Laboratoray Centrifuges Market Size, Growth, Share & Trends Analysis

Laboratoray Centrifuges Market by Product [Equipment (Microcentrifuge, Ultracentrifuge), Accessories (Tube, Plate)], Platform (Benchtop), Rotor Design (Swinging-bucket), Intended Use (Clinical), Application (Diagnostics), End User (Hospitals) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

The laboratory centrifuges market is expected to reach USD 1.86 billion by 2030, up from USD 1.58 billion in 2025, growing at a CAGR of 2.8% from 2025 to 2030. This growth is driven by increased R&D investments and research grants, technological advancements and innovative rotor designs, a rise in infectious diseases that boosts sample testing and cell-based research, and expanding applications of these centrifuges.

KEY TAKEAWAYS

-

BY PRODUCTThe products for the laboratory centrifuges market include equipment and accessories. Equipment as a product segment in the laboratory centrifuges market has acquired the largest share due to ongoing upgrades and frequent replacement cycles in research and clinical laboratories.

-

BY PLATFORM TYPEKey platforms of laboratory centrifuges include benchtop and floor-standing models. Benchtop centrifuges hold a major share because they are cost-effective, versatile, easy to use, smaller in size, and significantly lighter in weight.

-

BY ROTOR DESIGNKey rotor designs include fixed-angle rotors, swinging-bucket rotors, vertical rotors, and others. Fixed-angle rotors hold the largest share due to their superior design, which helps reduce turnaround time.

-

BY INTENDED USEKey uses include general-purpose, clinical, and preclinical centrifuges. The largest share was held by general-purpose centrifuges due to their wide range of applications.

-

BY APPLICATIONKey application segments for laboratory centrifuges include diagnostics, microbiology, cellomics, genomics, proteomics, blood component separation, and other uses. The diagnostics segment holds the largest share due to the high volume of diagnostic tests conducted for infectious and chronic diseases.

-

BY END USER

- Key end user segments include hospitals, biotechnology and pharmaceutical companies, academic and research institutes

- Hospitals, as an end-user segment, acquired the largest share due to the increased prevalence of infections and chronic diseases, which have resulted in increased case loads in disease detection.

-

BY REGIONThe laboratory centrifuges market covers Europe, North America, Asia Pacific, South America, and the Middle East & Africa. North America is the largest market for laboratory centrifuges.

-

COMPETITIVE LANDSCAPEThe key market players utilize both organic and inorganic strategies to strengthen their position in the market. Key players in the laboratory centrifuges market are Thermo Fisher Scientific, Inc. (US), Danaher Corporation (US), and Eppendorf AG (Germany). These players have formed strategic partnerships and expanded their capacity by establishing new manufacturing facilities to meet growing demand. Such activities will help them to maintain a dominant position in the market.

Growing research efforts in genomics, proteomics, personalized medicine, and biopharmaceuticals are leading to an increase in applications and a higher demand for modern centrifuge technologies. Key opportunities in the laboratory centrifuges market include the trend toward compact, portable centrifuges, which enable more field-based and point-of-care diagnostic applications, especially in rural or resource-limited settings. The growing adoption of precision medicine and genomics research drives demand for specialized, high-speed centrifuges capable of handling complex sample preparation, creating opportunities for manufacturers in the biopharma and molecular diagnostics segments.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Evolving trends and market disruptions are fundamentally reshaping the laboratory centrifuges business. Hospitals, pharmaceutical and biotechnology companies, alongside academic and research institutes, are increasing their adoption of advanced centrifugation technologies to support a broader array of applications—from routine diagnostics and clinical sample processing to high-throughput screening and specialized omics research workflows. The acceleration of precision medicine, rapid test development, and integrated automation are driving the need for more versatile, automated, and digitally connected centrifuge systems. As laboratories pivot toward high-throughput research, enhanced compliance, and integrated data management, the market is expected to see a revenue mix shift over the next 4–5 years—moving away from legacy products and traditional single-use scenarios toward scalable platforms and multi-application instruments. Disruptions such as the deployment of smart, AI-enabled, and IoT-connected centrifuges are prompting end users to seek outcomes like faster sample turnaround, improved accuracy, workflow standardization, and greater scalability.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Advances in laboratory automation and sample processing technologies are enhancing efficiency and reliability in laboratory centrifuges

Level

-

High acquisition and lifecycle costs limit adoption among resource-constrained end users

Level

-

Expansion of applications in biopharmaceuticals, omics research, and point-of-care diagnostics

Level

-

Market saturation, intense competition, and supply chain complexity

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Advances in laboratory automation and sample processing technologies

Recent innovations in laboratory centrifuges—including the integration of digital controls, automation, and advanced rotor designs—have elevated the reliability, safety, and versatility of these instruments across research, clinical diagnostics, and bioprocessing domains. Smart centrifuge systems equipped with IoT connectivity and AI-driven predictive maintenance are streamlining sample handling, minimizing human error, and optimizing instrument uptime. The adoption of energy-efficient refrigeration, programmable protocols, and modular accessories further enables laboratories to address increasingly complex workloads, such as those found in genomics, proteomics, and precision medicine. These advancements are supporting widespread adoption among hospitals, pharmaceutical companies, and academic labs aiming to increase throughput and shorten turnaround times, while still adhering to strict compliance and quality standards. Modern centrifuges now enable workflow automation, integration with laboratory information management systems (LIMS), and compatibility with a wide range of sample types—from blood and plasma to cell cultures and molecular biology extracts.

Restraint: High acquisition and lifecycle costs, limiting adoption among resource-constrained end users

Despite notable technological advancements, laboratory centrifuges—particularly high-speed and ultracentrifuge models—continue to represent significant capital expenditures for many facilities. Beyond the purchase price, organizations must consider expenses related to installation, calibration, ongoing maintenance, and replacement of consumables such as rotors, seals, and specialized tubes, all of which contribute to the total cost of ownership. The necessity for precision environmental controls (temperature, vibration dampening) and qualified personnel further increases operational complexity and overhead. Meeting strict regulatory standards (e.g., FDA, ISO 13485, GMP) for clinical use necessitates documentation, frequent performance audits, and operator training, further raising operational expenses. Non-compliance risks product recalls and fines, making quality assurance investment compulsory. These hurdles can restrict technology access for resource-limited or smaller clinical and research settings.

Opportunity: Opportunities in digital integration, portability, and advanced workflow solutions

The laboratory centrifuges market presents strong growth opportunities through expanding roles in biopharmaceutical development, advanced diagnostics, and next-generation research applications. Increasing demand for high-speed, gentle separation protocols in cell and gene therapy, vaccine manufacturing, and personalized medicine is driving the development of innovative centrifuge platforms tailored to emerging biological workflows. Additionally, the miniaturization of benchtop centrifuges and integration with point-of-care diagnostics are supporting decentralized laboratory models and field-based testing, particularly in resource-limited regions. The ability to provide modular, scalable solutions that seamlessly interface with laboratory information management systems (LIMS) and support regulatory compliance is likely to further differentiate market leaders and unlock new revenue streams. Asia Pacific, Latin America, and the Middle East are witnessing rapid adoption due to healthcare infrastructure upgrades and rising chronic disease prevalence. Strategic partnerships, acquisitions, and localized manufacturing are empowering global and regional companies to meet unmet needs. Further, the trend towards data interoperability—incentivized by new standards and funding frameworks—is driving adoption of digitally integrated centrifuges and seamless workflow solutions

Challenge: Market saturation, intense competition, and supply chain complexity

The global laboratory centrifuge market is characterized by strong competition among established brands, including Thermo Fisher Scientific, Eppendorf, Beckman Coulter, and Hettich, as well as the emergence of regional manufacturers offering lower-cost alternatives. Established companies leverage broad product portfolios, robust distribution networks, and integrated after-sale services to reinforce customer loyalty and sustain market positions. In this landscape, new entrants and smaller vendors face substantial entry barriers, including limited brand recognition, distribution reach, and R&D capacity. As end-users increasingly prioritize automation, digital connectivity, and workflow integration, successful market strategies will require continuous product innovation, specialization in niche research applications, and the formation of strategic partnerships to address evolving customer requirements and regulatory complexities.

