Digital Signage Market Size, Share & Growth

Digital Signage Market Size, Share & Trends by Product (Video Walls, Kiosks, Billboards, Menu Boards, System-on-chip Displays), Resolution (4K, 8K, FHD, HD), Installation Location (Indoor, Outdoor), Software, Display Size, Application, and Region - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The global digital signage market is projected to grow significantly, reaching USD 28.88 billion by 2030 from USD 21.45 billion in 2025, at a CAGR of 6.1% during the forecast period. Market growth is driven by the rising demand for dynamic, visually engaging communication across retail, transportation hubs, corporate environments, hospitality venues, and public spaces. The increasing adoption of high-brightness LED displays, 4K/8K screens, and interactive kiosks is accelerating global deployment. Cloud-based content management systems, AI-driven audience analytics, and connected signage networks are further enhancing real-time content delivery, personalization, and engagement.

Digital Signage Services Market

The digital signage services market plays a critical role in supporting the successful deployment and long-term performance of digital signage networks across commercial and public environments. These services typically include installation, integration, consulting, and system configuration, ensuring that digital signage hardware and software function seamlessly together. As organizations adopt more complex display formats such as video walls, interactive kiosks, and outdoor LED screens, the demand for professional installation and integration services continues to rise. Businesses increasingly rely on service providers to ensure optimal screen placement, network connectivity, content compatibility, and compliance with safety and regulatory standards.

KEY TAKEAWAYS

-

By REGIONBy region, Asia Pacific is expected to dominate the market and is projected to register a CAGR of 8.1% during the forecast period.

-

BY OFFERINGBy offering, the software segment is expected to register the highest CAGR during the forecast period.

-

BY DISPLAY SIZEBy display size, the larger than 52 inches segment is expected to dominate the market.

-

BY PRODUCT TYPEBy product type, the video walls segment is expected to register the highest CAGR during the forecast period.

-

BY APPLICATIONBy application, the infrastructural segment is expected to register the highest CAGR during the forecast period.

-

BY INSTALLATION LOCATIONBy installation location, the outdoor segment is expected to register the highest CAGR during the forecast period.

-

BY ENTERPRISE SIZEBy enterprise size, the large enterprises segment is expected to register the highest CAGR from 2025 to 2030.

-

COMPETITIVE LANDSCAPE - Key PlayersSamsung Electronics Co., Ltd., LG Electronics, Sharp NEC Display Solution, LEYARD, and Sony Group Corporation are identified as some of the star players in the digital signage market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPE - StartupsBroadsign, Raydiant, Inc., and Poppulo, among others, have distinguished themselves among SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

Digital signage systems are advanced display and content-delivery technologies designed to present dynamic visual information, interactive content, and advertising across a wide range of environments. Unlike traditional static signage, digital signage uses LED and LCD displays combined with media players, sensors, and cloud-based software to deliver real-time, data-driven communication. These systems enable high-resolution visuals, personalized messaging, and automated content scheduling across retail stores, transportation hubs, corporate offices, hospitality venues, healthcare facilities, and public spaces. Digital signage solutions incorporate features such as touch-enabled interfaces, AI-driven content targeting, audience analytics, and IoT-based remote monitoring to enhance engagement and operational efficiency. With the growing shift toward digital transformation, omnichannel marketing, and smart city development, demand for intelligent signage systems is rising sharply.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The revenue mix of the digital signage market is shaped by rapid digital transformation, expanding smart infrastructure programs, and advancements in high-resolution display and content-management technologies. Over the next 4–5 years, product portfolios are expected to shift from traditional standalone displays to more advanced networked, cloud-managed, AI-driven, and sensor-integrated signage ecosystems capable of real-time content adaptation. Two major trends are accelerating this evolution: the adoption of AI/ML-powered audience analytics for personalized content targeting and performance measurement, and the rise of interactive and immersive display technologies such as touch-enabled kiosks, LED video walls, and 3D/AR-integrated signage.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Rapid expansion of digital signage across retail, QSR, and transportation hubs

-

Growing adoption of cloud-based content management systems

Level

-

Higher upfront cost of advanced digital signage hardware and installation

-

Ongoing maintenance expenses for large multi-location digital signage networks

Level

-

Growing investments in smart city projects across major metro cities

-

Expanding use of digital signage in corporate workplaces and educational campuses

