Mobile and Wireless Backhaul Market by Component (Equipment and Services[Designing & Consulting, Integration & Deployment]), Equipment (Microwave, Millimetre Wave, Sub-6 Ghz), Network Technology (5G, 4G, and 3G & 2G), and Region - Global forecast to 2026

Updated on : May 10, 2023

Mobile and Wireless Backhaul Market Analysis

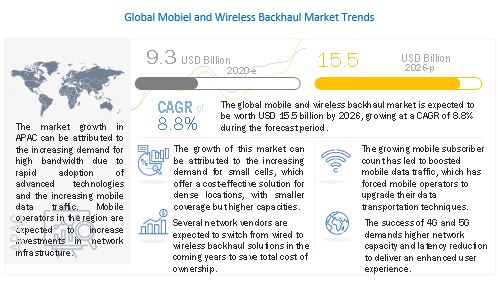

The global mobile and wireless backhaul market in terms of revenue was estimated to be worth $9.3 billion in 2020 and is poised to reach $15.5 billion by 2026, growing at a CAGR of 8.8% from 2020 to 2026. Growth in mobile subscriber count, growing adoption of small cells, success of 4G and 5G, and need for lower total cost of ownership are expected to be the major factors driving the growth of the Mobile and wireless backhaul Market.

To know about the assumptions considered for the study, download the pdf brochure

COVID-19 Impact

Owing to the outbreak of COVID-19, various countries follow strict lockdowns, shutdowns, and mobility restrictions to avoid the spread of the virus. Closure of borders, stringent lockdowns, and supply chain issues act as restraining factors for the onsite deployment of mobile and wireless backhaul equipment. The pandemic also has disrupted business efficiency and employee productivity across the globe. Telecom operators and enterprises have reduced their operational spending and are now focusing more on business continuity and sustainability. The demand for Mobile and wireless backhaul has increased manifolds during the pandemic as the use of mobile data has increased. Hence, the market is expected to grow post the pandemic.

Mobile and Wireless Backhaul Market Dynamics

Driver: Growth in mobile subscriber count

The number of mobile internet users around the world is rapidly increasing due to the increasing smartphone penetration and enhanced connectivity. The increased internet connectivity around the world has led to boosted mobile data traffic. As a result of traction in the mobile data traffic, the demand for network capacity has enormously increased. To fulfill this need for high capacity, along with delivering quality services, mobile operators are forced to upgrade their data transportation techniques. This, in turn, has created a prospect for vendors in the mobile and wireless backhaul market to enhance their offerings. The market for mobile and wireless backhaul is extensively being driven by high bandwidth demand.

Restraint: Spectrum crunch

At high congestion places, network is a poor and free spectrum is unavailable; backhaul and power is not readily available as well. Radio backhaul is one of the potential solutions for this issue; however, unit size reduction and throughput testing are must for the proper deployment of small cells. The demand for mobile and wireless backhaul is increasing rapidly, but corresponding increase in capacity is not seen. High demand for capacity is impacting the availability of spectrum and has created a crunch in it. Hence, network operators must come up with cost-effective alternatives to maximize the usage of limited spectrum. Over a period, if this issue of poor backhaul is not resolved, vendors may need to find alternative backhaul options.

Opportunity: Rise in demand for network connectivity to implement internet of things

With the rise of IoT, there has been an avalanche of data being added to networks and data processing. The increasing demand for networks to be IoT-ready is expected to create a significant opportunity for telecom service providers. The declining sensor prices have resulted in the increasing use of IoT sensors. Various organizations are implementing IoT solutions and looking to enhance their operations with the use of IoT in the future. Mobile and wireless backhaul solutions that provide scalability, low latency, and high performance and capacity can be a game-changer for IoT implementation. With the help of advanced backhaul solutions, operators would be able to meet IoT requirements and enable communication, and exchange data and derive actions from daily use physical objects. The increasing demand for network connectivity for IoT implementation is expected to boost global market growth in the upcoming years.

Challenge: Health issues related to microwave

Several people are not aware of the harmful effects of Radiofrequency Waves (RF) and their role in cancer and other serious risks. Scientific evidence suggests that cancer is not only linked to mobile phone radiation and that other factors also may be involved in its development. Most mobile operators use from radiofrequency waves in the range of up 300 MHz to 3 GHz that can be harmful to human health. One study published in 2015 in Military Medical Research says too much microwave radiation can cause brain dysfunction and structural brain damage and could cause headaches, fatigue, memory loss, and impaired learning. However, depending on the amount of exposure, microwave radiations do not have direct hazards to human health. The harmful effects of electromagnetic radiation increased with the rising exposure to the electromagnetic spectrum. The hazards of microwave radiations can be reduced if safety regulations are considered while designing and manufacturing devices that use microwave radiation, especially in its antennas, such a smart antenna that reduce the power level of the microwave radiations.