Laboratory Centrifuges Market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Launch of Cryofuge refrigerated floor models and benchtop centrifuges for precision medicine labs and diagnostic hospitals, optimized for automation and integration in high-throughput clinical settings | Reliable precision for large-volume sample separation in clinical diagnostics and personalized medicine; energy-efficient cooling for sensitive samples; improved workflow efficiency and reduced downtime due to advanced automation and integrated controls |

|

OptiMATE Gradient Maker and Biomek acoustic liquid handling system for molecular biology, genomics, and proteomics research, helping labs automate density gradient preparation and high-throughput nucleic acid extractions | Drastic reduction in prep time (up to 75%), superior reproducibility in molecular assays, streamlined NGS/sample processing workflows, and integration with data management platforms for error reduction and enhanced research productivity |

|

Centrifuge 5427 R microcentrifuge with environmentally friendly hydrocarbon cooling, designed for sustainability and sensitive molecular and cell biology workflows (DNA/RNA, protein extraction) in academic and pharmaceutical labs | Minimized ecological impact (near-zero GWP), robust cooling for precision sample integrity, and flexibility for a wide range of genomics and proteomics protocols, while supporting green laboratory initiatives |

|

Modular benchtop and floor centrifuges adopted by biotechnology and hospital networks for blood separation, cell therapy, and research; partnership expansion in Asia and US for integrated bioprocessing and diagnostic laboratory systems | Fast, robust cell and blood separation, scalable for both small and large labs; international support and modular upgrades for regional and workflow-specific needs, enabling laboratories to respond quickly to evolving bioprocess and diagnostic volumes |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The laboratory centrifuges market ecosystem includes a diverse network of manufacturers, raw material suppliers, distributors, and key end users, all of whom play vital roles in advancing laboratory diagnostics, research workflows, and bioprocessing innovations worldwide. Leading laboratory centrifuge manufacturers such as Thermo Fisher Scientific, Eppendorf, Hettich, Danaher (Beckman Coulter), Kubota, and NuAire offer a wide range of solutions, including benchtop, floor-standing, and high-speed centrifuges. These companies continuously invest in R&D to develop reliable, automated, and energy-efficient systems designed for clinical, academic, and industrial laboratories. The supply chain is robustly supported by global and regional OEMs supplying essential raw materials and components. Major suppliers like Jiangsu Kangjian Medical, Outokumpu, Cotaus, Alfa Laval, and Victrex provide medical-grade plastics, advanced alloys, rotors, and precision-machined internals, which are crucial for high throughput, safety, and compliance. Extensive distributors such as Krackeler Scientific, Woodley Equipment, Terra Universal, Helmer Scientific, and Alliance Scale serve as authorized partners, ensuring access to validated equipment, consumables, and after-sales support in both established and emerging markets. Their responsibilities include inventory management, technical training, and facilitating smooth market entry for new innovations. Prominent end users—including leading hospital networks (Cleveland Clinic, Charité, Johns Hopkins), research institutions (Union Health, VCU Health), and pioneering biotech firms (Gilead Sciences)—integrate laboratory centrifuges into their diagnostic, therapeutic, and R&D pipelines. Their adoption of advanced centrifuge technologies helps set standards for accuracy, productivity, and scalable sample processing across the global life sciences and healthcare sectors.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Laboratory Centrifuges Market, By Platform Type

Based on platform type, the laboratory centrifuges market is segmented into benchtop and floor-standing centrifuges. Among these, the benchtop centrifuges segment accounted for the largest market share since these centrifuges are cost-effective, versatile, easy to use, smaller in size, and considerably lighter in weight. Their ease of operation and maintenance further broaden their appeal, especially for laboratories with smaller teams or limited technical resources. Versatility is another important factor; benchtop centrifuges are designed to handle a wide range of sample types and volumes, making them adaptable to diverse protocols in diagnostics, biochemistry, microbiology, and molecular biology. Cost-effectiveness compared to large floor-standing models makes benchtop centrifuges accessible even to budget-constrained institutions, supporting widespread adoption across both mature and emerging markets. These advantages have resulted in their increased adoption in the laboratory centrifuges market.

Laboratory Centrifuges Market, By Product

The laboratory centrifuges market is segmented into equipment and accessories. In 2024, the equipment segment accounted for the largest share of the laboratory centrifuges market. The large share can be attributed to ongoing upgrades and frequent replacement cycles in research and clinical laboratories. Demand for laboratory centrifuge equipment is sustained by continuous technological innovation, as well as ongoing upgrades and replacement cycles in research and clinical laboratories. As new centrifuge models become available with enhanced features (such as higher speeds, digital interfaces, and automation capabilities), organizations are compelled to upgrade older equipment, fueling further growth in this segment. For companies in the laboratory centrifuge market, focusing on equipment innovation, after-sales service, and partnerships with research and healthcare organizations is crucial for capturing the largest revenue share.

Laboratory Centrifuges Market, By End User

The hospitals segment holds the largest share of the laboratory centrifuges market due to several interconnected trends and needs within the healthcare industry. Hospitals are on the frontline for diagnosis, disease monitoring, and treatment, which require extensive laboratory testing—most of which depend on centrifugation for activities such as blood separation, plasma analysis, and preparation of samples for microbiology or molecular diagnostics. The rise in the prevalence of chronic and infectious diseases has accelerated diagnostic workloads, compelling hospitals to invest in more centrifuges and advanced, automated models that can process samples quickly and reliably. Furthermore, the rapid increase in healthcare infrastructure—especially in emerging economies—alongside rising healthcare expenditure and government initiatives to improve diagnostic capacity, are expanding the number of hospitals and thereby increasing demand for centrifuge equipment. Collectively, these trends ensure that hospitals remain the dominant end user in the laboratory centrifuges market and continue to drive the greatest volume of purchases and innovation in this space.

REGION

Asia Pacific to be fastest-growing region in global laboratory centrifuges market during forecast period

Asia Pacific is experiencing the fastest growth rate in the global laboratory centrifuges market during the forecast period, driven by several dynamic and interconnected factors. One of the main contributors is the rapid economic development of emerging economies like China and India, which are significantly expanding their investments in healthcare infrastructure, scientific research, and laboratory capabilities. The rise in healthcare expenditure and government initiatives to improve healthcare access and diagnostic services are catalyzing market expansion for laboratory equipment in this region. Another crucial element is the surge in R&D investments by pharmaceutical and biotechnology companies, which are increasingly establishing research and manufacturing hubs in countries like China, India, and other Southeast Asian nations. This trend is complemented by the growing number of hospitals, diagnostic centers, and academic institutes, creating substantial demand for advanced laboratory instruments—including centrifuges.

