Seam Tapes Market by Type (Single layered, Multi layered), Material (Polyurethane, TPU, Polyamide), Application (Intimate apparel, Sports innerwear, Sportswear, Casual apparel, Shoes), and Region - Global Forecast to 2025

Updated on : August 25, 2025

Seam Tapes Market

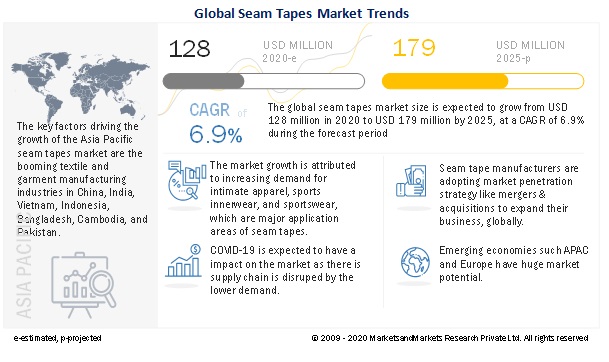

The seam tapes market was valued at USD 128 million in 2020 and is projected to reach USD 179 million by 2025, growing at 6.9% cagr from 2020 to 2025. Seam tapes is used across applications, such as intimate apparels, shoes, sportswear, sports innerwear, casual apparels is the key end-use industry owing to the wide applications of these seam tapes.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Seam tapes Market

The global Seam tapes market includes major Tier I and II suppliers like as Bemis Associates (US), Sealon (South Korea), HiMEL (South Korea), Gerlinger Industries (Germany), and Adhesive Films, Inc. (NJ). These suppliers have their manufacturing facilities spread across various countries across Asia Pacific, Europe, North America, and Rest of the World. COVID-19 has impacted their businesses as well.

These players have announced the suspension of production due to the lowered demand, supply chain bottlenecks, and to protect the safety of their employees in the US, France, Germany, Italy, and Spain during the COVID-19 pandemic. As a result, the demand for seam tapes is expected to decline in 2020. Manufacturers are likely to adjust production to prevent bottlenecks and plan production according to demand from tier 1 manufacturers.

Seam Tapes Market Dynamics

Driver:Increase in demand and awareness about best fit intimate apparels among millennial population

Increasing awareness about the best fit, growing millennial population, and rise in spending power among women are expected to drive the market over the forecast period. Increasing availability of a broad range of products in multiple designs for various purposes, such as sportswear, bridal wear, and regular wear, has also been driving the global market. Growing popularity of the global market is also attributed to increasing demand among women for beauty products. This has indirectly boosted the demand for seam tapes globally, which plays an important role in manufacturing any intimate apparel.

Restraint: Volatile raw material prices

Price and availability of raw materials are key factors for seam tape manufacturers to decide the cost structure for their products. Natural rubber, films, adhesives, and the top surface (nylon and polyester) are raw materials used in the manufacturing of seam tapes. Most of these raw materials are petroleum-based derivatives that are vulnerable to fluctuations in commodity prices. Oil prices have been highly volatile in the recent past due to the increasing global demand and unrest in the Middle East. The uncertainty and fluctuations in the cost and availability of feedstock impact the growth of the market.

The adhesive industry is affected by higher manufacturing costs resulting from increased energy costs. In addition, the consistently increasing global demand for chemicals and the capacity constraints in the supply of these primary chemicals and resin feedstock have fueled the rise in raw material prices. These supply shortages of monomers used to make adhesive raw materials, such as Piperylene and C9 monomers, have increased the costs. Hence, fluctuations in the prices of these raw materials act as a restraint in the market.

