NGS-based RNA-sequencing Market Size by Product & Services (Sample Preparation, Platforms & Consumables, Services, Data Analysis), Technology (SBS, SMRT, Nanopore), Application (De Novo, Epigenetics, small RNA), End-User, Region - Global Forecast to 2027

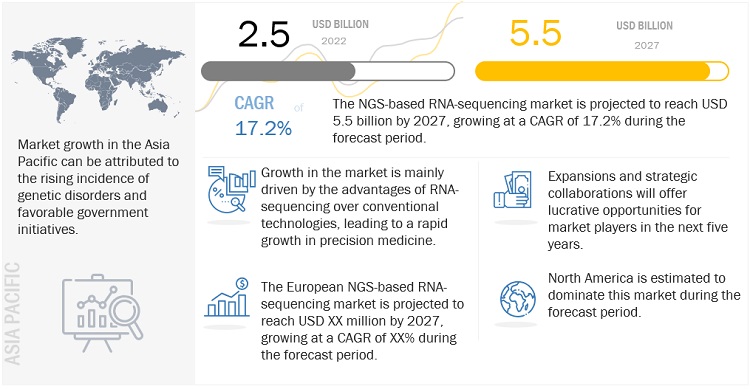

The global NGS-based RNA-sequencing market, stood at US$2.5 billion in 2022 and is projected to advance at a resilient CAGR of 17.2% from 2023 to 2027, culminating in a forecasted valuation of US$5.5 billion by the end of the period.

The key factors propelling the growth of this market are the advantages of RNA sequencing over conventional technologies, the decreasing costs of genome sequencing, increasing government funding to support genomics projects, growing research involving RNA sequencing, growing cancer cases, the increasing application of NGS in cancer research, and rapid growth in personalized medicine.

Attractive Opportunities in the NGS-based RNA-sequencing Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global NGS-based RNA-sequencing Market Dynamics

DRIVER: Decreasing costs of genome sequencing

In the last two decades, advances in genomics have resulted in a substantial reduction in the cost of genomic sequencing. For example, in 2019, the cost of whole human genome sequencing using Illumina’s technology was USD 1,000, compared to USD 14 million in 2008, and is expected to decline further in 2023. Pacific Biosciences of California provides human genome sequencing 10X coverage at ~USD 3,000 and 30X coverage at ~USD 10,000.

The cost of sequencing depends on the genome size, which varies from organism to organism. For instance, targeted sequencing is less expensive than whole-genome sequencing. Apart from genome size, data quality is another major factor associated with variations in the cost of sequencing. Sequencing cost also depends on the average number of times each base in the genome is actually “read” during the sequencing workflow. Due to the reduced costs, several companies are participating in RNA sequencing projects. The cost per raw megabase of RNA sequence has also declined in the last two decades. This has helped sequencing service providers to offer NGS-based RNA sequencing services at lower prices. Consequently, the application of these services is increasing with their affordability.

RESTRAINT: Standardization concerns of RNA-sequencing in diagnostic testing

A shift from research applications of RNA-sequencing to clinical diagnostic applications is expected due to the decreasing sequencing costs. Hence, there is a need to standardize tests to avoid discrepancies in understanding and studying reports of RNA-sequencing diagnostic applications. The US Food and Drug Administration (FDA) is working to establish regulations for RNA sequencing diagnostics to tackle uncertainties regarding the accuracy and reliability of NGS. The interpretation of RNA-sequencing data requires trained physicians as efficient RNA-sequencing data analysis is a critical factor for diagnosis. However, the complexity of NGS technologies and data presents significant challenges to its acceptance in clinical laboratory practices, quality measures, and compliance with regulatory and professional standards. There is a need to identify unmet gaps and processes for test validation, quality control, and quality assurance of NGS-based RNA-sequencing applications for clinical testing. Thus, the lack of standardization in RNA sequencing for diagnostic testing is expected to hamper the growth of the NGS-based RNA-sequencing market.

OPPORTUNITY: Adoption of blockchain technology and cloud computing

The adoption of blockchain technology in healthcare is still nascent. Still, it has a huge potential to transform the current healthcare industry, revolutionize public and private service delivery, and strengthen customer data transparency. The increasing adoption of Blockchain-as-a-Service (BaaS) with significant funding through venture capitalists and initial coin offerings (ICOs) creates growth opportunities. Companies such as Nebula Genomics (US) are working on projects to share genetic information available to researchers securely, and patients are expected to be paid for shared data. The UK-based EncrypGen did similar work in genomic data storage.

