Nanowire Battery Market by Material Type (Silicon, Germanium, Transition Metal Oxides, Gold), Industry (Consumer Electronics, Automotive, Aviation, Energy, Medical Devices), and Region (North America, Europe, APAC, RoW) – Global Forecast to 2025-2036

The global nanowire battery market was valued at USD 0.13 billion in 2024 and is estimated to reach USD 2.66 billion by 2036, at a CAGR of 30.8% between 2025 and 2036.

The nanowire battery market is experiencing significant growth, driven by the increasing demand for advanced energy storage solutions across various industries, including consumer electronics, electric vehicles, and renewable energy. Nanowire batteries, characterized by their high energy density, long cycle life, and fast-charging capabilities, are emerging as a next-generation alternative to conventional lithium-ion systems. Continuous advancements in nanotechnology and materials science have enhanced the durability and efficiency of these technologies, effectively mitigating issues such as dendrite formation that often lead to performance degradation. As the global emphasis on lightweight, compact, and high-capacity batteries intensifies, nanowire-based architectures are increasingly viewed as a breakthrough in battery innovation.

The increasing need for batteries with high charge retention capacity and superior performance characteristics further drives the growth of the nanowire battery market. Automotive manufacturers are substantially increasing their R&D investments to develop efficient and sustainable battery technologies. At the same time, the expanding consumer electronics industry continues to generate strong demand for compact, long-lasting power sources. These factors, combined with the global shift toward electrification and the adoption of renewable energy, are creating favorable conditions for market expansion and positioning nanowire batteries as a pivotal technology in the future energy storage landscape.

Market by Material

Silicon

Silicon-based nanowire batteries are expected to account for the largest share of the nanowire battery market, driven by their exceptional energy storage capacity and superior performance characteristics. The demand for longer battery life and faster charging has accelerated the adoption of silicon as a preferred anode material in advanced energy storage solutions. With a high theoretical charge retention capacity of approximately 4,200 mAh/g, nearly ten times that of traditional graphite, silicon enables significantly higher energy density, making it ideal for applications in electric vehicles, consumer electronics, and large-scale energy storage systems. The rising focus on electric mobility and the miniaturization of electronic devices continues to reinforce silicon’s dominance in the nanowire battery landscape.

Germanium

The Germanium-based nanowire battery segment is projected to witness a significant CAGR during the forecast period, supported by its superior electrical conductivity and excellent lithium-ion diffusion properties. Germanium offers faster charging and discharging rates compared to silicon, making it an attractive choice for high-performance applications where rapid energy transfer is critical. Although germanium is costlier and less abundant, advancements in material engineering and nanofabrication techniques are improving its commercial viability. As industries seek higher efficiency and power density in next-generation batteries, Germanium-based nanowires are expected to gain substantial traction in both automotive and high-end consumer electronics sectors.

Market by Industry

Medical

The medical devices segment is anticipated to witness substantial growth in the nanowire battery market over the coming years. Continuous innovation in healthcare technology is driving the development of advanced, battery-powered medical devices, including pacemakers, hearing aids, and wearable health monitors. Traditional lithium-ion batteries used in implantable devices pose safety and reliability concerns, particularly regarding overheating and leakage risks. Nanowire batteries, with their lightweight design, enhanced energy density, and improved safety, are emerging as a superior alternative. Their ability to deliver long-lasting, stable power in compact formats makes them especially suitable for life-supporting and minimally invasive medical applications.

Consumer Electronics

The consumer electronics segment represents a significant application area for nanowire batteries, driven by the growing demand for high-performance, compact, and rapidly charging energy storage solutions. Devices such as smartphones, laptops, wearables, and portable gadgets require batteries that can sustain prolonged usage while maintaining efficiency and safety. Nanowire batteries offer substantial advantages in terms of higher energy density, longer lifespan, and rapid recharge capability compared to conventional lithium-ion batteries. As consumer preferences shift toward thinner and more powerful electronic devices, the adoption of nanowire battery technology is expected to rise sharply, positioning it as a key enabler of next-generation portable electronics.

