Sports Composites Market by Resin Type (Epoxy, Polyamide, Polyurethane, Polypropylene) Fiber Type (Carbon, Glass), Application (Golf Sticks, Hockey Sticks, Rackets, Bicycles, Skis & Snowboards) and Region Global Forecast to 2026

Updated on : August 25, 2025

Sports Composites Market

The global sports composites market was valued at USD 4.1 billion in 2021 and is projected to reach USD 5.1 billion by 2026, growing at 4.8% cagr from 2021 to 2026. The increasing demand for lightweight materials for sports equipment is the primary factor supporting the market growth. The growing demand of composites for golf clubs and rackets will further drive the market growth during the forecast period.

Sports Composites Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Sports Composites Market

The global lockdown and virtual standstill caused by the pandemic COVID-19 have led to a global economic and business crisis. Various industrial sectors have been significantly affected and their supply chains have been disrupted. The market has been significantly affected due to the low demand, leading manufacturers in reducing production. The trade and travel bans throughout the globe has also hindered the supply chain.

Sports equipment has been facing declining demand due to the cancellation of events and international sports matches. Travel and trade restrictions also led to breaks in the supply of existing orders from manufacturers. Therefore, maintaining uninterrupted supply chains during the COVID-19 pandemic was a major challenge for the sports composites market.

Driver: Increasing demand for lightweight materials for sports goods equipment

Increased efficiency and low weight have always been the foremost drivers for utilizing composites in sports goods as they enhance athletic performance and lower the threat of injury. In addition, composites offer high strength-to-weight capabilities in comparison with other traditional materials such as titanium, alloy, high tensile strength steels, and others, thus helping create increasingly efficient and variety in designs. Carbon fiber and glass fiber are seen as substitutes for these traditional materials as they are lightweight, provide good mechanical performance, offer variety in designs, strength, stiffness, and others. Sports goods manufacturers are increasingly using carbon fiber.

Carbon fiber has a high demand for bicycle frames, fishing rods, golf shafts, tennis rackets, and other products because it offers compression and lateral stability, as well as is lightweight, strength, and durability. Glass fiber is also preferred by manufacturers as it provides strength, flexibility, durability, stability, is lightweight, as well as resistant to heat, temperature, and moisture. These composites are majorly used in the manufacture of skis & snowboards and hockey sticks. Apart from these applications, they are also used in bicycles, rackets, and others. However, glass fiber composites are not as strong as other materials or as stiff as carbon fiber. For instance, the use of composites in tennis rackets reduces the weight and increase the sweet spot size; in hockey sticks, they reduce weight and adjust the kick point to increase energy transfer; in fishing rods, they reduce weight and increase the sensitivity and accuracy.

Restraint: Rising costs of raw and auxiliary materials increasing cost of composite resins and glass fiber

Rising costs of raw and auxiliary materials. As per secondary sources and industry experts, the prices of composite resins have increased significantly in 2021. Costs of raw and auxiliary materials have consistently increased during the first three quarters of 2021, along with increased freight and logistics costs and packaging costs which have resulted in a surge in the prices of resins. General-purpose products are cheaper than specialty products. Specialty products compete to a greater extent on the basis of performance rather than price, as compared with general-purpose or commodity products. The prices of glass fiber are increasing, which is expected to restrict the growth of the market. For instance, companies such as Owens Corning and Certex have increased the prices of glass fibers. The ongoing advancements in the manufacturing process in line with the increasing production of glass fiber are expected to reduce the prices of glass fiber.

Opportunity: Rising demand for composites for new sports goods applications

Sports goods are required to be manufactured in different sizes and shapes depending upon the sport. The various properties of composites such as high tensile modulus, low density, and lightweight make them suitable for various sports goods applications such as tennis rackets, golf shafts, fishing poles, skis, snowboards, hockey sticks, and bicycle frames. Composites are finding new uses in various sports goods applications such as wheel-tire systems, fitness equipment, softballs, bats, baseballs, helmets, cycling shoes, boots, apparel for both, alpine and Nordic skiing, clothing and protective wear, footwear, and others. This is because composites offer compression and lateral stability as well as are lightweight and have high strength and durability. The increase in the demand for composites from new sports goods applications creates opportunities in this market. For example, Topkey Corporation (Taiwan) has developed safety products such as helmets and other products from composite materials using the UDPP process.

Challenge: Issues related to recycling

The use of composites in various end-use industries helps in the reduction of weight and increases performance. Difficulties in recycling composites is a major challenge faced by composite manufacturers. Most of the composites used are disposed of at landfills. However, the landfilling of composite wastes is not an environment-friendly solution. Many of the European Union countries have prohibited landfilling composite wastes. Globally, companies are trying to reduce global warming and exploring the potential of composites in reducing greenhouse gas emissions. However, difficulties in recycling glass fiber-reinforced composites is a stumbling block, where the pressure to recycle is high.

