Cloud Managed Services Market by Service Type (Managed Business, Managed Network, Managed Security, Managed Infrastructure, Managed Mobility), Organization Size, Vertical (BFSI, Telecom, Retail & Consumer Goods, IT) and Region - Global Forecast to 2027

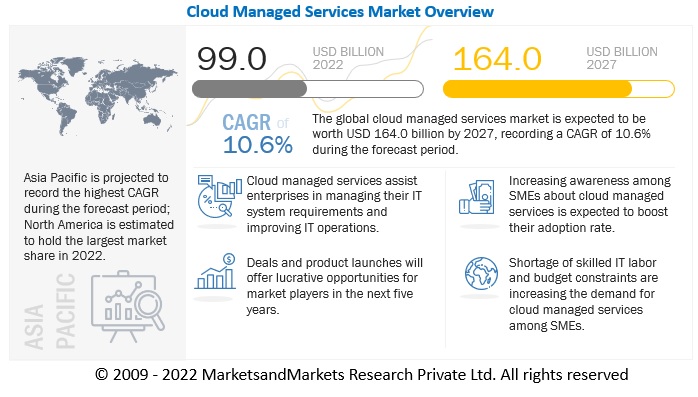

The global Cloud Managed Services Market size as per revenue was surpassed $99.0 billion in 2022 and is anticipated to exhibit a CAGR of 10.6% to reach over $164.0 billion by the end of 2027. Growing demand for cloud managed services among enterprises and inadequate cloud expertise among IT professionals are likely to drive the demand for cloud managed services during the study period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

The impact of the COVID-19 pandemic on the market is covered throughout the report. Since, the outbreak of COVID there has been an significant increase in the adoption of cloud based applications owing to the remote working models adopted by organizations. However, various industry verticals such as manufacturing, retail & consumer goods, and BFSI and others have faced significant decline revenues in 2020 due to declining customer base with government imposed restrictions. As cloud managed service providers offers services to these verticals. Thus, cloud managed service providers also seen declining revenue and growth in 2020.

Cloud Managed Services Market Dynamics

Driver: Increased cloud adoption during COVID-19 pandemic

COVID-19 has globally changed the dynamics of business operations. Though the COVID-19 outbreak has thrown light on weaknesses in business models across sectors, it has offered several opportunities to cloud managed service providers to expand their business across enterprises. The worldwide lockdown and remote working necessitated by the pandemic forced both small and large enterprises to focus on digital transformation and adopt cloud services to a large extent. Moving to cloud proves to be more cost-effective for organizations and allows them greater flexibility.

Restraint: Data security and privacy concerns

Cloud managed services involve several third parties outsourcing their abilities; this includes infrastructures in mobility, networks, endpoints, databases, cloud, web applications, and virtualization. Critical business details can thus be vulnerable to exposure, causing organizations opting for cloud managed services to deal with serious concerns over security and privacy. However, MSPs help organizations maintain proper security and privacy measures for the data that they deploy over the cloud. They ensure customers end-to-end network protection and encryption for extra security.

Opportunity: Increasing adoption of cloud managed services by SMEs

With IT spending among SMEs predicted to see a significant increase, they are expected to adopt more managed services. . According to a study, the CAGR for IT spend by SMEs in Europe, the Middle East, & Africa (EMEA) between 2018 and 2023 is expected to be 3.8%, compared to 2.7% for the overall market. The rise in IT spending by SMEs is expected to fuel the demand for MSPs that can provide cost-effective and efficient services.

SMEs are more at risk of cybercrime than large enterprises. According to the Verizon 2019 Data Breach Investigations Report (DBIR), 43% of cyberattacks target small businesses. SMEs face significant budget constraints and need to maintain compliance and data protection laws. Another study reveals that drivers for the adoption of cloud managed services include the desire to reduce CAPEX and other costs, increase efficiency, overcome internal skills shortages, and address security concerns. SMEs are found for be increasingly reaching out to cloud managed service providers to tackle these challenges.

Challenge: Increase in regulations and compliances

In recent years, regulatory and compliance requirements have been increasing due to the changes in business needs, growing data breaches and cyberattacks, and rising data security concerns. Companies have to strive to survive in the market by taking measures to meet regulatory needs and prevent financial penalties, reduce customer and revenue losses, and avoid exposure to legal action. The cloud managed services market caters to various industries such as BFSI, IT and ITeS, manufacturing, healthcare and life sciences, and retail and consumer goods. These industries are governed by different regulations and compliances, which can act as restraints for the managed services market.

Cloud Managed Services Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on service type, communication & collaboration services to grow at a higher CAGR during the forecast period

Communication & collaboration involves a variety of communication tools, such as voice, IP telephony calling, instant messaging, desktop sharing, telepresence, and web conferencing, audio conferencing, and video conferencing, that are required to interact together in a virtually seamless way. This report classifies the managed communication & collaboration services segment into managed voice over internet protocol (VoIP), managed email services, and managed unified communication as a service (UCaaS).

