High-speed Camera Market by Usage, Frame Rate (20,000100,000 fps, >100,000 fps), Resolution (02 MP, 25 MP), Throughput, Component, Spectrum (Visible RGB, Infrared, and X-ray), Application, Region - Global Forecast to 2025

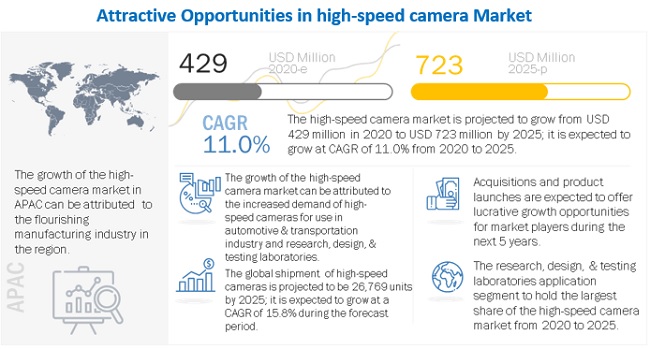

[271 Pages Report] The high-speed camera market is expected to grow from USD 429 million in 2020 to USD 723 million by 2025; it is expected to grow at a CAGR of 11.0% during 20202025.

Increasing applications of high-speed infrared cameras, especially for high-speed scanning of people to detect COVID-19, and the growing use of high-speed cameras in entertainment & media, and sports industries are the key factors driving the growth of the market. The high adoption of high-speed infrared cameras and rising need to assess the health of people and also assessing tests done in ballistics and explosives are factors propelling the growth of the market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on the high-speed camera market

The emergence of the COVID-19 pandemic, a deadly respiratory disease, has now become a worldwide issue and has also affected growth of the high-speed camera market. Global sales of high-speed cameras for key verticals such as research, design, and testing laboratories, and entertainment & media industry are expected to decline by 1015% in the fiscal year 2020, depending upon the progression of the virus in different parts of the world. The decline in the number of new research, design, and testing laboratories projects, and temporary shutdown of production facilities, are some factors hampering the growth of the market. However, the short-term supply chain disruptions are expected to affect market growth in key regions.

Market Dynamics

DRIVERS: Increasing applications of high-speed infrared cameras, especially for high-speed scanning of people to detect COVID-19

Technological advancements have made it possible to develop high-performance infrared cameras for use in a wide variety of demanding thermal imaging applications. These infrared cameras are now available with spectral sensitivity in the shortwave, mid-wave, and long-wave spectral bands or alternatively in two bands. The infrared cameras, nowadays, are also used to detect COVID-19 in patients. They are installed in public places such as airports, malls, and railway stations, where they enable precise non-reactive, contactless, and planar recording of surface temperatures while using the technical temperature measurement technology known as thermography.

RESTRAINTS: High setup cost for industrial usage

As opposed to conventional video cameras that capture natural-paced footage at 2460 frames per second, even the basic high-speed cameras capture several thousand frames. The overall setup required for the proper functioning of the camera requires components such as a camera controller, lens, LED lighting, and software for analysis and control of the overall process. A complete setup could cost approx. USD 150,000

OPPORTUNITIES: Emerging applications of high-speed cameras

The high-speed imaging domain has deepened vastlyfilms have been displaced by digital sensors, processors, and storage media, from a few thousand frames per second to millions of frames per second today. Technological advancements have increased the use of high-speed imaging in industrial operations, and the scope of applications of high-speed cameras has constantly been expandingfrom counting exact number of tablets filled in a container in a pharmaceutical plant to ballistics research in the defense industry.

CHALLENGES: Integration of artificial intelligence (AI) with high-speed cameras

The integration of artificial intelligence (AI) with a high-speed camera will provide quick analysis, maintenance, and faster intimidation of errors. Smart cameras, as well as configurable vision systems, have largely eliminated the need for machine vision system development, with most common applications now being accomplished with off-the-shelf plug-and-play technology.

To know about the assumptions considered for the study, download the pdf brochure

The >25 MP resolution cameras is estimated to register the highest CAGR growth during the forecast period

The market for >25 MP cameras is anticipated to register the highest CAGR during the forecast period. Applications such as spray analysis, combustion research, and vibration analysis in the scientific research, design, and testing laboratories require high-speed cameras with a high resolution to efficiently analyze events. Applications such as production line monitoring, maintenance, and troubleshooting employ such high-speed cameras. These cameras provide images with quality good enough for the detection of errors and monitoring of production lines in industrial manufacturing plants and are more cost-efficient than the high-speed cameras with a resolution of >5 MP.

Used high-speed cameras segment is estimated to register the highest CAGR growth during the forecast period

Due to the high cost of new high-speed cameras, the market for used equipment is likely to grow at the highest rate. Companies that do not require imagery products based on the latest technology and have budgetary constraints adopt used high-speed cameras. This also helps create an extended value chain by allowing manufacturers, resellers, and distributors to extend the life of a product and extract more value from it. Used instruments are mostly ex-demonstration instruments sold to customers.

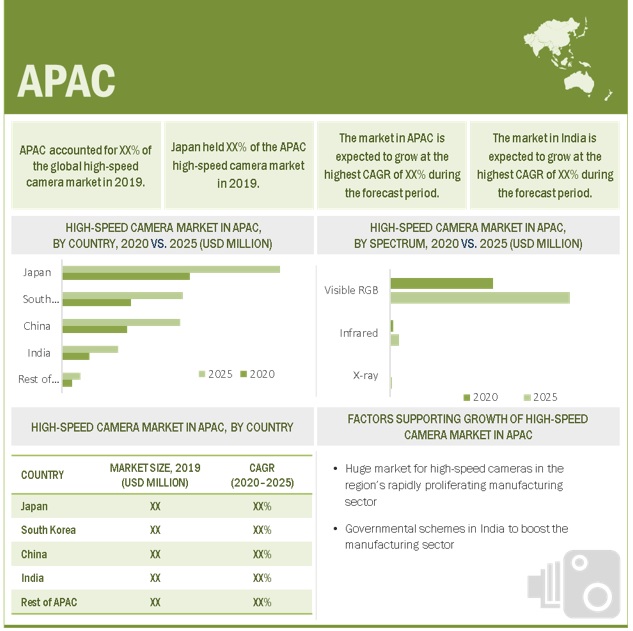

The high-speed camera market in APAC to grow at the highest CAGR during the forecast period

The market in APAC is expected to register the highest CAGR amongst all regions during the forecast period. Rapid industrialization and evolution of APAC countries as manufacturing hubs, particularly China and India, are expected to be the major drivers for the APAC market. For instance, Apple (US) has set up its manufacturing hub in India. These factors are expected to be the major drivers behind this growth.

Key Market Players

In 2019, the high-speed camera market was dominated by Photron (Japan), nac Image Technology (Japan), Vision Research (US), PCO AG (Germany), Mikrotron GmbH (Germany), Optronis (Germany), Integrated Design Tools (US), Monitoring Technology (US), AOS Technologies (Switzerland), and Fastec Imaging (US). These players have adopted various growth strategies, such as expansions, partnerships, agreements, and collaborations to achieve growth in the market from January 2018 to October 2020, which helped them to strengthen their product portfolio and broaden their customer base.