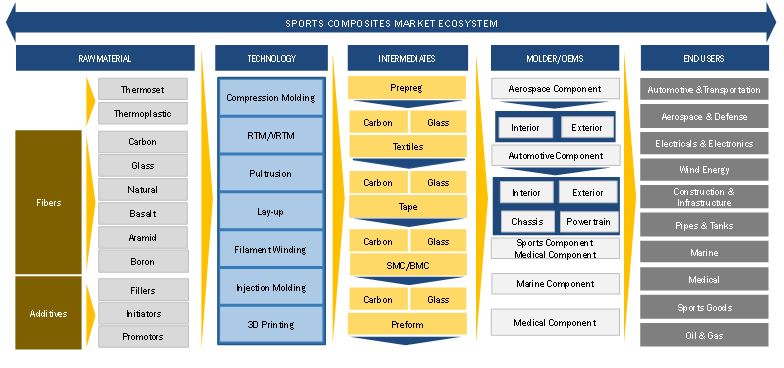

Sports Composites Market Ecosystem

Carbon fibers accounted for the largest market share, in terms of value

In terms of value, carbon fibers led the global sports composites market. This is due to the higher prices of carbon fibers used in the manufacture of sport goods such as golf shafts, fishing rods, bicycle frames, and rackets. Carbon fiber is one of the technologically advanced materials for reinforcement, providing the highest tensile strength than other reinforcement fibers. Carbon fiber composites are majorly used due to their low weight and high tensile strength, durability, impact absorption, resistance, and stiffness. Increased capacity expansions for the manufacture of carbon fibers by leading players and technical innovations are expected to reduce prices, thereby driving the penetration of carbon fiber composites in various sports goods applications.

Polyamide resin have the second-largest market share, in terms of both value and volume

The polyamide resin accounted for the second-largest share in the global sports composites market in terms of value in 2020. Thermoplastic composites containing polyamide resin matrix offer an ideal combination of properties for a wide range of applications in the sports market. The resin offers various properties such as excellent resistance to chemicals, wear, and abrasion; good mechanical properties at elevated temperatures; low permeability to gases; good dimensional stability; good toughness; high strength; and high impact resistance, among others.

Golf sticks applications accounted the second largest share in sports composites market in terms of both volume and value

Golf sticks holds the second largest share in the sports composites market in 2020 in terms of volume and value. Golf shafts are generally manufactured with the use of high modulus graphite, titanium, and high tensile strength steels. The two important considerations that influence the use of shaft materials for the design of the golf shaft and club performance are swing and strike. Therefore, the use of composites in the manufacture and production of golf club shafts and club heads has been aided, as these materials offer lighter weight, a high-tech image to a rather affluent market, and a variety of design options which are not available in traditional steel material.

To know about the assumptions considered for the study, download the pdf brochure

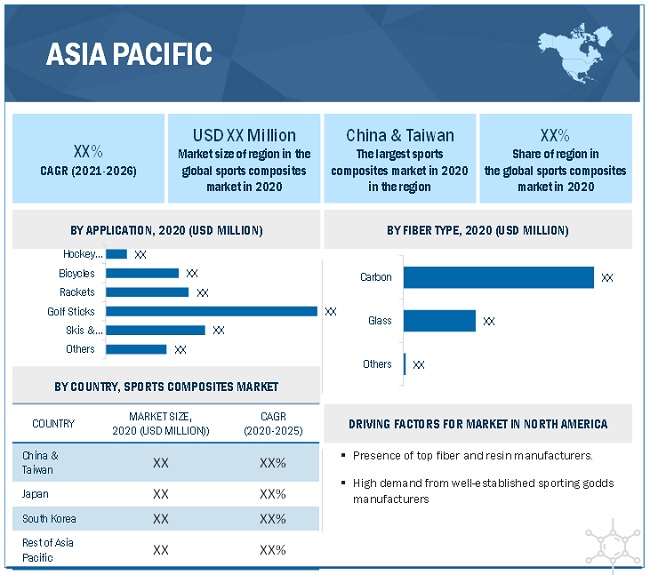

Asia Pacific is expected to be the fastest growing region in the sports composites market during the forecast period.

During the forecast period, Asia Pacific is estimated to the fastest growing region in the sports composites market due to the rising demand for composites from various sports applications in the region. The presence of well-established sports manufacturing companies such as Topkey Corporation, Zhongfu Shenying, Weihai Guangwei Composites, etc. in the region offers significant market opportunities. Increase in the demand from the golf sticks, rackets, and bicycles application segments in the Asia Pacific are expected to drive the market during the next five years.

Sports Composites Market Players

Some of the key players in the global sports composites market are:

- Amer Sports (Finland)

- Rossignol (France)

- Newell Brands (US)

- Ficher Sports (Austria)

- Topkey Corporation (Taiwan)

- ALDILA, Inc. (US)

- Fujikura Composites (Japan)

- Callway Golf (US)

- True Temper (US)

- Prokennex (Taiwan)

Please visit 360Quadrants to see the vendor listing of Top 20 Composites Companies, Worldwide 2023

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the sports composites market. The study includes an in-depth competitive analysis of these key players in the market, with their company profiles, recent developments, and key market strategies.

Recent Developments in Sports Composites Market

- In May 2021, Toray Industries, Inc. created high tensile modulus carbon fiber and thermoplastic pellets which are ideal for injection molding employing that fiber. The pellets are expected to enable the efficient production of complex, rigid parts which are also light, thereby lowering the environmental impact.

- In January 2021, Amer Sports entered into an agreement with Peloton Interactive Inc. for the contemplated sale of Precor, the manufacturer of commercial fitness equipment with a significant manufacturing presence in the US.

