Offshore Decommissioning Market by Service (Well Plugging & Abandonment, Platform Removal, Conductor Removal) Depth (Shallow, Deepwater) Structure (Topsides, Substructure) Removal (Leave in Place, Partial, Complete), and Region - Global Forecast to 2027

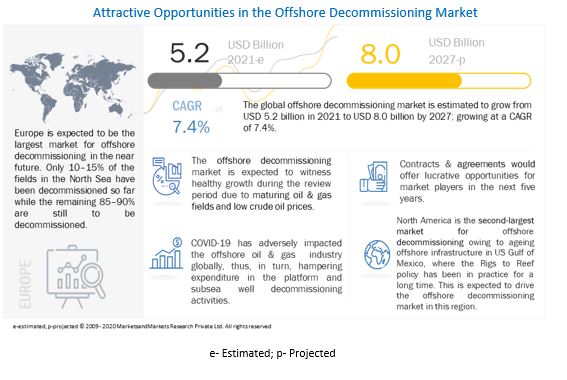

[254 Pages Report] The global offshore decommissioning market size was valued at $5.2 billion in 2021 and to reach $8.0 billion by 2027, growing at a compound annual growth rate (CAGR) of 7.4% from 2021 to 2027. This growth is attributed to increasing focus on mature oil and gas fields and aging offshore platforms, particularly in shallow water

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Offshore Decommissioning Market

The COVID-19 pandemic has adversely affected the growth of the oil & gas industry globally. Oil & gas companies worldwide had to shut down their manufacturing facilities and services as countries practiced partial or full lockdown measures to deal with the pandemic. Offshore decommissioning companies with international footprints have also had to work around inter-country travel and quarantine restrictions, which have forced crewmembers to overstay hitches for extended periods. The impact of COVID-19 on crude oil prices, offshore decommissioning activities, as well as on the supply chain has been analyzed in this report.

Offshore Decommissioning Market Dynamics

Driver: Growing number of abandoned wells and presence of large mature offshore oilfields worldwide

When a well reaches the end of its lifetime, it must be permanently plugged and abandoned. Such plug & abandoned (P&A) operations involve placing several cement plugs in the wellbore to isolate the reservoir and other fluid-bearing formations. The number of wells that need to be permanently plugged and abandoned, especially in mature, offshore areas such as the North Sea and the Gulf of Mexico is rapidly increasing. According to Oil & Gas UK, in Decommissioning insight 2019, overall, 2,624 wells are expected to be decommissioned in the North Sea during 2019–2028. Furthermore, increasing government focus on well plug & abandonment activities is driving the market for offshore decommissioning services. For instance, in April 2021, the US House of Representatives Democrat introduced a bill authorizing USD 8 billion to plug and clean up abandoned oil wells nationwide, a measure aimed at creating jobs for oil and gas workers and reducing climate-warming emissions. Thus, increasing need for well plugging & abandonment is driving the market for offshore decommissioning market.

Restraint: High cost associated with offshore decommissioning processes

Platforms may be similar in characteristics and configuration, but the cost of decommissioning them can differ significantly depending on the location, climate, and regulations. Decommissioning is a complex task requiring multiple equipment and skilled operators. An oilfield helps a company generate revenue during its hydrocarbon production phase. However, decommissioning operations are performed on oilfields, which have become a liability to the company. Decommissioning oil and gas installations are expensive. Although worldwide estimates vary greatly, on average, removing a complete platform in shallow waters such as in the Gulf of Mexico may cost USD 15 million to USD 20 million. Removing structures from deep water, as in the North Sea, could cost between £30 million for smaller platforms and £200 million for larger structures, according to the trade association Oil and Gas UK.

Opportunities: Aging offshore infrastructures, especially in North Sea and Gulf of Mexico

The process of crude oil & gas extraction requires a significant amount of infrastructure. Onshore projects require relatively less infrastructure than their offshore counterparts. Installing these infrastructure elements such as pipelines, platforms, rigs, and conductors is one of the most complex processes of oil & gas production. More than 7,500 offshore oil and gas platforms in 53 countries will become obsolete in the next few decades, with the eventual removal of rapidly growing infrastructure a looming issue. This is expected to create an opportunity for offshore decommissioning market.

Challenges: Growing adoption of technologies to increase production from mature fields

Oil & gas fields work in two phases, primary and secondary. Under the primary lifecycle, an oilfield produces crude oil or gas under natural reservoir pressure. However, during the second phase of a well, artificial aid, including enhanced oil recovery, injecting water/gas, and polymer insertion are needed for increased production. EOR can reverse the decline of mature fields and increase the overall percentage recovered. In a few fields, recovery rates are greater than 60%. According to IEA, between 2025 and 2040, the total production using the EOR technology is estimated to grow from 2.7 mb/d to more than 4.5 mb/d, and it is expected to account for about 4% of the global production in 2040. This acts as a major challenge offshore decommissioning market.

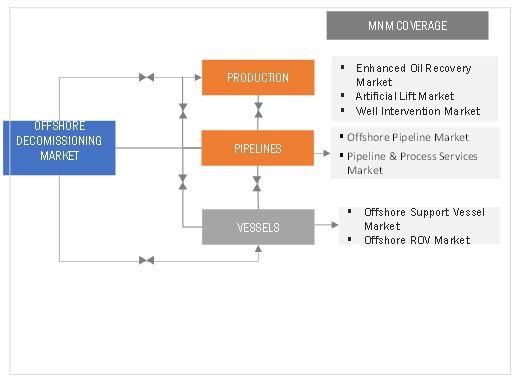

Market Interconnection

The well plugging & abandonment is expected to be the largest contributor to the offshore decommissioning market, by service, during the forecast period

The market is segmented, by service, project management, engineering, and planning, permitting and regulatory compliance, platform preparation, well plugging and abandonment, conductor removal, mobilization and demobilization of derrick barges, platform removal, pipeline and power cable decommissioning, materials disposal, and site clearance.

The well plugging & abandonment segment accounted for the largest market share in 2020, driven by demand from the European market. Well plugging & abandonment accounts for up to 49% of the total decommissioning cost of a project.