With advancements in life sciences and IT, bioinformatics is witnessing a new trend in cloud technology. Cloud computing can efficiently handle vast quantities of biological data generated by high-throughput experiments. Ongoing efforts in nanopore sequencing technology and cloud technology for bioinformatics involve developing a large variety of services from data storage, data acquisition, and data analysis, and accordingly developing utility-supplied cloud computing services delivered over the internet. Thus, future efforts in developing and commercializing novel services for blockchain and cloud technology are expected to offer growth opportunities in the NGS-based RNA-sequencing market.

CHALLENGE: Storage and interpretation of sequencing data

RNA-sequencing enables the quantitative and qualitative investigation of different RNAs, including microRNAs, messenger RNAs, small interfering RNAs, and long noncoding RNAs. The use of RNA sequencing has increased due to NGS, which yields readouts of billions of bases from a single instrument daily. As this sequencing data accumulates, standardization becomes difficult, due to which downstream computational analysis of RNA sequencing data remains complex and generates an enormous amount of data. The study and interpretation of complex data from NGS platforms pose a significant informatics challenge. The lack of automated methodologies and standardized procedures for analyzing this RNA sequencing data is a major hurdle in data interpretation. Although software solutions for data analysis are available, the demand for more efficient data management facilities has intensified. Furthermore, researchers working daily on these instruments must navigate the information provided by datasets. Hence, new data management tools and sufficient training of skilled professionals pose a major challenge for the NGS industry.

North America accounted for the largest share of the NGS-based RNA-sequencing industry

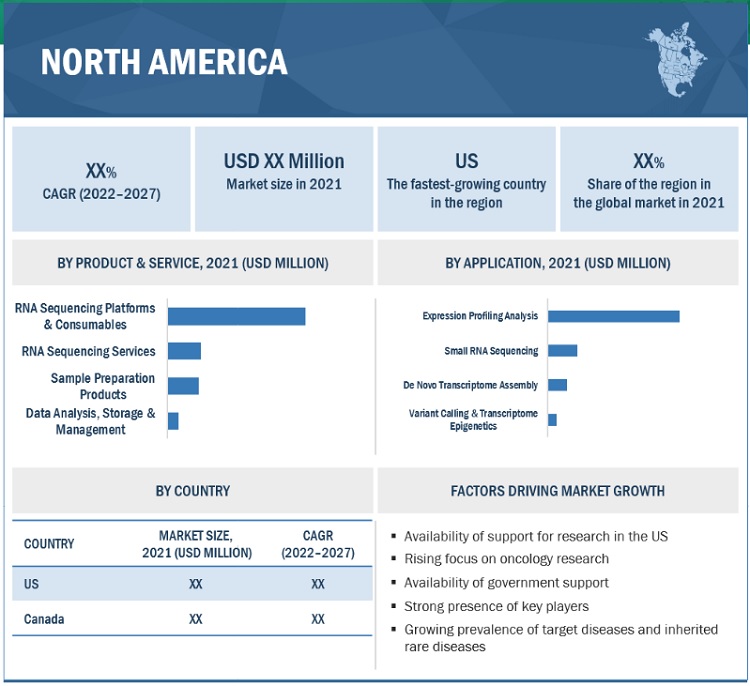

Geographically, the NGS-based RNA-sequencing market is segmented into North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America held the dominant share, followed by Europe. North America accounted for the largest share of the global market in 2021 owing to the availability of government support, advancements in RNA sequencing products, the growing prevalence of target diseases, growing research on cancer and inherited rare diseases, and the strong presence of key players in the region. However, the Asia Pacific market is projected to grow at the highest CAGR during the forecast period, owing to a significant focus on R&D, the decreasing costs of NGS products and services, and the increasing focus of major market players on strengthening their presence in the Asia Pacific.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the global NGS-based RNA-sequencing market are Illumina, Inc. (US), Thermo Fisher Scientific, Inc. (US), QIAGEN N.V. (Netherlands), PerkinElmer, Inc. (US), and Eurofins Scientific (UK).

