Needle-Free Injection System Market by Technology (Jet, Spring, Micro-array Patch), by Product (Prefilled, Fillable), Type of Medication (Liquid, Powder), Application (Vaccination, Dermatology), End Users (Hospital, Homecare) - Global Forecast to 2026

Market Growth Outlook Summary

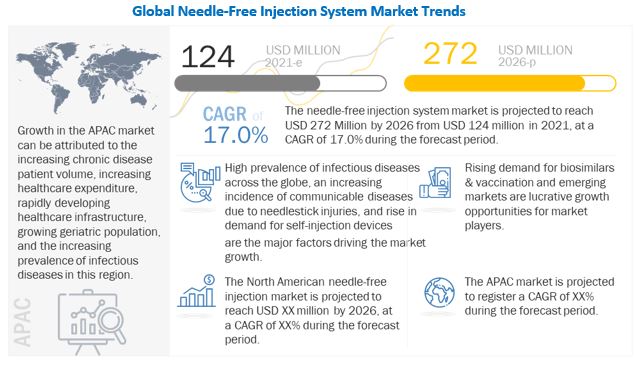

The global needle-free injection system market forecasted to transform from $124 million in 2021 to $272 million by 2026, driven by a CAGR of 17.0%. Growth in this market is mainly driven by technological advancements, increasing demand for self-injection devices, and the rising incidence of chronic diseases. With the rising geriatric population and the increasing prevalence of chronic diseases, the patient volume has increased significantly globally. This, in turn, is creating a greater demand for advanced and effective treatment approaches, including the use of needle-free injection systems. Moreover, the high adoption of advanced drug delivery technologies across the globe is supporting the growth of this market. On the other hand, limitations with large volume and intravenous administration systems are the key factors restraining the growth of the market

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of Covid-19 on Needle-Free injection system market

To assess the impact of COVID-19 and provide market forecasts, scenario-based approaches are considered.

In the optimistic scenario, it could be assumed that the COVID-19 pandemic has created a positive impact on the overall needle-free injection system market. The needle-free injection system market has been positively impacted by the COVID-19 pandemic, as the need for mass vaccination needs and self-injectable devices has been the focus since the inception of the pandemic outbreak in December 2019. As the number of cases has increased across regions, most of the major needle-free injection system market players have invested in R&D and have entered into partnerships and agreements with other industry players and government agencies to develop a needle-free injection system for the disease.

About 6.8 billion COVID-19 vaccinations have been administered globally, almost double the number of routine vaccines, compared to the total manufacturing capacity of about 6 billion immunization syringes a year. As per the WHO, there could be a shortage of one to two billion syringes needed to administer COVID-19 vaccinations in 2022, which could also impact routine immunizations and undermine needle safety. This has resulted in multiple product investments and research of COVID-19 vaccine delivery devices, with surplus production and distribution of these devices across regions to serve the rising demand. Also, the increasing incidence of communicable diseases due to needlestick injuries, difficulties in vaccine storage, and needle phobia have led to their high uptake and acceptance, especially for the screening for vaccination and insulin delivery.

In the realistic scenario, it could be assumed that the effect of COVID-19 on the needle-free injection system market is positive but could be transient. In this scenario, the major application segment vaccination is expected to be the most positively impacted.

Needle-free injection system market Dynamics:

DRIVERS

1. High prevalence of infectious diseases globally

Despite significant improvements in sanitation and medicine, the global prevalence of infectious diseases is still high. Although non-communicable diseases are the leading causes of morbidity and mortality, infectious diseases remain a major public health concern globally. According to the National Institute of Allergy and Infectious Diseases (NIAID), annually, infectious diseases claim more than 15 million lives globally. In 2019, according to the World Malaria Report by the World Health Organization (WHO), 229 million cases of malaria occurred worldwide. The WHO African Region, with an estimated 215 million malaria cases in 2019, accounted for about 94% of the malaria cases. Similarly, as per the WHO 2021 data, there were an estimated 37.7 million people living with HIV at the end of 2020, over two-thirds of whom (25.4 million) are in the WHO African Region.

The growing prevalence of chronic diseases has resulted in a significant increase in demand for biologics (large-molecule drugs). Most large-molecule drugs are administered through injectables.