The shallow water is expected to be the fastest-growing market during the forecast period

The offshore decommissioning market, by depth, is segmented based on the depth at which decommissioning projects happens, into shallow water and deepwater. The shallow water segment was the largest market and is projected to maintain its edge over the deepwater segment owing to its lower operational costs. However, in the future, the deepwater segment would compete with shallow water as many platform installations now are at deepwater and ultra-deepwater depths.

The topside segment is expected to be the fastest-growing market for the offshore decommissioning market, by structure, during the forecast period

The market has been categorized, based on the topside, substructure, and subsea infrastructure. Topsides comprise the largest share, by weight, of an offshore platform and the decommissioning of topsides and related equipment requires specialized heavy lift vessels and removal equipment. Thus, the market for topsides constitutes the largest segment of the market, by structure.

The complete removal activity is expected to be the largest contributor to the offshore decommissioning market, by removal, during the forecast period

The offshore decommissioning industry is segmented, by removal, partial, leave in place, and complete. The stringent regulations for complete offshore platform removal to restore the marine life and seafloor to its pre-production conditions is expected to drive the market, by removal

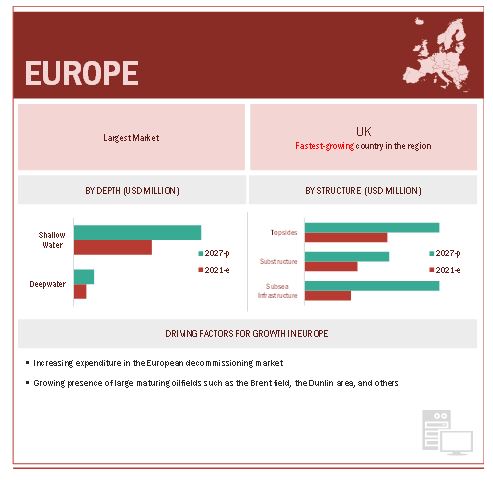

Europe is expected to be the largest market during the forecast period

In this report, the offshore decommissioning market has been categorized, based on region, into North America, Europe, Asia Pacific, the Middle East & Africa, and South America. The European market led the offshore decommissioning industry, with the largest market share during the forecast period In Europe, over 950,000 tons of topsides are scheduled for removal across the North Sea, out of which more than 605,000 tons will be from UKCS. The UK is expected to spend about EUR 15.3 billion on decommissioning, over the next ten years. Approximately, 2,400 wells are expected to be decommissioned across the whole North Sea and West of the Shetland region, by 2027. The market in North America will also play an important role in driving demand for offshore decommissioning. North America is the biggest market in terms of the number of platforms decommissioned per year. Most offshore decommissioning takes place in the US Gulf of Mexico, where the Rigs to Reef policy has been in practice for a long time.

Key Market Players

The key players profiled in this report are Heerema Marine Contractors (The Netherlands), Royal Boskalis Westminster N.V. (The Netherlands), Petrofac (Jersey), Oceaneering International (US), Baker Hughes Company (US), Halliburton (US), and Schlumberger (US). Between 2017 and 2021, the companies adopted growth strategies such as contracts & agreements, partnerships, collaborations, alliances & joint ventures to capture a larger share of the offshore decommissioning market.

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Service, Structure, Depth, Removal, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and South America |

|

Companies covered |

Aker Solutions (Norway), Ramboll Group (Denmark), AF Gruppen (Norway), TechniFMC (France), John Wood Group Plc (U.K.), Heerema Marine Contractors (The Netherlands), Royal Boskalis Westminster N.V. (The Netherlands), Petrofac (Jersey), Oceaneering International (US), Baker Hughes Company (US), Halliburton (US), Schlumberger (US), Weatherford (US), Subsea7 (UK), DeepOcean Group (Norway), Perenco (UK), Saipem (Italy), DNV GL (Norway), Allseas Group (Switzerland), Acteon Group (UK), Maersk Decom (Denmark), Able UK (UK), Enermech (UK), Mactech Offshore (US), and Linch-Pin Offshore (Australia)

|

This research report categorizes the Offshore Decommissioning market by service, structure, depth, removal, and region.

On the basis of by service type, the market has been segmented as follows:

- Project management, engineering & planning

- Permitting & regulatory compliance

- Platform preparation

- Well plugging & abandonment

- Conductor removal

- Mobilization & demobilization of derrick barges

- Platform removal

- Pipeline & power cable decommissioning

- Materials disposal

- Site clearance

On the basis of by removal, the market has been segmented as follows:

- Leave in place

- Partial

- Complete

On the basis of by depth, the market has been segmented as follows:

- Shallow water

- Deepwater

On the basis of by structure, the market has been segmented as follows:

- Topside

- Substructure

- Subsea infrastructure

On the basis of region, the market has been segmented as follows:

- Europe

- North America

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In May 2021, Heerema Marine Contractors and AF Offshore Decom have commenced one of the largest topside removal projects of its kind in the North Sea on behalf of TAQA. The Brae Bravo removal campaign is the first major asset removal project for TAQA, and as a late-life asset operator in the UK, safety and environmental impact principles are at the center of the project for TAQA and its partners

- In March 2021, Aker Solutions has signed an agreement with Heerema Marine Contractors for decommissioning to the Heimdal and Veslefrikk fields, offshore Norway. The scope includes the reception, dismantling, and recycling of three offshore installations from the Heimdal and Veslefrikk fields.

- In February 2021, Saipem was awarded a contract by Qatargas a contract for the offshore development of the North Field Production sustainability project. The scope includes the engineering, procurement, construction, and installation of various offshore facilities.

- In January 2021, Boskalis acquired all the shares of the subsea services business of Rever Offshores. Through this acquisition, Boskalis strengthens its current position in the subsea services market in Northwest Europe, Africa, and the Middle East. It has capabilities to serve both the traditional oil & gas market and the rapidly expanding offshore wind market.

- In June 2021, Baker Hughes opened a multimodal facility (MMF) for oil and gas in Luanda, Angola. The facility delivers a suite of products and services across the oil and gas value chain. It will serve as a hub to support customers and projects in Angola and Southern Africa and will also serve customers globally.

Frequently Asked Questions (FAQ):

What is the current size of the offshore decommissioning market?

The current market size of global offshore decommissioning market is 4.7 billion in 2020.

What is the major drivers for the offshore decommissioning market?

