In-Vehicle Infotainment Market Size, Share & Analysis

In-vehicle Infotainment Market by Component (Infotainment Unit, HUD, Passenger Display, Digital IC), Application (Navigation, VPA, App Store, Music, Rear Seat), OS, Connectivity, Form Factor, Display Size, Location, ICE & EV, and Region – Global Forecast to 2032

OVERVIEW

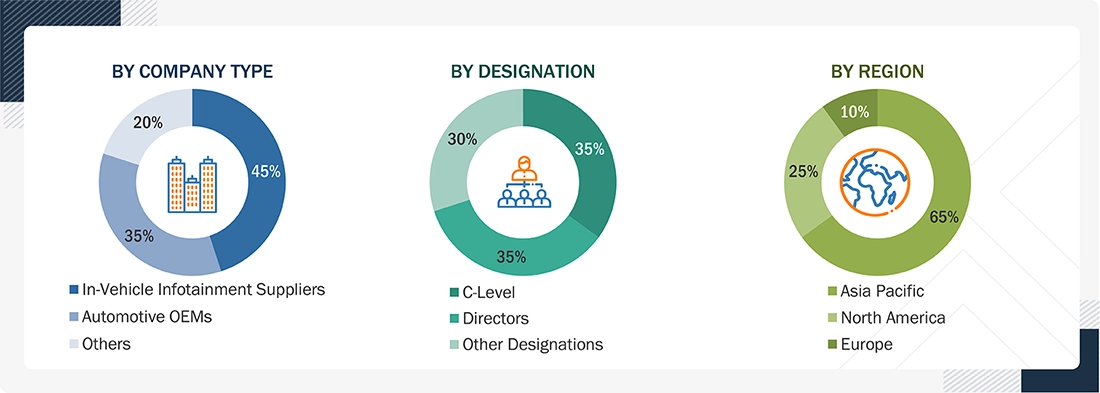

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The in-vehicle infotainment market is projected to reach USD 40.49 billion by 2032, growing from USD 23.07 billion in 2025 at a CAGR of 8.4% from 2025 to 2032. Advanced In-Vehicle Infotainment (IVI) is rapidly evolving, owing to primary HMI driven by software-defined vehicles, zonal architectures with Ethernet backbones, and high-bandwidth integration of ADAS/sensor data on GPU-accelerated displays. This transformation is accelerated by Android Automotive OS, containerized UX, seamless OTA updates, and app-ecosystem feature unlocks, enabling shorter development cycles and continuous revenue-generating functionality.

KEY TAKEAWAYS

-

By RegionThe Asia Pacific in-vehicle infotainment market is estimated to be the largest market in 2025. It is estimated to contribute more than 45% of the revenue share in 2025.

-

By ComponentThe head-up display segment is projected to register the highest CAGR (15.6%) during the forecast period.

-

By ICE Vehicle TypeThe heavy commercial vehicle segment is projected to grow at the highest rate from 2025 to 2032.

-

Retrofit Market, By Vehicle TypeThe passenger car segment is projected to dominate the in-vehicle infotainment market during the forecast period.

-

By ApplicationThe rear seat segment is projected to grow at the highest rate during the forecast period.

-

By LocationThe front row segment is projected to dominate the market, growing at the highest CAGR of 5.2%.

-

By ConnectivityThe 5G segment is projected to register the highest growth (25.9%) during the forecast period.

-

By Operating SystemThe Android segment is projected to grow at the highest rate from 2025 to 2032.

-

By Form FactorThe embedded segment is projected to dominate the car infotainment market during the forecast period.

-

By Display SizeThe > 10" segment is projected to grow at the highest rate during the forecast period.

-

Electric Vehicle Market, By Vehicle TypeThe battery electric vehicle segment is projected to grow at the highest CAGR (14.2%) during the forecast period.

-

Competitive LandscapeCompany Harman International (US), Alps Alpine Co Ltd (Japan), and Panasonic Corporation (Japan) were identified as some of the star players in the in-vehicle infotainment market (global), given their strong market share and product footprint.

