Mobile Security Market by End User (Individual and Enterprise (Solution (Authentication, Application Security, & Device Security), Service, Deployment Mode, Organization Size, Vertical), Operating System (iOS & Android), & Region - Global Forecast to 2024

Mobile Security Market Size, Share, Industry Growth, Latest Trends, Forecast - 2024

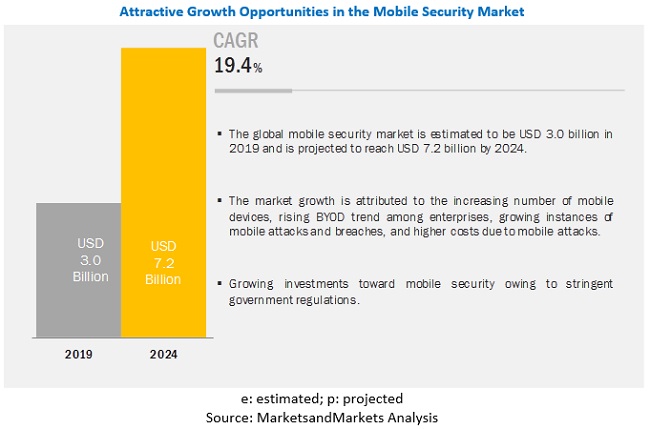

The global Mobile Security Market size was valued at $3.0 billion in 2019 and it is projected to reach $7.2 billion by the end of 2024 at a CAGR of 19.4% during the forecast period. Major growth drivers of the market are the increasing numbers of mobile phone subscriptions around the world and increasing adoption of third-party applications.

Among solutions, the endpoint detection and response segment to grow at a higher CAGR during the forecast period

The mobile security market is segmented by solution into the Endpoint Protection Platform (EPP) and Endpoint Detection and Response (EDR). The EDR segment is expected to be a faster-growing segment in the mobile security market, due to the growing need for detection and remediation of threats during any mobile security breach or an attack. These technologically advanced solutions help detect and remediate the most recent known and unknown threats. It forms the first level of defense for organizations to secure endpoints.

Among deployment modes, the cloud segment to grow at a rapid pace during the forecast period

Most vendors in the mobile security market offer cloud-based mobile security solutions. The adoption of cloud-based mobile security solutions is expected to grow due to benefits, such as easy maintenance of generated data, cost-effectiveness, scalability, and effective management of these solutions. The cloud deployment mode offers web-based management and enterprise-class protection for endpoints. It enables users to deploy endpoint protection without the need for an IT staff to manage the software.

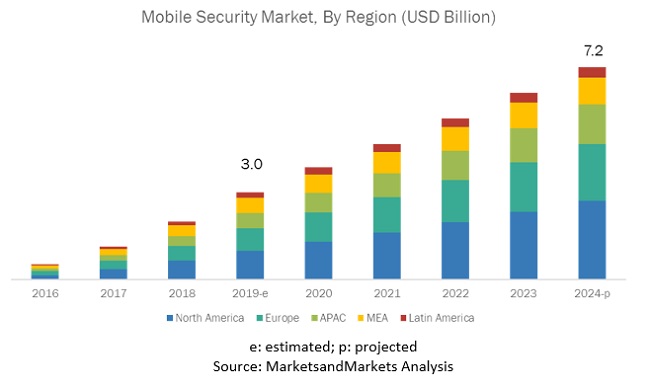

North America to hold the highest market share during the forecast period

North America is expected to hold the highest share in the global mobile security market, while Asia Pacific (APAC) is expected to grow at the highest CAGR during the forecast period. The enterprises in APAC need to develop a robust cyber-defense strategy to tackle data thefts and mobile data breaches. Lack of a common legislation framework among the APAC countries has led to an inconsistent and complex cyber landscape in the region, forcing the enterprises to implement advanced cybersecurity solutions. The governments in Asian countries such as China, Singapore, and Japan are investing significant amount of federal budgets for developing the nations’ cybersecurity.

North America is the most significant revenue contributor to the global mobile security market. The region is witnessing significant developments in the mobile security industry. In North America, the high penetration of this technology can be attributed to encouraging government initiatives to improve and maintain cybersecurity across all federal departments and government agencies. This would drive the adoption of mobile security solutions in the US and Canada.