Market by Geography

Geographically, the nanowire battery market is experiencing widespread adoption across North America, Europe, Asia Pacific, the Middle East & Africa, and South America. The Asia Pacific region is projected to register the fastest growth in the nanowire battery market during the forecast period. Substantial expansion across key industries such as automotive, consumer electronics, and renewable energy is driving the demand for advanced energy storage technologies in the region. The rising consumption of smartphones, wearable devices, and other portable electronics in countries such as China, Japan, and South Korea is significantly boosting the adoption of nanowire batteries. Moreover, China’s aggressive initiatives toward clean energy adoption, coupled with the rapid growth of its electric vehicle sector, are creating substantial opportunities for market expansion. With increasing investments in battery R&D and large-scale manufacturing capabilities, the Asia Pacific is set to emerge as the dominant hub for nanowire battery innovation and production.

Market Dynamics

Driver: Rising Demand for High-Performance Energy Storage Solutions

The growing adoption of electric vehicles, consumer electronics, and renewable energy systems is fueling the demand for batteries with higher energy density and faster charging capabilities. Nanowire batteries offer superior performance and longer life cycles compared to traditional lithium-ion batteries, making them an ideal solution for these emerging applications. This accelerating shift toward electrification continues to drive robust market growth.

Restraint: High Manufacturing Costs and Complex Fabrication Processes

Despite their promising characteristics, nanowire batteries face production challenges due to high material costs and complex manufacturing techniques. The precision required for nanowire synthesis and assembly significantly increases production expenses, limiting large-scale commercialization. Until cost-effective manufacturing methods are developed, widespread adoption may remain constrained to high-value applications.

Opportunity: Advancements in Nanotechnology and Material Innovation

Continuous progress in nanotechnology and material science is creating significant opportunities for enhancing the efficiency, safety, and scalability of nanowire batteries. Research efforts aimed at improving electrode stability, charge retention, and cost-effective nanowire fabrication are expected to open new avenues for commercialization. These advancements will play a critical role in expanding the application scope of nanowire batteries across multiple industries.

Challenge: Limited Commercialization and Scalability

The transition of nanowire batteries from laboratory research to mass production remains a significant challenge. Technical hurdles such as maintaining structural stability, ensuring consistent performance, and scaling up manufacturing processes have slowed commercialization efforts. Overcoming these barriers will be essential for achieving competitive pricing and broader market penetration.

Future Outlook

Between 2025 and 2036, the nanowire battery market is expected to experience substantial growth as demand for high-performance, compact, and sustainable energy storage solutions intensifies across various industries. Advancements in nanotechnology and material engineering will enable the development of batteries with higher energy density, faster charging times, and enhanced safety, positioning nanowire batteries as a transformative alternative to conventional lithium-ion systems. Growing adoption of electric vehicles, next-generation consumer electronics, and medical devices will further accelerate market growth. As large-scale production capabilities mature and costs decline, nanowire batteries are expected to become a key enabler of the global transition toward electrification and cleaner energy, driving innovation across the energy storage ecosystem.

Key Market Players

Top nanowire battery companies: Amprius Technologies (US), Sila Nanotechnologies Inc. (US), OneD Battery Sciences (US), Enevate Corporation (US), and Nexeon Ltd.(UK)

Key Questions addressed in this report:

- What are the global trends in demand for the market?

- What are the upcoming technologies/product areas that will have a significant impact on the market in the future?

- What will be the revenue pockets for the market players in the next 6 years?

- What are the prime strategies followed by key players in the market?

Table of Contents

1 Introduction (Page No. - 15)

1.1 Study Objectives

1.2 Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.3 Secondary and Primary Research

2.1.3.1 Key Industry Insights

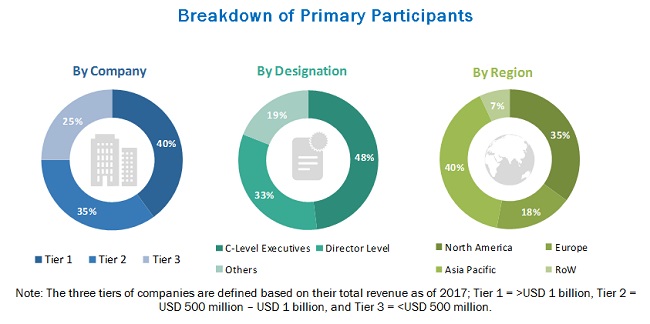

2.1.3.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Arriving at Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Share By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 31)

