Microporous Insulation Market by Product Type (Rigid boards & panels, flexible panels, machined parts, moldable products), Application (Industrial, Energy & Power, Oil & Gas, Aerospace & Defense, Automotive), and Region - Global Forecast to 2023

The global microporous insulation market is projected to reach USD 165.4 million by 2023, at a CAGR of 4.7%, between 2018 and 2023. Additionally, the microporous insulation market is expected to grow from 3,800 metric tons in 2018 to 4,608 metric tons by 2023, at a CAGR of 3.9% during the forecast period. Its unique property of space and weight conservation in the aerospace & defense application will drive the growth of this market during the forecast period.

Microporous insulation is a composite material comprising of a blend of ceramic powders and fibers, with an average interconnecting pore size comparable to or even less than the mean free path of air molecules at standard atmospheric pressure. It may contain opacifiers to reduce the amount of the radiant heat transmitted. The microporous insulation material is inorganic making it non-combustible and suitable for passive fire protection applications. It is ideal for any high-temperature application and has been used in aerospace, automotive, industrial, and commercial markets where space and weight conservation are critical requirements without compromising the thermal performance.

By type, rigid boards & panels to dominate the microporous insulation market during the forecast period

Based on product type, the microporous insulation market is segmented into rigid boards & panels, flexible panels, and others. Other product types include moldable products, machined parts, and pourable products. The flexible panels’ product type is expected to witness the highest growth during the forecast period, in terms of value. This is because flexible panels exhibit excellent dimensional stability and improved mechanical resistance to vibration and impact. They are energy-efficient and can be conveniently handled and transported.

By application, aerospace and defense segment to register the highest CAGR during the forecast period

Based on application, the microporous insulation market is segmented into industrial, energy & power, oil & gas, aerospace & defense, and others. Other applications include automotive and consumer appliances. The market in the aerospace & defense application segment is projected to register the highest CAGR, in terms of value, between 2018 and 2023. The demand for microporous insulation is increasing in the aerospace & defense application due to increasing demand for lightweight materials, which, in turn, saves the fuel consumed during the operation of an aircraft.

APAC to dominate the microporous insulation market during the forecast period

The microporous insulation market in APAC is projected to register the highest CAGR, in terms of value, between 2018 and 2023. The rising awareness about the benefits of microporous insulation materials and growing industrialization and infrastructure development in the region offer various opportunities regarding the use of microporous insulation. Also, the increase in demand for energy, power, metal, and automotive, is expected to drive the market. The microporous insulation market is significantly driven by the oil & gas segment, where there is a high demand for advanced insulation solutions, having a reduced thickness and low thermal conductivity.

Microporous Insulation Market Market Dynamics

Driver: Increase in demand for high thermal resistant insulation materials in oil & gas applications

Microporous insulation is high-temperature insulation, which provides extremely low thermal conductivity over a temperature ranging from 0.021 w/m.k (watt/meter/Kelvin temperature) to 0.034 w/m.k at a mean temperature of 800°C.

|

Materials |

Thermal Conductivity(W/m.K) at 800 °C |

|

Fiber Blanket |

0.20 |

|

Calcium Silicate |

0.17 |

|

Aerogel Blanket |

0.10 |

|

Still Air |

0.085 |

|

Microporous Insulation |

0.025 |

As compared to conventional insulation materials, such as glass-filled foams, fibers, and metals, microporous insulating materials have a thermal efficiency that is four to five times greater. The superior thermal resistance of microporous insulation shows enormous potential in oil & gas applications, where insulation is of prime importance. Besides excellent thermal performance, microporous insulating materials have significant resistance to flame and extreme weather conditions.

Also, as per the International Energy Agency, the global oil & gas sector is expected to witness considerable growth until 2020 due to increasing demand from the automotive and aviation industries. The growing oil & gas sector requires advanced insulation materials for transporting oil & gas to distant areas.

