Fiber Optic Cables Market for Military & Aerospace by Platform (Civil, Military, Space), Application (Avionics, Navigation, Weapon Systems, Communication Systems), Type (Single-mode, Multi-mode), Material, and Region (2022-2027)

Updated on : Sept 04, 2025

To know about the assumptions considered for the study, Request for Free Sample Report

Fiber optic cables used for military platform are the least impacted because of COVID-19 outbreak. Market for fiber optic cables used in communication systems is expected to grow at a very healthy rate, from 0.6 Billion USD in 2021 to 0.79 Billion USD in 2026.

COVID-19 Impact on the fiber optic cables market for military & aerospace

The fiber optic cables market for military & aerospace includes major players Amphenol fsi (US), Carlisle Interconnect Technologies (US), Radiall (Italy), Corning optical communications LLC (US), and TE Connectivity (US). These players have spread their business across various countries includes North America, Europe, Asia Pacific, Middle East, Africa, and Latin America. COVID-19 has impacted their businesses as well. Industry experts believe that COVID-19 has affected the services for defense & aerospace sector globally in 2020.

During the COVID-19 outbreak, the orders and deliveries of fiber optic cables in military were intact. However, owing to supply chain disruptions, slight negative impact is expected on the Fiber optic cables market for military & aerospace which recovers slowly in 1st quarter of 2021.

Fiber optic cables market for military & aerospace Dynamics

Driver: Increasing use in new and upgraded aircraft

The increase in the number of orders for new aircraft across the globe is one of the key factors driving the growth of the fiber optic cables market for military and aerospace. According to Airbus Outlook 2018, the global commercial aircraft fleet size is anticipated to increase from 21,450 aircraft in 2018 to 47,990 aircraft by 2037. As such, the number of aircraft deliveries is projected to reach 37,390 aircraft by 2037. Approximately 74.3% of new aircraft orders contribute to the replacement of existing aircraft, while the remaining orders are projected to contribute to the fleet growth of airlines to enable geographic expansion into emerging markets. New aircraft are also expected to ensure the development of innovative business models for various airlines.

There is an increasing demand for new and advanced aircraft in emerging markets in the Middle East, Asia Pacific, and Latin America. According to the Boeing 2016 Market Outlook, the Asia Pacific region is projected to account for a share of 40.0% of the global aircraft deliveries between 2016 and 2035. The rise in air passenger traffic due to an increase in the disposable income of the middle-class population in emerging economies, such as India and China, is expected to fuel the demand for new aircraft. Furthermore, there has been a rise in the profitability of airlines due to reduced prices of crude oil and increased efficiency of aircraft operations. The operational efficiency of an aircraft is determined by various factors, such as the design of aircraft engines, navigation & flight paths, and weather conditions. Advancements in navigation technologies used by aircraft, along with improvements in flight operations, technical operations, and ground operations, have enhanced the operational efficiency of different types of aircraft. This, in turn, has led to an increase in new aircraft orders across the globe, thereby leading to a rise in new aircraft deliveries.

Opportunity: Demand for optical add-drop multiplexer (OADM) networks

The increase in demand for high-speed data transfer is projected to drive the use of fiber frameworks in the fiber optic cables market for military and aerospace. Optical add-drop multiplexers and optical demultiplexers were introduced in the fiber optic network to enable the transfer of a large amount of data. These multiplexers are simple components that enable specific addition or reduction in optical channels to cater to the requirements for different wavelength administration capacities to ensure high-speed data transfer. The OADM network is increasingly used by aircraft and ships as well as for electronic warfare and C4ISR activities.

Challenges: Complex maintenance and installation requirements

The introduction of intense electrification concepts, such as fly-by-wire, in-flight entertainment systems, and glass cockpits, has propelled the use of fiber optic cables in aircraft and ships. Due to multiple inter-connected systems and components, optical cables are structurally complex and are prone to damage caused by vibrations or modifications to the entire wiring diagram. Issues faced during the maintenance and installation of fiber optic cables in aircraft include bending and fitting of fiber optic cables on airframes, which might cause possible damage to optic cable connectors and aircraft systems. Thus, complexities associated with the maintenance and installation of fiber optic cables are acting as a challenge to the growth of the fiber optic cables market for military and aerospace.

Demand for communication system will drive the demand for application segment of fiber optic cables.

Communication systems require an exceptional level of tactical grade equipment, which provides access to the global information grid of shared data and information. These systems utilize fiber optic cable networks to transmit intelligence, surveillance, and reconnaissance information through different communication systems. Satellites, interlinked ground links, and communication systems are considered an important part of communication networks as they enable data transmission through secure data links. These data links use compatible communication protocols to share information securely between allies. For instance, the North Atlantic Treaty Organization (NATO) forces use Link 16 to exchange air force data with member countries. Other prominent systems in use by NATO forces include the Joint Tactical Information Distribution System (JTIDS).

