Oil and Gas Security and Service Market by Component (Solution and Services), Services, Security Type (Physical Security and Network Security), Operation (Upstream, Midstream, and Downstream), and Region - Global Forecast to 2025

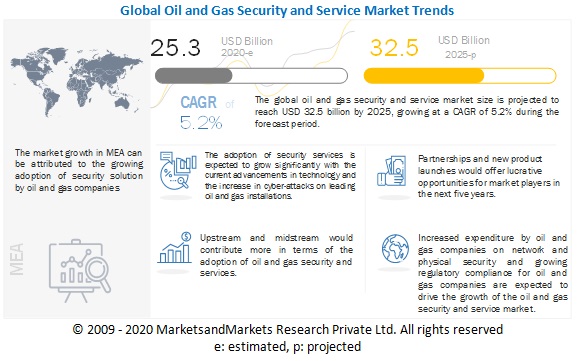

The global Oil and Gas Security and Service Market size was valued at USD 25.3 billion in 2020 and is anticipated to grow at CAGR of 5.2% between 2020 and 2025, attributed to the growing revenue of $32.5 billion by 2025. Increased expenditure by oil and gas companies on network and physical security is one of the major factors expected to drive the growth of this market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The COVID-19 pandemic is expected to impact the global oil and gas industry. According to McAfee, cyber-attacks between January and April have increased by 630%. Due to this pandemic, organizations are going through economic turmoil and the absence of service engineers has put a lot of pressure on oil companies due to which they are connecting Original Equipment Manufacturer Vendors (OEMs) with Operational Technology (OT) to carry out work. But due to this, their IT and OT systems are no longer segregated and are exposed to threats. Systems with no updated security patches are more prone to cyber-attacks. Further, the pandemic and subsequent response is already exerting pressure on governments, economies, households, and different industries across world. The oil and gas industry, both on shore and offshore, are mostly affected by Stuxnet and Exxon’s Torrance. Fluctuation in oil prices and political instability in the Middle East and Africa (MEA) and Asia Pacific (APAC) region have set the stage for cyber disasters in the oil and gas industry

Oil and Gas Security and Service Market Dynamics

Driver: Increased expenditure by oil and gas companies on network and physical security

Recent incidents of cyber-attacks have prompted oil and gas companies to strengthen their security infrastructure. Most of the oil and gas companies have gone through numerous cyberattacks in the recent years, which has led to huge losses. For instance, disruptions created by the attack in Saudi Aramco echoed for months describing the importance of cyber security to prevent such attacks. Countries such as Iraq and others in the MEA region, which are major oil producing countries, have gone through such circumstances earlier, which encouraged investment on network and physical security. In addition, in the light of the COVID-19 pandemic, the trend of Bring Your Own Device (BYOD) is consolidating, which can further expose oil and companies to the risk of phishing attacks. Thus, the usage of network security and firewall for protection is anticipated to surge in the coming years. A joint effort by Cisco and BT to survey approximately 2,200 office workers, businesses, and IT decision makers across 13 countries and 9 business verticals found out that 82% of companies supported BYOD.

Restraint: High reliance on existing security solutions

Many small and large oil and gas enterprises have adopted physical and cyber security solutions, but majority of enterprises still rely on existing security solutions. According to Xage security, the current security solutions of 95% companies are not meeting the needs of the company and industry. With innovation in technology and increased usage of cloud technologies and online platforms, the security perimeter of companies have become more porous to cyber threats and vulnerabilities. In 2017, an oil and gas plant in Saudi Arabia was hit by a Shamoon virus. The plant was using safety instrumented systems (SIS) of Schneider Electric. The presence of a remote access Trojan (RAT) called Triton helped the hackers to manipulate the controller so that it could not detect any possible safety hazard. In 2018, Saipem, an Italian oil service company, was hit by the same virus. It crippled more than 300 computers. The Shamoon virus had already created a havoc in Middle Eastern oil companies in 2012.

Opportunity: Adoption of cloud technologies in oil and gas security market

Increase in the adoption of cloud technologies in the oil and gas industry has made it more vulnerable to the cyber-attacks. Data protection and privacy being one of the key concerns in oil and gas industry has been achieved so far by isolating networks and strengthening perimeter defenses. The advent of cloud technology in oil and gas industry is an opportunity for companies to revitalize and improve their defense mechanism by adopting cyber security. Many companies lack expertise, capital, and on-premise servers due to which they need to adopt cloud technologies to secure data. Traditional network models mainly used to focus on the perimeter security; however, traditional strategies of perimeter security are no longer reliable as cyber attackers have already mastered the art of invading them. The most common types of cyber-attacks that have been witnessed in the COVID-19 period are malware, ransomware, and phishing, which take place through cloud ecosystem loopholes. Companies such as Hess and GRTgaz are moving to cloud as their digital strategy and have planned to majorly focus on cyber security

Challenge: Lack of awareness and security training within oil and gas industry

Offshore gas and oil fields are more vulnerable to threats. In the current era of globalization and interconnectivity, 80% of offshore cyber-attacks have been recorded to have occurred due to human error. It is a threat that needs to be prioritized; however, there are still many companies that do not take cyber security seriously. Lack of awareness and training is among the top causes of cyber espionages, thus, the need for proper employee training and awareness programs cannot be underrated.

Risk Management Services segment to grow at the highest CAGR during the forecast period

Rise in threat of terrorism, sabotage, and cybercrime on the oil and gas companies has raised concerns about the security of this sector. Managing risks and recognizing vulnerabilities in the current infrastructure is the major security concern among oil and gas enterprises. Robust security solution implementation is the requirement of the industry. Major security companies offer risk management services which help in evaluating and identifying hazards and risks. They help in quantitative risk analysis and security threat management for the overall oil and gas industry. Risk management services include business risk management, business continuity management, competency management, fire detection and management, environmental safeguard, and functional safety.