By Component, the Services segment to have a higher growth during the forecast period

The Services component of the Mobile and wireless backhaul Market is expected to have a higher growth rate during the forecast period. Services enable strategizing for an efficient, comprehensive, and programmable backhaul transport solution, minimizing costs, and maximizing operational efficiency. The service providers in the mobile and wireless backhaul market provide consulting for deploying the most appropriate topologies and network architectures to simplify the transformation of mobile transport networks.

By Network technology, the 4G segment to dominate the market during the forecast period

4G LTE has brought several important changes, which include higher backhaul capacity to cells and the use of Multiple Input Multiple Output (MIMO) antennas to increase the capacity of air interference between towers and User Equipment (UE). 4G operates in bands up to 6GHz with a peak speed of 1GB per second. It offers enhancements such as improved peak bandwidth and greater energy efficiency for IoT connections. The success of 4G LTE has placed even greater challenges on mobile operators as they strive for more network capacity, latency reduction, and the need to deliver an enhanced user experience.

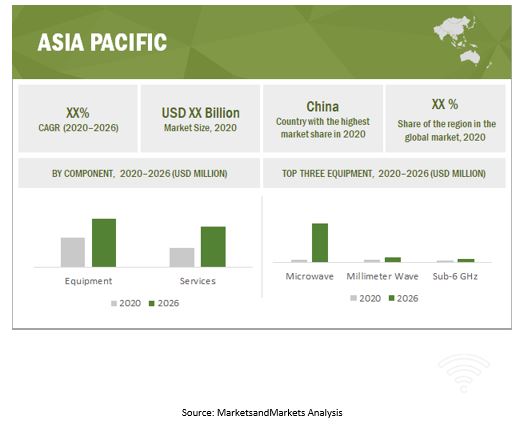

By Region, Asia Pacific to record the highest growth during the forecast period

The APAC Mobile and wireless backhaul Market is estimated to have strong growth in the future. With the constant rise in the mobile data traffic, APAC tends to hold significant potential in terms of backhaul deployments as the region is witnessing major spending in the market. The transition of mindsets from traditional wired backhaul to wireless links has been leading to large-scale investments in the telecom industry. Owing to a large number of 5G deployments and initiatives taken by major Asian mobile operators to resolve the problem of high bandwidth requirements, the mobile and wireless backhaul market in APAC is expected to anticipate enormous growth in the coming years.

Key Market Players

The report includes the study of key players offering mobile and wireless backhaul solutions and services. It profiles major vendors in the global Mobile and wireless backhaul Market. The major vendors in the Market include Ericssom (Sweden),Huawei(China), Nokia(Finland), NEC Corporation(Japan), ZTE(China), Fujitsu(Japan), Broadcom(US), Ceragon(Israel), Aviat(US), and SIAE(Italy). These players have adopted various strategies to grow in the global Market.

The study includes an in-depth competitive analysis of these key players in the Mobile and wireless backhaul Market with their company profiles, recent developments, and key market strategies.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2016-2026 |

|

Base year considered |

2020 |

|

Forecast period |

2020-2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Component, Equipment, Services, Nework technology, Region |

|

Regions covered |

North America, Europe, APAC, MEA, Latin America |

|

Companies covered |

Ericssom(Sweden), Huawei(China), Nokia(Finland), NEC Corporation(Japan), ZTE(China), Fujitsu(Japan), Broadcom(US), Ceragon(Israel), Aviat(US), SIAE(Italy), Proxim Wireless(US), Intracom Telecom(Greece), AR RF/Microwave Instrumentation(US), Redline(Canada), DragonWave-X(US), E-Band(US), CBNG(UK), Radwin(Israel), CableFree(UK), CommScope(US), CCS(UK), Siklu(US), Blu Wireless(US), Fastback(US), Eravant(US), BLiNQ(Canada), and EC SYSTEM(Czech Republic). |

This research report categorizes the Mobile and wireless backhaul Market to forecast revenues and analyze trends in each of the following subsegments:

By Component:

- Equipment

- Services

By Equipment:

- Microwave

- Millimeter Wave

- Sub-6 GHz

By Servcies:

- Designing and Consulting

- Integration and Deployment

- Support and Maintenance

By Network technology:

- 3G and 2G

- 4G

- 5G

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia

- United Arab Emirates

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2020, Nokia partnered with Zain Saudi Arabia (Zain KSA), a few of first 5G network operators, for rolling out 5G network to KSA for Nokia’s end-to-end portfolio that includes backhaul, where thousands of 5G sites will be deployed to bring faster speeds and higher quality networking services across the region.

- In July 2020, Ericsson partnered with US Cellular to supply its series of millimeter-wave equipment for backhaul transport solutions.

- In June 2020, ZTE partnered with China Telecom to deploy a 5G commercial ultra-broadband Qcell digital indoor distribution system. This was mainly deployed in high data traffic areas such as shopping malls and subway stations.

