G.Fast Chipset Market by Deployment Type (DPU and CPE), End User (Residential, and Enterprise/Commercial), Copper-Line Length (Lines Shorter Than 100 Meters, Lines Of 100 Meters–150 Meters, Lines Longer Than 250 Meters) - Global Forecast to 2022

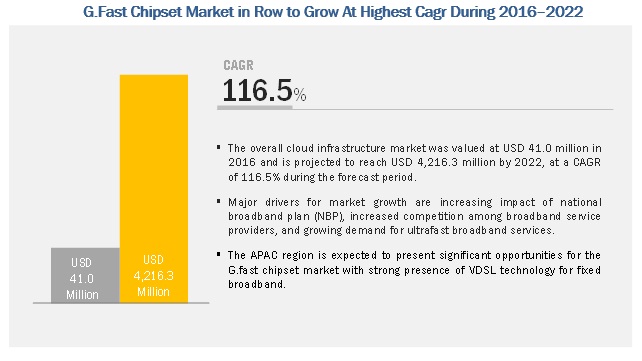

The overall G.fast chipset market is projected to reach USD 4,216.3 million by 2022 from USD 41.0 million in 2016, growing at a CAGR of 116.5% during 2016-2022. Major drivers for market growth are increasing impact of national broadband plan (NBP), increased competition among broadband service providers, and growing demand for ultrafast broadband services.

Attractive Opportunities In The G.Fast Chipset Market

CPE deployment type is expected to hold the largest market during the forecast period

In Tier 1 cities of developed countries, a large proportion of multi-story residential apartments are predominant driver for CPE-based deployment in the G.fast chipset market. Moreover, the high-speed variation of G.fast-based broadband over longer copper-line length makes it less suitable for long-distance DPU-based deployment in many parts of the world. The CPE-based deployment is more cost-effective compared to DPU-based deployment. The MDU-based CPEs deployment offers comparatively lesser equipment and maintenance cost over its counterparts.

The market for copper-line length longer than 250 meters is expected to register the highest CAGR during 2016-2022

The expected increase in the port density of G.fast chipset is expected to drive the G.fast deployment over longer cooper loops. Moreover the expected utilization of existing DSL street cabinets in Europe by the broadband service providers is expected to offer significant growth opportunity in deployment of G.fast technology over longer copper-line length, in the coming years.

The market for residential segment is expected to hold a larger share of the G.fast chipset market by 2022

The growth of the residential segment is largely attributed to the growing penetration of 4K TVs among middle-class residential customers in technologically advanced countries. Moreover, residential customers also use a diverse mix of interconnected devices such as laptops, smartphones, tablets, gaming consoles, Internet video consoles, and machine-to-machine (M2M) devices. In contrast, subscription video services remain tethered to slow-to-change set-top boxes linked to TV sets. Synergistic effects between these service offerings are spawning increased network usage and customers’ demand for high bandwidth from the fixed broadband service providers.

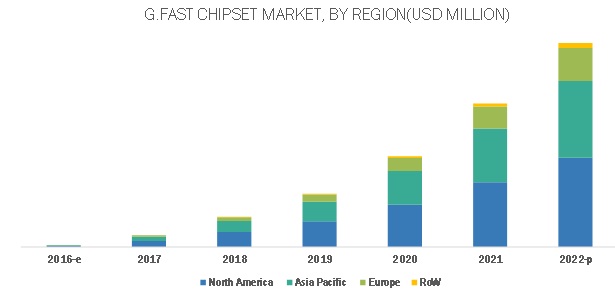

North America is expected to account for the largest market size during the forecast period

The presence of G.fast device manufacturers in this region contributes significantly to the G.fast chipset market. Factors such as increased competition among service providers, supportive government policies to meet national broadband plans, and faster speed of G.fast technology over shorter copper length are helping the G.fast chipset industry to grow rapidly in North America and Europe. Moreover, the extensive presence of MDUs in North America offers significant opportunity for the G.fast chipset market. The telecom companies in North America are expected to replace FTTH deployment by FTTdp for the last few meters, which can be replaced by copper without compromising the data rates.