Laboratory Centrifuges Market: COMPANY EVALUATION MATRIX

Thermo Fisher Scientific is the leading player, holding a significant market share and offering a comprehensive range of centrifuge solutions. Its leadership is based on strong technological capabilities, extensive R&D expertise, and a diverse product portfolio, including benchtop, floor-standing, refrigerated, and ultra-high-speed centrifuges designed for clinical diagnostics, biopharmaceuticals, and research labs. As labs move toward high-throughput screening, multi-omics research, and scalable cell therapy processes, Thermo Fisher's offerings, like the Sorvall and DynaSpin series, continue to set market standards for safety, precision, and versatility. Danaher maintains a solid position in the centrifuge market through its well-known Beckman Coulter brand, offering a broad lineup that includes the Optima XPN, Optima XE, and Microfuge series. Danaher's extensive portfolio, combined with its global service and distribution network, ensures reliability, scalability, and ongoing support for various laboratory and bioprocessing needs, helping it secure a competitive market position.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 1.53 Billion |

| Market Forecast in 2030 (value) | USD 1.86 Billion |

| Growth Rate | CAGR of 2.8% from 2025–2030 |

| Years Considered | 2023–2030 |

| Base Year | 2024 |

| Forecast Period | 2025–2030 |

| Units Considered | Value (USD Million), Volume (Installed Base) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, the Middle East & Africa, Latin America |

WHAT IS IN IT FOR YOU: Laboratory Centrifuges Market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Key Manufacturer |

|

|

RECENT DEVELOPMENTS

- April 2025 : Thermo Fisher Scientific, Inc (US) introduced the Cryofuge series of refrigerated floor models, targeting precision medicine and high-throughput clinical laboratories with enhanced automation and efficiency capabilities.

- April 2025 : Danaher (US) launched the OptiMATE Gradient Maker, an automated instrument that reduces ultracentrifuge preparation time supporting more efficient sample processing for research and biopharma labs.

- July 2024 : Hettich Group (Germany), a key centrifuge manufacturer, formed a strategic growth partnership with Bregal Unternehmerkapital. This partnership is intended to strengthen Hettich’s organic and inorganic expansion, with a strong focus on the Asia Pacific and US markets.

Table of Contents

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 49)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SEGMENTATION

1.3.1 MARKETS COVERED

FIGURE 1 LABORATORY CENTRIFUGES MARKET SEGMENTATION

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 EXCHANGE RATES UTILIZED FOR THE CONVERSION TO USD

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 55)

2.1 RESEARCH DATA

FIGURE 2 LABORATORY CENTRIFUGES MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

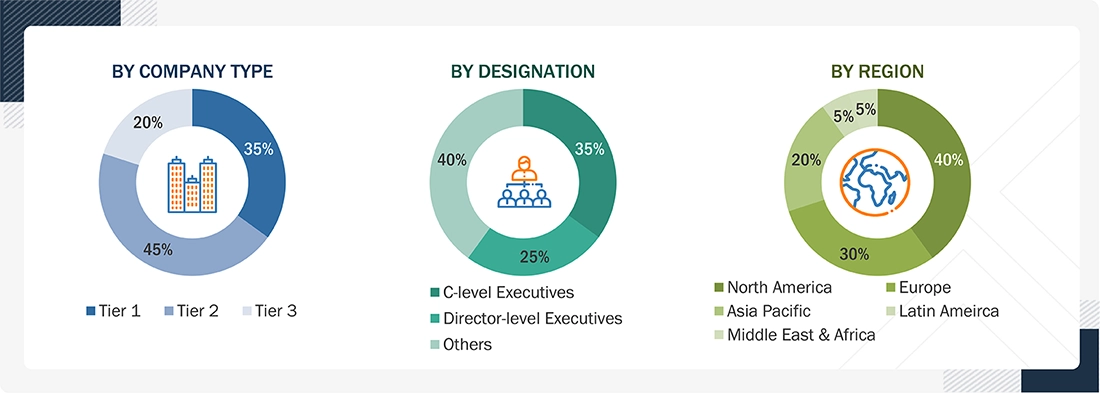

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 LABORATORY CENTRIFUGES INDUSTRY – REVENUE SHARE ANALYSIS ILLUSTRATION: THERMO FISHER SCIENTIFIC

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF LABORATORY CENTRIFUGES

FIGURE 7 CAGR PROJECTIONS

FIGURE 8 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 INDICATORS AND ASSUMPTIONS AND THEIR IMPACT ON THE STUDY

2.6.1 COVID-19-SPECIFIC ASSUMPTIONS

2.7 LIMITATIONS

2.8 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT

2.9 COVID-19 ECONOMIC ASSESSMENT

2.10 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 10 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 11 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 74)

FIGURE 12 LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2021 VS. 2026 (USD BILLION)

FIGURE 13 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 14 LABORATORY CENTRIFUGES INDUSTRY, BY INTENDED USE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN

FIGURE 16 MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 17 MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 18 GEOGRAPHIC SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 79)

4.1 LABORATORY CENTRIFUGES MARKET OVERVIEW

FIGURE 19 INCREASING PREVALENCE OF INFECTIOUS DISEASES AND RISING TECHNOLOGICAL ADVANCEMENTS IN LABORATORY CENTRIFUGES TO DRIVE THE MARKET GROWTH

4.2 ASIA PACIFIC: LABORATORY CENTRIFUGES INDUSTRY, BY PRODUCT (2020)

FIGURE 20 THE LABORATORY CENTRIFUGE EQUIPMENT SEGMENT DOMINATED THE ASIA PACIFIC MARKET IN 2020

4.3 MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 21 CHINA TO REGISTER THE HIGHEST REVENUE GROWTH DURING THE FORECAST PERIOD

4.4 MARKET, BY REGION (2021–2026)

FIGURE 22 NORTH AMERICA WILL CONTINUE TO DOMINATE THE MARKET DURING THE FORECAST PERIOD

4.5 LABORATORY CENTRIFUGES INDUSTRY: DEVELOPED VS. DEVELOPING MARKETS

FIGURE 23 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 83)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 LABORATORY CENTRIFUGES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 3 MARKET DYNAMICS: LABORATORY CENTRIFUGES INDUSTRY

5.2.1 DRIVERS

5.2.1.1 Increasing R&D investments and research grants

TABLE 4 R&D EXPENDITURE OF MAJOR LABORATORY CENTRIFUGES COMPANIES, 2019 VS. 2020

TABLE 5 EQUIPMENT FUNDING OFFERED BY THE HARVARD UNIVERSITY, 2021

5.2.1.2 Rising technological advancements and innovative rotor designs

5.2.1.3 Increasing prevalence of infectious diseases leads to a higher volume of sample testing & cell-based research in laboratory centrifuges

TABLE 6 GLOBAL DISEASE INCIDENCE

5.2.1.4 Widening applications of laboratory centrifuges

5.2.2 RESTRAINTS

5.2.2.1 Long equipment lifespans

5.2.2.2 Increasing adoption of refurbished laboratory centrifuges

5.2.2.3 High equipment costs

5.2.3 OPPORTUNITIES

5.2.3.1 Integration of automation and advanced features in laboratory centrifuges

TABLE 7 AUTOMATED CENTRIFUGES

5.2.3.2 Growth opportunities in emerging markets

5.2.4 CHALLENGES

5.2.4.1 Possibilities of mechanical, chemical, and fire hazards

5.2.4.2 Exposure to hazardous aerosols and lab-acquired infections

5.3 COVID-19 IMPACT ON THE MARKET

5.3.1 MARKET - GLOBAL FORECAST TO 2026

5.3.1.1 COVID-19 health hssessment

5.3.1.2 COVID-19 Impact on the laboratory centrifuges market

TABLE 8 COVID-19 IMPACT ON THE MARKET

FIGURE 25 COVID-19 IMPACT ON KEY PLAYER REVENUES OF THE LABORATORY CENTRIFUGE BUSINESSES

5.4 REGULATORY ANALYSIS

TABLE 9 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING THE MARKET

5.4.1 NORTH AMERICA

5.4.1.1 US

TABLE 10 US FDA: MEDICAL DEVICE CLASSIFICATION

TABLE 11 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

5.4.2 STANDARDS AND CERTIFICATIONS

TABLE 12 STANDARDS FOR LABORATORY CENTRIFUGES

TABLE 13 CGMP STANDARDS FOR LABORATORY CENTRIFUGES

5.4.2.1 Canada

TABLE 14 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

FIGURE 26 CANADA: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES

5.4.3 EUROPE

FIGURE 27 EUROPE: REGULATORY APPROVAL PROCESS FOR MEDICAL DEVICES (MDR)