Level

-

Rising cybersecurity risks due to connected and cloud-managed signage systems

-

Infrastructure and bandwidth limitations in remote or older building environments

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Rapid expansion of digital signage across retail, QSR, and transportation hubs

Digital signage adoption is accelerating in retail stores, quick-service restaurants, and transportation hubs as businesses shift toward dynamic, real-time customer engagement. These sectors rely heavily on visual communication to improve customer experience, streamline operations, boost footfall conversion, and deliver targeted messaging, fueling strong demand for high-impact digital displays and interactive content solutions.

Restraint: Higher upfront cost of advanced digital signage hardware and installation

The initial investment for digital signage, including professional-grade displays, media players, mounting systems, and installation, remains a major barrier for small and mid-sized businesses. Costs rise further when deploying large networks across multiple locations. This capital intensity slows adoption, especially for budget-constrained organizations evaluating long-term ROI and ongoing maintenance expenses.

Opportunity: Growing investments in smart city projects across major metro cities

Smart city initiatives globally are driving demand for connected digital signage used in public communication, real-time transit updates, emergency alerts, and interactive wayfinding. Large metropolitan areas are investing in modern digital infrastructure, providing strong opportunities for vendors offering outdoor displays, IoT-enabled signage, and cloud-managed content platforms.

Challenge: Rising cybersecurity risks due to connected and cloud-managed signage systems

As digital signage networks become more cloud-connected and integrated with corporate systems, cybersecurity threats such as unauthorized access, content manipulation, malware, and data breaches are increasing. Organizations must implement stronger security measures, which adds complexity and cost. These vulnerabilities pose operational risks that may slow the adoption of large-scale digital signage deployments.

DIGITAL SIGNAGE MARKET: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Samsung’s outdoor LED displays and cloud-connected signage platform were deployed across major US transportation hubs to deliver real-time passenger information, dynamic advertising, and emergency alerts. The system unified multiple display networks into a centralized management interface for seamless scheduling and monitoring. | The deployment improved communication efficiency, enhanced traveler experience, and boosted advertising revenue for operators. High-brightness displays ensured visibility in all conditions, while cloud integration reduced manual maintenance. Real-time alerts strengthened safety communication, supporting smart-infrastructure modernization initiatives. |

|

LG’s high-resolution digital signage and interactive touchscreens were installed across retail chains in North America to support product promotions, wayfinding, and omnichannel customer engagement. LG’s CMS enabled dynamic content updates across hundreds of store locations. | The solution increased customer engagement, improved in-store navigation, and enabled retailers to deliver targeted promotions. Centralized content control reduced labor costs, while energy-efficient displays lowered operational expenses. Enhanced visual experiences strengthened brand identity and improved shopper conversion rates. |

|

Accenture deployed Sony Crystal LED large-scale display systems at its Innovation Hub Tokyo to replace legacy LCD screens with a next-generation visual collaboration platform. The displays are used across executive briefings, client demonstrations, immersive workshops, and visitor engagement experiences. The solution supports flexible content formats, enabling high-resolution visualization for strategic presentations. | The adoption delivers superior image quality with high brightness, contrast, and wide viewing angles, significantly elevating the visual impact of client and executive interactions. Seamless, bezel-free integration eliminates visual disruptions, enabling more immersive and professional-grade presentations. The system enhances engagement, comprehension, and retention during complex technology and strategy discussions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The digital signage ecosystem includes component providers, digital signage solution providers, distributors, and end users. Component suppliers provide a range of components, including backlights, backplanes, display drivers, touch panels, glass panels, media players and controllers, mounts and accessories, and software platforms. Digital signage solution providers include manufacturers of digital signage products, such as video walls, standalone displays, menu boards, billboards, and general-purpose information displays. Digital signage solution providers also provide installation services and post-sale services. Samsung Electronics (South Korea), LG Electronics (South Korea), Sharp NEC Display (Japan), LEYARD (China), and Sony Group Corporation (Japan) are the key players that provide digital signage solutions and related services. These companies support deployments in retail, transportation hubs, corporate campuses, educational institutions, hospitality venues, and public-sector facilities.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Digital Signage Market, By Offering

The software segment is projected to register the highest CAGR as businesses increasingly shift toward cloud-based content management platforms, AI-driven analytics, and real-time content automation. Growing demand for centralized control, remote monitoring, personalization engines, and data-driven content optimization is accelerating the adoption of advanced digital signage software solutions across all major industries.