- In September 2019, India Bharti and Huawei partnered to launch 5G microwave enhanced MIMO technology. This solution of 5G microwave Huawei and Bharti India is able to deploy more than 100 MIMO microwave links able to deliver 1Gbps capacity over a single 28Mhz spectrum.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Mobile and wireless backhaul Market?

The global Mobile and wireless backhaul Market size to grow from USD 9.3 billion in 2020 to USD 15.5 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 8.8% during the forecast period.

Which region has the largest market share in the Mobile and wireless backhaul Market?

Asia Pacific is estimated to hold the largest share in the Mobile and wireless backhaul Market in 2020. Government initiatives to promote the digital infrastructure are responsible for driving the adoption of high-performance and high-capacity backhaul solutions in the region. APAC tends to hold significant potential in terms of backhaul deployments as the region is witnessing major spending in the mobile and wireless backhaul market.

Which Service is expected to hold a larger market size during the forecast period?

Among applications, designing and consulting segment is expected to hold the largest market size during the forecast period as it provides an enhanced strategic outlook and improved performance efficiencies to help clients achieve strategic business goals with the help of technical and business improvements.

Which Network technology is expected to hold a larger market size during the forecast period?

Among Network technologies, the 4G segment is expected to hold a larger market size during the forecast period as it offers offers enhancements such as improved peak bandwidth and greater energy efficiency for IoT connections.

Who are the major vendors in the Mobile and wireless backhaul Market?

Major vendors in the Mobile and wireless backhaul Market include Ericssom(Sweden), Huawei(China), Nokia(Finland), NEC Corporation(Japan), ZTE(China), Fujitsu(Japan), Broadcom(US), Ceragon(Israel), Aviat(US), SIAE(Italy), Proxim Wireless(US), Intracom Telecom(Greece), AR RF/Microwave Instrumentation(US), Redline(Canada), DragonWave-X(US), E-Band(US), CBNG(UK), Radwin(Israel), CableFree(UK), and CommScope(US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 31)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR THE STUDY

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 6 MOBILE AND WIRELESS BACKHAUL MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 8 RESEARCH METHODOLOGY: APPROACH 1-SUPPLY SIDE ANALYSIS (1/2)

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF MOBILE AND WIRELESS BACKHAUL VENDORS

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY: ILLUSTRATION OF THE COMPANY’S MOBILE AND WIRELESS BACKHAUL REVENUE ESTIMATION

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY- SUPPLY SIDE: MARKET SIZE ESTIMATIONS THROUGH TOP MARKET PLAYERS (2/2)

FIGURE 12 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2 (DEMAND SIDE): MARKET SIZE ESTIMATIONS THROUGH CAPEX

2.4 IMPLICATION OF COVID-19 ON MOBILE AND WIRELESS BACKHAUL MARKET

FIGURE 13 MARKET SIZE ESTIMATION METHODOLOGY: COVID-19 IMPACT ON MARKET

2.5 MARKET FORECAST

TABLE 1 FACTOR ANALYSIS

2.6 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 14 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.7.1 ASSUMPTIONS FOR THE STUDY

2.7.2 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 50)

FIGURE 15 MOBILE AND WIRELESS BACKHAUL MARKET: HOLISTIC VIEW

FIGURE 16 MARKET: GROWTH TRENDS

FIGURE 17 ASIA PACIFIC TO GROW AT THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MOBILE AND WIRELESS BACKHAUL MARKET

FIGURE 18 GROWING ADOPTION OF SMALL CELLS TO DRIVE MARKET GROWTH DURING THE FORECAST PERIOD

4.2 MARKET IN NORTH AMERICA, BY COMPONENT

FIGURE 19 MICROWAVE AND DESIGNING AND CONSULTING SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN NORTH AMERICA IN 2020

4.3 MARKET IN EUROPE, BY COMPONENT

FIGURE 20 MICROWAVE AND DESIGNING AND CONSULTING SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN EUROPE IN 2020

4.4 MARKET IN ASIA PACIFIC, BY COMPONENT

FIGURE 21 MICROWAVE AND DESIGNING AND CONSULTING SEGMENTS TO ACCOUNT FOR LARGE MARKET SHARES IN ASIA PACIFIC IN 2020

5 MARKET OVERVIEW (Page No. - 55)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 MOBILE AND WIRELESS BACKHAUL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth in mobile subscriber count

FIGURE 23 NUMBER OF MOBILE INTERNET USERS, BY REGION

5.2.1.2 Growing adoption of small cells

5.2.1.3 Success of 4G and 5G

5.2.1.4 Need for lower total cost of ownership

5.2.2 RESTRAINTS

5.2.2.1 Spectrum crunch

5.2.2.2 Case-by-case examination before certain deployments

5.2.3 OPPORTUNITIES

5.2.3.1 5G wireless backhaul

5.2.3.2 6 GHz spectrum band

5.2.3.3 Rise in demand for network connectivity to implement internet of things

5.2.4 CHALLENGES

5.2.4.1 Stringent latency requirements

5.2.4.2 Health issues related to microwave

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: AT&T HELPED ARMSTRONG’S CRICKET FARM