4.1 Nanowire Battery Market, 2021–2026 (USD Million)

4.2 Market, By Material Type

4.3 Market, By Industry and Region

4.4 Market, By Geography

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rising Demand for Batteries With High Charge Retention Capacity

5.2.1.2 Increasing Expenditure on R&D Activities By Automotive Companies

5.2.1.3 Growing Consumer Electronics Industry

5.2.2 Restraints

5.2.2.1 High Volume Change of Silicon Nanowires During Charge and Discharge Cycles

5.2.3 Opportunities

5.2.3.1 Emergence of Electric Vehicles

5.2.3.2 Need for High-Performance Batteries in Electric Grid Storage Applications

5.2.4 Challenges

5.2.4.1 Presence of Substitute Battery Technologies

5.2.4.2 Operational Obligations Such as Conducting Pilot and Safety Tests

5.3 Value Chain Analysis

5.4 Emerging Battery Technologies

5.4.1 Solid State Battery

5.4.1.1 Need for Safer and Lighter Batteries Drives Demand for Solid State Batteries

5.4.2 Lithium-Metal Battery

5.4.2.1 Lithium-Metal Batteries Offer Better Performance Than That of Lithium-Ion Batteries

5.4.3 Lithium-Air Battery

5.4.3.1 Lithium-Air Battery is Expected to Be Ideal Option to Replace Lithium-Ion Batteries

5.4.4 Aluminum-Air Battery

5.4.4.1 Rise in Adoption of Batteries With High Energy Density Makes Aluminum-Air Battery Attractive Substitute

5.4.5 Graphene Battery

5.4.5.1 Requirement for Fast-Charging Batteries Fuels Market for Graphene Battery Technology

6 Components Used in Nanowire Batteries (Page No. - 41)

6.1 Introduction

6.2 Common Cathode Materials

6.2.1 Lithium Iron Phosphate

6.2.2 Lithium Cobalt Oxide

6.2.3 Lithium Nickel Manganese Cobalt

6.2.4 Lithium Nickel Cobalt Aluminum

6.3 Common Anode Materials

6.3.1 Low-Charge Retention Capacity of Graphite Drives Demand for Substitute Anode Materials for Nanowire Batteries

6.4 Electrolytes

6.4.1 Growing Demand for Batteries With Higher Charge Retention Capacities Fuel Need for Efficient Electrolytes

6.5 Separators

6.5.1 Battery Separator is Essential for Safe Functioning of Nanowire Batteries

6.6 Other Materials

6.6.1 Supporting Material Plays A Crucial Role in Nanowire Battery Manufacturing Process

7 Nanowire Battery Market, By Material (Page No. - 45)

7.1 Introduction

7.2 Silicon

7.2.1 High-Charge Retention Capacity of Silicon Makes It an Ideal Anode Material for Nanowire Batteries

7.2.1.1 Advantages of Silicon

7.2.1.2 Disadvantages of Silicon

7.3 Germanium

7.3.1 Stable Electrical Conductivity of Germanium Fuels Its Demand for Nanowire Batteries

7.3.1.1 Advantages of Germanium

7.3.1.2 Disadvantages of Germanium

7.4 Transition Metal Oxides

7.4.1 Transition Metal Oxides Offer Great Potential for Nanowire Batteries When Used as Anodes

7.4.1.1 Advantages of Transition Metal Oxides

7.4.1.2 Disadvantages of Transition Metal Oxides

7.5 Gold

7.5.1 Gold as an Anode Material Offer High Storage Capacity for Nanowire Batteries

7.5.1.1 Advantages of Gold Nanowires

7.5.1.2 Disadvantages of Gold Nanowires

8 Nanowire Battery Market, By Industry (Page No. - 54)

8.1 Introduction

8.2 Consumer Electronics

8.2.1 Smartphones

8.2.1.1 High Demand for Smartphones With Longer Run Time to Fuel Growth of Market

8.2.2 Laptops

8.2.2.1 Penetration of Emerging Battery Technologies in Laptops Opened New Growth Opportunities

8.2.3 Digital Cameras

8.2.3.1 Advancements in Digital Technology has Significantly Changed Power Requirements for Digital Cameras

8.2.4 Wearables