5.4.4 ASIA PACIFIC

5.4.4.1 Japan

5.4.4.1.1 Revision of the pharmaceutical affairs law (PAL) and implementation of the new PMD Act in Japan

TABLE 15 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.4.4.2 China

TABLE 16 CHINA: CLASSIFICATION OF MEDICAL DEVICES

5.4.4.3 India

5.4.4.4 Australia

5.4.4.4.1 TGA device classification

5.5 TECHNOLOGY ANALYSIS

5.5.1 CONVENTIONAL CENTRIFUGES AND THE CHALLENGES

5.5.2 ADVANCED/NEXT-GENERATION CENTRIFUGATION: FUNCTIONALITY, SAFETY, AND EASE OF USE

5.6 PRICING ANALYSIS

TABLE 17 AVERAGE SELLING PRICES OF LABORATORY CENTRIFUGES IN THE NORTH AMERICA

TABLE 18 AVERAGE SELLING PRICES OF LABORATORY CENTRIFUGES IN EUROPE

TABLE 19 AVERAGE SELLING PRICES OF LABORATORY CENTRIFUGES IN THE ASIA PACIFIC

5.7 TRADE ANALYSIS

5.7.1 IMPORT DATA FOR HS CODE 842119, BY COUNTRY, 2016–2020 (USD MILLION)

5.7.2 EXPORT DATA FOR HS CODE 842119, BY COUNTRY, 2016–2020 (USD MILLION)

5.8 PATENT ANALYSIS

FIGURE 28 LIST OF MAJOR PATENTS FOR LABORATORY CENTRIFUGES

FIGURE 29 REGIONAL ANALYSIS OF PATENTS GRANTED FOR THE MARKET, 2011–2021

TABLE 20 INDICATIVE LIST OF LABORATORY CENTRIFUGES PATENTS

5.9 VALUE CHAIN ANALYSIS

FIGURE 30 VALUE CHAIN ANALYSIS: MAJOR VALUE IS ADDED DURING THE MANUFACTURING AND ASSEMBLY PHASES

5.10 SUPPLY CHAIN ANALYSIS

FIGURE 31 DIRECT DISTRIBUTION—THE PREFERRED STRATEGY OF PROMINENT COMPANIES

5.11 ECOSYSTEM ANALYSIS

FIGURE 32 MARKET: ECOSYSTEM ANALYSIS

5.11.1 ROLE IN THE ECOSYSTEM

FIGURE 33 KEY PLAYERS IN THE MARKET ECOSYSTEM

5.12 PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT FROM NEW ENTRANTS

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 INTENSITY OF COMPETITIVE RIVALRY

5.12.5 THREAT FROM SUBSTITUTES

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.13.1 REVENUE SHIFT AND REVENUE POCKETS FOR LABORATORY CENTRIFUGE MANUFACTURERS

FIGURE 34 REVENUE SHIFT FOR LABORATORY CENTRIFUGES

5.14 RANGES/SCENARIOS

5.14.1 PESSIMISTIC SCENARIO OF THE MARKET

FIGURE 35 PESSIMISTIC SCENARIO OF THE MARKET

5.14.2 REALISTIC SCENARIO OF THE MARKET

FIGURE 36 REALISTIC SCENARIO OF THE MARKET

5.14.3 OPTIMISTIC SCENARIO OF THE MARKET

FIGURE 37 OPTIMISTIC SCENARIO OF THE MARKET

6 LABORATORY CENTRIFUGES MARKET, BY PRODUCT (Page No. - 125)

6.1 INTRODUCTION

TABLE 21 LABORATORY CENTRIFUGES INDUSTRY, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 22 LABORATORY CENTRIFUGES INDUSTRY, BY PRODUCT, 2021–2026 (USD MILLION)

6.2 EQUIPMENT

TABLE 23 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 24 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 25 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 26 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.1 MULTIPURPOSE CENTRIFUGES

6.2.1.1 Wide range of laboratory applications and the high versatility of Multipurpose centrifuges drive the growth of this segment

TABLE 27 MULTIPURPOSE CENTRIFUGES AVAILABLE IN THE MARKET

TABLE 28 MULTIPURPOSE CENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 29 MULTIPURPOSE CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.2 MICROCENTRIFUGES

6.2.2.1 Laboratory microcentrifuges have a wide range of applications in PCR set-up and nucleic acid & protein-based reactions

TABLE 30 MICROCENTRIFUGES AVAILABLE IN THE MARKET

TABLE 31 MICROCENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 32 MICROCENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.3 ULTRACENTRIFUGES

6.2.3.1 Ultracentrifuges are actively used in nanoparticles, exosomes, viral, and biomolecule isolation

TABLE 33 ULTRACENTRIFUGES AVAILABLE IN THE MARKET

TABLE 34 ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 35 ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 36 ULTRACENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 ULTRACENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.3.2 Preparative ultracentrifuges

6.2.3.2.1 Preparative ultracentrifuges accounted for the largest share of the ultracentrifuges market in 2020

TABLE 38 PREPARATIVE ULTRACENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 PREPARATIVE ULTRACENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.3.3 Analytical ultracentrifuges

6.2.3.3.1 Analytical ultracentrifuges are used to determine sedimentation velocity and equilibrium

TABLE 40 ANALYTICAL ULTRACENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 41 ANALYTICAL ULTRACENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.4 MINICENTRIFUGES

TABLE 42 MINICENTRIFUGES AVAILABLE IN THE MARKET

TABLE 43 MINICENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 44 MINICENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.2.5 OTHER CENTRIFUGES

TABLE 45 OTHER CENTRIFUGES AVAILABLE IN THE MARKET

TABLE 46 OTHER CENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 47 OTHER CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3 ACCESSORIES

TABLE 48 LABORATORY CENTRIFUGE ACCESSORIES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 49 LABORATORY CENTRIFUGE ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 50 LABORATORY CENTRIFUGE ACCESSORIES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 LABORATORY CENTRIFUGE ACCESSORIES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.1 ROTORS

TABLE 52 ROTORS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 53 ROTORS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.2 TUBES

TABLE 54 CENTRIFUGE TUBES AVAILABLE IN THE MARKET

TABLE 55 TUBES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 56 TUBES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.3 CENTRIFUGE BOTTLES

TABLE 57 SOME CENTRIFUGE BOTTLES AVAILABLE IN THE MARKET

TABLE 58 CENTRIFUGE BOTTLES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 CENTRIFUGE BOTTLES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.4 CENTRIFUGE BUCKETS

TABLE 60 SOME CENTRIFUGE BUCKETS AVAILABLE IN THE MARKET

TABLE 61 CENTRIFUGE BUCKETS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 62 CENTRIFUGE BUCKETS MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.5 CENTRIFUGE PLATES

TABLE 63 PLATES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 64 CENTRIFUGE PLATES MARKET, BY REGION, 2021–2026 (USD MILLION)

6.3.6 OTHER CENTRIFUGE ACCESSORIES

TABLE 65 SOME OTHER CENTRIFUGE ACCESSORIES AVAILABLE IN THE MARKET

TABLE 66 OTHER CENTRIFUGE ACCESSORIES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 67 OTHER CENTRIFUGE ACCESSORIES MARKET, BY REGION, 2021–2026 (USD MILLION)

7 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE (Page No. - 148)

7.1 INTRODUCTION

TABLE 68 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 69 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

7.2 BENCHTOP CENTRIFUGES

7.2.1 BENCHTOP CENTRIFUGES HAVE A HIGH ADOPTION RATE DUE TO THEIR WIDE RANGE OF APPLICATIONS AND COMPACT SIZE

TABLE 70 BENCHTOP CENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 71 BENCHTOP CENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 72 BENCHTOP CENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 BENCHTOP CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

