Proteomics Market Size, Growth, Share & Trends Analysis

Proteomics Market by Product (Spectroscopy, Chromatography, Electrophoresis, X-Ray Crystallography), Reagent, Service (Core Proteomics, Bioinformatics), Application (Diagnostic, Drug Discovery), End User (Hospital, Biopharma) - Global Forecast to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

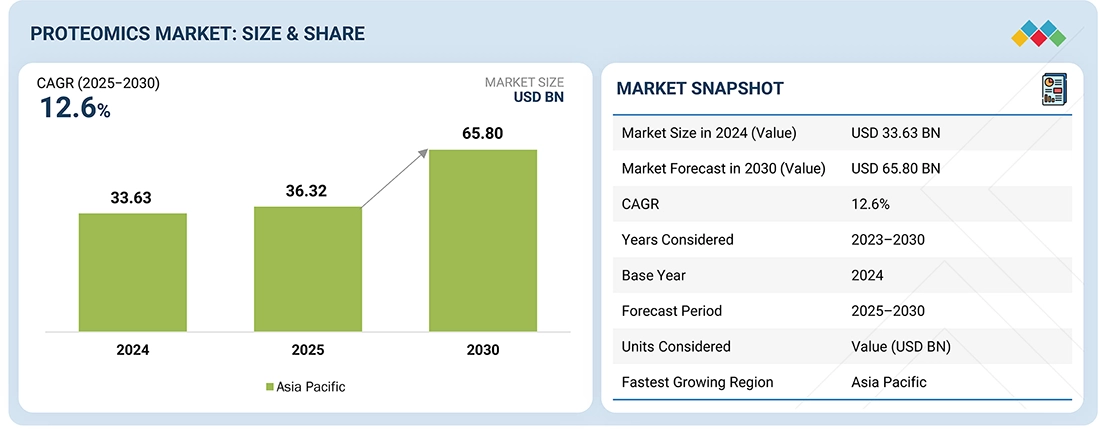

The global proteomics market, valued at US$33.63 billion in 2024, stood at US$36.32 billion in 2025 and is projected to advance at a resilient CAGR of 12.6% from 2025 to 2030, culminating in a forecasted valuation of US$65.80 billion by the end of the period. The global proteomics market is growing due to stronger mass spectrometry platforms, smarter bioinformatics, and more automated sample prep workflows. This is making large-scale protein profiling faster, more reproducible, and easier to run across labs. Proteomics is increasingly used to decode protein expression, modifications, and interactions, supporting real-world use cases in oncology, neurology, immunology, and precision medicine.

KEY TAKEAWAYS

-

BY REGIONNorth America accounted for a 38.8% revenue share in 2024.

-

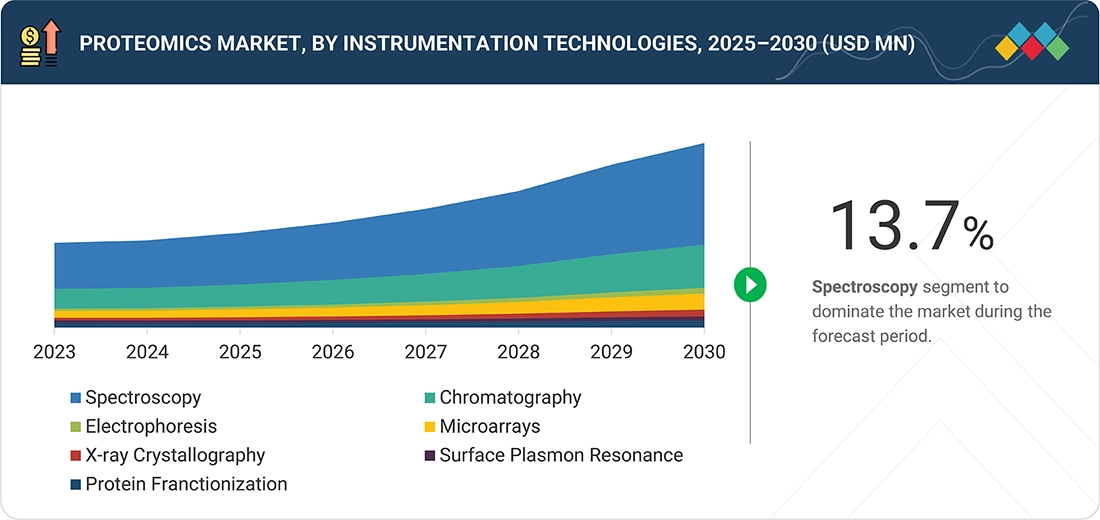

BY INSTRUMENTATION TECHNOLOGYBy product, the spectroscopy segment held 44.1% of the market in 2024.

