Military Simulation and Training Market by Application (Army, Aviation, Naval), Type (Live, Virtual, Constructive), Platform (Land, Maritime, Airborne), Solution, Environment (Synthetic, Gaming), Technology, and Region - Global Forecast

Updated on : Oct 22, 2024

Military Simulation and Training Market Size & Share

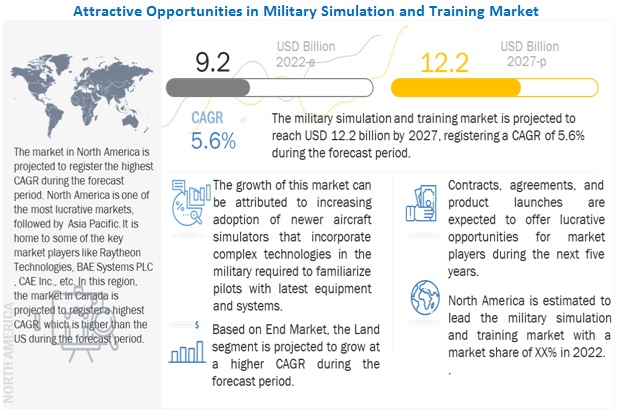

The Military Simulation and Training Market SIze is projected to reach USD 12.2 billion by 2027 growing at a CAGR of 5.6% during the forecast period. Increasing defense spending in the world and new technological developments to help strengthen military capabilities and efficiency is expected to drive the market for Military Simulation and Training across the globe.

Increasing geopolitical tensions across regions and overall strengthening activities across the world is triggering the defense spending across these regions. This, in turn, is pushing manufacturers and system component providers to design and manufacture more high technology, high resolution, military simulators for defense personnel to get trained upon.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the Military Simulation and Training Market

The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacture of digital battlefield products, including systems, subsystems, and components, has also been impacted. Although military simulation and training products for defense applications are of prime importance, disruptions in the supply chain have halted their manufacturing processes for the time being. Resuming manufacturing activities depends on COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still take orders, delivery schedules may not be fixed. Most key players in the Military Simulation and Training industry like Lockheed Martin Corporation (US), Raytheon Technologies (US) and Rheinmetall AG(Germany) have declared that business has largely be returned to normal but acknowledged the impact of cost and schedules on most programs

Military Simulation and Training Market Dynamics

Driver: Acceptance of virtual pilot training to ensure safety

Safety has been the main reason for the introduction of virtual pilot training. Virtual flight training has recently gained importance due to multiple benefits, such as effective training with a real-time view, reduced environmental impact, and cost-effectiveness. Most aircraft orientation and training are carried out with full flight simulators. Simulation-based training keeps the pilot and instructor in a low-risk environment, allows for training of impractical situations, and prevents trainees from damaging expensive aircraft. Simulators can also operate for over 20 hours per day with low carbon emissions at an operating cost 22 times lower than training pilots on an aircraft. In the case of the air force, flight simulation is prevalent for equipment-use training, such as computer-based battlefield training.

Most flight exercises have been substituted with simulation training and adopted by flight crews. The rise in fighter jets accidents results in the increasing demand for simulator-based training to ensure safer flights.

Opportunity: Development of simulators for unmanned aerial systems (UAS)

The increasing demand for unmanned systems for defense and commercial applications is expected to drive the demand for simulators. AEgis Technologies Group (US) and Havelsan Inc. (US) have introduced highly sophisticated unmanned simulators independent of hardware configurations to simulate any UAS with the help of any sensor operator and payload suite. These simulators can create a virtual battlefield in real-time, enabling ab-initio training, basic payload and flight operations, mission rehearsal, and mission planning. However, they need to be cost effective, capable of precise flight dynamics simulation, an error-tolerant control system design, and a multi-vehicle simulation with interoperability.

