Healthcare Simulation Market Size, Growth, Share & Trends Analysis

Healthcare Simulation Market by Product & Service (Simulation (Patient-Fidelity, Surgical-Laparoscopic, Ortho, Spine, Gynae, Ultrasound), Training), Technology (3D Printing, Virtual Patient, Procedural Rehearsal), End User, & Region - Global Forecast 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

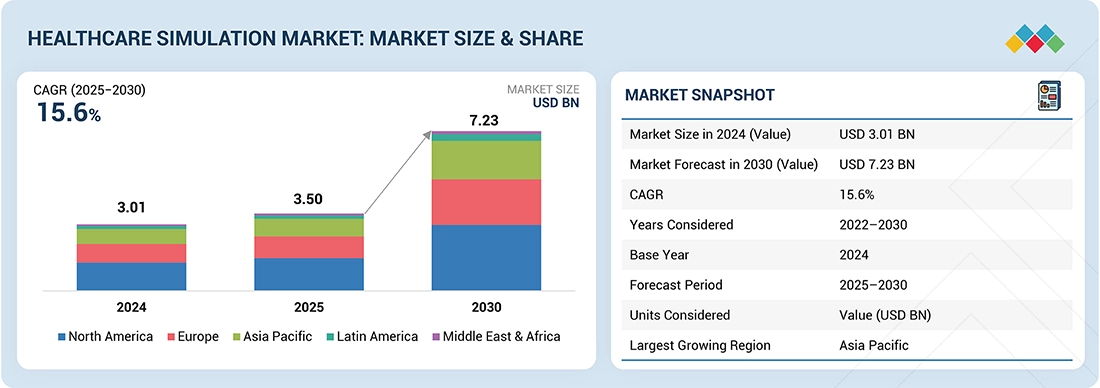

The global healthcare simulation market, valued at USD 3.01 billion in 2024, stood at USD 3.50 billion in 2025 and is projected to advance at a resilient CAGR of 15.6% from 2025 to 2030, culminating in a forecasted valuation of USD 7.23 billion by the end of the period. This growth is likely to be driven by rising demand for standardized clinical training, increasing prevalence of chronic diseases, higher investment in healthcare technology, and more medical and nursing schools adopting simulation.

KEY TAKEAWAYS

- North America accounted for largest market share of 42.6% in 2024.

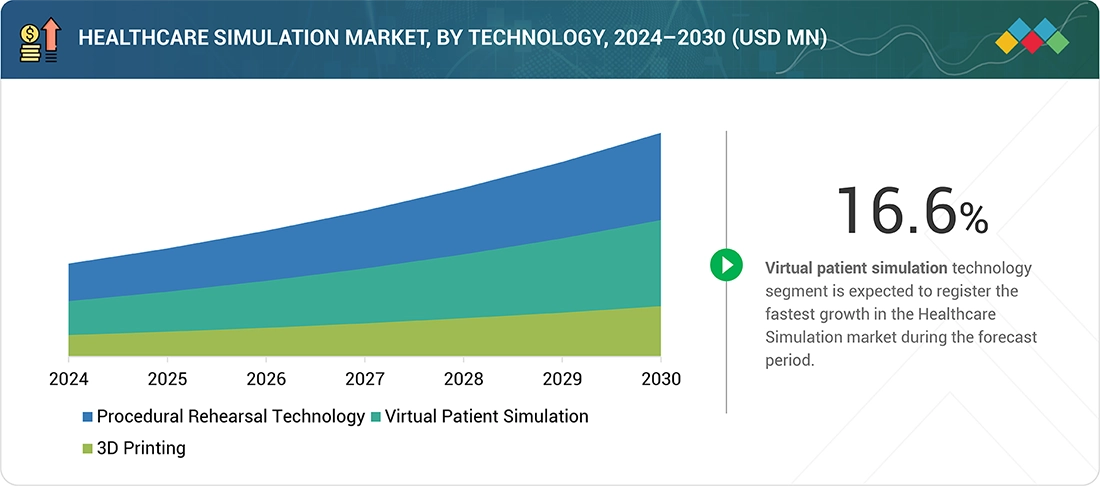

- web based simulation expected grow at the fastest CAGR of 17.3%.

- The procedural rehearsal technology segment accounted for the largest share of 40.3% in 2024.

- Academic institutes accounted for the largest share in 2024.