8.2.4.1 Exponential Rise in Demand for Wearable Devices Expected to Boost Market

8.3 Automotive

8.3.1 Battery Electric Vehicles (BEV)

8.3.1.1 Growing Use of Electric Vehicles to Boost Demand for Nanowire Batteries

8.3.2 Plug-In Hybrid Electric Vehicles (PHEVs)

8.3.2.1 Rising Market for PHEVs to Surge Demand for Nanowire Batteries

8.4 Aviation

8.4.1 Drones

8.4.1.1 Nanowire Battery—Excellent Option for Powering Commercial Drones

8.5 Energy

8.5.1 Power Storage

8.5.1.1 Transition From Non-Renewable to Renewable Sources Makes Nanowire Battery Crucial Component of Grid Power Storage Solution

8.6 Medical Devices

8.6.1 Implantable Devices

8.6.1.1 Nanowire Batteries to Offer Safer Operations for Implantable Devices Than That of Lithium-Ion Batteries

9 Nanowire Battery Market, By Region (Page No. - 66)

9.1 Introduction

9.2 North America

9.2.1 US

9.2.1.1 US Offers Highest Growth Potential for Market in North America

9.2.2 Canada

9.2.2.1 Abundance of Renewable Energy Sources Makes Canada Ideal Destination for Electric Grid Energy Storage Battery Systems

9.2.3 Mexico

9.2.3.1 Increased Use of Solar Power Systems in Mexico Fuels Demand for Advanced Battery Systems

9.3 Europe

9.3.1 Germany

9.3.1.1 Rising Installation of Nanowire Batteries at Home to Store Solar Power is Expected to Drive Market Growth

9.3.2 UK

9.3.2.1 High Adoption of Electric Vehicles in UK Would Provide Growth Opportunities for Nanowire Battery Market

9.3.3 France

9.3.3.1 French Government’s Investments in Battery Industry to Accelerate Market Growth

9.3.4 Rest of Europe

9.3.4.1 Favorable Government Policies Regarding Use of Battery-Powered Vehicles to Boost Demand for Nanowire Batteries

9.4 APAC

9.4.1 China

9.4.1.1 China’s Push for Clean Energy Generation to Boost Demand for Advanced Batteries Such as Nanowire

9.4.2 South Korea

9.4.2.1 Presence of Leading Battery Manufacturers Makes South Korea an Attractive Market for Nanowire Batteries

9.4.3 Japan

9.4.3.1 R&D Expenditure to Improve Performance of Batteries in Evs and Smartphones Would Create Lucrative Opportunities for Japanese Market

9.4.4 Rest of APAC

9.4.4.1 Government’s Focus on Minimizing Use of Non-Renewable Sources Will Escalate Demand for Advanced Batteries

9.5 RoW

9.5.1 South America

9.5.1.1 Rapidly Growing Demand for Smartphones to Positively Impact Nanowire Battery Market

9.5.2 Middle East

9.5.2.1 Government Plans of Establishing Solar Energy Plants Will Accelerate Demand for Battery-Powered Storage Systems

9.5.3 Africa

9.5.3.1 Abundance of Lithium Reserves in Africa Makes Region Important Market for Nanowire Batteries

10 Competitive Landscape (Page No. - 83)

10.1 Overview

10.2 Market Ranking Analysis for Nanowire Battery Manufacturers

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Innovators

10.3.3 Dynamic Differentiators

10.3.4 Emerging Companies

10.4 Strength of Product Portfolio

10.5 Business Strategy Excellence

10.6 Competitive Situations and Trends

10.6.1 Agreements, Partnerships, and Joint Ventures

10.6.2 Product Launches

10.6.3 Expansions

10.6.4 Contracts

11 Company Profiles (Page No. - 94)

11.1 Key Players

(Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, and MnM View)*

11.1.1 Amprius

11.1.2 Sila Nanotechnologies

11.1.3 OneD Material

11.1.4 Nexeon

11.1.5 NEI Corporation

11.1.6 XG Sciences

11.1.7 LG Chem

11.1.8 Panasonic

11.1.9 Samsung SDI

11.1.10 Enevate

* Business Overview, Products & Services Offered, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