Mobile Security Companies

Major vendors in the global mobile security market include Microsoft (US), CrowdStrike (US), Symantec (US), Trend Micro (Japan), Sophos (UK), McAfee (US), Kaspersky (Russia), VMware (US), IBM (US), ESET (Slovakia), BlackBerry (Canada), MobileIron (US), Samsung (South Korea), F-Secure (Finland), Check Point (Israel), Panda Security (Spain), Bitdefender (Romania), OneSpan (US), Quick Heal (India), Fortinet (US), Citrix Systems (US), Webroot (US), Keeper Security (US), Amtel (US), and Codeproof (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to expand their presence in the global mobile security market.

Microsoft offers Microsoft Endpoint Manager for the protection of mobile devices. Microsoft offers its mobile security solutions through an integrated management solution. This integrated platform is a combination of enterprise mobility and security capabilities. The platform helps protect and secure enterprises, thus providing the flexibility of working remotely using enterprise mobility management and Bring Your Own Device (BYOD) security. The company caters to a wide range of industry verticals, including finance and insurance, manufacturing and retail, media and entertainment, public sector, healthcare, and Information Technology (IT) and telecommunications. The company adopts a mix of organic and inorganic growth strategies to strengthen its market position. In November 2019, Microsoft launched the Endpoint Manager, which includes the capabilities of both Configuration Manager and Intune, along with additional Microsoft services and products. Endpoint Manager enables enterprises to manage a large number of devices used by their employees. In June 2017, Microsoft acquired Hexadite, a provider of automatic incident investigation and remediation solutions, to help organizations secure their businesses from cyberattacks.

Recent developments

- In October 2019, Fortinet acquired enSilo, an advanced endpoint security solutions provider, to enhance its current security portfolio with real-time automated detection and response features for the protection of mobile endpoints.

- In May 2019, Microsoft launched its Endpoint Manager, which includes the capabilities of both Configuration Manager and Intune, along with additional Microsoft services and products. The endpoint manager enables enterprises to manage a large number of mobile devices, which are used by their employees.

- In August 2019, Broadcom, a global technology provider of semiconductor and infrastructure software solutions, acquired the enterprise security business of Symantec. The integration of Symantec's enterprise security portfolio with Broadcom’s existing solution portfolio would significantly expand Broadcom's infrastructure software footprint.

- In October 2018, Trend Micro launched XGen endpoint security; it is a mixture of cross-generational threat defense systems that intelligently applies the right solution, resulting in more effective and efficient protection against threats.

- In April 2018, CrowdStrike launched CrowdStrike Falcon Endpoint Protection Platform (EPP) solutions with the combination of the EPP technology. The EPP technology comprises a skilled and experienced Falcon endpoint protection team.

Frequently Asked Questions (FAQ):

What is the Mobile Security Market growth?

What is the estimated growth rate (CAGR) of the global Mobile Security Market?

What are the major revenue pockets in the global Mobile Security Market currently?

Which are Leading Companies in Mobile Security Market?

What are the solution in Mobile Security Market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 21)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 26)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

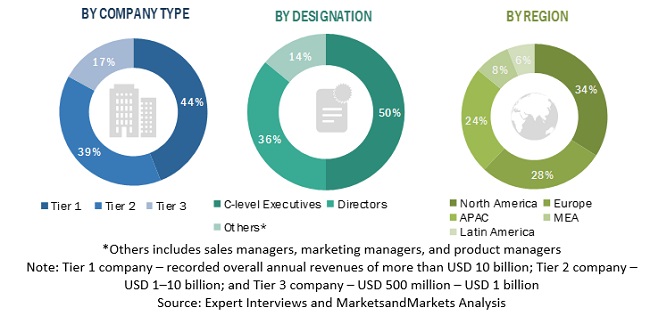

2.1.2.1 Breakup of Primary Profiles

2.1.2.2 Key Industry Insights

2.2 Market Breakup and Data Triangulation

2.3 Market Size Estimation

2.4 Market Forecast

2.5 Competitive Leadership Mapping Methodology

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 37)

4 Premium Insights (Page No. - 45)

4.1 Attractive Market Opportunities in the Mobile Security Market

4.2 Market By End User, 2019 vs 2024

4.3 Market By Enterprise Solution, 2019 vs 2024

4.4 Market By Enterprise Service, 2019 vs 2024

4.5 Market By Professional Service, 2019 Vs. 2024

4.6 Market By Operating System, 2019

4.7 Market By Enterprise Deployment Mode, 2019

4.8 Market By Organization Size, 2019 Vs. 2024

4.9 Market By Enterprise Vertical, 2017–2024

4.10 Market Investment Scenario

5 Market Overview and Industry Trends (Page No. - 50)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Number of Mobile Phone Subscriptions Around the World