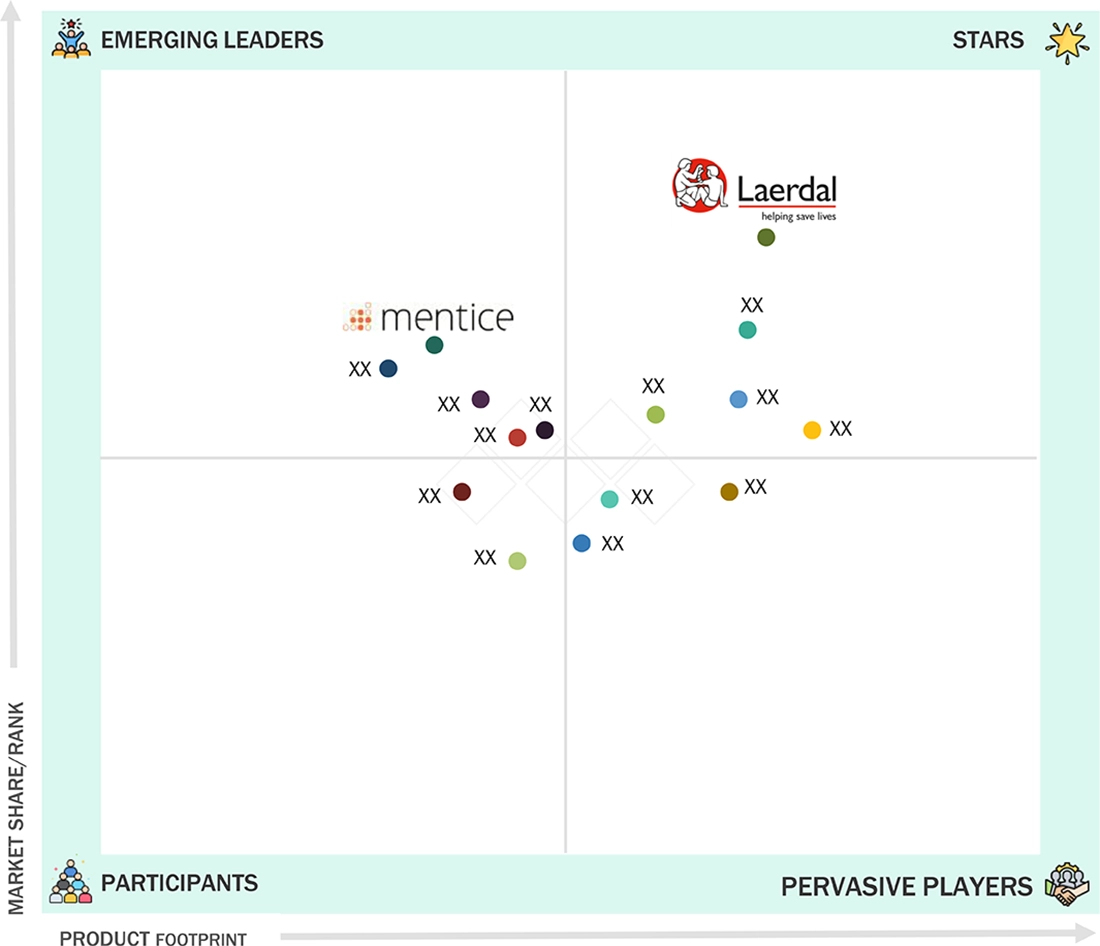

- Surgical Science Sweden AB, Laerdal Medical, Gaumard Scientific Co., and Kyoto Kagaku were identified as some of the star players in the healtchare simulation market (global), given their strong market share and product footprint.

- IngMar Medical, Tru Corp, Medical - X, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The Healthcare simulation market is projected to reach USD 7.23 billion by 2030 from USD 3.50 billion in 2025, at a CAGR of 15.6% from 2025 to 2030