-

Competitive LandscapeCompanies Denso Corporation (Japan), Hyundai Mobis (South Korea), and Desay SV Automotives (China), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The in-vehicle infotainment market is experiencing steady growth, driven by the rising demand for connected vehicles, larger touchscreen interfaces, and integrated navigation, media, and telematics functions. Automakers are increasingly adopting advanced digital cockpit platforms to meet evolving safety, connectivity, and software requirements. New partnerships among OEMs, Tier-1 suppliers, and chipset providers, along with investments in 5G integration, Android Automotive OS, and OTA-enabled architectures, are reshaping the competitive landscape and accelerating the shift toward software-defined infotainment systems.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The present revenue is generated from traditional head units, basic audio systems, wired connectivity modules, and conventional HMI controls. In future, it is expected to generate from software-defined platforms, OTA service models, feature-on-demand offerings, HUDs, and domain controllers. The technologies/applications used would include centralized compute, OTA frameworks, advanced HMI modules, AR-enabled HUDs, and integrated digital service ecosystems. The impact of adjacent factors impacting revenue is expected to include strong connectivity infrastructure, safety regulations pushing compute consolidation, and rising demand for connected services that support recurring monetization.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Expansion of connected and intelligent in-cabin ecosystems enhancing safety, comfort, and experience

-

Increase in demand for rear-seat entertainment

Level

-

Additional cost of annual subscriptions in infotainment systems

-

Lack of seamless connectivity

Level

-

Government mandates on telematics and e-call services

-

Emergence of technologies like 5G and AI

Level

-

Cybersecurity challenge

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increase in demand for rear-seat entertainment

The in-vehicle infotainment sector is witnessing a rising demand for rear-seat entertainment as consumers expect richer digital experiences inside vehicles. Automakers are integrating high-resolution touch displays, streaming platforms, gaming support, and multi-device connectivity to enhance passenger comfort and differentiate premium trims.

Restraint: Lack of seamless connectivity

Lack of seamless connectivity remains a structural restraint as variable 4G/5G coverage, network dropouts, and limited bandwidth undermine the reliability of cloud services, streaming, and real-time navigation. In markets with uneven telecom infrastructure, OEMs cannot guarantee consistent digital experiences, reducing consumer acceptance of advanced infotainment functions and slowing the shift toward fully connected vehicle platforms.

Opportunity: Government mandates on telematics and e-call services

Government mandates on telematics and e-call services are accelerating the adoption of advanced infotainment architectures, particularly in Europe, China, and emerging Asia. Regulations requiring automatic emergency response, location sharing, and real-time diagnostics are pushing OEMs to embed compliant, connected platforms across vehicle segments. These mandates create a scalable pathway for integrating richer infotainment features, expanding data-driven services, and strengthening the transition toward software-defined, safety-anchored vehicle ecosystems. Regulations mandating eCall, ADAS, and AEB position the IVI unit as the core interface for safety alerts, emergency communication, and driver feedback. This drives demand for higher connectivity, faster processing, and integrated telematics, creating a clear growth opportunity for advanced, safety-linked infotainment systems.

Challenge: Cybersecurity challenge

The shift toward connected and software-defined infotainment has intensified cybersecurity risks, exposing vehicles to potential breaches across cloud links, apps, and in-car networks. Rising attack surfaces, uneven security standards, and dependency on third-party integrations create vulnerabilities that can disrupt services or compromise user data. Ensuring end-to-end protection while managing compliance and upgrade costs has become a critical challenge for OEMs and suppliers as digital features scale across global vehicle platforms.