5.3.2 CASE STUDY 2: DRAGONWAVE-X HELPED CHOICE WIRELESS ESTABLISH HIGH CAPACITY MOBILE NETWORKS IN UNITED STATES VIRGIN ISLANDS

5.3.3 CASE STUDY 2: MIMOSA BOOSTED BACKHAUL CAPACITY AT TNB TELECOM

5.3.4 CASE STUDY 4: ERICSSON HELPED TELSTRA DEPLOY AUSTRALIA’S FIRST 5G NETWORK

5.3.5 CASE STUDY 5: HUGHES DEPLOYS CELLULAR BACKHAUL OVER SATELLITE IN DEMOCRATIC REPUBLIC OF CONGO

5.4 TECHNOLOGY ANALYSIS

5.4.1 INTRODUCTION

5.4.2 WIRELESS BACKHAUL TECHNOLOGIES

5.4.2.1 mmWave

5.4.2.2 Sub-6GHz

5.4.2.3 Microwave

5.4.3 5G

5.4.4 SOFTWARE-DEFINED NETWORKING

5.4.5 INTERNET OF THINGS

5.4.6 NETWORK SLICING IN TRANSPORT NETWORK

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 MOBILE AND WIRELESS BACKHAUL MARKET: VALUE CHAIN ANALYSIS

5.5.1 WIRELESS BACKHAUL EQUIPMENT VENDORS

5.5.2 CLOUD VENDORS (SDN SOLUTION PROVIDERS)

5.5.3 MOBILE TRANSPORT SOLUTION PROVIDERS

5.5.4 END USERS

5.6 SUPPLY CHAIN ANALYSIS

TABLE 2 MOBILE AND WIRELESS BACKHAUL MARKET: SUPPLY CHAIN ANALYSIS

5.7 PRICING ANALYSIS

5.8 COVID-19 MARKET OUTLOOK FOR MOBILE AND WIRELESS BACKHAUL

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MOBILE AND WIRELESS BACKHAUL PORTER’S FIVE FORCES MODEL

5.9.1 THREAT OF NEW ENTRANTS

5.9.2 THREAT OF SUBSTITUTES

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 BARGAINING POWER OF SUPPLIERS

5.9.5 COMPETITION RIVALRY

5.10 PATENT ANALYSIS

6 MOBILE AND WIRELESS BACKHAUL MARKET, BY COMPONENT (Page No. - 70)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 25 SERVICES SEGMENT TO EXHIBIT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 4 MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 5 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 EQUIPMENT

TABLE 6 EQUIPMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 7 EQUIPMENT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

TABLE 8 SERVICES MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 9 SERVICES MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 MOBILE AND WIRELESS BACKHAUL MARKET, BY EQUIPMENT (Page No. - 75)

7.1 INTRODUCTION

7.1.1 EQUIPMENT: MARKET DRIVERS

7.1.2 EQUIPMENT: COVID-19 IMPACT

FIGURE 26 SUB-6 GHZ SEGMENT TO EXHIBIT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 10 MARKET SIZE, BY EQUIPMENT, 2016–2019 (USD MILLION)

TABLE 11 MARKET SIZE, BY EQUIPMENT, 2020–2026 (USD MILLION)

7.2 MICROWAVE EQUIPMENT

TABLE 12 MICROWAVE EQUIPMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 13 MICROWAVE EQUIPMENT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 MILLIMETER WAVE EQUIPMENT

TABLE 14 MILLIMETER WAVE EQUIPMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 15 MILLIMETER WAVE EQUIPMENT MARKET SIZE, BY REGION,2020–2026 (USD MILLION)

7.4 SUB-6 GHZ EQUIPMENT

TABLE 16 SUB-6 GHZ EQUIPMENT MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 17 SUB-6 GHZ EQUIPMENT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 MOBILE AND WIRELESS BACKHAUL MARKET, BY SERVICE (Page No. - 81)

8.1 INTRODUCTION

8.1.1 SERVICES: MARKET DRIVERS

8.1.2 SERVICES: COVID-19 IMPACT

FIGURE 27 DESIGNING AND CONSULTING SEGMENT TO GROW AT THE HIGHEST CAGR IN THE MARKET FROM 2020 TO 2026

TABLE 18 MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 19 MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

8.2 DESIGNING AND CONSULTING

TABLE 20 DESIGNING AND CONSULTATION: MOBILE AND WIRELESS BACKHAUL MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 21 DESIGNING AND CONSULTATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 INTEGRATION AND DEPLOYMENT

