The study involved four major activities in estimating the current size of the image sensor market. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Various secondary sources have been referred to in the secondary research process to identify and collect information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain critical information about the industry’s supply chain, the market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), regional markets, and key developments from market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

List of major secondary sources

Primary Research

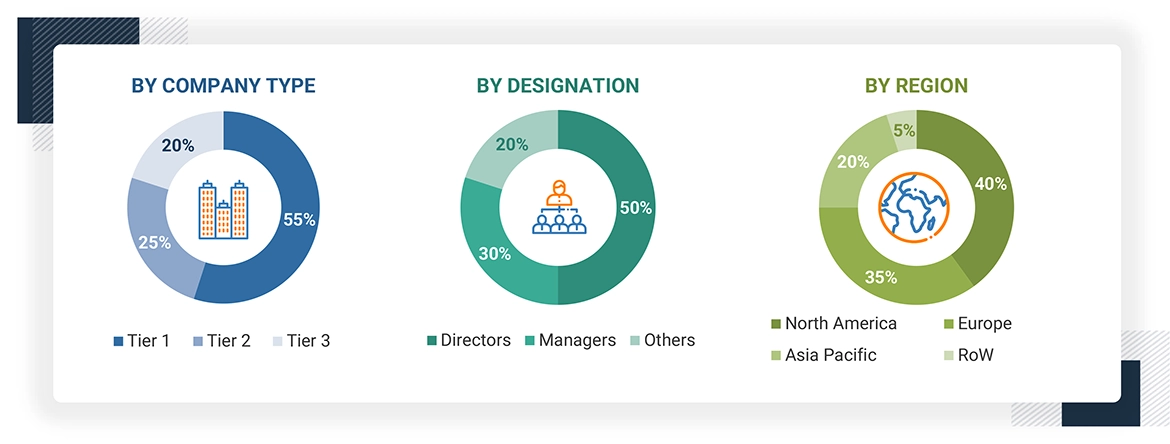

Extensive primary research was conducted after gaining knowledge about the current scenario of the image sensor market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

Note: Other designations include technology heads, media analysts, sales managers, marketing managers, and product managers.

The three tiers of the companies are based on their total revenues as of 2023 ? Tier 1: USD 1 billion, Tier 2: USD 500 million–1 billion, and Tier 3: USD 500 million.

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the complete market engineering process, top-down and bottom-up approaches and several data triangulation methods have been used to estimate and forecast the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources. All the parameters affecting the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report. The following figure represents this study’s overall market size estimation process.

Bottom-Up Approach

-

Identifying various applications of image sensors

-

Analyzing the penetration of each type of image sensor technology through secondary and primary research

-

Analyzing the penetration of image sensors for different applications and verticals through secondary and primary research

-

Conducting multiple discussion sessions with key opinion leaders to understand the detailed working of image sensor and their implementation in multiple applications; this helped analyze the break-up of the scope of work carried out by each major company

-

Verifying and cross-checking the estimates at every level with key opinion leaders, including CEOs, directors, operation managers, and finally with MarketsandMarkets domain experts

-

Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

-

Focusing initially on the top-line investments and expenditures made in the image sensor market; further, splitting the key market areas based on types, processing techniques, spectrum, imaging types, array types, resolutions, end users, and regions, as well as listing the key developments

-

Identifying all leading players and applications in the image sensor market based on region through secondary research, and fully verifying them through a brief discussion with industry experts

-

Analyzing revenues, product mix, geographic presence, and key applications served by all identified players to estimate and arrive at percentage splits for all key segments

-

Discussing splits with industry experts to validate the information and identify key growth pockets across all key segments

-

Breaking down the total market based on verified splits and key growth pockets across all segments

Image Sensors Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained in the previous section, the total market was split into several segments and subsegments. The data triangulation procedure was employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides, and the market size was validated using top-down and bottom-up approaches.

Lois

Aug, 2018

May I speak with the Analyst to get a better understanding for the breadth and depth of information you provide in this report?.

Lois

Aug, 2018

I would like to speak to an analyst to understand the scope and research methodology of the report and also can I get an sample for same market..

Sam

Apr, 2022

Image Sensor market will be driven by the increasing demand for high-resolution imaging in smartphones, tablets, and laptops. One of the key trends driving the market growth is the increasing adoption of CMOS image sensors..

Chrisy

Feb, 2019

We are an image sensor technology licensing company and interested to understand image sensor market in more detail. .

Vladimir

Feb, 2013

Interested to understand the global trends in the image sensor market over the next 5-10 years and the major players in this space. .

Charles

Oct, 2013

Is it possible to receive a copy of the report while waiting for the customized version? .

User

Jan, 2022

I would like to buy this report..

Mike

Apr, 2015

How supply chain shift of manufacturing companies from China to other countries will affect the market growth?.

Simon

Feb, 2015

How the adoption of embedded vision processors in semiconductors for use in automotive, smart phones, wearables, IP surveillance, robotics will impact the image sensor market ? .

Megan

Aug, 2017

I am a student and am working on a project to build a CMOS wafer fab. Part of the project is a market survey, which is why I am making this request. Let me know if there are any other documents you think might be helpful to me, that I can access..