Scope of the Report:

|

Report Metric |

Details |

|

Market size available for years |

20172025 |

|

Base year |

2019 |

|

Forecast period |

20202025 |

|

Units |

Value (USD Million/ Billion), Shipment (Units) |

|

Segments covered |

Usage, Throughput, Component, Resolution, Frame rate, Spectrum, Application, and Geography |

|

Region covered |

North America, Europe, APAC and RoW |

|

Companies covered |

By Photron (Japan), nac Image Technology (Japan), Vision Research(US), PCO AG (Germany), Mikrotron (Germany), Optronis (Germany), Integrated Design Tools (US), Monitoring Technology (US), AOS Technologies (Switzerland), Fastec Imaging (US), Weisscamm GMBH I.L (Germany), Motion Engineering Company (US), DEL Imaging (US), iX Camera (UK), and Xcitex (US). |

This report categorizes the high-speed camera market based on the usage, frame rate, resolution, throughput, component, spectrum, application, and region.

By Usage

- Rental High-Speed Camera

- Used High-Speed Camera

- New High-Speed Camera

- COVID-19 impact on high-speed camera market, by usage

By Frame Rate

- 1,0005,000 fps

- >5,00020,000 fps

- >20,000100,000 fps

- >100,000 fps

By Resolution

- 02 MP

- >25 MP

- >5 MP

By Throughput

- 02,000 MPPS

- >2,0005,000 MPPS

- >5,00010,000 MPPS

- >10,000 MPPS

By Component

- Image Sensors

- Lens

- Batteries

- Image Processors

- Fans and Cooling Systems

- Memory Systems

- Other Semiconductor Components

by Spectrum:

- Visible RGB

- Infrared

- X-ray

- COVID-19 impact on high-speed camera market, by Spectrum

By Application

- Automotive & Transportation Industry

- Industrial Manufacturing Plants

- Food & Beverages Industry

- Consumer Electronics Industry

- Entertainment & Media Industry

- Sports Industry

- Paper & Printing Industry

- Aerospace & Defense

- Research, Design, & Testing Laboratories

- Healthcare Industry

- Others(building materials inspection, tobacco product inspection, and nonwoven textile inspection)

- COVID-19 impact on high-speed camera market, by Application

Geographic Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

- RoW

- South America

- Middle East & Africa

Recent Developments

- In June 2020, Photron launched a high-performance, compact, and lightweight sealed housing, high-speed camera FASTCAM Nova R2, which captures videos/photos at a performance of 1,440 frames /sec with 4 million pixels.

- In May 2020, nac Image Technology launched a 60 Gpixel/sec camera, Memrecam ACS-1 M60. The ACS-1 M60 provides one-megapixel images at an incredible 60,000 frames per second in high-quality mode and an unreal 100,000 fps in nacs proprietary boost mode.

- In March 2019, Vision Research launched VEO 440, the product shoots at over 1,100 fps at the full four-megapixel resolution, over 2,000 fps at full 1080p HD, and up to 290,000 fps at the minimum resolution.

- In August 2018, PCO AG launched an intensified camera called pco.dicam C1. It is the first camera system with image intensifier technology that harnesses the full power of sCMOS sensors.

Frequently Asked Questions (FAQ):

What is a high-speed camera?

High-speed cameras included in this report are the cameras which capture series of images at high frame rates (more than 1000 frames per second) which allows cameras to capture details that cant be recorded with conventional camcorders.

How big is high-speed camera Market?

The market for high-speed cameras is expected to be worth USD 429 million in 2020. Improved specifications in terms of higher frame rates and resolutions are propelling the demand for high-speed cameras across different applications during forecast period.

Is high-speed camera in Demand?

Factors such as increasing demand for compact high-speed cameras, increasing use of high-speed cameras in media & entertainment and sports, and high adoption of high-speed cameras in manufacturing will further drive the demand for such systems

What is high-speed camera Applications?

Applications includes research, design, & testing laboratories, aerospace & defense, automotive and transportation industry, and entertainment and media industry. The market for entertainment and media industry is expected to, register the highest CAGR during the forecast period.

What are the various frame rates available in high-speed camera?

Frame rate is the underpinning feature that categorizes a camera as high-speed imaging equipmentit is counted in terms of number of images captured per second. The frame rates are categorized into 1,000 5,000 fps, >5,000 20,000 fps, >20,000 100,000 fps, and >100,000 fps.

Who is the Leader in high-speed camera market?

Photron is one of the key player in the high-speed camera market. The company is the leading provider of high-speed camera globally, relying on its R&D capabilities and balanced product portfolio.

What is the future of high-speed camera?

The demand for high-speed camera is expected to grow rapidly during forecast period. The factor driving the market growth are high adoption of high-speed cameras in manufacturing industry.

What is the COVID-19 impact on the high-speed camera market?

The COVID-19 has impacted the growth of the high-speed camera market. Global sales of high-speed cameras for key verticals such as research, design, and testing laboratories, and entertainment & media industry are expected to decline by 1015% in the fiscal year 2020, depending upon the progression of the virus in different parts of the world. The decline in the number of new research, design, and testing laboratories projects, and temporary shutdown of production facilities, are some factors hampering the growth of the high-speed camera market. However, the short-term supply chain disruptions are expected to affect market growth in key regions. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 36)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 YEARS CONSIDERED

1.4 CURRENCY AND PRICING

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 41)

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 53)

TABLE 1 RECOVERY SCENARIOS OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

4 PREMIUM INSIGHTS (Page No. - 62)

4.1 HIGH-SPEED CAMERA MARKET OPPORTUNITIES

4.2 MARKET, BY FRAME RATE

4.3 MARKET IN NORTH AMERICA, BY SPECTRUM AND COUNTRY

4.4 MARKET, BY COUNTRY

4.5 MARKET IN APAC, BY COUNTRY

5 MARKET OVERVIEW (Page No. - 65)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing use of high-speed infrared cameras, especially for high-speed scanning of people to detect COVID-19