IN-VEHICLE INFOTAINMENT MARKET SIZE, SHARE & ANALYSIS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Integration of next-gen curved infotainment display and OS 9 in 2024–2025 i series models, combining navigation, media, and ADAS data into a unified cockpit | Faster UI response, reduced driver distraction, improved personalization, and seamless OTA feature upgrades |

|

Deployment of the ccIC (connected car Integrated Cockpit) architecture in 2025 EV and ICE models, merging cluster, infotainment and telematics into a single high-compute domain | Lower system complexity, reduced hardware cost, enhanced real-time connectivity, and upgraded safety compliance |

|

Use of MBUX Superscreen and AI-powered interface in EQ electric models and new 2025 premium sedans | Higher consumer engagement, adaptive voice control, better rear-seat digital experience, and stronger luxury differentiation |

|

Rollout of large-format infotainment systems with Google-embedded services across 2024–2025 global models | Improved navigation accuracy, faster cloud-based search, reduced software fragmentation, and easier OTA maintenance |

|

Supply of Android Automotive-based infotainment head units for 2024–2025 mass-market vehicles across Europe and Asia | Scalable software platform, lower development time for OEMs, and increased compatibility with third-party apps and services |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The in-vehicle infotainment market ecosystem includes component & system manufacturers (Qualcomm, NVIDIA, MediaTek), infotainment platform & module manufacturers (Harman, Bosch, Continental, LG Electronics, Panasonic Automotive), telematics & software providers (TomTom International, HERE Technologies, Garmin, Google), and end users (Toyota, Hyundai, BMW, General Motors). Hardware elements, such as displays, domain controllers, and connectivity modules, are integrated with operating systems and software platforms to create digital cockpit systems for passenger and commercial vehicles. End users drive requirements for connectivity, personalization, and regulatory compliance, while manufacturers deliver high-compute, software-defined infotainment solutions that enable real-time navigation, media, and telematics. Collaboration across the value chain remains central to innovation and market expansion in 2025.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

In-Vehicle Infotainment Market, By Connectivity Type

In 2024, the 3G/4G segment accounted for the largest share of the in-vehicle infotainment market due to its wide network availability, low integration cost, and strong compatibility with existing telematics architectures across mass-market and mid-segment vehicles. The technology’s maturity, proven reliability for real-time navigation, OTA updates, e-call services, and cloud-based media functions, along with established partnerships between OEMs, Tier-1 suppliers, and telecom operators, reinforces its broad adoption. 4G remains the operational baseline for IVI, while 5G is scaling fastest in North America, China, Korea, Japan and Western Europe, creating tiered regional readiness for high-value connected services. OEMs are aligning product roadmaps around multi-mode 4G/5G platforms, eSIM provisioning and edge-cloud integration to secure consistent service delivery, unlock new revenue models and future-proof vehicles for C-V2X and 5G-Advanced deployments.

In-Vehicle Infotainment Market, By Location

In 2024, the front row segment accounted for the largest share of the in-vehicle infotainment market due to its central role in vehicle operation, higher installation rates across all vehicle classes, and regulatory requirements. Front-row systems are widely used because they integrate essential features, such as real-time navigation, ADAS visualizations, HVAC controls, smartphone connectivity, and vehicle diagnostics functions that are mandatory in ICE and EV platforms. The segment's dominance is further reinforced by rapid advancements in cockpit technologies, including larger curved displays, high-resolution touch interfaces, domain-controller architectures, and deeper integration of Android Automotive OS and AI-based voice assistants. These innovations enhance driver usability, reduce system latency, and support OTA software upgrades, ensuring that front-row infotainment remains the core digital interface within modern vehicles. Front-row systems in economy models stay within 7–8 inches with essential controls, while mid and luxury segments expand to 10–30 inches with multi-display layouts. Rear-row setups follow the same tiering, scaling from basic 7–9 inch entertainment screens to larger, high-resolution units with individualized control. Both front and rear domains draw from shared ADAS and telematics data pipelines, enabling synchronized alerts, routing context, and connectivity features across the cabin, reinforcing a unified software-driven interaction model.