Lockheed Martin develops communication satellites and satellites communication systems for the US Air Force to improve its ground communication.

The Multi-mode fiber type sector is projected to witness a higher CAGR during the forecast period

Multi-mode fiber optic cables have a large diameter core that allows multiple modes of light to propagate. This increases the number of light reflections created as the light passes through the core, enabling more data to pass through at a given time. The quality of the signal is hampered over long distances due to the transmission of data in large volumes and the high attenuation rate. The wavelengths of light waves in multi-mode fibers are in the visible spectrum ranging from 850 nm to 1300 nm. In a multimode fiber, the core-to-cladding diameter ratio is 50–125 µm and 62.5–125 µm. These fibers are typically used for short-distance data and audio/video applications in LANs.

The deployment and adoption of high-optic fiber optic networks in sophisticated avionics and aerospace systems continue to accelerate. This introduces a new set of challenges for the maintenance, test, and diagnostics of these critical systems.

Airlines are shifting to seatback screens serving each passenger from a few overhead screens serving multiple passengers. This shift enhances on-demand services tailored to each passenger, thus impacting airline revenue. Fiber optic cables are likely to replace traditional copper, eliminating the subsequent intermediate seat electronics, zone boxes, and intermediate switches. Multi-mode fiber optic cables are the first choice for carrying data rates of >10 GB/s across large wide-body aircraft.

Military and defense fiber optic cables focus on the development and manufacturing of application-specific products for harsh environments and are highly specialized. Fiber optic cables in the military are used across a wide variety of ground, air, sea, and space applications that require harsh environment certification and rigorous testing to ensure performance and reliability in the field.

Market for fiber optic cables used for military platform is projected to witness highest CAGR during the forecast period

Military operations undergo extreme conditions during rescue operations and hence require more ruggedized fiber optic cables. In military aircraft, fiber optic cables are used in avionics and mission control systems for high-speed data transfer for applications such as mission data, flight planning data, and sensor data fusion for weapon systems. Thus, the increasing adoption of fiber optic cables in military aircraft and increased procurement of these aircraft is expected to boost the market for fiber optic cables market for military and aerospace. Various 4th and 5th generation fighter aircraft such as the F-35, J-20, and Su-57 use fiber optic cables onboard to monitor the performance of engines, flight control systems, and avionics.

The Asia Pacific market is projected to contribute the largest share from 2021 to 2026

The fiber optic cables market for military and aerospace in the Asia Pacific region has been studied for China, Japan, India, South Korea and Australia. The Asia Pacific fiber optic cables market for military and aerospace is estimated at USD 876.0 million in 2021 and is projected to reach USD 967.9 million by 2026, at a CAGR of 5.3% from 2021 to 2026. Huge investments are being made in various programs by the Chinese & Indian militaries in aircraft and related systems, C4I systems, mission support, and space-based systems, etc. Owing to this, Asia Pacific is expected to lead the fiber optic cables market for military and aerospace during the forecast period. There are various well-established and prominent fiber optic cables manufacturers having their regional offices in this region, including Amphenol (US), Carlisle Interconnect Technologies (US), Corning Optical Communications LLC (US), W.L. Gore & Associates (US), TE Connectivity (Switzerland), and Radiall (France),

In this report, the Asia Pacific region is segmented into Japan, China, India, South Korea, and Australia. This region is expected to be the fastest-growing fiber optic cables market for military and aerospace. This is mainly attributed to the presence of growing economies such as China and India, increasing funding/investments toward the development of defense products, the growing focus of both international and domestic players on the region, and extensive R&D activities for defense systems. In addition, rising insurgencies, territorial disputes, increasing terrorism, unrest between neighboring nations, and political conflicts in the region are also fueling the growth of the fiber optic cable market for military and aerospace in this region. Favorable regulatory policies for the approval of new defense products are further intensifying the interest of players in the Asia Pacific fiber optic cables market for military and aerospace.

The market in this region is characterized by the increasing demand for better-performing

Optical Cables that ensure optimal reliability, safety, and quality to streamline and facilitate sensitive and complex operations. It is also driven by the stringent standards to meet the requirements of various platforms such as unmanned deployments (air and ground), flight communications, and harsh environment conditions.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The fiber optic cables market for military & aerospace is largely fragmented. Established players in the market include Amphenol fsi (UK), Carlisle Interconnect Technologies (US), Radiall (Italy), TE Connectivity (Switzerland), Corning Optical Communications LLC (US), Prysmian Group (Italy), Northrop Grumman Corporation (US).