Restraint: High manufacturing cost

The base ingredients used to manufacture microporous insulation boards and panels are inorganic oxides of silica, zirconia, among others. Another element used in the process are opacifiers, which are thermally stable and have controlled particle size, and are distributed uniformly along the surface area. These opacifiers help in reducing thermal transmission to the lowest level. These are held tightly using glass filaments that help in providing handling strength and prevent absorption of moisture. The end product obtained has the lowest thermal conductivity possible, and the cost associated with the whole process, and technology is three to five times higher than that of conventional insulating materials. Moreover, factors such as lack of commercialization and low industrial production capacity are also responsible for the high production cost. Higher volume production using more efficient chemical manufacturing technologies is expected to lower the cost of microporous insulation.

Opportunity: Infrastructure development in emerging economies

Infrastructure development is one of the major activities undertaken in any economy. Emerging economies are investing significantly in infrastructure development, owing to modernization and industrialization. Iron & steel is required for the construction of buildings, rails, and metros, among other infrastructures. Microporous insulation is used in back-up lining and furnaces, which, in turn, drives the demand in the microporous insulation market. The emerging economies are not only investing in the domestic infrastructure but are also seeking opportunities for foreign investments. China is the biggest trading partner of Brazil, Argentina, Peru, and Chile, investing in everything ranging from energy to aircraft and infrastructure. Similar agreements have been signed between India and China for the development in sectors including railways, renewable energy, and industrial parks. These factors are expected to drive the demand in the microporous insulation market.

Challenge: Lack of awareness and acceptance

The biggest challenge facing microporous insulation is the lack of awareness and acceptance of, especially in emerging economies, such as APAC, South America, and the Middle East & Africa. Even in Europe, which is the leading market, globally, microporous insulation is used only in the applications where space is a constraint, and low thermal conductivity is required. In APAC, microporous insulation is mostly used in critical and temperature-sensitive applications, for instance, industrial. Also, the high manufacturing cost of microporous insulation acts as a barrier for the potential end-users to accept it as a material of choice.

Scope Of Microporous Insulation Market Report

|

Report Metric |

Details |

|

Market size available for years |

2016 &;2023 |

|

Base year considered |

2017 |

|

Forecast period |

2018–2023 |

|

Forecast units |

USD Million (Value), Metric Tons (Volume) |

|

Segments covered |

Product Type, Application, and Region |

|

Regions covered |

Europe, North America, APAC, South America, and Middle East & Africa |

|

Companies covered |

Promat International N.V. (Belgium), Morgan Advanced Materials plc (UK), Isoleika S. Coop. (Spain), Unicorn Insulations Ltd. (China), Siltherm (Europe), Johns Manville (US), NICHIAS Corporation (Japan), ThermoDyne (US), Unifrax (US), Elmelin Ltd.(UK), among other players. |

The report categorizes the global microporous insulation market based on product type, application, and region.

By Product Type

- Rigid boards & panels

- Flexible panels

- Others

- Moldable products

- Machined parts

- Pourable products

By Application

- Industrial

- Energy & Power

- Oil & Gas

- Aerospace & Defense

- Others

- Automotive

- Consumer appliances

By Region:

-

Europe

- UK

- Germany

- France

- Italy

- Belgium

- Russia

- ROE

- North America

-

- US

- Canada

- Mexico

-

Asia Pacific

- China

- Australia

- India

- Japan

- Thailand

- Rest of APAC

-

South America

- Brazil

- Argentina

- Rest of South America

-

Middle East & Africa

- Saudi Arabia

- South Africa

- UAE

- Egypt

- Rest of MENA

Key Microporous Insulation Market Players

Promat International N.V. &;(Belgium), Morgan Advanced Materials plc &;(UK), Isoleika S. Coop. (Spain), Unicorn Insulations Ltd. (China), Siltherm (Europe)

Recent Developments

- In July 2014, Morgan Advanced Materials acquired Porextherm Dämmstoffe GmbH (Germany), one of the leading manufacturers of microporous insulation panels. This helped the company to strengthen its product portfolio of microporous insulation and vacuum insulation panels.

- In June 2014, Unifrax invested in Shandong Luyang Share Co. Ltd. (China) and bought 29% shares of the company. Luyang is a manufacturer of refractory insulation materials, which are primarily used in China. This helped the company to align joint capabilities in the Chinese market.