Challenge: Stringent regulatory approvals

Product development in the simulators market is a lengthy procedure, as it takes a significant amount of time to develop a replica of any aircraft tested. Developers of flight simulators also require approval from OEMs to develop a replica of an aircraft, which adds to the time and cost of development. Manufacturers also need to provide customer-centric products that are flexible and adaptable to the needs of customers while at the same time allowing them to cope with the changing environment of pilot training. They also need to comply with safety and regulatory management issues, making it a challenge to deliver required simulators on time.

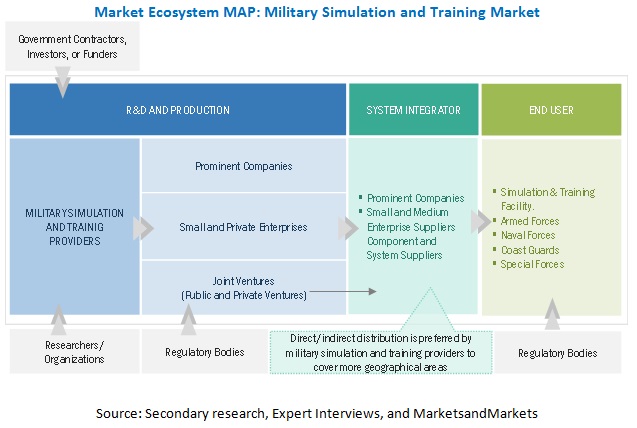

Military Simulation and Training Market Ecosystem

Prominent companies providing Military Simulation and Training, private and small enterprises, distributors/suppliers/retailers, and end customers are the key stakeholders in Military Simulation and Training market ecosystem. Investors, funders, academic researchers, distributors, service providers, and industries also serve as major influencers in the market.

To know about the assumptions considered for the study, download the pdf brochure

Aircraft Seat Actuation System Market Segmentation Analysis

Based on platform, the land segment of the Military Simulation and Training market is projected to grow at the highest CAGR is expected to account for the largest market share during the forecasted period.

Based on platform, the land segment is expected to grow at the highest CAGR of 6.2% during the forecast period. The growth in demand for military vehicles across the land, sea, and aerial platforms would drive the market growth. Several countries are modernizing their military fleets by inducting newer generation vehicle platforms. This is generating a simultaneous demand for simulation-based training for the military personnel on these platforms, thereby propelling the market prospects of the related military simulators.

Based on Application, Aviation makes the largest share of the market during the forecasted year.

The aviation segment is expected to have a larger market share in the forecasted year. This is majorly due to the complexity and risk involved in aircraft compared to the other end users. For example, a single mistake by pilots on board a military aircraft while landing or take-off will cost the lives of people on board and result in the loss of sophisticated military property and compromise the mission. Such complexity has forced the military authorities to incorporate simulator-based training for pilots. Moreover, the increasing adoption of newer generation aircraft that incorporate complex technologies in the military may require training for pilots to familiarize themselves with the latest equipment and systems. In such situations, providing hands-on experience may be difficult due to high-cost involvement. In such cases, the simulators act as the preferred option

Regional Analysis - Aircraft Seat Actuation System Market

“North America is projected to makes the largest share of the market during the forecasted year.”

The rising orders to replace the old navy fleet with new ones from the US and Canada and the rise in export of goods are the major factors driving the demand for new ship commanders and crew. This also leads to increased demand for military training systems. According to Boeing Technician Outlook 2019, North America is anticipated to require more than 193,000 aircraft technicians and maintenance crew between 2019 and 2038. This is anticipated to fuel the demand for maintenance crew training across the region during the forecast period

This region is expected to lead the market from 2021 to 2026, owing to increased investments and the adoption of advanced military simulators for all the platforms by countries in this region. The presence of prominent manufacturers and integrators of these Military Simulation and Training, including Lockheed Martin (US), Northrop Grumman (US), L3Harris Technologies, Inc. (US), and Raytheon Technologies (US), is also expected drive the market in the region over the forecast period.