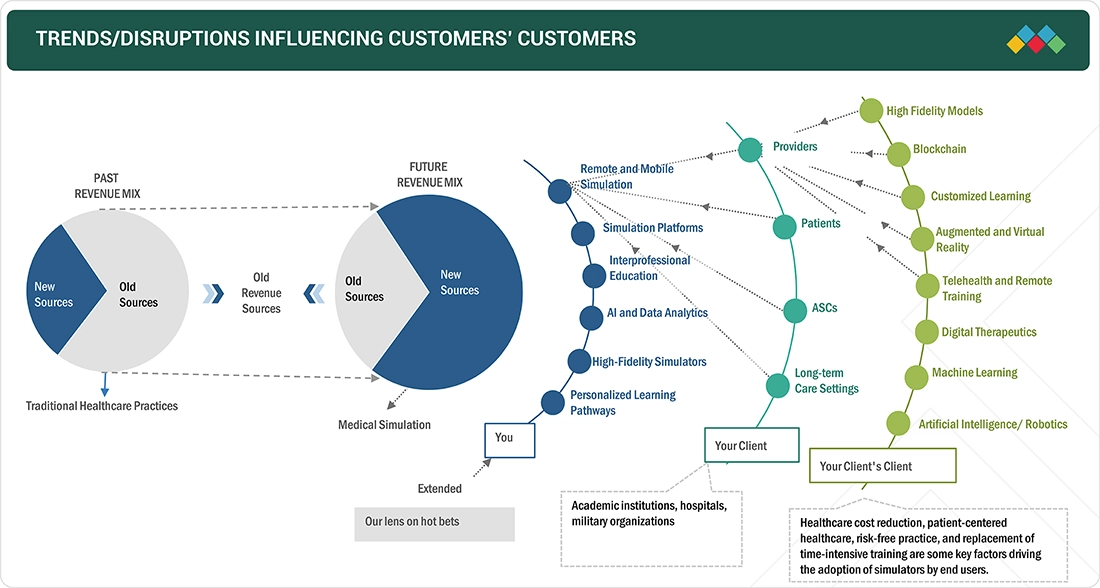

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

In the Healthcare Simulation Market, the impact on consumers’ businesses stems from evolving training methodologies and technological advancements in simulation tools. Hot prospects include medical device companies, academic institutions, hospitals, and defense healthcare organizations adopting high-fidelity simulation platforms. Target applications span surgical training, clinical skill assessment, patient safety programs, and competency-based education. Trends such as VR/AR integration, cloud-based simulation management, standardized certification programs, and digital twin-based training models are influencing end-user investments across hospitals, universities, and simulation centers. These shifts in institutional spending and training budgets directly impact the revenues of simulation vendors such as Laerdal Medical, Surgical Science Sweden AB, Gaumard Scientific, Kyoto Kagaku, and Limbs & Things.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rising demand for realistic and risk-free training environments in medical education

-

Rapid technological advancements in medical education

Level

-

Limited availability of funds to establish simulation training centers.

-

Poorly designed medical simulators

Level

-

Widening workforce gaps creating demand for simulation-based training solutions

-

Growing awareness about simulation training in emerging economies

Level

-

High cost of simulators

-

Operational challenges

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rising demand for realistic and risk-free training environments in medical education

Traditionally, medical education has used an apprentice-veteran knowledge transfer model, where the student gains expertise in patient care under the supervision of experienced staff. Students and trainees have a limited role in high-risk procedures that require critical decision-making skills in an apprentice- veteran knowledge transfer model. With the changing treatment landscape, medical simulators have gained a valued spot in medical education across the world as these simulators exhibit characteristics of a human. The use of simulation in professional training programs complements traditional learning and allows students to sharpen their clinical and critical thinking skills for high-risk events. Currently, there are several types of simulations, ranging from training with part simulators for specific skills to training multiple and complex skills in immersive environments using strategies such as VR, surgical simulation, and the use of standardized patients. The US government has prohibited live tissue testing in medical training since 2019. Therefore, in medicine, simulation offers significant scope for the enhanced training of interdisciplinary medical teams. The realistic scenarios and equipment allow for retraining and practice until one can master the procedure or skill. An increasing number of healthcare institutions and medical schools are now turning to simulation-based learning, thereby driving the growth of the healthcare simulation market.

Restraint: Limited availability of funds to establish simulation training centers.

The establishment of simulated learning environments and simulation programs requires significant capital investments, mainly due to the cost of high-fidelity simulators and virtual environments. Healthcare simulation training facilities usually rely heavily on government and private funding. In the US, Medicare supports teaching hospitals with USD 7.8 billion per year for their graduate medical education (GME), while Medicaid funds over USD 2 billion. Other bodies, including the Department of Defense and the Veterans Administration, and private payers also pay for portions of resident physician education. Despite the availability of substantial support, teaching hospitals are struggling financially to match challenging medical education standards.