Digital Signage Market, By Region

Asia Pacific is expected to dominate the digital signage market due to rapid urbanization, widespread retail expansion, and growing investments in smart city programs. Increasing adoption of advanced display technologies, rising digital transformation initiatives, and strong demand across transportation, hospitality, and corporate sectors are driving the region’s growth during the forecast period.

Digital Signage Market, By Display Size

The larger-than-52-inch display segment is expected to dominate the market due to rising demand for immersive visual communication in malls, airports, transportation hubs, stadiums, and corporate environments. High-impact advertising, improved audience engagement, and expanding adoption of LED video walls and large-format commercial displays are driving strong growth in this segment.

Digital Signage Market, By Product Type

The video walls segment is anticipated to register the highest CAGR as organizations increasingly deploy multi-screen, high-brightness, and bezel-less display systems for impactful visual experiences. Rising adoption in retail, transportation, control rooms, hospitality, and corporate lobbies, combined with advancements in LED technologies, is fueling strong expansion of this product category.

Digital Signage Market, By Application

The infrastructural segment is expected to witness the highest CAGR, driven by major deployments across airports, railway stations, bus terminals, highways, and public spaces. Growing investments in smart infrastructure, real-time passenger information systems, digital public communication, and high-brightness outdoor displays are accelerating adoption, making this the fastest-growing application.

REGION

Asia Pacific is expected to be fastest-growing region in the digital signage market during the forecast period

Asia Pacific is expected to witness the highest CAGR in the digital signage market due to the rapid expansion of retail, transportation, and hospitality sectors, alongside increasing investments in smart city initiatives. Rising adoption of high-brightness LED displays, interactive kiosks, and cloud-based content platforms, combined with strong digital transformation across emerging economies, is accelerating regional market growth.

DIGITAL SIGNAGE MARKET: COMPANY EVALUATION MATRIX

In the digital signage market matrix, Samsung Electronics and LG Electronics lead with strong market presence and broad commercial display portfolios, enabling extensive adoption across retail, transportation, corporate, education, and hospitality environments. Their advanced LED/LCD panels, high-brightness outdoor displays, interactive solutions, and cloud-integrated signage platforms drive large-scale deployments and reinforce their leadership position in the market.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Samsung Electronics Co., Ltd.

- LG Electronics

- Sharp NEC Display Solutions

- LEYARD

- Sony Group Corporation

- AUO Corporation

- Panasonic Holdings Corporation

- Barco

- Christie Digital Systems USA, Inc.

- KEYWEST TECHNOLOGY, INC.

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 20.12 Billion |

| Market Forecast in 2030 (Value) | USD 28.88 Billion |

| Growth Rate | CAGR of 6.1% from 2025-2030 |

| Years Considered | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) and Volume (Million Units) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regional Scope | North America, Europe, Asia Pacific, and RoW |

WHAT IS IN IT FOR YOU: DIGITAL SIGNAGE MARKET REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Display Manufacturer / OEM | Detailed benchmarking of display technologies by type (LCD, LED, OLED, fine-pixel-pitch LED, high-brightness outdoor displays) | Assessment of SoC vs external media player architectures |

| AV System Integrator / Digital Signage Deployment Contractor | Mapping of system integrators implementing digital signage across retail, transportation, hospitality, corporate campuses, and QSR chains | Evaluation of CMS integration workflows, media player interoperability, and device-management requirements |

| Regulatory / Public-Sector Body (Transportation, Smart Cities, Education) | Assessment of digital communication standards, accessibility mandates, content-compliance requirements, emergency messaging protocols, and public-display safety regulations | Evaluation of smart city digital signage initiatives, data privacy requirements, and public-sector procurement frameworks |

| End User (Major Retail Chains) | ROI and cost–benefit analysis of digital signage deployment across locations | Comparison of hardware, CMS, and media player solutions for specific operational needs |

RECENT DEVELOPMENTS

- January 2024 : Samsung unveiled its VXT platform. This new cloud-based system simplifies digital signage for businesses. VXT combines content creation and remote display management into a single, secure platform. It is designed to be user-friendly, allowing businesses to create and control their digital displays easily.