7.3 FLOOR-STANDING CENTRIFUGES

7.3.1 FLOOR-STANDING CENTRIFUGES ARE SUITABLE FOR CENTRIFUGING HIGH VOLUMES OF STANDARD TUBES AND PROCESSING LARGE-VOLUME SAMPLES

TABLE 74 FLOOR-STANDING CENTRIFUGES AVAILABLE IN THE MARKET

TABLE 75 FLOOR-STANDING CENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 76 FLOOR-STANDING CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

8 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN (Page No. - 154)

8.1 INTRODUCTION

TABLE 77 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 78 LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

8.2 FIXED-ANGLE ROTORS

8.2.1 FIXED-ANGLE ROTORS ACCOUNTED FOR THE LARGEST SHARE IN 2020 OWING TO THEIR USE IN PROTEIN RESEARCH, SPINNING OPERATIONS, AND PELLETING APPLICATIONS

TABLE 79 FIXED-ANGLE ROTORS AVAILABLE IN THE MARKET

TABLE 80 FIXED-ANGLE ROTORS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 81 FIXED-ANGLE ROTORS MARKET, BY REGION, 2021–2026 (USD MILLION)

8.3 SWINGING-BUCKET ROTORS

8.3.1 GROWING USE OF CLINICAL CENTRIFUGES AND INCREASING RESEARCH ON TISSUE CULTURES ARE DRIVING THE ADOPTION OF SWINGING-BUCKET ROTORS

TABLE 82 SWINGING-BUCKET ROTORS AVAILABLE IN THE MARKET

TABLE 83 SWINGING-BUCKET ROTORS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 84 SWINGING-BUCKET ROTORS MARKET, BY REGION, 2021–2026 (USD MILLION)

8.4 VERTICAL ROTORS

8.4.1 VERTICAL ROTORS HAVE VAST APPLICATIONS IN ISOPYCNIC SEPARATION

TABLE 85 VERTICAL ROTORS AVAILABLE IN THE MARKET

TABLE 86 VERTICAL ROTORS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 87 VERTICAL ROTORS MARKET, BY REGION, 2021–2026 (USD MILLION)

8.5 OTHER ROTORS

TABLE 88 OTHER ROTORS AVAILABLE IN THE MARKET

TABLE 89 OTHER ROTORS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 90 OTHER ROTORS MARKET, BY REGION, 2021–2026 (USD MILLION)

9 LABORATORY CENTRIFUGES MARKET, BY INTENDED USE (Page No. - 162)

9.1 INTRODUCTION

TABLE 91 LABORATORY CENTRIFUGES INDUSTRY, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 92 MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

9.2 GENERAL PURPOSE CENTRIFUGES

9.2.1 VAST APPLICATION AREAS OF GENERAL PURPOSE CENTRIFUGES DRIVES ITS ADOPTION IN THE MARKET

TABLE 93 SOME COVID-19 FUNDS GRANTED BY ORGANIZATIONS AND FUNDING PROGRAMS

TABLE 94 GENERAL PURPOSE CENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 95 GENERAL PURPOSE CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

9.3 CLINICAL CENTRIFUGES

9.3.1 CLINICAL CENTRIFUGES HAVE A BROAD RANGE OF APPLICATIONS

TABLE 96 CLINICAL CENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 97 CLINICAL CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

9.4 PRECLINICAL CENTRIFUGES

9.4.1 INCREASING COLLABORATIONS TO FACILITATE PRECLINICAL TRIALS AND THE GLOBAL BURDEN OF CANCER TO DRIVE THE MARKET GROWTH OF PRECLINICAL CENTRIFUGES

TABLE 98 PRECLINICAL CENTRIFUGES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 99 PRECLINICAL CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

10 LABORATORY CENTRIFUGES MARKET, BY APPLICATION (Page No. - 169)

10.1 INTRODUCTION

TABLE 100 LABORATORY CENTRIFUGES INDUSTRY, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 101 LABORATORY CENTRIFUGE MARKET, BY APPLICATIONS, 2021–2026 (USD MILLION)

10.2 DIAGNOSTICS

10.2.1 DIAGNOSTICS DOMINATED THE MARKET IN 2020 WITH THE HIGH NUMBERS OF DIAGNOSTIC TESTS FOR THE INFECTIOUS AND CHRONIC DISEASES

TABLE 102 MARKET FOR DIAGNOSTICS, BY REGION, 2016–2020 (USD MILLION)

TABLE 103 MARKET FOR DIAGNOSTICS, BY REGION, 2021–2026 (USD MILLION)

10.3 MICROBIOLOGY

10.3.1 RISING RESEARCH IN MICROBIOLOGY TO INCREASE THE DEMAND FOR CENTRIFUGES

TABLE 104 MARKET FOR MICROBIOLOGY, BY REGION, 2016–2020 (USD MILLION)

TABLE 105 MARKET FOR MICROBIOLOGY, BY REGION, 2021–2026 (USD MILLION)

10.4 CELLOMICS

10.4.1 INCREASING RESEARCH TRENDS IN CELLOMICS AND A RISING DISEASE PREVALENCE TO DRIVE THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 106 MARKET FOR CELLOMICS, BY REGION, 2016–2020 (USD MILLION)

TABLE 107 MARKET FOR CELLOMICS, BY REGION, 2021–2026 (USD MILLION)

10.5 GENOMICS

10.5.1 GENOMICS IS THE FASTEST-GROWING APPLICATION SEGMENT OF THE LABORATORY CENTRIFUGES MARKET DURING THE FORECAST PERIOD

TABLE 108 MARKET FOR GENOMICS, BY REGION, 2016–2020 (USD MILLION)

TABLE 109 MARKET FOR GENOMICS, BY REGION, 2021–2026 (USD MILLION)

10.6 PROTEOMICS

10.6.1 INCREASING IMPORTANCE OF PROTEOMICS RESEARCH ACROSS BIOLOGICAL RESEARCH TO DRIVE THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 110 MARKET FOR PROTEOMICS, BY REGION, 2016–2020 (USD MILLION)

TABLE 111 MARKET FOR PROTEOMICS, BY REGION, 2021–2026 (USD MILLION)

10.7 BLOOD COMPONENT SEPARATION

10.7.1 INCREASING PREVALENCE OF BLOOD-RELATED DISEASES TO DRIVE THE GROWTH OF THIS APPLICATION SEGMENT

TABLE 112 MARKET FOR BLOOD COMPONENT SEPARATION, BY REGION, 2016–2020 (USD MILLION)

TABLE 113 MARKET FOR BLOOD COMPONENT SEPARATION, BY REGION, 2021–2026 (USD MILLION)

10.8 OTHER APPLICATIONS

TABLE 114 MARKET FOR OTHER APPLICATIONS, BY REGION, 2016–2020 (USD MILLION)

TABLE 115 MARKET FOR OTHER APPLICATIONS, BY REGION, 2021–2026 (USD MILLION)

11 LABORATORY CENTRIFUGES MARKET, BY END USER (Page No. - 180)

11.1 INTRODUCTION

TABLE 116 LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 117 MARKET, BY END USER, 2021–2026 (USD MILLION)

11.2 HOSPITALS

11.2.1 INCREASING GOVERNMENT SUPPORT FOR PUBLIC HOSPITALS AND IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO DRIVE THE MARKET GROWTH

TABLE 118 HOSPITALS MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 119 HOSPITALS MARKET, BY REGION, 2021–2026 (USD MILLION)

11.3 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES

11.3.1 INCREASED PRODUCTION OF PROTEIN-BASED DRUGS IS EXPECTED TO DRIVE THE MARKET GROWTH FOR THIS END-USER SEGMENT

TABLE 120 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 121 BIOTECHNOLOGY & PHARMACEUTICAL COMPANIES MARKET, BY REGION, 2021–2026 (USD MILLION)