An injectable system is a relatively fast and safe method of drug delivery that is associated with several advantages, including the site-specific delivery of drugs, low drug dosage requirement, reduced hospital stays, better reproducibility, and ease of use. Although the demand for injectables has increased significantly in the past few years, there are still a few factors that may hinder market growth to a certain extent. These include the high risk of needlestick injuries and patient reluctance to use these devices due to needle phobia. Owing to this, companies are increasingly focusing on developing needle-free injection systems. In August 2021, PharmaJet partnered with Zydus Cadila and announced the Emergency Use Authorization (EUA) approval for the world’s first plasmid DNA COVID-19 vaccine delivery via needle-free injection. In October 2021, Enesi Pharma started developing next-generation vaccination products for targeting infectious diseases and emergent threat pathogens. Some needle-free injection systems used for the treatment of chronic conditions include InsuJet, Zetajet, Medi-Jector, and Injex30.

The growing prevalence of infectious and chronic diseases has led to an increase in the demand for and development of needle-free injection systems, which is expected to drive market growth to a considerable extent in the coming years.

2. Increasing incidence of communicable diseases due to needlestick injuries

Needlestick injuries from contaminated needles are a major area of concern for most healthcare providers. Needlestick injuries are one of the most serious health and safety threats.

Injections are one of the most common devices used for the administration of drugs, due to which healthcare workers are at a high risk of exposure to blood-borne pathogens due to needlestick injuries, which can occur accidentally. According to the CDC, some 385,000 health care workers accidentally stick themselves with needles every year. Needlestick injuries have the potential to transmit infectious diseases such as hepatitis B, hepatitis C, and human immunodeficiency virus (AIDS) among healthcare workers.

Listed below are some statistics related to needlestick injuries:

- According to the WHO reports, it was found that 37.6% of all hepatitis B cases, 39% of hepatitis C cases, and 4.4% of HIV/AIDS cases in healthcare workers around the world are due to needlestick injuries. The WHO Eastern Mediterranean Regional Office reports an average of 4 needlestick injuries per year per healthcare worker.

-

The worldwide pooled prevalence of needle stick injuries among healthcare workers during career time and year 2020 was 56.2% and 32.4%, respectively.

Considering the various hazards associated with injectable systems, there is a significant demand for safer and more effective drug delivery systems, such as needle-free injections. - Needle phobia is another major factor limiting the demand for injectable devices. To increase patient compliance, many companies are now focusing on developing needle-free injection systems, which are one of the most effective and painless solutions.

3. Rise in demand for self-injection devices

Self-injection technologies are a relatively faster means of delivering drugs and enable better reproducibility over invasive drug delivery technologies. Self-injections reduce the drug dosage requirement, which ultimately translates into better patient compliance, especially among the elderly.

Most biologic drugs are delivered using injections, which involve the risk of needlestick injuries. To overcome this challenge, pharmaceutical companies are developing more patient-friendly needle-free injectors and self-administered medication-device combination products. Needle-free injectors such as jet injectors are more convenient and effective, bring about better patient compliance, reduce hospital stays and overall healthcare costs, and are easy to use in-home care settings.

Driven by a dual desire to support patient convenience and respond to the growth of chronic diseases, new self-injection technologies, which can be rapidly deployed at scale, are necessary as the biopharma industry pivots to meet demand. The wider drug delivery market has historically shown consistent and healthy growth, despite the grim realities of the pandemic. As the world begins to recover from the long-lasting effects of COVID-19 and approaches a period of greater stability and normality, drug deliverables are expected to flourish.

4. Increased number of technological advancements

New technologies, including artificial intelligence (AI), bar code identification (BI), telecare, e-prescription, and others, can help clinicians and pharmacists in many ways by allowing the storage of patient planned proceedings and records and smoothening the vaccination progress. As a result, information technology (IT) has improved patient health and safety and even allowed pharmaceutical industry experts & professionals to provide high-quality and effective treatments. It also assists patients in understanding most of their medications.