Network Security segment to grow at a higher CAGR during the forecast period

Rise in cyber-attacks due to increase in the usage of Internet of Things (IoT) technologies is driving the network security market for oil and gas security and service market. Refineries and storage areas for oil and gas are high-security zones and are typically located in areas which are out of bound for casual visitors, and the employees handling day to day affairs of refineries are highly skilled to follow safety norms. They also have critical operational and controller applications which are prone to cyber-attacks and cause massive operational damages and monetary losses. companies. To secure the networks, companies implement firewalls, Identity Access Management (IAM) solutions, Security Information and Event Management (SIEM), Unified Threat Management (UTM), and Supervisory Control and Data Acquisition (SCADA) security solutions. Moreover, increased government spending towards cyber-security and regulatory compliances are also driving the market. According to Accenture more than 50 % of oil and gas industrialists have agreed to spend more in cyber security.

To know about the assumptions considered for the study, download the pdf brochure

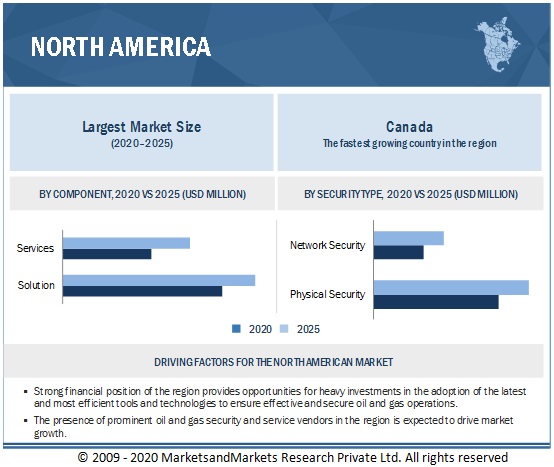

North America to hold the largest market size during the forecast period

North America is expected to hold the largest market size in the global oil and gas security and service market, while Middle East and Africa (MEA) is likely to grow at the highest CAGR during the forecast period. North America has been at the forefront in adopting oil and gas security solutions. Furthermore, this region has been extremely responsive towards adopting the latest technological advancements such as integration with cloud and mobile technologies within oil and gas security solutions to yield proper secured access mechanism and enforcing a security governance framework within a secured installation. The US and Canada are expected to be the major contributors to the North American market. Further, the presence of major oil and gas security and service vendors in the region to drive market growth.

Key Players

The oil and gas security and service market is dominated by a few globally established players such as, Cisco (US), NortonLifeLock (US), Honeywell (US), Siemens (Germany), and Microsoft (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 25.3 billion |

|

Revenue forecast for 2025 |

USD 32.5 billion |

|

Growth Rate |

5.2% CAGR |

|

Market size available for years |

2014–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast unit |

Value (USD Billion) |

|

Segments covered |

Component, Services, Security Type, Operation, and Region |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

The major market players include Cisco (US), NortonLifeLock (US), Honeywell (US), Siemens (Germany), Microsoft (US) (Total 30 companies) |

This research report categorizes the oil and gas security and service market to forecast revenues and analyze trends in each of the following submarkets:

By Component:

- Solution

- Services

By Services:

- Risk Management Services

- System Design, Integration, and Consulting

- Managed Services

By Security Type:

- Physical Security

- Network Security

By Operation:

- Upstream

- Midstream

- Downstream

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Russia

- Rest of Europe

-

APAC

- China

- India

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- Kuwait

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In July 2019, Cisco acquired Sentryo, a provider of visibility and security solutions for Industrial Control Systems (ICS) networks. By combining Sentryo’s capabilities with its network architecture, Cisco can provide IoT benefits to the oil and gas sector.

- In June 2018, Honeywell launched a new connected gas detector that listens for leaks ultrasonically, complementing fixed gas detectors to better protect workers and facilities against deadly toxic and explosive gas leaks.

- In November 2017, Waterfall Security Solutions and SecurityMatters partnered to protect oil and gas infrastructure from cyberattacks. This partnership integrates SecurityMatters’ SilentDefense network monitoring platform with Waterfall’s Unidirectional Security Gateways.

Frequently Asked Questions (FAQ):

What is the current size of global oil and gas security and service market?

The global oil and gas security and service market is estimated to be USD 25.3 billion in 2020 and projected to reach USD 32.5 billion by 2025, at a CAGR of 5.2%.

What is oil and gas security and service?

Oil and gas security is defined as the security process in which the oil and gas operational sectors, namely, upstream, midstream, and downstream are secured with the help of stringent physical and network security measures, to ensure operational efficiency and minimize losses associated to security breaches.

Who are the key market players in the oil and gas security and service market?

Lockheed Martin (US), ABB (Switzerland), Cisco (US), NortonLifeLock (US), Honeywell (US), Siemens (Germany), Microsoft (US), Parsons (US), Fortinet (US), Trend Micro (Japan), Forescout (US), GE (US), Synectics (UK), Intel (US), Speedcast (Australia), Booz Allen (US), Thales (France), HCL (India), IBM (US), BAE Systems (UK), Sophos (UK), Xage Security (US), Waterfall Security Solutions (Israel), Nozomi Networks (US), CNL Software (UK), Moxa (Taiwan), GPS Security (Canada), Athos (US), TSN (US), and J&G Security (US).

What are the top trends in the in the oil and gas security and service market?