The growth of the offshore decommissioning market can be attributed to increasing focus on mature oil and gas fields and aging offshore platforms, particularly in shallow water.

Which is the fastest-growing region during the forecasted period in offshore decommissioning market?

Asia Pacific is the fastest-growing region during the forecasted period. The Asia Pacific region is a newer region in terms of oil and gas, thus providing an opportunity for offshore decommissioning. In a long-term forecast, it is expected to invest between USD 30 billion and USD 60 billion. Approximately 2,600 platforms and 35,000 wells, with up to 600 fields are ceasing production in the next 10 years.

Which is the fastest growing segment, by service type during the forecasted period in offshore decommissioning market?

The well plugging & abandonment segment is the fastest-growing market during the forecasted period. The demand is primarily driven by European market. Well plugging & abandonment accounts for up to 49% of the total decommissioning cost of a project. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 OFFSHORE DECOMMISSIONING MARKET, BY DEPTH: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 GEOGRAPHICAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.2 PRIMARY DATA

2.2.2.1 Key industry insights

2.2.2.2 Breakdown of primaries

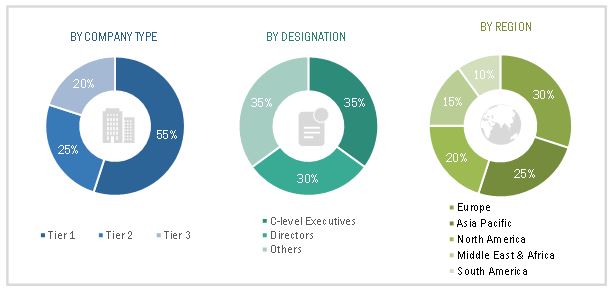

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, & REGION

2.3 IMPACT OF COVID-19 ON OIL & GAS INDUSTRY

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.5 DEMAND-SIDE METRICS

FIGURE 6 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR OFFSHORE DECOMMISSIONING

TABLE 1 NUMBER OF DECOMMISSIONING APPROVALS AND PROJECT COSTS ARE DETERMINING FACTORS FOR GLOBAL MARKET

FIGURE 7 MARKET SIZE ESTIMATION: DEMAND-SIDE METRICS APPROACH

2.5.1 RESEARCH ASSUMPTIONS FOR DEMAND-SIDE METRICS

2.6 SUPPLY-SIDE ANALYSIS

FIGURE 8 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF OFFSHORE DECOMMISSIONING SERVICES

FIGURE 9 MARKET: SUPPLY-SIDE ANALYSIS, 2020

2.6.1 CALCULATIONS FOR SUPPLY SIDE

2.6.2 ASSUMPTIONS FOR SUPPLY SIDE

2.6.2.1 Key primary insights for supply side

2.7 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 52)

TABLE 2 OFFSHORE DECOMMISSIONING MARKET SNAPSHOT

FIGURE 10 EUROPE DOMINATED OFFSHORE DECOMMISSIONING MARKET(BY VALUE) IN 2020

FIGURE 11 WELL PLUGGING & ABANDONMENT SEGMENT IS EXPECTED TO HOLD LARGEST SHARE OF MARKET, BY SERVICE, DURING FORECAST PERIOD

FIGURE 12 TOPSIDES SEGMENT IS EXPECTED TO HOLD LARGEST SHARE OF MARKET, BY STRUCTURE, DURING FORECAST PERIOD

FIGURE 13 SHALLOW WATER SEGMENT IS EXPECTED TO LEAD MARKET, BY DEPTH, DURING FORECAST PERIOD

FIGURE 14 COMPLETE REMOVAL SEGMENT IS EXPECTED TO LEAD MARKET, BY REMOVAL, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE OPPORTUNITIES IN OFFSHORE DECOMMISSIONING MARKET

FIGURE 15 MATURING OIL & GAS FIELDS, AND LOW CRUDE OIL PRICES TO DRIVE GROWTH OF MARKET, 2021–2027

4.2 MARKET, BY REGION

FIGURE 16 MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY SERVICE

FIGURE 17 WELL PLUGGING & ABANDONMENT SEGMENT DOMINATED MARKET IN 2020

4.4 MARKET, BY STRUCTURE

FIGURE 18 TOPSIDES SEGMENT DOMINATED MARKET, BY STRUCTURE, IN 2020

4.5 MARKET, BY DEPTH

FIGURE 19 SHALLOW WATER SEGMENT DOMINATED MARKET IN 2020

4.6 MARKET, BY REMOVAL

FIGURE 20 COMPLETE REMOVAL DOMINATED MARKET, BY REMOVAL, IN 2020

4.7 MARKET IN EUROPE, BY STRUCTURE & COUNTRY

FIGURE 21 TOPSIDES AND UK WERE LARGEST SHAREHOLDERS IN MARKET IN EUROPE, BY STRUCTURE AND COUNTRY, IN 2020

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 22 COVID-19 GLOBAL PROPAGATION

FIGURE 23 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 24 RECOVERY ROAD FOR 2020 & 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 25 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 26 OFFSHORE DECOMMISSIONING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Growing number of abandoned wells and presence of large mature offshore oilfields worldwide

FIGURE 27 WELL DECOMMISSIONING ACTIVITIES IN NORTH SEA, 2020 TO 2029

FIGURE 28 DECLINE RATES OF MATURE NON-OPEC FIELDS, 2000–2019

5.5.1.2 Fluctuations in oil prices boost offshore decommissioning activities

FIGURE 29 WEST TEXAS INTERMEDIATE (WTI) CRUDE OIL PRICES, JANUARY 2018–MARCH 2021

5.5.2 RESTRAINTS

5.5.2.1 High cost associated with offshore decommissioning processes

5.5.2.2 Lack of skilled workers in developing countries

5.5.2.3 Environmental concerns associated with offshore decommissioning

5.5.3 OPPORTUNITIES

5.5.3.1 Aging offshore infrastructures, especially in North Sea and Gulf of Mexico

FIGURE 30 ANNUAL AVERAGE DECOMMISSIONING NEED FOR OFFSHORE OIL AND GAS ASSETS, BY REGION, 2000–2040

5.5.3.2 Deepwater discovery and development in offshore areas

5.5.4 CHALLENGES

5.5.4.1 Growing adoption of technologies to increase production from mature fields

5.5.4.2 Impact of COVID-19 on offshore decommissioning spending

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN OFFSHORE DECOMMISSIONING MARKET