Opportunity: Emerging economies in Asia Pacific

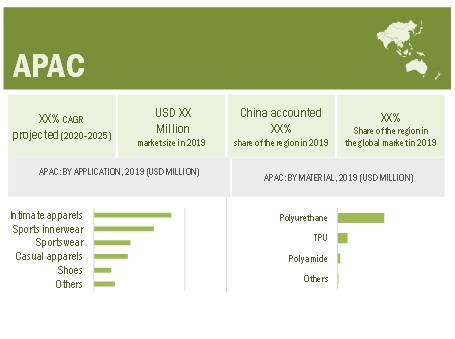

Growing population in emerging countries, such as China, India, Sri Lanka, and Bangladesh, coupled with changing consumption patterns, is expected to create growth opportunities for the seam tapes market. The rising population, in line with the growing disposable income level, fuels the demand for high-end value-added clothing. The apparel retail market in Asia Pacific, especially in countries, such as China and India, is driven by increased affordability and sustained urbanization. Rise in the per capita income of the growing middle-class population is expected to further drive urbanization in these countries.

The growing middle-class population and upgrading of consumption pattern lead to the demand for high-quality and fashionable apparels. The rise in health awareness, coupled with an increase in purchasing power, fuels the demand for sportswear and outdoor apparel. The urban population in the Asia Pacific is becoming more brand conscious; as a result, most leading apparel and sportswear brands are opening multiple company-owned stores in China, India, Indonesia, among other countries in the region.

In addition, Asia Pacific is the largest manufacturer of textiles and garments, globally, with China accounting for ~30% of the global textile and garment production volume. Apparel manufacturers in China are capable of delivering high value-added products, having well-developed infrastructure for textile production. The US is the largest importer of textiles and garments made in China. After China, India, Bangladesh, Vietnam, and Cambodia, are the leading producers of textiles and garments that are exported, globally. Among all categories of apparels produced in these countries, lifestyle wear holds the largest share, followed by the sportswear and outdoor apparel categories. With favorable trade policies and government support, abundant labor force with relatively low cost, and enhancement of technology in the manufacturing process and supply chain management, apparel manufacturers in Asia Pacific can win orders from both domestic and international markets, thereby ensuring stable growth of the textile and apparel manufacturing applications in the region.

Challenges: Availability of alternative seamless technologies

Seam tape is facing competition from another stitch-free/seamless method, namely, seam welding. The seam welding method involves welding two fabrics with radio frequency/ultrasound. In this technique, pressure and heat are applied to the seams of two or more fabrics to fuse them together into a sealed formation. The term welding refers to the thermal bonding and sealing of seams in knitted, woven, and nonwoven thermoplastic materials without adhesives, chemical binders, staples, needle, or thread. The three principles for welding are heat, speed, and pressure. The precise combination of these principles allows one to achieve a properly welded seam in thermoplastic materials either by point bonding of fabric or continuous sealing of film. The efficiency of welding of a woven fabric is affected by yarn density, thermoplastic content, the tightness of weave and uniformity of material thickness while the random orientation of fibers in nonwovens gives them excellent bond strength. In knits, the style and elasticity of construction affect the bond strength. Coated materials are often welded to seal the seams. The nature of coating, film thickness, and other substrate properties are important parameters in such cases.

Materials suitable for processing with the welding technique include 100% synthetics, such as nylon, polyester, polypropylene, polyethylene, modified acrylics, some vinyl, urethane, film, coated paper, and synthetic blends with 35-50% non-synthetic fiber content. Seam welding is used in the making of sleeping bags, tents, and backpacks. For example, in sleeping bags, the baffle is bonded to the shell fabric for preventing the shell from being punctured. However, currently, this is only done on fabrics having a laminate or coating, to maintain the waterproofing integrity of the outer fabric. Thermoplastic coatings, such as polypropylene (PP), polyvinylchloride (PVC), and polyethylene (PE) are used for seam welding on fabrics.

"Intimate apparels segment is expected to lead the Seam tapes market during the forecast period."

The intimate apparels industry will continue to lead the Seam tapes market, , accounting for a share of 31.4% of the overall market, in 2019 terms of value. This was due to the rise in spending power among women are expected to drive the market. Increasing availability of a broad range of products in multiple designs for various purposes, such as sportswear, bridal wear, and regular wear, has also been driving the global market.

“Asia Pacific is the largest market for Seam tapes.”