Opportunity: Widening workforce gaps creating demand for simulation-based training solutions

The worldwide shortage of skilled healthcare workers continues to be a critical challenge impacting the quality and accessibility of healthcare services. The World Health Organization's latest projections (2023) indicate a critical global shortfall of approximately 11 million healthcare professionals by 2030, predominantly impacting low- and middle-income nations. This shortage contributes directly to millions of preventable deaths and hampers efforts to achieve universal health coverage. In March 2024, the Association of American Medical Colleges (AAMC) projected a significant disparity between the demand for and supply of physicians in the United States. This imbalance is anticipated to lead to a shortfall of approximately 86,000 physicians by the year 2036, underscoring the growing challenges in healthcare workforce planning and resource allocation. These workforce gaps are compounded by the growing burden of chronic diseases, aging populations, and expanding healthcare needs worldwide.

Challenge: High cost of simulators

Patient simulators are highly expensive devices, priced between USD 50,000 and USD 400,000 in developed countries (depending on type, services, brand, and features). This is a key deterrent to their adoption in countries where government funding is limited. In developing countries, the need to ensure the affordability of healthcare simulation is a major challenge for manufacturers. The cost involved in simulated training includes products, services, software, and maintenance. The requirements in simulation training vary as per the solutions selected, from the use of manikins to web- based virtual environments or both. Thus, economic evaluations play a significant role in determining the return on investments. Lack of proper economic evaluation creates a low return on investments for end- users, which increases the overall cost of their projects. Thus, the lack of economic evaluation, coupled with the high cost of simulators, often restricts the adoption of simulated training solutions among end users.

Healthcare Simulation Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Offers high-fidelity simulators like LapSim and TraumaVR for surgical training, including robotic surgery and endovascular procedures. Provides customizable training modules through MentorLearn and iCase. | Improves surgical proficiency and reduces error rates through evidence-based, proficiency-based training. |

|

Develops immersive simulation solutions including SimMan and virtual reality training for emergency, obstetric, and neonatal care. Collaborates with Unity for scalable simulation platforms. | Enhances team communication and coordination, leading to improved patient safety outcomes. |

|

Provides advanced patient simulators like HAL S5301 and robotic obstetric simulators for training across specialties including trauma, pediatrics, and obstetrics. | Facilitates safe, repeatable training scenarios, enabling learners to practice rare or high-risk events without patient risk. |

|

Manufactures anatomical models, imaging phantoms, and simulators for medical imaging and procedural training. | Provides realistic, hands-on training tools that enhance understanding of anatomy and procedural techniques. |

|

Offers simulation products like the Laparoscopic Skills Trainer and AR-based trainers for catheterization and wound care. Provides augmented reality training apps to visualize internal anatomy. | Improves clinical skills and team coordination, leading to better patient outcomes. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The healthcare simulation ecosystem includes diverse stakeholders, such as simulation equipment manufacturers (e.g., CAE Healthcare, Laerdal Medical), software and platform developers, and curriculum creators. Technology partners provide Al, VR/AR hardware, and IT infrastructure to enhance training experiences. End users include medical and nursing schools, hospitals, government agencies, and professional societies that drive demand for simulation- based education. Regulatory bodies ensure safety, quality, and data privacy compliance, while accreditation organizations set standards for simulation programs. Government agencies and funders support growth through policies and grants, fostering innovation and wider adoption of healthcare simulation solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Healthcare Simulation Market , By End User

In 2024, academic institutes held the largest share of the healthcare simulation market. This dominance is attributed to the increasing integration of simulation-based learning in medical and nursing education. Simulation offers students a risk-free environment to practice clinical skills, enhancing their preparedness for real-world medical scenarios. This approach improves technical proficiency and fosters better decision-making and communication skills among healthcare professionals. Institutions are investing in state-of-the-art simulation centers equipped with high-fidelity mannequins and virtual reality tools to provide immersive training experiences. For instance, in September 2024, St. John's University opened the USD 106-million St. Vincent's Health Sciences Center, featuring lifelike mannequins that can speak, sweat, cry, and blink, along with VR and X-ray technology. This center offers immersive, realistic training for nursing, radiology, and physician assistant students. Similarly, in April 2025, Goodwin University started building a USD 3-million nursing simulation center, with interactive mannequins that simulate real medical conditions to provide hands-on experience. As medical education continues to evolve, the role of simulation in academic institutions is expected to expand, solidifying their position as the primary contributors to the growth of the healthcare simulation market.