Following are the current market trends impacting the oil and gas security and service market:

Driving factors for the oil and gas security and service market:

- Increased expenditure by oil and gas companies on network and physical security

- Growing political instability in Middle East

Opportunities for the oil and gas security and service market:

- Adoption of cloud technologies in oil and gas security market

- Rise in adoption of Internet of Things (IoT)

What are the different services consider in the oil and gas security and service market?

The different services consider in oil and gas security and service market are:

- Risk Management Services

- System Design, Integration, and Consulting

- Managed Services

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 STUDY OBJECTIVES

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

FIGURE 6 OIL AND GAS SECURITY AND SERVICE MARKET: MARKET SEGMENTATION

FIGURE 7 MARKET: REGIONS COVERED

1.6.2 YEARS CONSIDERED

1.7 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2014–2019

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 8 OIL AND GAS SECURITY AND SERVICE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 10 OIL AND GAS SECURITY AND SERVICE MARKET: RESEARCH METHODOLOGY

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY SIDE): ILLUSTRATIVE EXAMPLE OF PARSONS

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 ASSUMPTIONS

2.6 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

3.1 MARKET ESTIMATES AND FORECASTS, 2014–2025

TABLE 3 GLOBAL OIL AND GAS SECURITY AND SERVICE MARKET, 2014–2019 (USD MILLION)

TABLE 4 POST- COVID-19: GLOBAL MARKET, 2019–2025 (USD MILLION)

FIGURE 12 GLOBAL MARKET, 2018–2025

FIGURE 13 SEGMENTS WITH HIGH MARKET SHARES IN MARKET IN 2020

FIGURE 14 NORTH AMERICA TO ACCOUNT FOR HIGHEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 ATTRACTIVE OPPORTUNITIES IN OIL AND GAS SECURITY AND SERVICE MARKET

FIGURE 15 GROWING NUMBER OF CYBER AND TERRORIST ATTACKS TO BOOST ADOPTION OF SECURITY SOLUTION AMONG OIL AND GAS PROVIDERS

4.2 NORTH AMERICA: MARKET, BY COMPONENT AND COUNTRY, 2020

FIGURE 16 SOLUTION SEGMENT AND UNITED STATES TO ACCOUNT FOR HIGHER MARKET SHARES IN 2020

4.3 MARKET, BY COMPONENT, 2020–2025

FIGURE 17 SERVICES TO GROW AT A HIGHER GROWTH RATE DURING FORECAST PERIOD

4.4 MARKET, BY OPERATION, 2020–2025

FIGURE 18 MIDSTREAM SEGMENT TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increased expenditure by oil and gas companies on network and physical security

5.2.1.2 Growing political instability in Middle East

5.2.1.3 Need to ensure compliance with industry regulations

5.2.2 RESTRAINT

5.2.2.1 High reliance on existing security solutions

5.2.3 OPPORTUNITY

5.2.3.1 Adoption of cloud technologies in oil and gas industry

5.2.3.2 Rise in adoption of Internet of Things (IoT)

5.2.4 CHALLENGES

5.2.4.1 Lack of awareness and security training within oil and gas industry

5.2.4.2 Difficulty in implementation of comprehensive security solutions in multisite facilities

5.3 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS

5.3.1 DRIVERS AND OPPORTUNITIES

5.3.2 RESTRAINTS AND CHALLENGES

5.3.3 CUMULATIVE GROWTH ANALYSIS

TABLE 5 COVID-19 IMPACT: OIL AND GAS SECURITY AND SERVICE MARKET, USD BILLION

5.4 USE CASES

5.4.1 KAZTRANSOIL DEPLOYED ERPSCAN FOR ITS SAP SYSTEM TO PREVENT CYBER ATTACKS AND KEEP CRITICAL INFRASTRUCTURE MORE SECURED

5.4.2 A LEADING OIL AND GAS COMPANY IN US ENHANCED ITS INDUSTRIAL CYBERSECURITY WITH HELP OF MOXA

5.4.3 GLOBAL OFFSHORE OIL AND GAS COMPANY DEPLOYED SOLUTIONS PROVIDED BY WATERFALL SECURITY SOLUTIONS TO PROTECT OFFSHORE EXPLORATION AND PRODUCTION FROM EVOLVING CYBER THREATS

5.5 VALUE CHAIN ANALYSIS

5.5.1 OIL AND GAS SECURITY AND SERVICE MARKET: VALUE CHAIN ANALYSIS

FIGURE 19 VALUE CHAIN ANALYSIS

5.6 ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

5.7.1 ARTIFICIAL INTELLIGENCE AND PREDICTIVE ANALYTICS

5.7.2 CLOUD AND MOBILITY

5.8 PRICING ANALYSIS

TABLE 6 CISCO KINETIC PLATFORM

TABLE 7 NORTON LIFELOCK

5.9 REGULATORY LANDSCAPE

5.9.1 ISO 29001 FOR OIL AND GAS

5.9.2 FEDERAL ENERGY REGULATORY COMMISSION

5.9.3 SARBANES-OXLEY ACT

5.1 ADJACENT MARKETS

TABLE 8 ADJACENT MARKETS OF MARKET

6 OIL AND GAS SECURITY AND SERVICE MARKET, BY COMPONENT (Page No. - 63)

6.1 INTRODUCTION

6.1.1 COMPONENT: COVID-19 IMPACT

FIGURE 20 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

6.1.2 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 9 MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 10 MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

6.2 SOLUTION

6.2.1 SOLUTION: MARKET DRIVERS

6.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 11 SOLUTION: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 12 SOLUTION: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 13 NORTH AMERICA: SOLUTION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 14 NORTH AMERICA: SOLUTION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 15 EUROPE: SOLUTION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 16 EUROPE: SOLUTION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 17 APAC: SOLUTION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 18 APAC: SOLUTION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.2.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 19 MEA: SOLUTION MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 20 MEA: SOLUTION MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