-

BY REAGENTBy reagent, the immunoassay reagents segment held 26.4% of the overall market in 2024.

-

BY SERVICEBy service, core proteomics services dominate the proteomics market.

-

BY SOFTWAREBy software, the bioinformatics tools segment is expected to dominate the market.

-

BY APPLICATIONBy application, the clinical diagnostics segment will grow the fastest rate during the forecast period.

-

BY END USERBy end user, the biopharmaceutical companies segment is expected to dominate the market.

-

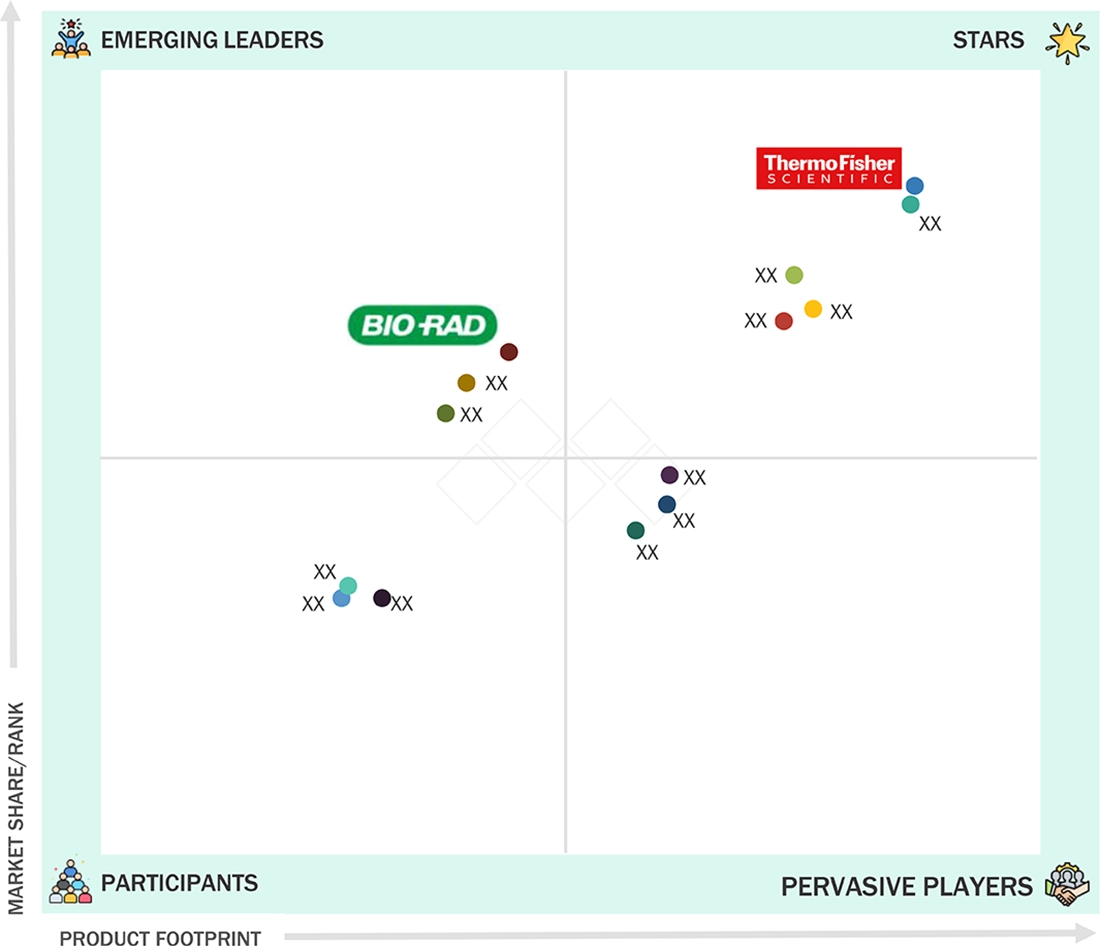

COMPETITIVE LANDSCAPEThermo Fisher Scientific (US), Danaher Corporation (US), and Agilent Technologies (US) were identified as some of the star players in the proteomics market, given their strong market share and product footprint.