Scope of the NGS-based RNA-sequencing Industry

|

Report Metrics |

Details |

|

Market Revenue in 2022 |

$2.5 billion |

|

Projected Revenue in 2027 |

$5.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 17.2% |

|

Market Driver |

Decreasing costs of genome sequencing |

|

Market Opportunity |

Adoption of blockchain technology and cloud computing |

This report categorizes the NGS-based RNA-sequencing market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

-

Sample Preparation Products

-

By Workflow

- Library Preparation and Target Enrichment

- Quality Control

-

By Method

- Manual Sample Preparation

- Microfluidic Sample Preparation

- Robotic Liquid Handling Sample Preparation

-

By Workflow

- RNA-sequencing Platforms and Consumables

- RNA-sequencing Services

- Data Analysis, Storage & Management

By Technology

- Sequencing by Synthesis

- Ion Semiconductor Sequencing

- Single-molecule Real-time Sequencing

- Nanopore Sequencing

By Application

- Expression Profiling Analysis

- Small RNA-sequencing

- De Novo Transcriptome Assembly

- Variant Calling and Transcriptome Epigenetics

By End User

- Research and Academia

- Hospitals and Clinics

- Pharmaceutical and Biotechnology Companies

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of NGS-based RNA-sequencing Industry

- In July 2022, Illumina Inc. (US) launched Illumina DRAGEN v4.0, an accurate and comprehensive secondary analysis platform.

- In January 2021, Oxford Nanopore Technologies collaborated with NVIDIA to integrate the NVIDIA DGX Station A100 into Oxford Nanopore’s ultra-high-throughput sequencing system, PromethION.

- In July 2019, Oxford Nanopore Technologies (UK) launched GridION for real-time, on-demand, long-read, direct DNA or RNA sequencing.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the NGS-based RNA-sequencing market?

The NGS-based RNA-sequencing market boasts a total revenue value of $5.5 billion by 2027.

What is the estimated growth rate (CAGR) of the NGS-based RNA-sequencing market?

The global market for NGS-based RNA-sequencing has an estimated compound annual growth rate (CAGR) of 17.2% and a revenue size in the region of $2.5 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Decreasing costs of genome sequencing- Advantages of RNA-sequencing over conventional technologies- Increasing government funding to support genomics projects- Growing research involving RNA-sequencing- Rising cancer cases and increasing applications of NGS in cancer research- Rapid growth in personalized medicine adoptionRESTRAINTS- Lack of qualified specialists- End-user budget constraints in developing countries- Standardization concerns of RNA-sequencing in diagnostic testingOPPORTUNITIES- Adoption of blockchain technology and cloud computingCHALLENGES- Storage and interpretation of sequencing data- Analysis of RNA-sequencing data to detect novel transcripts- Ethical issues and challenges in testing procedure

- 6.1 INTRODUCTION

-

6.2 RNA-SEQUENCING PLATFORMS & CONSUMABLESINCREASING AVAILABILITY OF PLATFORMS AND GROWING CONSUMABLE USAGE TO ENSURE GROWTH

-

6.3 SAMPLE PREPARATION PRODUCTSSAMPLE PREPARATION TO BE FIRST STEP OF NGS WORKFLOWSAMPLE PREPARATION PRODUCTS, BY WORKFLOW- Library preparation & target enrichment- Quality controlSAMPLE PREPARATION PRODUCTS, BY METHOD- Manual sample preparation- Microfluidic sample preparation- Robotic liquid handling sample preparation