11.4 ACADEMIC & RESEARCH INSTITUTES

11.4.1 INCREASING FUNDING FOR LIFE SCIENCE & BIOTECHNOLOGY RESEARCH FROM GOVERNMENTS AND NON-PROFIT ORGANIZATIONS SUPPORTS THE GROWTH OF THIS SEGMENT

TABLE 122 ACADEMIC & RESEARCH INSTITUTES MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 123 ACADEMIC & RESEARCH INSTITUTES MARKET, BY REGION, 2021–2026 (USD MILLION)

12 LABORATORY CENTRIFUGES MARKET, BY REGION (Page No. - 187)

12.1 INTRODUCTION

TABLE124 LABORATORY CENTRIFUGES INDUSTRY, BY REGION, 2016–2020 (USD MILLION)

TABLE125 LABORATORY CENTRIFUGES MARKET, BY REGION, 2021–2026 (USD MILLION)

12.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: LABORATORY CENTRIFUGES MARKET SNAPSHOT (2020)

TABLE126 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE127 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE128 NORTH AMERICA: MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE129 NORTH AMERICA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE130 NORTH AMERICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE131 NORTH AMERICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE132 NORTH AMERICA: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE133 NORTH AMERICA: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE134 NORTH AMERICA: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE135 NORTH AMERICA: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE136 NORTH AMERICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE137 NORTH AMERICA: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE138 NORTH AMERICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE139 NORTH AMERICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE140 NORTH AMERICA: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE141 NORTH AMERICA: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE142 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE143 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE144 NORTH AMERICA: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE145 NORTH AMERICA: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.2.1 US

12.2.1.1 Rapid growth in R&D to drive the growth of the market

TABLE 146 US: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 147 US: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 148 US: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 149 US: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 150 US: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 151 US: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 152 US: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 153 US: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 154 US: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 155 US: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 156 US: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 157 US: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 158 US: LABORATORY CENTRIFUGES MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 159 US: LABORATORY CENTRIFUGE MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 160 US: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 161 US: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 162 US: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 163 US: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.2.2 CANADA

12.2.2.1 Increasing government funding to drive the market growth for laboratory centrifuges market in Canada

FIGURE 39 INCREASING FUNDS OFFERED BY THE CANADIAN GOVERNMENT, USD BN (2017-2021)

TABLE 164 CANADA: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 165 CANADA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 166 CANADA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 167 CANADA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 168 CANADA: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 169 CANADA: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 170 CANADA: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 171 CANADA: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 172 CANADA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 173 CANADA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 174 CANADA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 175 CANADA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 176 CANADA: LABORATORY CENTRIFUGES MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 177 CANADA: LABORATORY CENTRIFUGE MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 178 CANADA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 179 CANADA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 180 CANADA: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 181 CANADA: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3 EUROPE

TABLE182 EUROPE: LABORATORY CENTRIFUGES MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE183 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE184 EUROPE: MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE185 EUROPE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE186 EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE187 EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE188 EUROPE: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE189 EUROPE: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE190 EUROPE: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE191 EUROPE: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE192 EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE193 EUROPE: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE194 EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE195 EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE196 EUROPE: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE197 EUROPE: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE198 EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE199 EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE200 EUROPE: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE201 EUROPE: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.1 GERMANY

12.3.1.1 Increasing emphasis on R&D activities to accelerate market growth in Germany

TABLE 202 GERMANY: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 203 GERMANY: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 204 GERMANY: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 205 GERMANY: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 206 GERMANY: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 207 GERMANY: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 208 GERMANY: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 209 GERMANY: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 210 GERMANY: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 211 GERMANY: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 212 GERMANY: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 213 GERMANY: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 214 GERMANY: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 215 GERMANY: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 216 GERMANY: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 217 GERMANY: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 218 GERMANY: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 219 GERMANY: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.2 FRANCE

12.3.2.1 increasing R&D activities in infectious disease diagnosis to support the market growth in France

TABLE 220 FRANCE: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 221 FRANCE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 222 FRANCE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 223 FRANCE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 224 FRANCE: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 225 FRANCE: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 226 FRANCE: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 227 FRANCE: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 228 FRANCE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 229 FRANCE: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 230 FRANCE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 231 FRANCE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 232 FRANCE: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 233 FRANCE: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 234 FRANCE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 235 FRANCE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 236 FRANCE: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 237 FRANCE: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.3 UK

12.3.3.1 The rising number of infectious disease cases in the UK supports the market growth for laboratory centrifuges

TABLE 238 UK: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 239 UK: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 240 UK: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 241 UK: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 242 UK: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 243 UK: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 244 UK: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 245 UK: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 246 UK: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 247 UK: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 248 UK: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 249 UK: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 250 UK: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 251 UK: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 252 UK: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 253 UK: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 254 UK: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 255 UK: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.3.4 REST OF EUROPE

TABLE 256 REST OF EUROPE: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 257 REST OF EUROPE: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 258 REST OF EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 259 REST OF EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 260 REST OF EUROPE: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 261 REST OF EUROPE: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 262 REST OF EUROPE: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 263 REST OF EUROPE: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 264 REST OF EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 265 REST OF EUROPE: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 266 REST OF EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 267 REST OF EUROPE: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 268 REST OF EUROPE: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 269 REST OF EUROPE: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 270 REST OF EUROPE: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 271 REST OF EUROPE: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 272 REST OF EUROPE: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 273 REST OF EUROPE: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4 ASIA PACIFIC

FIGURE 40 ASIA PACIFIC: LABORATORY CENTRIFUGES MARKET SNAPSHOT (2020)

TABLE274 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE275 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE276 ASIA PACIFIC: MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE277 ASIA PACIFIC: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE278 ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE279 ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE280 ASIA PACIFIC: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE281 ASIA PACIFIC: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE282 ASIA PACIFIC: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE283 ASIA PACIFIC: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE284 ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE285 ASIA PACIFIC: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE286 ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE287 ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE288 ASIA PACIFIC: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE289 ASIA PACIFIC: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE290 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE291 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE292 ASIA PACIFIC: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE293 ASIA PACIFIC: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.1 CHINA

12.4.1.1 Growth of the pharma & biotech industry in China is anticipated to propel the market growth for laboratory centrifuges

TABLE 294 CHINA: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 295 CHINA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 296 CHINA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 297 CHINA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 298 CHINA: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 299 CHINA: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 300 CHINA: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 301 CHINA: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 302 CHINA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 303 CHINA: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 304 CHINA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 305 CHINA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 306 CHINA: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 307 CHINA: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 308 CHINA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 309 CHINA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 310 CHINA: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 311 CHINA: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.2 JAPAN

12.4.2.1 The implementation of favorable government initiatives primarily drives the growth of the laboratory centrifuges market in Japan

TABLE 312 JAPAN: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 313 JAPAN: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 314 JAPAN: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 315 JAPAN: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 316 JAPAN: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 317 JAPAN: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 318 JAPAN: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 319 JAPAN: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 320 JAPAN: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 321 JAPAN: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 322 JAPAN: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 323 JAPAN: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 324 JAPAN: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 325 JAPAN: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 326 JAPAN: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 327 JAPAN: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 328 JAPAN: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 329 JAPAN: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.3 INDIA

12.4.3.1 Rising incidence of diseases that require an early-stage diagnosis to drive the market growth for laboratory centrifuges

TABLE 330 INDIA: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 331 INDIA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 332 INDIA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 333 INDIA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 334 INDIA: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 335 INDIA: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 336 INDIA: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 337 INDIA: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 338 INDIA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 339 INDIA: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 340 INDIA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 341 INDIA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 342 INDIA: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 343 INDIA: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 344 INDIA: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 345 INDIA: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 346 INDIA: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 347 INDIA: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.4.4 REST OF ASIA PACIFIC