Asia Pacific accounted for the largest share of the Seam tape market in 2020. Factors such as the rapidly increasing consumption of seam tapes in the intimate apparels and sportswear industries in countries such as China, Japan, and India have led to an increased demand for Seam tapes in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Seam Tapes Market Players

Seam tapes is a diversified and competitive market with a large number of global players and few regional and local players. Bemis Associates (US), Sealon (South Korea), HiMEL (South Korea), Gerlinger Industries (Germany), and Adhesive Films, Inc. (NJ) are some of the key players in the market.

Recent Developments

- In August 2020, Bemis Associates Inc. acquired Safe Reflections International LLC, a Taiwan-based operation, and the “play” products of Safe Reflections Inc., a textile products company that develops solutions to enhance the safety and visibility of apparel.

- In May 2020, Framis Italia launched “ProTape 1000” a protective coverall suit against infectious agents and low-pressure liquids. In October 2018, the company launched “Ecolife,” a thermos-adhesive product used to reinforce and cover seams in outerwear, swimwear, fashion clothing, sportswear, and underwear.

Frequently Asked Questions (FAQ):

Does this report cover volume tables in addition to the value tables?

Yes, volume tables are provided for each segment except offering.

Which countries are considered in the European region?

The report includes the following European countries

- Germany

- Spain

- Italy

- Rest of Europe

What is the COVID-19 impact on the seam tapes market?

Industry experts believe that COVID-19 would have a impact on seam tapes market as there is an increase in demand for seam tapes in various industries such as intimate apparels and sportswear industries. Furthermore, they also believe that the market will rebound in Q4 in 2020. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

#####

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 19)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

FIGURE 1 SEAM TAPES MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 STAKEHOLDERS

1.7 LIMITATIONS

1.8 SUMMARY OF CHANGES MADE IN THE REVAMPED VERSION

2 RESEARCH METHODOLOGY (Page No. - 23)

2.1 RESEARCH DATA

FIGURE 2 SEAM TAPES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 SUPPLY-SIDE ANALYSIS

FIGURE 3 MARKET NUMBER ESTIMATION

2.3 MARKET NUMBER ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 30)

FIGURE 7 SINGLE LAYERED SEAM TAPES TO DOMINATE THE MARKET THROUGH THE FORECAST PERIOD

FIGURE 8 POLYURETHANE, AS A MATERIAL FOR SEAM TAPES, TO GROW AT THE HIGHEST CAGR

FIGURE 9 INTIMATE AND CASUAL APPAREL APPLICATIONS FOR SEAM TAPES TO GROW AT THE HIGHEST CAGR

4 PREMIUM INSIGHTS (Page No. - 32)

4.1 ATTRACTIVE OPPORTUNITIES IN THE SEAM TAPES MARKET

FIGURE 10 INCREASING DEMAND FOR INTIMATE APPAREL OFFERS GROWTH OPPORTUNITIES IN THE SEAM TAPES MARKET

4.2 SEAM TAPES MARKET, BY APPLICATION

FIGURE 11 INTIMATE APPAREL APPLICATION TO LEAD THE SEAM TAPES MARKET

4.3 SEAM TAPES MARKET, BY TYPE AND REGION, 2019

FIGURE 12 SINGLE LAYERED TYPE AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARES

4.4 SEAM TAPES MARKET, BY MATERIAL

FIGURE 13 POLYURETHANE MATERIAL TO ACCOUNT FOR THE LARGEST SHARE

4.5 SEAM TAPES MARKET, BY REGION

FIGURE 14 SEAM TAPES MARKET IN ASIA PACIFIC TO GROW AT THE HIGHEST CAGR

5 MARKET OVERVIEW (Page No. - 35)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES, IN THE SEAM TAPES MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in demand and awareness about best fit intimate apparels among millennial population

5.2.1.2 Rise in the trend of replacing sewing with adhesive film bonding

5.2.1.3 Growth of the sports and outdoor apparel industries

5.2.2 RESTRAINTS

5.2.2.1 Volatile raw material prices

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging economies in Asia Pacific

5.2.4 CHALLENGES

5.2.4.1 Availability of alternative seamless technologies

5.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 SEAM TAPES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 BARGAINING POWER OF SUPPLIERS