FIGURE 31 REVENUE SHIFT OF OFFSHORE DECOMMISSIONING PROVIDERS

5.7 SUPPLY CHAIN OVERVIEW

FIGURE 32 MARKET: SUPPLY CHAIN

TABLE 3 MARKET: SUPPLY CHAIN/ECOSYSTEM

5.7.1 KEY INFLUENCERS

5.7.1.1 EPC companies

5.7.1.2 Service Providers

5.7.1.3 Operators

5.8 MARKET MAP

FIGURE 33 OFFSHORE DECOMMISSIONING MARKET MAP

5.9 TECHNOLOGY ANALYSIS

5.10 PATENT ANALYSIS

5.10.1 LIST OF MAJOR PATENTS

5.11 MARKET: REGULATIONS

TABLE 4 REGULATORY LANDSCAPE

5.12 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS FOR OFFSHORE DECOMMISSIONING MARKET

TABLE 5 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.12.1 THREAT OF SUBSTITUTES

5.12.2 BARGAINING POWER OF SUPPLIERS

5.12.3 BARGAINING POWER OF BUYERS

5.12.4 THREAT OF NEW ENTRANTS

5.12.5 INTENSITY OF COMPETITIVE RIVALRY

5.13 CASE STUDY ANALYSIS

5.13.1 OCEANEERING PROVIDED DECOMMISSIONING SUPPORT FOR FIELD REDEVELOPMENT IN PERSIAN GULF

6 OFFSHORE DECOMMISSIONING MARKET, BY SERVICE TYPE (Page No. - 82)

6.1 INTRODUCTION

FIGURE 35 MARKET, BY SERVICE, 2020

TABLE 6 MARKET, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 7 MARKET, BY SERVICE TYPE, 2020–2027 (USD MILLION)

6.2 PROJECT MANAGEMENT, ENGINEERING, AND PLANNING

6.2.1 PROJECT MANAGEMENT, ENGINEERING, AND PLANNING PHASE OF DECOMMISSIONING CAN START AS EARLY AS 2–3 YEARS PRIOR TO CESSATION OF PRODUCTION

TABLE 8 MARKET FOR PROJECT MANAGEMENT, ENGINEERING, AND PLANNING, BY REGION, 2017–2019 (USD MILLION)

TABLE 9 MARKET FOR PROJECT MANAGEMENT, ENGINEERING, AND PLANNING, BY REGION, 2020–2027 (USD MILLION)

6.3 PERMITTING & REGULATORY COMPLIANCE

6.3.1 MIDDLE EAST & AFRICA IS AMONG FASTEST MARKETS IN FOLLOWING REGULATORY COMPLIANCE

TABLE 10 MARKET FOR PERMITTING & REGULATORY COMPLIANCE, BY REGION, 2017–2019 (USD MILLION)

TABLE 11 MARKET FOR PERMITTING & REGULATORY COMPLIANCE, BY REGION, 2020–2027 (USD MILLION)

6.4 PLATFORM PREPARATION

6.4.1 PLATFORM PREPARATION HELPS IN REDUCING OFFSHORE DECOMMISSIONING COSTS AND TIME

TABLE 12 MARKET FOR PLATFORM PREPARATION, BY REGION, 2017–2019 (USD MILLION)

TABLE 13 MARKET FOR PLATFORM PREPARATION, BY REGION, 2020–2027 (USD MILLION)

6.5 WELL PLUGGING & ABANDONMENT

6.5.1 INCREASING INVESTMENTS IN WELL PLUGGING & ABANDONMENT ARE DRIVING MARKET

TABLE 14 MARKET FOR WELL PLUGGING & ABANDONMENT, BY REGION, 2017–2019 (USD MILLION)

TABLE 15 MARKET FOR WELL PLUGGING & ABANDONMENT, BY REGION, 2020–2027 (USD MILLION)

6.6 CONDUCTOR REMOVAL

6.6.1 GROWING EMPHASIS ON SAFETY IS EXPECTED TO DRIVE MARKET FOR CONDUCTOR REMOVAL SEGMENT DURING FORECAST PERIOD

TABLE 16 MARKET FOR CONDUCTOR REMOVAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 17 MARKET FOR CONDUCTOR REMOVAL, BY REGION, 2020–2027 (USD MILLION)

6.7 MOBILIZATION & DEMOBILIZATION OF DERRICK BARGES

6.7.1 RISING NEED FOR ECONOMICAL AND SAFE TRANSPORTATION OF STRUCTURES TO ONSHORE LOCATIONS IS EXPECTED TO DRIVE MARKET DURING FORECAST PERIOD 91

TABLE 18 MARKET FOR MOBILIZATION & DEMOBILIZATION OF DERRICK BARGES, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 MARKET FOR MOBILIZATION & DEMOBILIZATION OF DERRICK BARGES, BY REGION, 2020–2027 (USD MILLION)

6.8 PLATFORM REMOVAL

6.8.1 NORTH SEA AND GULF OF MEXICO ARE HOME TO MAXIMUM NUMBER OF PLATFORMS, WHICH ARE IDEAL AND NOT PRODUCING ANY TYPE OF HYDROCARBONS AND ELIGIBLE FOR DECOMMISSIONING

TABLE 20 MARKET FOR PLATFORM REMOVAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 21 MARKET FOR PLATFORM REMOVAL, BY REGION, 2020–2027 (USD MILLION)

6.9 PIPELINE & POWER CABLE DECOMMISSIONING

6.9.1 AGEING OFFSHORE INFRASTRUCTURES ARE ESTIMATED TO DRIVE MARKET FOR THIS SEGMENT DURING FORECAST PERIOD

TABLE 22 MARKET FOR PIPELINE & POWER CABLE DECOMMISSIONING, BY REGION, 2017–2019 (USD MILLION)

TABLE 23 MARKET FOR PIPELINE & POWER CABLE DECOMMISSIONING, BY REGION, 2020–2027 (USD MILLION)

6.10 MATERIAL DISPOSAL

6.10.1 RISING NEED FOR SAFE DISPOSAL AND RECYCLING OF STRUCTURE IS EXPECTED TO PROPEL MARKET GROWTH DURING FORECAST PERIOD