- In January 2021, SGL carbon revealed its plan to launch a USD 4.5 million expansion project at its Arkadelphia, AR plant with a plan to increase its capacity for carbon composites. The expansion is expected to become operational by the end of the year. SGL Carbon operates 31 production facilities in Europe, Asia, and North America. This expansion is expected to boost the growth of the sports composites market.

Frequently Asked Questions (FAQ):

What is the anticipated size and growth rate for the Sports Composites market?

The global sports composites market size is projected to grow from USD 4.1 billion in 2021 to USD 5.1 billion by 2026, at a CAGR of 4.8% during the forecast period.

What are the factors influencing the growth of the sports composites market?

The growing demand for carbon fibers from golf sticks, rackets, bicycles, and other applications.

Which is the largest country-level market for sports composites?

China & Taiwan is the largest sports composites market due to the presence major sporting goods manufacturers

What are the factors contributing to the final price of sports composites?

Fiber grade and technical route adopted plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of sports composites.

What are the challenges in the sports composites market?

Recycling of waste composites is the major challenge in the sports composites market.

Which type of sports composite resins holds the largest market share?

Epoxy resins hold the largest share in terms of both value and volume.

How is the sports composites market aligned?

The market is growing at a moderate pace. It is a potential market and many manufactures are undertaking business strategies to expand their business especially in the developing countries.

Who are the major manufacturers?

Amer Sports (Finland), ALDILA, Inc. (US), Jarden Corporation (US), ProKennex (Taiwan), Fischer Sports GmbH (Austria), Topkey Corporation (Taiwan), Rossignol (France), and others are the key players in the sports composites market. Some of the raw material suppliers have also been profiled in the report and include Toray industries Inc. (Japan), SGL Group (Germany), Teijin Limited (Japan), Hexcel Corporation (US), Hexion Inc. (US), and E. I. Du Pont De Nemours and Company (US).

What are the major applications for sports composite?

The major applications for sports composites are golf sticks, rackets, hockey sticks, bicycles, skis & snowboards, and others

What are the fibers used for sports composites?

The major fibers used in sports composites are glass, carbon, aramid, boron, and natural fibers.

What is the biggest restraint in the sports composites market?

High cost of sports composites is the biggest restraint in the growth of sports composites market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 37)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 MARKET SCOPE

FIGURE 1 SPORTS COMPOSITES MARKET SEGMENTATION

1.4.1 REGIONS COVERED

1.4.2 YEARS CONSIDERED FOR THE REPORT

1.5 CURRENCY

1.6 UNIT CONSIDERED

1.7 LIMITATIONS

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH 1

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

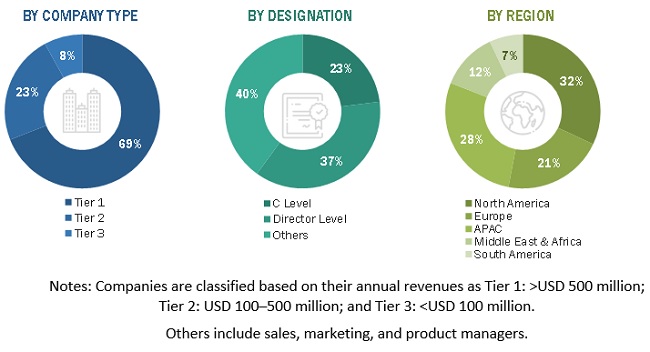

2.3.2.1 Primary interviews – Top sports composite goods and raw material manufacturers

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 SPORTS COMPOSITES MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 SPORTS COMPOSITES MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 SPORTS COMPOSITES MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 5 EPOXY RESIN DOMINATED SPORTS COMPOSITES MARKET IN 2020, BY RESIN TYPE

FIGURE 6 CARBON FIBER SEGMENT TO LEAD SPORTS COMPOSITES MARKET DURING FORECAST PERIOD, 2021–2026

FIGURE 7 BICYCLES APPLICATION PROJECTED TO GROW AT HIGHEST CAGR IN SPORTS COMPOSITES MARKET, 2021–2026

FIGURE 8 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF MARKET FOR SPORTS COMPOSITES, IN TERMS OF VALUE, 2020

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE OPPORTUNITIES IN SPORTS COMPOSITES MARKET

FIGURE 9 HIGH DEMAND FOR HIGH STRENGTH AND SUPERIOR PERFORMING MATERIALS TO DRIVE PENETRATION OF COMPOSITES IN SPORTS INDUSTRY

4.2 SPORTS COMPOSITES MARKET, BY FIBER TYPE AND REGION

FIGURE 10 ASIA PACIFIC AND CARBON FIBER ACCOUNTED FOR HIGHEST SHARES OF SPORTS COMPOSITES MARKET IN 2020

4.3 SPORTS COMPOSITES MARKET, BY RESIN TYPE

FIGURE 11 EPOXY RESIN SEGMENT DOMINATED MARKET IN 2020

4.4 SPORTS COMPOSITES MARKET, BY APPLICATION

FIGURE 12 SKIS & SNOWBOARDS SEGMENT TO DOMINATE SPORTS COMPOSITES MARKET

4.5 SPORTS COMPOSITES MARKET, BY KEY COUNTRIES

FIGURE 13 MARKET IN CHINA & TAIWAN TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SPORTS COMPOSITES MARKET

5.2.1 DRIVERS

5.2.1.1 Increasing demand for lightweight materials for sports goods equipment

5.2.1.2 Rising demand for composites for golf sticks and rackets application segments

5.2.1.3 Increasing demand for carbon fibers from bicycle frame manufacturers

5.2.2 RESTRAINTS

5.2.2.1 Rising costs of raw and auxiliary materials increasing cost of composite resins and glass fiber

5.2.2.2 Impact of climate warming on winter sports equipment market

5.2.2.3 High processing and manufacturing costs

5.2.2.4 Lack of standardization in manufacturing technologies

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for composites for new sports goods applications