5.3.2 THREAT OF NEW ENTRANTS

5.3.3 THREAT OF SUBSTITUTES

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 17 RAW MATERIAL SUPPLIERS AND MANUFACTURERS ADD MAJOR VALUE TO SEAM TAPES VALUE CHAIN

5.5 REGULATIONS

5.6 KEY MARKET FOR EXPORT/IMPORT

5.6.1 IMPORT VALUE OF POLYURETHANE (PRODUCT HARMONIZED SYSTEM CODE: 3909) (VALUE UNIT: USD MILLION)

5.6.2 EXPORT VALUE OF POLYURETHANE (PRODUCT HARMONIZED SYSTEM CODE:3909) (VALUE UNIT: USD MILLION)

6 COVID-19 IMPACT ON SEAM TAPES MARKET (Page No. - 44)

6.1 COVID-19 IMPACT ON SEAM TAPES END-USE APPLICATIONS

7 SEAM TAPES MARKET, BY TYPE (Page No. - 45)

7.1 INTRODUCTION

FIGURE 18 SINGLE LAYERED SEAM TAPES TO DOMINATE MARKET DURING FORECAST PERIOD (USD MILLION)

7.2 SEAM TAPES MARKET, BY TYPE

TABLE 1 SEAM TAPE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 2 SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

7.3 SINGLE LAYERED

FIGURE 19 ASIA PACIFIC IS FASTEST-GROWING MARKET FOR SINGLE LAYERED SEGMENT

TABLE 3 SINGLE LAYERED SEAM TAPES MARKET SIZE , BY REGION, 2018—2025 (USD MILLION)

TABLE 4 SINGLE LAYERED SEAM TAPE MARKET SIZE, BY REGION, 2018—2025 (MILLION METER)

7.4 MULTI LAYERED

FIGURE 20 ASIA PACIFIC TO BE LARGEST MARKET FOR MULTI LAYERED SEGMENT

TABLE 5 MULTI LAYERED SEAM TAPES MARKET SIZE, BY REGION, 2018—2025 (USD MILLION)

TABLE 6 MULTI LAYERED SEAM TAPE MARKET SIZE, BY REGION, 2018—2025 (MILLION METER)

8 SEAM TAPES MARKET, BY MATERIAL (Page No. - 50)

8.1 INTRODUCTION

FIGURE 21 POLYURETHANE TO DOMINATE OVERALL MARKET DURING THE FORECAST PERIOD

8.2 SEAM TAPES MARKET, BY MATERIAL

TABLE 7 SEAM TAPE MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 8 SEAM TAPES MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

8.3 POLYURETHANE

8.3.1 SUPERIOR CHARACTERISTICS OF POLYURETHANE DRIVING THE DEMAND

FIGURE 22 ASIA PACIFIC TO BE LARGEST MARKET IN THE POLYURETHANE SEGMENT

TABLE 9 POLYURETHANE SEAM TAPES MARKET SIZE, BY REGION, 2018—2025 (USD MILLION)

TABLE 10 POLYURETHANE SEAM TAPE MARKET SIZE, BY REGION, 2018—2025 (MILLION METER)

8.4 TPU

8.4.1 TPU IS WIDELY USED IN PRODUCTION OF INTIMATE APPARELS, SHOES, AND SPORTS INNERWEAR

FIGURE 23 ASIA PACIFIC TO BE LARGEST MARKET FOR TPU SEGMENT

TABLE 11 TPU SEAM TAPES MARKET SIZE, BY REGION, 2018—2025 (USD MILLION)

TABLE 12 TPU SEAM TAPE MARKET SIZE, BY REGION, 2018—2025 (MILLION METER)

8.5 POLYAMIDE

8.5.1 HIGH DURABILITY, FLAME & HEAT RESISTANCE AND GREAT STRENGTH DRIVING POLYAMIDE SEGMENT

FIGURE 24 ASIA PACIFIC IS LARGEST MARKET FOR POLYAMIDE SEGMENT

TABLE 13 POLYAMIDE SEAM TAPES MARKET SIZE, BY REGION, 2018—2025 (USD MILLION)