Key players in the G.fast chipset market include Qualcomm, Inc. (US), Broadcom Ltd. (US), Marvell Technology Group Ltd. (Bermuda), MediaTek, Inc. (Taiwan), Sckipio Technologies SI Ltd. (Israel), Metanoia Communications, Inc. (Taiwan), Chunghwa Telecom Co., Ltd. (Taiwan), CenturyLink, Inc. (US), BT Group plc (UK), and Swisscom AG (Switzerland).

Recent Developments

- Qualcomm, Inc. in May 2016, announced that its subsidiary, Qualcomm Technologies, Inc. launched a new GigaDSL chip which includes the QCO5700 for multi-dwelling unit (MDU) networks and the QCM5720 for customer premises equipment (CPE). The new chips are expected to offer 1 gigabit per second (Gbps) broadband over existing telephone lines.

- In October 2015, Broadcom Ltd. announced VDSL2 35b and G.fast bonding support for two new protocols under the International Telecommunication Union (ITU) guidelines. The new product is intended to strengthen the company’s G.fast portfolio.

- In August 2015, Cambridge Industries Group (CIG), an Israel-based broadband service provider, announced to enter the G.fast chipset market with Sckipio-based G.fast CPE.

Critical questions the report answers:

- Where will all these developments take the various regions in the mid to long term?

- How high cost of on-premises fiber deployment is acting as boon for G.fast market growth rate?

- What are the competitive advantage for G.fast over VDSL2 and DOCSIS 3.1 technology?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Breakdown of Primaries

2.3 Market Size Estimation

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.3.3 Market Share Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Global G.Fast Chipset Market

