Liquid Handling System Market: Growth, Size, Share, and Trends

Liquid Handling System Market by Type (Automated, Electronic, Manual), Product (Pipettes, Consumables, Accessories, Software), Application (Drug Discovery, Genomics, Diagnostics, Proteomics, Food, Forensic, Environmental), End User, Region - Global Forecasts to 2030

OVERVIEW

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

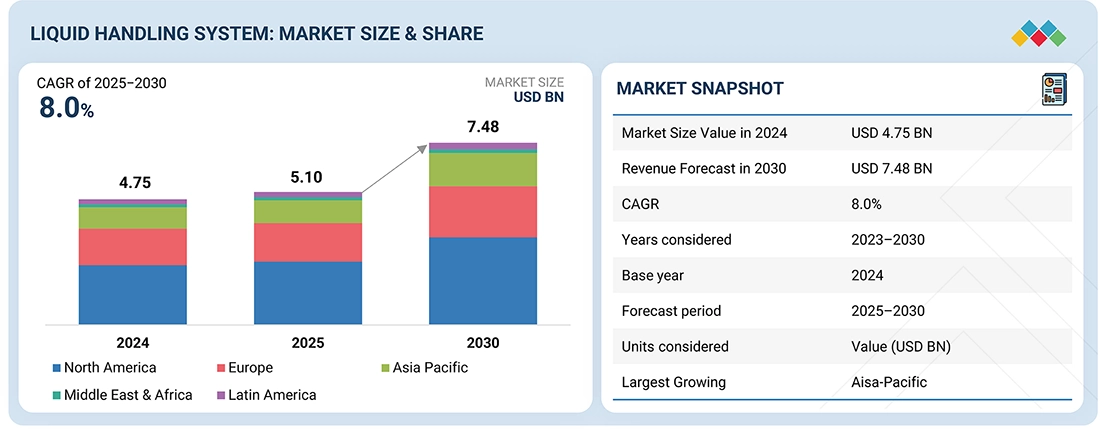

The liquid handling system market is projected to reach USD 7.4 billion by 2030 from USD 5.1 billion in 2025, at a CAGR of 8.0% from 2025 to 2030. The global liquid handling systems market is witnessing robust growth driven by increasing automation in laboratories, rising throughput requirements in genomics and proteomics research, and expanding biopharmaceutical R&D investments. Liquid handling systems—comprising automated, semi-automated, and manual solutions—play a critical role in sample preparation, assay setup, and compound management across diverse workflows in life sciences and analytical testing. As precision, reproducibility, and speed have become key performance benchmarks, laboratories are shifting toward advanced robotic and sensor-integrated pipetting systems. The market is expected to grow at a healthy pace through 2030, supported by the integration of AI-driven automation, IoT-enabled workflow monitoring, and the evolution of digital lab ecosystems.

KEY TAKEAWAYS

- North America accounted for 42.9% of the revenue share for liquid handling system market in 2024.

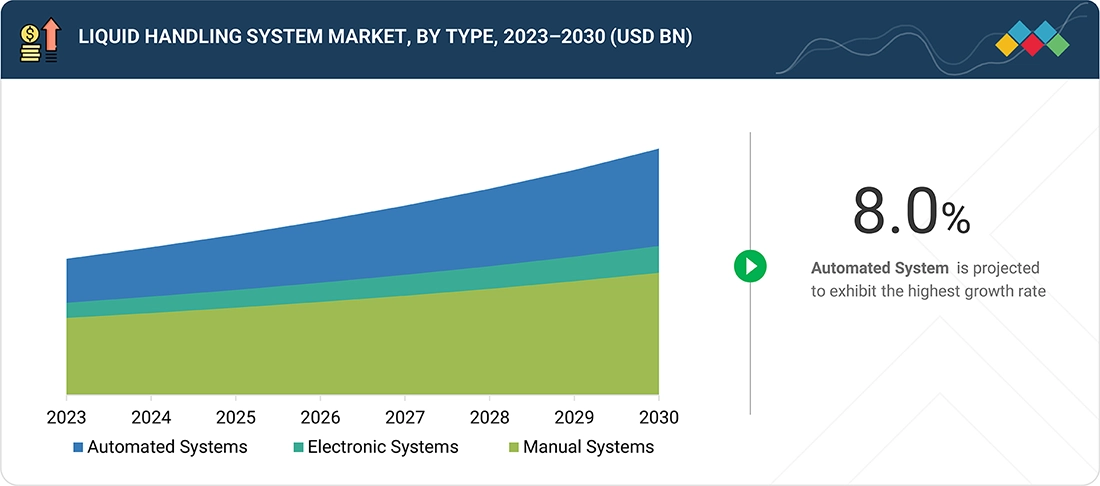

- By type, the automated systems segment is projected to record the highest CAGR of 9.0% during the forecast period from 2025 to 2030

- By product type, the pipettes segment captured a 33.5% revenue share in 2024.