TABLE 22 INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 23 INTEGRATION AND DEPLOYMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.4 SUPPORT AND MAINTENANCE

TABLE 24 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 25 SUPPORT AND MAINTENANCE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 MOBILE AND WIRELESS BACKHAUL MARKET, BY NETWORK TECHNOLOGY (Page No. - 87)

9.1 INTRODUCTION

9.1.1 NETWORK TECHNOLOGY: MARKET DRIVERS

9.1.2 NETWORK TECHNOLOGY: COVID-19 IMPACT

FIGURE 28 5G SEGMENT TO GROW AT THE HIGHEST CAGR IN THE MARKET FROM 2020 TO 2026

TABLE 26 MARKET SIZE, BY NETWORK TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 27 MARKET SIZE, BY NETWORK TECHNOLOGY, 2020–2026 (USD MILLION)

9.2 3G AND 2G

TABLE 28 3G AND 2G: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 29 3G AND 2G: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 4G

TABLE 30 4G: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 31 4G: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 5G

TABLE 32 5G: MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 33 5G: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 MOBILE AND WIRELESS BACKHAUL MARKET, BY REGION (Page No. - 93)

10.1 INTRODUCTION

FIGURE 29 ASIA PACIFIC TO LEAD THE MARKET FROM 2020 TO 2026

FIGURE 30 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 34 MARKET SIZE, BY REGION, 2016–2019 (USD MILLION)

TABLE 35 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET REGULATORY IMPLICATIONS

10.2.2 NORTH AMERICA: MARKET DRIVERS

10.2.3 NORTH AMERICA: COVID-19 IMPACT

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 36 NORTH AMERICA: MOBILE AND WIRELESS BACKHAUL MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 37 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 38 NORTH AMERICA: MARKET SIZE, BY EQUIPMENT, 2016–2019 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET SIZE, BY EQUIPMENT, 2020–2026 (USD MILLION)

TABLE 40 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET SIZE, BY NETWORK TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET SIZE, BY NETWORK TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 44 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 45 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.4 UNITED STATES

TABLE 46 UNITED STATES: MOBILE AND WIRELESS BACKHAUL MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 47 UNITED STATES: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

10.2.5 CANADA

10.3 ASIA PACIFIC

10.3.1 ASIA PACIFIC: MARKET REGULATORY IMPLICATIONS

10.3.2 ASIA PACIFIC: MARKET DRIVERS

10.3.3 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 48 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 49 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET SIZE, BY EQUIPMENT, 2016–2019 (USD MILLION)

TABLE 51 ASIA PACIFIC: MARKET SIZE, BY EQUIPMENT, 2020–2026 (USD MILLION)

TABLE 52 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET SIZE, BY NETWORK TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 55 ASIA PACIFIC: MARKET SIZE, BY NETWORK TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 56 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 57 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.4 CHINA

TABLE 58 CHINA: MOBILE AND WIRELESS BACKHAUL MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 59 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

10.3.5 JAPAN

TABLE 60 JAPAN: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 61 JAPAN: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

10.3.6 REST OF ASIA PACIFIC

10.4 EUROPE

10.4.1 EUROPE: MOBILE AND WIRELESS BACKHAUL MARKET REGULATORY IMPLICATIONS

10.4.2 EUROPE: MARKET DRIVERS

10.4.3 EUROPE: COVID-19 IMPACT

TABLE 62 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 64 EUROPE: MARKET SIZE, BY EQUIPMENT, 2016–2019 (USD MILLION)

TABLE 65 EUROPE: MARKET SIZE, BY EQUIPMENT, 2020–2026 (USD MILLION)

TABLE 66 EUROPE: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 67 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 68 EUROPE: MARKET SIZE, BY NETWORK TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 69 EUROPE: MARKET SIZE, BY NETWORK TECHNOLOGY, 2020–2026 (USD MILLION)

TABLE 70 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 71 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.4 UNITED KINGDOM

TABLE 72 UNITED KINGDOM: MOBILE AND WIRELESS BACKHAUL MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 73 UNITED KINGDOM: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

10.4.5 GERMANY

TABLE 74 GERMANY: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 75 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

10.4.6 REST OF EUROPE

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: MARKET REGULATORY IMPLICATIONS

10.5.2 MIDDLE EAST AND AFRICA: MOBILE AND WIRELESS BACKHAUL MARKET DRIVERS

10.5.3 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 76 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 77 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 78 MIDDLE EAST AND AFRICA: MARKET SIZE, BY EQUIPMENT, 2016–2019 (USD MILLION)

TABLE 79 MIDDLE EAST AND AFRICA: MARKET SIZE, BY EQUIPMENT, 2020–2026 (USD MILLION)

TABLE 80 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICES, 2016–2019 (USD MILLION)

TABLE 81 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 82 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 83 MIDDLE EAST AND AFRICA: MARKET SIZE, BY NETWORK TECHNOLOGY, 2020–2026 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