TABLE 348 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 349 REST OF ASIA PACIFIC: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 350 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 351 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 352 REST OF ASIA PACIFIC: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 353 REST OF ASIA PACIFIC: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 354 REST OF ASIA PACIFIC: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 355 REST OF ASIA PACIFIC: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 356 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 357 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGES MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 358 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 359 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 360 REST OF ASIA PACIFIC: MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 361 REST OF ASIA PACIFIC: MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 362 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 363 REST OF ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 364 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 365 REST OF ASIA PACIFIC: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

12.5 REST OF THE WORLD (ROW)

TABLE 366 REST OF THE WORLD: LABORATORY CENTRIFUGES MARKET, BY COUNTRY/REGION, 2016–2020 (USD MILLION)

TABLE 367 REST OF THE WORLD: MARKET, BY COUNTRY/REGION, 2021–2026 (USD MILLION)

TABLE 368 REST OF THE WORLD: MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 369 REST OF THE WORLD: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 370 REST OF THE WORLD: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 371 REST OF THE WORLD: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 372 REST OF THE WORLD: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 373 REST OF THE WORLD: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 374 REST OF THE WORLD: LABORATORY ACCESSORIES MARKET, BY TYPE 2016–2020 (USD MILLION)

TABLE 375 REST OF THE WORLD: LABORATORY ACCESSORIES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 376 REST OF THE WORLD: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2016–2020 (USD MILLION)

TABLE 377 REST OF THE WORLD: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY MODEL TYPE, 2021–2026 (USD MILLION)

TABLE 378 REST OF THE WORLD: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2016–2020 (USD MILLION)

TABLE 379 REST OF THE WORLD: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY ROTOR DESIGN, 2021–2026 (USD MILLION)

TABLE 380 REST OF THE WORLD: LABORATORY CENTRIFUGES MARKET, BY INTENDED USE, 2016–2020 (USD MILLION)

TABLE 381 REST OF THE WORLD: LABORATORY CENTRIFUGE MARKET, BY INTENDED USE, 2021–2026 (USD MILLION)

TABLE 382 REST OF THE WORLD: MARKET, BY APPLICATION, 2016–2020 (USD MILLION)

TABLE 383 REST OF THE WORLD: MARKET, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 384 REST OF THE WORLD: LABORATORY CENTRIFUGES INDUSTRY, BY END USER, 2016–2020 (USD MILLION)

TABLE 385 REST OF THE WORLD: LABORATORY CENTRIFUGES MARKET, BY END USER, 2021–2026 (USD MILLION)

TABLE 386 MIDDLE EAST & AFRICA: LABORATORY CENTRIFUGES MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 387 MIDDLE EAST & AFRICA: MARKET, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 388 MIDDLE EAST & AFRICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 389 MIDDLE EAST & AFRICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 390 MIDDLE EAST & AFRICA: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 391 MIDDLE EAST & AFRICA: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 392 LATIN AMERICA: MARKET, BY PRODUCT, 2016–2020 (USD MILLION)

TABLE 393 LATIN AMERICA: LABORATORY CENTRIFUGES INDUSTRY, BY PRODUCT, 2021–2026 (USD MILLION)

TABLE 394 LATIN AMERICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 395 LATIN AMERICA: LABORATORY CENTRIFUGE EQUIPMENT MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 396 LATIN AMERICA: ULTRACENTRIFUGES MARKET, BY TYPE, 2016–2020 (USD MILLION)

TABLE 397 LATIN AMERICA: ULTRACENTRIFUGES MARKET, BY TYPE, 2021–2026 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 294)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

13.2.1 OVERVIEW OF THE STRATEGIES ADOPTED BY KEY PLAYERS IN THE LABORATORY CENTRIFUGES MARKET

13.3 REVENUE ANALYSIS

FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS IN THE LABORATORY CENTRIFUGES MARKET

13.4 MARKET SHARE ANALYSIS OF KEY COMPANIES IN THE LABORATORY CENTRIFUGES INDUSTRY

FIGURE 42 GLOBAL LABORATORY CENTRIFUGES INDUSTRY SHARE ANALYSIS OF KEY COMPANIES, 2020

TABLE 398 LABORATORY CENTRIFUGES INDUSTRY: DEGREE OF COMPETITION

13.4.1 GLOBAL LABORATORY ULTRACENTRIFUGES MARKET SHARE ANALYSIS OF KEY COMPANIES

FIGURE 43 PREPARATIVE ULTRACENTRIFUGES MARKET SHARE ANALYSIS OF KEY COMPANIES IN 2020 (% OF USD MILLION)

TABLE 399 GLOBAL PREPARATIVE ULTRACENTRIFUGES MARKET: DEGREE OF COMPETITION

FIGURE 44 NORTH AMERICA: PREPARATIVE ULTRACENTRIFUGES MARKET SHARE ANALYSIS OF KEY COMPANIES IN 2020 (% OF USD MILLION)

FIGURE 45 EUROPE: PREPARATIVE ULTRACENTRIFUGES MARKET SHARE ANALYSIS OF KEY COMPANIES IN 2020 (% OF USD MILLION)

FIGURE 46 ASIA PACIFIC: PREPARATIVE ULTRACENTRIFUGE MARKET SHARE ANALYSIS OF KEY COMPANIES IN 2020 (% OF USD MILLION)

FIGURE 47 REST OF THE WORLD: PREPARATIVE ULTRACENTRIFUGES MARKET SHARE ANALYSIS OF KEY COMPANIES IN 2020 (% OF USD MILLION)

13.5 COMPANY EVALUATION QUADRANT (MAJOR PLAYERS)

13.5.1 STARS

13.5.2 PERVASIVE PLAYERS

13.5.3 EMERGING LEADERS

13.5.4 PARTICIPANTS

FIGURE 48 LABORATORY CENTRIFUGES INDUSTRY (GLOBAL): COMPANY EVALUATION QUADRANT, 2020

13.6 COMPANY EVALUATION QUADRANT (SMES/STARTUPS)

13.6.1 PROGRESSIVE COMPANIES

13.6.2 STARTING BLOCKS

13.6.3 RESPONSIVE COMPANIES

13.6.4 DYNAMIC COMPANIES

FIGURE 49 LABORATORY CENTRIFUGES INDUSTRY: COMPANY EVALUATION QUADRANT FOR START-UPS/SMES, 2020

13.7 COMPETITIVE BENCHMARKING

13.7.1 COMPANY PRODUCT FOOTPRINT (25 COMPANIES)

13.7.2 COMPANY REGIONAL FOOTPRINT

13.7.3 COMPANY FOOTPRINT

13.8 COMPETITIVE SCENARIO AND TRENDS

13.8.1 PRODUCT LAUNCHES

TABLE 400 PRODUCT LAUNCHES, JANUARY 2018–OCTOBER 2021

13.8.2 OTHER DEVELOPMENTS

TABLE 401 OTHER DEVELOPMENTS, JANUARY 2018–OCTOBER 2021

13.8.3 DEALS

TABLE 402 DEALS, JANUARY 2018–OCTOBER 2021

14 COMPANY PROFILES (Page No. - 315)

14.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

14.1.1 THERMO FISHER SCIENTIFIC INC.

TABLE 403 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

FIGURE 50 COMPANY SNAPSHOT: THERMO FISHER SCIENTIFIC, INC. (2020)

14.1.2 DANAHER CORPORATION

TABLE 404 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 51 COMPANY SNAPSHOT: DANAHER CORPORATION (2020)

14.1.3 EPPENDORF AG

TABLE 405 EPPENDORF AG: BUSINESS OVERVIEW

FIGURE 52 COMPANY SNAPSHOT: EPPENDORF AG (2020)