- By application, the genomics application segment is projected to record the highest CAGR of 8.8% during the forecast period from 2025 to 2030

- By end users, the research and academic institutes segment is projected to lead the market, registering the highest CAGR of 8.9% during the forecast period from 2025 to 2030

- Thermo Fisher Scientific, Danaher, and Eppendorf were recognized as leading players in the liquid handling system market due to their substantial market share and broad product footprint.

- Metrohm AG, SPT Labtech Ltd., and Tomtec, among others, have set themselves apart among startups and SMEs by establishing strong positions in specialized niche areas, highlighting their potential as emerging market leaders.

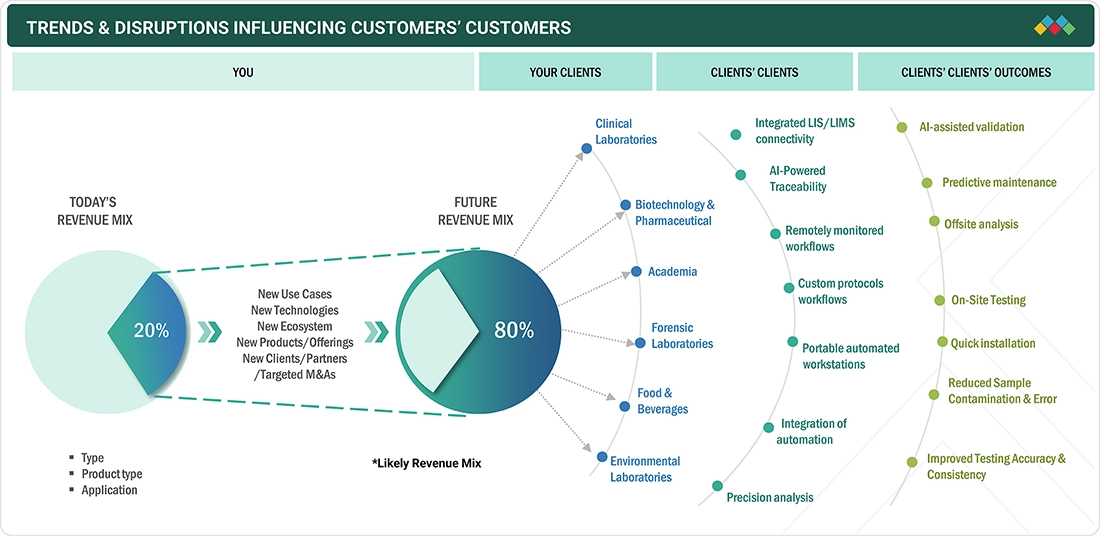

Recent market trends indicate a decisive movement toward smart, connected, and miniaturized liquid handling platforms. The adoption of automated liquid handlers with adaptive pipetting, low-volume dispensing, and contamination control capabilities has surged, particularly in next-generation sequencing (NGS) and high-throughput screening (HTS) workflows. Integration with Laboratory Information Management Systems (LIMS) and cloud-based analytics platforms is becoming a differentiator, enabling real-time traceability and predictive maintenance. Additionally, sustainability considerations—such as low-plastic consumables and energy-efficient systems—are influencing purchasing decisions across both academic and industrial laboratories.