In-Vehicle Infotainment Market, By Operating System

In 2024, the Android segment accounted for the largest share of the in-vehicle infotainment market driven by its open-source architecture, lower development cost, and strong ecosystem support from global automakers and software partners. Android is widely used because it enables fast customization, seamless integration of Google services, and broad compatibility with third-party applications, making it suitable for both mass-market and premium vehicle segments. Its dominance is further reinforced by rapid advancements in Android Automotive OS, including deeper vehicle-level integration, improved security layers, enhanced HMI frameworks, and over-the-air update capabilities that allow continuous feature enhancements without hardware changes. These technology improvements solidify Android as the preferred operating system in modern infotainment platforms.

In-Vehicle Retrofit Infotainment Market, By Vehicle Type

In 2024, the passenger car segment is projected to lead the in-vehicle infotainment market during the forecast period. The growth of the market is supported by higher vehicle production volumes, stronger consumer demand for connected features, and rapid adoption of digital cockpits across compact, mid-size, and premium models. Passenger cars widely use infotainment systems because they integrate essential real-time navigation, media streaming, smartphone connectivity, and ADAS-linked displays that shape the core user experience in both ICE and electric platforms. The segment’s dominance is further reinforced by advancements, such as larger high-resolution touchscreens, integrated cluster-infotainment architectures, Android Automotive-based systems, AI-enabled voice assistants, and OTA-upgrade capabilities that enhance functionality throughout the vehicle lifecycle. These continuous technology improvements strengthen the segment’s leading position in the global in-vehicle infotainment market.

REGION

Asia Pacific to be fastest-growing region in global in-vehicle infotainment market during forecast period

Asia Pacific is projected to record the highest growth in the in-vehicle infotainment market during the forecast period. The growth of the region is supported by rapid expansion in vehicle production, rising penetration of connected and software-defined vehicles, and accelerated EV adoption across China, India, Japan, and South Korea. Automotive OEMs in the region are increasingly integrating high-compute infotainment platforms, large touchscreen displays, and embedded navigation and telematics systems to enhance user experience and comply with evolving digital and safety standards. Government-led initiatives in digital mobility, 5G deployment, and smart-city programs are further strengthening the adoption of connected infotainment technologies. Growing consumer demand for real-time navigation, streaming, smartphone integration, and personalized interfaces is amplifying the need for advanced infotainment systems across mass-market and premium vehicle segments in Asia Pacific.

IN-VEHICLE INFOTAINMENT MARKET SIZE, SHARE & ANALYSIS: COMPANY EVALUATION MATRIX

In the in-vehicle infotainment market evaluation matrix, Harman International (Star) leads with strong market share and a broad technology footprint, supported by its advanced digital cockpit platforms, audio systems, and Android Automotive-based solutions widely adopted across global OEMs in 2024–2025. Pioneer Corporation (Emerging Leader) is gaining momentum with its expanding infotainment portfolio, including modular head units, integrated navigation systems, and connectivity solutions tailored for mid-segment and aftermarket demand. While Harman maintains its leadership through scale, software depth, and long-term OEM partnerships, Pioneer shows clear potential to advance toward the leaders’ quadrant as demand rises for flexible, cost-optimized infotainment platforms across emerging markets.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Alps Alpine Co., Ltd. (Japan)

- Garmin (Switzerland)

- Pioneer Corporation (Japan)

- Harman International (US)

- Panasonic Corporation (Japan)

- Robert Bosch LLC (Germany)

- Mitsubishi Electric Corporation (Japan)

- TomTom International BV (Netherlands)

- Continental AG (Germany)

- Visteon Corporation (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 21.05 Billion |

| Market Size in 2032 (Value) | USD 40.49 Billion |

| Growth Rate | CAGR of 8.4% from 2025–2032 |

| Years Considered | 2021–2032 |

| Base Year | 2024 |

| Forecast Period | 2025–2032 |

| Units Considered | Value (USD Billion), Volume (Thousand Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Rest of the World |