- March 2023 : LG Electronics launched ProBeam signage projector to produce 4K UHD resolution pictures with a 3,000,000:1 contrast ratio in sizes ranging from 40 to 300 inches.

- August 2022 : Sharp NEC Display Solutions, Ltd. launched PN-HC and PN-HE 4K Ultra-HD LCD professional displays for professional and commercial applications. These displays provide solutions for environments requiring larger formats.

FAQ

1. How digital signage helps to market your business?

The global digital signage market was valued at around USD 20.1 billion in 2024 and is projected to grow to approximately USD 27.3 billion by 2029, exhibiting a compound annual growth rate (CAGR) of about 6.3 % over the forecast period.

2. What factors are driving growth in the digital signage market?

Key drivers include the rising adoption of digital signage solutions in commercial sectors, increasing demand for advanced high-resolution displays like 4K and 8K, and ongoing technological advancements in display technologies and content software.

3. Which applications and sectors are adopting digital signage most widely?

Digital signage is increasingly used in retail, hospitality, transportation, healthcare, corporate, and institutional settings to enhance customer engagement, deliver real-time information, and improve communication.

4. What are some challenges facing the digital signage market?

Major challenges include high initial hardware and installation costs, security concerns related to networked displays, and infrastructure and energy consumption considerations that can slow adoption among some organizations.

5. Which regions are expected to lead market growth?

North America currently holds a significant share due to strong adoption in retail and corporate sectors, while the Asia Pacific region is projected to grow at the fastest CAGR, driven by rapid infrastructure development and strong presence of display manufacturers.

Table of Contents

Methodology

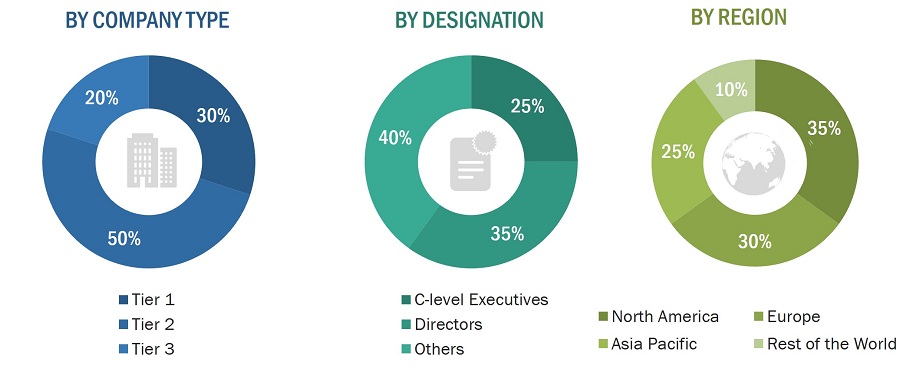

The study involved four major activities in estimating the digital signage market size. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information relevant to this study on the digital signage market. The secondary sources included the Digital Signage Federation, International Sign Association, IAA Global, annual reports, press releases, and investor presentations of companies; white papers, certified publications, and articles by recognized authors; directories; and databases.

The global size of the digital signage market has been obtained from the secondary data available through paid and unpaid sources. It has also been determined by analyzing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry's supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. It has also been conducted to identify and analyze the industry trends and key developments undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources have been interviewed to obtain qualitative and quantitative information about the market across four main regions—Asia Pacific, North America, Europe, and the Rest of the World (the Middle East & Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and other related key executives from major companies and organizations operating in the digital signage market size or related markets.

After completing market engineering, primary research was conducted to gather information and verify and validate critical numbers from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Most primary interviews have been conducted with the market's supply side. This primary data has been collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete engineering process, both top-down and bottom-up approaches and several data triangulation methods have been used to estimate and validate the size of the overall digital signage market and other dependent submarkets. Key players in the market have been identified through secondary research, and their market positions in the respective geographies have been determined through both primary and secondary research. This entire procedure includes studying top market players’ annual and financial reports and extensive interviews with industry leaders such as CEOs, VPs, directors, and marketing executives for key insights (qualitative and quantitative).