TRENDS & DISRUPTIONS IMPACTING CUSTOMERS' CUSTOMERS

Customers in the life sciences and analytical testing sectors are experiencing major transformations driven by automation, digitalization, and regulatory compliance. The convergence of robotics and AI is revolutionizing how liquid handling operations are executed, allowing error-free, hands-free operations even in complex assays. The increasing demand for remote lab operation capabilities post-pandemic has accelerated investment in networked, automated liquid handling systems. Furthermore, the emergence of microfluidic liquid handling and acoustic dispensing is disrupting traditional pipetting by reducing reagent volumes, enhancing reproducibility, and enabling single-cell precision—offering significant cost and efficiency advantages to end users.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

MARKET DYNAMICS

Level

-

Growing demand for automated solution in drug discovery processes

-

Innovation in artificial intelligence and robotic systems

Level

-

High cost of liquid handling systems

-

Limited uptake of liquid handling systems in developing markets

Level

-

Growing healthcare spending across regions

-

Rising activities in pharma and biotech industries

Level

-

System integration issues

-

Lack of skilled workforce for operating advanced labs

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Driver: Growing demand for automated solution in drug discovery processes

Liquid handling is critical in drug discovery as it streamlines complex and repetitive tasks, enhances precision, and increases efficiency. Through the automation of high-throughput screening, researchers can rapidly test thousands of compounds, significantly accelerating the identification of promising drug candidates compared to traditional manual methods. Automation reduces human error, maintains experimental consistency, and supports robust data management and analysis. Given the complexity of molecular testing, biochemical assays, and genomic research, automation enables better handling of large datasets and optimizes workflows, ultimately shortening the drug development timeline. Automation also brings major benefits to other key areas of drug discovery and development, including target identification and compliance with regulatory standards. Leading companies, like Tecan Group, are at the forefront of advancing target discovery and hit identification through cutting-edge automation technologies. ArrayJet, for instance, leverages bioprinting to deposit proteins and compounds onto slides and microplates efficiently, minimizing sample usage and speeding up screening. Tecan also addresses automation challenges in cell-based models with end-to-end cellomics workflows integrating steps from cell seeding to imaging. These advancements highlight a significant evolution toward more efficient, reliable, and integrated automation solutions in the drug discovery process. For instance, Tecan Group, a Switzerland-based company, offers advanced liquid handling technologies through its end-to-end cellomics workflows. These solutions integrate cutting-edge instruments, such as single-cell dispensers, automated liquid handling workstations, and multimode plate readers to support fully automated processes. Designed to streamline drug discovery, the workflows enable seamless operations from cell seeding to live-cell imaging and analysis, enhancing efficiency and precision in cellular research

Restraint: Limited uptake of liquid handling systems in developing markets.

In developing regions, cost barriers significantly hinder the adoption of liquid handling automation systems. Although automation offers long-term gains in accuracy, productivity, and sample reliability, the financial burden associated with purchasing, deploying, and maintaining these systems remains substantial. Beyond the initial capital cost, laboratories face considerable ongoing expenses, including routine maintenance, hardware and software upgrades, replacement parts, and service contracts often representing 20–30% of the total cost of ownership and frequently surpassing the initial software investment. Training, system integration, and implementation activities add another ~15% to overall expenditure, further stretching already-tight operating budgets in emerging markets. Many small and mid-sized laboratories in developing regions operate with limited funding, restricted technology budgets, and dependence on government or institutional grants. As a result, they prioritize essential operational needs over capital-intensive automation. In addition, limited access to skilled operators and service engineers increases reliance on external technical support, adding to long-term expenses and creating downtime risks. Poor infrastructure, such as inconsistent power supply, also discourages investments in sensitive automated systems that require stable environments. Evaluating cost-efficiency is further complicated by the low penetration of automation in these regions. With fewer reference installations and limited real-world performance data, laboratories struggle to accurately forecast ROI and justify the upfront investment. Consequently, decision-makers adopt a cautious, risk-averse approach, delaying automation deployments until clear performance, cost-savings, and throughput benefits are demonstrated locally. This scarcity of proven outcomes, combined with budget limitations, insufficient technical expertise, and concerns over system reliability in resource-constrained settings, represents a key restraint to the uptake of liquid handling systems in developing markets

Opportunity: Growing healthcare spending across regions.