WHAT IS IN IT FOR YOU: IN-VEHICLE INFOTAINMENT MARKET SIZE, SHARE & ANALYSIS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Automotive OEM |

|

|

| Tier 1 Infotainment System Manufacturer |

|

|

| Semiconductor Supplier (Chipset Vendor) |

|

|

| Navigation/Telematics Provider |

|

|

| Aftermarket Infotainment Manufacturer |

|

|

RECENT DEVELOPMENTS

- August 2025 : Alps Alpine Co., Ltd. launched this compact 2-pole 2-position switch for electric parking brakes, featuring silent operation (5dB quieter), 50% width reduction (W6.3×D8.5×H7.0 mm), 1.8N actuating force, IP6K7 protection, and 300,000-cycle durability for enhanced vehicle layout flexibility and EV compatibility .

- June 2025 : Garmin launched Trend 2 Overland Edition, an 8-inch ultrabright, glove-friendly touchscreen off-road navigator with IP67 rating, turn-by-turn trail navigation, topographic maps for North/South America, custom street routing, satellite imagery, and compatibility with inReach for satellite communication in extreme conditions.

- January 2025 : Pioneer Corporation launched an immersive in-vehicle audio system integrating Apple CarPlay with Spatial Audio and Dolby Atmos, using only 4 discrete amplifier channels and existing front/rear speakers for aftermarket and OEM applications, demonstrated in a mid-size sedan at CES 2025 ?.