-

6.4 RNA-SEQUENCING SERVICESINCREASING ADOPTION OF ADVANCED INFRASTRUCTURE AND EXPERTISE AMONG END USERS TO DRIVE DEMAND

-

6.5 DATA ANALYSIS, STORAGE & MANAGEMENTINTEGRATION OF CLOUD COMPUTING AND BIOINFORMATICS TO PROPEL MARKET

- 7.1 INTRODUCTION

-

7.2 SEQUENCING BY SYNTHESISSBS TECHNOLOGY TO ENABLE HIGHEST PRODUCTION OF BASE PAIRS WITHIN SHORTEST TIME

-

7.3 ION SEMICONDUCTOR SEQUENCINGION SEMICONDUCTOR SEQUENCING PLATFORMS TO POSSESS HIGH-THROUGHPUT CAPABILITIES

-

7.4 SINGLE-MOLECULE REAL-TIME SEQUENCINGSMRT SEQUENCING TO PRODUCE RESULTS IN SHORTER TIME AND LOWER COSTS

-

7.5 NANOPORE SEQUENCINGNANOPORE SEQUENCING TO POSSESS DIRECT RNA-SEQUENCING CAPABILITIES

- 8.1 INTRODUCTION

-

8.2 EXPRESSION PROFILING ANALYSISINCREASING NEED FOR IMPROVED PROGNOSIS OF PATIENTS TO PROPEL MARKET

-

8.3 SMALL RNA-SEQUENCINGRISING NEED FOR ACCURATE DIAGNOSTIC ANALYSIS TO SUPPORT MARKET

-

8.4 DE NOVO TRANSCRIPTOME ASSEMBLYINCREASING CANCER CASES TO DRIVE SEGMENT

-

8.5 VARIANT CALLING & TRANSCRIPTOME EPIGENETICSCOMPLICATED RNA SEQUENCE DATA ANALYSIS TO RESTRAIN SEGMENT

- 9.1 INTRODUCTION

-

9.2 RESEARCH & ACADEMIAINCREASING COLLABORATIONS WITH NGS PLAYERS AND RISING GOVERNMENT FUNDING TO PROPEL MARKET

-

9.3 HOSPITALS & CLINICSINCREASING ADOPTION OF NGS SYSTEMS TO DRIVE MARKET

-

9.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIESCONSOLIDATION WITH NGS PLAYERS FOR TARGET THERAPIES TO PROPEL MARKET

- 9.5 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- Favorable funding scenario and growing R&D activity to drive marketCANADA- Government initiatives for genome research to boost market

-

10.3 EUROPEGERMANY- Germany to dominate European market during forecast periodUK- Strong presence of NGS organizations and their initiatives to stimulate marketFRANCE- Growing awareness of high-throughput sequencing in genetic characterization to accelerate growthREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- Established players and favorable government initiatives to drive marketJAPAN- Growing awareness and rising incidence of genetic disorders to propel marketINDIA- Rising interest of companies for collaborations to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICABRAZIL- High HIV prevalence to drive demand for NGS in researchMEXICO- Economic growth and support for infrastructural development to propel marketREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICALACK OF INFRASTRUCTURE TO RESTRAIN MARKET

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

-

11.5 COMPETITIVE LEADERSHIP MAPPINGTERMINOLOGY/NOMENCLATURE- Visionary leaders- Innovators- Dynamic differentiators- Emerging companies

- 11.6 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSILLUMINA, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewQIAGEN N.V.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewPERKINELMER, INC.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEUROFINS SCIENTIFIC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewOXFORD NANOPORE TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developmentsAGILENT TECHNOLOGIES, INC.- Business overview- Products/Services/Solutions offeredBGI GROUP- Business overview- Products/Services/Solutions offered- Recent developmentsGENEWIZ (PART OF BROOKS AUTOMATION)- Business overview- Products/Services/Solutions offered- Recent developmentsHAMILTON COMPANY- Business overview- Products/Services/Solutions offeredNUGEN TECHNOLOGIES (PART OF TECAN TRADING AG)- Business overview- Products/Services/Solutions offeredPSOMAGEN (FORMERLY KNOWN AS MACROGEN)- Business overview- Products/Services/Solutions offeredF. HOFFMANN-LA ROCHE AG- Business overview- Products/Services/Solutions offered- Recent developmentsTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products/Services/Solutions offered- Recent developmentsTAKARA BIO, INC.- Business overview- Products/Services/Solutions offeredPACIFIC BIOSCIENCES- Business overview- Products/Services/Solutions offered

-

12.2 OTHER PLAYERSZYMO RESEARCHLUCIGEN CORPORATIONGENOTYPIC TECHNOLOGYOXFORD GENE TECHNOLOGY (PART OF SYSMEX)BECTON, DICKINSON AND COMPANY

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 AVAILABLE CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 CANCER INCIDENCE, 2020 VS. 2040

- TABLE 2 NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027 (USD MILLION)