- In May 2014, Industrial Insulation Group, LLC (US), a subsidiary of Johns Manville, launched InsulThin, a high temperature, flexible, hydrophobic, microporous, and fumed silica blanket insulation. The new product launch helped the company to broaden its industrial insulation product portfolio.

- In March 2014, Promat International opened Nippon Microtherm Factory in Tsu City, in Japan. The expansion helped the company to strengthen its high-performance insulation product business.

Key Questions Addressed In The Report

- Which key industries will adopt this material during the forecast period? How will this adoption boost the growth of the Microporous Insulation Market?

- What are the different application segments of microporous insulation material?

- Which regions will witness the highest adoption rate of this material?

- Who are the key manufacturers of Microporous Insulation and what is their market share? What steps are they taking to sustain and grow their revenues from this industry segment?

Frequently Asked Questions (FAQ):

What is microporous insulation?

What are the factors driving the microporous insulation market?

What are the major restraints for microporous insulation market?

What are the advantages of microporous insulation?

Microporous insulation offers the following advantages:

- Extremely low thermal conductivity

- Space and energy savings

- Ease in fabrication

- Easy to handle

- Resistant to water and most chemicals

What was the market size of microporous insulation in 2017 and how is it estimated to grow?

Which are the top players which exist in microporous insulation market?

Which region leads the microporous insulation market and why?

What are the different product types of microporous insulation market? Which product type is mostly used in the market and why?

Which are the application areas of microporous insulation? And which from which segment microporous insulation is demanded more?

How is the market of microporous insulation aligned?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Regions Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Unit Considered

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primary Interviews

2.1.2.3 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Microporous Insulation Market

4.2 Microporous Insulation Market, By Region

4.3 Europe: Microporous Insulation Market, By Application and Country

4.4 Microporous Insulation Market: Major Countries

4.5 Microporous Insulation Market, By Application

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increase in Demand for High thermal Resistant Insulation Materials in Oil & Gas Applications

5.2.1.2 Increasing Demand From Various Applications

5.2.1.3 Growth in Demand for Space and Weight Saving in the Aerospace & Defense and Industrial Sectors

5.2.1.4 Stringent Energy Consumption and Insulation Standards

5.2.2 Restraints

5.2.2.1 High Manufacturing Cost

5.2.2.2 Need for Hydrophobic Materials in Humid Conditions

5.2.3 Opportunities

5.2.3.1 Infrastructure Development in Emerging Economies

5.2.4 Challenges

5.2.4.1 Lack of Awareness and Acceptance

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of Substitutes

5.3.2 Threat of New Entrants

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

5.4 Macroeconomic Indicators

5.4.1 GDP Trends and Forecast of Major Economies

5.4.2 Trends and Forecast of Infrastructure Sector and Its Impact on the Microporous Insulation Market

5.4.3 Trends and Forecast of Automotive Sector and Its Impact on the Microporous Insulation Market

6 Microporous Insulation Market, By Product Type (Page No. - 46)

6.1 Introduction

6.2 Rigid Boards & Panels

6.2.1 Rigid Boards & Panels are the Most Common Microporous Insulation Products

6.3 Flexible Panels

6.3.1 Flexible Panels are Used in Limited Space for Insulation

6.4 Others

6.4.1 Moldable Products

6.4.2 Machined Parts

6.4.3 Pourable Products

7 Microporous Insulation, By Application (Page No. - 52)

7.1 Introduction

7.2 Industrial

7.2.1 Heat Loss Prevention in Industrial Segment Drives the Demand for Microporous Insulation

7.2.2 Iron & Steel

7.2.3 Glass

7.2.4 Cement

7.2.5 Non-Ferrous Metal

7.2.6 Ceramic

7.3 Energy & Power

7.3.1 The Need for thermal Efficiency Drives the Growth of Microporous Insulation in Energy & Power Application

7.3.2 Conventional Power Generation

7.3.3 Nuclear Power Generation

7.3.4 Fuel Cells

7.4 Oil & Gas

7.4.1 Reduced Thickness and Superior Insulation Performance Drive the Demand for Microporous Insulation in Oil & Gas Application

7.4.2 Petrochemical

7.4.3 Transportation

7.5 Aerospace & Defense

7.5.1 Requirement of Space and Weight Saving Drives the Microporous Insulation Market in the Aerospace & Defense Application