Healthcare Simulation Market, By Healthcare Simulation Anatomical Models

Healthcare simulation anatomical models consist of patient simulators, task trainers, interventional/surgical simulators, ultrasound, dental, and eye simulators. The patient simulator segment accounts for the largest market share and is expected to register the highest CAGR during the forecast period due to its advanced realism and ability to replicate complex physiological responses, enhancing hands-on training for healthcare professionals. These simulators enable the safe practice of critical procedures without risk to real patients, supporting improved patient safety and clinical outcomes. Additionally, rising demand for continuous medical education and certification drives adoption in hospitals and academic institutes. For instance, CAE Healthcare launched the CAE Apollo, a high-fidelity patient simulator designed for diverse clinical scenarios. Laerdal Medical and the American Heart Association partnered to deliver innovative resuscitation training using advanced patient simulators. Such developments highlight the increasing industry focus on sophisticated patient simulators to meet evolving healthcare training needs. Integrating wireless technology, Al-driven feedback systems, and modular components further enhances simulator performance, supporting personalized and adaptive learning experiences.

REGION

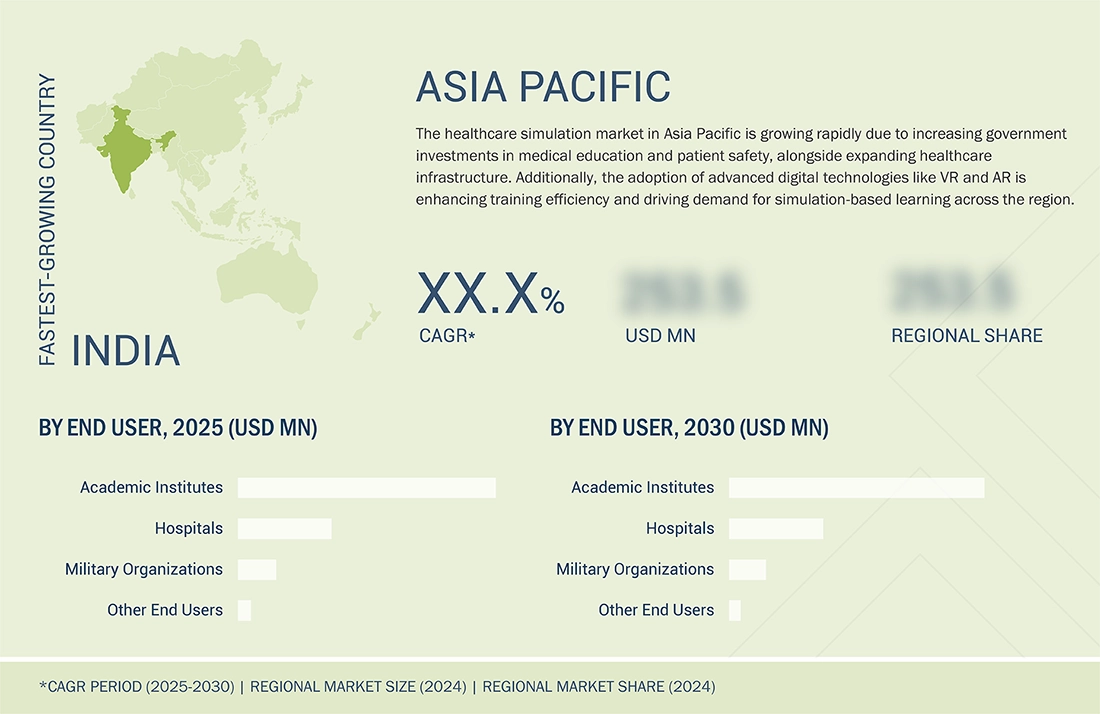

The Asia Pacific region is expected to be the fastest-growing region in the healthcare simulation market in 2024.

The Healthcare Simulation Market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the Asia Pacific region emerged as the fastest-growing market, driven by rising investments in medical education and dedicated simulation centers, rapid adoption of VR/AR and cloud-based simulation platforms, and growing demand for procedure-specific training (robotics, endovascular, minimally invasive surgery). Countries such as China, India, Japan, and Australia are scaling simulation programs across hospitals, medical schools, and nursing institutions to address clinician shortages and improve patient safety; partnerships between vendors, academic institutions, and government training initiatives, along with favorable regulatory and accreditation moves, are expected to accelerate regional adoption and market growth.

