIGHEST CAGR IN FLOCCULANT & COAGULANT MARKET BETWEEN 2023 AND 2028

- FIGURE 29 NORTH AMERICA: FLOCCULANT & COAGULANT MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: FLOCCULANT & COAGULANT MARKET SNAPSHOT

- FIGURE 31 COMPANIES ADOPTED ACQUISITION AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- FIGURE 32 RANKING OF TOP FIVE PLAYERS IN FLOCCULANT & COAGULANT MARKET, 2022

- FIGURE 33 FLOCCULANT & COAGULANT MARKET SHARE, BY COMPANY (2022)

- FIGURE 34 FLOCCULANT & COAGULANT MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 35 FLOCCULANT & COAGULANT MARKET: START–UPS AND SMES MATRIX, 2022

- FIGURE 36 KEMIRA OYJ: COMPANY SNAPSHOT

- FIGURE 37 BASF SE: COMPANY SNAPSHOT

- FIGURE 38 ECOLAB INC: COMPANY SNAPSHOT

- FIGURE 39 SOLVAY: COMPANY SNAPSHOT

- FIGURE 40 KURITA WATER INDUSTRIES LTD.: COMPANY SNAPSHOT

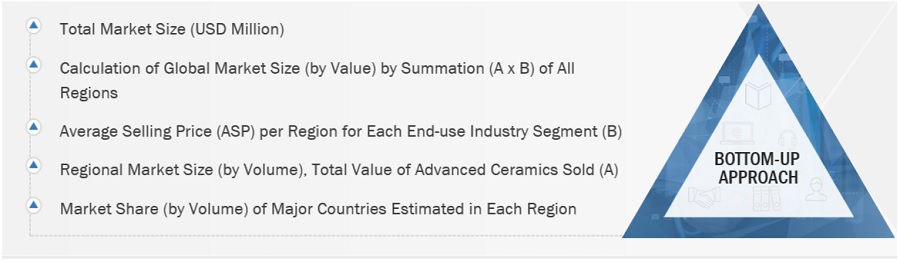

The study involved four major activities in estimating the current market size for flocculants & coagulants. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources have been referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research. Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

Flocculant & coagulant market involves a variety of stakeholders across the value chain, including raw material suppliers, manufacturers, and end-users. For this study, both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information. Key opinion leaders from various end-use sectors were interviewed from the demand side, while manufacturers and associations interviewed from the supply side.

Primary interviews helped to gather insights on market statistics, revenue data, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped to identify trends related to grade, application, end-use industries, and region. C-level executives from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand their perspective on suppliers, products, and component providers, which will affect the overall market.

Breakdown of Primaries

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The top-down approach was used to estimate and validate the size of various submarkets for flocculants & coagulants for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, end-use industry, and country were determined using secondary sources and verified through primary sources.

All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Flocculant & Coagulant Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Flocculant & Coagulant Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of flocculants & coagulants and their applications.

Market Definition

Flocculants and coagulants can be defined as chemical compounds used in the water treatment process to remove impurities, which may be of metallic, organic, or non-organic nature. Coagulants are used to destabilize the suspended particles through chemical reaction and flocculants are responsible for the transportation of the destabilized particles that cause collisions.

Stakeholders

- Manufacturers of flocculants & coagulants

- Raw Material Suppliers

- Manufacturers In End-use Industries

- Traders, Distributors, and Suppliers

- Regional Manufacturers’ Associations

- Government & Regional Agencies and Research Organizations

The main objectives of this study are as follows:

- To analyze and forecast the size of the flocculant & coagulant market in terms of value and volume.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market

- To analyze and forecast the market by type/material, end-use industry, and region.

- To forecast the size of the market with respect to five regions: Asia Pacific, Europe, North America, South America, and the Middle East & Africa, along with their key countries

- To strategically analyze micromarkets1 with respect to individual trends, growth prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape for the market leaders.

- To analyze competitive developments in the market, such as investment & expansion, joint venture, partnership, and merger & acquisition

- To strategically profile key players and comprehensively analyze their market shares and core competencies2.

- Notes: Micromarkets1 are the sub-segments of the flocculant & coagulant market included in the report.

- Core competencies2 of companies are determined in terms of their key developments, SWOT analysis, and key strategies adopted by them to sustain in the market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report.

- Additional country-level analysis of flocculant & coagulant market

- Profiling of additional market players (up to 3)

Growth opportunities and latent adjacency in Flocculant & Coagulant Market