Based on organization size, the large enterprises to be a larger contributor to the cloud managed services market growth during the forecast period

Organizations with more than 1,000 employees are termed large enterprises. These enterprises constantly focus on improving customer experiences by innovating products and services. Cloud managed services offer an end-to-end hosting solution that ensures consistent delivery of services to customers. Cloud managed service providers offer robust infrastructure and support digital transformation to meet the growing business requirements of an enterprise. Affordability of resources and high economies of scale are supporting the adoption of cloud managed services among large enterprises.

Based on vertical, retail & consumer goods to grow at a higher CAGR during the forecast period.

The retail industry has to deal with a growing number of customers and increasing demand for goods and services. Cloud managed services can help retailers to reduce infrastructure, storage costs, and computing costs, and offer real time access to operational and inventory data. The retail sector is one of the fastest-growing due to the rising consumer purchasing power. The growing trends in mobile data consumption and the increased usage of smartphones and tablets worldwide have paved the way for greater demand for mobility solutions in the retail industry. Security services have also become essential for retail organizations to protect their IT environments and customer-sensitive data. Hence, there are ample opportunities for MSPs in the retail sector.

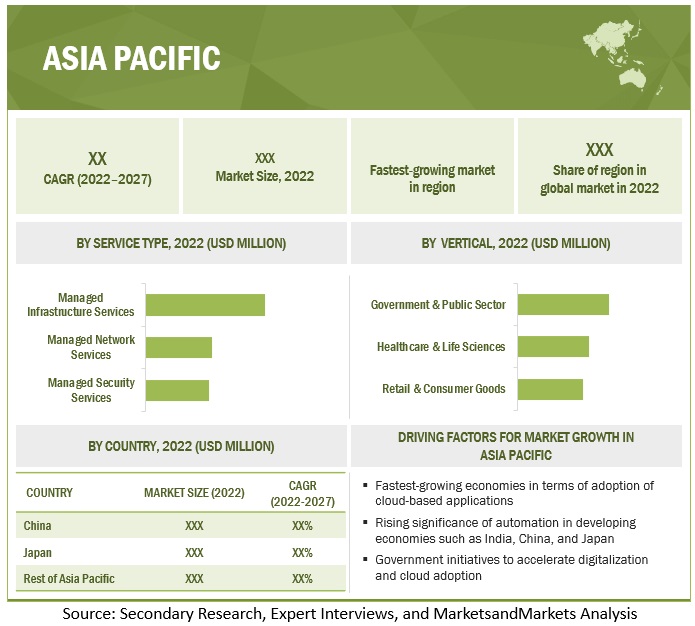

Asia Pacific to grow at the highest CAGR during the forecast period.

ICT applications are key elements for socio-economic development in the region, and it boasts significant expertise in the ICT field. Asia Pacific Telecommunity is an international organization that is making efforts to bring ICT and telecommunications facilities to people at affordable prices and address issues related to increasing efficiency, improving productivity and bridging the digital divide within countries in the region. The growth in 5G infrastructure is likely to boost the adoption of cloud services in the region. According to GSMA, by 2025 there will be 400 million 5G connections across the region. 5G’s ability to support next generation offerings such as cloud services, AI, IoT and edge computing, will drive digital economic growth and innovation within the region.

Key Market Players

The cloud managed services market is dominated by companies such as IBM (US), Ericsson (Sweden), Cisco (US), Fujitsu (Japan), Accenture (Ireland), AWS (US), NTT DATA (Japan); Infosys (India); HPE (US); NEC (Japan), Atos (France); TCS (India), Wipro (India), Datacom (New Zealand), AT&T (US), HCL Technologies (India), CDW Corporation (US), Huawei (China) and Nokia (Finland). These vendors have a large customer base and strong geographic presence with distribution channels globally to drive business revenue and growth.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 99.0 Billion |

|

Market size value in 2027 |

USD 164.0 Billion |

|

Growth rate |

CAGR of 10.6% |

|

Segments covered |

Cloud Managed Services Market by Service Type (Managed Business, Managed Network, Managed Security, Managed Infrastructure, Managed Communication & Collaboration, Managed Mobility), Organization Size, Vertical (BFSI, Telecom, Retail & Consumer Goods, IT), and Region-Global Forecast to 2027 |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Ericsson (Sweden), Cisco (US), Fujitsu (Japan), Accenture (Ireland), AWS (US), NTT DATA (Japan), Infosys (India), HPE (US), NEC (Japan) and many more.. |

This research report categorizes the cloud managed services market to forecast revenue and analyze trends in each of the following submarkets:

Based on Service Type:

- Managed Security Services

- Managed Network Services

- Managed Infrastructure Services

- Managed Communication & Collaboration Services

- Managed Mobility Services

- Managed Business Services

Based on the Managed Security Services:

- Managed Identity & Access Management

- Managed Antivirus/Anti-Malware

- Managed Firewall

- Managed Risk & Compliance Management

- Managed Vulnerability Management

- Managed Security Information & Event Management

- Managed Intrusion Detection System/Intrusion Prevention System

- Managed Data Loss Prevention

- Other Managed Security Services

Based on the Managed Network Services:

