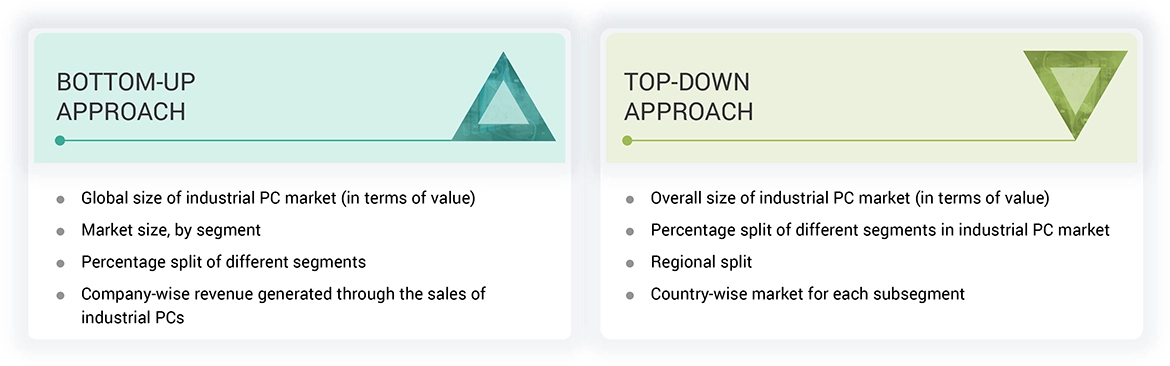

The study involves major activities for estimating the current size of the industrial PC market. Exhaustive secondary research was carried out to collect information on the market. The next step involves the validation of these findings, assumptions, and sizing with industry experts, identified in the value chain, through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information important for this study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements, press releases); trade, business, and professional associations; white papers, industrial PC-related journals, and certified publications; articles by recognized authors; gold and silver standard websites; and directories.

Secondary research was mainly conducted to obtain key information about the market value chain, the industry supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both markets- and technology-oriented perspectives. Data from secondary research was collected and analyzed to arrive at the overall market size, which was further validated by primary research.

Primary Research

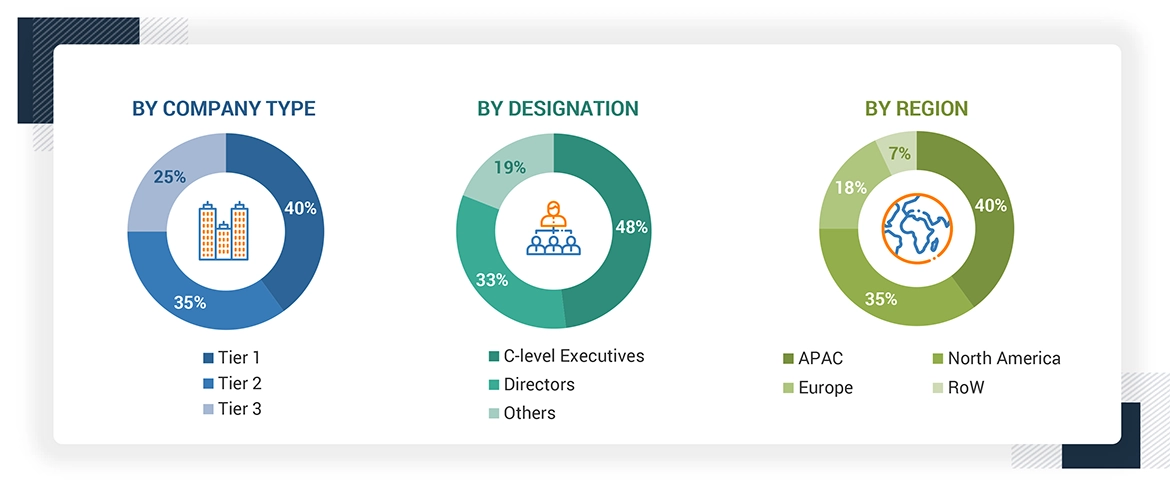

In the primary research process, various industry respondents from both supply and demand sides of the industrial PC market have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects.

Key players in the industrial PC market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

Note: The three tiers of the companies have been defined based on their total revenue as of 2021; tier 1: revenue greater than USD 1 billion, tier 2: revenue between USD 500 million and USD 1 billion, and tier 3: revenue less than USD 500 million. “Others” includes sales consultants and marketing managers.

About the assumptions considered for the study, To know download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the industrial PC market.

-

Information related to revenues obtained from key manufacturers and providers of industrial PCs has been studied and analyzed to estimate the global size of the industrial PC market.

-

The industrial PC market is expected to observe a linear growth trend during the forecast period owing to the fact that it is a mature market with a number of well-established players serving various verticals.

-

Revenue, geographic presence, and key verticals, as well as different types of offerings of all identified players in the industrial PC market, have been studied to estimate and arrive at the percentage split of different segments of the market.

-

All major players in each category (type and sales channel) of the industrial PC market have been identified through secondary research and duly verified through brief discussions with the industry experts.

-

Multiple discussions with key opinion leaders (KOLs) of all major companies developing the industrial PC have been conducted to validate the market split based on type, sales channel, end-user industry, and region.

-

Geographic splits have been estimated using secondary sources based on various factors, such as the number of players offering industrial PCs in a specific country or region and the type of industrial PCs offered by these players.

The bottom-up procedure has been employed to arrive at the overall size of the industrial PC market.

-

Information related to revenues obtained from key manufacturers and providers of industrial PCs has been studied and analyzed to estimate the global size of the industrial PC market.

-

The industrial PC market is expected to observe a linear growth trend during the forecast period owing to the fact that it is a mature market with a number of well-established players serving various verticals.

-

Revenue, geographic presence, and key verticals, as well as different types of offerings of all identified players in the industrial PC market, have been studied to estimate and arrive at the percentage split of different segments of the market.

-

All major players in each category (type and sales channel) of the industrial PC market have been identified through secondary research and duly verified through brief discussions with the industry experts.

-

Multiple discussions with key opinion leaders (KOLs) of all major companies developing the industrial PC have been conducted to validate the market split based on type, sales channel, end-user industry, and region.

-

Geographic splits have been estimated using secondary sources based on various factors, such as the number of players offering industrial PCs in a specific country or region and the type of industrial PCs offered by these players.

Data Triangulation

After arriving at the overall industrial PC market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

-

To describe and forecast the industrial PC market, in terms of value, by type, sales channel, end-user industry, and region

-

To forecast the market size, in terms of value, by region—North America, Europe, the Asia Pacific (APAC), and the Rest of the World (RoW)

-

To provide detailed information regarding market dynamics, namely, drivers, restraints, opportunities, and challenges, influencing the growth of the market

-

To provide a detailed overview of the value chain of the industrial PC ecosystem

-

To analyze probable impact of recession on the market in future

-

To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the total industrial PC market

-

To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2, along with a detailed competitive landscape for the market leaders.

-

To analyze the major growth strategies such as product launches adopted by the key market players to enhance their position in the industrial PC market.

sudheerganta

Mar, 2021

hello ,please provide details of industrial pc suitable for automated guided vehicle used in warehouse for material handling .