Many pharmaceutical manufacturers have embraced computer technology owing to various benefits of automated IT. On the other hand, people have faced significant challenges on a global scale due to changing disease eugenics, population burdens, the COVID-19 pandemic, and healthcare stipulations. In the past, pharmacists had to deal with a variety of challenges in their professional life. These challenges can be addressed by increasing the presence and participation of emerging technology in the global push to achieve universal healthcare. Therefore, understanding the role of technology in overcoming these obstacles is critical.

Currently, some of the key players in the needle-free injection system market, such as Antares Pharma and Vaxxas, have described their focus on advanced technology, such as digital needle-free injection system micro-array patches, and wearable needle-free insulin injectors to deal with issues related to traditional challenges related to breakage, leaching, and needlestick prevention.

5. Reduction in injection system costs

The needle-free jet injection has the potential to improve safety by eliminating needles from the process of administering vaccines. For example, jet injectors have created a fine stream of pressurized liquid that penetrates the skin, delivering doses of medications and vaccines while reducing the burden of hazardous waste management. The potential benefits of jet injectors include a rise inconsistent delivery, reduced vaccine wastage, increased elimination of the need to transport large volumes of sharps, and a reduction of the risk of needle sticks and of the costs associated with sharps waste.

Jet injectors and micro-array patches can also deliver vaccines intradermally. For some vaccines, intradermal delivery has the potential to reduce the amount of vaccine required, leading to cost savings and expanded coverage for vaccines in limited supply.

RESTRAINTS

1. Higher cost of development as compared to conventional injection systems

The overall development cost of a needle-free injection system is relatively higher due to the additional associated costs such as high infrastructural and labor costs. Development costs also increase due to the complexity of these devices. High investments in development result in a high cost of units, which decreases the adoption of these devices by patients.

Sterilizable needles and conventional needle injections are the most affordable options at USD 5 to 15 for 1,000 injections. However, needle-free injections require very high initial investments and are likely to be more expensive as manufacturers are required to spend more on the production standard and quality control of the devices. The starter kits for needle-free injections themselves cost around USD 165 for AdvantaJet, USD 260 for Injex 30, and USD 300 for Medi-Jector. Owing to these high costs, affordability becomes a major issue for needle-free injection devices as compared to conventional needle injections.

In addition to this, meeting all the standards and specifications makes the manufacturing process costlier than traditional injections.

Furthermore, regulatory bodies in different regions often mandate a separate approval system for a device and for formulations combination products. For instance, a separate NDA/BLA approval is required in the US for a combination product with an injector system, which requires additional safety and clinical trial data. Thus, a manufacturer trying to market a needle-free injection system along with a previously marketed conventional delivery formulation needs to provide additional device safety data and conduct new clinical trials to meet regulatory requirements. Owing to this, such products have a higher development cost and take a longer time to enter the market as compared to conventional drug delivery systems.

2. Limitation with large volume and intravenous administration systems

The needle-free jet injection is another vaccine delivery approach that has been investigated extensively as a method of immunization and was approved by the US FDA for intramuscular and subcutaneous applications. This is based on the administration of a DNA vaccine in buffered saline using a device consisting of an injector that can be set to deliver DNA to distinct layers, the epidermis, dermis, or subcutaneous muscles, depending on the speed of the ejected solution. The major limitations to the clinical use of jet injection are the requirement for large amounts of DNA and the DNA degradation from the high-pressure delivery. Moreover, it also has limitations with intravenous drug delivery.

OPPORTUNITIES

1. Rising demand for biosimilars and vaccination processes

Biosimilars are increasingly being used in the treatment of diseases such as cancer, diabetes, hepatitis, anemia, and several other acute and chronic diseases. With the rising prevalence of these diseases, the need for biosimilars is also increasing. This, in turn, is presenting a significant opportunity for pharmaceutical & medical device manufacturers to develop innovative delivery solutions for biosimilars. Several biosimilars and vaccines are administered through injections; in this regard, the needle-free technology provides an easy-to-use and safe method for administering biosimilars without the need for a traditional injection apparatus or trained personnel. Also, to leverage the growth potential in the vaccines market, many biopharmaceutical manufacturers, vaccine companies, and needle-free device manufacturers are focusing on strategic acquisitions, collaborations, and the launch of effective and safe drug delivery devices using needle-free injection technology. For instance, in August 2021, PharmaJet partnered with Zydus Cadila and announced EUA approval for the world’s first plasmid DNA COVID-19 vaccine delivery via needle-free injection. Also, PharmaJet has announced its partnership with Abnova to develop and deliver COVID-19 mRNA vaccine using needle-free Injection technology. Moreover, in January 2019, Enesi Pharma and Geovax collaborated for the development of multiple vaccines administered by Implavax needle-free injection device.