6.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 21 SERVICES: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 22 SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

6.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 23 NORTH AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 24 NORTH AMERICA: SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 25 EUROPE: SERVICE MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 26 EUROPE: SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 27 APAC: SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 28 APAC: SERVICE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

6.3.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 29 MEA: SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 30 MEA: SERVICE MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7 OIL AND GAS SECURITY AND SERVICE MARKET, BY SERVICE (Page No. - 74)

7.1 INTRODUCTION

7.1.1 SERVICES: COVID-19 IMPACT

FIGURE 21 RISK MANAGEMENT SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

7.1.2 MARKET ESTIMATES AND FORECASTS, BY SERVICES, 2014–2025

TABLE 31 SERVICES: MARKET SIZE, BY TYPE, 2014–2019 (USD MILLION)

TABLE 32 SERVICES: MARKET SIZE, BY TYPE, 2019–2025 (USD MILLION)

7.2 RISK MANAGEMENT SERVICES

7.2.1 RISK MANAGEMENT SERVICES: MARKET DRIVERS

7.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014-2025

TABLE 33 RISK MANAGEMENT SERVICES: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 34 RISK MANAGEMENT SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 35 NORTH AMERICA: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 36 NORTH AMERICA: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 37 EUROPE: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 38 EUROPE: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.2.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 39 APAC: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 40 APAC: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.2.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 41 MEA: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 42 MEA: RISK MANAGEMENT SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3 SYSTEM DESIGN, INTEGRATION, AND CONSULTING

7.3.1 SYSTEM DESIGN, INTEGRATION, AND CONSULTING: MARKET DRIVERS

7.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014-2025

TABLE 43 SYSTEM DESIGN, INTEGRATION, AND CONSULTING: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 44 SYSTEM DESIGN, INTEGRATION, AND CONSULTING: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 45 NORTH AMERICA: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 46 NORTH AMERICA: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 47 EUROPE: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 48 EUROPE: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 49 APAC: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 50 APAC: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.3.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 51 MEA: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 52 MEA: SYSTEM DESIGN, INTEGRATION, AND CONSULTING MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.4 MANAGED SERVICES

7.4.1 MANAGED SERVICES: MARKET DRIVERS

7.4.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014-2025

TABLE 53 MANAGED SERVICES: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 54 MANAGED SERVICES: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

7.4.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 55 NORTH AMERICA: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 56 NORTH AMERICA: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.4.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 57 EUROPE: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 58 EUROPE: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.4.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 59 APAC: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 60 APAC: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

7.4.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 61 MEA: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 62 MEA: MANAGED SERVICES MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8 OIL AND GAS SECURITY AND SERVICE MARKET, BY SECURITY TYPE (Page No. - 92)

8.1 INTRODUCTION

8.1.1 SECURITY TYPE: COVID-19 IMPACT

8.1.2 BY SECURITY TYPE: MARKET DRIVERS

FIGURE 22 NETWORK SECURITY SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

8.1.3 MARKET ESTIMATES AND FORECASTS, BY SECURITY TYPE, 2014–2025

TABLE 63 MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 64 MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

8.2 PHYSICAL SECURITY

8.2.1 PHYSICAL SECURITY: MARKET DRIVERS

8.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 65 PHYSICAL SECURITY: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 66 PHYSICAL SECURITY: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 67 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 69 EUROPE: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 70 EUROPE: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.2.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 71 APAC: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 72 APAC: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.2.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 73 MEA: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 74 MEA: PHYSICAL SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.2.7 BIOMETRICS AND ACCESS CONTROLS

8.2.8 VIDEO SURVEILLANCE

8.2.9 GROUND, COASTAL, AND AIR SURVEILLANCE

8.2.10 PERSONNEL TRACKING AND RADIO FREQUENCY IDENTIFICATION (RFID)

8.2.11 OVER AND UNDERWATER SURVEILLANCE

8.2.12 SECURE COMMUNICATION

8.2.13 LONG RANGE RADAR

8.2.14 SCREENING AND SCANNING

8.2.15 BUILDING MANAGEMENT SYSTEM

8.2.16 FIRE DETECTION AND SECURITY SYSTEM

8.2.17 PERIMETER FENCING

8.2.18 CBRNE/HAZMAT

8.3 NETWORK SECURITY

8.3.1 NETWORK SECURITY: MARKET DRIVERS

8.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 75 NETWORK SECURITY: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 76 NETWORK SECURITY: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

8.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 77 NORTH AMERICA: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 79 EUROPE: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 80 EUROPE: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 81 APAC: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 82 APAC: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 83 MEA: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 84 MEA: NETWORK SECURITY MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

8.3.7 IDENTITY AND ACCESS MANAGEMENT (IAM)

8.3.8 FIREWALLS

8.3.9 UPDATE AND PATCH MANAGEMENT

8.3.10 SECURITY INFORMATION AND EVENT MANAGEMENT (SIEM)

8.3.11 INCIDENT RESPONSE AND DISASTER RECOVERY

8.3.12 SUPERVISORY CONTROL AND DATA ACQUISITION (SCADA)

8.3.13 UNIFIED THREAT MANAGEMENT (UTM)

9 OIL AND GAS SECURITY AND SERVICE MARKET, BY OPERATION (Page No. - 106)

9.1 INTRODUCTION

9.1.1 OPERATION: COVID-19 IMPACT

FIGURE 23 MIDSTREAM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

9.1.2 MARKET ESTIMATES AND FORECASTS, BY OPERATION, 2014–2025

TABLE 85 MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 86 MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