Table of Contents

Methodology

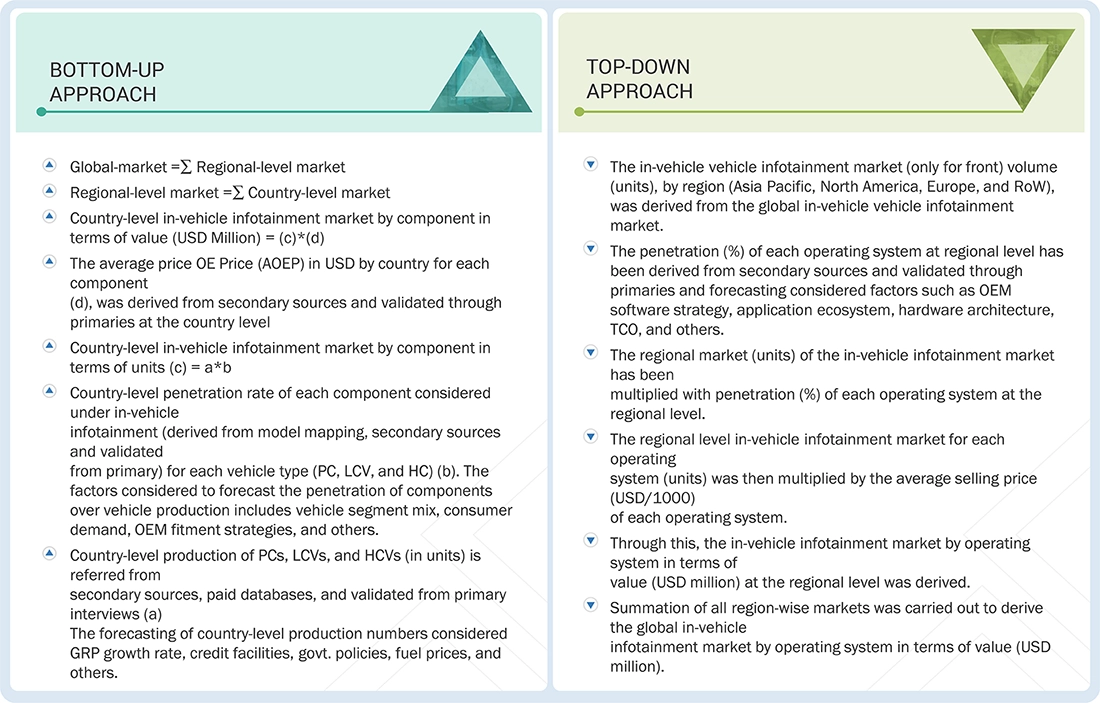

The study involves the use of four main activities to estimate the current size of the in-vehicle infotainment market. Exhaustive secondary research was conducted to gather information on the market segments based on component, operating system, location, connectivity, application, form factor, display size, retrofit by vehicle type, electric by vehicle type, ICE vehicle type, and region. The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research. Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The secondary sources referred to the in-vehicle infotainment system market is directly dependent on vehicle production volume, which is derived through secondary sources, such as automotive industry organizations [Organisation Internationale des Constructeurs d'Automobiles (OICA)], publications from government sources [country-level automotive associations and organizations, Organisation for Economic Co-operation and Development (OECD), EV Volumes, Marklines, SIAM and others], corporate filings (such as annual reports, investor presentations, and financial statements); and trade & paid repository. Historical production data has been collected and analyzed. The industry trend is considered to inform the forecast, which is further validated by primary research.

Primary Research

During the primary research process, various primary sources from the supply and demand sides were interviewed to gather qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, Vice Presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, as well as key opinion leaders, were also interviewed.

Primary interviews have been conducted to gather insights, including vehicle production forecasts, in-vehicle infotainment system market forecasts, future technology trends, and upcoming technologies in the in-vehicle infotainment system market. Data triangulation was conducted across all these points using information gathered from secondary research and model mapping. Stakeholders from the demand and supply sides have been interviewed to understand their views on the aforementioned points. These interviews have been conducted with market experts from the demand side (original equipment manufacturers, or OEMs) and supply side (in-vehicle infotainment system solution and service providers) players across four major regions, namely North America, Europe, Asia Pacific, and the Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply sides, respectively. The data has been collected through questionnaires, emails, and telephonic interviews. After interacting with industry experts, brief sessions with highly experienced independent consultants have been conducted to reinforce the findings from primaries. This, along with the opinions of our in-house subject matter experts, has led us to the conclusions described in the remainder of this report.

• **Others include Sales, Marketing, and Product Managers.

• Other Designations include Infotainment Component and Technology Providers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was employed to estimate and validate the value of the in-vehicle infotainment system market, as well as its dependent submarkets, as outlined below. The following considerations were made:

The research methodology used to estimate the market size also includes the following details:

- Key players in the in-vehicle infotainment system market were identified through secondary research, and their global market ranking was determined through primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports and regulatory filings of significant market players (public), as well as interviews with industry experts for detailed market insights.

- All vehicle-level penetration rates, percentage shares, splits, and breakdowns for the in-vehicle infotainment system market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain validated and verified quantitative and qualitative data.

- The market data gathered was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

The bottom-up approach has been used to estimate and validate the size of the global market. The market size for components, by volume, of the in-vehicle infotainment system market has been derived by multiplying the penetration rate of each component considered under in-vehicle infotainment systems by the production numbers for PCs, LCVs, and HCVs. Country-level, model-wise mapping has been conducted to identify vehicle models equipped with infotainment systems and related components. Industry experts have further validated this information.

The forecasting of country-level vehicle production considered the analysis of distinct growth vectors, including GDP growth and overall economic outlook, interest rates & vehicle financing availability, government policies & incentives, international trade policies, fuel prices, and others. The installation rate of in-vehicle infotainment components has been implemented by vehicle type for a particular country, considering forecasting factors, which included vehicle segment mix (Entry vs. mid vs premium), OEM feature strategy (Standard vs. optional content), IVI system cost trends & compute availability, consumer demand for connected and digital features, and others. This method will yield the volume of infotainment components at the country level. The next step involved multiplying the volume of components by vehicle type and their respective average OE pricing to generate the country-level market by vehicle type and component. The summation of volume and value for the country-level market provides a regional market, which is then broken down into a global infotainment system market, categorized by component in terms of volume and value. The findings are then verified with various industry participants. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and is presented in this report.