Healthcare Simulation Market: COMPANY EVALUATION MATRIX

In the Healthcare Simulation Market matrix, Laerdal Medical (Star) leads with a strong market share and an extensive product footprint, driven by its high-fidelity patient simulators, integrated training ecosystems, and advanced data-driven learning platforms widely adopted across hospitals, universities, and emergency training centers. Mentice (Emerging Leader) is gaining momentum with its cutting-edge endovascular and interventional simulation solutions, offering high clinical realism, seamless integration with medical devices, and expanding partnerships with healthcare institutions and OEMs. While Laerdal dominates through scale, diversified product offerings, and global reach, Mentice demonstrates strong potential to move toward the leaders’ quadrant as demand for specialized, VR-based, and procedure-specific simulation solutions continues to accelerate.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 3.01 Billion |

| Market Forecast in 2030 (value) | USD 7.23 Billion |

| Growth Rate | CAGR of 15.6% from 2025-2030 |

| Years Considered | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends. |

| Segments Covered | Product & Service, Technology, and End User |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

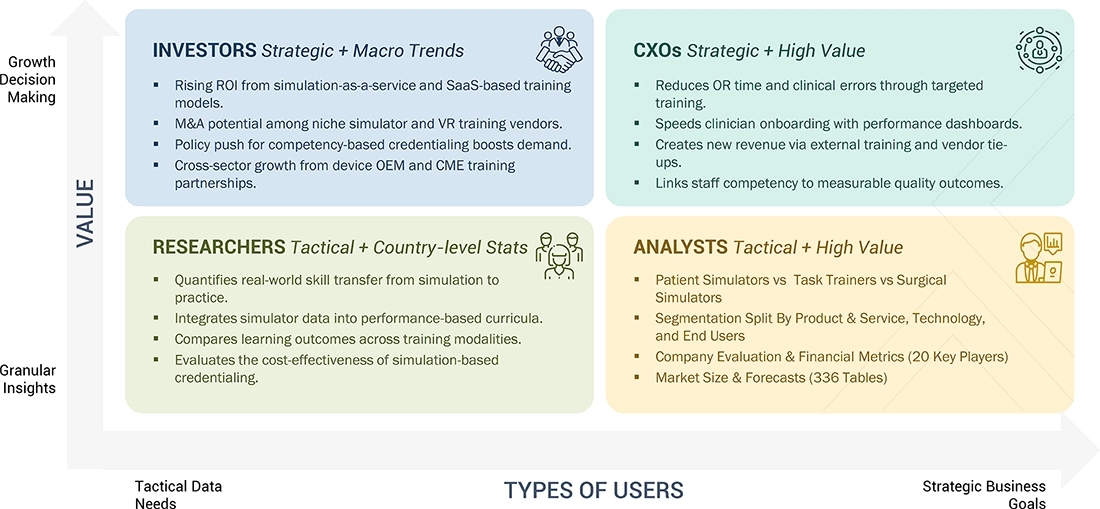

WHAT IS IN IT FOR YOU: Healthcare Simulation Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Client requested insights on the Healthcare Simulation Market in Middle East, focusing on growth drivers, regional trends, and market dynamics. | Provided a detailed analysis highlighting the expansion of simulation-based medical training, government-backed investments in healthcare education, and the integration of advanced VR/AR and haptic technologies enhancing clinical competency and patient safety across the Middle East (GCC countries). | Included custom growth drivers, regional adoption examples (e.g., UAE’s healthcare education reforms, Saudi Arabia’s Vision 2030 medical training initiatives), and strategic insights on the role of simulation in improving clinician preparedness, procedural accuracy, and overall healthcare quality. |

RECENT DEVELOPMENTS

- In May 2025 : The Society for Imaging Informatics in Medicine (SIIM) unveiled the enhanced Virtual Hospital Platform (VHP) 2.0 at the SIIM25 Annual Meeting. Developed in partnership with MEDIC at Mohawk College (Canada), this platform delivers an immersive, scalable training environment for imaging informatics professionals.

- In March 2025 : The University of Texas at Arlington (UTA) launched its Mobile Simulation Lab, a state-of-the-art training unit from the College of Nursing and Health Innovation's Center for Rural Health and Nursing. The initiative aims to enhance healthcare education in rural Texas communities, where nearly a quarter of Texans reside and access to clinical training is limited.