9.2 UPSTREAM

9.2.1 UPSTREAM: MARKET DRIVERS

9.2.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 87 UPSTREAM: MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 88 UPSTREAM: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.2.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 89 NORTH AMERICA: UPSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 90 NORTH AMERICA: UPSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.2.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 91 EUROPE: UPSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 92 EUROPE: UPSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.2.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 93 APAC: UPSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 94 APAC: UPSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.2.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 95 MEA: UPSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 96 MEA: UPSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3 MIDSTREAM

9.3.1 MIDSTREAM: MARKET DRIVERS

9.3.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 97 MIDSTREAM: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 98 MIDSTREAM: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.3.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 99 NORTH AMERICA: MIDSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 100 NORTH AMERICA: MIDSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 101 EUROPE: MIDSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 102 EUROPE: MIDSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 103 APAC: MIDSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 104 APAC: MIDSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.3.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 105 MEA: MIDSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 106 MEA: MIDSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4 DOWNSTREAM

9.4.1 DOWNSTREAM: MARKET DRIVERS

9.4.2 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 107 DOWNSTREAM: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 108 DOWNSTREAM: MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

9.4.3 MARKET ESTIMATES AND FORECASTS, BY NORTH AMERICAN COUNTRY, 2014–2025

TABLE 109 NORTH AMERICA: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 110 NORTH AMERICA: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4.4 MARKET ESTIMATES AND FORECASTS, BY EUROPEAN COUNTRY, 2014–2025

TABLE 111 EUROPE: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 112 EUROPE: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4.5 MARKET ESTIMATES AND FORECASTS, BY APAC COUNTRY, 2014–2025

TABLE 113 APAC: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 114 APAC: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

9.4.6 MARKET ESTIMATES AND FORECASTS, BY MEA COUNTRY, 2014–2025

TABLE 115 MEA: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 116 MEA: DOWNSTREAM MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10 OIL AND GAS SECURITY AND SERVICE MARKET, BY REGION (Page No. - 121)

10.1 INTRODUCTION

FIGURE 24 MEA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

10.1.1 MARKET ESTIMATES AND FORECASTS, BY REGION, 2014–2025

TABLE 117 MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 118 MARKET SIZE, BY REGION, 2019–2025 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATIONS

10.2.3.1 Federal energy regulatory commission (FERC)

FIGURE 25 NORTH AMERICA: MARKET SNAPSHOT

10.2.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 119 NORTH AMERICA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.2.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 121 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.2.6 MARKET ESTIMATES AND FORECASTS, BY SECURITY TYPE, 2014–2025

TABLE 123 NORTH AMERICA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 124 NORTH AMERICA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.2.7 MARKET ESTIMATES AND FORECASTS, BY OPERATION, 2014–2025

TABLE 125 NORTH AMERICA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 126 NORTH AMERICA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.2.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 127 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 128 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.2.9 UNITED STATES

10.2.9.1 Market estimates and forecasts, by component, 2014-2025

TABLE 129 UNITED STATES: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 130 UNITED STATES: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.2.9.2 Market estimates and forecasts, by service, 2014-2025

TABLE 131 UNITED STATES: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 132 UNITED STATES: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.2.9.3 Market estimates and forecasts, by security type, 2014-2025

TABLE 133 UNITED STATES: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 134 UNITED STATES: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.2.9.4 Market estimates and forecasts, by operation, 2014-2025

TABLE 135 UNITED STATES: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 136 UNITED STATES: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.2.10 CANADA

10.2.10.1 Market estimates and forecasts, by component, 2014-2025

TABLE 137 CANADA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 138 CANADA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.2.10.2 Market estimates and forecasts, by service, 2014-2025

TABLE 139 CANADA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 140 CANADA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.2.10.3 Market estimates and forecasts, by security type, 2014-2025

TABLE 141 CANADA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 142 CANADA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.2.10.4 Market estimates and forecasts, by operation, 2014-2025

TABLE 143 CANADA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 144 CANADA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: COVID-19 IMPACT

10.3.2 EUROPE: MARKET DRIVERS

10.3.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 145 EUROPE: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 146 EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.4 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 147 MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 148 EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.3.5 MARKET ESTIMATES AND FORECASTS, BY SECURITY TYPE, 2014–2025

TABLE 149 EUROPE: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 150 EUROPE: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.3.6 MARKET ESTIMATES AND FORECASTS, BY OPERATION, 2014–2025

TABLE 151 EUROPE: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 152 EUROPE: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.3.7 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 153 EUROPE: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 154 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.3.8 UNITED KINGDOM

10.3.8.1 Market estimates and forecasts, by component, 2014-2025

TABLE 155 UNITED KINGDOM: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 156 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.8.2 Market estimates and forecasts, by service, 2014-2025

TABLE 157 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 158 UNITED KINGDOM: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.3.8.3 Market estimates and forecasts, by security type, 2014-2025

TABLE 159 UNITED KINGDOM: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 160 UNITED KINGDOM: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.3.8.4 Market estimates and forecasts, by operation, 2014-2025

TABLE 161 UNITED KINGDOM: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 162 UNITED KINGDOM: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.3.9 RUSSIA

10.3.9.1 Market estimates and forecasts, by component, 2014-2025

TABLE 163 RUSSIA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 164 RUSSIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.9.2 Market estimates and forecasts, by service, 2014-2025

TABLE 165 RUSSIA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 166 RUSSIA: MARKET SIZE, BY SERVICE TYPE, 2019–2025 (USD MILLION)

10.3.9.3 Market estimates and forecasts, by security type, 2014-2025

TABLE 167 RUSSIA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 168 RUSSIA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.3.9.4 Market estimates and forecasts, by operation, 2014-2025

TABLE 169 RUSSIA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 170 RUSSIA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.3.10 REST OF EUROPE