5.2.1.2 Growing demand for high-speed cameras from entertainment & media and sports industries

TABLE 2 VIEWS OF DIFFERENT SHOWS BROADCASTED BY DISCOVERY CHANNEL

5.2.1.3 Surging adoption of high-speed cameras in manufacturing and automotive industries

TABLE 3 REGULATIONS RELATED TO AUTOMOTIVE INDUSTRY

5.2.2 RESTRAINTS

5.2.2.1 High setup cost for industrial usage

5.2.3 OPPORTUNITIES

5.2.3.1 Emerging applications of high-speed cameras

5.2.4 CHALLENGES

5.2.4.1 Increased need to integrate artificial intelligence (AI) with high-speed cameras

5.2.4.2 Slow data offloading speed

5.2.4.3 Escalated requirement for high storage capacity to store large volume of data generated by high-speed cameras

TABLE 4 FRAME RATES

5.3 TARIFFS & REGULATIONS

5.3.1 TARIFF AND HISTORIC COMMODITIZATION

TABLE 5 MFN TARIFFS FOR VARIOUS COMPONENTS OF HIGH-SPEED CAMERAS EXPORTED BY US

TABLE 6 MFN TARIFFS FOR VARIOUS COMPONENTS OF HIGH-SPEED CAMERAS EXPORTED BY CHINA

5.3.2 SAFETY REGULATIONS FOR USE OF X-RAY CAMERAS OR RADIOGRAPHY CAMERAS

5.4 USE CASES

5.4.1 BIOCHEMISTRY

5.4.1.1 High-speed photography in high-throughput biochemistry

5.4.2 EXPLOSIVES

5.4.2.1 High-speed imaging used for analyzing fluid-desensitized detonators

5.4.3 AUTOMOTIVE

5.4.3.1 High-speed cameras used to analyze crash tests

5.4.3.2 High resolution high-speed cameras capture strain on and displacement of tire

5.4.4 AEROSPACE & DEFENSE INDUSTRY

5.4.4.1 Virtual engineering labs use high-speed cameras offered by Photron for aviation research

5.4.4.2 Cameras were recently used during drop test of airplane fuselage

5.4.5 HEALTHCARE

5.4.5.1 High-speed cameras required for high-throughput nanoscale nuclear architecture mapping

5.4.6 METALS & MINING

5.4.6.1 Capturing nanoscale behavior of fast-moving ferrofluids

5.5 AVERAGE SELLING PRICE BASED ON APPLICATIONS

TABLE 7 FEW ENTRY-LEVEL MODELS OF HIGH-SPEED CAMERAS AND THEIR COSTS

TABLE 8 PRICE RANGE OF HIGH-SPEED CAMERAS, BY APPLICATION

6 INDUSTRY TRENDS (Page No. - 80)

6.1 INTRODUCTION

6.2 EVOLUTION

6.3 TECHNOLOGY ANALYSIS

6.3.1 INTEGRATION OF HIGH-SPEED CAMERAS AND CLOUD COMPUTING

6.3.2 WIRELESS CONTROL IN HIGH-SPEED CAMERAS (COMPLEMENTARY TECHNOLOGY)

6.3.3 AI-ENABLED HIGH-SPEED CAMERAS (ADJACENT TECHNOLOGY)

6.4 SUPPLY CHAIN ANALYSIS

TABLE 9 KEY PLAYERS AND THEIR ROLE IN ECOSYSTEM

6.5 ECOSYSTEM/MARKET MAP

6.6 PATENT ANALYSIS

TABLE 10 IMPORTANT INNOVATIONS AND PATENTS REGISTRATION

6.7 TRADE ANALYSIS

TABLE 11 NUMBER OF IMAGE SENSORS SHIPPED, BY TECHNOLOGY, 20172025 (MILLION UNITS)

TABLE 12 NUMBER OF IMAGE SENSORS SHIPPED, BY REGION, 20172025 (MILLION UNITS)

6.7.1 IMPORT SCENARIO FOR VARIOUS COMPONENTS RELATED TO HIGH-SPEED CAMERAS

6.7.2 EXPORT SCENARIO FOR VARIOUS COMPONENTS RELATED TO HIGH-SPEED CAMERAS

7 HIGH-SPEED CAMERA MARKET, BY USAGE (Page No. - 89)

7.1 INTRODUCTION

TABLE 13 HIGH-SPEED CAMERA MARKET, BY USAGE, 20172019 (USD MILLION)

TABLE 14 MARKET, BY USAGE, 20202025 (USD MILLION)

TABLE 15 MARKET, BY USAGE, 20172019 (UNITS)

TABLE 16 MARKET, BY USAGE, 20202025 (UNITS)

7.2 RENTAL HIGH-SPEED CAMERAS

7.2.1 EASY AVAILABILITY OF AFFORDABLE HIGH-SPEED INDUSTRIAL CAMERAS ON RENTAL BASIS FOR SHORT-TERM PROJECTS SPURS MARKET GROWTH

TABLE 17 RENTAL CATALOGUE OF PHANTOM CAMERAS

TABLE 18 MARKET FOR RENTAL CAMERAS, BY APPLICATION, 20172019 (USD THOUSAND)

TABLE 19 HIGH-SPEED CAMERA MARKET FOR RENTAL CAMERAS, BY APPLICATION, 20202025 (USD THOUSAND)

7.3 USED HIGH-SPEED CAMERAS

7.3.1 BUDGETARY CONSTRAINTS OF VARIOUS SMALL-SCALE COMPANIES BOOST DEMAND FOR USED HIGH-SPEED CAMERAS

TABLE 20 COST OF USED HIGH-SPEED CAMERAS, BY MARKET PLAYERS

TABLE 21 HIGH-SPEED CAMERA MARKET FOR USED CAMERAS, BY APPLICATION, 20172019 (USD THOUSAND)

TABLE 22 MARKET FOR USED CAMERAS, BY APPLICATION, 20202025 (USD THOUSAND)

7.4 NEW HIGH-SPEED CAMERAS

7.4.1 INCREASED NEED FOR IMAGERY PRODUCTS BASED ON LATEST TECHNOLOGIES TO PROPEL GROWTH OF MARKET FOR NEW HIGH-SPEED CAMERAS

TABLE 23 COST OF NEW HIGH-SPEED CAMERA, BY MARKET PLAYERS

TABLE 24 MARKET FOR NEW CAMERAS, BY APPLICATION, 20172019 (USD MILLION)

TABLE 25 MARKET FOR NEW CAMERAS, BY APPLICATION, 20202025 (USD MILLION)

7.5 COVID-19 IMPACT ON HIGH-SPEED CAMERA MARKET, BY USAGE

7.5.1 MOST AFFECTED USAGE TYPE

7.5.2 LEAST AFFECTED USAGE TYPE

8 HIGH-SPEED CAMERA MARKET, BY FRAME RATE (Page No. - 100)

8.1 INTRODUCTION

TABLE 26 HIGH-SPEED CAMERA MARKET, BY FRAME RATE (FPS), 20172019 (USD MILLION)

TABLE 27 MARKET, BY FRAME RATE (FPS), 20202025 (USD MILLION)

TABLE 28 MARKET, BY FRAME RATE (FPS), 20172019 (UNITS)

TABLE 29 MARKET, BY FRAME RATE (FPS), 20202025 (UNITS)

8.2 FRAME RATE: 1,0005,000 FPS

8.2.1 1,0005,000 FPS HIGH-SPEED CAMERAS INCREASINGLY USED IN AUTOMOTIVE, SPORTS, AND ENTERTAINMENT & MEDIA APPLICATIONS

TABLE 30 MODELS OF 1,0005,000 FPS HIGH-SPEED CAMERAS, BY MARKET PLAYER

TABLE 31 1,0005,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (USD MILLION)

TABLE 32 1,0005,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20202025 (USD MILLION)

TABLE 33 1,0005,000 FPS MARKET, BY RESOLUTION, 20172019 (UNITS)

TABLE 34 1,0005,000 FPS MARKET, BY RESOLUTION, 20202025 (UNITS)

TABLE 35 1,0005,000 FPS MARKET, BY SPECTRUM, 20172019 (USD THOUSAND)

TABLE 36 1,0005,000 FPS MARKET, BY SPECTRUM, 20202025 (USD THOUSAND)

TABLE 37 1,0005,000 FPS MARKET, BY SPECTRUM, 20172019 (UNITS)

TABLE 38 1,0005,000 FPS MARKET, BY SPECTRUM, 20202025 (UNITS)

8.3 FRAME RATE: >5,00020,000 FPS

8.3.1 >5,00020,000 FPS CAMERAS HAVE HIGH DEMAND FROM ENTERTAINMENT & MEDIA INDUSTRY

TABLE 39 MODELS OF >5,00020,000 FPS HIGH-SPEED CAMERAS, BY MARKET PLAYER

TABLE 40 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (USD MILLION)

TABLE 41 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20202025 (USD MILLION)

TABLE 42 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (UNITS)