7.5.2 Aerospace

7.5.3 Naval & Sea

7.5.4 Army Munition

7.6 Others

7.6.1 Automotive

7.6.2 Consumer Appliances

8 Microporous Insulation Market, By Region (Page No. - 62)

8.1 Introduction

8.2 Europe

8.2.1 Russia

8.2.1.1 The Presence of Huge Oil & Gas Sector Drives the Demand for Microporous Insulation

8.2.2 Germany

8.2.2.1 The Growing Demand for Energy Efficiency to Drive the Microporous Insulation Market

8.2.3 France

8.2.3.1 Presence of Global Energy Giants to Drive the Demand for Microporous Insulation

8.2.4 Italy

8.2.4.1 Large Production of Steel to Drive the Demand for Microporous Insulation

8.2.5 UK

8.2.5.1 Rapid Advancement in the Aerospace & Defense Sector to Drive the Demand for Microporous Insulation

8.2.6 Belgium

8.2.6.1 Export Dynamism Drives the Demand for Microporous Insulation in Belgium

8.2.7 Rest of Europe

8.3 North America

8.3.1 US

8.3.1.1 Heavy Investments in Advanced Technologies of Oil & Gas Sector to Drive the Microporous Insulation Market

8.3.2 Canada

8.3.2.1 Growing Aerospace & Defense Sector in the Country to Drive the Demand for Microporous Insulation

8.3.3 Mexico

8.3.3.1 Growing Iron & Steel Manufacturing to Drive the Demand for Microporous Insulation

8.4 APAC

8.4.1 China

8.4.1.1 Increased Demand for Steel to Drive the Microporous Insulation Market

8.4.2 Japan

8.4.2.1 Growing Production of Defense Aircraft and Satellite Launch Vehicles to Drive the Demand for Microporous Insulation

8.4.3 India

8.4.3.1 Rapid Economic Expansion and Growing Manufacturing Sector to Drive the Demand for Microporous Insulation

8.4.4 Australia

8.4.4.1 Increase in Aircraft Manufacturing Activity to Drive the Demand for Microporous Insulation

8.4.5 Thailand

8.4.5.1 Rapid Industrialization to Drive the Market for Microporous Insulation

8.4.6 Rest of APAC

8.5 Middle East & Africa

8.5.1 Saudi Arabia

8.5.1.1 Massive Oil & Gas Production in the Country to Drive the Demand for Microporous Insulation

8.5.2 UAE

8.5.2.1 Growing Demand for Energy & Power to Drive the Growth of the Microporous Insulation Market

8.5.3 Egypt

8.5.3.1 Increasing Production of Iron & Steel to Drive the Demand for Microporous Insulation

8.5.4 South Africa

8.5.4.1 Rapid Urbanization and Structural Transformation in the Country to Drive the Demand for Microporous Insulation

8.5.5 Rest of Middle East & Africa

8.6 South America

8.6.1 Brazil

8.6.1.1 Rising Production of Commercial, Defense, and Executive Aviation in the Country to Drive the Growth and Demand for Microporous Insulation