10.3.10.1 Market estimates and forecasts, by component, 2014-2025

TABLE 171 REST OF EUROPE: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 172 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.3.10.2 Market estimates and forecasts, by service, 2014-2025

TABLE 173 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 174 REST OF EUROPE: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.3.10.3 Market estimates and forecasts, by security type, 2014-2025

TABLE 175 REST OF EUROPE: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 176 REST OF EUROPE: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.3.10.4 Market estimates and forecasts, by operation, 2014-2025

TABLE 177 REST OF EUROPE: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 178 REST OF EUROPE: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: COVID-19 IMPACT

10.4.2 ASIA PACIFIC: MARKET DRIVERS

FIGURE 26 ASIA PACIFIC: MARKET SNAPSHOT

10.4.3 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 179 ASIA PACIFIC: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 180 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.4.4 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 181 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 182 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.4.5 MARKET ESTIMATES AND FORECASTS, BY SECURITY TYPE, 2014–2025

TABLE 183 ASIA PACIFIC: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 184 ASIA PACIFIC: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.4.6 MARKET ESTIMATES AND FORECASTS, BY OPERATION, 2014–2025

TABLE 185 ASIA PACIFIC: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 186 ASIA PACIFIC: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.4.7 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 187 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 188 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.4.8 CHINA

10.4.8.1 Market estimates and forecasts, by component, 2014–2025

TABLE 189 CHINA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 190 CHINA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.4.8.2 Market estimates and forecasts, by service, 2014-2025

TABLE 191 CHINA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 192 CHINA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.4.8.3 Market estimates and forecasts, by security type, 2014–2025

TABLE 193 CHINA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 194 CHINA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.4.8.4 Market estimates and forecasts, by operation, 2014–2025

TABLE 195 CHINA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 196 CHINA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.4.9 INDIA

10.4.9.1 Market estimates and forecasts, by component, 2014–2025

TABLE 197 INDIA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 198 INDIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.4.9.2 Market estimates and forecasts, by service, 2014–2025

TABLE 199 INDIA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 200 INDIA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.4.9.3 Market estimates and forecasts, by security type, 2014–2025

TABLE 201 INDIA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 202 INDIA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.4.9.4 Market estimates and forecasts, by operation, 2014–2025

TABLE 203 INDIA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 204 INDIA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.4.10 REST OF ASIA PACIFIC

10.4.10.1 Market estimates and forecasts, by component, 2014–2025

TABLE 205 REST OF ASIA PACIFIC: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 206 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.4.10.2 Market estimates and forecasts, by service, 2014–2025

TABLE 207 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 208 REST OF ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.4.10.3 Market estimates and forecasts, by security type, 2014–2025

TABLE 209 REST OF ASIA PACIFIC: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 210 REST OF ASIA PACIFIC: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.4.10.4 Market estimates and forecasts, by operation, 2014–2025

TABLE 211 REST OF ASIA PACIFIC: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 212 REST OF ASIA PACIFIC: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

10.5.2 MIDDLE EAST AND AFRICA: MARKET DRIVERS

10.5.3 MIDDLE EAST AND AFRICA: REGULATIONS

10.5.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 213 MIDDLE EAST AND AFRICA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 214 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.5.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 215 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE,2014–2019 (USD MILLION)

TABLE 216 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.5.6 MARKET ESTIMATES AND FORECASTS, BY SECURITY TYPE, 2014–2025

TABLE 217 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 218 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.5.7 MARKET ESTIMATES AND FORECASTS, BY OPERATION, 2014–2025

TABLE 219 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 220 MIDDLE EAST AND AFRICA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.5.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 221 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 222 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.5.9 KINGDOM OF SAUDI ARABIA

10.5.9.1 Market estimates and forecasts, by component, 2014–2025

TABLE 223 KINGDOM OF SAUDI ARABIA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 224 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.5.9.2 Market estimates and forecasts, by service, 2014–2025

TABLE 225 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE,2014–2019 (USD MILLION)

TABLE 226 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.5.9.3 Market estimates and forecasts, by security type, 2014–2025

TABLE 227 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 228 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.5.9.4 Market estimates and forecasts, by operation, 2014–2025

TABLE 229 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 230 KINGDOM OF SAUDI ARABIA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.5.10 KUWAIT

10.5.10.1 Market estimates and forecasts, by component, 2014–2025

TABLE 231 KUWAIT: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 232 KUWAIT: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.5.10.2 Market estimates and forecasts, by service, 2014–2025

TABLE 233 KUWAIT: MARKET SIZE, 2014–2019 (USD MILLION)

TABLE 234 KUWAIT: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.5.10.3 Market estimates and forecasts, by security type, 2014–2025

TABLE 235 KUWAIT: MARKET SIZE, SECURITY TYPE 2014–2019 (USD MILLION)

TABLE 236 KUWAIT: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.5.10.4 Market estimates and forecasts, by operation, 2014–2025

TABLE 237 KUWAIT: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 238 KUWAIT: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.5.11 REST OF MIDDLE EAST AND AFRICA

10.5.11.1 Market estimates and forecasts, by component, 2014–2025

TABLE 239 REST OF MIDDLE EAST AND AFRICA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 240 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.5.11.2 Market estimates and forecasts, by service, 2014–2025

TABLE 241 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 242 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.5.11.3 Market estimates and forecasts, by security type, 2014–2025

TABLE 243 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 244 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.5.11.4 Market estimates and forecasts, by operation, 2014–2025

TABLE 245 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 246 REST OF MIDDLE EAST AND AFRICA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: COVID-19 IMPACT

10.6.2 LATIN AMERICA: MARKET DRIVERS

10.6.3 LATIN AMERICA: REGULATIONS

10.6.4 MARKET ESTIMATES AND FORECASTS, BY COMPONENT, 2014–2025

TABLE 247 LATIN AMERICA: OIL AND GAS SECURITY AND SERVICE MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 248 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2019–2025 (USD MILLION)