10.5.5 UNITED ARAB EMIRATES

10.5.6 REST OF MIDDLE EAST AND AFRICA

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: REGULATORY IMPLICATIONS

10.6.2 LATIN AMERICA: MOBILE AND WIRELESS BACKHAUL MARKET DRIVERS

10.6.3 IMPACT OF COVID-19 ON LATIN AMERICA MARKET

TABLE 84 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2019 (USD MILLION)

TABLE 85 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 86 LATIN AMERICA: MARKET SIZE, BY EQUIPMENT, 2016–2019 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET SIZE, BY EQUIPMENT, 2020–2026 (USD MILLION)

TABLE 88 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2019 (USD MILLION)

TABLE 89 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 90 LATIN AMERICA: MARKET SIZE, BY NETWORK TECHNOLOGY, 2016–2019 (USD MILLION)

TABLE 91 LATIN AMERICA: MARKET SIZE, BY NETWORK TECHNOLOGY, 2020–2026 (USD MILLION)

10.6.4 BRAZIL

10.6.5 MEXICO

10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE (Page No. - 125)

11.1 INTRODUCTION

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 33 MARKET EVALUATION FRAMEWORK, 2019–2021

11.3 KEY MARKET DEVELOPMENTS

11.3.1 NEW PRODUCT LAUNCHES

TABLE 92 MOBILE AND WIRELESS BACKHAUL MARKET: PRODUCT LAUNCHES (2019–2021)

11.3.2 PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS

TABLE 93 MARKET: PARTNERSHIPS, AGREEMENTS, AND COLLABORATIONS (2019–2021)

11.4 HISTORICAL REVENUE ANALYSIS

FIGURE 34 HISTORIC FIVE-YEAR REVENUE OF LEADING PLAYERS

11.5 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

TABLE 94 MOBILE AND WIRELESS BACKHAUL: DEGREE OF COMPETITION

11.6 RANKING OF KEY PLAYERS IN MOBILE AND WIRELESS BACKHAUL MARKET, 2020

FIGURE 35 RANKING OF KEY PLAYERS, 2020

11.7 COMPANY EVALUATION MATRIX

11.7.1 STAR

11.7.2 EMERGING LEADER

11.7.3 PERVASIVE

11.7.4 PARTICIPANT

FIGURE 36 MARKET (GLOBAL), COMPANY EVALUATION MATRIX, 2020

11.7.5 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS

TABLE 95 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN THE MOBILE AND WIRELESS BACKHAUL MARKET

11.8 STARTUP/SME EVALUATION MATRIX OVERVIEW

11.8.1 PROGRESSIVE COMPANIES

11.8.2 RESPONSIVE COMPANIES

11.8.3 DYNAMIC COMPANIES

11.8.4 STARTING BLOCKS

FIGURE 37 MARKET: STARTUP/SME EVALUATION MATRIX, 2020

12 COMPANY PROFILES (Page No. - 133)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, MnM View, Key Strengths/Right to Win, Strategic Choices Made, and Weakness and Competitive Threats)*