TABLE 14 POLYAMIDE SEAM TAPE MARKET SIZE, BY REGION, 2018—2025 (MILLION METER)

8.6 OTHERS

8.6.1 TRICOT

8.6.2 NONWOVEN

FIGURE 25 ASIA PACIFIC TO BE LARGEST MARKET FOR OTHERS SEGMENT

TABLE 15 OTHERS SEAM TAPES MARKET SIZE , BY REGION, 2018—2025 (USD MILLION)

TABLE 16 OTHERS SEAM TAPE MARKET SIZE, BY REGION, 2018—2025 (MILLION METER)

9 SEAM TAPES MARKET, BY APPLICATION (Page No. - 59)

9.1 INTRODUCTION

FIGURE 26 INTIMATE APPAREL TO DOMINATE MARKET DURING FORECAST PERIOD

9.2 SEAM TAPES MARKET, BY APPLICATION

TABLE 17 SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 18 SEAM TAPES MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

9.3 INTIMATE APPAREL

9.3.1 GROWING HEALTH AWARENESS AND CHANGING LIFESTYLES OF CONSUMERS DRIVING THE DEMAND

FIGURE 27 ASIA PACIFIC TO BE LARGEST MARKET IN INTIMATE APPAREL SEGMENT

TABLE 19 SEAM TAPES MARKET SIZE IN INTIMATE APPAREL, BY REGION, 2018—2025 (USD MILLION)

TABLE 20 SEAM TAPE MARKET SIZE IN INTIMATE APPAREL, BY REGION, 2018—2025 (MILLION METER)

9.4 SHOES

9.4.1 SEAM TAPES MAKE SHOES LIGHTWEIGHT AND WATERPROOF

FIGURE 28 ASIA PACIFIC TO BE LARGEST MARKET IN SHOE APPLICATION

TABLE 21 SEAM TAPES MARKET SIZE IN SHOES, BY REGION, 2018—2025 (USD MILLION)

TABLE 22 SEAM TAPE MARKET SIZE SHOES, BY REGION, 2018—2025 (MILLION METER)

9.5 SPORTS INNERWEAR

9.5.1 INCREASING FITNESS ACTIVITIES AND DEMAND FOR COMFORTABLE AND FLEXIBLE APPARELS DRIVING THE MARKET

FIGURE 29 ASIA PACIFIC TO BE LARGEST MARKET IN SPORTS INNERWEAR SEGMENT

TABLE 23 SEAM TAPES MARKET SIZE IN SPORTS INNERWEAR, BY REGION, 2018—2025 (USD MILLION)

TABLE 24 SEAM TAPE MARKET SIZE IN SPORTS INNERWEAR, BY REGION, 2018—2025 (MILLION METER)

9.6 SPORTSWEAR

9.6.1 SEAM TAPES ALLOW SPORTSWEAR TO WITHSTAND STRAIN FROM REPEATED WEAR THROUGHOUT LIFETIME

FIGURE 30 ASIA PACIFIC IS LARGEST MARKET IN SPORTSWEAR SEGMENT

TABLE 25 SEAM TAPES MARKET SIZE IN SPORTSWEAR, BY REGION, 2018—2025 (USD MILLION)

TABLE 26 SEAM TAPE MARKET SIZE IN SPORTSWEAR, BY REGION, 2018—2025 (MILLION METER)

9.7 CASUAL APPAREL

9.7.1 SEAM TAPES MAKES GARMENTS LIGHTWEIGHT, WATERPROOF, FLEXIBLE, AND MOISTURE RESISTANT

FIGURE 31 ASIA PACIFIC TO BE LARGEST MARKET FOR SEAM TAPES IN CASUAL APPAREL APPLICATION

TABLE 27 SEAM TAPES MARKET SIZE IN CASUAL APPAREL, BY REGION, 2018—2025 (USD MILLION)

TABLE 28 SEAM TAPE MARKET SIZE IN CASUAL APPAREL, BY REGION, 2018—2025 (MILLION METER)

9.8 OTHERS

FIGURE 32 ASIA PACIFIC IS DOMINANT MARKET IN OTHERS SEGMENT

TABLE 29 SEAM TAPES MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018—2025 (USD MILLION)