10.6.5 MARKET ESTIMATES AND FORECASTS, BY SERVICE, 2014–2025

TABLE 249 MARKET SIZE, BY SERVICE, 2014–2019 (USD MILLION)

TABLE 250 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2019–2025 (USD MILLION)

10.6.6 MARKET ESTIMATES AND FORECASTS, BY SECURITY TYPE, 2014–2025

TABLE 251 LATIN AMERICA: MARKET SIZE, BY SECURITY TYPE, 2014–2019 (USD MILLION)

TABLE 252 LATIN AMERICA: MARKET SIZE, BY SECURITY TYPE, 2019–2025 (USD MILLION)

10.6.7 MARKET ESTIMATES AND FORECASTS, BY OPERATION, 2014–2025

TABLE 253 LATIN AMERICA: MARKET SIZE, BY OPERATION, 2014–2019 (USD MILLION)

TABLE 254 LATIN AMERICA: MARKET SIZE, BY OPERATION, 2019–2025 (USD MILLION)

10.6.8 MARKET ESTIMATES AND FORECASTS, BY COUNTRY, 2014–2025

TABLE 255 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 256 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2019–2025 (USD MILLION)

10.6.9 BRAZIL

10.6.10 MEXICO

10.6.11 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 187)

11.1 INTRODUCTION

FIGURE 27 KEY DEVELOPMENTS IN OIL AND GAS SECURITY AND SERVICE MARKET DURING 2017–2020

11.1.1 NEW SOLUTION LAUNCHES/SOLUTION ENHANCEMENTS

TABLE 257 NEW SOLUTION LAUNCHES/SOLUTION ENHANCEMENTS, 2019–2020

11.1.2 PARTNERSHIPS

TABLE 258 PARTNERSHIPS, 2018–2020

11.1.3 ACQUISITIONS

TABLE 259 ACQUISITIONS, 2017–2020

11.2 COMPANY EVALUATION MATRIX

11.2.1 STAR

11.2.2 EMERGING LEADER

11.2.3 PERVASIVE

FIGURE 28 OIL AND GAS SECURITY AND SERVICE (GLOBAL) MARKET, COMPANY EVALUATION MATRIX, 2020

11.3 START-UP QUADRANT

11.3.1 PROGRESSIVE COMPANIES

11.3.2 STARTING BLOCKS

11.3.3 RESPONSIVE COMPANIES

11.3.4 DYNAMIC COMPANIES

FIGURE 29 OIL AND GAS SECURITY AND SERVICE (GLOBAL) MARKET, START-UP/SME EVALUATION MATRIX, 2020

11.4 MARKET SHARE, 2020

FIGURE 30 MARKET SHARE OF KEY PLAYERS IN OIL AND GAS SECURITY AND SERVICE MARKET, 2020

12 COMPANY PROFILES (Page No. - 195)

12.1 INTRODUCTION

FIGURE 31 GEOGRAPHIC REVENUE MIX OF MARKET PLAYERS, 2019

(Business overview, Products/Solutions/Services offered, Recent developments, COVID-19-related strategies & MnM View)*

12.2 CISCO

FIGURE 32 CISCO: COMPANY SNAPSHOT

FIGURE 33 CISCO: SWOT ANALYSIS

12.3 HONEYWELL

FIGURE 34 HONEYWELL: COMPANY SNAPSHOT

FIGURE 35 HONEYWELL: SWOT ANALYSIS

12.4 SIEMENS

FIGURE 36 SIEMENS: COMPANY SNAPSHOT

FIGURE 37 SIEMENS: SWOT ANALYSIS

12.5 MICROSOFT

FIGURE 38 MICROSOFT: COMPANY SNAPSHOT

FIGURE 39 MICROSOFT: SWOT ANALYSIS

12.6 NORTONLIFELOCK

FIGURE 40 NORTONLIFELOCK: COMPANY SNAPSHOT

FIGURE 41 NORTONLIFELOCK: SWOT ANALYSIS

12.7 LOCKHEED MARTIN

FIGURE 42 LOCKHEED MARTIN: COMPANY SNAPSHOT

12.8 WATERFALL SECURITY SOLUTIONS

12.9 ABB

FIGURE 43 ABB: COMPANY SNAPSHOT

12.10 PARSONS

FIGURE 44 PARSONS: COMPANY SNAPSHOT

12.11 FORTINET

FIGURE 45 FORTINET: COMPANY SNAPSHOT

12.12 TREND MICRO

FIGURE 46 TREND MICRO: COMPANY SNAPSHOT

12.13 SOPHOS

FIGURE 47 SOPHOS: COMPANY SNAPSHOT

12.14 FORESCOUT

12.15 GE

12.16 NOZOMI NETWORKS

12.17 CNL SOFTWARE

12.18 MOXA

12.19 SYNECTICS

12.20 INTEL

12.21 SPEEDCAST

12.22 GPS SECURITY

12.23 ATHOS

12.24 TSN

12.25 J&G SECURITY

12.26 BOOZ ALLEN

12.27 THALES

12.28 HCL

12.29 IBM

12.30 BAE SYSTEMS

12.31 XAGE SECURITY

12.32 RIGHT TO WIN

*Details on Business overview, Products/Solutions/Services offered, Recent developments, COVID-19-related strategies & MnM View might not be captured in case of unlisted companies.