TABLE 24 MARKET FOR MATERIAL DISPOSAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 25 MARKET FOR MATERIAL DISPOSAL, BY REGION, 2020–2027 (USD MILLION)

6.11 SITE CLEARANCE

6.11.1 AVAILABILITY OF REGULATORY FRAMEWORK GUIDES OPERATING COMPANIES TO CONDUCT THEIR SITE CLEARANCE IN ENVIRONMENTALLY SAFE MANNER

TABLE 26 MARKET FOR SITE CLEARANCE, BY REGION, 2017–2019 (USD MILLION)

TABLE 27 MARKET FOR SITE CLEARANCE, BY REGION, 2020–2027 (USD MILLION)

7 OFFSHORE DECOMMISSIONING MARKET, BY STRUCTURE (Page No. - 97)

7.1 INTRODUCTION

FIGURE 36 MARKET, BY STRUCTURE, 2020

TABLE 28 MARKET, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 29 MARKET, BY STRUCTURE, 2020–2027 (USD MILLION)

7.2 TOPSIDES

7.2.1 GROWING NUMBER OF PROJECTS & INVESTMENTS FOR TOPSIDE REMOVAL IS EXPECTED TO DRIVE MARKET DURING FORECAST PERIOD

TABLE 30 MARKET FOR TOPSIDES, BY REGION, 2017–2019 (USD MILLION)

TABLE 31 MARKET FOR TOPSIDES, BY REGION, 2020–2027 (USD MILLION)

7.3 SUBSTRUCTURE

7.3.1 INCREASING SUBSTRUCTURE DECOMMISSIONING ACTIVITIES IN NORTH SEA ARE DRIVING MARKET DURING FORECAST PERIOD

TABLE 32 MARKET FOR SUBSTRUCTURE, BY REGION, 2017–2019 (USD MILLION)

TABLE 33 MARKET FOR SUBSTRUCTURE, BY REGION, 2020–2027 (USD MILLION)

7.4 SUBSEA INFRASTRUCTURE

7.4.1 AGING SUBSEA EQUIPMENT AND INFRASTRUCTURE ARE EXPECTED TO BOOST MARKET GROWTH

TABLE 34 MARKET FOR SUBSEA INFRASTRUCTURE, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 MARKET FOR SUBSEA INFRASTRUCTURE, BY REGION, 2020–2027 (USD MILLION)

8 OFFSHORE DECOMMISSIONING MARKET, BY DEPTH (Page No. - 103)

8.1 INTRODUCTION

FIGURE 37 SHALLOW WATER HELD LARGER SHARE OF MARKET, BY DEPTH, IN 2020

TABLE 36 OFFSHORE DECOMMISSIONING MARKET SIZE, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 37 OFFSHORE DECOMMISSIONING MARKET SIZE, BY DEPTH, 2020–2027 (USD MILLION)

8.2 SHALLOW WATER

8.2.1 SHALLOW WATER PROJECTS ARE 30–40 YEARS OLD AND HENCE NEED TO BE DECOMMISSIONED

TABLE 38 MARKET FOR SHALLOW WATER, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 MARKET FOR SHALLOW WATER, BY REGION, 2020–2027(USD MILLION)

8.3 DEEPWATER

8.3.1 INCREASING NEED TO DECOMMISSION ABANDONED WELLS IN DEEPWATER AREAS IS DRIVING MARKET

TABLE 40 MARKET FOR DEEPWATER, BY REGION, 2017–2019 (USD MILLION)

TABLE 41 MARKET FOR DEEPWATER, BY REGION, 2020–2027(USD MILLION)

9 OFFSHORE DECOMMISSIONING MARKET, BY REMOVAL (Page No. - 108)

9.1 INTRODUCTION

FIGURE 38 MARKET, BY REMOVAL, 2020

TABLE 42 MARKET, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 43 MARKET, BY REMOVAL, 2020–2027 (USD MILLION)

9.2 COMPLETE REMOVAL

9.2.1 SAFETY CONCERNS REGARDING MARINE LIFE ARE EXPECTED TO DRIVE MARKET FOR COMPLETE REMOVAL SEGMENT DURING FORECAST PERIOD

TABLE 44 MARKET FOR COMPLETE REMOVAL, BY REGION, 2017–2019 (USD MILLION)

TABLE 45 MARKET FOR COMPLETE REMOVAL, BY REGION, 2020–2027 (USD MILLION)

9.3 PARTIAL REMOVAL

9.3.1 GOVERNMENT POLICIES IN US GULF OF MEXICO ARE DRIVING MARKET FOR THIS SEGMENT

TABLE 46 PARTIAL REMOVAL: MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 47 PARTIAL REMOVAL: MARKET, BY REGION, 2020–2027 (USD MILLION)

9.4 LEAVE IN PLACE

9.4.1 LEAVE IN PLACE REMOVAL REQUIRES NO SITE CLEARANCE AND PROVIDES MIGRATORY ANIMAL HABITAT, WHICH IS ESTIMATED TO BOOST MARKET GROWTH FOR THIS SEGMENT

TABLE 48 MARKET FOR LEAVE IN PLACE, BY REGION, 2017–2019 (USD MILLION)

TABLE 49 LEAVE IN PLACE: MARKET, BY REGION, 2020–2027 (USD MILLION)

10 OFFSHORE DECOMMISSIONING MARKET, BY REGION (Page No. - 114)

10.1 INTRODUCTION

FIGURE 39 OFFSHORE DECOMMISSIONING MARKET IN ASIA PACIFIC IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 40 EUROPE HELD LARGEST SHARE OF OFFSHORE DECOMMISSIONING MARKET, BY REGION, 2020

TABLE 50 MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 51 MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 EUROPE

FIGURE 41 EUROPE: REGIONAL SNAPSHOT

10.2.1 BY SERVICE TYPE

TABLE 52 OFFSHORE DECOMMISSIONING MARKET IN EUROPE, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 53 MARKET IN EUROPE, BY SERVICE TYPE, 2020–2027 (USD MILLION)

10.2.2 BY STRUCTURE

TABLE 54 MARKET IN EUROPE, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 55 MARKET IN EUROPE, BY STRUCTURE, 2020–2027 (USD MILLION)