-

COMPETITIVE LANDSCAPESeer Inc. (US) and Alamar Biosciences Inc. (US), among others, have distinguished themselves among startups and SMEs by securing strong footholds in specialized niche areas, underscoring their potential as emerging market leaders.

The global proteomics market is expanding at a stable pace. This trend is mainly attributed to the growth of protein-related research and the increase in clinical phosphotranslation. Pharmas and biotech companies are eagerly resorting to proteomics for drug, target discovery, biomarker validation, and MoA studies. In addition, diagnostics and precision medicine initiatives are also fueling the demand for proteomics as protein signatures help in patient stratification and therapy response monitoring. The ongoing use of high-throughput mass spectrometry, multiplex assays, and AI-empowered data analysis is making proteomics workflows more and more effectively integrated globally.

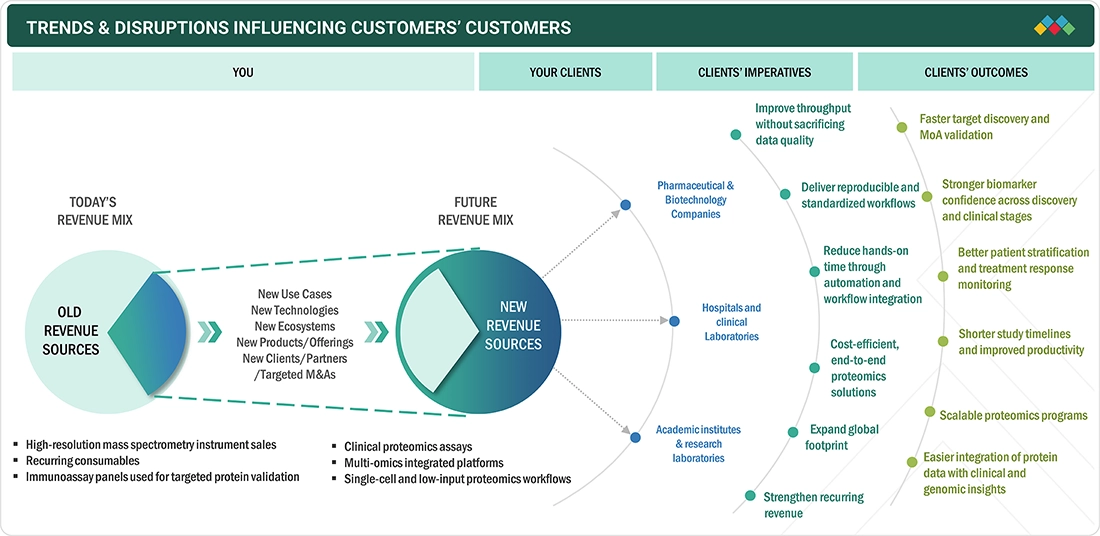

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

The impact on stakeholders’ businesses in the global proteomics market is shaped by a few clear shifts. There is a strong move toward deeper protein characterization, driven by biomarker-led drug development and precision medicine. This is pushing higher demand for robust, quantitative workflows across discovery and translational studies. Another shift is the rapid normalization of data-driven decision-making in life sciences. As multi-omics becomes standard in oncology, immunology, and neuroscience programs, labs are increasing spending on mass spectrometry consumables, sample prep kits, affinity reagents, and proteomics software.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Strong pull from oncology and proteogenomics programs

-

Growth in multi-omics

Level

-

High total cost of ownership

Level

-

Single-cell and low-input proteomics

-

Cloud and shared data platforms to accelerate discovery

Level

-

Data volume, interpretation, and bioinformatics bottlenecks

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Strong pull from oncology and proteogenomics programs

Proteomics is moving closer to disease decision-making. Cancer research is a driver. Large initiatives are building proteogenomic evidence. They connect genome changes to protein-level biology. This improves patient subtyping and supports better target prioritization. As these datasets grow, they create more demand for instruments, consumables, and analytics. They also push repeat purchases for sample prep and LC-MS workflows.

