The research study involved 4 major activities in estimating the size of the home automation system market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s supply chain, the pool of key market players, market segmentation according to industry trends, regional outlook, and developments from both market and technology perspectives.

In the home automation system market report, the global market size has been estimated using both the top-down and bottom-up approaches, along with several other dependent submarkets. The major players in the market were identified using extensive secondary research, and their presence in the market was determined using secondary and primary research. All the percentage shares splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Primary Research

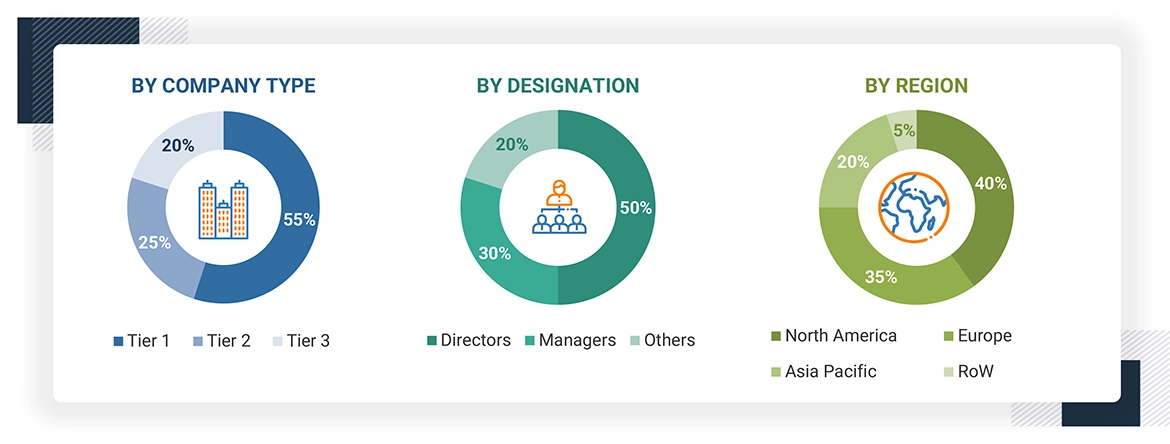

Extensive primary research has been conducted after understanding the home automation system market scenario through secondary research. Several primary interviews have been conducted with key opinion leaders from both demand- and supply-side vendors across 4 major regions— North America, Europe, Asia Pacific, and the Rest of the World. Approximately 25% of the primary interviews have been conducted with the demand-side vendors and 75% with the supply-side vendors. Primary data has been collected mainly through telephonic interviews, which consist of 80% of the total primary interviews; questionnaires and emails have also been used to collect the data.

After successful interaction with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings of our primary research. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the report. The breakdown of primary respondents is as follows:

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches, along with data triangulation methods, have been used to estimate and validate the size of the home automation and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

-

Identifying top-line investments and spending in the ecosystem and considering segment-level splits and major market developments

-

Identifying different stakeholders in the home automation system market that influence the entire market, along with participants across the supply chain

-

Analyzing major manufacturers and solution providers in the home automation system market and studying their solutions and service portfolios

-

Analyzing trends related to the adoption of home automation solutions and services

-

Tracking recent and upcoming market developments, including investments, R&D activities, solution launches, collaborations, acquisitions, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

-

Carrying out multiple discussions with key opinion leaders to identify the adoption trends of home automation systems

-

Segmenting the overall market into various other market segments

-

Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Home Automation System Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the home automation system market.

Daniel

Jan, 2014

I am interested to know ongoing trends in home & building automation industry. Also, the difference between IP-based systems versus vintage proprietary closed systems like BACnet, LON, Crestron, AMX, etc..

Sureshchandra

Jun, 2014

We are in the field of security control and home automation solutions as system integrators .We are interested to have idea of market potential globally..

Benedikt

Nov, 2012

I am interested to know, what are the key players and new entry players strategies in home automation market..

Mark

Jul, 2015

Interested in data such as market forecast by solutions, competitive trends , key competitors, installation or purchase type in Canadian home automation market..

Michael

Sep, 2011

I would like to have a call to understand the data sources and methodology used, and overview of your research needs. When would you be available for a call? .

Girish

Feb, 2014

I am doing a project in the field of home automation, as part of that I needed some idea about the industry, trends and major challenges related to home automation. Any assistance will be greatly appreciated!.

Bruno

Oct, 2016

We are interested to publish an article related to home automation in our upcoming month issue, so can you share a detailed summary or article on same?.

smruti

Nov, 2017

After implementing artificial intelligence, What are the future impacts on the demand of home automation solutions?.

User

Sep, 2019

I am interest to understand the home automation system market. Also, want to understand the company profiles of leading players with focus on their annual turnover ?.

Barb

Jul, 2015

Table of Contents suggests the report gives a breakdown of regions, one of which is North America which includes Mexico. But does it lump Mexico in with North America? Or does the report give the market size in Mexico, US, and Canada broken down by country? .

Sameh

Jun, 2014

I am doing a research on the strategies of key players in home automation or smart home market, so will be interested in the analysis of the 20 key players in this market..