5.2.3.2 Rising adoption of natural composites

5.2.4 CHALLENGES

5.2.4.1 Lack of major research and technological advancements

5.2.4.2 Issues related to recycling

5.2.4.3 Overcoming bottlenecks in supply chains due to the COVID-19 pandemic

5.3 INDUSTRY TRENDS

FIGURE 15 SPORTS COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF BUYERS

5.3.4 BARGAINING POWER OF SUPPLIERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 1 SPORTS COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

5.4 TECHNOLOGY ANALYSIS

TABLE 2 COMPARATIVE STUDY OF MAJOR COMPOSITE MANUFACTURING PROCESSES

5.5 ECOSYSTEM: SPORTS COMPOSITES MARKET

FIGURE 16 ECOSYSTEM: SPORTS COMPOSITES MARKET

5.6 VALUE CHAIN ANALYSIS

FIGURE 17 VALUE CHAIN ANALYSIS: SPORTS COMPOSITES MARKET

5.7 IMPACT OF COVID-19

5.7.1 RAW MATERIALS

5.7.2 INTERMEDIATES

5.7.3 OEMS

5.8 SUPPLY CHAIN ANALYSIS

TABLE 3 SUPPLY CHAIN ANALYSIS: SPORTS COMPOSITES MARKET

5.9 SPORTS COMPOSITES MARKET: OPTIMISTIC, PESSIMISTIC, AND REALISTIC SCENARIOS

TABLE 4 SPORTS COMPOSITES MARKET: CAGR (IN TERMS OF VALUE) IN REALISTIC, PESSIMISTIC, AND OPTIMISTIC SCENARIOS

5.9.1 OPTIMISTIC SCENARIO

5.9.2 PESSIMISTIC SCENARIO

5.9.3 REALISTIC SCENARIO

5.10 PRICING ANALYSIS

5.11 AVERAGE SELLING PRICE

TABLE 5 SPORTS COMPOSITES AVERAGE SELLING PRICE, BY REGION

5.12 KEY MARKETS FOR IMPORTS/EXPORTS

5.12.1 CHINA & TAIWAN

5.12.2 US

5.12.3 GERMANY

5.12.4 JAPAN

5.12.5 SOUTH KOREA

5.13 CASE STUDY ANALYSIS

FIGURE 18 CASE STUDY ANALYSIS: SPORTS COMPOSITES MARKET

5.14 THE TRADE POLICIES ON CARBON FIBERS FOR MAJOR COUNTRIES ARE SUMMARIZED BELOW:

5.14.1 US

5.14.2 JAPAN

5.14.3 EUROPE

5.14.4 CHINA

5.15 IMPACT ON CUSTOMER BUSINESSES

FIGURE 19 IMPACT ON CUSTOMER BUSINESS: SPORTS COMPOSITES MARKET

5.16 PATENT ANALYSIS

5.16.1 METHODOLOGY

5.16.2 DOCUMENT TYPE

TABLE 6 PATENTS REGISTERED: SPORTS COMPOSITES MARKET, 2010–2020

FIGURE 20 PATENT APPLICATIONS VS PATENTS GRANTED, 2010–2020

FIGURE 21 PATENT PUBLICATION TRENDS, 2010–2020

5.16.3 INSIGHTS

5.16.4 LEGAL STATUS OF PATENTS

FIGURE 22 LEGAL STATUS OF PATENTS: SPORTS COMPOSITES MARKET

5.16.5 JURISDICTION ANALYSIS

FIGURE 23 TOP JURISDICTION-BY DOCUMENT

5.16.6 TOP COMPANIES/APPLICANTS

FIGURE 24 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENTS

5.16.6.1 List of Patents by Campagnolo S.r.l.

TABLE 7 LIST OF PATENTS BY CAMPAGNOLO S.R.L

5.16.6.2 List of Patents by Henkel AG & Co KGaA

TABLE 8 LIST OF PATENTS BY HENKEL AG & CO KGAA

5.16.6.3 List of Patents by BASF

TABLE 9 LIST OF PATENTS BY BASF

5.16.7 TOP TEN PATENT OWNERS (US) DURING LAST TEN YEARS

TABLE 10 TOP TEN PATENT OWNERS (US), 2010-2020

6 SPORTS COMPOSITES MARKET, BY RESIN TYPE (Page No. - 76)

6.1 INTRODUCTION

FIGURE 25 EPOXY RESIN TO DOMINATE SPORTS COMPOSITES MARKET

TABLE 11 SPORTS COMPOSITES MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 12 MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 13 MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