Restraint: High total cost of ownership

Proteomics requires LC systems, clean sample prep, and steady consumables. It also needs software, storage, and skilled operators. Many labs struggle to justify full in-house setups. This is more visible in mid-size institutes and emerging markets. Budget cycles can slow adoption even when demand exists. As a result, some work shifts to shared cores or CROs instead.

Opportunity: Single-cell and low-input proteomics

Single-cell biology is becoming a priority across disease areas. MS-based single-cell proteomics is advancing. It is improving in sensitivity and throughput. This supports tumor heterogeneity studies and immune profiling. It also creates demand for new reagents, automation, and smarter acquisition methods. Vendors can differentiate with end-to-end kits and analysis software. Service providers can scale premium offerings for complex studies.

Challenge: Data volume, interpretation and bioinformatics bottlenecks

Proteomics generates complex, high-dimensional outputs. The analysis is not always plug-and-play. End users are required to handle processing, statistics, and interpretation. They also need strong metadata and QC logic. Without this, insights can be slow or inconsistent. This becomes a bottleneck in large studies. It also drives dependence on expert analysts and specialized vendors.

PROTEOMICS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Collaborated for clinical proteomics workflows with Thermo Fisher Scientific to strengthen biomarker discovery and translational decision-making. Focus stayed on improving sample processing and downstream analysis for disease-focused programs. | Faster biomarker validation cycles. Better confidence in protein signatures linked to drug response. Stronger, more consistent data packages for internal development decisions. |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The global proteomics market ecosystem includes suppliers supporting both research-grade and clinical-grade workflows. It starts with core inputs such as reagents, antibodies, enzymes, columns, resins, and sample preparation consumables. These are increasingly sourced through global suppliers with localized distribution to improve lead times and supply stability. The ecosystem also encompasses mass spectrometry manufacturers, chromatography system vendors, and automation players, who facilitate higher throughput and reproducible protein analysis. With the growing demand for complex and quantitative proteomics, focus is growing on workflow integration, in-line quality checks, data integrity, and reliable software platforms to provide consistent, holistic proteomics solutions.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Proteomics Market, By Instrumentation Technology

In 2024, mass spectrometry-based (MS) platforms accounted for the largest share of the global proteomics market. LC-MS/MS continues to be the main tool for protein identification and quantification without bias in both discovery and translational studies. Growing access to high-resolution instruments, better automation, and more standardized workflows are setting the trend of globally increasing the number of runs.

Proteomics Market, By Reagent

In 2024, consumables and reagents continued to capture a major share, led by immunoassay reagents and targeted protein panels. Labs are increasingly running panel-based validation after discovery experiments, especially for oncology, inflammation, and cardiometabolic research. These workflows create recurring demand for kits, antibodies, assay plates, and sample prep reagents. The repeat-purchase nature of consumables also makes this segment structurally strong.

Proteomics Market, By Service

Proteomics services are a key revenue pool at the global level, with core proteomics services contributing a significant share. Outsourcing is rising as study sizes grow and timelines reduce. Pharma, biotech, and academic labs rely on CROs and specialist service providers for LC-MS runs, method development, and multi-omics integration. This helps them avoid CAPEX-heavy lab expansion while still generating high-quality datasets.

Proteomics Market, By Software

In 2024, proteomics software and bioinformatics tools represented one of the most critical shares in the workflow stack. The market is shifting from raw data generation to insight generation. Users require tools for peptide identification, quant workflows, pathway mapping, and integration with genomics and clinical metadata. Cloud adoption and workflow standardization are also increasing spending on enterprise-grade analysis platforms and data management.

Proteomics Market, By Application

Clinical diagnostics, by application, is expected to witness the fastest growth globally. Protein signatures are gaining adoption for early detection, patient stratification and treatment monitoring. This is mainly in oncology and immune-driven diseases. More research is being conducted with well-defined clinical endpoints, which is driving the demand for reproducible proteomics assays and validated panels.