- In April 2025 : Munster Technological University (MTU), Kerry Campus, launched a state-of-the-art healthcare simulation centre to address Ireland's nursing shortage. Funded by the Higher Education Authority, the facility features high-fidelity labs, Al-powered manikins, and interprofessional training spaces.

- In January 2024 : GigXR and CAE Healthcare formed a strategic alliance to enhance clinical training through multimodal simulation, combining analog, digital, and immersive XR technologies. This collaboration aims to boost training efficiency for medical and nursing schools, hospitals, first responders, and government agencies.

Table of Contents

Methodology

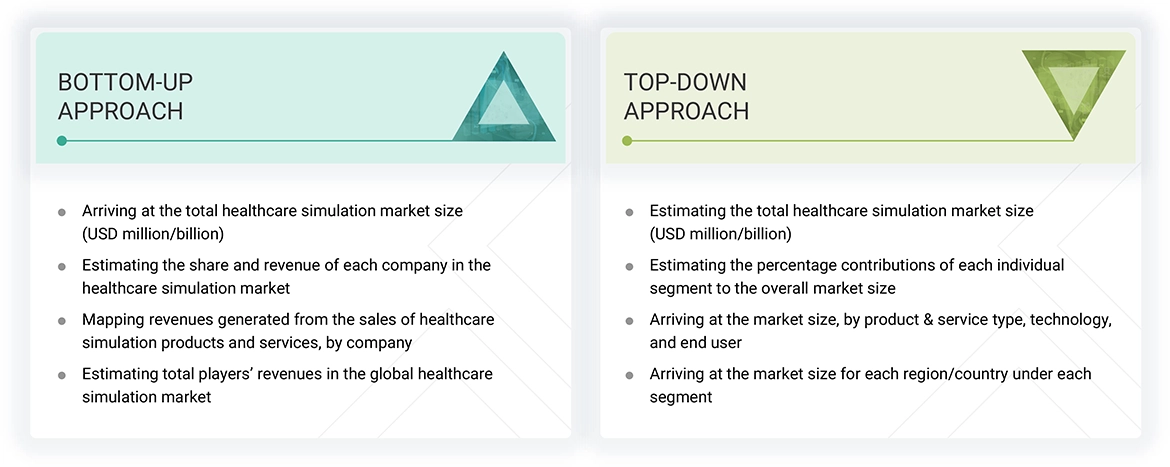

The study involved five major activities to estimate the current size of the healthcare simulation market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study used secondary sources, directories, and databases such as Dun & Bradstreet, Bloomberg Business, and Factiva; white papers, annual reports, and companies’ house documents; investor presentations; and the Securities and Exchange Commission (SEC) filings of companies. The market for companies providing healthcare simulation solutions is assessed using secondary data from paid and free sources. This involves analyzing the product portfolios of major players in the industry and evaluating these companies based on their performance and quality. Various resources were utilized in the secondary research process to gather information for this study. The sources include annual reports, press releases, investor presentations, white papers, academic journals, certified publications, articles by recognized authors, directories, and databases. The secondary research process involved referring to various secondary sources to identify and collect information related to the study. These sources included annual reports, press releases, investor presentations of healthcare simulation vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

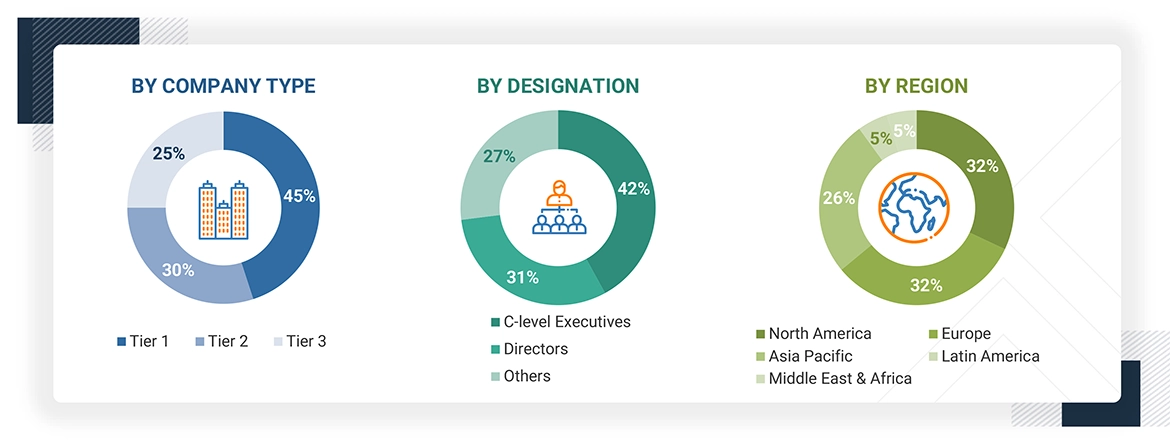

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources are mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, technology developers, researchers, and organizations related to all segments of this industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information and assess prospects.