Fiber Optic Cables Market for Military & Aerospace Report Scope:

|

Report Metric |

Details |

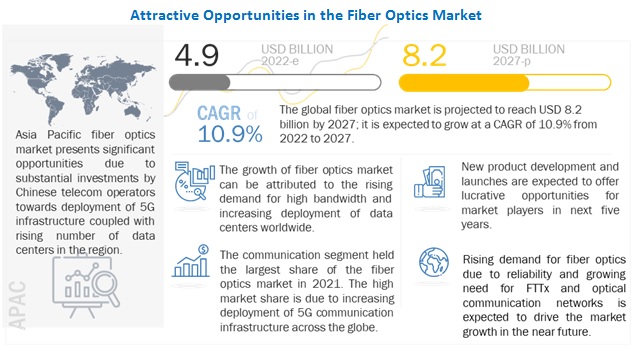

| Estimated Market Size in 2022 | USD 4.9 Billion |

| Revenue Forecast in 2027 | USD 8.2 Billion |

| Growth Rate | 10.9% |

|

Forecast period |

2022-2027 |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2022 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Application, By Platform, By Type, By Material |

|

Geographies covered |

|

|

Companies covered |

Amphenol FSI (US), Carlisle Interconnect Technologies (US), Radiall (France), TE Connectivity (Switzerland), and Corning Optical Communications LLC (US) |

The study categorizes the fiber optic cables market for military & aerospace based on Application, Platform, Type, Material, and Region.

By Application

- Cabin Interior

- Weapons Systems

- ISR Systems

- Communication Systems

- Navigation & Sensing

- Avionics

- Others

By Platform

- Civil

- Military

- Space

By Type

- Single Mode

- Multi-Mode

By Material

- Glass

- Plastic

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Rest of the World

Recent Developments

- In October 2020, The Evolv Hardened Connectivity Solutions developed by the Corning Optical Communications LLC with Pushlok Technology are designed to simplify fiber deployment for all types of communications networks.

- In November 2019, W. L. Gore & Associates offers new design options in the sample inventory of GORE high speed data cables to meet aerospace industry needs and protocols.

Frequently Asked Questions (FAQ):

What are your views on the growth prospect of the fiber optic cables market for military & aerospace?

The fiber optic cables market for military & aerospace is expected to grow substantially owing to the technological development in designing of the new and compact missiles.

What are the key sustainability strategies adopted by leading players operating in the fiber optic cables market for military & aerospace?

Key players have adopted various organic and inorganic strategies to strengthen their position in the fiber optic cables market for military & aerospace. The major players include Radiall (France), Amphenol fsi (US), Carlisle Interconnect Technologies (US), TE Connectivity (Switzerland), Prysmian Group (Italy), Corning Optical Communications LLC (US), these players have adopted various strategies, such as contracts and agreements, to expand their presence in the market further.

What are the new emerging technologies and use cases disrupting the fiber optic cables market for military & aerospace?

Some of the major emerging technologies and use cases disrupting the market include Advanced Digital Avionics in More Electric Aircrafts, Fiber optics based military communication systems, etc.

Who are the key players and innovators in the ecosystem of the Fiber optic cables market for military & aerospace?

The key players in the fiber optic cables market for military & aerospace include Radiall (France), Amphenol fsi (US), Carlisle Interconnect Technologies (US), TE Connectivity (Switzerland), Prysmian Group (Italy), Corning Optical Communications LLC (US).

Which region is expected to hold the highest market share in the fiber optic cables market for military & aerospace?

fiber optic cables market for military & aerospace in North America is projected to hold the highest market share during the forecast period. The key factor responsible for North America, leading the fiber optic cables market for military & aerospace owing to the rapid growth of the demand for fiber optics systems by US and Canada, and technological advancements of fiber optics communication systems in terms of reduced loss of information, and compact size. The increasing demand for fiber optic cables and the presence of some of the leading players operating in the market, such as Amphenol fsi (US), Carlisle Interconnect Technologies (US) are expected to drive the fiber optic cables market for military & aerospace in Asia Pacific. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

1.2.2 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM: INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 MARKET STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 1 REPORT PROCESS FLOW

FIGURE 2 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Break-up of primaries

2.2 FACTOR ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.3 MARKET SIZE ESTIMATION & METHODOLOGY

2.3.1 BOTTOM-UP APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.1.1 COVID-19 impact on market analysis

2.3.2 TOP-DOWN APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 DATA TRIANGULATION

FIGURE 5 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY ON FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE

2.6 LIMITATIONS/GREY AREAS

2.7 RISKS

3 EXECUTIVE SUMMARY (Page No. - 47)

FIGURE 6 SINGLE-MODE CABLES TO LEAD FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE DURING FORECAST PERIOD

FIGURE 7 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2021 & 2026 (USD MILLION)