Proteomics Market, By End User

By end user, biopharmaceutical companies lead the global market in 2024. These end users use proteomics heavily in target discovery, MoA confirmation, biomarker development, and clinical trial stratification. Increased activity in biologics, cell and gene therapies, and immuno-oncology is also expanding the need for protein-level understanding.

REGION

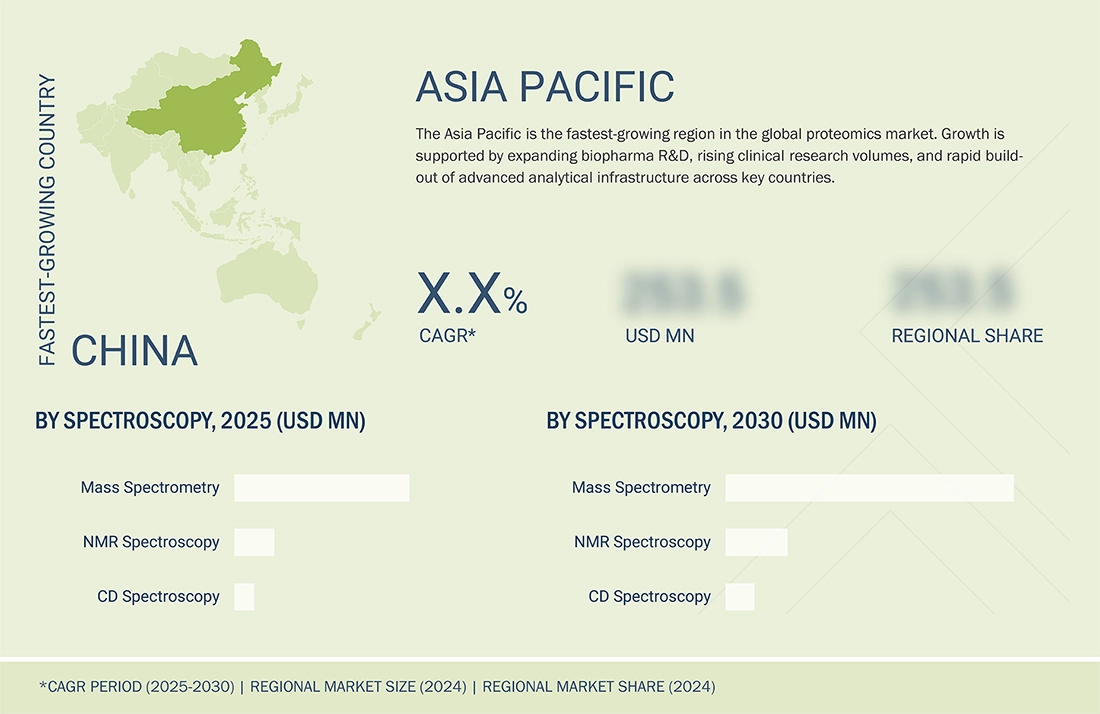

Asia Pacific to be the fastest-growing region in the global Proteomics market during the forecast period

Asia Pacific is growing as a high-growth region in the global proteomics market. This surge is due to booming biopharma R&D, a wave of clinical research activity, and large amounts of investments in cutting-edge analytical tools. The region is observing higher adoption of mass spectrometry, proteomics software, and automated sample preparation. This is across academic centers, hospitals, and pharma laboratories. Local service providers and CROs are also scaling proteomics capabilities. This trend is also fueling a sharp rise in outsourcing demand for oligo services. Leading countries like China, Japan, and others are aiding the growth through high funding, booming pools of omics experts, and broader use of proteomics in oncology trials and precision medicine efforts.

PROTEOMICS MARKET: GROWTH, SIZE, SHARE, AND TRENDS: COMPANY EVALUATION MATRIX

On the global proteomics market map, Thermo Fisher Scientific (Star) continues to be the main reference for the whole range of workflows. The company has a broad mass spectrometry line, allowing it to benefit, as well as sample preparation and separation tools, and integrated software, which is compatible with discovery through to translational use cases. Its massive scale and installed base across pharma, CROs, and academia maintain it as a powerhouse in the proteomics field, with more and more people adopting proteomics globally. Bio-Rad Laboratories (Emerging Leader) is picking up the pace through its protein separation, electrophoresis, and chromatography products and multiplex immunoassay platforms that enable targeted and translational proteomics. Its strengths are in reproducible workflows and lab-friendly platforms, which make it a strong player for the growing demand in biomarker validation, immunology, and clinical research situations.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