Emerging markets are poised to present substantial growth opportunities for manufacturers and distributors of liquid handling system products during the forecast period. This growth potential is largely driven by increased healthcare spending and ongoing enhancements in healthcare infrastructure across these regions. Notable examples include the following: 1) In the US, healthcare spending was estimated to have risen by 7.5% in 2023, reaching USD 4.8 trillion and outpacing the projected GDP growth rate of 6.1%, according to federal data published in June 2024. 2) Austria’s healthcare expenditure in 2023 was approximately USD 56.58 billion, accounting for 10.9% of its GDP, based on preliminary data from Statistics Austria released in June 2024. 3) The Asia Pacific region is projected to be the fastest-growing market in terms of healthcare spending. It is expected to contribute over 20% to global healthcare expenditures by 2030 (Source: Bain & Company, April 2024). 4) The Economic Survey 2023–24, presented by Union Finance Minister Nirmala Sitharaman, underscores that India’s robust economic growth is paralleled by notable social and institutional advancements, driven by effective government initiatives. Since FY16, social sector spending has consistently risen, with overall social welfare expenditure increasing at a compounded annual growth rate (CAGR) of 12.8% and health expenditure at 15.8% between FY18 and FY24. In the 2023–24 Budget Estimates, ?23.5 lakh crore (approximately USD 283.13 billion) is allocated for social services, with ?5.85 lakh crore (approximately USD 70.42 billion) designated for health. This marks a significant rise from ?11.39 lakh crore (approximately USD 137.23 billion) for social services and ?2.43 lakh crore (approximately USD 29.28 billion) for health in 2017–18. As a percentage of GDP, expenditure on social services grew from 6.7% in 2017–18 to 7.8% in 2023–24, while health expenditure increased from 1.4% to 1.9% over the same period. Within total expenditure, social services now comprise 26%, with health accounting for 6.5%.

Challenge: Lack of skilled workforce for operating advanced labs.

The effective use of life science and analytical technologies demands a high level of expertise and practical experience in areas such as high-throughput screening, compound weighing and dissolution, DNA/RNA purification, next-generation sequencing (NGS), PCR, and sample preparation. A lack of adequate knowledge and skills can lead to direct and indirect costs and increase researchers’ workload and time pressure. This skill gap often results in inefficient hands-on experience and limited understanding of the phenotypic implications derived from sequencing-based data. A research paper on NGS published by the National Center for Biotechnology Information (US) highlights the rising demand and adoption of NGS technologies in Australia, underscoring the urgent need for trained biologists to manage and interpret NGS data. This underlines the critical requirement for skilled professionals in method development, validation, operation, and troubleshooting processes. The shortage of such talent presents a significant obstacle to market expansion. There is a pronounced deficit of qualified personnel for these technical activities, which poses a challenge to the growth of the liquid handling system market. This lack of skilled labor, particularly in key regions, is anticipated to constrain the market’s full growth potential over the forecast period. Moreover, as laboratories in the pharmaceutical and biotechnology sectors increasingly work with smaller liquid volumes and complex multi-step processes like serial dilution and PCR, even a minor error such as a one-microliter variation—can critically impact results. These procedures are susceptible to volume discrepancies, making operator proficiency essential. The limited awareness especially in developing nations—contributes to this shortage of diverse and rewarding career paths available in the life sciences. These collective issues are expected to hamper the market’s growth in the coming years

liquid handling system market: COMMERCIAL USE CASES ACROSS INDUSTRIES

| COMPANY | USE CASE DESCRIPTION | BENEFITS |

|---|---|---|

|

Thermo Fisher excels in integrating automated liquid handling with high-content imaging, enabling seamless dispense-to-image workflows for advanced cell-based assays | Delivers up to ~90% time savings and higher throughput by automating cell-based workflows, combining precise liquid handling with integrated high-content imaging for faster, consistent results and reduced manual effort |

|

Danaher’s core strength in the liquid-handling market lies in high-throughput genomic, proteomic, and cellular workflow automation, enabling efficient NGS library prep, advanced sample processing, and large-volume dispensing for large-scale research and screening applications | Provides adaptable automation across miniaturized acoustic dispensing for reagent savings and reliable tip-based systems, enabling labs to scale throughput and workflows seamlessly as their demands increase |

|

Encore Multispan system, combining multispan pipetting and robotics to automate high-throughput sample prep, compound management, and screening workflows. | Delivers higher throughput and productivity through dual pipetting banks and extended-reach robotic arms, enabling seamless automation of both upstream and downstream workflow steps |

|

High-throughput, modular Fluent Automation Workstations, which seamlessly integrate advanced pipetting, detection, and handling capabilities across plates, tubes, and tips for scalable and versatile lab workflows | Delivers highly modular and configurable automation, with multi-arm systems that adapt to diverse labware, combine multiple pipetting technologies, and integrate detection tools enabling tailored, scalable workflows for varied research needs |

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET ECOSYSTEM

The liquid handling ecosystem comprises equipment manufacturers, consumable suppliers, automation software providers, system integrators, and end-user laboratories. Leading OEMs such as Thermo Fisher Scientific, Agilent Technologies, Hamilton Company, Eppendorf, and Beckman Coulter dominate the automated systems segment, while niche players focus on miniaturized and acoustic dispensing technologies. Partnerships between automation specialists and LIMS providers are shaping a connected ecosystem, enabling integrated data management and streamlined workflows across the laboratory value chain.