FIGURE 8 WEAPON SYSTEMS PROJECTED TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

FIGURE 9 ASIA PACIFIC PROJECTED TO DOMINATE FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE IN 2021

4 PREMIUM INSIGHTS (Page No. - 51)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN FIBER OPTIC CABLES MARKET FOR MILITARY & AEROSPACE

FIGURE 10 INCREASING USE OF AVIONICS SYSTEMS IN CIVIL AIRCRAFT RESPONSIBLE FOR THE MARKET GROWTH

4.2 FIBER OPTIC CABLE MARKET FOR MILITARY & AEROSPACE, BY PLATFORM

FIGURE 11 LAND SEGMENT TO LEAD MARKET THROUGH FORECAST PERIOD

4.3 FIBER OPTIC CABLE MARKET FOR MILITARY & AEROSPACE MARKET, BY COUNTRY

FIGURE 12 RUSSIA EXPECTED TO LEAD FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 13 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing use in new and upgraded aircraft

TABLE 2 ESTIMATED REGION-WISE DELIVERIES OF NEW AIRCRAFT BETWEEN 2016 AND 2035

5.2.1.2 Improved interoperability of military systems

5.2.1.3 Increase in demand for more electric aircraft and glass cockpit concepts

5.2.1.4 Rise in demand for throughput and reliability

5.2.1.5 Use of IoT and fiber optics in sensing applications

5.2.2 RESTRAINTS

5.2.2.1 Susceptibility to physical damage and transmission loss

5.2.3 OPPORTUNITIES

5.2.3.1 Use of photonics technology in electronic warfare networks

5.2.3.2 Demand for optical add-drop multiplexer (OADM) networks

5.2.4 CHALLENGES

5.2.4.1 Adherence to stringent regulatory norms

5.2.4.2 Threat to optical network security

5.2.4.3 Complex maintenance and installation requirements

5.3 COVID-19 IMPACT SCENARIOS

FIGURE 14 COVID-19 IMPACT SCENARIOS (PESSIMISTIC, REALISTIC, AND OPTIMISTIC)

5.4 IMPACT OF COVID-19 ON FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE

FIGURE 15 COVID-19 IMPACT: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE

5.4.1 DEMAND-SIDE IMPACT

5.4.1.1 Key developments from January 2020 to August 2021

TABLE 3 KEY DEVELOPMENTS IN FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE 2020-2021

5.4.2 SUPPLY-SIDE IMPACT

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.5.1 DEVELOPMENT OF MORE ELECTRIC AIRCRAFT (MEA)

5.5.2 INCREASED USE OF DIGITAL AVIONICS IN COMMERCIAL AND MILITARY AIRCRAFT

FIGURE 16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.6 MARKET ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 17 MILITARY AND AEROSPACE FIBER OPTIC CABLES MARKET ECOSYSTEM

TABLE 4 MARKET ECOSYSTEM: FIBER OPTIC CABLES FOR MILITARY AND AEROSPACE

5.7 PRICING ANALYSIS

TABLE 5 AVERAGE SELLING PRICE ANALYSIS OF FIBER OPTIC CABLES FOR MILITARY & AEROSPACE (2020)

5.8 TARIFF AND REGULATORY LANDSCAPE FOR DEFENSE INDUSTRY

5.9 TRADE ANALYSIS

TABLE 6 COUNTRY-WISE EXPORTS, 2019-2020 (USD THOUSAND)

TABLE 7 COUNTRY-WISE IMPORTS, 2019-2020 (USD THOUSAND)

5.10 VALUE CHAIN ANALYSIS OF FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE

FIGURE 18 VALUE CHAIN ANALYSIS

5.11 PORTER’S FIVE FORCES MODEL

TABLE 8 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE: PORTER’S FIVE FORCES ANALYSIS

FIGURE 19 MARKET FOR MILITARY AND AEROSPACE: PORTER’S FIVE FORCES ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 TECHNOLOGY ANALYSIS

5.12.1 HONEYWELL: NEXT-GENERATION FLIGHT MANAGEMENT SYSTEM (NGFMS)

5.13 USE CASES

5.13.1 AIRBUS: USE OF FIBER OPTIC CABLES IN A380 AIRCRAFT

5.14 OPERATIONAL DATA

TABLE 9 NEW COMMERCIAL AIRPLANE DELIVERIES, BY REGION, 2019-2038

6 INDUSTRY TRENDS (Page No. - 69)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 20 SUPPLY CHAIN ANALYSIS

6.2.1 MAJOR COMPANIES

6.2.2 SMALL AND MEDIUM ENTERPRISES

6.2.3 END USERS/CUSTOMERS

6.3 EMERGING INDUSTRY TRENDS

6.3.1 USE OF FIBER OPTIC CABLES IN IN-FLIGHT ENTERTAINMENT (IFE)

6.3.2 USE OF FIBER OPTIC CABLES IN FLIGHT CONTROL SYSTEMS

6.4 INNOVATIONS AND PATENTS REGISTRATIONS, 2012-2021

6.5 IMPACT OF MEGATREND

6.5.1 IN-FLIGHT HIGH-SPEED INTERNET AND WI-FI ACCESS PROVIDED

6.5.2 ONGOING INNOVATION IN DEFENSE SECTOR

7 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY APPLICATION (Page No. - 74)