All percentage shares and breakdowns have been determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study have been accounted for, viewed in detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data has been consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Global Digital signage Market Size: Bottom-Up Approach

Global Digital signage Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the market breakdown and data triangulation procedures have been employed, wherever applicable. Data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Digital signage refers to the installation of digital signs, billboards, and other display devices to provide visual information. Its major function is to communicate informational or promotional messages. The goal of digital signage is to deliver specific messages to specified groups of individuals, such as internal office teams, school children, or potential brand customers.

This digital setup displays multimedia or video content for information or advertising objectives. It uses LCD, OLED, direct-view LED, micro-LED, and other displays, such as projection cubes and e-paper, to display digital photos, videos, web sites, weather data, restaurant menus, and text. It is employed in a variety of venues, including retail establishments, transportation networks, public places, museums, stadiums, hotels, restaurants, and office buildings.

Key Stakeholders

- Raw material suppliers

- Digital Signage Hardware Providers

- Digital Signage Software Providers

- Digital Signage Service Providers

- Display Panel Manufacturers

- Display Material and Component Suppliers

- Research organizations

- Original equipment manufacturers (OEMs)

- Technology investors

- Analysts and strategic business planners

- Government bodies, venture capitalists, and private equity firms

- End users

Report Objectives

- To define, describe, estimate, and forecast the digital signage market size, in terms of value, on the basis of offering, display size, product type, installation location, application, and enterprise size.

- To define, analyze and forecast the digital signage market size, by product type, in terms of volume

- To forecast the market size of concerned segments with respect to 4 main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide a detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To analyze micromarkets with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the value chain, market ecosystem; trends/disruptions impacting customer’s business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders & buying criteria; case study analysis; trade analysis; patent analysis; key conferences & events, 2024–2025; regulations related to the digital signage market; size and investment and funding scenario.

- To profile key players and comprehensively analyze their market ranks and core competencies, along with detailing the competitive landscape for market leaders

- To benchmark players within the market using the proprietary Company Evaluation Matrix framework, which analyzes market players on various parameters within the broad categories of market rank and product offering

- To track and analyze competitive developments such as product launches and acquisitions, and research and development (R&D) activities in the digital signage market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape to the market leaders

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5 players) based on various blocks of the supply chain

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Digital Signage Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Digital Signage Market

Paul

Jul, 2015

we are interested in digital signage software market in Asian countries. Covering Microsoft, Android and Linux O/S platform. Does your report cover this..

KI

Oct, 2014

Can I see more detailed information about - vertical market (healthcare, retail, education, etc) - region (North America and Europe).

Nazira

Jul, 2019

Shopping Mall Almaly Trade is aiming for the installation of the digital signage within its interior. We need an objective proof of Digital Signage for commertial vertical. .

Parthiv

Dec, 2015

we are interested in digital signage market report specifically for Indian market..

Yashoda

Nov, 2017

Will you please help me provide free sample of following information for geographical analysis from your table of content? Required information: 10.2.1 US 10.2.2 Canada 10.3.1 UK.

richard

Jul, 2015

does it inlcude detail analysis (market share) of the industry players.

kyle

Jun, 2017

I would like to see some actual pages before I decide to purchase. Specifically a profile sheet of a manufacturer and a summary on one of the markets - transportation or manufacturing..

Duong

Apr, 2022

I would like to know more about the Professional Display market in Vietnam. Kindly help to share the report. Many thanks with BR/Ha Phuong .

Olumide

Apr, 2022

Our company wants to penetrate the digital signage market. We would like to start the sales of the intel brand because we believe in the quality of your product. We would like to be your partner in Nigeria and what is the Minimum Order Quantity to start with. In addition, we would also want to know what other services your company will render to make us succeed in the industry. Thank you. .

philippe

Apr, 2022

need figures to write a paper on digital signage .

Christopher

Mar, 2019

does this report covers technological trends and its impact on the digital signage market .

Britton

Aug, 2019

Hello, I am working on a story for the WSJ about digital signage. I do love to speak with your analyst for the same.