TABLE 14 MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

6.2 EPOXY RESIN

FIGURE 26 ASIA PACIFIC TO DOMINATE EPOXY-BASED SPORTS COMPOSITES MARKET

TABLE 15 EPOXY RESIN-BASED SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 EPOXY RESIN-BASED MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 17 EPOXY RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 18 EPOXY RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.3 POLYAMIDE RESIN

FIGURE 27 ASIA PACIFIC TO LEAD POLYAMIDE-BASED SPORTS COMPOSITES MARKET

TABLE 19 POLYAMIDE RESIN-BASED SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 POLYAMIDE RESIN-BASED MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 21 POLYAMIDE RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 22 POLYAMIDE RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.4 POLYURETHANE RESIN

TABLE 23 POLYURETHANE RESIN--BASED SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 POLYURETHANE RESIN-BASED MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 25 POLYURETHANE RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 26 POLYURETHANE RESIN BASED MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.5 POLYPROPYLENE RESIN

TABLE 27 POLYPROPYLENE RESIN-BASED SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 POLYPROPYLENE RESIN-BASED MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 29 POLYPROPYLENE RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 30 POLYPROPYLENE RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

6.6 OTHERS

TABLE 31 OTHER RESIN-BASED SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 32 OTHER RESIN-BASED MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 33 OTHER RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 OTHER RESIN-BASED MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7 SPORTS COMPOSITES MARKET, BY FIBER TYPE (Page No. - 88)

7.1 INTRODUCTION

FIGURE 28 CARBON FIBER COMPOSITES TO DOMINATE SPORTS COMPOSITES MARKET

TABLE 35 SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 36 MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 37 MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

TABLE 38 MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

7.2 GLASS FIBER COMPOSITES

FIGURE 29 EUROPE TO BE LARGEST GLASS FIBER SPORTS COMPOSITES MARKET DURING FORECAST PERIOD

7.2.1 GLASS FIBER SPORTS COMPOSITES, BY REGION

TABLE 39 GLASS FIBER SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 GLASS FIBER MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 41 GLASS FIBER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 GLASS FIBER MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.2.2 GLASS FIBER SPORTS COMPOSITES, BY APPLICATION

TABLE 43 GLASS FIBER SPORTS COMPOSITES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 44 GLASS FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 45 GLASS FIBER MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 46 GLASS FIBER MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

7.3 CARBON FIBER COMPOSITES

FIGURE 30 ASIA PACIFIC IS EXPECTED TO DOMINATE CARBON FIBER SPORTS COMPOSITES MARKET BY 2026

7.3.1 CARBON FIBER SPORTS COMPOSITES, BY REGION

TABLE 47 CARBON FIBER SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 48 CARBON FIBER MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 49 CARBON FIBER MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 CARBON FIBER MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.3.2 CARBON FIBER SPORTS COMPOSITES, BY APPLICATION

TABLE 51 CARBON FIBER SPORTS COMPOSITES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 52 CARBON FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 53 CARBON FIBER MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 54 CARBON FIBER MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

7.4 OTHER FIBER COMPOSITES

FIGURE 31 ASIA PACIFIC TO BE LARGEST OTHER FIBERS SPORTS COMPOSITES MARKET

7.4.1 OTHER FIBERS SPORTS COMPOSITES, BY REGION

TABLE 55 OTHER FIBER SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 56 OTHER FIBERS MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 57 OTHER FIBERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 58 OTHER FIBERS MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

7.4.2 OTHER FIBERS SPORTS COMPOSITES, BY APPLICATION

TABLE 59 OTHER FIBER SPORTS COMPOSITES MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 60 OTHER FIBER MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 61 OTHER FIBER MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 62 OTHER FIBER MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

8 SPORTS COMPOSITES MARKET, BY APPLICATION (Page No. - 103)

8.1 INTRODUCTION

FIGURE 32 SKIS & SNOWBOARDS APPLICATION PROJECTED TO LEAD GLOBAL SPORTS COMPOSITES MARKET

8.2 SPORTS COMPOSITES MARKET, BY APPLICATION

TABLE 63 MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 64 MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 65 MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 66 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

8.3 GOLF STICKS

FIGURE 33 ASIA PACIFIC REGION TO LEAD GOLF STICKS APPLICATION SEGMENT

8.3.1 SPORTS COMPOSITES MARKET IN GOLF STICKS APPLICATION, BY REGION

TABLE 67 MARKET SIZE IN GOLF STICKS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 68 MARKET SIZE IN GOLF STICKS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 MARKET SIZE IN GOLF STICKS APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 70 MARKET SIZE IN GOLF STICKS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.4 RACKETS

8.4.1 SPORTS COMPOSITES MARKET IN RACKETS APPLICATION, BY REGION

TABLE 71 MARKET SIZE IN RACKETS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 72 MARKET SIZE IN RACKETS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 73 MARKET SIZE IN RACKETS APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 74 MARKET SIZE IN RACKETS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.5 BICYCLES

8.5.1 INCREASING USE OF COMPOSITES IN BICYCLES SEGMENT TO DRIVE MARKET GROWTH

8.5.2 SPORTS COMPOSITES MARKET IN BICYCLES APPLICATION, BY REGION

TABLE 75 SPORTS COMPOSITES MARKET SIZE IN BICYCLES APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 76 MARKET SIZE IN BICYCLES APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 MARKET SIZE IN BICYCLES APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 78 MARKET SIZE IN BICYCLES APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.6 HOCKEY STICKS