- TABLE 3 RNA-SEQUENCING PLATFORMS & CONSUMABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 4 NORTH AMERICA: RNA-SEQUENCING PLATFORMS & CONSUMABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 5 EUROPE: RNA-SEQUENCING PLATFORMS & CONSUMABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 6 ASIA PACIFIC: RNA-SEQUENCING PLATFORMS & CONSUMABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 7 LATIN AMERICA: RNA-SEQUENCING PLATFORMS & CONSUMABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 8 SAMPLE PREPARATION PRODUCTS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 9 NORTH AMERICA: SAMPLE PREPARATION PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 10 EUROPE: SAMPLE PREPARATION PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 11 ASIA PACIFIC: SAMPLE PREPARATION PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 12 LATIN AMERICA: SAMPLE PREPARATION PRODUCTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 13 RNA-SEQUENCING SERVICES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 14 NORTH AMERICA: RNA-SEQUENCING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 15 EUROPE: RNA-SEQUENCING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 16 ASIA PACIFIC: RNA-SEQUENCING SERVICES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 17 LATIN AMERICA: RNA-SEQUENCING PLATFORMS & CONSUMABLES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 18 DATA ANALYSIS, STORAGE & MANAGEMENT MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 19 NORTH AMERICA: DATA ANALYSIS, STORAGE & MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 20 EUROPE: DATA ANALYSIS, STORAGE & MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 21 ASIA PACIFIC: DATA ANALYSIS, STORAGE & MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 22 LATIN AMERICA: DATA ANALYSIS, STORAGE & MANAGEMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 23 NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

- TABLE 24 SEQUENCING BY SYNTHESIS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 25 NORTH AMERICA: SEQUENCING BY SYNTHESIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 26 EUROPE: SEQUENCING BY SYNTHESIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 27 ASIA PACIFIC: SEQUENCING BY SYNTHESIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 28 LATIN AMERICA: SEQUENCING BY SYNTHESIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 29 ION SEMICONDUCTOR SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 30 NORTH AMERICA: ION SEMICONDUCTOR SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 31 EUROPE: ION SEMICONDUCTOR SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 32 ASIA PACIFIC: ION SEMICONDUCTOR SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 33 LATIN AMERICA: ION SEMICONDUCTOR SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 34 SINGLE-MOLECULE REAL-TIME SEQUENCING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 35 NORTH AMERICA: SINGLE-MOLECULE REAL-TIME SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 36 EUROPE: SINGLE-MOLECULE REAL-TIME SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 37 ASIA PACIFIC: SINGLE-MOLECULE REAL-TIME SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 38 LATIN AMERICA: SINGLE-MOLECULE REAL-TIME SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 39 NANOPORE SEQUENCING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 40 NORTH AMERICA: NANOPORE SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 41 EUROPE: NANOPORE SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 42 ASIA PACIFIC: NANOPORE SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 43 LATIN AMERICA: NANOPORE SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 44 NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 45 EXPRESSION PROFILING ANALYSIS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 46 NORTH AMERICA: EXPRESSION PROFILING ANALYSIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 47 EUROPE: EXPRESSION PROFILING ANALYSIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 48 ASIA PACIFIC: EXPRESSION PROFILING ANALYSIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 49 LATIN AMERICA: EXPRESSION PROFILING ANALYSIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 50 SMALL RNA-SEQUENCING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 51 NORTH AMERICA: SMALL RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 52 EUROPE: SMALL RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 53 ASIA PACIFIC: SMALL RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 54 LATIN AMERICA: SMALL RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 55 DE NOVO TRANSCRIPTOME ASSEMBLY MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 56 NORTH AMERICA: DE NOVO TRANSCRIPTOME ASSEMBLY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 57 EUROPE: DE NOVO TRANSCRIPTOME ASSEMBLY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 58 ASIA PACIFIC: DE NOVO TRANSCRIPTOME ASSEMBLY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 59 LATIN AMERICA: DE NOVO TRANSCRIPTOME ASSEMBLY MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 60 VARIANT CALLING & TRANSCRIPTOME EPIGENETICS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: VARIANT CALLING & TRANSCRIPTOME EPIGENETICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 62 EUROPE: VARIANT CALLING & TRANSCRIPTOME EPIGENETICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 63 ASIA PACIFIC: VARIANT CALLING & TRANSCRIPTOME EPIGENETICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 64 LATIN AMERICA: VARIANT CALLING & TRANSCRIPTOME EPIGENETICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 65 NGS-BASED RNA-SEQUENCING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 66 NGS-BASED RNA-SEQUENCING MARKET FOR RESEARCH & ACADEMIA, BY REGION, 2020–2027 (USD MILLION)

- TABLE 67 NGS-BASED RNA-SEQUENCING MARKET FOR HOSPITALS & CLINICS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 68 NGS-BASED RNA-SEQUENCING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 69 NGS-BASED RNA-SEQUENCING MARKET FOR OTHER END USERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 70 NGS-BASED RNA-SEQUENCING MARKET, BY REGION, 2020–2027(USD MILLION)