TABLE 43 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20202025 (UNITS)

TABLE 44 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20172019 (USD THOUSAND)

TABLE 45 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20202025 (USD THOUSAND)

TABLE 46 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20172019 (UNITS)

TABLE 47 >5,00020,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20202025 (UNITS)

8.4 FRAME RATE: >20,000100,000 FPS

8.4.1 USE OF >20,000100,000 FPS CAMERAS IN PRODUCTION LINE MONITORING AND MAINTENANCE AND MATERIAL TESTING APPLICATIONS TO PROPEL MARKET GROWTH

TABLE 48 MODELS OF >20,000100,000 FPS HIGH-SPEED CAMERA, BY MARKET PLAYER

TABLE 49 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (USD MILLION)

TABLE 50 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20202025 (USD MILLION)

TABLE 51 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (UNITS)

TABLE 52 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20202025 (UNITS)

TABLE 53 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 54 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 55 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20172019 (UNITS)

TABLE 56 >20,000100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20202025 (UNITS)

8.5 FRAME RATE: >100,000 FPS

8.5.1 NEED FOR HIGHLY DETAILED ANALYSIS IN EXPLOSIVES AND BALLISTICS APPLICATIONS TO SURGE DEMAND FOR > 100,000 FPS HIGH-SPEED CAMERAS

TABLE 57 MODELS OF > 100,000 FPS HIGH-SPEED CAMERAS WITH FRAME RATE

TABLE 58 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (USD MILLION)

TABLE 59 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 202O2025 (USD MILLION)

TABLE 60 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (UNITS)

TABLE 61 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20202025 (UNITS)

TABLE 62 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20172019 (USD THOUSAND)

TABLE 63 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20202025 (USD THOUSAND)

TABLE 64 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20172019 (UNITS)

TABLE 65 >100,000 FPS HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20202025 (UNITS)

9 HIGH-SPEED CAMERA MARKET, BY RESOLUTION (Page No. - 115)

9.1 INTRODUCTION

TABLE 66 HIGH-SPEED CAMERA MARKET, BY RESOLUTION, 20172019 (USD MILLION)

TABLE 67 MARKET, BY RESOLUTION, 20202025 (USD MILLION)

TABLE 68 MARKET, BY RESOLUTION, 20172019 (UNITS)

TABLE 69 MARKET, BY RESOLUTION, 20202025 (UNITS)

9.2 02 MP

9.2.1 HIGH-SPEED CAMERAS WITH 02 MP RESOLUTIONS ARE COST-EFFICIENT IMAGING SOLUTIONS

TABLE 70 HIGH-SPEED CAMERAS WITH 02 MP RESOLUTIONS, BY MARKET PLAYER

TABLE 71 02 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20172019 (USD MILLION)

TABLE 72 02 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20202025 (USD MILLION)

TABLE 73 02 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20172019 (UNITS)

TABLE 74 02 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20202025 (UNITS)

9.3 >25 MP

9.3.1 >25 MP HIGH-SPEED CAMERAS ARE MOST OPTIMUM SOLUTION FOR HIGH-SPEED IMAGING APPLICATIONS

TABLE 75 HIGH-SPEED CAMERAS WITH >25 MP RESOLUTIONS, BY MARKET PLAYER

TABLE 76 >25 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20172019 (USD MILLION)

TABLE 77 >25 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20202025 (USD MILLION)

TABLE 78 >25 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20172019 (UNITS)

TABLE 79 >25 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20202025 (UNITS)

9.4 >5 MP

9.4.1 NEED FOR DETAILED AND RELIABLE ANALYSIS IN CRITICAL RESEARCH APPLICATIONS BOOSTING DEMAND FOR CAMERAS WITH ABOVE 5 MP RESOLUTIONS

TABLE 80 HIGH-SPEED CAMERAS WITH >5 MP RESOLUTIONS, BY MARKET PLAYER

TABLE 81 >5 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20172019 (USD THOUSAND)

TABLE 82 >5 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20202025 (USD THOUSAND)

TABLE 83 >5 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20172019 (UNITS)

TABLE 84 >5 MP HIGH-SPEED CAMERA MARKET, BY FRAME RATE, 20202025 (UNITS)

10 HIGH-SPEED CAMERA MARKET, BY THROUGHPUT (Page No. - 124)

10.1 INTRODUCTION

TABLE 85 HIGH-SPEED CAMERA MARKET, BY THROUGHPUT, 20172019 (USD MILLION)

TABLE 86 MARKET, BY THROUGHPUT, 20202025 (USD MILLION)

TABLE 87 MARKET, BY THROUGHPUT, 20172019 (UNITS)

TABLE 88 MARKET, BY THROUGHPUT, 20202025 (UNITS)

10.2 02,000 MPPS

10.2.1 02,000 MPPS THROUGHPUT CAMERAS ARE MOST COST-EFFICIENT SOLUTIONS FOR RESEARCH AND INDUSTRIAL APPLICATIONS

TABLE 89 HIGH-SPEED CAMERAS WITH THROUGHPUT OF 02,000 MPPS

10.3 >2,0005,000 MPPS

10.3.1 HIGH-SPEED CAMERAS WITH >2,0005,000 MPPS THROUGHPUT HELD LARGEST MARKET SHARE IN 2019

TABLE 90 HIGH-SPEED CAMERA WITH THROUGHPUT OF >2,0005,000 MPPS

10.4 >5,00010,000 MPPS

10.4.1 >5,00010,000 MPPS CAMERAS ARE USED IN COMPLEX APPLICATIONS SUCH AS AUTOMOTIVE AND EXPLOSIVES TESTING

TABLE 91 HIGH-SPEED CAMERA WITH THROUGHPUT OF >5,00010,000 MPPS

10.5 >10,000 MPPS

10.5.1 >10,000 MPPS CAMERAS ARE ADOPTED MOSTLY IN RESEARCH APPLICATIONS TO STUDY COMPLEX PROCESSES

TABLE 92 HIGH-SPEED CAMERAS WITH THROUGHPUT OF >10,000 MPPS

11 HIGH-SPEED CAMERA MARKET, BY COMPONENT (Page No. - 129)

11.1 INTRODUCTION

TABLE 93 MARKET, BY COMPONENT, 20172019 (USD MILLION)

TABLE 94 MARKET, BY COMPONENT, 20202025 (USD MILLION)

11.2 IMAGE SENSORS

11.2.1 IMAGE SENSORS TO CONTINUE TO ACCOUNT FOR LARGEST SHARE OF MARKET DURING FORECAST PERIOD

11.2.1.1 CCD sensors

11.2.1.1.1 Increased adoption of CCD sensors in variety of imaging applications to surge their demand

11.2.1.2 CMOS sensors

11.2.1.2.1 Better imaging quality, ease of control, and low cost to drive adoption of CMOS sensors

11.3 LENSES

11.3.1 LENSES ARE KEY COMPONENTS OF CAMERAS AS THEY DEFINE IMAGE QUALITY

11.4 BATTERIES

11.4.1 QUICK RECHARGEABLE LITHIUM-ION BATTERIES ARE MOST USED BATTERIES IN HIGH-SPEED CAMERAS

11.5 IMAGE PROCESSORS

11.5.1 MARKET FOR IMAGE PROCESSORS TO GROW AT FASTEST RATE DURING FORECAST PERIOD

11.6 FANS AND COOLING SYSTEMS

11.6.1 INCREASING DEMAND FOR HIGH-SPEED CAMERAS IN EXTREME APPLICATIONS SUCH AS AEROSPACE &DEFENSE AND INDUSTRIAL MANUFACTURING PLANTS TO DRIVE ADOPTION OF FANS AND COOLING SYSTEMS