- Thermo Fisher Sceintific, Inc. (US)

- Danaher Corporation (US)

- Agilent Technologies, Inc. (US)

- Bio-Rad Laboratories (US)

- Revvity (US)

- Illumina Inc. (US)

- Promega Corporation (US)

- Charles River Laboratories (US)

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 33.63 Billion |

| Market Forecast in 2030 (Value) | USD 65.78 Billion |

| Growth Rate | CAGR of 12.6% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Related Segment & Geographic Reports |

North America Proteomics Market Asia Pacific Proteomics Market Protein Microarray Market Proteomics Services Market Europe Proteomics Market |

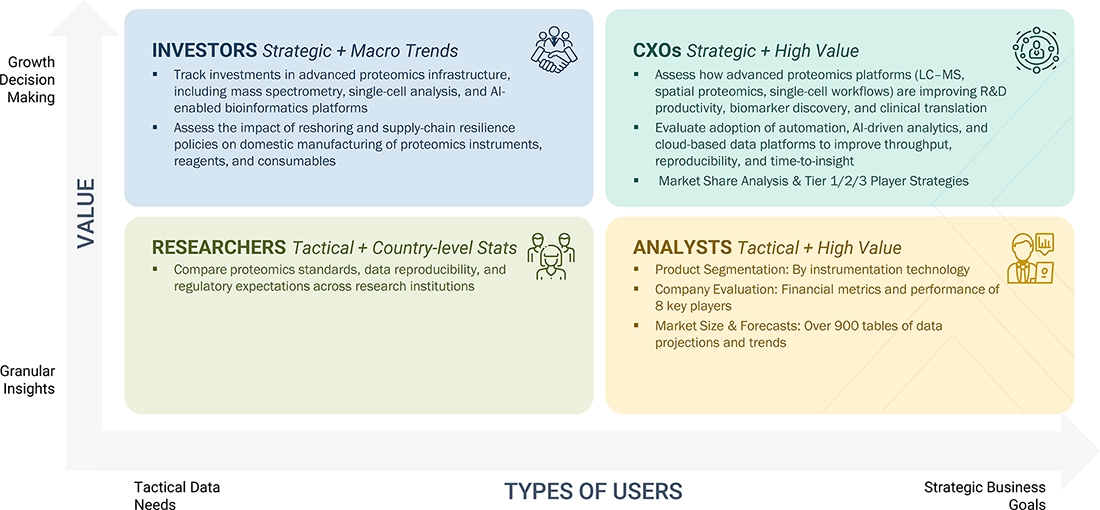

WHAT IS IN IT FOR YOU: PROTEOMICS MARKET: GROWTH, SIZE, SHARE, AND TRENDS REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Regional demand and adoption analysis (US-based client company) | Assessed proteomics adoption across North America, Europe, Asia Pacific by end user and application; identified fastest-growing countries and funding hotspots | Supports region-specific go-to-market strategies and capacity planning for instruments, consumables and services |

| Competitive positioning and market matrix | Positioned key players and emerging specialists across instruments, reagents, software, and services; assessed strengths, gaps, and white spaces | Enables clients to sharpen differentiation, refine messaging, and identify acquisition or partnership targets |

RECENT DEVELOPMENTS

- June 2024 : Danaher entered into a collaboration with Spain-based Mass Analytica to launch AI Quant, an artificial-intelligence-driven quantitation software that supports high-resolution MS/MS workflows using an intelligent fragment-selection algorithm.

- June 2024 : Agilent Technologies launched two new products—Agilent 7010D Triple Quadrupole GC/MS System and Agilent ExD Cell—for the 6545XT AdvanceBio LC/Q-TOF at the 72nd ASMS Conference on Mass Spectrometry and Allied Topics, bringing advancements in the areas of gas chromatography-mass spectrometry (GC/MS) and LC/Q-TOF Technology.