7.1 INTRODUCTION

FIGURE 21 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY APPLICATION, 2021 & 2026 (USD MILLION)

TABLE 10 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 11 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY APPLICATION, 2021–2026 (USD MILLION)

7.2 AVIONICS

7.3 COMMUNICATION SYSTEMS

7.4 NAVIGATION & SENSING

7.5 WEAPON SYSTEMS

7.6 OTHERS

8 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM (Page No. - 78)

8.1 INTRODUCTION

FIGURE 22 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2021 & 2026 (USD MILLION)

TABLE 12 MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 13 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2021–2026 (USD MILLION)

8.2 CIVIL

TABLE 14 CIVIL: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY AIRCRAFT TYPE, 2017–2020 (USD MILLION)

TABLE 15 CIVIL: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY AIRCRAFT TYPE, 2021–2026 (USD MILLION)

8.2.1 COMMERCIAL

8.2.1.1 Narrow-body aircraft

8.2.1.2 Wide-body aircraft

8.2.1.3 Regional transport aircraft

8.2.2 BUSINESS JETS

8.2.3 LIGHT AIRCRAFT

8.2.4 ROTORCRAFT

8.3 MILITARY

TABLE 16 MILITARY: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 17 MILITARY: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2021–2026 (USD MILLION)

8.3.1 AIRBORNE

TABLE 18 MILITARY: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY AIRBORNE PLATFORM, 2017–2020 (USD MILLION)

TABLE 19 MILITARY: MARKET, BY AIRBORNE PLATFORM, 2021–2026 (USD MILLION)

8.3.1.1 Combat aircraft

8.3.1.2 Unmanned aerial vehicles

8.3.1.3 Military transport aircraft

8.3.1.4 Military helicopters

8.3.2 LAND

TABLE 20 LAND: MARKET BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 21 LAND: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2021–2026 (USD MILLION)

8.3.2.1 Armored vehicles

8.3.2.2 Unmanned ground vehicles

8.3.2.3 C4ISR

8.3.3 MARINE

TABLE 22 MARINE: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 23 MARINE: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

8.3.3.1 Destroyers

8.3.3.2 Frigates

8.3.3.3 Unmanned maritime vehicles

8.3.3.4 Submarines

8.3.3.5 Offshore Patrol Vessels (OPVS)

8.3.3.6 Aircraft carriers

8.4 SPACE

TABLE 24 SPACE: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 25 SPACE: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

8.4.1 SPACE LAUNCH VEHICLES

8.4.2 SATELLITES

9 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY TYPE (Page No. - 88)

9.1 INTRODUCTION

FIGURE 23 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY TYPE, 2021 & 2026 (USD MILLION)

TABLE 26 MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 27 MARKET, BY TYPE, 2021–2026 (USD MILLION)

9.2 SINGLE-MODE

9.3 MULTI-MODE

10 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL (Page No. - 91)

10.1 INTRODUCTION

FIGURE 24 GLASS FIBERS SEGMENT TO COMMAND LARGEST SHARE DURING FORECAST PERIOD

TABLE 28 FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 29 MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

10.2 GLASS FIBER

TABLE 30 MILITARY AND AEROSPACE SYSTEMS THAT USE GLASS FIBERS

10.3 PLASTIC FIBER

TABLE 31 MILITARY AND AEROSPACE SYSTEMS THAT USE PLASTIC FIBERS

11 REGIONAL ANALYSIS (Page No. - 94)

11.1 INTRODUCTION

FIGURE 25 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE: REGIONAL SNAPSHOT

11.2 IMPACT OF COVID-19 ON FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE

FIGURE 26 IMPACT OF COVID-19 ON FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE

TABLE 32 MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 33 MARKET, BY REGION, 2021–2026 (USD MILLION)

TABLE 34 GLOBAL: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 35 GLOBAL: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 36 GLOBAL: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 37 GLOBAL: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 38 GLOBAL: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 39 GLOBAL: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.3 NORTH AMERICA

11.3.1 IMPACT OF COVID-19

FIGURE 27 NORTH AMERICA: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE SNAPSHOT