11.7 MEMORY SYSTEMS

11.7.1 INCREASING DEMAND FOR MEMORY SYSTEMS IN HIGH-SPEED CAMERAS DUE TO SHORTAGE OF STORAGE SPACE

TABLE 95 HIGH-SPEED CAMERA MARKET FOR MEMORY SYSTEMS, BY CAPACITY, 20172019 (USD MILLION)

TABLE 96 MARKET FOR MEMORY SYSTEMS, BY CAPACITY, 20202025 (USD MILLION)

11.7.2 050 GB

11.7.3 >50100 GB

11.7.4 >100 GB

11.8 OTHERS

12 HIGH-SPEED CAMERA MARKET, BY SPECTRUM (Page No. - 136)

12.1 INTRODUCTION

TABLE 97 HIGH-SPEED CAMERA MARKET, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 98 MARKET, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 99 MARKET, BY SPECTRUM, 20172019 (UNITS)

TABLE 100 MARKET, BY SPECTRUM, 20202025 (UNITS)

12.2 VISIBLE RGB

12.2.1 HIGH ADOPTION IN ENTERTAINMENT & MEDIA AND SPORTS APPLICATIONS TO DRIVE DEMAND FOR HIGH-SPEED VISIBLE RGB CAMERAS

TABLE 101 EXAMPLES OF HIGH-SPEED VISIBLE RGB CAMERAS, BY MARKET PLAYER

TABLE 102 HIGH-SPEED VISIBLE RGB CAMERAS MARKET, BY FRAME RATE, 20172019 (USD MILLION)

TABLE 103 HIGH-SPEED VISIBLE RGB CAMERAS MARKET, BY FRAME RATE, 20202025 (USD MILLION)

TABLE 104 HIGH-SPEED VISIBLE RGB CAMERAS MARKET, BY FRAME RATE, 20172019 (UNITS)

TABLE 105 HIGH-SPEED VISIBLE RGB CAMERAS MARKET, BY FRAME RATE, 20202025 (UNITS)

TABLE 106 HIGH-SPEED VISIBLE RGB CAMERAS MARKET, BY APPLICATION, 20172019 (USD MILLION)

TABLE 107 HIGH-SPEED VISIBLE RGB CAMERAS MARKET, BY APPLICATION, 20202025 (USD MILLION)

12.3 INFRARED

12.3.1 INCREASED USE OF HIGH-SPEED INFRARED CAMERAS IN HEALTHCARE INDUSTRY TO DETECT BODY TEMPERATURE

TABLE 108 EXAMPLES OF HIGH-SPEED INFRARED CAMERAS, BY MARKET PLAYER

TABLE 109 HIGH-SPEED INFRARED CAMERAS MARKET, BY FRAME RATE, 20172019 (USD THOUSAND)

TABLE 110 HIGH-SPEED INFRARED CAMERAS MARKET, BY FRAME RATE, 20202025 (USD THOUSAND)

TABLE 111 HIGH-SPEED INFRARED CAMERAS MARKET, BY FRAME RATE, 20172019 (UNITS)

TABLE 112 HIGH-SPEED INFRARED CAMERAS MARKET, BY FRAME RATE, 20202025 (UNITS)

TABLE 113 HIGH-SPEED INFRARED CAMERAS MARKET, BY APPLICATION, 20172019 (USD THOUSAND)

TABLE 114 HIGH-SPEED INFRARED CAMERAS MARKET, BY APPLICATION, 20202025 (USD THOUSAND)

12.4 X-RAY

12.4.1 EXTENSIVE ADOPTION OF HIGH-SPEED X-RAY CAMERAS IN BALLISTICS AND EXPLOSIVES TESTING TO SPUR MARKET GROWTH

TABLE 115 EXAMPLES OF HIGH-SPEED X-RAY CAMERAS, BY MARKET PLAYER

TABLE 116 HIGH-SPEED X-RAY CAMERAS MARKET, BY FRAME RATE, 20172019 (USD THOUSAND)

TABLE 117 HIGH-SPEED X-RAY CAMERAS MARKET, BY FRAME RATE, 20202025 (USD THOUSAND)

TABLE 118 HIGH-SPEED X-RAY CAMERAS MARKET, BY FRAME RATE, 20172019 (UNITS)

TABLE 119 HIGH-SPEED X-RAY CAMERAS MARKET, BY FRAME RATE, 20202025 (UNITS)

TABLE 120 HIGH-SPEED X-RAY CAMERAS MARKET, BY APPLICATION, 20172019 (USD THOUSAND)

TABLE 121 HIGH-SPEED X-RAY CAMERAS MARKET, BY APPLICATION, 20202025 (USD THOUSAND)

12.5 COVID-19 IMPACT ON HIGH-SPEED CAMERA MARKET, BY SPECTRUM

12.5.1 MOST IMPACTED SPECTRUM TYPE

12.5.2 LEAST IMPACTED SPECTRUM TYPE

13 HIGH-SPEED CAMERA MARKET, BY APPLICATION (Page No. - 150)

13.1 INTRODUCTION

TABLE 122 HIGH-SPEED CAMERA MARKET, BY APPLICATION, 20172019 (USD MILLION)

TABLE 123 MARKET, BY APPLICATION, 20202025 (USD MILLION)

TABLE 124 MARKET, BY APPLICATION, 20172019 (UNITS)

TABLE 125 MARKET, BY APPLICATION, 20202025 (UNITS)

13.2 AUTOMOTIVE & TRANSPORTATION INDUSTRY

TABLE 126 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 127 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 128 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 129 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 130 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY USAGE, 20172019 (USD MILLION)

TABLE 131 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY USAGE, 20202025 (USD MILLION)

TABLE 132 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY USAGE, 20172019 (UNITS)

TABLE 133 MARKET FOR AUTOMOTIVE & TRANSPORTATION INDUSTRY, BY USAGE, 20202025 (UNITS)

13.2.1 CRASH TESTING

13.2.1.1 Adoption of high-speed cameras by automobile engineers for improving vehicle safety

13.2.2 OTHERS

13.3 INDUSTRIAL MANUFACTURING PLANTS

TABLE 134 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 135 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 136 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 137 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 138 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY USAGE, 20172019 (USD MILLION)

TABLE 139 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY USAGE, 20202025 (USD MILLION)

TABLE 140 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY USAGE, 20172019 (UNITS)

TABLE 141 MARKET FOR INDUSTRIAL MANUFACTURING PLANTS, BY USAGE, 20202025 (UNITS)

13.3.1 PACKAGING

13.3.1.1 Increased use of high-speed cameras for inspections in packaging industry

13.3.2 MACHINE DESIGNING

13.3.2.1 Surged adoption of high-speed cameras for analyzing machine designs

13.3.3 PRODUCTION LINE MONITORING

13.3.3.1 Escalated demand for high-speed cameras from industrial manufacturing plants to detect production errors

13.3.4 OTHERS

13.4 FOOD & BEVERAGES INDUSTRY

TABLE 142 HIGH-SPEED CAMERA MARKET FOR FOOD & BEVERAGES INDUSTRY, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 143 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 144 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 145 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 146 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY USAGE, 20172019 (USD MILLION)