5.2.1.2 Increasing Number of Mobile Threats and Breaches

5.2.1.3 Increasing Adoption of Third-Party Applications

5.2.1.4 Increasing Productivity of Employees and Enterprises Through BYOD

5.2.2 Restraints

5.2.2.1 Use of Free Mobile Security Solutions

5.2.2.2 Cost of Deploying Enterprise Mobility Management Solutions

5.2.3 Opportunities

5.2.3.1 Rapid Digitalization of Emerging Economies

5.2.3.2 Increasing Trend of BYOD

5.2.4 Challenges

5.2.4.1 Addressing the Complexity of Advanced Threats

5.2.4.2 Lack of Awareness Regarding Mobile Security Solutions Among End Users

5.2.4.3 Interoperability Between Mobile OS

5.3 Mobile Attack Vectors

5.3.1 Malware

5.3.2 Data Exfiltration

5.3.3 Data Tampering

5.3.4 Data Loss

5.4 Use Cases

5.4.1 Provide the Right Level of Access to Data on Mobile Devices to the Right People

5.4.2 Prevent Data From Intentionally or Accidentally Leaking to Unauthorized Mobile Apps And/Or the Cloud From Mobile Devices

5.4.3 Sharing Sensitive Data Between Top Executives in the Byod Environment

5.4.4 Protect Corporate Data in Byod and Cyod Environments

5.4.5 Mobile Security Application to Protect Financial Data on Personal Devices

5.5 Regulations

5.5.1 General Data Protection Regulation (GDPR)

5.5.2 Payment Card Industry Data Security Standard (PCI DSS)

5.5.3 Health Insurance Portability and Accountability Act (HIPAA)

5.5.4 Federal Information Security Management Act (FISMA)

5.5.5 Gramm-Leach-Bliley Act (GLBA)

5.5.6 Sarbanes–Oxley (SOX) Act

5.5.7 Underwriters Laboratories (UL)

5.5.8 Distributed Management Task Force (DMTF)

5.5.9 Organization for the Advancement of Structured Information Standards (OASIS)

6 Mobile Security Market, By End User (Page No. - 63)

6.1 Introduction

6.2 Individual User

6.2.1 Individual User: Market Drivers

6.3 Enterprise

6.3.1 Enterprise: Market Drivers

7 Mobile Security Market, By Operating System (Page No. - 68)

7.1 Introduction

7.2 iOS

7.2.1 iOS: Market Drivers

7.3 Android

7.3.1 Android: Market Drivers

7.4 Others

8 Mobile Security Market, By Enterprise Solution (Page No. - 73)

8.1 Introduction

8.2 Authentication

8.2.1 Authentication: Market Drivers

8.3 Mobile Application Security

8.3.1 Mobile Application Security: Market Drivers

8.4 Mobile Data Protection

8.4.1 Mobile Data Protection: Market Drivers

8.5 Web Protection

8.5.1 Web Protection: Market Drivers

8.6 Mobile Device Security

8.6.1 Mobile Device Security: Market Drivers

8.7 Other Solutions

9 Mobile Security Market, By Enterprise Service (Page No. - 82)

9.1 Introduction

9.2 Professional Services

9.2.1 Professional Services: Market Drivers

9.2.2 Training and Consulting

9.2.3 Integration and Implementation

9.2.4 Support and Maintenance

9.3 Managed Services

9.3.1 Managed Services: Market Drivers

10 Mobile Security Market, By Enterprise Deployment Mode (Page No. - 90)

10.1 Introduction

10.2 Cloud

10.2.1 Cloud: Market Drivers

10.3 On-Premises

10.3.1 On-Premises: Market Drivers

11 Mobile Security Market, By Organization Size (Page No. - 96)

11.1 Introduction

11.2 Small and Medium-Sized Enterprises

11.2.1 Small and Medium-Sized Enterprises: Market Drivers

11.3 Large Enterprises

11.3.1 Large Enterprises: Market Drivers

12 Mobile Security Market, By Enterprise Vertical (Page No. - 101)

12.1 Introduction

12.2 Banking, Financial Services, and Insurance

12.2.1 Banking, Financial Services, and Insurance: Market Drivers

12.3 Telecommunications and IT

12.3.1 Telecommunications and IT: Market Drivers

12.4 Retail and Ecommerce

12.4.1 Retail and Ecommerce: Market Drivers

12.5 Healthcare and Life Sciences

12.5.1 Healthcare and Life Sciences: Market Drivers

12.6 Government and Defense

12.6.1 Government and Defense: Market Drivers

12.7 Manufacturing

12.7.1 Manufacturing: Market Drivers

12.8 Other Enterprise Verticals

