Large Format Printer Market Size, Share & Trends

Large Format Printer Market by Offering, Connectivity (Wired, Wireless), Technology (Ink-based, Toner-based), Printing Material, Print Width, Ink Type ( UV-Cured, Aqueous, Solvent, Latex, Dye Sublimation - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The large format printer market is expected to reach USD 10.36 billion by 2030, up from USD 7.94 billion in 2025, with a CAGR of 5.5% from 2025 to 2030. The expansion is driven by increasing demand for high-quality, customizable, and eco-friendly printing in advertising, textiles, packaging, and industrial sectors.

KEY TAKEAWAYS

- The North American large format printer market is dominating the market with a 39.3% revenue share in 2024

- By offering, after-sales services in the offering segment are expected to grow the fastest during the forecast period

- By connectivity, wireless connectivity is projected to have the highest CAGR of 5.7% during the forecast period

- By technology, ink-based technology is expected to dominate the large format printer market with a market share of 91.5% in 2025

- By application, décor application is expected to grow at the highest growth rate of 12.3% from 2025 to 2030

- HP, Canon, and Epson were identified as some of the star players in the large format printer market (global), given their strong market share and product footprint.

- HP, Canon, and Epson were identified as some of the star players in the large format printer market (global), given their strong market share and product footprint.

- Shenzhen Runtianzhi Digital Equipment Co., Ltd and Mutoh, among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized.

The large format printer industry is experiencing steady growth due to rising demand for high-quality, versatile, and eco-friendly printing solutions across the advertising, textiles, packaging, and industrial sectors. New advancements, including strategic partnerships between printer manufacturers and ink or substrate suppliers, investments in sustainable inks and energy-efficient printing systems, and innovations in high-speed, high-resolution, and multifunctional printers, are transforming the industry landscape.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The large format printer market is evolving through new technologies, affecting applications in signage & advertising, apparel & textiles, CAD & technical printing, and décor. Emerging trends generate new revenue sources, decrease reliance on traditional segments, and push clients to adapt strategies for customizable, high-quality, and efficient printing solutions.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Increasing demand for lightweight and fuel-efficient aircraft.

-

Substantial surge in outdoor advertising

Level

-

Requirement for high initial investment

Level

-

Growing adoption of large format printers in home furnishing, decor, and vehicle wrap applications

-

Rising use of large format printers in in-plant operations

Level

-

High preference for digital advertising over conventional advertising techniques

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Increased use of large format printers by textile, e-commerce, and retail companies

Large format printers help businesses in textiles, e-commerce, retail, and packaging produce customized, high-quality visuals. They improve branding through apparel, signage, packaging, and digital campaigns by providing fast turnaround times, cost savings, eco-friendly inks, and flexible designs, boosting customer engagement, setting products apart, and increasing sales in competitive markets.

Restraint: Requirement for high initial investment

The installation and operation of large format printers involve a high initial cost, which remains the main barrier to their adoption. They require various specialized substrates like vinyl, wood, magnetic sheets, and photo paper, increasing ongoing expenses. Their annual electricity consumption also tends to be high, raising long-term costs. The technical complexity of large format printers and the need for high-resolution, true-color, and clear prints further increase maintenance requirements and expenses. Additionally, different inks designed for durability, UV resistance, and accurate colors are essential for professional-grade output but often come at a premium. Despite manufacturers releasing more affordable models, the ongoing costs for consumables, service, and power still pose hurdles for many customers. Therefore, the high initial investment and consistently high operational costs are key issues that can limit the widespread use of large format printers among certain user groups and emerging markets.

Opportunity: Growing adoption of large format printers in home furnishing, decor, and vehicle wrap applications

Large format printers are quickly becoming popular in the décor industry because they can produce high-quality, vibrant images on various media. They are commonly used for personalized wallpapers, wall stickers, canvas art, vehicle wraps, as well as floor plans and interior design concepts. Offering efficiency, clarity, and perfect sizing, these printers support creative and decorative projects, with vehicle wraps providing affordable mobile advertising options and boosting market growth.