Prakash

Sep, 2019

I am interested in wayfinding and digital signage, as part of modeling work place architectures alongside enterprise taxonomy. .

patrick

May, 2016

we focuse on infrastructure segment of digital signage market. Does this report cover this.

Manon

Mar, 2015

Hello, I would like to know it is possible to buy only a portion of the report as only the French country data is of interest to us Also I would like to know if you have specific data on digital signage for the retail industry ?.

Mats

Nov, 2012

We are a company that is looking into how this industry works and would like more information about the developing Digital Signage market!.

Finn

Oct, 2017

Could you please provide a detailed table of contents specific to Digital Signage Media Player Industry. It would be nice to have a proposal from your firm as well so as to have better price to value comparison..

Kelly

Aug, 2014

we would like to buy sections of this report - is that possible? Interested in the Hardware section: LCD and other display technologies, volume, and unit forecasts in this industry..

Eunjoo

Jul, 2015

we are interested in software market. Nowaday, audiance measurement is the hot issue in the commercial vertical and I wanna know what companies are rising in this area, and your opinion of this segmented s/w market.

Aaron

Jan, 2016

can you provide Market trends in PID (Public Information Display) for the US, offering growth rates, competitors in screen, development (SAMSUNG, NEC, Hitachi, SONY), and application..

Alain

Nov, 2016

Just my time of the year to educate myself on trends. Can you share the sample of the report..

Christie

Oct, 2017

we would like to understand the level of granularity you have on the geographies and how much focus you have on the media players versus the displays .

yoeri

Aug, 2016

Hello, would it be possible to buy a version of this report focussing only on Europe and thus taking out the other parts? The report is quite expensive so we were hoping on buying just a part of it. Since I am responsible for Europe and Asia that is our primary interest..

Rao

Apr, 2019

Please mail your sample report of Digital Signage Market by Offering (Hardware (Displays, Media Players, Projectors), Software, Services), Product, Application, Vertical (Retail, Transportation & Public Places, Sports & Entertainment, Education), and Geography - Global Forecast to 2024.

Tim

Jun, 2015

Please provide sample of Digital Signage Market by Type (Hardware (Displays, Media players, Projectors), Software, Services (Installation & Maintenance)), Application (Commercial, Infrastructural, Institutional, Industrial) & Geography - Global forecast to 2024.

Marion

Jan, 2017

I would like to access the pages of the report only for the digital signage - software sections. (e.g not the overall forecast and hardware section). Is this possible?.

vipin

Dec, 2016

we are interested in 1. Offering (Hardware (Display Panels, Media Players, Projectors) 2. Asia Pacific region and India. is it possible to provide this information.

Chris

Nov, 2018

Digital Signage market, Commercial Displays, Interactive Displays, LCD Video Walls, LED Video Walls: used in retail, venue, food and beverage vertical.

Brian

Jan, 2019

we are interested in part of this report. can you offer digital signage market for automotive vertical only. .

Praveen

Jan, 2015

Market share analysis by each player.Market penetration of digital signage in retail vertical; future trends of Digital Signage ecosystem.

Luis

Dec, 2014

we are resellers of digital signage in Latin America (We Offer Digital Signage licenses, Digital Signage as a Service, Contents, Operation, Hosting); could you suggest how this report will help us to grow our business.

Tim

Nov, 2015

Hi, I’m interested in learning more about your research report on digital signage market.

Glenn

Aug, 2015

Can I utilize some of the data from this report to share with our association constituents (members, Exposition attendees etc..).

claudio

Feb, 2019

can you provide market for hardware and services with wearable devices in monitoring and public health.

S.

Sep, 2013

it is possible to customise the digital signage market report for Europe..

Ashley

Aug, 2022

I want to find more information about the digital signage market in Australia. May I get the sample regarding the Corporate Digital Signage Market? Thanks for your post. .

Jane

Mar, 2016

On the Digital Signage Market report. we are interested inmarkets by application. we are also interested in regional breakout by units (vs dollars). does this come in the report?.