- October 2023 : Thermo Fisher Scientific acquired Olink Holding AB, a Swedish company, strengthening its position in the rapidly expanding proteomics space. The deal is intended to speed up protein biomarker discovery and create meaningful synergies between Thermo Fisher’s analytical platforms and Olink’s targeted proteomics technologies.

Table of Contents

Methodology

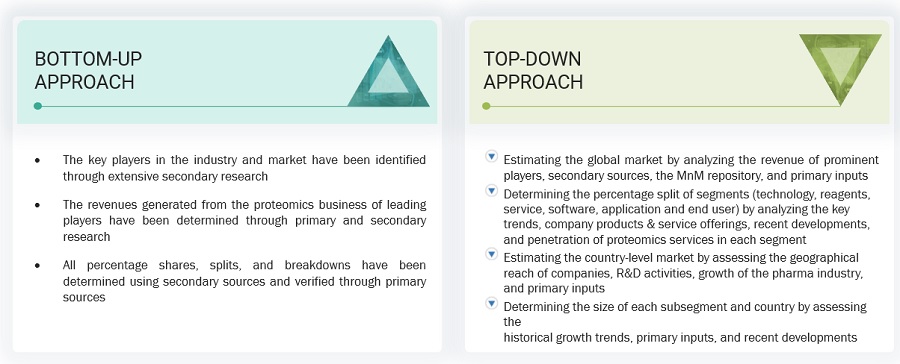

This study involved four major activities in estimating the current size of the proteomics market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The top-down and other approaches were employed to estimate the complete market size (proteomics market size). After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the proteomics market. The secondary sources referred to for this research study include publications from government and private sources such as the Indian Pharmaceutical Association (IPA), the Pharmaceutical Research and Manufacturers of America (PhRMA), the European Federation of Pharmaceutical Industries and Associations (EFPIA), Central Drugs Standard Control Organization (CDSCO), Indian Brand Equity Foundation (IBEF), European Medicines Agency (EMA), Global Cancer Observatory (GCO), American Chemical Society (ACS), National Center for Biotechnology Information (NCBI), Food and Drug Administration (FDA), Biotechnology and Biological Sciences Research Council (BBSRC), Pharmaceutical Research and Manufacturers of America (PhRMA), and the World Journal of Pharmaceutical Sciences, Company Websites, Annual Reports, SEC Filings, Press Releases, Investor Presentations, Journals, Expert Interviews, MarketsandMarkets Analysis. Secondary data was collected and analyzed to arrive at the overall size of the global proteomics market, which was then validated by primary research.

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Proteomics Market Size Estimation

A top-down approach was used to estimate and validate the total size of the proteomics market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the total proteomics market size includes the following:

Market Size Estimation Methodology Bottom up approach & Top down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall proteomics market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Proteomics is the complete evaluation of the structure and function of proteins to understand an organism’s nature. It is the systemic identification and characterization of proteins along with their sequence, abundance, post-translational modifications, interactions, activity, subcellular localization, and structure. The market study includes the assessment of various instruments, reagents, software, and services used in proteomics.

Key Stakeholders

- Life sciences instrumentation and reagent companies

- Pharmaceutical and biotechnology companies

- Proteomics database and software providers

- Proteomics service providers

- Research and consulting firms

- Academic medical centers

- Government research organizations

- Clinical research institutes

- Contract Research Organizations

Report Objectives

- To define, describe, and forecast the global proteomics market based on the instrumentation technologies, reagents, software & services, application, end-user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, challenges, and opportunities)

- To strategically analyze micro markets with respect to individual growth trends, future prospects, and contributions to the overall proteomics market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To strategically profile the key players and comprehensively analyze their product & service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as product launches, acquisitions, expansions, agreements, collaborations, and R&D activities in the proteomics market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographic Analysis

- Further breakdown of the Rest of Europe proteomics market into respective countries

- Further breakdown of the Rest of Asia Pacific proteomics market into respective countries

- Further breakdown of the Rest of Latin America proteomics market into respective countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

- An additional five company profiles

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Proteomics Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Proteomics Market

Gary

Mar, 2022

Looking to gain more insights on the global Proteomics Market.

Nicholas

Mar, 2022

What are the growth opportunities in Proteomics Market?.

Eric

Mar, 2022

Can you enlighten us on geographical growth analysis in Proteomics Market?.