Challenge: High preference for digital advertising over conventional advertising techniques

The increasing adoption of digital technology will continue to influence the demand for large format printers. Rising demand for digital signage, digital billboards, and electronic media is driving a slowdown in the demand for traditional advertising methods. Digital signage, the leading segment within the out-of-home advertising market, encompasses various formats such as backlit digital displays, interactive LCDs, and digital point-of-sale displays. This medium is increasingly used for diverse functions, including disseminating public information, promoting restaurant menus, expanding brand visibility, and shaping consumer behavior. One key advantage of digital signage is its flexibility; advertisements can be easily modified. Dynamic digital displays can be updated in real time, managed centrally, and support interactive and immersive advertising campaigns. In contrast, traditional banners, posters, flyers, and brochures incur higher recurring costs and only convey static information. Their non-interactive nature makes them less effective in today’s fast-paced marketing environment. Consequently, the expanding trend toward digital advertising primarily challenges players in the large format printer market, especially within signage and promotional graphics segments.

Large Format Printer Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

OK To Colour, a UK-based print services provider, upgraded its operations with the Canon Colorado M3W printer developed by Canon Inc. (Japan) and supplied by CMYUK (UK). The roll-to-roll UVgel printer offered automation, low maintenance, and consistent high-quality output, helping the company enhance production speed and meet increasing market demand efficiently. | The Canon Colorado M3W improved OK To Colour’s workflow efficiency, reduced turnaround times, and delivered superior print quality with accurate color and sharp graphics. Its reliable, low-maintenance design minimized downtime, enabling the company to handle larger volumes confidently. This investment enhanced OK To Colour’s service capabilities and positioned it for sustainable growth. |

|

Simpsons Printing, facing increased demand for large-format banners, struggled with high outsourcing costs and limited control over production schedules. To bring production in-house and improve operational efficiency, the company adopted the Fujifilm Acuity Prime LED flatbed printer, made by Fujifilm Holdings Corporation (Japan). This printer offered advanced substrate handling, reliable printheads, and durable ink technology, allowing Simpsons Printing to handle high-volume orders and support long-term growth in the competitive large-format printing market. | The adoption of the Fujifilm Acuity Prime enabled Simpsons Printing to cut outsourcing costs while expanding its service offerings. The printer’s versatility supported higher production rates and handled a broader range of substrates. Reliable performance and advanced technology improved operational control, efficiency, and print quality, positioning the company for sustainable growth and increased competitiveness. |

|

Wedneshurx Commercial and Car Ltd (WCC), a UK-based print and signage company, aimed to expand into the vehicle graphics segment to meet growing demand for high-quality, durable, and visually striking wraps. To achieve this, WCC invested in the Mimaki JV300-160plus, an advanced large-format eco-solvent printer developed by Mimaki Engineering Co., Ltd. (Japan). The printer enabled in-house production, consistent results across various materials, and faster turnaround, supporting WCC’s strategic growth in the automotive and signage markets. | The Mimaki JV300-160plus helped WCC cut outsourcing costs, speed up turnaround times, and produce high-quality, vibrant prints for vehicle graphics. It enabled the launch of a dedicated vehicle graphics division, expanded service offerings, attracted new clients, and boosted the company’s competitiveness in the signage and automotive graphics market. The investment improved operational control and positioned WCC for sustainable growth. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The large-format printer ecosystem includes hardware manufacturers like Ricoh, HP Development Company, L.P., and Fujifilm Holdings Corporation, software providers such as Canon Inc. and Seiko Epson Corporation, and service providers including Xerox Corporation and Lexmark International, Inc. Together, they promote innovation, improve operational efficiency, and drive adoption across advertising, textiles, packaging, retail, and décor applications.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Large Format Printer Market, By Offering

As of 2024, printers hold the largest share of the large format printer market and are expected to maintain their dominance through 2025 due to their high resolution, versatility, and efficiency. Widely used across advertising, textiles, packaging, and décor applications, these printers provide reliable performance, quick turnaround times, and compatibility with various substrates. Technological advancements in inkjet and UV printing further improve print quality, speed, and eco-friendliness, reinforcing printers’ leading position in the market.

Large Format Printer Market, By Connectivity

As of 2024, wired connectivity dominates the large format printer market and is expected to stay in control through 2025 because of its reliability, steady data transfer, and compatibility with current IT systems. Widely used in advertising, textiles, packaging, and industrial sectors, wired connectivity ensures continuous operation, high-speed performance, and secure workflow management. Ongoing improvements in network integration and hybrid connectivity solutions further strengthen its position in the market.