Roberto

Jan, 2015

We are manufacturing HAVC & Lighting Control and interested in a depth market analysis for entering in the US home automation market. .

Connor

Mar, 2014

Can you provide the data related to the upcoming products in retrofit window coverings and lighting devices market, which will easily integrated with home automation systems?.

Michael

Feb, 2013

HI, I am a university researcher and working on the home automation market for a research purpose. Would it be possible to get a copy of this report? .

Michael

Feb, 2013

I am an university student and doing research on the home automation market. Would it be possible to get understanding on same? Please let me know, if you can share some insights. .

Michael

Dec, 2013

We are performing a market assessment on the US smart homes We are interested in penetration growth and ARPU growth by product type (e.g. monitored home security, HVAC management, lighting control, access control, etc.). We're also interested in customer purchasing preferences (DIY vs. professional install) and who is best positioned to win in this space . We're comparing our products with some of competitors, so any information you can provide about the competitors strategies related to this market. Also, we're heavily budget constrained, so I'd be interested in whatever price breaks you can provide as well..

User

Sep, 2019

till what extend , the growth of IoT based solutions will drive the growth for home automation system market . Also, there is any role of AI in this market? If, yes then what is that. .

HEMANTH

Jul, 2018

Can I get access for the details of the value chain of the home automation system market present in the report. I will cite the source in my research document with the analyst views..

Eduardo

Nov, 2011

I am a Portuguese student. I am Studying Network Communications, and at the moment writing a thesis whose subject is home automation using wireless sensor networks. This report seems interesting for my research. .

Manuel

May, 2015

I'm developing home connected products using Internet of things technology. While we launch our products into the market, I would like to study a little the home automation market globally..

User

Sep, 2019

Would like to know market opportunities for home automation systems and government regulations for the Middle Eastern counties? Also, the cost of these home automation solutions in this region?.

Sureshchandra

Aug, 2014

US is the leader in the smart home market. How do you look towards the market in Middle East, and use of home automation solutions in this region? Have you provided the estimates for solutions in this region?.

Wolfgang

Jul, 2015

Interested in global home automation market overview with emphasis on control technologies and interfaces (remote access & control). .

nathan

Mar, 2016

I am a college student and require to do market research for home automation Solutions. Can you help me to understand the market? .

nathan

Mar, 2016

till what extend, the growth of IoT based solutions will drive the growth for home automation system market. Also, there is any role of AI in this market. If, yes then what is that?.

joydip

Feb, 2015

Are we getting a report with editable MS Excel calculation sheet to understand the market for home automation? .

nello

Dec, 2018

Please help me with research methodology of home automation systems market calculations? Also, the market share for the key players who deal in home automation market?.

User

Nov, 2019

Please help me with research methodology of home automation systems market calculations? Also, the market share for the key players who deal in home automation market ?.

Tom

Nov, 2016

Our client is dealing in window & door automation and energy saving solutions for home automation. We are currently focusing on partnerships with strategic entities in the "smart home "market , any specific marketing, media or consumer sales info related to market will help us to target the correct ones. .

Manuel

Nov, 2019

I am interest to understand the home automation system market. Also, want to understand the company profiles of leading players with focus on their annual turnover. .

Connor

Nov, 2014

We are focusing on home automation devices that aren't necessarily part of centralized hub controllers. Also, the market for devices designed by third parties that integrate with home automation systems. .

Adeleke

Oct, 2019

I need information regarding the current size and potential of the home automation market in Nigeria and West Africa..

Leandro

Sep, 2019

I am planning to enter in the home automation business, so I need more information to analyze the market. .

Sreepriya

Sep, 2022

We are manufacturers in this segment and would like to understand more about the industry. .

Victor

Sep, 2013

till what extend, the growth of IoT based solutions will drive the growth for home automation system market. Also, there is any role of AI in this market? If, yes then what is that. .

Victor

Sep, 2013

Is this study will help to compare the energy savings of traditional renovation methods and demand side management implementation in buildings? Also, there is any market share for the retrofit installations of home automation solutions?.

Leor

Aug, 2019

I am interested in the market share and role of Creston System in home automation market. Do you provide the details as customization?.

Greg

Jul, 2014

Is it possible to buy a section of the report or profiles on specific companies contained with in the report? Our project doesn't have much budget, but it might be helpful to get useful insights about the key players of home automation market. .

glenn

Jul, 2019

Intending to research on publicly-traded and private, middle-market firms who are focused in these aforementioned markets. Can MarketsandMarkets provide the information? .

Christopher

Jun, 2017

I am interested specifically in the growth in terms of the African market and more specifically the SADC member states aiming specifically at Domestic Garage and Gate Acres and security. .

Stephen

Jun, 2013

Would like to know market opportunities for home automation systems and government regulations for the Middle Eastern counties? Also, the cost of these home automation solutions in this region?.

Jevon

May, 2013

I am interested in lighting control, HVAC control, and Security solutions mentioned in this study. .

dario

May, 2015

Can I get a separate study related to Italian home automation market? .

User

Mar, 2019

Is this study will help to compare the energy savings of traditional renovation methods and demand side management implementation in buildings? Also, there is any market share for the retrofit installations of home automation solutions?.