2. Increasing number of emerging markets

The needle-free injection system market in emerging countries is expected to witness significant growth in the coming years. This can primarily be attributed to the rising prevalence of chronic diseases, robust economic growth, and increasing purchasing power. The markets in emerging countries, such as India and China, are characterized by the presence of many people suffering from chronic diseases and the availability of skilled labor at a lower cost. In India, the percent increase in the cause of death from 2009-2019, 40.8% increases cause of death in ischemic heart disease, 35.4% in COPD, and 54.2% in diabetes. In the case of China, 12.4% in stroke, 39.3% in ischemic heart disease, and 63.7% in hypertensive heart disease (Source: WHO).

According to the WHO estimates, in 2019, chronic diseases were responsible for 74% of total deaths globally. The world’s biggest killer is ischemic heart disease, responsible for 16% of the world’s total deaths. Since 2000, the largest increase in deaths has been for this disease, rising by more than 2 million to 8.9 million deaths in 2019. Stroke and chronic obstructive pulmonary disease are the second and third leading causes of death, responsible for approximately 11% and 6% of total deaths, respectively. (Source: WHO).

Also, with growing disposable income, a need for mass vaccination and the affordability of various advanced treatments has increased in emerging countries. Owing to these factors, manufacturers of needle-free injector devices are focusing more resources on emerging markets.

CHALLENGES

1. Rise in need to ensure system sterility

Sterility is a major challenge for manufacturers of injectables, including needle-free injection systems. In the drug delivery market, the sterility of formulations can be affected by a variety of visible and invisible particles, including solids, environmental factors, packaging components, formulations-related contaminants (agglomerates, precipitates, and undissolved materials), and other chemical agents, all of which can disable the therapeutic components of a solution.

Additionally, it is possible for the sterility of a drug to be affected by the delivery system itself; therefore, manufacturers of needle-free injection systems are required to focus on ensuring quality and purity during production. Sterility testing involves several processes and imposes a significant drain in terms of time, money, and resources. It is mandatory for manufacturers to follow current good manufacturing practices (cGMPs) to ascertain and report the sterility of the injectables produced. Strict adherence to cGMP guidelines is necessary for maintaining quality standards in the manufacturing process and in the end products, as non-adherence to these standards could lead to a ban.

2. Growth in alternative modes of drug delivery

Needle-free injection systems provide a safe, effective, and rapid mode of drug delivery and eliminate the risk of needlestick injuries. However, a needle-free system cannot be used for drugs administered intravenously. Another problem associated with a needle-free injection system is that they leave behind residues on the skin in the form of a wet patch, which may lead the administrator to conclude that the vaccine was improperly administered. These factors serve to limit the growth of the market to a certain extent and steer consumers to other modes of drug delivery.

The topical route of drug administration is considered better than injections as the drug is applied directly to the skin; it is non-invasive, easy, and ensures a high level of patient compliance. Inhalation enables rapid absorption due to the huge surface area of the respiratory endothelium. Bronchodilators and inhaled steroids can be targeted at the lungs with low levels of systemic absorption.

Additionally, alternative routes of drug administration have been developed by pharma companies. For example, Glenmark Pharma on May-2021 announced the launch of its nasal spray Ryaltris, which is used for the treatment of moderate to severe allergic rhinitis, in India. Moreover, Aptar Pharma announced that its Bidose nasal spray device was recently approved by the US FDA for therapy in the field of depression.

While proteins and peptides were administered as injectables due to their large molecular size and stability issues, the use of methods such as nanotechnology has enabled the development of smaller molecules of peptides-in turn, allowing their oral administration. As a result, this factor can be considered to pose a challenge to the future growth of this market.

Fillable needle-free injectors segment accounted for the largest share in the needle-free injection system market.