TABLE 30 SEAM TAPE MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2018—2025 (MILLION METER)

10 SEAM TAPES MARKET, BY REGION (Page No. - 69)

10.1 INTRODUCTION

FIGURE 33 ASIA PACIFIC TO RECORD HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 31 SEAM TAPES MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 32 SEAM TAPE MARKET SIZE, BY REGION, 2018–2025 (MILLION METER)

10.2 ASIA PACIFIC

10.2.1 IMPACT OF COVID-19 ON SEAM TAPES MARKET IN ASIA PACIFIC

FIGURE 34 ASIA PACIFIC: SEAM TAPES MARKET SNAPSHOT

TABLE 33 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 34 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION METER)

TABLE 35 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 36 ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 37 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 38 ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 39 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 40 ASIA PACIFIC: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.2 CHINA

10.2.2.1 Growing garment and textile industries driving the seam tapes market

TABLE 41 CHINA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 42 CHINA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 43 CHINA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 44 CHINA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 45 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 46 CHINA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.3 INDIA

10.2.3.1 Increasing demand for sportswear, outerwear, intimate wear, and casual clothing drives the seam tapes market

TABLE 47 INDIA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 48 INDIA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 49 INDIA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 50 INDIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 51 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 52 INDIA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.4 VIETNAM

10.2.4.1 Growing awareness of fashion industry driving the seam tapes market

TABLE 53 VIETNAM: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 54 VIETNAM: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 55 VIETNAM: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 56 VIETNAM: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 57 VIETNAM: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 58 VIETNAM: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.5 INDONESIA

10.2.5.1 Textile & garment industries contribute significantly to growth of seam tapes market

TABLE 59 INDONESIA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 60 INDONESIA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 61 INDONESIA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 62 INDONESIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 63 INDONESIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 64 INDONESIA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.6 CAMBODIA

10.2.6.1 Growing footwear and apparel manufacturing industry fueling demand for seam tapes

TABLE 65 CAMBODIA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 CAMBODIA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 67 CAMBODIA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 68 CAMBODIA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 69 CAMBODIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 70 CAMBODIA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.7 BANGLADESH

10.2.7.1 Favorable government policies for textile industry support growth of the seam tapes market

TABLE 71 BANGLADESH: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 72 BANGLADESH: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 73 BANGLADESH: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 74 BANGLADESH: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 75 BANGLADESH: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 76 BANGLADESH: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.8 PAKISTAN

10.2.8.1 Single layered seam tape is larger and faster-growing segment in Pakistan

TABLE 77 PAKISTAN: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 PAKISTAN: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 79 PAKISTAN: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 80 PAKISTAN: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 81 PAKISTAN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 82 PAKISTAN: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.2.9 REST OF ASIA PACIFIC

TABLE 83 REST OF ASIA PACIFIC: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 84 REST OF ASIA PACIFIC: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 85 REST OF ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 86 REST OF ASIA PACIFIC: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 87 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 88 REST OF ASIA PACIFIC: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.3 NORTH AMERICA

FIGURE 35 NORTH AMERICA: SEAM TAPES MARKET SNAPSHOT

10.3.1 IMPACT OF COVID-19 ON SEAM TAPE MARKET IN NORTH AMERICA

TABLE 89 NORTH AMERICA: SEAM TAPES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION METER)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 92 NORTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 93 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 94 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 95 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 96 NORTH AMERICA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.3.2 US

10.3.2.1 One of the leading consumers of seam tapes in the region

TABLE 97 US: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 98 US: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 99 US: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 100 US: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 101 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 102 US: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.3.3 MEXICO

10.3.3.1 Second-largest market for seam tapes in North America

TABLE 103 MEXICO: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 104 MEXICO: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 105 MEXICO: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 106 MEXICO: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 107 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 108 MEXICO: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.3.4 CANADA

10.3.4.1 Apparel industry in Canada is growing due to new and advanced techniques

TABLE 109 CANADA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 111 CANADA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 113 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 114 CANADA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.4 EUROPE