4.2 G.Fast Chipset Market, By Deployment Type

4.3 G.Fast Chipset Market, By Copper-Line Length

4.4 Country-Wise Market Share Analysis of the G.Fast Chipset Market

4.5 G.Fast Chipset Market Size, By Region

4.6 G.Fast Chipset Market, By End-User

4.7 Fixed Broadband Life Cycle Analysis, By DSL Broadband Access Technology (2016)

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 History and Evolution

5.3 Block Diagram of G.Fast Technology Over Fttdp and Fttb

5.4 Market Segmentation

5.4.1 G.Fast Chipset Market, By Copper-Line Length

5.4.2 G.Fast Chipset Market, By Deployment Type

5.4.3 G.Fast Chipset Market, By End User

5.4.4 G.Fast Chipset Market, By Geography

5.5 Market Dynamics

5.5.1 Drivers

5.5.1.1 Increasing Impact of National Broadband Plan (NBP)

5.5.1.2 Increased Competition Among Broadband Service Providers

5.5.1.3 Growing Demand for Ultrafast Broadband Services

5.5.2 Restraints

5.5.2.1 Limited Residential Application of Gigabits Rates

5.5.2.2 Declining Market for Copper-Based Broadband Technology Globally

5.5.3 Opportunities

5.5.3.1 Greater Cost-Effectiveness of G.Fast Compared to Ftth

5.5.4 Challenges

5.5.4.1 Limitation of G.Fast in Areas With Low Population Density

5.5.4.2 Technical Complexity in Reverse Power Feeding

6 Industry Trends (Page No. - 56)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Threat of New Entrants

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Suppliers

6.3.4 Bargaining Power of Buyers

6.3.5 Competitive Rivalry

7 G.Fast Chipset Market, By Deployment Type (Page No. - 65)

7.1 Introduction

7.2 CPE

7.3 DPU

8 G.Fast Chipset Market By End User (Page No. - 75)

8.1 Introduction

8.2 Residential

8.3 Enterprise/Commercial

9 G.Fast Chipset Market, By Copper Line Length (Page No. - 84)

9.1 Introduction

9.1.1 Copper-Line Length of Shorter Than 100 Meters

9.1.2 Copper-Line Length of 100 Meters–150 Meters

9.1.3 Copper-Line Length of 150 Meters–200 Meters

9.1.4 Copper-Line Length of 200 Meters–250 Meters

9.1.5 Copper-Line Length Longer Than 250 Meters

10 Geographical Analysis (Page No. - 104)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 Australia

10.4.4 Rest of APAC

10.5 RoW

10.5.1 Israel

10.5.2 Others

11 Competitive Landscape (Page No. - 129)

11.1 Overview

11.2 Ranking Analysis, G.Fast Chipset Market in 2016

11.3 Battle for Market Share: New Product Launches as Key Strategy During 2014 and 2016

11.3.1 New Product Launches

11.3.2 Merger & Acquisition

11.3.3 Partnerships/Agreements/Contracts/Collaborations

12 Company Profile (Page No. - 134)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

12.1 Overview

12.2 Qualcomm, Inc.

12.3 Broadcom Ltd.

12.4 Marvell Technology Group Ltd.

12.5 Mediatek, Inc.

12.6 Sckipio Technologies Si Ltd.

12.7 Metanoia Communications, Inc.

12.8 Chunghwa Telecom Co., Ltd.

12.9 Centurylink, Inc.

12.10 BT Group PLC

12.11 Swisscom AG

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 158)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (62 Tables)

Table 1 G.Fast vs VDSL: Comparative Analysis

Table 2 G.Fast Chipset Market Segmentation: By Copper-Line Length

Table 3 Market Segmentation: By Deployment

Table 4 Market Segmentation: By End User

Table 5 Market Segmentation: By Geography

Table 6 Internet Speed Needed for Various Residential Applications

Table 7 Porter’s Five Forces Analysis With Their Weightage Impact

Table 8 G.Fast Chipset Market, By Deployment Type, 2016–2022 (USD Million)

Table 9 CPE G.Fast Chipset Market, By Copper-Line Length, 2016–2022 (USD Million)

Table 10 Market for CPE, By Region, 2016–2022 (USD Million)

Table 11 Market for CPE, By End-User, 2016–2022 (USD Million)

Table 12 Market for DPU, By Copper-Line Length, 2016–2022 (USD Million)

Table 13 Market for DPU, By Region, 2016–2022 (USD Million)

Table 14 G.Fast Chipset Market for DPU, By End-User, 2016–2022 (USD Million)

Table 15 Market, By End User, 2016–2022

Table 16 Market for Residential End Users, By Copper-Line Length, 2016–2022

Table 17 Market for Residential End Users, By Region, 2016–2022 (USD Million)

Table 18 Market for Residential End Users, By Deployment Type, 2016–2022 (USD Million)

Table 19 G.Fast Chipset Market for Enterprise/Commercial End Users, By Copper-Line Length, 2016–2022 (USD Million)

Table 20 Market for Enterprise/Commercial End Users, By Region, 2016–2022 (USD Million)

Table 21 Market for Enterprise/Commercial End Users, By Deployment Type, 2016–2022 (USD Million)

Table 22 Market, By Copper-Line Length, 2016–2022 (USD Million)

Table 23 Market for Copper-Line Length of Shorter Than 100 Meters, By Region, 2016–2022 (USD Million)

Table 24 G.Fast Chipset Market for Copper-Line Length of Shorter Than 100 Meters, By End Users, 2016–2022 (USD Million)

Table 25 Copper-Line Length of Shorter Than 100 Meters, By Deployment, 2016–2022 (USD Million)

Table 26 G.Fast Chipset Market for Copper-Line Length of 100 Meters–150 Meters, By Region, 2016–2022 (USD Million)

Table 27 Market for Copper-Line Length of 100 Meters–150 Meters, By End User, 2016–2022 (USD Million)