12.1.1 ERICSSON

TABLE 96 ERICSSON: BUSINESS OVERVIEW

FIGURE 38 ERICSSON: COMPANY SNAPSHOT

TABLE 97 ERICSSON: PRODUCTS OFFERED

TABLE 98 NOKIA: MOBILE AND WIRELESS BACKHAUL MARKET: DEALS

12.1.2 HUAWEI

TABLE 99 HUAWEI: BUSINESS OVERVIEW

FIGURE 39 HUAWEI: COMPANY SNAPSHOT

TABLE 100 HUAWEI: PRODUCTS OFFERED

TABLE 101 HUAWEI: MARKET: PRODUCT LAUNCH

TABLE 102 HUAWEI: MARKET: DEAL

12.1.3 NOKIA

TABLE 103 NOKIA: BUSINESS OVERVIEW

FIGURE 40 NOKIA: COMPANY SNAPSHOT

TABLE 104 NOKIA: PRODUCTS OFFERED

TABLE 105 NOKIA: MOBILE AND WIRELESS BACKHAUL MARKET: DEAL

12.1.4 NEC

TABLE 106 NEC: BUSINESS OVERVIEW

FIGURE 41 NEC: COMPANY SNAPSHOT

TABLE 107 NEC: PRODUCTS OFFERED

TABLE 108 NEC: MARKET: DEAL

12.1.5 ZTE

TABLE 109 ZTE: BUSINESS OVERVIEW

FIGURE 42 ZTE: COMPANY SNAPSHOT

TABLE 110 ZTE: PRODUCTS OFFERED

TABLE 111 ZTE: MOBILE AND WIRELESS BACKHAUL MARKET: DEALS

12.1.6 FUJITSU

TABLE 112 FUJITSU: BUSINESS OVERVIEW

FIGURE 43 FUJITSU: COMPANY SNAPSHOT

TABLE 113 FUJITSU: PRODUCTS OFFERED

TABLE 114 FUJITSU: MARKET: DEAL

12.1.7 BROADCOM

TABLE 115 BROADCOM: BUSINESS OVERVIEW

FIGURE 44 BROADCOM: COMPANY SNAPSHOT

TABLE 116 BROADCOM: PRODUCTS OFFERED

TABLE 117 BROADCOM: MOBILE AND WIRELESS BACKHAUL MARKET: PRODUCT LAUNCH

TABLE 118 BROADCOM: MARKET: DEAL

12.1.8 CERAGON

TABLE 119 CERGAON: BUSINESS OVERVIEW

FIGURE 45 CERAGON: COMPANY SNAPSHOT

TABLE 120 CERAGON: PRODUCTS OFFERED

TABLE 121 CERAGON: MARKET: DEAL

12.1.9 AVIAT NETWORKS

TABLE 122 AVIAT NETWORKS: BUSINESS OVERVIEW

TABLE 123 AVIAT NETWORKS: PRODUCTS OFFERED

FIGURE 46 AVIAT NETWORKS: COMPANY SNAPSHOT

TABLE 124 AVIAT NETWORKS: MOBILE AND WIRELESS BACKHAUL: SERVICE LAUNCH

TABLE 125 AVIAT NETWORKS: MOBILE AND WIRELESS BACKHAUL MARKET: DEAL

12.1.10 SIAE

TABLE 126 SIAE: BUSINESS OVERVIEW

TABLE 127 SIAE: PRODUCTS OFFERED

TABLE 128 SIAE: MARKET: DEAL

12.1.11 PROXIM WIRELESS

12.1.12 INTRACOM TELECOM

12.1.13 AR RF/MICROWAVE INSTRUMENTATION

12.1.14 REDLINE

12.1.15 DRAGONWAVE-X

12.1.16 E-BAND

12.1.17 CBNG

12.1.18 RADWIN

12.1.19 CABLEFREE

12.1.20 COMMSCOPE

12.2 OTHER PLAYERS

12.2.1 CCS

12.2.2 SIKLU

12.2.3 BLU WIRELESS

12.2.4 FASTBACK

12.2.5 ERAVANT

12.2.6 BLINQ

12.2.7 EC SYSTEM

*Details on Business Overview, Products Offered, Recent Developments, MnM View, Key Strengths/Right to Win, Strategic Choices Made, and Weakness and Competitive Threats might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKETS (Page No. - 174)

13.1 5G INFRASTRUCTURE MARKET

13.1.1 MARKET DEFINITION

13.1.2 LIMITATIONS OF THE STUDY

13.1.3 MARKET OVERVIEW

13.1.4 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE

TABLE 129 5G INFRASTRUCTURE MARKET, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 130 5G COMMUNICATION INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 131 5G COMMUNICATION INFRASTRUCTURE MARKET IN ROW, BY REGION, 2018–2027 (USD MILLION)

TABLE 132 5G COMMUNICATION INFRASTRUCTURE MARKET, BY END USER, 2018–2027 (USD MILLION)

13.1.5 5G INFRASTRUCTURE MARKET, BY REGION

TABLE 133 5G INFRASTRUCTURE MARKET, BY REGION, 2018–2027 (USD MILLION)

TABLE 134 5G INFRASTRUCTURE MARKET IN NORTH AMERICA, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 135 5G INFRASTRUCTURE MARKET IN NORTH AMERICA, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 136 5G INFRASTRUCTURE MARKET IN CANADA, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 137 5G INFRASTRUCTURE MARKET IN MEXICO, BY COMMUNICATION INFRASTRUCTURE, 2020–2027 (USD MILLION)

TABLE 138 5G INFRASTRUCTURE MARKET IN EUROPE, BY OPERATIONAL FREQUENCY, 2018–2027 (USD MILLION)

TABLE 139 5G INFRASTRUCTURE MARKET IN GERMANY, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 140 5G INFRASTRUCTURE MARKET IN ITALY, BY CORE NETWORK TECHNOLOGY, 2019–2027 (USD MILLION)

TABLE 141 5G INFRASTRUCTURE MARKET IN REST OF EUROPE, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 142 5G INFRASTRUCTURE MARKET IN REST OF EUROPE, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 143 5G INFRASTRUCTURE MARKET IN APAC, BY COUNTRY, 2018–2027 (USD MILLION)

TABLE 144 5G INFRASTRUCTURE MARKET IN APAC, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 145 5G INFRASTRUCTURE MARKET IN APAC, BY END USER,2018–2027 (USD MILLION)

TABLE 146 5G INFRASTRUCTURE MARKET IN ASIA PACIFIC, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 147 5G INFRASTRUCTURE MARKET IN JAPAN, BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 148 5G INFRASTRUCTURE MARKET IN JAPAN, BY CORE NETWORK TECHNOLOGY, 2019–2027 (USD MILLION)