TABLE 40 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 47 NORTH AMERICA: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.3.2 PESTLE ANALYSIS: NORTH AMERICA

11.3.3 US

TABLE 48 US: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 49 US: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 50 US: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 51 US: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 52 US: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 53 US: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.3.4 CANADA

TABLE 54 CANADA: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 55 CANADA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 56 CANADA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 57 CANADA: MARKET BY TYPE, 2021–2026 (USD MILLION)

TABLE 58 CANADA: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 59 CANADA: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.4 EUROPE

11.4.1 IMPACT OF COVID-19

FIGURE 28 EUROPE: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE SNAPSHOT

TABLE 60 EUROPE: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.4.2 PESTLE ANALYSIS: EUROPE

11.4.2.1 Political

11.4.2.2 Economic

11.4.2.3 Social

11.4.2.4 Technological

11.4.2.5 Legal

11.4.2.6 Environmental

11.4.3 UK

TABLE 68 UK: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 69 UK: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 70 UK: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 71 UK: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 72 UK: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 73 UK: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.4.4 FRANCE

TABLE 74 FRANCE FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 75 FRANCE: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 76 FRANCE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 77 FRANCE: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 78 FRANCE: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 79 FRANCE: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.4.5 GERMANY

TABLE 80 GERMANY: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 82 GERMANY: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 83 GERMANY: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 84 GERMANY: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.4.6 ITALY

TABLE 86 ITALY: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 87 ITALY: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 88 ITALY: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 89 ITALY: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 90 ITALY: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 91 ITALY: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.4.7 RUSSIA

TABLE 92 RUSSIA: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 93 RUSSIA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 94 RUSSIA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 95 RUSSIA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 96 RUSSIA: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 97 RUSSIA: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.4.8 REST OF EUROPE

TABLE 98 REST OF EUROPE: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 99 REST OF EUROPE: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET FOR MILITARY AND AEROSPACE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.5 ASIA PACIFIC

FIGURE 29 ASIA PACIFIC FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE SNAPSHOT

TABLE 104 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 107 ASIA PACIFIC: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.5.1 COVID-19 IMPACT ON ASIA PACIFIC

11.5.2 PESTLE ANALYSIS: ASIA PACIFIC

11.5.3 CHINA

TABLE 112 CHINA: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 113 CHINA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 114 CHINA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 115 CHINA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 116 CHINA: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 117 CHINA: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.5.4 JAPAN

TABLE 118 JAPAN: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 119 JAPAN: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 120 JAPAN: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 121 JAPAN: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 122 JAPAN: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 123 JAPAN: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.5.5 INDIA

TABLE 124 INDIA: MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 125 INDIA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 126 INDIA: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 127 INDIA: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 128 INDIA: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 129 INDIA: MARKET , BY MATERIAL, 2021–2026 (USD MILLION)

11.5.6 SOUTH KOREA

TABLE 130 SOUTH KOREA: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 131 SOUTH KOREA: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 132 SOUTH KOREA: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 133 SOUTH KOREA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 134 SOUTH KOREA: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 135 SOUTH KOREA: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.5.7 AUSTRALIA

TABLE 136 AUSTRALIA: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 137 AUSTRALIA: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 138 AUSTRALIA: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 139 AUSTRALIA: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 140 AUSTRALIA: FIBER OPTIC CABLE MARKET , BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 141 AUSTRALIA: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.5.8 REST OF ASIA PACIFIC

TABLE 142 REST OF ASIA PACIFIC: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 144 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 145 REST OF ASIA PACIFIC: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 146 REST OF ASIA PACIFIC: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 147 REST OF ASIA PACIFIC: MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.6 MIDDLE EAST

11.6.1 COVID-19 IMPACT ON MIDDLE EAST

FIGURE 30 MIDDLE EAST: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE SNAPSHOT

TABLE 148 MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 149 MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 150 MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 151 MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 152 MIDDLE EAST: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 153 MIDDLE EAST: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 154 MIDDLE EAST: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 155 MIDDLE EAST: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.6.2 PESTLE ANALYSIS: MIDDLE EAST

11.6.3 SAUDI ARABIA

TABLE 156 SAUDI ARABIA: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 157 SAUDI ARABIA: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 158 SAUDI ARABIA: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 159 SAUDI ARABIA: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 160 SAUD ARABIA: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 161 SAUDI ARABIA: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.6.4 ISRAEL

TABLE 162 ISRAEL: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 163 ISRAEL: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 164 ISRAEL: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 165 ISRAEL: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 166 ISRAEL: MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 167 ISRAEL: MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.6.5 UAE

TABLE 168 UAE: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 169 UAE: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 170 UAE: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 171 UAE: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 172 UAE: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 173 UAE: MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2021–2026 (USD MILLION)