10.2.3 BY DEPTH

TABLE 56 MARKET IN EUROPE, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 57 MARKET IN EUROPE, BY DEPTH, 2020–2027 (USD MILLION)

10.2.4 BY REMOVAL

TABLE 58 MARKET IN EUROPE, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 59 MARKET IN EUROPE, BY REMOVAL, 2020–2027 (USD MILLION)

10.2.5 BY COUNTRY

TABLE 60 MARKET IN EUROPE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 61 MARKET IN EUROPE, BY COUNTRY, 2020–2027 (USD MILLION)

10.2.5.1 UK

10.2.5.1.1 Presence of major mature offshore oilfields and government policies such as tax refunds for decommissioning of its oil & gas assets are fostering market growth

TABLE 62 MARKET IN UK, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 63 MARKET IN UK, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 64 MARKET IN UK, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 65 MARKET IN UK, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 66 MARKET IN UK, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 67 MARKET IN UK, BY REMOVAL, 2020–2027 (USD MILLION)

10.2.5.2 Norway

10.2.5.2.1 Increasing number of mature oilfields is expected to lead to growth of market

TABLE 68 OFFSHORE DECOMMISSIONING MARKET IN NORWAY, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 69 MARKET IN NORWAY, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 70 MARKET IN NORWAY, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 71 MARKET IN NORWAY, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 72 MARKET IN NORWAY, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 73 MARKET IN NORWAY, BY REMOVAL, 2020–2027 (USD MILLION)

10.2.5.3 Netherlands

10.2.5.3.1 Most old structures and platforms in shallow water areas are now eligible for decommissioning, thereby offering opportunities for market growth

TABLE 74 MARKET IN NETHERLANDS, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 75 MARKET IN NETHERLANDS, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 76 MARKET IN NETHERLANDS, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 77 MARKET IN NETHERLANDS, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 78 MARKET IN NETHERLANDS, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 79 MARKET IN NETHERLANDS, BY REMOVAL, 2020–2027 (USD MILLION)

10.2.5.4 Rest of Europe

TABLE 80 MARKET IN REST OF EUROPE, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 81 MARKET IN REST OF EUROPE, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 82 MARKET IN REST OF EUROPE, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 83 MARKET IN REST OF EUROPE, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 84 MARKET IN REST OF EUROPE, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 85 MARKET IN REST OF EUROPE, BY REMOVAL, 2020–2027 (USD MILLION)

10.3 NORTH AMERICA

FIGURE 42 NORTH AMERICA: REGIONAL SNAPSHOT

10.3.1 BY SERVICE TYPE

TABLE 86 OFFSHORE DECOMMISSIONING MARKET IN NORTH AMERICA, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 87 MARKET IN NORTH AMERICA, BY SERVICE TYPE, 2020–2027 (USD MILLION)

10.3.2 BY STRUCTURE

TABLE 88 MARKET IN NORTH AMERICA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 89 MARKET IN NORTH AMERICA, BY STRUCTURE, 2020–2027 (USD MILLION)

10.3.3 BY DEPTH

TABLE 90 MARKET IN NORTH AMERICA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 91 MARKET IN NORTH AMERICA, BY DEPTH, 2020–2027 (USD MILLION)

10.3.4 BY REMOVAL

TABLE 92 MARKET IN NORTH AMERICA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 93 MARKET IN NORTH AMERICA, BY REMOVAL, 2020–2027 (USD MILLION)

10.3.5 BY COUNTRY

TABLE 94 MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 95 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2027 (USD MILLION)

10.3.5.1 US

10.3.5.1.1 Presence of large number of abandoned wells, which need to be decommissioned is expected to boost market growth

TABLE 96 MARKET IN US, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 97 MARKET IN US, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 98 MARKET IN US, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 99 MARKET IN US, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 100 MARKET IN US, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 101 MARKET IN US, BY REMOVAL, 2020–2027 (USD MILLION)

10.3.5.2 Canada

10.3.5.2.1 Support polices for offshore decommissioning are expected to drive market in Canada during forecast period

TABLE 102 MARKET IN CANADA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 103 MARKET IN CANADA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 104 MARKET IN CANADA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 105 MARKET IN CANADA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 106 MARKET IN CANADA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 107 MARKET IN CANADA, BY REMOVAL, 2020–2027 (USD MILLION)

10.3.5.3 Mexico

10.3.5.3.1 Complete removal of aging infrastructure dominated offshore decommissioning market in Mexico

TABLE 108 OFFSHORE DECOMMISSIONING MARKET IN MEXICO, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 109 MARKET IN MEXICO, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 110 MARKET IN MEXICO, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 111 MARKET IN MEXICO, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 112 MARKET IN MEXICO, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 113 MARKET IN MEXICO, BY REMOVAL, 2020–2027 (USD MILLION)

10.4 SOUTH AMERICA

10.4.1 BY SERVICE TYPE

TABLE 114 OFFSHORE DECOMMISSIONING MARKET IN SOUTH AMERICA, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 115 MARKET IN SOUTH AMERICA, BY SERVICE TYPE, 2020–2027 (USD MILLION)

10.4.2 BY STRUCTURE

TABLE 116 MARKET IN SOUTH AMERICA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 117 MARKET IN SOUTH AMERICA, BY STRUCTURE, 2020–2027 (USD MILLION)

10.4.3 BY DEPTH

TABLE 118 MARKET IN SOUTH AMERICA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 119 MARKET IN SOUTH AMERICA, BY DEPTH, 2020–2027 (USD MILLION)

10.4.4 BY REMOVAL

TABLE 120 MARKET IN SOUTH AMERICA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 121 MARKET IN SOUTH AMERICA, BY REMOVAL, 2020–2027 (USD MILLION)

10.4.5 BY COUNTRY

TABLE 122 MARKET IN SOUTH AMERICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 123 MARKET IN SOUTH AMERICA, BY COUNTRY, 2020–2027 (USD MILLION)

10.4.5.1 Brazil

10.4.5.1.1 Increasing investments and new regulations are driving market in Brazil

TABLE 124 MARKET IN BRAZIL, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 125 MARKET IN BRAZIL, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 126 MARKET IN BRAZIL, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 127 MARKET IN BRAZIL, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 128 MARKET IN BRAZIL, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 129 OFFSHORE DECOMMISSIONING MARKET IN BRAZIL, BY REMOVAL, 2020–2027 (USD MILLION)