Tobias

Sep, 2016

Hello, we are interested in learning about display prices per square meter for 2016 (pixel pitches 1 - 20). Does your report cover this? We are also interested in the total size of the market for display system manufacturers, as well as the share of LEDs in the bill of materials of displays; and furthermore the value add and margins of the LED display manufacturers. Would your report cover this? Thanks for letting me know. Tobias Hahn.

Sendil

May, 2017

Hi, I am Sendil Kumar working as a business development engineer for Applied Materials. We provide tools and technology for leading display companies around the world who produces LCD and LED panels. We are doing some research on the technology advancement to be made in LCD and LED panels to make it play a positive role in the digital signage advertising growth. We heard about you and your contribution in digital advertising. We would like to talk to your key business people to better understand the industry and get their feedbacks on this. This could help us in determining what are the modifications/improvement to be done in the display medium so that it can aid in the tremendous growth of Digital Signage and add more value to both the retailers and consumers. Please point to proper people for further discussion. .

Felix

Apr, 2019

I want to download the pdf of the digital signage market global forecast to 2024; please assist.

ari

Jul, 2016

I am doing at the business school at UW and am doing my final paper for the summer quarter is on the digital signage industry. I would much appreciate a copy of this report if possible..

Vicki

May, 2012

can you provide sample of digital signage market forecasts to 2024..

Andre

Mar, 2014

Need to validate the quality of the report as this is MarketsnMarkets first report and none other exists from previous years. Could you send us a few diagrams specifically on verticals, depth of info on verticals, executive summary, table of contents, and at least 4 to 5 diagrams that demonstrate the depth of research, any comprehevie review of which market players exist and what percentage of market they are, list of players in priority order..

Susan

Nov, 2013

we are interested in digital signage market in the food and beverage industry: market value and growth rate, key end user needs, and competitive landscape for integrators .

HeeKyung

Oct, 2019

I would like to know the details of license type of this report. Can I print out the report with Single User license? Also, please let me know if there is any discount for the same. Hope to get the answer and the sample report ASAP. .

Grégoire

Oct, 2017

Hi, I would like to purchase the Digital Signage Market Report with forecasts to 2024, and I have few questions about the content of the report. - I understand that there is a segmentation of the Digital Signage market by application (retail for example), and then by type of advertisement (indoor // outdoor): could you provide us with a specification of what is included in "indoor" and "outdoor" advertisement?.

Greg

Aug, 2016

Looking for detail informatin on dive into the market size and competitor market share for digital signage. Thanks!.

leila

Aug, 2014

HI, I want to know more about digital signage business in Asia & Europe. Can I have specific information about that with same table of contents on this paper.

David

Jul, 2015

we want to understand who are the major companies by market share in the digital signage marketplace both globally and in the US..

Seongshik

May, 2015

I do like to see sample of your report before purchasing. Would you mind telling me how I can get some contents of your paper?.

Dan

May, 2022

TAKKT AG is on the digital signage market and needs rhe research in order to evaluate further market opportunities. .

Yağızhan

Apr, 2019

I would like to download PDF of Digital Signage market reports. Please help Thanks.

james

Apr, 2018

What is the size of the market for the following digital signage segments? 1. Retail 2. Medical locations a. Dialysis b. ER’s c. Urgent Cares 3. Banks 4. Restaurants 5. Campuses What is the percentage of the market that utilizes live TV in its digital signage platform? does all this covers in the report .

Jan

Mar, 2014

Digital Signage as an industry - looking to learn more about the whole of the market, its trends and what is hot and what is not. .

Gusztav

Feb, 2019

I would like to know who are the service providers for Digital Signage device rental. I would like to have out of the box solution for advertising campaigns..

Lyle

Feb, 2014

can you provide detail infromation of the report - How data was collected - Level of analysis of data - Table of Contents - Charts - Illustrations - Other research attributed (indicating validation) in the report.

Balázs

Feb, 2016

Hi, we are a startup in the validation phase in Hungary. We have a lightweight digital signage solution for the commercial market. Especially for Clubs, Bars, Pubs, we offer a free Digital Signage solution to place ads and social media content to their displays. We are creating our business plans to show some Venture Capital. please sugguest how this report will help us to grow our business. .

Ian

Feb, 2014

does your report convers network infrastructures and video/media distribution techniques and products with respect to applications and vertical markets for US, EMEA and ROW..