TABLE 147 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY USAGE, 20202025 (USD MILLION)

TABLE 148 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY USAGE, 20172019 (UNITS)

TABLE 149 MARKET FOR FOOD & BEVERAGES INDUSTRY, BY USAGE, 20202025 (UNITS)

13.4.1 PACKAGING

13.4.1.1 Growing utilization of high-speed cameras for monitoring packaging processes in food & beverages industry

13.4.2 FOOD & BEVERAGE PRODUCTION

13.4.2.1 Rising adoption of high-speed cameras for inspection and error detection in food & beverage production facilities

13.5 CONSUMER ELECTRONICS INDUSTRY

TABLE 150 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 151 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 152 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY SPECTRUM, 20172019 (USD THOUSAND)

TABLE 153 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY SPECTRUM, 20202025 (USD THOUSAND)

TABLE 154 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY USAGE, 20172019 (USD THOUSAND)

TABLE 155 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY USAGE, 20202025 (USD THOUSAND)

TABLE 156 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY USAGE, 20172019 (UNITS)

TABLE 157 MARKET FOR CONSUMER ELECTRONICS INDUSTRY, BY USAGE, 20202025 (UNITS)

13.5.1 DROP TESTING

13.5.1.1 Ability to capture images at high frame rates for detailed analysis lead to increased demand for high-speed cameras

13.5.2 OTHERS

13.6 ENTERTAINMENT & MEDIA INDUSTRY

TABLE 158 HIGH-SPEED CAMERA MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 159 MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 160 MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 161 MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 162 MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY USAGE, 20172019 (USD MILLION)

TABLE 163 MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY USAGE, 20202025 (USD MILLION)

TABLE 164 HIGH-SPEED CAMERA MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY USAGE, 20172019 (UNITS)

TABLE 165 HIGH-SPEED CAMERA MARKET FOR ENTERTAINMENT & MEDIA INDUSTRY, BY USAGE, 20202025 (UNITS)

13.6.1 DOCUMENTARIES

13.6.1.1 Surged adoption of high-speed cameras for recording certain movements not visible to naked eyes

13.6.2 ADVERTISING AND MOTION PICTURES

13.6.2.1 Increased use of high-speed cameras to generate slow-motion sequences for advertising and motion pictures

13.7 SPORTS INDUSTRY

TABLE 166 MARKET FOR SPORTS INDUSTRY, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 167 MARKET FOR SPORTS INDUSTRY, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 168 MARKET FOR SPORTS INDUSTRY, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 169 HIGH-SPEED CAMERA MARKET FOR SPORTS INDUSTRY, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 170 MARKET FOR SPORTS INDUSTRY, BY USAGE, 20172019 (USD MILLION)

TABLE 171 HIGH-SPEED CAMERA MARKET FOR SPORTS INDUSTRY, BY USAGE, 20202025 (USD MILLION)

TABLE 172 MARKET FOR SPORTS INDUSTRY, BY USAGE, 20172025 (UNITS)

TABLE 173 MARKET FOR SPORTS INDUSTRY, BY USAGE, 20202025 (UNITS)

13.7.1 BROADCASTING

13.7.1.1 Increased demand for high-speed cameras to broadcast sports events

13.7.2 MOTION ANALYSIS

13.7.2.1 Accelerated use of high-speed cameras during sports events to analyze movements of sportspersons

13.8 PAPER & PRINTING INDUSTRY

TABLE 174 HIGH-SPEED CAMERA MARKET FOR PAPER & PRINTING INDUSTRY, BY APPLICATION TYPE, 20172019 (USD THOUSAND)

TABLE 175 MARKET FOR PAPER & PRINTING INDUSTRY, BY APPLICATION TYPE, 20202025 (USD THOUSAND)

TABLE 176 MARKET FOR PAPER & PRINTING INDUSTRY, BY SPECTRUM, 20172019 (USD THOUSAND)

TABLE 177 MARKET FOR PAPER & PRINTING INDUSTRY, BY SPECTRUM, 20202025 (USD THOUSAND)

TABLE 178 MARKET FOR PAPER & PRINTING INDUSTRY, BY USAGE, 20172019 (USD THOUSAND)

TABLE 179 MARKET FOR PAPER & PRINTING INDUSTRY, BY USAGE, 20202025 (USD THOUSAND)

TABLE 180 HIGH-SPEED CAMERA MARKET FOR PAPER & PRINTING INDUSTRY, BY USAGE, 20172019 (UNITS)

TABLE 181 MARKET FOR PAPER & PRINTING, BY USAGE, 20202025 (UNITS)

13.8.1 CONVERTED PAPER MANUFACTURING

13.8.1.1 Increased adoption of high-speed cameras to monitor tissue manufacturing and converting processes

TABLE 182 ROLE OF HIGH-SPEED CAMERAS IN VARIOUS STAGES OF TISSUE MANUFACTURING AND CONVERTING

13.8.2 OTHERS

13.9 AEROSPACE & DEFENSE INDUSTRY

TABLE 183 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 184 HIGH-SPEED CAMERA MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 185 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 186 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 187 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY USAGE, 20172019 (USD MILLION)

TABLE 188 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY USAGE, 20202025 (USD MILLION)

TABLE 189 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY USAGE, 20172019 (UNITS)

TABLE 190 MARKET FOR AEROSPACE & DEFENSE INDUSTRY, BY USAGE, 20202025 (UNITS)

13.9.1 EXPLOSIVES AND PYROTECHNICS

13.9.1.1 Surged deployment of high-speed cameras to study impact physics of explosives and pyrotechnics

13.9.2 PROJECTILE AND COMPONENT TRACKING

13.9.2.1 Accelerated demand for high-speed cameras from government agencies for projectile tracking

13.9.3 FLOW VISUALIZATION

13.9.3.1 High-speed cameras enable visualization of flow patterns of several gases

13.9.4 OTHERS

13.10 RESEARCH, DESIGN, & TESTING LABORATORIES

TABLE 191 HIGH-SPEED CAMERA MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 192 MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 193 MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 194 MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 195 MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY USAGE, 20172019 (USD MILLION)

TABLE 196 MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY USAGE, 20202025 (USD MILLION)

TABLE 197 MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY USAGE, 20172019 (UNITS)

TABLE 198 MARKET FOR RESEARCH, DESIGN, & TESTING LABORATORIES, BY USAGE, 20202025 (UNITS)

13.10.1 COMBUSTION RESEARCH

13.10.1.1 Ability of high-speed cameras to capture split second events resulting in their increased use in combustion research activities

13.10.2 FLUID DYNAMICS (PIV) AND SOLID MECHANICS (DIC)

13.10.2.1 Use of high-speed cameras to analyze motions of seeding particles

13.10.3 PRODUCT AND MATERIAL TESTING

13.10.3.1 Deployment of high-speed cameras to check adherence of products and materials with client expectations

13.10.4 SPRAY ANALYSIS

13.10.4.1 Adoption of high-speed cameras for evaluation and analysis of transient spray characteristics

13.10.5 OTHERS

13.11 HEALTHCARE INDUSTRY

TABLE 199 MARKET FOR HEALTHCARE INDUSTRY, BY APPLICATION TYPE, 20172019 (USD MILLION)