Logos and trademarks shown above are the property of their respective owners. Their use here is for informational and illustrative purposes only.

MARKET SEGMENTS

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

Liquid Handling System Market, By Type

Automated liquid handling systems account for the largest market share, driven by their ability to deliver high throughput, precision, and reproducibility in complex assays. These systems are increasingly deployed in genomics, proteomics, and drug screening laboratories, where manual or semi-automated approaches cannot meet scalability requirements. The integration of robotic arms, grippers, and vision-guided pipetting modules enhances workflow efficiency and minimizes contamination, making automation the preferred solution across high-volume laboratories.

Liquid Handling System Market, By Application

Drug discovery and development represent the largest application segment for liquid handling systems. The need for efficient compound management, accurate sample dispensing, and reproducible assay setup in pharmaceutical R&D has driven significant automation adoption. High-throughput screening campaigns and ADME-Tox studies rely heavily on precise liquid handling to ensure data reliability and cost efficiency. Additionally, the surge in genomic and cell-based research further reinforces the segment’s dominance.

Liquid Handling System Market, By End user

Pharmaceutical and biotechnology companies are the largest end users of liquid handling systems, accounting for a dominant market share. These organizations prioritize automation to enhance productivity, ensure compliance with GLP/GMP standards, and reduce human error across R&D and quality control workflows. Academic and research institutes follow closely, driven by government funding and the expansion of omics and translational research programs.

REGION

North America to be fastest-growing region in global aerospace materials market during forecast period