10.4.1 IMPACT OF COVID-19 ON SEAM TAPES MARKET IN EUROPE

FIGURE 36 EUROPE: SEAM TAPES MARKET SNAPSHOT

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION METER)

TABLE 117 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 118 EUROPE: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 119 EUROPE: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 120 EUROPE: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 121 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 122 EUROPE: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.4.2 GERMANY

10.4.2.1 Growing automobile industry drives seam tapes market in the country

TABLE 123 GERMANY: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 124 GERMANY: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 125 GERMANY: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 126 GERMANY: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 127 GERMANY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 128 GERMANY: SEAM TAP MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.4.3 SPAIN

10.4.3.1 Increasing demand for sportswear products driving the market

TABLE 129 SPAIN: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 130 SPAIN: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 131 SPAIN: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 132 SPAIN: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 133 SPAIN: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 134 SPAIN: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.4.4 ITALY

10.4.4.1 Increasing demand for healthcare services support market growth

TABLE 135 ITALY: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 136 ITALY: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 137 ITALY: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 138 ITALY: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 139 ITALY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 140 ITALY: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.4.5 REST OF EUROPE

TABLE 141 REST OF EUROPE: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 142 REST OF MEA: SEAM TAPE MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 143 REST OF EUROPE: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 144 REST OF EUROPE: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 145 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 146 REST OF EUROPE: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.5 MIDDLE EAST & AFRICA

10.5.1 IMPACT OF COVID-19 ON SEAM TAPES MARKET IN THE MIDDLE EAST & AFRICA

FIGURE 37 MIDDLE EAST & AFRICA: SEAM TAPES MARKET SNAPSHOT

TABLE 147 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 148 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION METER)

TABLE 149 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 150 MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 151 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 152 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 153 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 154 MIDDLE EAST & AFRICA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.5.2 TURKEY

10.5.2.1 Growing textile & apparel industry drives the seam tapes market in the country

TABLE 155 TURKEY: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 156 TURKEY: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 157 TURKEY: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 158 TURKEY: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 159 TURKEY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 160 TURKEY: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.5.3 SOUTH AFRICA

10.5.3.1 Wide range of applications in sports, healthcare, and military apparels drives the market

TABLE 161 SOUTH AFRICA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 162 SOUTH AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 163 SOUTH AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 164 SOUTH AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 165 SOUTH AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 166 SOUTH AFRICA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 167 REST OF MIDDLE EAST & AFRICA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 168 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 169 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD THOUSAND)

TABLE 170 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 171 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 172 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.6 SOUTH AMERICA

FIGURE 38 SOUTH AMERICA: SEAM TAPES MARKET SNAPSHOT

10.6.1 IMPACT OF COVID-19 ON SEAM TAPE MARKET IN SOUTH AMERICA

TABLE 173 SOUTH AMERICA: SEAM TAPES MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 174 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (MILLION METER)

TABLE 175 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 176 SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 177 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 178 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 179 SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 180 SOUTH AMERICA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.6.2 BRAZIL

10.6.2.1 Rapid industrialization projected to boost seam tapes market in Brazil

TABLE 181 BRAZIL: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 182 BRAZIL: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 183 BRAZIL: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 184 BRAZIL: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 185 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 186 BRAZIL: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.6.3 ARGENTINA

10.6.3.1 Increasing requirement for sports & outdoor apparel due to improving economic conditions driving the market

TABLE 187 ARGENTINA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD THOUSAND)

TABLE 188 ARGENTINA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 189 ARGENTINA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 190 ARGENTINA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 191 ARGENTINA: ARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

TABLE 192 ARGENTINA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

10.6.4 REST OF SOUTH AMERICA

TABLE 193 REST OF SOUTH AMERICA: SEAM TAPES MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 194 REST OF SOUTH AMERICA: MARKET SIZE, BY TYPE, 2018–2025 (MILLION METER)

TABLE 195 REST OF SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (USD MILLION)

TABLE 196 REST OF SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2018–2025 (MILLION METER)

TABLE 197 REST OF SOUTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD THOUSAND)