Large Format Printer Market, By Technology

Ink-based printing technology maintains the largest market share within the large format printer sector and is projected to sustain its dominance through 2025 owing to its versatility, high-resolution output, and cost-efficiency. Extensively utilized in advertising, textiles, packaging, and interior décor, ink-based techniques accommodate a variety of substrates, enable rapid production, and promote environmentally sustainable printing practices. Continuous advancements in ink formulations and printing mechanisms further enhance efficiency, precision, and market penetration.

Large Format Printer Market, By Print Width

Printers with a 60-72" print width are projected to have the highest CAGR during the forecast period, fueled by rising demand for large-format applications in advertising, signage, textiles, and industrial printing. These wide-format printers enable high-efficiency production, superior image quality, and versatility across various media, supporting customization and faster turnaround times for commercial and industrial customers.

Large Format Printer Market, By Ink Type

UV-cured inks are projected to register the highest CAGR during the forecast period, driven by their fast-drying properties, durability, and compatibility with diverse substrates. Widely used across advertising, signage, packaging, and décor applications, UV-cured inks enable high-resolution, vibrant, and scratch-resistant prints, supporting sustainable and efficient large format printing solutions.

Large Format Printer Market, By Application

The décor application segment is forecasted to have the highest CAGR during the forecast period, driven by increasing demand for customized wallpapers, wall graphics, vehicle wraps, canvas art, and interior design solutions. Large format printers enable vibrant, high-resolution, and durable prints, supporting creative, personalized, and visually striking décor across residential, commercial, and retail spaces.

REGION

Asia Pacific to be fastest-growing region in global large format printer market during forecast period

The Asia Pacific large format printer market is anticipated to attain the highest compound annual growth rate (CAGR) throughout the forecast period, driven by rapid expansion in the advertising, retail, textiles, and packaging industries. Prominent manufacturers in China, Japan, and India are implementing advanced inkjet, ultraviolet (UV), and printing technologies to fulfill the escalating demand for high-resolution, customizable, and environmentally sustainable printing solutions. Additionally, the growth of e-commerce, urbanization, and the increasing adoption of digital signage are further propelling market expansion in the region.

Large Format Printer Market: COMPANY EVALUATION MATRIX

In the large-format printer market matrix, HP Development Company, L.P. (Star) leads with a strong market share and extensive product lineup, driven by its high-performance printers widely adopted in advertising, textiles, packaging, and décor applications. Fujifilm Holdings Corporation (Emerging Leader) is gaining recognition with its advanced printing technologies and specialized solutions, strengthening its position through innovation and niche offerings. While HP dominates through scale and a diverse portfolio, Fujifilm shows significant potential to move into the emerging leaders' quadrant as demand for high-resolution, versatile, and eco-friendly printing solutions continues to grow.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 7.76 Billion |

| Market Forecast in 2030 (Value) | USD 10.36 Billion |

| Growth Rate | CAGR of 5.5% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion), Volume (Thousands) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, South America, RoW |

WHAT IS IN IT FOR YOU: Large Format Printer Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Advertising Agency |

|

|

| Textiles & Apparel Brand |

|

|

| Packaging Manufacturer |

|

|

| Retail & E-Commerce Client |

|

|

RECENT DEVELOPMENTS

- April 2025 : Konica Minolta, Inc. launched the Accuriolet 30000 B2 HS-UV inkjet press, which offers the most productive and high-quality printing. This is the successor to the Accuriolet KM-1/KM-1e line, featuring improvements such as lower RIP time, automatic double-sided printing, and enhanced print quality.

- April 2025 : Seiko Epson Corporation's SureColor S7170 was launched as a 64-inch signage printer for small sign shops that demand versatility and high performance. This model features a PrecisionCore micro TFP printhead (1.33 inches), UltraChrome sublimation inks, GS3 solvent inks, and a user-friendly system that provides efficient production without requiring high-investment equipment.

- January 2025 : Canon Inc. introduced large-format printers, the Image PROGRAF TZ-5320 and the TX Series (TX-5420/5320/5220), with enhanced color brilliance with improved magenta ink and a high printing speed of up to 4 pages per minute. These models also feature environmentally friendly functionalities, consuming less energy and using eco-friendly packaging.