8.6.1 SPORTS COMPOSITES MARKET IN HOCKEY STICKS APPLICATION, BY REGION

TABLE 79 SPORTS COMPOSITES MARKET SIZE IN HOCKEY STICKS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 80 MARKET SIZE IN HOCKEY STICKS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 81 MARKET SIZE IN HOCKEY STICKS APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 82 MARKET SIZE IN HOCKEY STICKS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.7 SKIS & SNOWBOARDS

8.7.1 SPORTS COMPOSITES MARKET IN SKIS & SNOWBOARDS APPLICATION, BY REGION

TABLE 83 MARKET SIZE IN SKIS & SNOWBOARDS APPLICATION, BY REGION, 2017–2020 (KILOTON)

TABLE 84 MARKET SIZE IN SKIS & SNOWBOARDS APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 SPORTS COMPOSITES MARKET SIZE IN SKIS & SNOWBOARDS APPLICATION, BY REGION, 2021–2026 (KILOTON)

TABLE 86 MARKET SIZE IN SKIS & SNOWBOARDS APPLICATION, BY REGION, 2021–2026 (USD MILLION)

8.8 OTHER APPLICATIONS

8.8.1 SPORTS COMPOSITES MARKET SIZE IN OTHER APPLICATIONS, BY REGION

TABLE 87 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (KILOTON)

TABLE 88 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (KILOTON)

TABLE 90 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

9 SPORTS COMPOSITES MARKET, BY REGION (Page No. - 118)

9.1 INTRODUCTION

FIGURE 34 CHINA & TAIWAN TO BE FASTEST-GROWING SPORTS COMPOSITES MARKET DURING FORECAST PERIOD

TABLE 91 SPORTS COMPOSITES MARKET SIZE, BY REGION, 2017–2020 (KILOTON)

TABLE 92 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 MARKET SIZE, BY REGION, 2021–2026 (KILOTON)

TABLE 94 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9.2 ASIA PACIFIC

FIGURE 35 ASIA PACIFIC: SPORTS COMPOSITES MARKET SNAPSHOT

9.2.1 ASIA PACIFIC: SPORTS COMPOSITES MARKET, BY RESIN TYPE

TABLE 95 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 96 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 97 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 98 ASIA PACIFIC: MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

9.2.2 ASIA PACIFIC: SPORTS COMPOSITES MARKET, BY FIBER TYPE

TABLE 99 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 100 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 101 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 102 ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.2.3 ASIA PACIFIC: SPORTS COMPOSITES MARKET, BY APPLICATION

TABLE 103 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 104 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 106 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.2.4 ASIA PACIFIC: SPORTS COMPOSITES MARKET, BY COUNTRY

TABLE 107 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 108 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 110 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.2.4.1 China & Taiwan

TABLE 111 CHINA & TAIWAN: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 112 CHINA & TAIWAN: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 113 CHINA & TAIWAN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 114 CHINA & TAIWAN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.2.4.2 Japan

TABLE 115 JAPAN: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 116 JAPAN: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 117 JAPAN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 118 JAPAN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.2.4.3 South Korea

TABLE 119 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 120 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 121 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 122 SOUTH KOREA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.2.4.4 Rest of Asia Pacific

TABLE 123 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 124 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 125 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 126 REST OF ASIA PACIFIC: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.3 EUROPE

FIGURE 36 EUROPE: SPORTS COMPOSITES MARKET SNAPSHOT

9.3.1 EUROPE: SPORTS COMPOSITES MARKET, BY RESIN TYPE

TABLE 127 EUROPE: MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 128 EUROPE: MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 129 EUROPE: MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 130 EUROPE: MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

9.3.2 EUROPE: SPORTS COMPOSITES MARKET, BY FIBER TYPE

TABLE 131 EUROPE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 132 EUROPE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 134 EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.3.3 EUROPE: SPORTS COMPOSITES MARKET, BY APPLICATION

TABLE 135 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 136 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 138 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.3.4 EUROPE: SPORTS COMPOSITES MARKET, BY COUNTRY

TABLE 139 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 140 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 142 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.3.4.1 Germany

TABLE 143 GERMANY: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 144 GERMANY: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 145 GERMANY: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 146 GERMANY: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.3.4.2 France

TABLE 147 FRANCE: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 148 FRANCE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 149 FRANCE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 150 FRANCE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.3.4.3 UK

TABLE 151 UK: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 152 UK: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 153 UK: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 154 UK: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.3.4.4 Italy

TABLE 155 ITALY: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 156 ITALY: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 157 ITALY: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 158 ITALY: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.3.4.5 Spain

TABLE 159 SPAIN: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 160 SPAIN: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 161 SPAIN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 162 SPAIN: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.3.4.6 Rest of Europe

TABLE 163 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 164 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 165 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 166 REST OF EUROPE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.4 NORTH AMERICA

FIGURE 37 NORTH AMERICA: SPORTS COMPOSITES MARKET SNAPSHOT

9.4.1 NORTH AMERICA: MARKET, BY RESIN TYPE

TABLE 167 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 168 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 169 NORTH AMERICA: SPORTS COMPOSITES MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 170 NORTH AMERICA: MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