Top Military Simulation and Training Companies - Key Market Players

The Military Simulation and Training Companies are dominated by a few globally established players such as Raytheon Technologies (US), Rheinmetall AG (Germany), BAE Systems (US), Lockheed Martin Corporation (US).

Military Simulation and Training Market Report Scope

|

Report Metric |

Details |

| Estimated Market Size | USD 9.2 Billion |

| Projected Market Size | USD 12.2 Billion |

| Growth Rate | 5.6% |

|

Forecast period |

2022-2027 |

|

Market size available for years |

2019-2027 |

|

Base year considered |

2021 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Based on Type, Application, Platform, Environment, Solution Technology |

|

Geographies covered |

|

|

Companies covered |

Raytheon Technologies (US), Rheinmetall AG (Germany), BAE Systems (US), Lockheed Martin Corporation (US). |

This research report categorizes the Military Simulation and Training Market based on industry, forecasting type, purpose, organization size, and region.

Military Simulation and Training Market, By Type.

- Live

- Virtual

- Constructive

By Application

- Army

- Aviation

- Naval

By Platform

- Land

- Maritime

- AIrborne

By Environment

- Synthetic

- Gaming

By Solution

- Product

- Services

By Technology

- IoT

- 5G

- Big Data Analytics

- Artificial Intelligence

- Cloud Computing and Master Data Management

- AR & VR

- Digital Twin

- Robotic Process Automation

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World (Africa & Latin America)

Recent Developments in Aircraft Seat Actuation System Market

- In October 2021, Rheinmetall and Thales provided 20 contemporary Tiger simulators as well as servicing and maintenance support at sites in Le Luc, Fritzlar, Pau, and Phalsbourg. The 8 full-mission simulators and 12 cockpit procedure trainers enable crews to train using the latest configuration of the aircraft in service.

- In June 2021, Varjo Technologies and SAAB AB collaborate to revolutionize flight simulators. Varjo created a mixed reality (XR) technology for integration into all Saab Gripen E/F simulators. The alliance provided several new training options at a fraction of the cost, in addition to the finest resolution and the largest field of vision in the market.

- In August 2020, BAE Systems was granted a contract by the US Marine Corps (USMC) to produce a prototype design for a new state-of-the-art Wargaming Center built at Marine Corps Base Quantico in Virginia. Artificial intelligence, machine learning, game theory, multi-domain modeling & simulation, and predictive data analytics are integrated into the prototype for more measurements and training on numerous wargaming procedures.

Frequently Asked Questions (FAQ):

What is the current size of the Military Simulation and Training market?

The Military Simulation and Training market size is forecasted to grow from an estimated USD 9.2 billion in 2022 to USD 12.2 billion by 2027, at a CAGR of 5.6% during the forecast period.

Who are the winners in the Military Simulation and Training market?

Lockheed Martin (US), Northrop Grumman (US), CAE Inc. (US), and Raytheon Technologies (US) are some of the winners in the market.

What is the COVID-19 impact on Military Simulation and Training market?

The COVID-19 pandemic has caused significant damage to the economic activities of countries across the world. The manufacture of digital battlefield products, including systems, subsystems, and components, has also been impacted. Although military simulation and training products for defense applications are of prime importance, disruptions in the supply chain have halted their manufacturing processes for the time being. Resuming manufacturing activities depends on COVID-19 exposure, the level at which manufacturing operations are running, and import-export regulations, among other factors. While companies may still take orders, delivery schedules may not be fixed. Most key players in the Military Simulation and Training markets like Lockheed Martin Corporation (US), Raytheon Technologies (US), and Rheinmetall AG(Germany) have declared that business has largely be returned to normal but acknowledged the impact of cost and schedules on most programs.

What are some of the technological advancements in the market?