- June 2024 : Brother Industries, Ltd. partnered with ColorBase to launch the WF1-L640 Launching Profiles Program, which offers Brother WF1-L640 latex wide-format printer users direct access to 96 high-quality images across 48 premium print materials. This partnership simplifies color application, resulting in plug-and-print processing that enhances efficiency and quality printing.

Table of Contents

Methodology

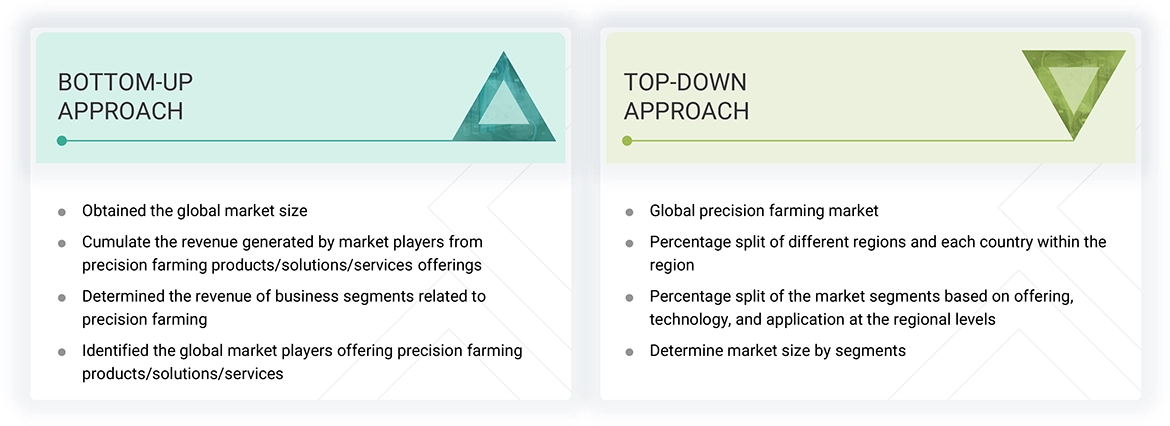

The study involved major activities in estimating the current size of the large format printer market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the supply chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, the data triangulation method has been used to estimate the market size of segments and subsegments. Secondary and primary sources have been used to identify and collect information for an extensive technical and commercial study of the large format printer market.

Secondary Research

Secondary research for this study involved gathering information from various credible sources such as company reports, white papers, journals, and industry publications. This process helped understand the supply and value chains, identify key players, analyze market segmentation and regional trends, and track major market and technology developments. The data collected was used to estimate the overall market size, which was later validated through primary research.

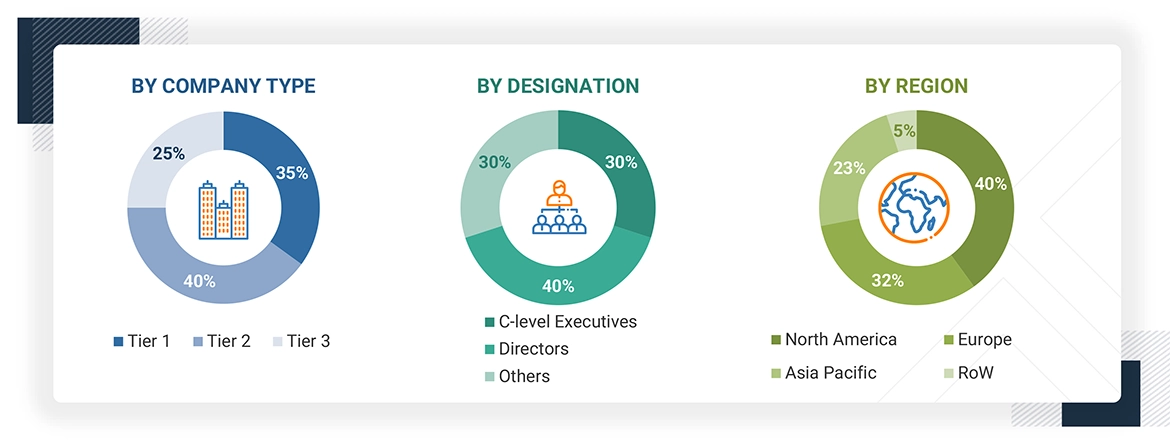

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the large format printer market through secondary research. Several primary interviews were conducted with experts from the demand and supply sides across four major regions: North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephone interviews.