Table 28 Market for Copper-Line Length of 100 Meters–150 Meters, By Deployment, 2016–2022 (USD Million)

Table 29 Market for Copper-Line Length of 150 Meters–200 Meters, By Geography, 2016–2022 (USD Million)

Table 30 G.Fast Chipset Market for Copper-Line Length of 150 Meters–200 Meters, By End User, 2016–2022 (USD Million)

Table 31 Market for Copper-Line Length of 150 Meters–200 Meters, By Deployment, 2016–2022 (USD Million)

Table 32 Market for Copper-Line Length of 200 Meters–250 Meters, By Region, 2016–2022 (USD Million)

Table 33 Market for Copper-Line Length of 200 Meters–250 Meters, By End User, 2016–2022 (USD Million)

Table 34 Market for Copper-Line Length of 200 Meters–250 Meters, By Deployment, 2016–2022 (USD Million)

Table 35 G.Fast Chipset Market for Copper-Line Length of Longer Than 250 Meters, By Region, 2016–2022 (USD Million)

Table 36 Market for Copper-Line Length of Longer Than 250 Meters, By End User, 2016–2022 (USD Million)

Table 37 Market for Copper-Line Length of Longer Than 250 Meters, By Deployment, 2016–2022 (USD Million)

Table 38 Market, By Region, 2016–2022 (USD Million)

Table 39 Market in North America, By Deployment Type, 2016–2022 (USD Million)

Table 40 G.Fast Chipset Market in North America, By End User, 2016–2022 (USD Million)

Table 41 Market in North America, By Copper-Line Length, 2016–2022 (USD Million)

Table 42 Market in North America, By Country, 2016–2022 (USD Million)

Table 43 Market in U.S., By Deployment Type, 2016–2022 (USD Million)

Table 44 Market in U.S., By End User, 2016–2022 (USD Million)

Table 45 G.Fast Chipset Market in Europe, By Deployment Type, 2016–2022 (USD Million)

Table 46 Market in Europe, By End User, 2016–2022 (USD Million)

Table 47 Market in Europe, By Copper-Line Length, 2016–2022 (USD Million)

Table 48 Market in Europe, By Country, 2016–2022 (USD Million)

Table 49 Market in U.K., By Deployment Type, 2016–2022 (USD Million)

Table 50 G.Fast Chipset Market in U.K., By End User, 2016–2022 (USD Million)

Table 51 Market in APAC, By Country, 2016–2022 (USD Million)

Table 52 Market in APAC, By Deployment Type, 2016–2022 (USD Million)

Table 53 Market in APAC, By End User, 2016–2022 (USD Million)

Table 54 Market in APAC, By Copper-Line Length, 2016–2022 (USD Million)

Table 55 G.Fast Chipset Market in RoW, By Deployment Type, 2016–2022 (USD Million)

Table 56 Market in RoW, By Country, 2016–2022 (USD Million)

Table 57 Market in RoW, By End User, 2016–2022 (USD Million)

Table 58 Market in RoW, By Copper-Line Length, 2016–2022 (USD Million)

Table 59 Sckipio Technologies Si Ltd. and Broadcom Ltd. are Expected to Lead the G.Fast Chipset Market in 2016

Table 60 New Product Launches, 2014–2016

Table 61 Merger & Acquisition (2014–2016)

Table 62 Partnerships/Agreements/Contracts/Collaborations (2014–2016)

List of Figures (87 Figures)

Figure 1 Market Segmentation

Figure 2 G.Fast Chipset Market: Research Design

Figure 3 Research Flow

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions of the Research Study

Figure 8 CPE Deployment to Hold A Larger Share of the G.Fast Chipset Market By 2022

Figure 9 Copper-Line Length Segment of Less Than 100 Meters to Hold the Largest Size of the Market By 2022