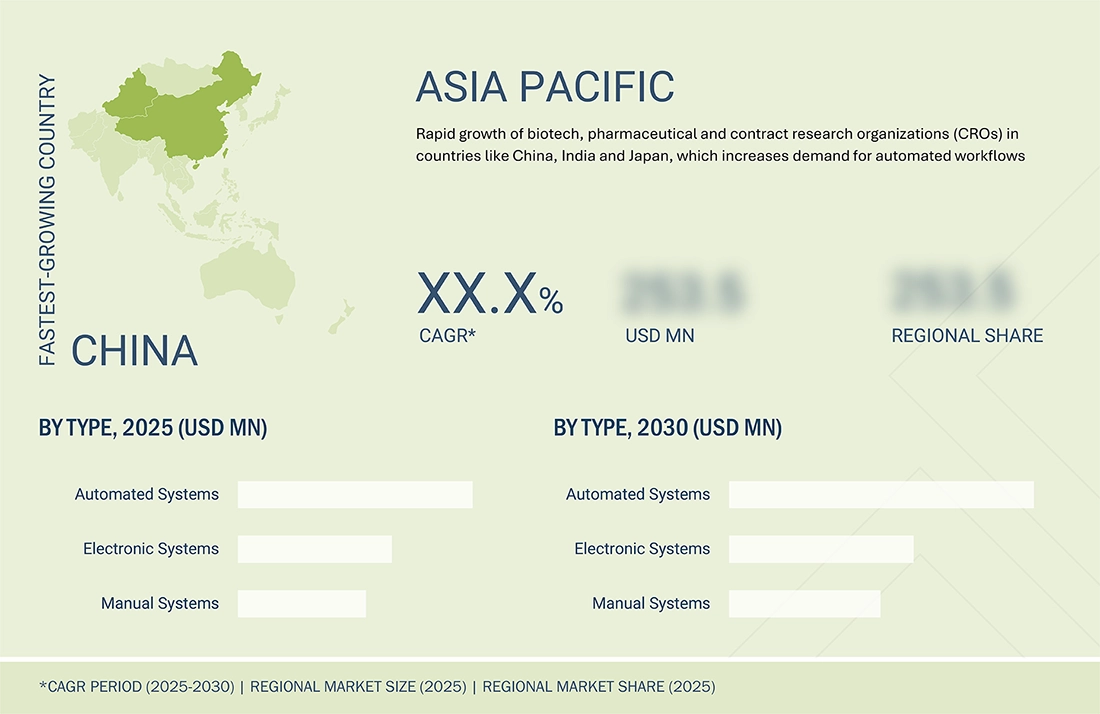

North America remains the largest market, supported by a well-established pharmaceutical and biotech sector, strong presence of key OEMs, and early adoption of automation technologies. The region’s focus on precision medicine, coupled with heavy investment in high-throughput labs and clinical diagnostics, sustains its leadership position. In contrast, the Asia-Pacific region is projected to witness the fastest growth due to increasing government support for research infrastructure, expanding biopharma manufacturing bases, and the rise of contract research and testing organizations in China, India, and South Korea. Growing awareness around lab automation efficiency and cost advantages is further accelerating regional demand.

liquid handling system market: COMPANY EVALUATION MATRIX

The competitive landscape is characterized by a mix of global leaders and innovative niche players focusing on next-generation automation technologies. Tier I players such as Thermo Fisher Scientific, Agilent Technologies, Hamilton Company, Tecan Group, Eppendorf, and PerkinElmer dominate with robust product portfolios and integrated workflow solutions. Tier II and emerging players like Opentrons, Andrew Alliance (Cytiva), and SPT Labtech are gaining traction through affordable robotic systems and open-source automation platforms. Competitive differentiation increasingly revolves around system modularity, software interoperability, AI integration, and sustainability in consumable design. Strategic collaborations, M&A activity, and digital workflow partnerships continue to reshape the competitive matrix, with vendors striving to offer end-to-end, data-driven lab automation ecosystems.

Source: Secondary Research, Interviews with Experts, MarketsandMarkets Analysis

KEY MARKET PLAYERS

MARKET SCOPE

| REPORT METRIC | DETAILS |

|---|---|

| Market Size in 2024 (Value) | USD 4.75 Billion |

| Market Forecast in 2030 (Value) | USD 7.48 Billion |

| Growth Rate | CAGR of 8.0% from 2025-2030 |

| Years Considered | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Report Coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments Covered |

|

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East & Africa |

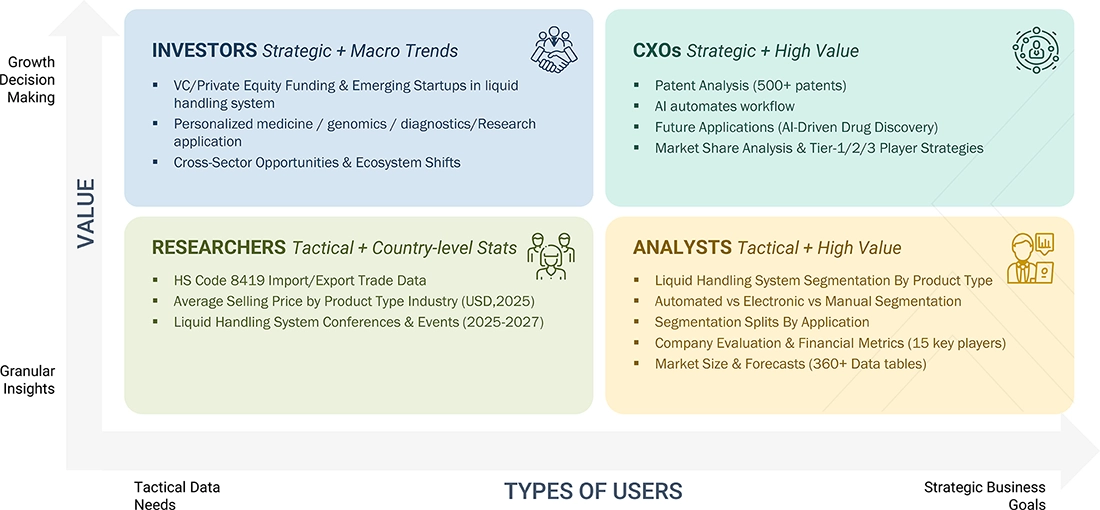

WHAT IS IN IT FOR YOU: liquid handling system market REPORT CONTENT GUIDE

DELIVERED CUSTOMIZATIONS

We have successfully delivered the following deep-dive customizations:

| CLIENT REQUEST | CUSTOMIZATION DELIVERED | VALUE ADDS |

|---|---|---|

| Leading Liquid handling OEM |

|

|

| Raw Material Supplier |

|

|

RECENT DEVELOPMENTS

- March 2024 : Agilent Technologies and the University of Vermont (UVM) announced the establishment of the Agilent Laboratory for Chemical Analysis for advanced instrumentation that will allow students, institutional colleagues, industrial partners, and regional high-tech start-ups to study the composition and structure of chemical samples