13 Mobile Security Market, By Region (Page No. - 112)

13.1 Introduction

13.2 North America

13.2.1 North America: Market Drivers

13.2.2 United States

13.2.3 Canada

13.3 Europe

13.3.1 Europe: Market Drivers

13.3.2 United Kingdom

13.3.3 Germany

13.3.4 France

13.3.5 Rest of Europe

13.4 Asia Pacific

13.4.1 Asia Pacific: Mobile Security Market Drivers

13.4.2 Australia and New Zealand

13.4.3 China

13.4.4 Japan

13.4.5 Singapore

13.4.6 Rest of Asia Pacific

13.5 Middle East and Africa

13.5.1 Middle East and Africa: Market Drivers

13.5.2 United Arab Emirates

13.5.3 Kingdom of Saudi Arabia

13.5.4 Qatar

13.5.5 South Africa

13.5.6 Rest of Middle East and Africa

13.6 Latin America

13.6.1 Latin America: Market Drivers

13.6.2 Brazil

13.6.3 Mexico

13.6.4 Rest of Latin America

14 Competitive Landscape (Page No. - 162)

14.1 Introduction

14.2 Competitive Leadership Mapping

14.2.1 Visionary Leaders

14.2.2 Innovators

14.2.3 Dynamic Differentiators

14.2.4 Emerging Companies

14.3 Strength of Product Portfolio (25 Players)

14.4 Business Strategy Excellence (25 Players)

14.5 Ranking of Key Players in the Mobile Security Market, 2019

15 Company Profiles (Page No. - 167)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

15.1 Introduction

15.2 Microsoft

15.3 IBM

15.4 Symantec

15.5 Trend Micro

15.6 Sophos

15.7 McAfee

15.8 Kaspersky Lab

15.9 ESET

15.10 VMware

15.11 Samsung

15.12 CrowdStrike

15.13 BlackBerry

15.14 Citrix Systems

15.15 Mobileiron

15.16 Quick Heal Technologies

15.17 Panda Security

15.18 F-Secure

15.19 Fortinet

15.20 Check Point

15.21 Amtel

15.22 Bitdefender

15.23 Codeproof

15.24 Webroot

15.25 Keeper Security

15.26 OneSpan

15.27 Right-To-Win

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 219)

16.1 Insight of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Available Customizations

16.5 Related Reports

16.6 Author Details

List of Tables (103 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2018

Table 2 Factor Analysis

Table 3 Mobile Security Market Size, By End User, 2017–2024 (USD Million)

Table 4 End User: Market Size By Region, 2017–2024 (USD Million)

Table 5 Individual User: Market Size By Region, 2017–2024 (USD Million)

Table 6 Enterprise: Market Size By Region, 2017–2024 (USD Million)

Table 7 Mobile Security Market Size, By Operating System, 2017–2024 (USD Million)

Table 8 Operating System: Market Size By Region, 2017–2024 (USD Million)

Table 9 iOS: Market Size By Region, 2017–2024 (USD Million)

Table 10 Android: Market Size By Region, 2017–2024 (USD Million)

Table 11 Other Operating Systems: Market Size By Region, 2017–2024 (USD Million)

Table 12 Mobile Security Market Size, By Enterprise Solution, 2017–2024 (USD Million)

Table 13 Enterprise Solutions: Market Size By Region, 2017–2024 (USD Million)

Table 14 Authentication: Market Size By Region, 2017–2024 (USD Million)

Table 15 Mobile Application Security: Market Size By Region, 2017–2024 (USD Million)

Table 16 Mobile Data Protection: Market Size By Region, 2017–2024 (USD Million)

Table 17 Web Protection: Market Size By Region, 2017–2024 (USD Million)

Table 18 Mobile Device Security: Market Size By Region, 2017–2024 (USD Million)

Table 19 Other Solutions: Market Size By Region, 2017–2024 (USD Million)

Table 20 Mobile Security Market Size, By Enterprise Service, 2017–2024 (USD Million)

Table 21 Enterprise Services: Market Size By Region, 2017–2024 (USD Million)

Table 22 Mobile Security Market Size, By Professional Service, 2017–2024 (USD Million)

Table 23 Professional Services: Market Size By Region, 2017–2024 (USD Million)

Table 24 Training and Consulting: Market Size By Region, 2017–2024 (USD Million)

Table 25 Integration and Implementation: Market Size By Region, 2017–2024 (USD Million)

Table 26 Support and Maintenance: Market Size By Region, 2017–2024 (USD Million)