Figure 10 North America Expected to Hold the Largest Share of the Market By 2022

Figure 11 Growing Competition Among Service Providers Expected to Drive G.Fast Chipset Market During Forecast Period

Figure 12 CPE Segment to Lead the G.Fast Chipset Market During the Forecast Period

Figure 13 Copper-Line Length of Shorter Than 100 Meters Expected to Hold the Largest Share of the Market in 2016

Figure 14 U.S. to Account for the Largest Share of the Market By 2022

Figure 15 North America to Hold the Largest Size of the Market By 2022

Figure 16 Residential Segment to Hold the Largest Share of the Overall G.Fast Chipset Market During the Forecast Period

Figure 17 VDSL2 and G.Fast Technologies Have Entered the Growth Stage and Expected to Grow at the Highest Rate During the Forecast Period

Figure 18 ITU Development Stages for G.Fast Technology

Figure 19 G.Fast Over Fttdp: Sample Block Diagram

Figure 20 G.Fast Speed Variations Over Length of the Local Loop

Figure 21 Ultra-Fast Broadband Technology Mapping

Figure 22 G.Fast Chipset Market : Segmentation

Figure 23 Increased Competition Among Broadband Service Providers is Driving the G.Fast Chipset Market

Figure 24 Number of Countries With Effective Broadband National Plan (Bnp) 2005 - 2015

Figure 25 Broadband Subscriber Growth By Technology, 2014–2015

Figure 26 Last 200 Meters Deployment Cost for Ftth and G.Fast

Figure 27 Value Chain Analysis: Major Value is Added During the Component Supplier and Solution Provider Stages in 2016

Figure 28 Porter’s Five Force Model for G.Fast Chipset Market, 2016

Figure 29 Porter’s Five Forces Analysis

Figure 30 High Growth and Embryonic Nature of the G.Fast Chipset Market Increases the Threat of New Entrants

Figure 31 Easy Availability of Docsis 3.0 and Ftth Gigabit Broadband Technology Strengthen the Threat of Substitutes

Figure 32 Large Number of Suppliers Weakens Bargaining Power of Suppliers

Figure 33 Limited Number of Suppliers Limits the Bargaining Power of Buyers

Figure 34 Limited Number of Players Minimizes Competitive Rivalry in the Market

Figure 35 CPE to Hold the Largest Size of the G.Fast Chipset Market During the Forecast Period

Figure 36 The Copper-Line Length Segment of Shorter Than 100 Meters to Hold the Largest Size of the G.Fast Chipset Market for CPE Deployment By 2022

Figure 37 North America to Hold the Largest Size of the G.Fast Chipset Market for CPE in 2016

Figure 38 Enterprise/Commercial Segment to Witness Faster Growth in the Market for CPE During Forecast Period

Figure 39 The Copper-Line Length Segment of Longer Than 250 Meters to Hold the Largest Size of the G.Fast Chipset Market for DPU By 2022

Figure 40 North America to Hold the Largest Size of the Market for DPU By 2022

Figure 41 Residential Segment Expected to Hold the Largest Size of the G.Fast Chipset Market for DPU During the Forecast Period

Figure 42 Residential Segment to Hold A Larger Size of the Market By 2022

Figure 43 Lines Shorter Than 100 Meters to Hold the Largest Share of the Residential End-User Segment of the G.Fast Chipset Market By 2022

Figure 44 North America to Hold the Largest Market Size of G.Fast Chipset for Residential End Users in 2016

Figure 45 CPE Segment Expected to Hold A Larger Size of the G.Fast Chipset Market for Residential End Users During Forecast Period

Figure 46 Copper-Line Segment of Lines Shorter Than 100 Meters to Hold the Largest Size of Market for Enterprise/Commercial End Users By 2022

Figure 47 North America to Hold the Largest Market Size for the Enterprise/Commercial Segment By 2022

Figure 48 CPE Segment Expected to Lead the Market for Enterprise/Commercial End Users During Forecast Period