TABLE 149 5G INFRASTRUCTURE MARKET IN REST OF ASIA PACIFIC , BY COMMUNICATION INFRASTRUCTURE, 2019–2027 (USD MILLION)

TABLE 150 5G INFRASTRUCTURE MARKET IN ROW, BY REGION, 2018–2027 (USD MILLION)

TABLE 151 5G INFRASTRUCTURE MARKET IN ROW, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 152 5G INFRASTRUCTURE MARKET IN ROW, BY END USER,2018–2027 (USD MILLION)

TABLE 153 5G INFRASTRUCTURE MARKET IN ROW, BY CORE NETWORK TECHNOLOGY, 2018–2027 (USD MILLION)

TABLE 154 5G INFRASTRUCTURE MARKET IN MIDDLE EAST AND AFRICA, BY COMMUNICATION INFRASTRUCTURE, 2018–2027 (USD MILLION)

TABLE 155 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY COMMUNICATION INFRASTRUCTURE, 2020–2027 (USD MILLION)

TABLE 156 5G INFRASTRUCTURE MARKET IN SOUTH AMERICA, BY CORE NETWORK TECHNOLOGY, 2020–2027 (USD MILLION)

13.2 LTE AND 5G BROADCAST MARKET

13.2.1 MARKET DEFINITION

13.2.2 LIMITATIONS OF THE STUDY

13.2.3 MARKET OVERVIEW

13.2.4 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY

TABLE 157 LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY,2015–2024 (USD MILLION)

TABLE 158 5G BROADCAST MARKET, BY END USER, 2015–2024 (USD MILLION)

13.2.5 LTE AND 5G BROADCAST MARKET, BY REGION

TABLE 159 NORTH AMERICAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 160 NORTH AMERICAN LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 161 NORTH AMERICAN 5G BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 162 EUROPEAN LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY, 2015–2024 (USD MILLION)

TABLE 163 EUROPE LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 164 ASIA PACIFIC LTE BROADCAST MARKET, BY COUNTRY, 2015–2024 (USD MILLION)

TABLE 165 ROW LTE AND 5G BROADCAST MARKET, BY TECHNOLOGY,2015–2024 (USD MILLION)

14 APPENDIX (Page No. - 189)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

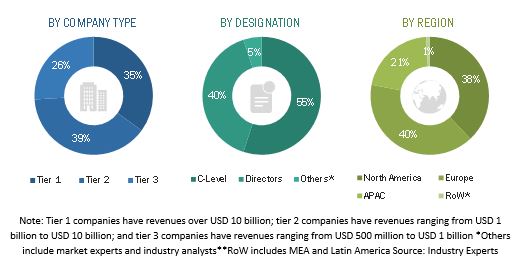

The study involved four major activities in estimating the current size of the Mobile and wireless backhaul Market. Exhaustive secondary research was done to collect information on the wireless backhaul industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Mobile and wireless backhaul Market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

Primary sources were mainly industry experts from core and related industries, preferred system developers, service providers, System Integrators (SIs), resellers, partners, and organizations related to the various segments of the industry’s value chain. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the mobile and wireless backhaul market. The primary sources from the demand side included mobile and wireless backhaul network end users, network administrators/consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts from enterprises and government associations.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global Mobile and wireless backhaul Market and various other dependent submarkets in the overall market. An exhaustive list of all the vendors offering solutions and services in the Mobile and wireless backhaul Market was prepared while using the top-down approach. The market share for all the vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its offering (hardware and services). The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

In the bottom-up approach, , the key companies offering mobile and wireless backhaul networks were identified, such as Ericsson, Huawei, Nokia, NEC, and ZTE. After confirming these companies through primary interviews with industry experts, their total revenue was estimated through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. The revenue of these companies from Business Units (BUs) that offer mobile and wireless backhaul was identified through similar sources. Then through primaries, the data on revenue generated through specific mobile and wireless backhaul components was collected.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and managers.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To describe and forecast the size of the Mobile and wireless backhaul Market by component, equipment, services, network technology, and region.

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA)

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the Market

- To analyze the impact of COVID-19 on the Market

- To analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall Mobile and wireless backhaul Market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as Mergers and Acquisitions (M&A); new product launches and product enhancements; agreements, partnerships, and collaborations; expansions; and Research and Development (R&D) activities in the market.

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information:

- Detailed analysis and profiling of additional market players (Up to 5)

Geographic analysis:

- Further breakdown of the MEA Mobile and wireless backhaul Market

- Further breakdown of the Latin America Market

- Further breakdown of China Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Mobile and Wireless Backhaul Market

Market Forecast for Mobile and Wireless Backhaul Market by Equipment and by services

Interested in Unlicensed band or sub 6 GHz UBR backhaul market for india