Based on product, needle-free injection system market is segmented into fillable and pre-filled needle-free injectors. In 2020, the fillable needle-free injectors accounted for the larger share of 63.4% of the needle-free injection system market. This product segment is projected to reach USD 179.7 million by 2026 from 79.4 million in 2021, at a CAGR of 17.7 % during the forecast period. The large share of this segment can be attributed to the increasing application of needle-free injections in vaccination, insulin, and other drug delivery.

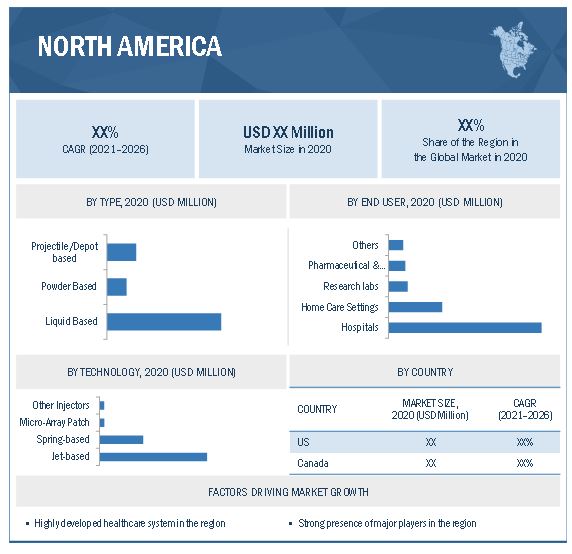

Jet-based needle-free injectors segment accounted for the largest share in the needle-free injection system market.

On the basis of technology, the needle-free injection system market can be segmented into jet-based, spring-based, microarray patches and other injectors. In 2020, the jet-based needle-free injectors segment is expected to command the largest share of 67.4% of the global needle-free injection system devices market by technology. This segment is projected to reach USD 196.9 million by 2026 from USD 71.4 million in 2020, at a CAGR of 18.3% during the forecast period. The large share of this segment can be attributed to benefits associated with this technology, including rapid drug administration, improved dosage accuracy, better diffusion into the tissue, and a faster response rate.

liquid-based injectors segment accounted for the largest share in the needle-free injection system market.

Based on the type, the needle-free injection system market is segmented into liquid-based, powder-based and projectile/depot-based needle-free injectors. The liquid-based segment accounted for the largest share of 70.9% of the needle-free injection system market in 2020. The large share of this segment can be attributed to the ability of a liquid jet, which is stronger enough to penetrate the skin and the underlying fat layer without harming the skin or the integrity of the drug molecule.

Subcutaneous injectors segment accounted for the largest share in the needle-free injection system market.

Based on site of delivery, the needle-free injection system market is segmented into subcutaneous, intramuscular and intradermal. In 2020, the subcutaneous injectors segment is estimated to account for the largest share of 48% of the needle-free injection system market by the site of delivery. The higher growth of this segment is due to its greater effectiveness as the drug moves into the capillaries when it is injected and from there, it is carried to the bloodstream.

Fillable segment accounted for the largest share in the needle-free injection system market.

Based on applications, the needle-free injection system market is segmented into vaccine delivery, insulin delivery, oncology, pain management, dermatology, and other applications. In 2020, vaccine delivery is estimated to account for the largest share of 32.8% of the needle-free injection system market by application. The rising prevalence of chronic diseases and infectious diseases worldwide has increased the demand for vaccination in the considered year and the increasing demand for patient-centric care are the major factors driving the growth of the needle-free injection market by application.

Hospitals & clinics segment accounted for the largest share in the needle-free injection system market.

Based on end users, the needle-free injection market is segmented into hospitals & clinics, home care settings, research laboratories, pharmaceutical and biotechnology companies, and other end users. The hospitals & clinics segment accounted for the largest market share of 61.0% in 2020. Factors such as technological advancements and an increase in demand for vaccination are driving the growth of the hospitals & clinics segment.

North America accounted segment accounted for the largest share in the needle-free injection system market.