Figure 49 Copper-Line Length of Shorter Than 100 Meters to Lead the G.Fast Chipset Market By 2022

Figure 50 North America to Lead the Market With Copper-Line Length of Shorter Than 100 Meters By 2022

Figure 51 Enterprise/Commercial End-Users to Lead the Market With Copper-Line Length Shorter Than 100 Meters By 2022

Figure 52 CPE G.Fast Chipset to Lead Copper-Line Length of Shorter Than 100 Meters in 2022

Figure 53 North America to Lead the Market With Copper-Line Length of 150 Meters–200 Meters in the G.Fast Chipset Market By 2022

Figure 54 Enterprise/Commercial Segment to Grow at Highest Rate Over Copper-Line Length of 100 Meters–150 Meters During Forecast Period

Figure 55 G.Fast Chipset to Witness Faster Growth in the DPU Segment Over Copper-Line Length of 100 Meters–150 Meters During Forecast Period

Figure 56 Europe to Dominate the G.Fast Chipset Over Copper-Line Length of 150 Meters–200 Meters By 2022

Figure 57 Enterprise/Commercial to Lead the G.Fast Chipset Market Over Copper-Line Length of 150 Meters–200 Meters By 2022

Figure 58 Market for CPE Segment to Witness Faster Growth Over Copper-Line Length of 150 Meters–200 Meters During the Forecast Period

Figure 59 Europe to Dominate the G.Fast Chipset Over Copper-Line Length of 200 Meters–250 Meters By 2022

Figure 60 Residential Segment to Lead the G.Fast Chipset Market Over Copper-Line Length of 200 Meters–250 Meters By 2022

Figure 61 CPE Segment to Witness Faster Growth Over Copper-Line Length of 200 Meters–250 Meters During the Forecast Period

Figure 62 Europe to Dominate the Market Over Copper-Line Length Longer Than 250 Meters in 2016

Figure 63 Residential Segment to Lead the G.Fast Market Over Copper-Line Length of Longer Than 250 Meters By 2022

Figure 64 DPU Segment to Hold the Larger Share Over Copper-Line Length of Longer Than 250 Meters By 2022

Figure 65 North America to Hold the Largest Size of the G.Fast Chipset Market in 2016

Figure 66 G.Fast Chipset Market Snapshot in North America

Figure 67 The U.S. to Lead the North American G.Fast Chipset Market During the Forecast Period

Figure 68 G.Fast Chipset Market Snapshot in Europe

Figure 69 The U.K. to Lead the European G.Fast Chipset Market During the Forecast Period

Figure 70 G.Fast Chipset Market Snapshot in APAC

Figure 71 China Expected to Hold the Largest Size of the G.Fast Chipset Market in APAC During the Forecast Period

Figure 72 Israel Estimated to Lead the G.Fast Chipset Market in RoW in 2016

Figure 73 Companies Adopted Product Innovation as the Key Growth Strategy During 2014 to 2016