11.6.6 REST OF MIDDLE EAST

TABLE 174 REST OF MIDDLE EAST: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 175 REST OF MIDDLE EAST: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 176 REST OF MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 177 REST OF MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 178 REST OF MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 179 REST OF MIDDLE EAST: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.7 REST OF THE WORLD

11.7.1 COVID-19 IMPACT ON REST OF THE WORLD

FIGURE 31 REST OF THE WORLD: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE SNAPSHOT

TABLE 180 REST OF THE WORLD: MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 181 REST OF THE WORLD: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY REGION, 2021–2026 (USD MILLION)

TABLE 182 REST OF THE WORLD: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 183 REST OF THE WORLD: FIBER OPTIC CABLESMARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 184 REST OF THE WORLD: FIBER OPTIC CABLE MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 185 REST OF THE WORLD: FIBER OPTIC CABLE MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 186 REST OF THE WORLD: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 187 REST OF THE WORLD: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.7.2 PESTLE ANALYSIS: REST OF THE WORLD

11.7.3 LATIN AMERICA

TABLE 188 LATIN AMERICA: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 189 LATIN AMERICA: MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 190 LATIN AMERICA: MARKET, BY TYPE, 2017–2020 (USD MILLION)

TABLE 191 LATIN AMERICA: MARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 192 LATIN AMERICA: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 193 LATIN AMERICA: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

11.7.4 AFRICA

TABLE 194 AFRICA: FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE, BY PLATFORM, 2017–2020 (USD MILLION)

TABLE 195 AFRICA: FIBER OPTIC CABLE MARKET, BY PLATFORM, 2021–2026 (USD MILLION)

TABLE 196 AFRICA: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 197 AFRICA: FIBER OPTIC CABLESMARKET, BY TYPE, 2021–2026 (USD MILLION)

TABLE 198 AFRICA: FIBER OPTIC CABLE MARKET FOR MILITARY AND AEROSPACE, BY MATERIAL, 2017–2020 (USD MILLION)

TABLE 199 AFRICA: FIBER OPTIC CABLE MARKET, BY MATERIAL, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 156)

12.1 INTRODUCTION

TABLE 200 KEY DEVELOPMENTS BY LEADING PLAYERS IN FIBER OPTIC CABLES MARKET FOR MILITARY & AEROSPACE (2018-2021)

12.2 MARKET SHARE ANALYSIS OF LEADING PLAYERS 2020

TABLE 201 DEGREE OF COMPETITION

FIGURE 32 COLLECTIVE REVENUE SHARE OF TOP 5 PLAYERS

12.3 RANK ANALYSIS, 2020

FIGURE 33 REVENUE GENERATED BY MAJOR PLAYERS IN FIBER OPTIC CABLE MARKET FOR MILITARY & AEROSPACE, 2020

TABLE 202 COMPANY REGION FOOTPRINT

TABLE 203 COMPANY PLATFORM FOOTPRINT

TABLE 204 COMPANY APPLICATION FOOTPRINT

12.4 COMPETITIVE EVALUATION QUADRANT

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

FIGURE 34 FIBER OPTIC CABLES MARKET FOR MILITARY & AEROSPACE COMPETITIVE LEADERSHIP MAPPING, 2021

12.5 STARTUP EVALUATION QUADRANT

12.5.1 PROGRESSIVE COMPANIES

12.5.2 RESPONSIVE COMPANIES

12.5.3 STARTING BLOCKS

12.5.4 DYNAMIC COMPANIES

FIGURE 35 FIBER OPTIC CABLES MARKET FOR MILITARY AND AEROSPACE COMPETITIVE LEADERSHIP MAPPING (SME)

12.6 COMPETITIVE SCENARIO

12.6.1 NEW PRODUCT LAUNCHES

TABLE 205 NEW PRODUCT LAUNCHES, 2018–OCTOBER 2021

12.6.2 DEALS

TABLE 206 DEALS, 2018–AUGUST 2021

13 COMPANY PROFILES (Page No. - 167)

(Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 AMPHENOL FSI

TABLE 207 AMPHENOL FSI: BUSINESS OVERVIEW

FIGURE 36 AMPHENOL FSI: COMPANY SNAPSHOT

13.2.2 CARLISLE INTERCONNECT TECHNOLOGIES

TABLE 208 CARLISLE INTERCONNECT TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 37 CARLISLE INTERCONNECT TECHNOLOGIES: COMPANY SNAPSHOT