Notes: RoW mainly comprises the Middle East, Africa, and South America.

Other designations include product managers, sales managers, and marketing managers.

Three tiers of companies have been defined based on their total revenue as of 2024: tier 3: revenue less than USD 500 million; tier 2: revenue between USD 500 million and 1 billion; and tier 1: revenue more than USD 1 billion

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the large format printer market.

- Identifying applications that are either used or are expected to use large format printers

- Analyzing major providers of large format printers and original equipment manufacturers (OEMs), as well as studying their portfolios and understanding different technologies used

- Analyzing historical and current data pertaining to the market, in terms of volume, for each technology used in large format printers

- Analyzing the average selling price of large format printers based on different technologies used in other applications

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the overall market size

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information

- Tracking the ongoing developments and identifying the upcoming ones in the market that include research and development activities, product launches, collaborations, and partnerships undertaken, as well as forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the large format printer technologies and related raw materials, as well as products designed and developed to analyze the break-up of the scope of work carried out by key companies manufacturing printers

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders such as chief experience officers (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets

The top-down approach has been used to estimate and validate the total size of the large format printer market.

- Focusing initially on the investments and expenditures made in the ecosystems of various applications

- Calculating the market size considering revenues generated by major players through the cost of the large format printers

- Segmenting each application of large format printer in each region and deriving the global market size based on region

- Acquiring and analyzing information related to revenues generated by players through their key offerings

- Conducting multiple on-field discussions with key opinion leaders involved in the development of large format printers based on different technologies and a wide variety of applications of such printers

- Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region, and the technologies used in large format printers that are used in apparel & textile, signage & advertising, décor, CAD & technical printing applications

Large Format Printer Market : Top-Down and Bottom-Up Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the large format printer market.

Market Definition

Large format printing, also referred to as wide-format printing, is a specialized segment of the printing industry that involves the production of high-resolution, large-scale graphics and technical documents using printers capable of handling media widths greater than standard sizes, typically from 17” to 72” and above. It focuses on delivering high-quality output for visual communication across applications such as apparel & textile, signage & advertisement, décor, and CAD & technical printing. Technologies such as ink-based and toner-based printing, utilizing ink types including aqueous, latex, UV-cured, solvent, and dye sublimation, enable compatibility with diverse substrates like canvas, fabric, and film. These printers meet commercial and industrial demands by ensuring precision, media versatility, and efficient output across advertising, design, and engineering environments.

Key Stakeholders

- Large format printing material and component suppliers

- Manufacturing equipment suppliers

- System integrators

- Technology/IP developers

- End users of printers, printing service providers, and printing presses

- Investors (private equity, venture capital, and others)

- Original equipment manufacturers (OEMs)

- Large format printing and material-related associations, organizations, forums, and alliances

- Venture capitalists and startups

- Research institutes and organizations

- Market research and consulting firms

- Distributors and resellers

Report Objectives

- To define, describe, and forecast the large format printer market size, by offering, connectivity, print width, printing material, ink type, technology, and application, in terms of value

- To forecast the large format printer market size for the technology segment, in terms of volume

- To estimate and forecast the market size, in terms of value, for various segments across four regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed overview of the value chain pertaining to the large format printer ecosystem, along with the average selling prices of different types of large format printers

- To strategically analyze trends/disruptions impacting customer business, pricing analysis, technology analysis, key stakeholders & buying criteria, case study analysis, trade analysis, patent analysis, Porter’s five forces, key conferences & events, AI impact, impact of 2025 US tariff, and regulations related to the large format printer market

- To analyze the manufacturers of large format printers, their strategies, and new production plans to evaluate the large format printer ecosystem/supply chain, which consists of suppliers of materials and components, and product manufacturers

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market and providing a detailed competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and ranking, as well as core competencies

- To analyze competitive developments, such as collaborations, contracts, partnerships, acquisitions, and product launches and developments, in the large format printer market

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the company‘s specific needs. The following customization options are available for the report.

Company Information:

- Detailed analysis and profiling of additional market players (up to five)

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Large Format Printer Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Large Format Printer Market

Sergio

Oct, 2022

I am entering the large format digital printing market, both Mexico and USA, therefore I am looking for statisticts .