- June 2023 : Agilent Technologies Inc. launched the BioTek 406 FX Washer Dispenser, a compact device featuring both plate-washing and multifunctional reagent dispensing capabilities

- October 2023 : PerkinElmer Inc (US). launched its new Fontus Automated Liquid Handling Wor. Thermon at the 2023 AACC, accelerating NGS library preparation workflows

- October 2023 : PerkinElmer Inc (US) and Element Biosciences (US) announces a partnership to enhance next-generation sequencing research workflows.

- COLUMN 'A' SHOULD BE IN TEXT FORMAT AND NOT DATE FORMAT :

Table of Contents

Methodology

This research study extensively utilized secondary sources, directories, and databases to identify and gather valuable information for analyzing the global liquid handling systems market. Additionally, in-depth interviews were conducted with primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives from leading market players, and industry consultants. These interviews helped obtain and validate critical qualitative and quantitative data while assessing the market's growth prospects. The global market size, initially estimated through secondary research, was then refined and finalized through triangulation with insights from primary research.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the liquid handling system market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

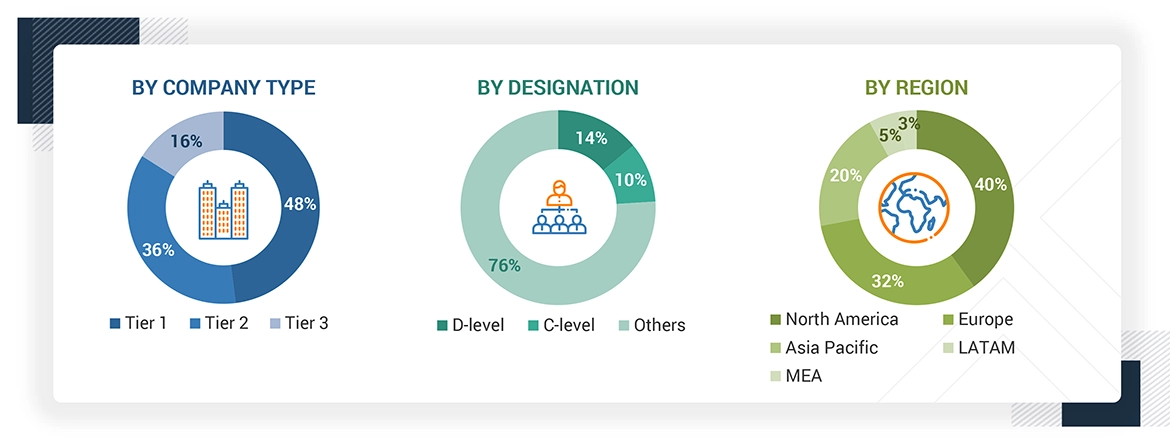

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the liquid handling systems market. The primary sources from the demand side included OEMs, private and contract testing organizations, and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights into key industry trends & key market dynamics.

The following is a breakdown of the primary respondents:

Note: LATAM stands for Latin America; MEA stands for Middle East & Africa

To know about the assumptions considered for the study, download the pdf brochure