- Managed Network Provisioning

- Managed Network Monitoring & Management

Based on the Managed Infrastructure Services:

- Storage Management

- Server Management

- Managed Print Services

Based on the Managed Communication & Collaboration Services:

- Managed Voice Over Internet Protocol

- Managed Unified Communication as a Service

Based on the Managed Mobility Services:

- Device Management Services

- Application Management Services

Based on the Managed Business Services:

- Business Process Services

- Continuity & Disaster Recovery Services

- Other Managed Business Services

Based on the organization size:

- SMEs

- Large Enterprises

Based on verticals:

- BFSI

- Telecom

- IT

- Government & Public Sector

- Healthcare & Life Sciences

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Other Verticals

Based on regions:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of APAC

-

Middle East & Africa

- KSA

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In August 2022, SkyMax signed a memorandum of understanding with Ericsson to create a partnership to build the next generation of the 5G broadband network, including digital services delivery platform, across Sub-Saharan Africa

- In June 2022, Cisco launched new cloud management capabilities that provide a unified experience across the Cisco Meraki, Cisco Catalyst and Cisco Nexus portfolios, and a new Cisco ThousandEyes product to proactively forecast and optimize WAN performance. These innovations highlight Cisco’s strategy to provide customers with the agility, resiliency, and productivity that their businesses need to thrive in the face of unpredictability through the power of cloud-managed platforms.

- In October 2021, IBM and Deloitte announced the launch of DAPPER, an AI-enabled managed analytics solution to help organizations accelerate the adoption of hybrid cloud and AI. Its end-to-end capabilities ensure that the insights on data are provided through a secured, simple-to-consume managed service offering.

- In March 2020, Fujitsu launched Fujitsu Cloud Service for OSS enables the construction and delivery of information systems that handle highly confidential information with secure and flexible operations, traditionally delivered through on-premises or in the cloud. This is introduced to support the Japanese government. Fujitsu's government cloud meets the security standards unique to government agencies in Japan.

Frequently Asked Questions (FAQ):

What is the projected market value of the global cloud managed services market?

The global market for cloud managed services is projected to reach USD 164.0 billion.

What is the estimated growth rate (CAGR) of the global cloud managed services market for the next five years?

The global cloud managed services market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.6% from 2022 to 2027.

What are the major revenue pockets in the cloud managed services market currently?

ICT applications are key elements for socio-economic development in the region, and it boasts significant expertise in the ICT field. Asia Pacific Telecommunity is an international organization that is making efforts to bring ICT and telecommunications facilities to people at affordable prices and address issues related to increasing efficiency, improving productivity and bridging the digital divide within countries in the region. The growth in 5G infrastructure is likely to boost the adoption of cloud services in the region. According to GSMA, by 2025 there will be 400 million 5G connections across the region. 5G’s ability to support next generation offerings such as cloud services, AI, IoT and edge computing, will drive digital economic growth and innovation within the region.

Which are the major vendors in the cloud managed services market?

IBM (US), Ericsson (Sweden), Cisco (US), Fujitsu (Japan), and Accenture (Ireland) are major vendors in cloud managed services market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

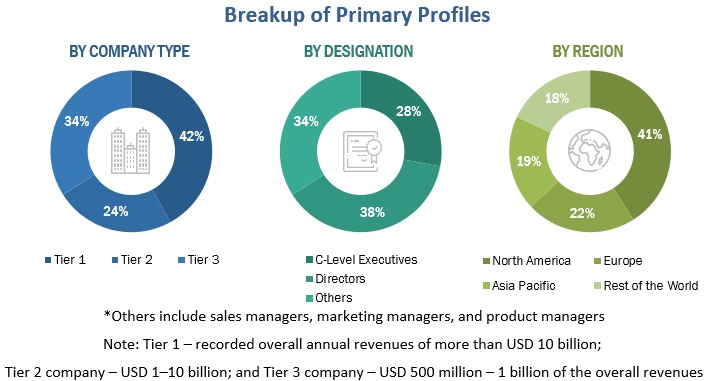

The study involved 4 major activities to estimate the current market size of cloud managed services market. Extensive secondary research was done to collect information on the market, the competitive market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the various segments in the cloud managed services.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, vendor data sheets, product demos, Cloud Computing Association (CCA), Vendor Surveys, Asia Cloud Computing Association, and The Software Alliance. All these sources were referred to for identifying and collecting information useful for this technical, market-oriented, and commercial study of the Cloud managed services market.

Primary Research

Primary sources were several industry experts from the core and related industries, preferred software providers, hardware manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market’s prospects.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom up and top-down approaches were utilized to estimate and validate the total cloud managed services market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through paid and unpaid secondary resources.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the Cloud managed services market.

Report Objectives

- To define, describe, and forecast the Cloud managed services market based on service type, organization size, industry verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the impact of COVID-19 on the market

- To forecast the market size of main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the clmarket

- To profile the key players in the Cloud managed services market and comprehensively analyze their core competencies in each subsegment

- To track and analyze competitive developments, such as mergers and acquisitions, new product launches, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Managed Services Market