10.4.5.2 Rest of South America

10.4.5.2.1 Low crude oil prices would increase demand for offshore decommissioning during forecast period

TABLE 130 MARKET IN REST OF SOUTH AMERICA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 131 MARKET IN REST OF SOUTH AMERICA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 132 MARKET IN REST OF SOUTH AMERICA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 133 MARKET IN REST OF SOUTH AMERICA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 134 MARKET IN REST OF SOUTH AMERICA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 135 MARKET IN REST OF SOUTH AMERICA, BY REMOVAL, 2020–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 BY SERVICE TYPE

TABLE 136 OFFSHORE DECOMMISSIONING MARKET IN MIDDLE EAST & AFRICA, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 137 MARKET IN MIDDLE EAST & AFRICA, BY SERVICE TYPE, 2020–2027 (USD MILLION)

10.5.2 BY STRUCTURE

TABLE 138 MARKET IN MIDDLE EAST & AFRICA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 139 MARKET IN MIDDLE EAST & AFRICA, BY STRUCTURE, 2020–2027 (USD MILLION)

10.5.3 BY DEPTH

TABLE 140 MARKET IN MIDDLE EAST & AFRICA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 141 MARKET IN MIDDLE EAST & AFRICA, BY DEPTH, 2020–2027 (USD MILLION)

10.5.4 BY REMOVAL

TABLE 142 MARKET IN MIDDLE EAST & AFRICA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 143 MARKET IN MIDDLE EAST & AFRICA, BY REMOVAL, 2020–2027 (USD MILLION)

10.5.5 BY COUNTRY

TABLE 144 MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 145 MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2020–2027 (USD MILLION)

10.5.5.1 UAE

10.5.5.1.1 Increasing number of mature oilfields in shallow water is expected to dominate offshore decommissioning market in UAE

TABLE 146 OFFSHORE DECOMMISSIONING MARKET IN UAE, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 147 MARKET IN UAE, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 148 MARKET IN UAE, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 149 MARKET IN UAE, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 150 MARKET IN UAE, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 151 MARKET IN UAE, BY REMOVAL, 2020–2027 (USD MILLION)

10.5.5.2 Angola

10.5.5.2.1 Implementation of new regulations is boosting offshore decommissioning market in Angola

TABLE 152 MARKET IN ANGOLA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 153 MARKET IN ANGOLA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 154 MARKET IN ANGOLA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 155 MARKET IN ANGOLA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 156 MARKET IN ANGOLA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 157 MARKET IN ANGOLA, BY REMOVAL, 2020–2027 (USD MILLION)

10.5.5.3 Saudi Arabia

10.5.5.3.1 Increasing investments for decommissioning activities in offshore field

TABLE 158 OFFSHORE DECOMMISSIONING MARKET IN SAUDI ARABIA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 159 MARKET IN SAUDI ARABIA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 160 MARKET IN SAUDI ARABIA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 161 MARKET IN SAUDI ARABIA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 162 MARKET IN SAUDI ARABIA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 163 MARKET IN SAUDI ARABIA, BY REMOVAL, 2020–2027 (USD MILLION)

10.5.5.4 Rest of Middle East & Africa

TABLE 164 MARKET IN REST OF MIDDLE EAST & AFRICA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 165 MARKET IN REST OF MIDDLE EAST & AFRICA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 166 MARKET IN REST OF MIDDLE EAST & AFRICA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 167 MARKET IN REST OF MIDDLE EAST & AFRICA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 168 MARKET IN REST OF MIDDLE EAST & AFRICA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 169 MARKET IN REST OF MIDDLE EAST & AFRICA, BY REMOVAL, 2020–2027 (USD MILLION)

10.6 ASIA PACIFIC

10.6.1 BY SERVICE TYPE

TABLE 170 OFFSHORE DECOMMISSIONING MARKET IN ASIA PACIFIC, BY SERVICE TYPE, 2017–2019 (USD MILLION)

TABLE 171 MARKET IN ASIA PACIFIC, BY SERVICE TYPE, 2020–2027 (USD MILLION)

10.6.2 BY STRUCTURE

TABLE 172 MARKET IN ASIA PACIFIC, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 173 MARKET IN ASIA PACIFIC, BY STRUCTURE, 2020–2027 (USD MILLION)

10.6.3 BY DEPTH

TABLE 174 MARKET IN ASIA PACIFIC, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 175 MARKET IN ASIA PACIFIC, BY DEPTH, 2020–2027 (USD MILLION)

10.6.4 BY REMOVAL

TABLE 176 MARKET IN ASIA PACIFIC, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 177 MARKET IN ASIA PACIFIC, BY REMOVAL, 2020–2027 (USD MILLION)

10.6.5 BY COUNTRY

TABLE 178 MARKET IN ASIA PACIFIC, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 179 MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2027 (USD MILLION)

10.6.5.1 China

10.6.5.1.1 Shallow water segment is expected to dominate offshore decommissioning market in China

TABLE 180 MARKET IN CHINA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 181 MARKET IN CHINA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 182 MARKET IN CHINA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 183 MARKET IN CHINA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 184 MARKET IN CHINA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 185 MARKET IN CHINA, BY REMOVAL, 2020–2027 (USD MILLION)

10.6.5.2 Indonesia

10.6.5.2.1 Declining oil & gas production over past 10 years from aging oilfields is expected to drive market

TABLE 186 OFFSHORE DECOMMISSIONING MARKET IN INDONESIA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 187 MARKET IN INDONESIA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 188 MARKET IN INDONESIA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 189 MARKET IN INDONESIA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 190 MARKET IN INDONESIA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 191 MARKET IN INDONESIA, BY REMOVAL, 2020–2027 (USD MILLION)

10.6.5.3 Malaysia

10.6.5.3.1 Growing number of maturing well and decommissioning activities in Malaysian offshore fields is expected to drive market

TABLE 192 MARKET IN MALAYSIA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 193 MARKET IN MALAYSIA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 194 MARKET IN MALAYSIA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 195 MARKET IN MALAYSIA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 196 MARKET IN MALAYSIA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 197 MARKET IN MALAYSIA, BY REMOVAL, 2020–2027 (USD MILLION)