Table 27 Managed Services: Market Size By Region, 2017–2024 (USD Million)

Table 28 Mobile Security Market Size, By Enterprise Deployment Mode, 2017–2024 (USD Million)

Table 29 Enterprise Deployment Modes: Market Size By Region, 2017–2024 (USD Million)

Table 30 Cloud: Market Size By Region, 2017–2024 (USD Million)

Table 31 On-Premises: Market Size By Region, 2017–2024 (USD Million)

Table 32 Mobile Security Market Size, By Organization Size, 2017–2024 (USD Million)

Table 33 Organization Size: Market Size By Region, 2017–2024 (USD Million)

Table 34 Small and Medium-Sized Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 35 Large Enterprises: Market Size By Region, 2017–2024 (USD Million)

Table 36 Mobile Security Market Size, By Enterprise Vertical, 2017–2024 (USD Million)

Table 37 Enterprise Verticals: Market Size By Region, 2017–2024 (USD Million)

Table 38 Banking, Financial Services, and Insurance: Market Size By Region, 2017–2024 (USD Million)

Table 39 Telecommunications and IT: Market Size By Region, 2017–2024 (USD Million)

Table 40 Retail and Ecommerce: Market Size By Region, 2017–2024 (USD Million)

Table 41 Healthcare and Life Sciences: Market Size By Region, 2017–2024 (USD Million)

Table 42 Government and Defense: Market Size By Region, 2017–2024 (USD Million)

Table 43 Manufacturing: Market Size By Region, 2017–2024 (USD Million)

Table 44 Other Enterprise Verticals: Market Size By Region, 2017–2024 (USD Million)

Table 45 Cybersecurity Spending, By Region, 2019 (USD Billion)

Table 46 Mobile Security Market Size, By Region, 2017–2024 (USD Million)

Table 47 Individual User: Market Size By Region, 2017–2024 (USD Million)

Table 48 Enterprise: Market Size By Region, 2017–2024 (USD Million)

Table 49 North America: Cybersecurity Spending, By Country, 2019 (USD Billion)

Table 50 North America: Mobile Security Market Size, By End User, 2017–2024 (USD Million)

Table 51 North America: Market Size By Component, 2017–2024 (USD Million)

Table 52 North America: Market Size By Enterprise Solution, 2017–2024 (USD Million)

Table 53 North America: Market Size By Enterprise Service, 2017–2024 (USD Million)

Table 54 North America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 55 North America: Market Size By Operating System, 2017–2024 (USD Million)

Table 56 North America: Market Size By Enterprise Deployment Mode, 2017–2024 (USD Million)

Table 57 North America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 58 North America: Market Size By Enterprise Vertical, 2017–2024 (USD Million)

Table 59 North America: Market Size By Country, 2017–2024 (USD Million)

Table 60 Europe: Cybersecurity Spending, By Country, 2019 (USD Billion)

Table 61 Europe: Mobile Security Market Size, By End User, 2017–2024 (USD Million)

Table 62 Europe: Market Size By Component, 2017–2024 (USD Million)

Table 63 Europe: Market Size By Enterprise Solution, 2017–2024 (USD Million)

Table 64 Europe: Market Size By Enterprise Service, 2017–2024 (USD Million)

Table 65 Europe: Market Size By Professional Service, 2017–2024 (USD Million)

Table 66 Europe: Market Size By Operating System, 2017–2024 (USD Million)

Table 67 Europe: Market Size By Enterprise Deployment Mode, 2017–2024 (USD Million)

Table 68 Europe: Market Size By Organization Size, 2017–2024 (USD Million)

Table 69 Europe: Market Size By Enterprise Vertical, 2017–2024 (USD Million)

Table 70 Europe: Market Size By Country, 2017–2024 (USD Million)

Table 71 Asia Pacific: Cybersecurity Spending, By Country, 2019 (USD Billion)

Table 72 Asia Pacific: Mobile Security Market Size, By End User, 2017–2024 (USD Million)

Table 73 Asia Pacific: Market Size By Component, 2017–2024 (USD Million)

Table 74 Asia Pacific: Market Size By Enterprise Solution, 2017–2024 (USD Million)

Table 75 Asia Pacific: Market Size By Enterprise Service, 2017–2024 (USD Million)

Table 76 Asia Pacific: Market Size, By Professional Service, 2017–2024 (USD Million)

Table 77 Asia Pacific: Market Size By Operating System, 2017–2024 (USD Million)

Table 78 Asia Pacific: Market Size By Enterprise Deployment Mode, 2017–2024 (USD Million)