9.4.2 NORTH AMERICA: SPORTS COMPOSITES MARKET, BY FIBER TYPE

TABLE 171 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 172 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 173 NORTH AMERICA: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 174 NORTH AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.4.3 NORTH AMERICA: SPORTS COMPOSITES MARKET, BY APPLICATION

TABLE 175 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 176 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 177 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 178 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.4.4 NORTH AMERICA: MARKET, BY COUNTRY

TABLE 179 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 180 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 181 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 182 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.4.4.1 US

TABLE 183 US: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 184 US: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 185 US: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 186 US: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.4.4.2 Canada

TABLE 187 CANADA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 188 CANADA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 189 CANADA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 190 CANADA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.5 LATIN AMERICA

9.5.1 LATIN AMERICA: SPORTS COMPOSITES MARKET, BY RESIN TYPE

TABLE 191 LATIN AMERICA: MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 192 LATIN AMERICA: MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 193 LATIN AMERICA: MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 194 LATIN AMERICA: MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

9.5.2 LATIN AMERICA: SPORTS COMPOSITES MARKET, BY FIBER TYPE

TABLE 195 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 196 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 197 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 198 LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.5.3 LATIN AMERICA: SPORTS COMPOSITES MARKET, BY APPLICATION

TABLE 199 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 200 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 201 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 202 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.5.4 LATIN AMERICA: SPORTS COMPOSITES MARKET, BY COUNTRY

TABLE 203 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 204 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 205 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 206 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.5.4.1 Brazil

TABLE 207 BRAZIL: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 208 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 209 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 210 BRAZIL: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.5.4.2 Mexico

TABLE 211 MEXICO: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 212 MEXICO: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 213 MEXICO: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 214 MEXICO: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.5.4.3 Rest of Latin America

TABLE 215 REST OF LATIN AMERICA: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 216 REST OF LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 217 REST OF LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 218 REST OF LATIN AMERICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.6 MIDDLE EAST & AFRICA

9.6.1 MIDDLE EAST & AFRICA: SPORTS COMPOSITES MARKET, BY RESIN TYPE

TABLE 219 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2017–2020 (KILOTON)

TABLE 220 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2017–2020 (USD MILLION)

TABLE 221 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2021–2026 (KILOTON)

TABLE 222 MIDDLE EAST & AFRICA: MARKET SIZE, BY RESIN TYPE, 2021–2026 (USD MILLION)

9.6.2 MIDDLE EAST & AFRICA: MARKET, BY FIBER TYPE

TABLE 223 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 224 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 225 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 226 MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.6.3 MIDDLE EAST & AFRICA: SPORTS COMPOSITES MARKET, BY APPLICATION

TABLE 227 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (KILOTON)

TABLE 228 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 229 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (KILOTON)

TABLE 230 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

9.6.4 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY

TABLE 231 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (KILOTON)

TABLE 232 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 233 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (KILOTON)

TABLE 234 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

9.6.4.1 UAE

TABLE 235 UAE: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 236 UAE: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 237 UAE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 238 UAE: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.6.4.2 Saudi Arabia

TABLE 239 SAUDI ARABIA: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 240 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 241 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 242 SAUDI ARABIA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

9.6.4.3 Rest of Middle East & Africa

TABLE 243 REST OF MIDDLE EAST & AFRICA: SPORTS COMPOSITES MARKET SIZE, BY FIBER TYPE, 2017–2020 (KILOTON)

TABLE 244 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2017–2020 (USD MILLION)

TABLE 245 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (KILOTON)

TABLE 246 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY FIBER TYPE, 2021–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 183)

10.1 INTRODUCTION

10.2 MARKET SHARE ANALYSIS

FIGURE 38 SHARES OF TOP FIVE COMPANIES IN THE SPORTS COMPOSITES MARKET

TABLE 247 DEGREE OF COMPETITION: CONSOLIDATED

10.3 MARKET RANKING

FIGURE 39 RANKING OF TOP FIVE PLAYERS IN THE SPORTS COMPOSITES MARKET

10.4 MARKET EVALUATION FRAMEWORK

TABLE 248 SPORTS COMPOSITES MARKET: NEW PRODUCT LAUNCHES/DEVELOPMENTS, 2016–2021

TABLE 249 SPORTS COMPOSITES MARKET: OTHER DEALS, 2016–2021

TABLE 250 SPORTS COMPOSITES MARKET: OTHER DEALS, 2016–2021

10.5 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

FIGURE 40 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS: SPORTS COMPOSITES MARKET

10.6 COMPANY EVALUATION MATRIX

TABLE 251 COMPANY PRODUCT FOOTPRINT

TABLE 252 COMPANY APPLICATION FOOTPRINT

TABLE 253 COMPANY REGION FOOTPRINT

10.6.1 STAR

10.6.2 PERVASIVE

10.6.3 PARTICIPANTS

10.6.4 EMERGING LEADERS

FIGURE 41 SPORTS COMPOSITES MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2020

FIGURE 42 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 43 BUSINESS STRATEGY EXCELLENCE

10.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

10.7.1 PROGRESSIVE COMPANIES

10.7.2 RESPONSIVE COMPANIES

10.7.3 DYNAMIC COMPANIES

10.7.4 STARTING BLOCKS

FIGURE 44 SPORTS COMPOSITES MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2020