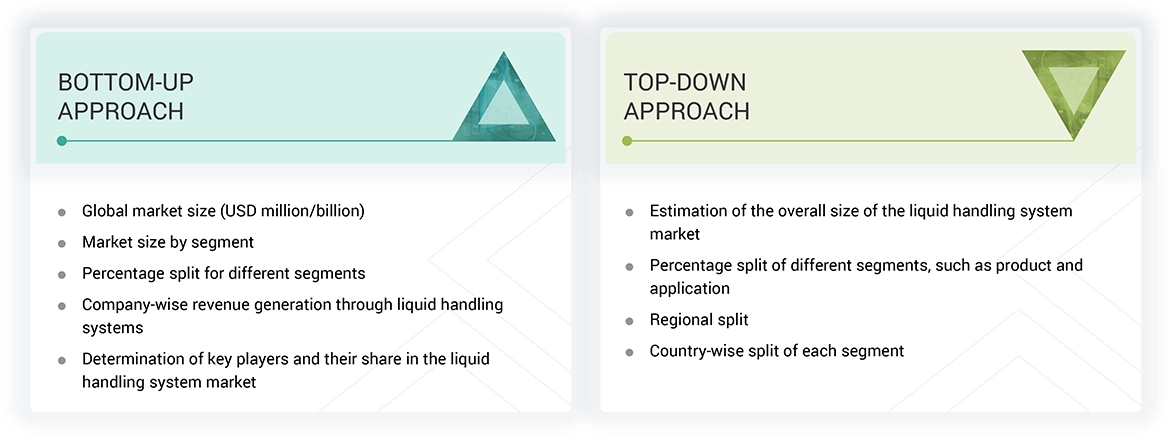

Market Size Estimation

The bottom-up approach was used to estimate and validate the total size of the liquid handling system market. It was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- A list of the major global players operating in the liquid handling system market

- Mapping annual revenues generated by major global players from the liquid handling systems segment (or nearest reported business unit/service category)

- Revenue mapping of key players to cover a major share of the global market as of 2024

- Extrapolating the global value of the liquid handling systems industry

Global Liquid Handling System Market Size: Bottom-up Approach and Top-down Approach

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Liquid handling systems are devices—automated, semi-automated, or manual—designed to accurately dispense and transfer liquids in laboratory environments. Commonly used in life sciences, chemical analysis, and drug discovery labs, these systems facilitate the precise movement of fluids into target containers or solutions. They play a critical role in supporting downstream applications such as next-generation sequencing (NGS), mass spectrometry, cell analysis, flow cytometry, epigenetics, and genetics.

Stakeholders

- Transfection products manufacturing companies

- Pharmaceutical & Biopharmaceutical Companies

- Chemical Companies

- Biopharmaceutical Companies

- Contract Research Organizations (CROs)

- Contract Development and Manufacturing Organizations (CDMOs)

- Research Institutes and Universities

- Venture Capitalists & Investors

- Government Associations

Report Objectives

- To define, describe, and forecast the liquid handling system market based on type, product type, application, end users, and region

- To provide detailed information regarding the major factors influencing the growth potential of the market (drivers, restraints, opportunities, challenges, and trends)

- To analyze the micro markets with respect to individual growth trends, prospects, and contributions to the market

- To analyze key growth opportunities in the market for key stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of market segments and/or subsegments with respect to five major regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the market, such as agreements, expansions, and mergers & acquisitions

Frequently Asked Questions (FAQ)

What is the estimated market value of the global liquid handling system market?

The global liquid handling system market is estimated at USD 5.1 billion in 2025.

What is the CAGR of the global liquid handling system market for the next five years?

The global liquid handling system market is projected to grow at a CAGR of 8.0% from 2025 to 2030.

Which product segment of the liquid handling system market is projected to witness the fastest growth?

The pipettes segment is projected to grow at the highest CAGR during the forecast period.

What are the major revenue pockets in the liquid handling system market currently?

The Asia Pacific market is projected to experience the highest CAGR, driven by increased R&D investment, emphasis on cancer research, and growth in pharmaceutical research outsourcing.

Which end user segment is likely to show the highest growth in the liquid handling system market?

Hospitals & diagnostic laboratories are expected to grow at the highest rate in the liquid handling system market by end user.

Need a Tailored Report?

Customize this report to your needs

Get 10% FREE Customization

Customize This ReportPersonalize This Research

- Triangulate with your Own Data

- Get Data as per your Format and Definition

- Gain a Deeper Dive on a Specific Application, Geography, Customer or Competitor

- Any level of Personalization

Let Us Help You

- What are the Known and Unknown Adjacencies Impacting the Liquid Handling System Market

- What will your New Revenue Sources be?

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- Get a Scorecard for Target Partners

Custom Market Research Services

We Will Customise The Research For You, In Case The Report Listed Above Does Not Meet With Your Requirements

Get 10% Free CustomisationGrowth opportunities and latent adjacency in Liquid Handling System Market

GILHO

Nov, 2019

Flow sensor of Liquid Handling System .