The top-down approach has been employed to calculate the market for in-vehicle infotainment systems by operating system and connectivity type. The global market for infotainment systems has been segmented by region based on the penetration of specific operating systems and connectivity within each region. These findings are further discussed with primary respondents to validate the data, assumptions, penetrations, and factors that will affect the market in the future.

In-Vehicle Infotainment Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall size of the small satellite market from the estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the small satellite market size was validated using the top-down and bottom-up approaches.

Market Definition

The in-vehicle infotainment market encompasses a digital device that integrates navigation, media, communication, and connected services into a single interface, serving as the primary software layer connecting users with their vehicle. As OEMs shift toward software-defined architectures, infotainment systems have become a core control point for user experience, data services, and recurring revenue models, positioning them as a strategic pillar in next-generation vehicle programs.

Key Stakeholders

- In-vehicle Infotainment system manufacturers

- Parts and component suppliers

- Automotive OEMs

- Automotive Association and Regulatory Bodies

- Infotainment service providers

- Fleet owners

- Telecom companies

Report Objectives

-

-

To define, describe, and forecast the in-vehicle infotainment market in terms of value (USD million) and volume (thousand units), based on the following segments:

- By ICE Vehicle Type [Passenger Car, Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV)]

- By Component (Infotainment, Passenger Display, Digital Instrument Cluster, and Head-Up Display)

- By Operating System (Android, Linux, QNX, and Others)

- By Application [Navigation, Virtual Personal Assistant (VPA) Application, App Store, Music, and Rear Seat]

- By Location (Front Row and Rear Row)

- By Connectivity (3G/4G and 5G)

- By Form Factor (Embedded, Tethered, and Integrated)

- By Display Size (< 5”, 5–10”, and > 10”)

- Retrofit Market, By Vehicle Type (Passenger Car and Commercial Vehicle)

- Electric Vehicle, By Vehicle Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, and Fuel-Cell Electric Vehicle)

- By Region (Asia Pacific, Europe, North America, and RoW)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the in-vehicle infotainment market

- To analyze the market ranking/share of key players operating in the in-vehicle infotainment market

- To understand the dynamics of the in-vehicle infotainment market competitors in terms of hardware and software providers, and distinguish them into visionary leaders, innovators, emerging companies, and dynamic differentiators according to their product portfolio and business strategy

- To analyze recent developments, collaborations, joint ventures, mergers & acquisitions, product launches, and other activities carried out by key industry participants in the in-vehicle infotainment market

- To determine the average selling price (ASP) of in-vehicle infotainment and analyze revenue-missed scenarios

- To determine pessimistic scenarios, most likely scenarios, and optimistic scenarios related to the in-vehicle infotainment market

- To give a brief understanding of the in-vehicle infotainment market in the recommendations chapter

-

To define, describe, and forecast the in-vehicle infotainment market in terms of value (USD million) and volume (thousand units), based on the following segments:

Available customizations:

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs. The following customization options are available:

- In-Vehicle Infotainment Market, By Display Type, at the Country Level (For Countries Covered in the Report)

- In-Vehicle Infotainment Market, By Form Factor, at the Country Level (For Countries Covered in the Report)

- Company Information, Profiling of Additional Market Players (Up to 5)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the In-vehicle Infotainment Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in In-vehicle Infotainment Market

User

Aug, 2019

Do we have Mobile Audio Aftermarket Retail Tracking? Data: Brand Item Features – Blue tooth, car size, compatible OS etc Price brands .

User

Aug, 2019

Does the report have content like Market overview, PESTLE analysis, Porter Five Forces, In-car entertainment by prodcuts and applications .

User

Aug, 2019

We are working on OEM and after market strategy. Looking for what we can get from this report which can help us to validate our strategy in this area..

Nilesh

Jun, 2019

I am trying to understand the spending trends on automotive between different functions/domains like ADAS, infotainment, telematics, etc.

User

May, 2020

What are the upcoming trends in the market?.