11.2 Other Key Players

11.2.1 ACS Materials

11.2.2 Novarials Corporation

11.2.3 Boston Power

11.2.4 Lithium Werks

11.2.5 Targray

12 Appendix (Page No. - 117)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (37 Tables)

Table 1 Market, By Material, 2019–2026 (USD Million)

Table 2 Silicon Nanowire Battery Market, By Industry, 2019–2026 (USD Million)

Table 3 Silicon Nanowire Battery Market, By Region, 2019–2026 (USD Million)

Table 4 Germanium Nanowire Battery Market, By Industry, 2019–2026 (USD Million)

Table 5 Germanium Nanowire Battery Market, By Region, 2019–2026 (USD Million)

Table 6 Transition Metal Oxides Nanowire Battery Market, By Industry, 2019–2026 (USD Million)

Table 7 Transition Metal Oxides Nanowire Battery Market, By Region, 2019–2026 (USD Million)

Table 8 Gold Nanowire Battery Market, By Industry, 2019–2026 (USD Million)

Table 9 Gold Nanowire Battery Market, By Region, 2019–2026 (USD Million)

Table 10 Market, By Industry, 2019–2026 (USD Million)

Table 11 Market for Consumer Electronics, By Region, 2019–2026 (USD Million)

Table 12 Market for Consumer Electronics, By Material, 2019–2026 (USD Million)

Table 13 Market for Automotive Industry, By Region, 2019–2026 (USD Million)

Table 14 Market for Automotive Industry, By Material, 2019–2026 (USD Million)

Table 15 Market for Aviation Industry, By Region, 2019–2026 (USD Million)

Table 16 Market for Aviation Industry, By Material, 2019–2026 (USD Million)

Table 17 Market for Energy Industry, By Region, 2019–2026 (USD Million)

Table 18 Market for Energy Industry, By Material, 2019–2026 (USD Million)

Table 19 Market for Medical Devices, By Region, 2019–2026 (USD Million)

Table 20 Market for Medical Devices, By Material, 2019–2026 (USD Million)

Table 21 Nanowire Battery Market, By Region, 2019–2026 (USD Million)

Table 22 Market in North America, By Country, 2019–2026 (USD Million)

Table 23 Market in North America, By Industry, 2019–2026 (USD Million)

Table 24 Market in North America, By Material Type, 2019–2026 (USD Million)

Table 25 Market in Europe, By Country, 2019–2026 (USD Million)

Table 26 Market in Europe, By Industry, 2019–2026 (USD Million)

Table 27 Market in Europe, By Material Type, 2019–2026 (USD Million)

Table 28 Market in APAC, By Country, 2019–2026 (USD Million)

Table 29 Market in APAC, By Industry, 2019–2026 (USD Million)

Table 30 Market in APAC, By Material Type, 2019–2026 (USD Million)

Table 31 Market in RoW, By Region, 2019–2026 (USD Million)

Table 32 Market in RoW, By Industry, 2019–2026 (USD Million)

Table 33 Nanowire Battery Market in RoW, By Material Type, 2019–2026 (USD Million)

Table 34 Agreements, Partnerships, and Joint Ventures (2016–2019)

Table 35 Product Launches (2016–2018)

Table 36 Expansions (2016–2018)

Table 37 Contracts (2017–2019)

List of Figures (38 Figures)

Figure 1 Market: Research Design

Figure 2 Bottom-Up Approach to Arrive at Market Size

Figure 3 Top-Down Approach to Arrive at Market Size

Figure 4 Data Triangulation

Figure 5 Assumptions of Research Study

Figure 6 Nanowire Battery Market Segmentation

Figure 7 Silicon Expected to Account for Largest Share of Market in 2021

Figure 8 Medical Devices to Register Highest CAGR in Market During Forecast Period