14.1.4 KUBOTA CORPORATION

TABLE 406 KUBOTA CORPORATION: BUSINESS OVERVIEW

14.1.5 SIGMA LABORZENTRIFUGEN GMBH

TABLE 407 SIGMA LABORZENTRIFUGEN GMBH: BUSINESS OVERVIEW

14.1.6 NUAIRE

TABLE 408 NUAIRE: BUSINESS OVERVIEW

14.1.7 QIAGEN N.V.

TABLE 409 QIAGEN N.V.: BUSINESS OVERVIEW

FIGURE 53 COMPANY SNAPSHOT: QIAGEN N.V. (2020)

14.1.8 ANDREAS HETTICH GMBH & CO.KG

TABLE 410 ANDREAS HETTICH GMBH & CO.KG: BUSINESS OVERVIEW

14.1.9 HERMLE LABORTECHNIK GMBH

TABLE 411 HERMLE LABORTECHNIK GMBH: BUSINESS OVERVIEW

14.1.10 SARTORIUS AG

TABLE 412 SARTORIUS AG: BUSINESS OVERVIEW

FIGURE 54 COMPANY SNAPSHOT: SARTORIUS AG (2020)

14.1.11 CARDINAL HEALTH

TABLE 413 CARDINAL HEALTH: BUSINESS OVERVIEW

FIGURE 55 COMPANY SNAPSHOT: CARDINAL HEALTH (2021)

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

14.2 OTHER PLAYERS

14.2.1 CENTURION SCIENTIFIC

TABLE 414 CENTURION SCIENTIFIC: COMPANY OVERVIEW

14.2.2 BIO-RAD LABORATORIES, INC.

TABLE 415 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

14.2.3 AGILENT TECHNOLOGIES

TABLE 416 AGILENT TECHNOLOGIES: COMPANY OVERVIEW

14.2.4 HAIER BIOMEDICAL

TABLE 417 HAIER BIOMEDICAL: COMPANY OVERVIEW

14.2.5 ANTYLIA SCIENTIFIC (COLE-PARMER INDIA PVT. LTD.)

TABLE 418 ANTYLIA SCIENTIFIC (COLE-PARMER INDIA PVT. LTD.).: COMPANY OVERVIEW

14.2.6 HEAL FORCE

TABLE 419 HEAL FORCE: COMPANY OVERVIEW

14.2.7 BENCHMARK SCIENTIFIC

TABLE 420 BENCHMARK SCIENTIFIC: COMPANY OVERVIEW

14.2.8 VISION SCIENTIFIC CO., LTD

TABLE 421 VISION SCIENTIFIC CO., LTD: COMPANY OVERVIEW

14.2.9 MEDITECH TECHNOLOGIES INDIA PRIVATE LIMITED

TABLE 422 MEDITECH TECHNOLOGIES INDIA PRIVATE LIMITED: COMPANY OVERVIEW

14.2.10 LABY INSTRUMENTS INDUSTRY

TABLE 423 LABY INSTRUMENTS INDUSTRY: COMPANY OVERVIEW

14.2.11 KAY & COMPANY

TABLE 424 KAY & COMPANY: COMPANY OVERVIEW

14.2.12 NARANG MEDICAL LIMITED

TABLE 425 NARANG MEDICAL LIMITED: COMPANY OVERVIEW

14.2.13 REMI GROUP

TABLE 426 REMI GROUP: COMPANY OVERVIEW

15 APPENDIX (Page No. - 363)

15.1 INSIGHTS FROM INDUSTRY EXPERTS

15.2 DISCUSSION GUIDE

15.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.4 AVAILABLE CUSTOMIZATIONS

15.5 RELATED REPORTS

15.6 AUTHOR DETAILS

Methodology

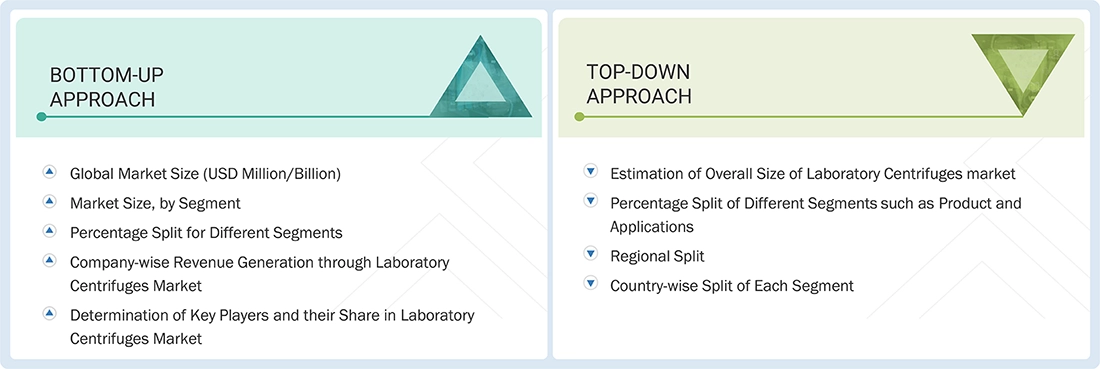

The study involved four main activities to determine the current size of the laboratory centrifuges market. Comprehensive secondary research was conducted to gather information on the market and its various subsegments. The next step was to confirm these findings, assumptions, and size estimates with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to calculate the global market size. Afterwards, market segmentation and data triangulation methods were applied to estimate the size of segments and subsegments.

Secondary Research

Secondary research sources included directories, Factiva, white papers, Bloomberg Business, annual reports, SEC filings, business filings, and investor presentations. These sources offered valuable insights into market leaders, sector divisions, and technological differences within various segments of the laboratory centrifuges market.

Primary Research

Several stakeholders, including manufacturers of laboratory centrifuge products, vendors, distributors, and technologists from hospitals and clinics, were consulted for this report. The demand side of this market is characterized by increasing R&D investments and research grants, technological advancements and innovative rotor designs, the rising prevalence of infectious diseases leading to higher volumes of sample testing and cell-based research in laboratory centrifuges, and expanding applications of laboratory centrifuges. Various primary sources from both the supply and demand sides of the market were interviewed to gather qualitative and quantitative information.

A breakdown of the primary respondents is provided below.

Note q: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note 2: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 1 billion, Tier 2 = < USD 500 million, and Tier 3 = < USD 100 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the laboratory centrifuges market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

This report utilized the revenue share analysis of major companies to evaluate the size of the global laboratory centrifuges market. This analysis involved identifying key market participants and calculating their revenue from laboratory centrifuges using a variety of data.

Global Laboratory Centrifuges Market: Bottom-up and Top-down Approach

Data Triangulation

To ensure precise data, the laboratory centrifuges market was segmented into various parts and subparts. A data triangulation method using both top-down and bottom-up approaches was employed. This involved examining factors and trends from both the demand and supply sides to confirm the findings for each segment. Combining this segmentation with the triangulation method helps make sure that the market data is both accurate and trustworthy.

Market Definition

A laboratory centrifuge is a motor-powered device used in labs to quickly spin liquid samples, applying centrifugal force to separate components based on their density. Its primary purpose is to speed up the sedimentation of suspended particles—such as cells, blood components, organelles, or macromolecules—inside a tube or container. Laboratory centrifuges are essential in diagnostics, biomedical research, pharmaceutical development, and industrial labs, allowing efficient separation, purification, and preparation of biological and chemical samples for further analysis or processing.

Stakeholders

- Suppliers and distributors of laboratory equipment

- Hospitals and clinical laboratories

- Biotechnology and pharmaceutical companies

- Academic and research institutions

- Regulatory and standards agencies

- Contract research organizations (CROs)

- End users such as laboratory technicians, clinicians, and researchers

- Manufacturers of laboratory centrifuges

Report Objectives

- To define, describe, and forecast the laboratory centrifuges market based on product, platform type, rotor design, application. intended use, end user, and region