Primary research was conducted to identify segmentation types, industry trends, key players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies adopted by key players.

After completing the market engineering process, which includes calculations for market statistics, market breakdown, size estimations, forecasting, and data triangulation, extensive primary research was conducted. This research aimed to gather information and verify the critical numbers obtained during the market analysis. Additionally, primary research was conducted to identify different types of market segmentation, analyze industry trends, evaluate the competitive landscape of healthcare simulation solutions offered by various players, and understand key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and strategies employed by key market participants.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Breakdown of Primary Respondents:

Note: Other designations include sales, marketing, and product managers.

Tiers are defined based on a company’s total revenue as of 2024: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = < USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis of leading players) and the top-down approach (assessment of utilization/adoption/penetration trends by product and service, technology, end user, and region).

Data Triangulation

After arriving at the overall market size, the market size estimation processes split the market into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the healthcare simulation market.

Market Definition

Healthcare simulation uses virtual patients, mannequins, task trainers, or computer-based environments to replicate real-life clinical situations for training, education, evaluation, or system improvement without risking patient safety. It is a strategic tool that enables safe, repeatable, and immersive learning experiences, enhancing clinical performance, reducing medical errors, and improving healthcare delivery outcomes.

Stakeholders

- Healthcare simulation vendors

- Government bodies

- Healthcare service providers

- Clinical/physician centers

- Healthcare professionals

- Health IT service providers

- Healthcare associations/institutes

- Ambulatory care centers

- Venture capitalists

- Distributors and resellers

- Maintenance and support service providers

- Integration service providers

- Healthcare payers

- Military organizations

- Advocacy groups

- Investors and financial institutions

- Industry associations and trade groups

Report Objectives

- To define, describe, and forecast the global healthcare simulation market by product & service, technology, end user, and region

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall healthcare simulation market

- To assess the healthcare simulation market with regard to Porter’s five forces, regulatory landscape, value chain, ecosystem map, patent protection, impact of 2025 US tariff and AI/Gen AI on the market under study, and key stakeholders’ buying criteria

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the healthcare simulation market with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the healthcare simulation market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, partnerships, and acquisitions; expansions; product launches and enhancements; and R&D activities in the healthcare simulation market

Frequently Asked Questions(FAQ)

Which are the top industry players in the global healthcare simulation market?

CAE Inc. (Canada), Laerdal Medical (Norway), Gaumard Scientific Co. (US), Kyoto Kagaku (Japan), Limbs & Things (UK), Mentice AB (Sweden), Simulab Corporation (US), and Surgical Science Sweden AB (Sweden).

Which products & services have been included in the healthcare simulation market report?

The report includes: Healthcare Simulation Anatomical Models, Patient Simulators (by type and application), Task Trainers, Interventional/Surgical Simulators (Laparoscopic, Gynecology, Cardiovascular, Orthopedic, Spine, Endovascular, Other), Ultrasound Simulators, Dental Simulators, Eye Simulators, Web-based Simulation, Healthcare Simulation Software, and Healthcare Simulation Training Services (Vendor-based Training, Educational Societies, Custom Consulting Services).

Which region is likely to dominate the global healthcare simulation market?

North America holds the largest share in the healthcare simulation market, while Asia Pacific is expected to register the highest CAGR during the forecast period.

Which end users have been included in the healthcare simulation market report?

Academic Institutes, Hospitals, Military Organizations, and Other End Users.

At what CAGR is the market expected to grow from 2025 to 2030?

The healthcare simulation market is projected to grow at a CAGR of 15.6% from 2025 to 2030.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Healthcare Simulation Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Healthcare Simulation Market

John

Jun, 2022

Which are the top companies hold the market share in medical simulation market?.

Kahlill

Jun, 2022

What are the key trends in the healthcare simulation market report?.