TABLE 198 REST OF SOUTH AMERICA: SEAM TAPE MARKET SIZE, BY APPLICATION, 2018–2025 (MILLION METER)

11 COMPETITIVE LANDSCAPE (Page No. - 133)

11.1 OVERVIEW

FIGURE 39 COMPANIES PRIMARILY ADOPTED EXPANSION AS KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

11.2 MARKET RANKING ANALYSIS

FIGURE 40 SEAM TAPES MARKET RANKING, 2019

11.3 COMPETITIVE SCENARIO

11.3.1 MERGERS & ACQUISITIONS

TABLE 199 MERGERS & ACQUISITIONS, 2017–2020

11.3.2 NEW PRODUCT LAUNCHES

TABLE 200 NEW PRODUCT LAUNCHES, 2017–2020

12 COMPANY PROFILES (Page No. - 136)

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View)*

12.1 BEMIS ASSOCIATES

FIGURE 41 BEMIS ASSOCIATES: SWOT ANALYSIS

12.2 SEALON

FIGURE 42 SEALON: SWOT ANALYSIS

12.3 HIMEL CORP.

FIGURE 43 HIMEL CORP: SWOT ANALYSIS

12.4 GERLINGER INDUSTRIES

FIGURE 44 GERLINGER INDUSTRIES: SWOT ANALYSIS

12.5 ADHESIVE FILMS, INC.

FIGURE 45 ADHESIVE FILMS, INC.: SWOT ANALYSIS

12.6 DING ZING

12.7 FRAMIS ITALIA S.P.A

12.8 TIWAN HIPSTER ENTERPRISE

12.9 E. TEXTINT CORP.

12.10 SAN CHEMICALS LTD.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

12.11 OTHER COMPANIES

12.11.1 LOXY AS.

13 APPENDIX (Page No. - 155)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

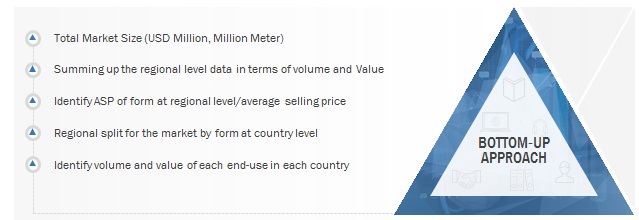

The study involved four major activities in estimating the size of the Seam tapes Market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg Businessweek, Factiva, World Bank, and Industry Journals were used. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; and databases.

Primary Research

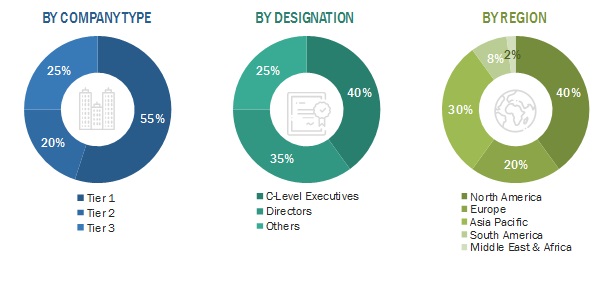

The seam tapes market comprises several stakeholders, such as raw material suppliers, end-product manufacturers, and regulatory organizations in the supply chain. Developments in the seam tapes market characterize the demand side. Market consolidation activities undertaken by manufacturers characterize the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the seam tapes market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Seam tapes: Bottom-Up-Approach

Seam tapes : Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above— the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the seam tapes market.

Report Objectives

- To define, describe, and forecast the seam tapes market in terms of value and volume

- To provide detailed information about the key factors influencing the market growth, such as drivers, restraints, opportunities, and challenges

- To analyze and forecast the market size based on material, type, packaging type, and applications

- To forecast the market size of five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and Middle East and Africa(MEA)

- To strategically analyze the micromarkets1 with respect to individual growth trends, growth prospects, and contribution to the overall market

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders

- To analyze the competitive developments, such as expansion, mergers & acquisitions, new product developments, and agreement) in the seam tapes market

- To strategically profile the key players and comprehensively analyze their core competencies2

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific needs of the companies.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of a region with respect to a particular country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Seam Tapes Market