Figure 9 APAC to Witness Highest CAGR in Market During Forecast Period

Figure 10 Growing Consumer Electronics Industry to Boost Market

Figure 11 Silicon to Account for Largest Size of Market From 2021 to 2026

Figure 12 Consumer Electronics and North America are Expected to Be Largest Shareholders in Nanowire Battery Market, By Industry and Region, Respectively, in 2023

Figure 13 US Expected to Hold Largest Share of Market in 2021

Figure 14 Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 Research & Development Stage Adds Major Value to Nanowire Battery Ecosystem

Figure 16 Emerging Battery Technologies

Figure 17 Major Components of Nanowire Battery

Figure 18 Market, By Material

Figure 19 Consumer Electronics to Hold Largest Size of Germanium Nanowire Battery Market From 2023 to 2026

Figure 20 APAC to Register Highest CAGR in Gold Nanowire Battery Market During Forecast Period

Figure 21 Market, By Industry

Figure 22 North America to Account for Largest Size Ofnanowire Battery Market for Consumer Electronics During Forecast Period

Figure 23 Germanium Nanowire Battery Market for Automotive Industry to Grow at Highest CAGRfrom 2023 to 2026

Figure 24 Silicon Nanowire Batteries to Account for Largest Market Size for Energy Industry From 2023 to 2026

Figure 25 Market in China to Grow at Highest CAGR From 2021 to 2026

Figure 26 North America: Market Snapshot

Figure 27 Europe: Market Snapshot

Figure 28 APAC: Market Snapshot

Figure 29 RoW: Nanowire Battery Market Snapshot

Figure 30 Agreements, Partnerships, and Joint Ventures as Major Growth Strategies Adopted By Key Players in Market During 2016–2019

Figure 31 Ranking of Top 5 Players: Nanowire Battery Market (2018)

Figure 32 Market (Global) Competitive Leadership Mapping, 2018

Figure 33 Market Evolution Framework: Agreements, Partnerships, and Joint Ventures Fuelled Nanowire Battery Market Growth During 2016–2019

Figure 34 Agreements, Partnerships, and Joint Ventures – Key Strategies Adopted By Market Players During 2016–2019

Figure 35 XG Sciences: Company Snapshot

Figure 36 LG Chem: Company Snapshot

Figure 37 Panasonic: Company Snapshot

Figure 38 Samsung SDI: Company Snapshot

The study involved four major activities for estimating the current size of the nanowire battery market. Exhaustive secondary research was carried out to collect information on the market. The next step involved the validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. Secondary sources such as encyclopedias, directories, and databases [Energy Storage Association, American Chemical Society (ACS), Stanford News, OneSource, and Factiva] have been used to identify and collect information for an extensive technical and commercial study of the nanowire battery market.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. Primary sources, such as experts from related industries and suppliers, have been interviewed to obtain and verify critical information as well as to assess prospects. Key players in the nanowire battery market have been identified through secondary research, and their respective market rankings have been determined through primary and secondary research. This research includes the study of annual reports of the top market players and interviews with key opinion leaders, such as CEOs, directors, and marketing personnel.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the nanowire battery market and other dependent submarkets listed in this report.

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size through the estimation process, the total market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the market breakdown and data triangulation procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. The market has also been validated using both top-down and bottom-up approaches.

The objectives of the study are as follows:

- To describe and forecast the nanowire battery market, in terms of value, by material type and industry

- To forecast the market size, in terms of value, by region—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding components of a nanowire battery

- To provide detailed information regarding major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To provide a comprehensive overview of the value chain of the nanowire battery ecosystem

- To strategically analyze micro markets with regard to individual growth trends, prospects, and contributions to the total market

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing competitive landscape for market leaders

- To analyze the major growth strategies implemented by the key market player, such as agreements, partnerships, joint ventures, and product launches

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to a company’s specific need. The following customization options are available for the report.

Company information

Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Nanowire Battery Market