- TABLE 71 NORTH AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027(USD MILLION)

- TABLE 72 NORTH AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 73 NORTH AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 74 NORTH AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 75 NORTH AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY END USER, 2020–2027(USD MILLION)

- TABLE 76 US: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 77 US: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 78 US: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 79 CANADA: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 80 CANADA: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 81 CANADA: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 82 EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027(USD MILLION)

- TABLE 83 EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 84 EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 85 EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 86 EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY END USER, 2020–2027(USD MILLION)

- TABLE 87 GERMANY: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 88 GERMANY: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 89 GERMANY: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 90 UK: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 91 UK: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 92 UK: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 93 FRANCE: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 94 FRANCE: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 95 FRANCE: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 96 REST OF EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 97 REST OF EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 98 REST OF EUROPE: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 99 ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027(USD MILLION)

- TABLE 100 ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 101 ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 102 ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 103 ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY END USER, 2020–2027(USD MILLION)

- TABLE 104 CHINA: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 105 CHINA: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 106 CHINA: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 107 JAPAN: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 108 JAPAN: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 109 JAPAN: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 110 INDIA: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 111 INDIA: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 112 INDIA: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 113 REST OF ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 115 REST OF ASIA PACIFIC: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 116 LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY COUNTRY, 2020–2027(USD MILLION)

- TABLE 117 LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 118 LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 119 LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 120 LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY END USER, 2020–2027(USD MILLION)

- TABLE 121 BRAZIL: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 122 BRAZIL: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 123 BRAZIL: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 124 MEXICO: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 125 MEXICO: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 126 MEXICO: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 127 REST OF LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 128 REST OF LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 129 REST OF LATIN AMERICA: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2020–2027(USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2020–2027(USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2020–2027(USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: NGS-BASED RNA-SEQUENCING MARKET, BY END USER, 2020–2027(USD MILLION)

- TABLE 134 NGS-BASED RNA-SEQUENCING MARKET: DEGREE OF COMPETITION

- TABLE 135 NGS-BASED RNA-SEQUENCING MARKET: PRODUCT/SERVICE LAUNCHES

- TABLE 136 NGS-BASED RNA-SEQUENCING MARKET: DEALS

- TABLE 137 NGS-BASED RNA-SEQUENCING MARKET: OTHER DEVELOPMENTS

- TABLE 138 ILLUMINA, INC.: COMPANY OVERVIEW

- TABLE 139 ILLUMINA, INC.: PRODUCT LAUNCHES

- TABLE 140 ILLUMINA, INC.: DEALS

- TABLE 141 ILLUMINA, INC.: OTHER DEVELOPMENTS

- TABLE 142 QIAGEN N.V.: COMPANY OVERVIEW

- TABLE 143 QIAGEN N.V.: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 144 QIAGEN N.V.: DEALS

- TABLE 145 PERKINELMER, INC.: COMPANY OVERVIEW

- TABLE 146 PERKINELMER, INC.: PRODUCT LAUNCHES

- TABLE 147 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- TABLE 148 EUROFINS SCIENTIFIC: DEALS

- TABLE 149 OXFORD NANOPORE TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 150 OXFORD NANOPORE TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 151 OXFORD NANOPORE TECHNOLOGIES: DEALS

- TABLE 152 OXFORD NANOPORE TECHNOLOGIES: OTHER DEVELOPMENTS

- TABLE 153 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 154 BGI GROUP: COMPANY OVERVIEW

- TABLE 155 BGI GROUP: DEALS

- TABLE 156 GENEWIZ: COMPANY OVERVIEW

- TABLE 157 GENEWIZ: SERVICES LAUNCHED

- TABLE 158 HAMILTON COMPANY: COMPANY OVERVIEW

- TABLE 159 NUGEN TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 160 PSOMAGEN: COMPANY OVERVIEW

- TABLE 161 F. HOFFMANN-LA ROCHE AG: COMPANY OVERVIEW

- TABLE 162 F. HOFFMANN-LA ROCHE AG: DEALS

- TABLE 163 THERMO FISHER SCIENTIFIC, INC.: COMPANY OVERVIEW

- TABLE 164 THERMO FISHER SCIENTIFIC, INC.: DEALS

- TABLE 165 TAKARA BIO, INC.: COMPANY OVERVIEW

- TABLE 166 PACIFIC BIOSCIENCES: COMPANY OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARIES

- FIGURE 3 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 4 PRODUCT-BASED MARKET ESTIMATION