8.6.2 Argentina

8.6.2.1 Growing Demand for Energy & Power to Drive the Microporous Insulation Market

8.6.3 Rest of South America

9 Competitive Landscape (Page No. - 106)

9.1 Overview

9.2 Competitive Leadership Mapping, 2017

9.2.1 Visionary Leaders

9.2.2 Dynamic Differentiators

9.2.3 Innovators

9.2.4 Emerging Companies

9.3 Strength of Product Portfolio

9.4 Business Strategy Excellence

9.5 Market Share Analysis

9.6 Competitive Situation and Trends

9.6.1 Expansion

9.6.2 New Product Launch

9.6.3 Acquisition

9.6.4 Investment

10 Company Profiles (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

10.1 Promat International

10.2 Morgan Advanced Materials

10.3 Isoleika S. Coop.

10.4 Unicorn Insulations

10.5 Guangzhou Huineng Environmental Protection Materials Co. (SILTHERM)

10.6 Johns Manville

10.7 NICHIAS Corporation

10.8 Thermodyne

10.9 Unifrax

10.10 Elmelin

10.11 Other Key Market Players

10.11.1 Advanced Ceramics Corp.

10.11.2 Kingspan Group Plc

10.11.3 Kyungdong One Co., Ltd.

10.11.4 Laizhou Mingguang thermal Insulation Material Co. Ltd.

10.11.5 Luyang Energy-Saving Materials Co., Ltd.

10.11.6 Mcallister Mills, Inc.

10.11.7 Nati Refractories Co., Ltd.

10.11.8 Refraltec

10.11.9 Shanghai Nanovix thermal Insulation Co., Ltd.

10.11.10 Silca Service- Und Vertriebsgesellschaft Für Dämmstoffe Mbh

10.11.11 Tianjin Morgan-Kundom Hi-Tech Development Co., Ltd.

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 132)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (106 Tables)

Table 1 Thermal Conductivity of Microporous Insulation as Compared to Conventional Insulating Materials

Table 2 Trends and Forecast of GDP, By Major Economy,2018–2023 (USD Billion)

Table 3 Microporous Insulation Market Size, By Product Type, 2016–2023 (Metric Ton)

Table 4 Microporous Insulation Market Size, By Product Type, 2016–2023 (USD Million)

Table 5 Rigid Boards & Panels: Microporous Insulation Market Size, By Region, 2016–2023 (Metric Ton)

Table 6 Rigid Boards & Panels: Microporous Insulation Market Size, By Region, 2016–2023 (USD Million)

Table 7 Flexible Panels: Microporous Insulation Market Size, By Region, 2016–2023 (Metric Ton)

Table 8 Flexible Panels: Microporous Insulation Market Size, By Region, 2016–2023 (USD Million)

Table 9 Other Product Types: Microporous Insulation Market Size, By Region, 2016–2023 (Metric Ton)

Table 10 Other Product Types: Microporous Insulation Market Size, By Region, 2016–2023 (USD Million)

Table 11 Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 12 Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 13 Microporous Insulation Market Size in Industrial Application, By Region, 2016–2023 (Metric Ton)

Table 14 Microporous Insulation Market Size in Industrial Application, By Region, 2016–2023 (USD Million)

Table 15 Microporous Insulation Market Size in Energy & Power, By Region, 2016–2023 (Metric Ton)

Table 16 Microporous Insulation Market Size in Energy & Power, By Region, 2016–2023 (USD Million)

Table 17 Microporous Insulation Market Size in Oil & Gas, By Region, 2016–2023 (Metric Ton)

Table 18 Microporous Insulation Market Size in Oil & Gas, By Region, 2016–2023 (USD Million)

Table 19 Microporous Insulation Market Size in Aerospace & Defense, By Region, 2016–2023 (Metric Ton)

Table 20 Microporous Insulation Market Size in Aerospace & Defense, By Region, 2016–2023 (USD Million)

Table 21 Microporous Insulation Market Size in Other Applications, By Region, 2016–2023 (Metric Ton)

Table 22 Microporous Insulation Market Size in Other Applications,By Region, 2016–2023 (USD Million)

Table 23 Microporous Insulation Market Size, By Region, 2016–2023 (Metric Ton)

Table 24 Microporous Insulation Market Size, By Region, 2016–2023 (USD Million)

Table 25 Europe: Microporous Insulation Market Size, By Country, 2016–2023 (Metric Ton)

Table 26 Europe: Microporous Insulation Market Size, By Country, 2016–2023 (USD Million)

Table 27 Europe: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 28 Europe: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 29 Europe: Microporous Insulation Market Size, By Product Type, 2016–2023 (Metric Ton)

Table 30 Europe: Microporous Insulation Market Size, By Product Type, 2016–2023 (USD Million)

Table 31 Russia: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 32 Russia: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 33 Germany: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 34 Germany: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 35 France: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 36 France: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 37 Italy: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 38 Italy: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 39 UK: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 40 UK: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 41 Belgium: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 42 Belgium: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 43 Rest of Europe: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 44 Rest of Europe: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 45 North America: Microporous Insulation Market Size, By Country, 2016–2023 (Metric Ton)