Table 79 Asia Pacific: Market Size By Organization Size, 2017–2024 (USD Million)

Table 80 Asia Pacific: Market Size By Enterprise Vertical, 2017–2024 (USD Million)

Table 81 Asia Pacific: Market Size By Country, 2017–2024 (USD Million)

Table 82 Middle East and Africa: Cybersecurity Spending, By Country, 2019 (USD Billion)

Table 83 Middle East and Africa: Mobile Security Market Size, By End User, 2017–2024 (USD Million)

Table 84 Middle East and Africa: Market Size By Component, 2017–2024 (USD Million)

Table 85 Middle East and Africa: Market Size By Enterprise Solution, 2017–2024 (USD Million)

Table 86 Middle East and Africa: Market Size By Enterprise Service, 2017–2024 (USD Million)

Table 87 Middle East and Africa: Market Size By Professional Service, 2017–2024 (USD Million)

Table 88 Middle East and Africa: Market Size By Operating System, 2017–2024 (USD Million)

Table 89 Middle East and Africa: Market Size By Enterprise Deployment Mode, 2017–2024 (USD Million)

Table 90 Middle East and Africa: Market Size By Organization Size, 2017–2024 (USD Million)

Table 91 Middle East and Africa: Market Size By Enterprise Vertical, 2017–2024 (USD Million)

Table 92 Middle East and Africa: Market Size By Country, 2017–2024 (USD Million)

Table 93 Latin America: Cybersecurity Spending, By Country, 2019 (USD Billion)

Table 94 Latin America: Mobile Security Market Size, By End User, 2017–2024 (USD Million)

Table 95 Latin America: Market Size By Component, 2017–2024 (USD Million)

Table 96 Latin America: Market Size By Enterprise Solution, 2017–2024 (USD Million)

Table 97 Latin America: Market Size By Enterprise Service, 2017–2024 (USD Million)

Table 98 Latin America: Market Size By Professional Service, 2017–2024 (USD Million)

Table 99 Latin America: Market Size By Operating System, 2017–2024 (USD Million)

Table 100 Latin America: Market Size By Enterprise Deployment Mode, 2017–2024 (USD Million)

Table 101 Latin America: Market Size By Organization Size, 2017–2024 (USD Million)

Table 102 Latin America: Market Size By Enterprise Vertical, 2017–2024 (USD Million)

Table 103 Latin America: Market Size By Country, 2017–2024 (USD Million)

List of Figures (91 Figures)

Figure 1 Mobile Security Market: Research Design

Figure 2 Market Size Estimation Methodology—Approach 1 (Supply Side): Revenue of Solutions/Services of Mobile Security Vendors

Figure 3 Market Size Estimation Methodology—Approach 1, Bottom Up (Supply Side): Collective Revenue of All Solutions/Services of Mobile Security Vendors

Figure 4 Market Size Estimation Methodology—Approach 2, Top Down (Demand Side): Share of Mobile Security Through Overall IT and Cybersecurity Market

Figure 5 Competitive Leadership Mapping: Criteria Weightage

Figure 6 Android Operating System Segment to Dominate the Mobile Security Market

Figure 7 Market Smartphone Adoption vs Smartphone Penetration, 2018

Figure 8 Market Scenario: Individual User vs Enterprise, 2019

Figure 9 Global Mobile Security Market to Witness Steady Growth During the Forecast Period

Figure 10 Highest-Growing Segments in the Mobile Security Market During the Forecast Period

Figure 11 Mobile Security Market: Regional Snapshot

Figure 12 Rising Need to Curb Mobile Data Breaches and Attacks to Drive the Mobile Security Market Growth

Figure 13 Enterprise Segment to Hold a Higher Market Share in the Market in 2019

Figure 14 Mobile Application Security Segment to Hold the Highest Market Share in the Market in 2019

Figure 15 Among Mobile Security Services, Professional Services Segment to Account for a Higher Market Share in 2019

Figure 16 Integration and Implementation Services Segment to Lead the Market During the Forecast Period

Figure 17 Android Operating System Segment to Lead the Mobile Security Market in 2019

Figure 18 On-Premises Deployment Mode Segment to Lead the Market in 2019

Figure 19 Large Enterprises Segment to Hold a Higher Market Share During the Forecast Period

Figure 20 Banking, Financial Services, and Insurance Segment to Lead the Market During the Forecast Period

Figure 21 Asia Pacific to Emerge as the Best Market for Investments During the Forecast Period

Figure 22 Mobile Security Market: Drivers, Restraints, Opportunities, and Challenges