13 ADJACENT MARKETS (Page No. - 243)

13.1 INTRODUCTION

TABLE 260 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 OIL AND GAS SECURITY AND SERVICE ECOSYSTEM AND ADJACENT MARKETS

13.4 OIL AND GAS SECURITY AND SERVICE ADJACENT MARKET – OIL AND GAS CLOUD APPLICATIONS MARKET

TABLE 261 OIL AND GAS CLOUD APPLICATIONS MARKET SIZE, BY REGION, 2018–2024 (USD MILLION)

TABLE 262 OIL AND GAS CLOUD APPLICATIONS MARKET SIZE, BY COMPONENT, 2018–2024 (USD MILLION)

TABLE 263 OIL AND GAS CLOUD APPLICATIONS MARKET SIZE, BY SOLUTION, 2018–2024 (USD MILLION)

TABLE 264 OIL AND GAS CLOUD APPLICATIONS MARKET SIZE, BY SERVICES, 2018–2024 (USD MILLION)

TABLE 265 OIL AND GAS CLOUD APPLICATIONS MARKET SIZE, BY OPERATION, 2018–2024 (USD MILLION)

TABLE 266 OIL AND GAS CLOUD APPLICATIONS MARKET SIZE, BY DEPLOYMENT TYPE, 2018–2024 (USD MILLION)

13.5 OIL AND GAS SECURITY AND SERVICE ADJACENT MARKET – PERIMETER INTRUSION AND DETECTION SYSTEM MARKET

TABLE 267 PERIMETER INTRUSION AND DETECTION SYSTEM MARKET SIZE, BY REGION, 2017–2023 (USD MILLION)

TABLE 268 PERIMETER INTRUSION AND DETECTION SYSTEM MARKET SIZE, BY COMPONENT, 2017–2023 (USD MILLION)

TABLE 269 PERIMETER INTRUSION AND DETECTION SYSTEM MARKET SIZE, BY SOLUTIONS, 2017–2023 (USD MILLION)

TABLE 270 PERIMETER INTRUSION AND DETECTION SYSTEM MARKET SIZE, BY SERVICES, 2017–2023 (USD MILLION)

TABLE 271 PERIMETER INTRUSION AND DETECTION SYSTEM MARKET SIZE, BY DEPLOYMENT TYPE, 2017–2023 (USD MILLION)

TABLE 272 PERIMETER INTRUSION AND DETECTION SYSTEM MARKET SIZE, BY ORGANIZATION SIZE, 2017–2023 (USD MILLION)

TABLE 273 PERIMETER INTRUSION AND DETECTION SYSTEM MARKET SIZE, BY VERTICAL, 2017–2023 (USD MILLION)

13.6 OIL AND GAS SECURITY AND SERVICE ADJACENT MARKET – MASS NOTIFICATION SYSTEMS MARKET

TABLE 274 MASS NOTIFICATION SYSTEMS MARKET SIZE, BY REGION, 2018–2024 (USD MILLION)

TABLE 275 MASS NOTIFICATION SYSTEMS MARKET SIZE, BY COMPONENT, 2018–2024 (USD MILLION)

TABLE 276 MASS NOTIFICATION SYSTEMS MARKET SIZE, BY SOLUTION, 2018–2024 (USD MILLION)

TABLE 277 MASS NOTIFICATION SYSTEMS MARKET SIZE, BY VERTICAL, 2018–2024 (USD MILLION)

13.7 OIL AND GAS SECURITY AND SERVICE ADJACENT MARKET – INDUSTRIAL CONTROL SYSTEMS MARKET

TABLE 278 INDUSTRIAL CONTROL SYSTEMS MARKET SIZE, BY REGION, 2016–2022 (USD MILLION)

TABLE 279 INDUSTRIAL CONTROL SYSTEMS MARKET SIZE, BY COMPONENT, 2016–2022 (USD MILLION)

TABLE 280 INDUSTRIAL CONTROL SYSTEMS MARKET SIZE, BY SOLUTIONS, 2016–2022 (USD MILLION)

TABLE 281 INDUSTRIAL CONTROL SYSTEMS MARKET SIZE, BY SERVICE, 2016–2022 (USD MILLION)

TABLE 282 INDUSTRIAL CONTROL SYSTEMS MARKET SIZE, BY SECURITY TYPE, 2016–2022 (USD MILLION)

TABLE 283 INDUSTRIAL CONTROL SYSTEMS MARKET SIZE, BY VERTICALS, 2016–2022 (USD MILLION)

14 APPENDIX (Page No. - 253)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

The study involved four major activities in estimating the current market size for the oil and gas security and service market. An exhaustive secondary research was done to collect information on the oil and gas security and service industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the oil and gas security and service market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, and databases.

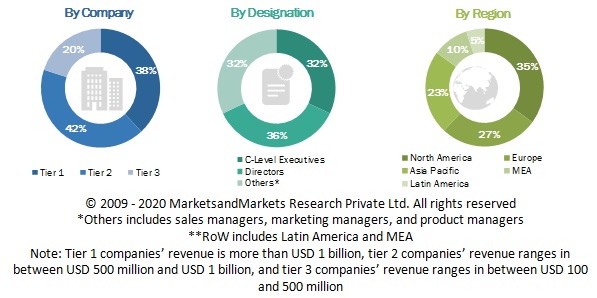

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for making this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the oil and gas security and service market.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecasting, and data triangulation), an extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types; the competitive landscape of oil and gas security and service solution and service providers; and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key players’ strategies.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the oil and gas security and service market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The aggregate of all companies’ revenues were extrapolated to estimate the overall market size.

- All percentage shares and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the oil and gas security and service market by component, services, security type, operation, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players of the oil and gas security and service market and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as new product launches and enhancements; acquisitions; and partnerships and collaborations, in the market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic analysis

- Further breakup of the Latin America oil and gas security and service market into countries

Company information

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Oil and Gas Security and Service Market