Table 46 North America: Microporous Insulation Market Size, By Country, 2016–2023 (USD Million)

Table 47 North America: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 48 North America: Microporous Insulation Market Size, By Application, 2015–2022 (USD Million)

Table 49 North America: Microporous Insulation Market Size, By Product Type, 2016–2023 (Metric Ton)

Table 50 North America: Microporous Insulation Market Size, By Product Type, 2016–2023 (USD Million)

Table 51 US: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 52 US: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 53 Canada: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 54 Canada: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 55 Mexico: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 56 Mexico: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 57 APAC: Microporous Insulation Market Size, By Country, 2016–2023 (Metric Ton)

Table 58 APAC: Microporous Insulation Market Size, By Country, 2016–2023 (USD Million)

Table 59 APAC: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 60 APAC: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 61 APAC: Microporous Insulation Market Size, By Product Type,2016–2023 (Metric Ton)

Table 62 APAC: Microporous Insulation Market Size, By Product Type, 2016–2023 (USD Million)

Table 63 China: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 64 China: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 65 Japan: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 66 Japan: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 67 India: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 68 India: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 69 Australia: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 70 Australia: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 71 Thailand: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 72 Thailand: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 73 Rest of APAC: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 74 Rest of APAC: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 75 Middle East & Africa: Microporous Insulation Market Size, By Country, 2016–2023 (Metric Ton)

Table 76 Middle East & Africa: Microporous Insulation Market Size, By Country, 2016–2023 (USD Million)

Table 77 Middle East & Africa: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 78 Middle East & Africa: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 79 Middle East & Africa: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 80 Middle East & Africa: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 81 Saudi Arabia: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 82 Saudi Arabia: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 83 UAE: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 84 UAE: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 85 Egypt: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 86 Egypt: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 87 South Africa: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 88 South Africa: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 89 Rest of Middle East & Africa: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 90 Rest of Middle East & Africa: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 91 South America: Microporous Insulation Market Size, By Country, 2016–2023 (Metric Ton)

Table 92 South America: Microporous Insulation Market Size, By Country, 2016–2023 (USD Million)

Table 93 South America: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 94 South America: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 95 South America: Microporous Insulation Market Size, By Product Type, 2016–2023 (Metric Ton)

Table 96 South America: Microporous Insulation Market Size, By Product Type, 2016–2023 (USD Million)

Table 97 Brazil: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 98 Brazil: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 99 Argentina: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 100 Argentina: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 101 Rest of South America: Microporous Insulation Market Size, By Application, 2016–2023 (Metric Ton)

Table 102 Rest of South America: Microporous Insulation Market Size, By Application, 2016–2023 (USD Million)

Table 103 Expansion, 2013–2018

Table 104 New Product Launch, 2013–2018

Table 105 Acquisition, 2013–2018

Table 106 Investment, 2013–2018

List of Figures (37 Figures)

Figure 1 Microporous Insulation: Market Segmentation

Figure 2 Microporous Insulation Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Microporous Insulation Market: Data Triangulation

Figure 6 Rigid Boards & Panels to Be the Dominant Microporous Insulation Product Type Between 2018 and 2023

Figure 7 Industrial Segment to Be the Leading Application Between 2018 and 2023

Figure 8 Europe Accounted for the Largest Share in the Microporous Insulation Market in 2017

Figure 9 Stringent Energy Consumption and Insulation Standards to Drive the Microporous Insulation Market

Figure 10 Europe to Be the Largest Microporous Insulation Market

Figure 11 Industrial Segment and Russia Accounted for the Largest Market Shares in 2017

Figure 12 India to Be the Fastest-Growing Microporous Insulation Market in Terms of Volume

Figure 13 Industrial Was the Largest Application in the Microporous Insulation Market, in 2017

Figure 14 Drivers, Restraints, Opportunities, and Challenges in the Microporous Insulation Market

Figure 15 Consolidated Market of Microporous Insulation Due to Dominance of Promat International and Morgan Advanced Materials

Figure 16 Top 15 Countries With the Best Infrastructure in 2018

Figure 17 Global Motor Vehicle Production, 2018 (Million Units)