In recent times developments The Tactical Vehicle Driving Simulator (TVDS) is used to train the Higuard Mine-Resistant Ambush Protector (MRAP) vehicle operators. Featuring a complete simulation system built on an integrated and scalable architecture, the TVDS can be easily networked to maximize individual and team-based multi-level mission training in a common virtual environment management simulation.

What are the factors driving the growth of the market?

Need for cost-cutting technique in pilot training: Regulatory bodies across the globe have strict mandates for pilot training to ensure aviation safety. A minimum of 750 hours of training is required, which is usually expensive, owing to increased aircraft insurance, high price of aviation fuel, and increased maintenance cost. This high cost of pilot training can be reduced by adopting simulator-based training.

Simulators provide a real-time training environment to pilots without the aircraft, significantly saving training costs. The cost of simulation training is approximately 22 times lower than that incurred in training pilots on an aircraft. The figure below compares the per hour cost of training on an aircraft against a simulator. The cost effectiveness provided by simulation training is one of the major factors leading to the growth of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

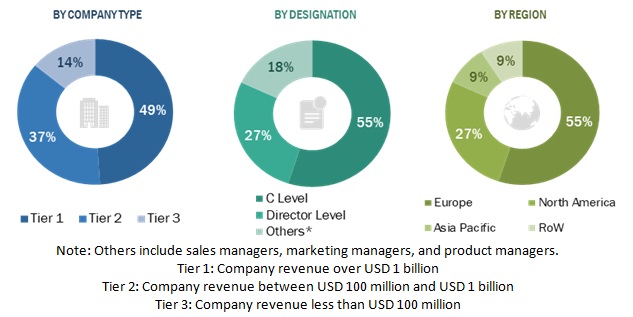

The research study conducted on the Military Simulation and Training market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the market. The primary sources considered included industry experts from the Military Simulation and Training market consisting of Military Simulation and Training service providers, government agencies, technology vendors, system integrators, research organizations, and original equipment manufacturers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives, have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the Military display as well as to assess the growth prospects of the market.

Secondary Research

Secondary sources referred for this research study included Boeing and Airbus Market Outlook 2019, General Aviation Manufacturers Association (GAMA); International Air Transport Association (IATA) publications; Flight Global World Airforce Fleet; Stockholm International Peace Research Institute, corporate filings (such as annual reports, investor presentations, and financial statements); Federal Aviation Administration (FAA) and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

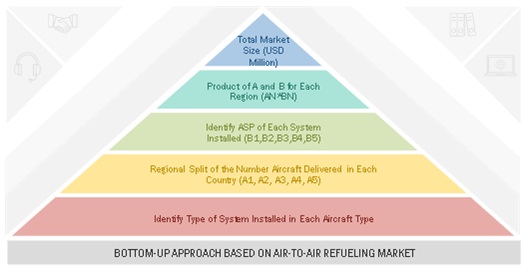

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the Military display market. The research methodology used to estimate the market size also included the following details:

- Key players in the market were identified through secondary research, and their market ranking was determined through primary and secondary research. This included a study of annual and financial reports of top market players and extensive interviews with industry experts with knowledge on Military display

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated, enhanced with detailed inputs, and analyzed by MarketsandMarkets and presented in this report.

Market size estimation methodology: Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for the segments and subsegments of Military display market. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the size of the Military display market based on System, Propulsion Type, Passenger Capacity, End use, Range, Autonomy and Region.

- To identify and analyze key drivers, opportunities, and challenges influencing the growth of the market

- To identify industry trends, market trends, and technology trends currently prevailing in the market

- To forecast the size of different segments of the market with respect to North America, Europe, Asia Pacific, Middle East and Latin America.

- To profile leading market players based on their product portfolios, financial positions, and key growth strategies

- To analyze the degree of competition in the market by identifying key growth strategies, such as mergers & acquisitions, contracts, agreements, collaborations, new product launches, and funding, adopted by leading market players.

- To provide a detailed competitive landscape of the market, along with rank analysis, revenue share analysis, and market share analysis of key players

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Military Simulation and Training Market