TABLE 200 MARKET FOR HEALTHCARE INDUSTRY, BY APPLICATION TYPE, 20202025 (USD MILLION)

TABLE 201 MARKET FOR HEALTHCARE INDUSTRY, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 202 MARKET FOR HEALTHCARE INDUSTRY, BY SPECTRUM, 20202025 (USD MILLION)

TABLE 203 MARKET FOR HEALTHCARE INDUSTRY, BY USAGE, 20172019 (USD MILLION)

TABLE 204 HIGH-SPEED CAMERA MARKET FOR HEALTHCARE INDUSTRY, BY USAGE, 20202025 (USD MILLION)

TABLE 205 MARKET FOR HEALTHCARE INDUSTRY, BY USAGE, 20172019 (UNITS)

TABLE 206 MARKET FOR HEALTHCARE INDUSTRY, BY USAGE, 20202025 (UNITS)

13.11.1 DIAGNOSTICS

13.11.1.1 Surged adoption of high-speed cameras to detect diseases

13.11.2 MICROSCOPY

13.11.2.1 Increased employment of high-speed cameras to study micro-level objects

13.11.3 OTHERS

13.12 OTHERS

TABLE 207 HIGH-SPEED CAMERA MARKET FOR OTHER APPLICATIONS, BY APPLICATION TYPE, 20172019 (USD THOUSAND)

TABLE 208 MARKET FOR OTHER APPLICATIONS, BY APPLICATION TYPE, 20202025 (USD THOUSAND)

TABLE 209 MARKET FOR OTHER APPLICATIONS, BY SPECTRUM, 20172019 (USD THOUSAND)

TABLE 210 HIGH-SPEED CAMERA MARKET FOR OTHER APPLICATIONS, BY SPECTRUM, 20202025 (USD THOUSAND)

TABLE 211 MARKET FOR OTHER APPLICATIONS, BY USAGE, 20172019 (USD THOUSAND)

TABLE 212 HIGH-SPEED CAMERA MARKET FOR OTHER APPLICATIONS, BY USAGE, 20202025 (USD THOUSAND)

TABLE 213 MARKET FOR OTHER APPLICATIONS, BY USAGE, 20172019 (UNITS)

TABLE 214 HIGH-SPEED CAMERA MARKET FOR OTHER APPLICATIONS, BY USAGE, 20202025 (UNITS)

13.13 IMPACT OF COVID-19 ON HIGH-SPEED CAMERA MARKET, BY APPLICATION

13.13.1 MOST IMPACTED APPLICATION SEGMENT

13.13.2 LEAST IMPACTED APPLICATION SEGMENT

14 GEOGRAPHIC ANALYSIS (Page No. - 193)

14.1 INTRODUCTION

TABLE 215 HIGH-SPEED CAMERA MARKET, BY REGION, 20172019 (USD MILLION)

TABLE 216 MARKET, BY REGION, 20202025 (USD MILLION)

TABLE 217 MARKET, BY REGION, 20172025 (UNITS)

TABLE 218 MARKET, BY REGION, 20202025 (UNITS)

14.2 NORTH AMERICA

TABLE 219 HIGH-SPEED CAMERA MARKET IN NORTH AMERICA, BY COUNTRY, 20172019 (USD MILLION)

TABLE 220 MARKET IN NORTH AMERICA, BY COUNTRY, 20202025 (USD MILLION)

TABLE 221 HIGH-SPEED CAMERA MARKET IN NORTH AMERICA, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 222 MARKET IN NORTH AMERICA, BY SPECTRUM, 20202025 (USD MILLION)

14.2.1 US

14.2.1.1 US is largest market for high-speed cameras in North America

14.2.2 CANADA

14.2.2.1 Growing food & beverages industry in Canada to boost demand for high-speed cameras

14.2.3 MEXICO

14.2.3.1 Mexican high-speed camera market to witness highest growth rate in North American market

14.3 EUROPE

TABLE 223 MARKET IN EUROPE, BY COUNTRY, 20172019 (USD MILLION)

TABLE 224 MARKET IN EUROPE, BY COUNTRY, 20202025 (USD MILLION)

TABLE 225 MARKET IN EUROPE, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 226 MARKET IN EUROPE, BY SPECTRUM, 20202025 (USD MILLION)

14.3.1 GERMANY

14.3.1.1 Increasing adoption of high-speed cameras in automotive industry to drive market growth in Germany

14.3.2 FRANCE

14.3.2.1 Growing manufacturing activities in country drive demand for high-speed cameras

14.3.3 UK

14.3.3.1 Rising adoption of cameras in aerospace and automotive industries to accelerate market growth

14.3.4 ITALY

14.3.4.1 Increasing industrialization fosters growth of high-speed cameras

14.3.5 SPAIN

14.3.5.1 Food & beverages industry accounts for major share of high-speed camera market in Spain

14.3.6 REST OF EUROPE

14.4 APAC

TABLE 227 HIGH-SPEED CAMERA MARKET IN APAC, BY COUNTRY, 20172019 (USD MILLION)

TABLE 228 MARKET IN APAC, BY COUNTRY, 20202025 (USD MILLION)

TABLE 229 MARKET IN APAC, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 230 MARKET IN APAC, BY SPECTRUM, 20202025 (USD MILLION)

14.4.1 CHINA

14.4.1.1 R&D investments aimed at driving innovations for industrial operations to propel market growth in China

14.4.2 JAPAN

14.4.2.1 Japan accounts for largest market size in APAC due to high adoption of cameras in industrial manufacturing applications

14.4.3 SOUTH KOREA

14.4.3.1 Booming manufacturing sector in South Korea fueling demand for high-speed cameras

14.4.4 INDIA

14.4.4.1 Rapid industrialization drives demand for high-speed cameras in India

14.4.5 REST OF APAC

14.5 ROW

TABLE 231 HIGH-SPEED CAMERA MARKET IN ROW, BY REGION, 20172019 (USD MILLION)

TABLE 232 MARKET IN ROW, BY REGION, 20202025 (USD MILLION)

TABLE 233 MARKET IN ROW, BY SPECTRUM, 20172019 (USD MILLION)

TABLE 234 MARKET IN ROW, BY SPECTRUM, 20202025 (USD MILLION)

14.5.1 SOUTH AMERICA

14.5.1.1 High adoption of cameras in industrial manufacturing and automotive applications to propel South American market growth