On the basis of region, the needle-free injection system market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2020, North America accounted for the largest share of 58% of the needle-free injection market, followed by Europe, the Asia Pacific (APAC), Latin America, and the Middle East & Africa. However, the APAC region is expected to grow at the highest CAGR of 18.7% during the forecast period. The rapidly developing healthcare industry in China and India, growth in the aging population, rising life expectancy, rising per capita income, increasing investments in the region by key market players, the expansion of private-sector hospitals & clinics to rural areas, the availability of low-cost labor for manufacturing, the presence of a favorable regulatory environment, and growing demand for self-injectable devices testing are supporting market growth in the APAC region.

Geographic Snapshot: Needle-free Injection System Market

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players :

The prominent players in global needle-free injection market include PharmaJet (US), Portal Instruments (US), Medical International Technology, Inc (MIT) (US), NuGen Medical Devices (Canada), Crossject SA (US), and Bioject Medical Technologies (US).

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019–2026 |

|

Base Year Considered |

2020 |

|

Forecast Period |

2021–2026 |

|

Forecast Unit |

Value (USD Million) |

|

Segments Covered |

By Product Type, Application, products, Technology, Site of delivery, End User and Region |

|

Countries Covered |

|

|

Companies Covered |

PharmaJet (US), Portal Instruments (US), Medical International Technology, Inc (MIT) (US), NuGen Medical Devices (Canada), Crossject SA (US), Bioject Medical Technologies (US) among others. |

The research report categorizes needle-free injection market into the following segments and sub-segments:

By Product

- Fillable needle-free injectors

- Prefilled needle-free injectors

By Technology

- Jet-based needle-free injectors

- Spring-based needle-free injectors

- Micro array patch injectors

- Other technologies

By Type

- Liquid-based needle-free injectors

- Projectile/depot-based needle-free injectors

- Powder-based needle-free injectors

By Usability

- Disposable needle-free injectors

- Reusable needle-free injectors

By Site of delivery

- Subcutaneous injectors

- Intramuscular injectors

- Intradermal injectors

By Application

- Vaccine delivery

- Insulin delivery

- Oncology

- Pain management

- Dermatology

- Other applications

By End user

- Hospitals

- Home care settings

- Research laboratories

- Pharmaceutical and biotechnological companies

- Other end users

By Region

-

North America

- Us

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of europe

-

Asia pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin america

- Middle east & africa

Recent Developments:

- In December 2021, PharmaJet partner, Nykode Therapeutics announces phase 1/2 clinical trial with next-generation DNA-based COVID-19 vaccine candidates

- In August 2021, PharmaJet partner Zydus Cadila announced Emergency Use Authorization approval for world’s first plasmid DNA COVID-19 vaccine deliver via needle-free injection.

- In May 2021, Enesi pharma achieves key milestone in development of thermostable solid-dose live vaccines against Measles and Rubella and soon entering into clinical trials

Frequently Asked Questions (FAQ):

Which are the top industry players in the needle-free injection system market?

The prominent players in global needle-free injection market include PharmaJet (US), Portal Instruments (US), Medical International Technology, Inc (MIT) (US), NuGen Medical Devices (Canada), Crossject SA (US), and Bioject Medical Technologies (US).

What are the top trends in the needle-free injection system market?

Trends in needle-free injection system market:

- Jet-based needle-free injectors

- Liquid-based needle-free injectors

Which region is dominating in the needle-free injection system market?

On the basis of region, the needle-free injection system market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2020, North America accounted for the largest share of 58% of the needle-free injection market, followed by Europe, the Asia Pacific (APAC), Latin America, and the Middle East & Africa. However, the APAC region is expected to grow at the highest CAGR of 18.7% during the forecast period. The rapidly developing healthcare industry in China and India, growth in the aging population, rising life expectancy, rising per capita income, increasing investments in the region by key market players, the expansion of private-sector hospitals & clinics to rural areas, the availability of low-cost labor for manufacturing, the presence of a favorable regulatory environment, and growing demand for self-injectable devices testing are supporting market growth in the APAC region.

Which is the leading technology type in the needle-free injection system market?

On the basis of technology, the needle-free injection system market can be segmented into jet-based, spring-based, microarray patches and other injectors. In 2020, the jet-based needle-free injectors segment is expected to command the largest share of 67.4% of the global needle-free injection system devices market by technology. This segment is projected to reach USD 196 million by 2026 from USD 71 million in 2020, at a CAGR of 18.3% during the forecast period. The large share of this segment can be attributed to benefits associated with this technology, including rapid drug administration, improved dosage accuracy, better diffusion into the tissue, and a faster response rate.