Figure 18 Rigid Boards & Panels to Lead the Microporous Insulation Market

Figure 19 Industrial Segment to Lead the Microporous Insulation Market

Figure 20 Europe to Be the Largest Microporous Insulation Market During the Forecast Period

Figure 21 Europe: Microporous Insulation Market Snapshot

Figure 22 North America: Microporous Insulation Market Snapshot

Figure 23 APAC: Microporous Insulation Market Snapshot

Figure 24 Middle East & Africa: Microporous Insulation Market Snapshot

Figure 25 South America: Microporous Insulation Market Snapshot

Figure 26 Competitive Leadership Mapping, 2017

Figure 27 Strength of Product Portfolio, 2017

Figure 28 Business Strategy Excellence, 2017

Figure 29 Expansion Was the Key Growth Strategy Adopted By the Market Players Between 2013 and 2018

Figure 30 Market Share Analysis, 2017

Figure 31 Promat International: SWOT Analysis

Figure 32 Morgan Advanced Materials: Company Snapshot

Figure 33 Morgan Advanced Materials: SWOT Analysis

Figure 34 Isoleika S. Coop.: SWOT Analysis

Figure 35 Unicorn Insulations: SWOT Analysis

Figure 36 Guangzhou Huineng Environmental Protection Materials Co.: SWOT Analysis

Figure 37 NICHIAS Corporation: Company Snapshot

The study involves four major activities to estimate the size of the microporous insulation market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. The market breakdown and data triangulation procedures were then used to estimate the market sizes of the segments and subsegments.

Secondary Research

Secondary sources used in this study are annual reports, press releases, and investor presentations of companies; white papers; certified publications; articles from recognized authors; and gold standard & silver standard websites, such as Factiva, ICIS, Bloomberg, International Energy Association (IEA), Insulation Manufacturers Association (IMA), North American Insulation Manufacturers Association (NAIMA), American Society for Testing and Materials (ASTM), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), and Restriction of Hazardous Substances (RoHS), and Thermal Insulation Manufacturers and Suppliers Association (TIMSA). The findings of this study were verified through primary research by conducting extensive interviews with key officials, such as CEOs, vice presidents, directors, and other executives.

Primary Research

The microporous insulation market comprises several stakeholders, such as raw material suppliers, end-use applications, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of the industrial, oil & gas, energy & power, aerospace & defense, and others applications. The supply side is characterized by advancements in technology and diverse application industries. Various primary sources from both supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

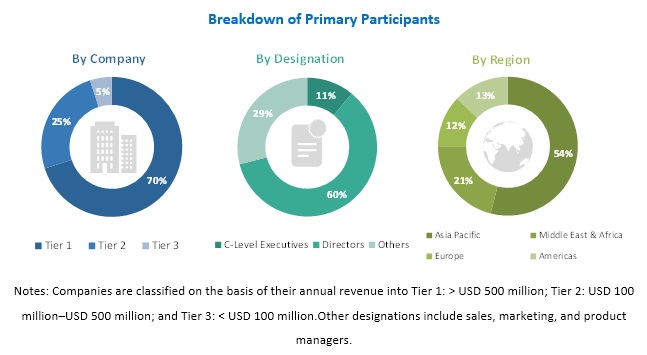

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the microporous insulation market. These methods were also used extensively to estimate the sizes of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the estimation process explained above-the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both demand and supply sides in the oil & gas, industrial, energy & power, aerospace & defense, consumer appliances, and automotive applications.

Report Objectives

- To define, describe, and forecast the microporous insulation market size, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the market growth

- To estimate and forecast the market size, by product type, application, and region

- To forecast the size of the market with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), South America, and the Middle East & Africa, along with their key countries

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To track and analyze recent developments, such as expansion, acquisition, new product launch, and investment, in the market

- To strategically profile the key market players and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers customizations according to client-specific needs with the given market data.

- Further breakdown of Rest of Asia Pacific, Rest of Europe, Rest of South America, and Rest of the Middle East & Africa microporous insulation markets

- Detailed analysis and profiles of additional market players (up to five)

Growth opportunities and latent adjacency in Microporous Insulation Market

Overview of microporous market and SWOT analysis of main players

Information on microporous market , market segment, regional analysis, company share and profile