14.5.2 MIDDLE EAST & AFRICA

14.5.2.1 Rapid industrialization in Middle Eastern & African countries to spur demand for high-speed cameras

14.6 IMPACT OF COVID-19 ON REGIONAL HIGH-SPEED CAMERA MARKETS

14.6.1 MOST IMPACTED REGION

14.6.2 LEAST IMPACTED REGION

15 HIGH-SPEED CAMERA ACCESSORIES (QUALITATIVE) (Page No. - 211)

15.1 INTRODUCTION

15.2 MEMORY CARTRIDGES

TABLE 235 COST COMPARISON OF MEMORY CARTRIDGES

15.3 LENS ADAPTERS AND EXTENDERS

15.3.1 LENS ADAPTERS

TABLE 236 COST OF LENS ADAPTERS, BY MARKET PLAYERS

15.3.2 LENS EXTENDERS

TABLE 237 COST OF LENS EXTENDERS, BY MARKET PLAYERS

15.4 CAMERA LENSES

15.5 HIGH-SPEED LIGHTING ACCESSORIES

15.5.1 HALOGENS

15.5.2 FIBER AND LIQUID LIGHT GUIDES

15.6 TRIGGERS

TABLE 238 COST OF TRIGGERS, BY MARKET PLAYERS

15.7 TRIPODS AND LIQUID HEADS

16 COMPETITIVE LANDSCAPE OF HIGH-SPEED CAMERA MARKET (Page No. - 216)

16.1 OVERVIEW

16.2 MARKET EVALUATION FRAMEWORK

TABLE 239 OVERVIEW OF STRATEGIES DEPLOYED BY KEY HIGH-SPEED CAMERA MANUFACTURERS

16.2.1 PRODUCT PORTFOLIO

16.2.2 REGIONAL FOCUS

16.2.3 MANUFACTURING FOOTPRINT

16.2.4 ORGANIC/INORGANIC PLAY

16.3 HIGH-SPEED CAMERA MARKET SHARE ANALYSIS, 2019

16.4 REVENUE ANALYSIS OF TOP 5 PLAYERS IN HIGH-SPEED CAMERA MARKET

16.5 COMPANY EVALUATION QUADRANT

16.5.1 STAR

16.5.2 EMERGING LEADER

16.5.3 PERVASIVE

16.5.4 PARTICIPANT

16.5.5 COMPANY PRODUCT FOOTPRINT

TABLE 240 COMPANY PRODUCT FOOTPRINT

TABLE 241 COMPANY SPECTRUM FOOTPRINT

TABLE 242 COMPANY REGION FOOTPRINT

16.6 START-UP/SME EVALUATION MATRIX

TABLE 243 LIST OF START-UP COMPANIES IN HIGH-SPEED CAMERA MARKET

16.6.1 PROGRESSIVE COMPANIES

16.6.2 RESPONSIVE COMPANIES

16.6.3 DYNAMIC COMPANIES

16.6.4 STARTING BLOCKS

16.7 COMPETITIVE SITUATIONS AND TRENDS

16.7.1 PRODUCT LAUNCHES

TABLE 244 PRODUCT LAUNCHES, APRIL 2020AUGUST 2020

16.7.2 PARTNERSHIPS AND COLLABORATIONS & JOINT VENTURES

TABLE 245 PARTNERSHIPS AND COLLABORATIONS & JOINT VENTURES, SEPTEMBER 2018AUGUST 2020

16.7.3 EXPANSIONS

TABLE 246 EXPANSIONS, JANUARY 2018 TO MAY 2020

17 COMPANY PROFILES (Page No. - 229)

17.1 KEY COMPANIES

(Business Overview, Products/Software Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices, and Weaknesses and Competitive Threats)*

17.1.1 PHOTRON

17.1.2 NAC IMAGE TECHNOLOGY

17.1.3 VISION RESEARCH

17.1.4 PCO AG

17.1.5 MIKROTRON GMBH

17.1.6 OPTRONIS

17.1.7 INTEGRATED DESIGN TOOLS

17.1.8 MONITORING TECHNOLOGY

17.1.9 AOS TECHNOLOGIES

17.1.10 FASTEC IMAGING

17.2 OTHER KEY COMPANIES

17.2.1 WEISSCAM GMBH I.L

17.2.2 MOTION ENGINEERING COMPANY

17.2.3 DEL IMAGING

17.2.4 IX CAMERA

17.2.5 XCITEX

17.2.6 MOTION CAPTURE TECHNOLOGIES

17.2.7 PCE INSTRUMENTS

17.2.8 BAUMER

17.2.9 DITECT

17.2.10 HIGH SPEED IMAGING

*Details on Business Overview, Products/Software Offered, Recent Developments, MNM View, Key Strengths/Right to Win, Strategic Choices, and Weaknesses and Competitive Threats might not be captured in case of unlisted companies.

18 APPENDIX (Page No. - 264)

18.1 DISCUSSION GUIDE

18.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

18.3 AVAILABLE CUSTOMIZATIONS

18.4 RELATED REPORT

18.5 AUTHOR DETAILS

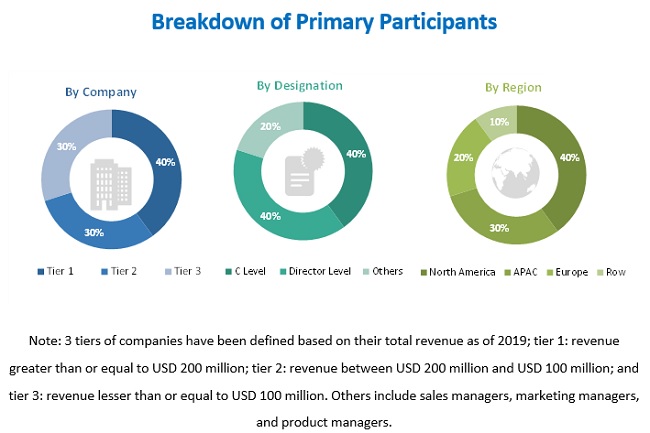

The study involved 4 major activities in estimating the current size of the high-speed camera market. Exhaustive secondary research has been done to collect information about the market, the peer market, and the parent market. Validating findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study on the high-speed camera market. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles by recognized authors, directories, and databases. Secondary research has been conducted to obtain key information about the supply chain of the high-speed cameras industry, the value chain of the market, the total pool of the key players, the market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

After the complete market engineering, which includes calculations for market statistics, market breakdown, data triangulation, market size estimations, and market forecasting, extensive primary research has been carried out to gather information, as well as to verify and validate the critical numbers obtained. Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, subject matter experts (SMEs), consultants and related key executives from major companies and organizations operating in the display market. Several primary interviews have been conducted with experts from both demand and supply sides across 4 major regions: North America, Europe, APAC, and RoW (Middle East, South America, and Africa). Approximately 20% and 80% of the primary interviews have been conducted with parties from demand and supply sides, respectively. This primary data has been collected through questionnaires, e-mails, and telephonic interviews. Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches, along with several data triangulation methods, have been used to estimate and validate the size of the high-speed camera market and other dependent submarkets. The key players in the market have been determined through primary and secondary research. This entire research methodology involves the study of the annual and financial reports of the top market players and extensive interviews with the industry experts, such as CEOs, vice presidents, directors, and marketing executives, for both qualitative and quantitative key insights related to the high-speed camera market.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the market segments covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in the report.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. The data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market size has also been validated using both top-down and bottom-up approaches.

Report Objectives

- To describe and forecast the high-speed camera market, in terms of value, based on usage, frame rate, resolution, throughput, component, spectrum, and application

- To describe and forecast the high-speed camera market, in terms of volume, based on usage, frame rate, resolution, throughput, spectrum, and application

- To describe and forecast the high-speed camera market, in terms of value and volume, with respect to 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the high-speed camera market

- To provide a detailed overview of the supply chain of the high-speed camera ecosystem

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments of the market

- To benchmark the market players using the proprietary, company evaluation matrix framework, which analyzes the market players on various parameters within the broad categories of business strategy excellence and strength of product portfolios

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with a detailed competitive landscape of the market

- To analyze competitive developments such as acquisitions, product launches, partnerships, expansions, and collaborations undertaken in the high-speed camera market

Available customizations:

With the given market data, MarketsandMarkets offers customizations based on the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in High-speed Camera Market

does this report provide application wise product analysis for Indian market

I would like to understand the commercial market for innovative technologies in this space

What are the market sizing and segmentation provided for low and mid end market