Figure 23 Mobile Subscriber Penetration 2018-2025

Figure 24 Smartphone Adoption 2018–2025

Figure 25 Frequency of Attacks (Known and Unknown), 2017–2019

Figure 26 Global Mobile Application Downloads, 2016–2019

Figure 27 Google Play vs App Store App Downloads, 2016–2018

Figure 28 Distribution of Free and Paid Apps, 2019

Figure 29 Global Mobile Operating System Market Share, 2019

Figure 30 Individual End User Segment to Account for a Higher CAGR During the Forecast Period

Figure 31 Android Operating System Segment to Account for the Highest CAGR During the Forecast Period

Figure 32 Mobile Application Security Segment to Grow at the Highest CAGR During the Forecast Period

Figure 33 Managed Services Segment to Hold a Higher CAGR During the Forecast Period

Figure 34 Security Awareness Training Reduces the Impact of Cyberattacks Significantly

Figure 35 Integration and Implementation Services Segment to Grow at the Highest CAGR During the Forecast Period

Figure 36 State of Managed Security Services, 2019

Figure 37 Cloud Deployment Segment to Grow at a Higher CAGR During the Forecast Period

Figure 38 Software-As-A-Service Adoption Among Enterprises

Figure 39 Enterprises Planning to Migrate From On-Premises to Cloud Deployment By 2021

Figure 40 Small and Medium-Sized Enterprises Segment to Hold a Higher CAGR During the Forecast Period

Figure 41 State of Breach in Small and Medium-Sized Enterprises

Figure 42 Cloud Security Adoption By Industry Vertical, 2018

Figure 43 Increased Cybersecurity Investments in 2019

Figure 44 Government and Defense Enterprise Vertical to Grow at the Highest CAGR During the Forecast Period

Figure 45 Asia Pacific to Account for the Highest CAGR During the Forecast Period

Figure 46 Canada to Account for the Highest CAGR During the Forecast Period

Figure 47 North America to Hold the Largest Market Size During the Forecast Period

Figure 48 North America: Market Snapshot

Figure 49 Mobile Application Security Segment to Grow at the Highest CAGR During the Forecast Period

Figure 50 North America: Country-Wise Analysis

Figure 51 United States: Mobile Operating System Market Share, 2016–2019

Figure 52 Canada: Mobile Operating System Market Share, 2016–2019

Figure 53 Mobile Application Security Segment to Grow at the Highest CAGR During the Forecast Period

Figure 54 Europe: Country-Wise Analysis

Figure 55 United Kingdom: Mobile Operating System Market Share, 2016–2019

Figure 56 Germany: Mobile Operating System Market Share, 2016–2019

Figure 57 France: Mobile Operating System Market Share, 2016–2019

Figure 58 Asia Pacific: Market Snapshot

Figure 59 Mobile Application Security Segment to Grow at the Highest CAGR During the Forecast Period

Figure 60 Asia Pacific: Country-Wise Analysis

Figure 61 Australia and New Zealand: Mobile Operating System Market Share, 2016–2019

Figure 62 China: Mobile Operating System Market Share, 2016–2019

Figure 63 Japan: Mobile Operating System Market Share, 2016–2019

Figure 64 Singapore: Mobile Operating System Market Share, 2016–2019

Figure 65 Mobile Application Security Segment to Grow at the Highest CAGR During the Forecast Period

Figure 66 United Arab Emirates: Mobile Operating System Market Share, 2016–2019

Figure 67 Kingdom of Saudi Arabia: Mobile Operating System Market Share, 2016–2019

Figure 68 Qatar: Mobile Operating System Market Share, 2016–2019

Figure 69 South Africa: Mobile Operating System Market Share, 2016–2019

Figure 70 Mobile Application Security Segment to Grow at the Highest CAGR During the Forecast Period