13.2.3 RADIALL

TABLE 209 RADIALL: BUSINESS OVERVIEW

FIGURE 38 RADIALL: COMPANY SNAPSHOT

TABLE 210 RADIALL: NEW PRODUCT DEVELOPMENT

TABLE 211 RADIALL: DEALS

13.2.4 TE CONNECTIVITY

TABLE 212 THALES: BUSINESS OVERVIEW

FIGURE 39 TE CONNECTIVITY: COMPANY SNAPSHOT

13.2.5 CORNING OPTICAL COMMUNICATIONS LLC

TABLE 213 CORNING OPTICAL COMMUNICATIONS LLC: BUSINESS OVERVIEW

FIGURE 40 CORNING OPTICAL COMMUNICATIONS LLC: COMPANY SNAPSHOT

TABLE 214 CORNING OPTICAL COMMUNICATIONS LLC: NEW PRODUCT DEVELOPMENT

13.2.6 PRYSMIAN GROUP

TABLE 215 PRYSMIAN GROUP: BUSINESS OVERVIEW

FIGURE 41 PRYSMIAN GROUP: COMPANY SNAPSHOT

TABLE 216 PRYSMIAN GROUP: DEALS

13.2.7 OPTICAL CABLE CORPORATION

TABLE 217 OPTICAL CABLE CORPORATION: BUSINESS OVERVIEW

FIGURE 42 OPTICAL CABLE CORPORATION: COMPANY SNAPSHOT

13.2.8 TIMBERCON

TABLE 218 TIMBERCON: BUSINESS OVERVIEW

TABLE 219 TIMBERCON: DEALS

13.3 OTHER KEY PLAYERS

13.3.1 INTERCONNECT SYSTEMS PTY LTD.

TABLE 220 INTERCONNECT SYSTEMS PTY LTD.: BUSINESS OVERVIEW

13.3.2 W.L. GORE & ASSOCIATES

TABLE 221 W.L. GORE & ASSOCIATES: BUSINESS OVERVIEW

TABLE 222 W.L. GORE & ASSOCIATES: NEW PRODUCT DEVELOPMENT

13.3.3 AFL

TABLE 223 AFL: BUSINESS OVERVIEW

13.3.4 OFS FITEL LLC

TABLE 224 OFS FITEL LLC: BUSINESS OVERVIEW

13.3.5 TECH OPTICS LTD.

TABLE 225 TECH OPTICS LTD.: BUSINESS OVERVIEW

13.3.6 LEVITON MANUFACTURING CO. LTD.

TABLE 226 LEVITON MANUFACTURING CO. LTD.: BUSINESS OVERVIEW

*Details on Business Overview, Products/solutions/services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 191)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATION

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

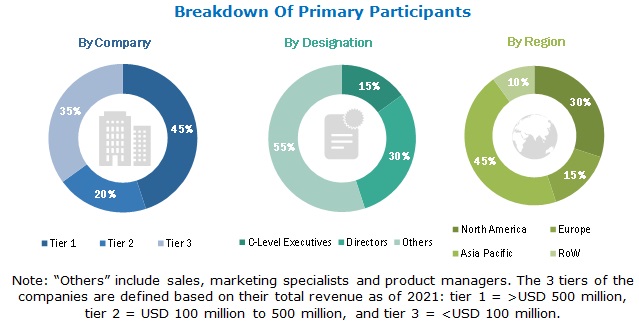

The study involved four major activities in estimating the current size of the fiber optic cables market for military & aerospace. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources included government sources, such as SIPRI; corporate filings such as annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from fiber optic cables vendors; system integrators; component providers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, and installation teams of the customer/end users who are using fiber optic cables vendors were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of missile seekers vendors and future outlook of their business which will affect the overall market.

To know about the assumptions considered for the study, download the pdf brochure

|

Fiber optic cables OEMs |

Others |

|

Amphenol fsi |

Prysmian Group |

|

Carlisle Interconnect Technologies |

Optical Fiber Corporation |

|

Radiall |

TE Connectivity |

|

Corning Optical Communications LLC |

Leviton Manufacturing Co. Ltd |

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the fiber optic cables market for military & aerospace. These methods were also used extensively to estimate the size of various segments and subsegments of the market. The research methodology used to estimate the market size included the following:

- Key players in the industry and market were identified through extensive secondary research of their product matrix and geographical presence and developments undertaken by them.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Global Fiber optic cables market for military & aerospace Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the fiber optic cables market for military & aerospace using the market size estimation processes explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from demand as well as supply sides of the fiber optic cables market for military & aerospace.

Report Objectives

- To define, describe, segment, and forecast the size of the fiber optic cables market for military & aerospace based on technology, missile type, launch mode, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, and Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the fiber optic cables market for military & aerospace

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets1, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customization

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific requirements. The following customization options are available for the report:

Country-level analysis

- Market sizing and forecasting for other countries of the Rest of the World

- Additional company profiles (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fiber Optic Cables Market