Figure 74 Geographic Revenue Mix of Top 5 Market Players

Figure 75 Qualcomm, Inc.: Company Snapshot

Figure 76 Qualcomm, Inc.: SWOT Analysis

Figure 77 Broadcom Ltd: Company Snapshot

Figure 78 Broadcom Ltd: SWOT Analysis

Figure 79 Marvell Technology Group Ltd.: Company Snapshot

Figure 80 Marvell Technology Group Ltd.: SWOT Analysis

Figure 81 Mediatek, Inc: Company Snapshot

Figure 82 Mediatek, Inc.:SWOT Analysis

Figure 83 Sckipio Technologies Si Ltd.: SWOT Analysis

Figure 84 Chunghwa Telecom Co., Ltd.: Company Snapshot

Figure 85 Centurylink, Inc.: Company Snapshot

Figure 86 BT Group PLC: Company Snapshot

Figure 87 Swisscom AG: Company Snapshot

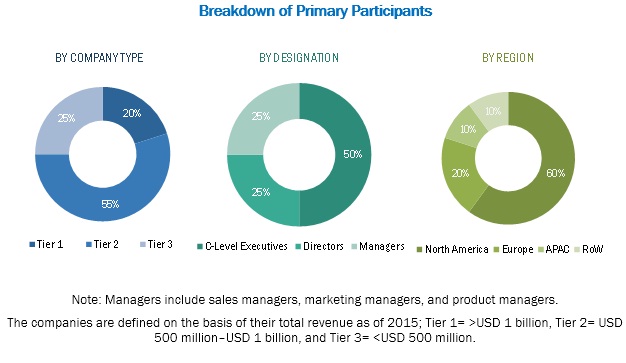

The study involved four major activities to estimate the current market size of G.fast chipset market. Exhaustive secondary research was done to collect information on market, peer market and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred for this study include corporate filings (annual reports, investor presentations, and financial statements) and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has further been validated through the primary research

Primary Research

Extensive primary research has been conducted after acquiring knowledge about the G.fast chipset market scenario through secondary research. Several primary interviews have been conducted with experts from both demand and supply sides across four major regions, namely, the Americas, Europe, Asia- Pacific, and rest of the world (the Middle East & Africa). This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches have been used to estimate and validate the size of the global G.fast chipset market and various dependent submarkets. Key players in the market have been identified through the secondary research and their market share in the respective regions has been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of top players and extensive interviews of industry leaders, such as CEOs, VPs, directors, and marketing executives.

- The key players in the markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall G.fast chipset market size from the market size estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. In addition to this, the market size has been validated using both top-down and bottom-up approaches.

The following are the major objectives of the study.

- To define, describe, and forecast the G.fast chipset market based on the length of copper line, deployment type, end-users, and geography

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contribution to the G.fast chipset market

- To provide detailed information of the major factors that influence the growth of the G.fast chipset market (drivers, restraints, opportunities, and industry-specific challenges)

- To conduct a detailed value chain and Porter’s five forces analysis of the G.fast chipset market

- To analyze the opportunities in the G.fast chipset market for stakeholders and provide the details of a competitive landscape to market leaders

- To strategically profile key players of the G.fast market and comprehensively analyze their market shares and core competencies2

- To analyze various developments such as joint ventures, mergers and acquisitions, and new product developments, along with research and development in the G.fast chipset market

|

Report Metric |

Details |

|

Market size available for years |

2016-2022 |

|

Base year considered |

2016 |

|

Forecast period |

2016–2022 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Deployment Type, End-user, Copper Length, and Geography |

|

Geographies covered |

North America, APAC, Europe, and RoW |

|

Companies covered |

Qualcomm, Inc. (US), Broadcom Ltd. (US), Marvell Technology Group Ltd. (Bermuda), MediaTek, Inc. (Taiwan), Sckipio Technologies SI Ltd. (Israel), Metanoia Communications, Inc. (Taiwan), Chunghwa Telecom Co., Ltd. (Taiwan), CenturyLink, Inc. (US), BT Group plc (UK), and Swisscom AG (Switzerland) |

This research report categorizes the G.fast chipset market based deployment type, end-user, copper length, and geography

By Deployment Type:

- CPE

- DPU

By End-user:

- Residential

- Enterprise/commercial

By Copper Line Length

- Copper-line length of Shorter than 100 Meters

- Copper-line length of 100 meters–150 meters

- Copper-line length of 150 meters–200 meters

- Copper-line length of 200 meters–250 meters

- Copper-line length longer than 250 meters

By Geography:

- North America

- Europe

- Asia Pacific

-

RoW (Israel and Others)

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports as per the client’s specific requirements. The available customization options are as follows:

Geographic Analysis

- Further country-wise breakdown of the market for all 4 regions based on various application

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Growth opportunities and latent adjacency in G.Fast Chipset Market