- FIGURE 5 APPLICATION-BASED MARKET ESTIMATION

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 STUDY ASSUMPTIONS

- FIGURE 8 NGS-BASED RNA-SEQUENCING MARKET, BY PRODUCT & SERVICE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 NGS-BASED RNA-SEQUENCING MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 NGS-BASED RNA-SEQUENCING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 NGS-BASED RNA-SEQUENCING MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 REGIONAL SNAPSHOT OF NGS-BASED RNA-SEQUENCING MARKET

- FIGURE 13 GROWING RESEARCH ACTIVITIES INVOLVING RNA-SEQUENCING TO DRIVE MARKET

- FIGURE 14 CHINA TO DOMINATE ASIA PACIFIC MARKET IN 2021

- FIGURE 15 CHINA TO WITNESS HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 16 NORTH AMERICA TO DOMINATE NGS-BASED RNA-SEQUENCING MARKET IN 2027

- FIGURE 17 NGS-BASED RNA-SEQUENCING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 COST OF HUMAN WHOLE-GENOME SEQUENCING, 2001–2021

- FIGURE 19 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 20 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 21 KEY DEVELOPMENTS IN NGS-BASED RNA-SEQUENCING MARKET, 2019–2022

- FIGURE 22 NGS-BASED RNA-SEQUENCING MARKET SHARE, BY KEY PLAYER, 2021

- FIGURE 24 NGS-BASED RNA-SEQUENCING MARKET, COMPETITIVE LEADERSHIP MAPPING, 2021 (OVERALL MARKET)

- FIGURE 25 NGS-BASED RNA-SEQUENCING MARKET, COMPETITIVE LEADERSHIP MAPPING, 2021 (SMES/START-UPS)

- FIGURE 26 ILLUMINA, INC.: COMPANY SNAPSHOT, 2021

- FIGURE 27 QIAGEN N.V.: COMPANY SNAPSHOT, 2021

- FIGURE 28 PERKINELMER, INC.: COMPANY SNAPSHOT, 2021

- FIGURE 29 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT, 2021

- FIGURE 30 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT, 2021

- FIGURE 31 F. HOFFMANN-LA ROCHE AG: COMPANY SNAPSHOT, 2021

- FIGURE 32 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT, 2021

- FIGURE 33 TAKARA BIO, INC.: COMPANY SNAPSHOT, 2021

- FIGURE 34 PACIFIC BIOSCIENCES: COMPANY SNAPSHOT, 2021

This study involved four major activities in estimating the current size of the NGS-based RNA-sequencing market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the NGS-based RNA-sequencing market. The secondary sources used for this study include the National Institutes of Health (NIH), the Biotechnology and Biological Science Research Council (BBSRC), GLOBOCAN, the Department of Biotechnology (DBT), National Human Genome Research Institute (NHGRI), The RNA Society, European Molecular Biology Laboratory (EMBL), World Bank, United States Food and Drug Administration (US FDA), Eurostat, Statistics Canada, Factiva, ScienceDirect, corporate filings such as annual reports, SEC filings, investor presentations, and financial statements, research journals, press releases, and trade and business professional associations, among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

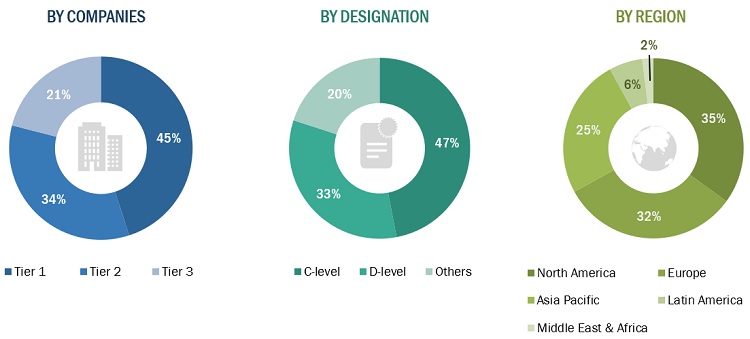

Primary Research

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the NGS-based RNA-sequencing market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the NGS-based RNA-sequencing business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global NGS-based RNA-sequencing market based on product & service, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the overall NGS-based RNA-sequencing market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- To strategically profile the key players and comprehensively analyze their product & service portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product and service launches, expansions, and R&D activities in the NGS-based RNA-sequencing market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in NGS-based RNA-sequencing Market