11 COMPANY PROFILES (Page No. - 197)

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1 KEY COMPANIES: COMPOSITE-BASED SPORTS GOODS MANUFACTURERS

11.1.1 ALDILA INC.

TABLE 254 ALDILA INC: BUSINESS OVERVIEW

TABLE 255 ALDILA, INC. : PRODUCTS OFFERED

TABLE 256 ALDILA INC.: NEW PRODUCT/TECHNOLOGY DEVELOPMENTS

11.1.2 AMER SPORTS

TABLE 257 AMER SPORTS: BUSINESS OVERVIEW

TABLE 258 AMER SPORTS: PRODUCTS OFFERED

TABLE 259 AMER SPORTS: DEALS

TABLE 260 AMER SPORTS: OTHER DEVELOPMENTS

11.1.3 FISCHER SPORTS GMBH

TABLE 261 FISCHER SPORTS GMBH: BUSINESS OVERVIEW

TABLE 262 FISCHER SPORTS GMBH: PRODUCTS OFFERED

11.1.4 ROSSIGNOL

TABLE 263 ROSSIGNOL: BUSINESS OVERVIEW

TABLE 264 ROSSIGNOL: PRODUCTS OFFERED

TABLE 265 ROSSIGNOL: DEALS

11.1.5 NEWELL BRANDS (JARDEN CORPORATION)

TABLE 266 NEWELL BRANDS: BUSINESS OVERVIEW

FIGURE 45 NEWELL BRANDS: COMPANY SNAPSHOT

TABLE 267 NEWELL BRANDS: PRODUCTS OFFERED

TABLE 268 NEWELL BRANDS: DEALS

11.1.6 TOPKEY CORPORATION

TABLE 269 TOPKEY CORPORATION: BUSINESS OVERVIEW

TABLE 270 TOPKEY CORPORATION: PRODUCTS OFFERED

11.2 KEY COMPANIES: COMPOSITE-BASED SPORTS & RECREATION GOODS RAW MATERIAL SUPPLIERS

11.2.1 DUPONT DE NEMOURS, INC.

TABLE 271 DU PONT DE NEMOURS, INC.: BUSINESS OVERVIEW

FIGURE 46 DUPONT DE NEMOURS, INC.: COMPANY SNAPSHOT

TABLE 272 DU PONT DE NEMOURS, INC.: PRODUCTS OFFERED

11.2.2 HEXION, INC.

TABLE 273 HEXION, INC.: BUSINESS OVERVIEW

FIGURE 47 HEXION, INC.: COMPANY SNAPSHOT

TABLE 274 HEXION, INC.: PRODUCTS OFFERED

TABLE 275 HEXION, INC.: DEALS

TABLE 276 HEXION, INC.: OTHER DEVELOPMENTS

11.2.3 SGL CARBON SE

TABLE 277 SGL CARBON SE: BUSINESS OVERVIEW

FIGURE 48 SGL CARBON SE: COMPANY SNAPSHOT

TABLE 278 SGL CARBON SE: PRODUCTS OFFERED

TABLE 279 SGL CARBON SE: DEALS

TABLE 280 SGL CARBON SE: OTHER DEVELOPMENTS

11.2.4 TORAY INDUSTRIES, INC.

TABLE 281 TORAY INDUSTRIES, INC.: BUSINESS OVERVIEW

FIGURE 49 TORAY INDUSTRIES, INC: COMPANY SNAPSHOT

TABLE 282 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

TABLE 283 TORAY INDUSTRIES, INC.: NEW PRODUCT/TECHNOLOGY DEVELOPMENT

TABLE 284 TORAY INDUSTRIES, INC.: DEALS

TABLE 285 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

11.3 OTHER COMPANIES

11.3.1 FUJIKURA COMPOSITES, INC.

11.3.2 CALLAWAY GOLF COMPANY

11.3.3 EXEL COMPOSITES OYJ

11.3.4 ELAN D.O.O.

11.3.5 ISOSPORT VERBUNDBAUTEILE GMBH

11.3.6 TRUE TEMPER SPORTS

11.3.7 TECNICA GROUP

11.3.8 UNITED SPORTS TECHNOLOGIES

11.3.9 PROKENNEX

11.3.10 SALOMON GROUP

11.3.11 HEAD SPORT GMBH

11.3.12 ROCKWEST COMPOSITES

11.3.13 ARVIND COMPOSITES

11.3.14 REIN4CED

11.3.15 PROTECH COMPOSITES

11.3.16 ENTROPY RESINS

11.3.17 PROTENSION COMPOSITES

11.3.18 AREVO, INC.

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 233)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

The study involved two major activities in estimating the current size of the sports composites market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information was sourced from annual reports, press releases & investor presentations of companies; white papers; certified publications; trade directories; articles from recognized authors; gold standard and silver standard websites; and databases. Secondary research was used to obtain critical information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about key developments from a market-oriented perspective.

Primary Research

The sports composites market comprises several stakeholders in the value chain, including raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use industries of carbon fibers. The primary sources from the supply side include experts from companies manufacturing carbon fibers.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Sports composites market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall Sports composites market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the sports composites market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on fiber type, resin type, application, and region

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC Sports composites market

- Further breakdown of Rest of Europe Sports composites market

- Further breakdown of Rest of MEA Sports composites market

- Further breakdown of Rest of Latin American Sports composites market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Sports Composites Market