Which is the leading end user of the needle-free injection system market?

Based on end users, the needle-free injection market is segmented into hospitals & clinics, home care settings, research laboratories, pharmaceutical and biotechnology companies, and other end users. The hospitals & clinics segment accounted for the largest market share of 61.0% in 2020. Factors such as technological advancements and an increase in demand for vaccination are driving the growth of the hospitals & clinics segment. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

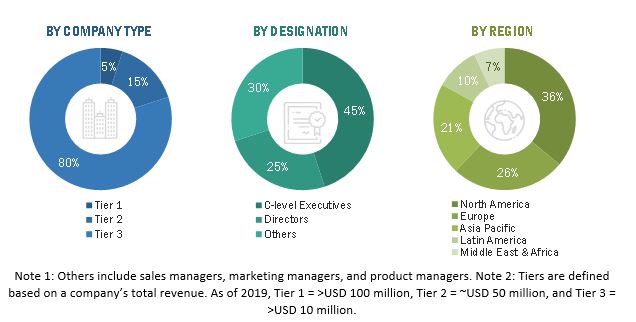

This study involved four major approaches in estimating the current needle-free injection system market size. Extensive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the value market. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved widespread secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the needle-free injection system market. It was also used to obtain important information about key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the needle-free injection system market. Primary sources from the demand side include personnel from hospitals, diagnostic labs, pharma companies, and food & beverage companies.

Breakdown of Primary Interviews

A breakdown of the primary respondents for needle-free injection system market (supply side) market is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the needle-free injectors was arrived at after data triangulation from four different approaches, as mentioned below.

Bottom-up Approach: Revenues of individual companies were gathered from public sources and databases. Shares of the needle-free injection businesses of leading players were gathered from secondary sources to the extent available. In certain cases, the share of the business unit was ascertained after a detailed analysis of various parameters, including product portfolio, market positioning, selling price, and geographic reach and strength. Individual shares or revenue estimates were validated through expert interviews.

Country level Analysis: The size of the needle-free injection system market was obtained from the annual presentations of leading players and secondary data available in the public domain. The share of kits & reagents in the overall needle-free injection system market was obtained from secondary data and validated by primary participants to arrive at the total needle-free injection system market. Primary participants further validated the numbers.

Primary Interviews: As a part of the primary research process, individual respondent insights on the market size and growth were taken during the interview (regional and global, as applicable). All the responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Geographic market assessment (by region & country): The geographic assessment was done using the following approaches:

Approach 1: Geographic revenue contributions/splits of leading players in the market (wherever available) and respective growth trends

Approach 2: Geographic adoption trends for individual product segments by end users and growth prospects for each of the segments (assumptions and indicative estimates validated from primary interviews)

At each point, the assumptions and approaches were validated through industry experts contacted during primary research. Considering the limitations of data available from secondary research, revenue estimates for individual companies (for the overall needle-free injection system market and geographic market assessment) were ascertained based on a detailed analysis of their respective product offerings, geographic reach/strength (direct or through distributors or suppliers), and the shares of the leading players in a particular region or country.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable.

Approach to derive the market size and estimate market growth

The market rankings for leading players were ascertained after a detailed assessment of their revenues from the needle-free injection business using secondary data available through paid and unpaid sources. Owing to data limitations, in certain cases, the revenue share was arrived at after a detailed assessment of the product portfolios of major companies and their respective sales performance. At each point, this data was validated through primary interviews with industry experts.

Objectives of the Study

- To define, describe, analyze, and forecast the needle-free injection system market by product, application, type, technology, site of delivery, end user, and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the needle-free injection system market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To strategically profile key players in the global needle-free injection system market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as product launches, expansions, acquisitions, partnerships, agreements, and other developments of leading players in the global needle-free injection system market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Further segmentation of individual product segments by application and end user

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific needle-free injection system market into South Korea, Australia, New Zealand, and others

- Further breakdown of the Rest of Europe needle-free injection system market into Belgium, Russia, the Netherlands, Switzerland, and others

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Needle-Free Injection System Market