Figure 71 Brazil: Mobile Operating System Market Share, 2016–2019

Figure 72 Mexico: Mobile Operating System Market Share, 2016–2019

Figure 73 Mobile Security Market (Global), Competitive Leadership Mapping, 2019

Figure 74 Ranking of Key Players, 2019

Figure 75 Geographic Revenue Mix of the Top Market Players

Figure 76 Microsoft: Company Snapshot

Figure 77 Microsoft: SWOT Analysis

Figure 78 IBM: Company Snapshot

Figure 79 IBM: SWOT Analysis

Figure 80 Symantec: Company Snapshot

Figure 81 Symantec: SWOT Analysis

Figure 82 Trend Micro: Company Snapshot

Figure 83 Trend Micro: SWOT Analysis

Figure 84 Sophos: Company Snapshot

Figure 85 Sophos: SWOT Analysis

Figure 86 VMware: Company Snapshot

Figure 87 Samsung: Company Snapshot

Figure 88 BlackBerry: Company Snapshot

Figure 89 Citrix Systems: Company Snapshot

Figure 90 Mobileiron: Company Snapshot

Figure 91 Quick Heal Technologies: Company Snapshot

The study involved four major activities in estimating the current size of the mobile security market. Extensive secondary research was done to collect information on the market, peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the mobile security market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, Dun Bradstreet, and Factiva, have been referred to, for identifying and collecting information for this study. Secondary sources included annual reports; press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; Research and Development (R&D) organizations; regulatory bodies; and databases. Journals, repositories, and resources from the Journal of Cybersecurity, International Journal of Cyber-Security and Digital Forensics, International Information Systems Security Certification Consortium, Forum of Incident Response and Security Teams, and Association of Information Technology Professionals (AITP) were referred to understand the integration of mobile security.

Primary Research

Various primary sources from both the supply and demand sides of the mobile security market were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), technology and innovation directors, and related key executives from various vendors offering mobile security solutions, associated service providers, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

The following is the breakup of primary profiles:

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the mobile security market. The top-down approach was used to derive the revenue contribution of top vendors and their offerings in the mobile security industry. The bottom-up approach was used to arrive at the overall market size of the global mobile security market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the market were identified through extensive secondary research.

- The market size, in terms of value, was determined through primary and secondary research processes.

- All percentages, shares split, and breakups were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and forecast the mobile security market by end user, enterprise solution, enterprise service, Operating System (OS), enterprise deployment mode, organization size, enterprise vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and Research and Development (R&D) activities, in the market

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Billion (USD) |

|

Segments covered |

End Users, Operating Systems, Components, Enterprise Solutions, Enterprise Services, Deployment Modes, Organization Sizes, Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, Latin America, and MEA |

|

List of Companies in Mobile Security |

Microsoft (US), CrowdStrike (US), Symantec (US), Trend Micro (Japan), Sophos (UK), McAfee (US), Kaspersky (Russia), VMware (US), IBM (US), ESET (Slovakia), BlackBerry (Canada), MobileIron (US), Samsung (South Korea), F-Secure (Finland), Check Point (Israel), Panda Security (Spain), Bitdefender (Romania), OneSpan (US), Quick Heal (India), Fortinet (US), Citrix Systems (US), Webroot (US), Keeper Security (US), Amtel (US), and Codeproof (US). 25 prominent mobile security solutions and services providers are profiled in the report. |

This research report categorizes the mobile security market based on end users, components, enterprise solutions, enterprise services, deployment modes, organization sizes, verticals, and regions

By Component:

-

Enterprise Solutions

- Authentication

- Mobile Application Security

- Mobile Data Protection

- Web Protection

- Mobile Device Security

- Other Solutions (anti-phishing solution, password management solution, anti-spyware solution, and adware removal solutions)

-

Enterprise Services

-

Professional Services

- Training and Consulting

- Integration and Implementation

- Support and Maintenance

- Managed Services

-

Professional Services

By Operating System:

- iOS

- Android

- Other Operating Systems (Nokia, Windows, Series 40, BlackBerry OS, Samsung, SymbianOS, Linux, Tizen, LG, Sony Ericsson, MeeGo, Bada, and Playstation)

By Deployment Mode:

- Cloud

- On-premises

By Organization size:

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By vertical:

- Banking, Financial Services and Insurance (BFSI)

- Telecommunications and IT

- Retail and Ecommerce

- Healthcare and Life Sciences

- Government and Defense

- Manufacturing

- Other enterprise verticals (transportation and logistics, travel and hospitality, media and entertainment, energy and utilities, and education)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific (APAC)

- Australia and New Zealand

- China

- Japan

- Singapore

- Rest of APAC

-

Middle East and Africa (MEA)

- United Arab Emirates (UAE)

- Kingdom of Saudi Arabia

- Qatar

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Critical Questions the Report Answers

- What are the current trends driving the mobile security market?

- In which vertical are most industrial companies deploying mobile security solutions?

- Where will recent developments of market vendors take the industry in the mid to long-term?

- Who are the top vendors in the market and what is their competitive analysis?

- What are the drivers and challenges faced by vendors in the mobile security market?

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American mobile security market

- Further breakup of the European market

- Further breakup of the APAC market

- Further breakup of the Latin American market

- Further breakup of the MEA mobile security market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Growth opportunities and latent adjacency in Mobile Security Market