10.6.5.4 Australia

10.6.5.4.1 Supporting government investments in country are expected to drive offshore decommissioning market during forecast period

TABLE 198 MARKET IN AUSTRALIA, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 199 MARKET IN AUSTRALIA, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 200 MARKET IN AUSTRALIA, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 201 MARKET IN AUSTRALIA, BY DEPTH, 2020–2027 (USD MILLION)

TABLE 202 MARKET IN AUSTRALIA, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 203 MARKET IN AUSTRALIA, BY REMOVAL, 2020–2027 (USD MILLION)

10.6.5.5 Rest of Asia Pacific

TABLE 204 MARKET IN REST OF ASIA PACIFIC, BY STRUCTURE, 2017–2019 (USD MILLION)

TABLE 205 MARKET IN REST OF ASIA PACIFIC, BY STRUCTURE, 2020–2027 (USD MILLION)

TABLE 206 MARKET IN REST OF ASIA PACIFIC, BY DEPTH, 2017–2019 (USD MILLION)

TABLE 207 MARKET IN REST OF ASIA PACIFIC,BY DEPTH, 2020–2027 (USD MILLION)

TABLE 208 MARKET IN REST OF ASIA PACIFIC, BY REMOVAL, 2017–2019 (USD MILLION)

TABLE 209 MARKET IN REST OF ASIA PACIFIC, BY REMOVAL, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 180)

11.1 OVERVIEW

FIGURE 43 KEY DEVELOPMENTS IN MARKET, 2017 TO 2021

11.2 REVENUE ANALYSIS OF TOP 6 MARKET PLAYERS

FIGURE 44 TOP 6 PLAYERS DOMINATED MARKET IN LAST 5 YEARS

11.3 SHARE ANALYSIS OF KEY PLAYERS, 2020

TABLE 210 OFFSHORE DECOMMISSIONING MARKET: DEGREE OF COMPETITION

FIGURE 45 SHARE ANALYSIS OF TOP PLAYERS IN OFFSHORE DECOMMISSIONING MARKET, 2020

11.4 MARKET EVALUATION FRAMEWORK

TABLE 211 MARKET EVALUATION FRAMEWORK, 2017–2021

11.5 COMPETITIVE LEADERSHIP MAPPING

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 46 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

11.6 COMPETITIVE SCENARIO AND TRENDS

11.6.1 DEALS

11.6.2 MARKET: DEALS, 2017–2021

TABLE 212 COMPANY SERVICE TYPE FOOTPRINT

TABLE 213 COMPANY REGIONAL FOOTPRINT

12 COMPANY PROFILES (Page No. - 193)

12.1 KEY COMPANIES

(Business overview, Products offered, Recent Developments, MNM view)*

12.1.1 HALLIBURTON

TABLE 214 HALLIBURTON: BUSINESS OVERVIEW

FIGURE 47 HALLIBURTON: COMPANY SNAPSHOT

TABLE 215 HALLIBURTON: DEALS

12.1.2 PETROFAC

TABLE 216 PETROFAC: BUSINESS OVERVIEW

FIGURE 48 PETROFAC: COMPANY SNAPSHOT

TABLE 217 PETROFAC: DEALS

12.1.3 OCEANEERING INTERNATIONAL

TABLE 218 OCEANEERING INTERNATIONAL: BUSINESS OVERVIEW

FIGURE 49 OCEANEERING INTERNATIONAL: COMPANY SNAPSHOT

TABLE 219 OCEANEERING INTERNATIONAL: DEALS

TABLE 220 OCEANEERING INTERNATIONAL: OTHERS

12.1.4 ROYAL BOSKALIS WESTMINSTER N.V.

TABLE 221 ROYAL BOSKALIS WESTMINSTER N.V.: BUSINESS OVERVIEW

FIGURE 50 ROYAL BOSKALIS WESTMINSTER N.V.: COMPANY SNAPSHOT

TABLE 222 ROYAL BOSKALIS WESTMINSTER N.V.: DEALS

12.1.5 AKER SOLUTIONS

TABLE 223 AKER SOLUTIONS: BUSINESS OVERVIEW

FIGURE 51 AKER SOLUTIONS: COMPANY SNAPSHOT

TABLE 224 AKER SOLUTIONS: DEALS

TABLE 225 AKER SOLUTIONS: OTHERS

12.1.6 SCHLUMBERGER

TABLE 226 SCHLUMBERGER: BUSINESS OVERVIEW

FIGURE 52 SCHLUMBERGER: COMPANY SNAPSHOT

TABLE 227 SCHLUMBERGER: DEALS

12.1.7 BAKER HUGHES COMPANY

TABLE 228 BAKER HUGHES COMPANY: BUSINESS OVERVIEW

FIGURE 53 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

TABLE 229 BAKER HUGHES COMPANY: DEALS

12.1.8 TECHNIPFMC

TABLE 230 TECHNIPFMC: BUSINESS OVERVIEW

FIGURE 54 TECHNIPFMC: COMPANY SNAPSHOT

TABLE 231 TECHNIPFMC: DEALS

12.1.9 SUBSEA 7

TABLE 232 SUBSEA 7: BUSINESS OVERVIEW

FIGURE 55 SUBSEA 7: COMPANY SNAPSHOT

TABLE 233 SUBSEA 7: DEALS

12.1.10 WEATHERFORD

TABLE 234 WEATHERFORD: BUSINESS OVERVIEW

FIGURE 56 WEATHERFORD: COMPANY SNAPSHOT

TABLE 235 WEATHERFORD: DEALS

12.1.11 SAIPEM

TABLE 236 SAIPEM: BUSINESS OVERVIEW

FIGURE 57 SAIPEM: COMPANY SNAPSHOT

TABLE 237 SAIPEM: DEALS

12.1.12 JOHN WOOD GROUP PLC

TABLE 238 JOHN WOOD GROUP PLC: BUSINESS OVERVIEW

FIGURE 58 JOHN WOOD GROUP PLC: COMPANY SNAPSHOT

TABLE 239 JOHN WOOD GROUP: DEALS

12.1.13 AF GRUPPEN

TABLE 240 AF GRUPPEN: BUSINESS OVERVIEW

FIGURE 59 AF GRUPPEN: COMPANY SNAPSHOT

TABLE 241 AF GRUPPEN: DEALS

12.1.14 HEEREMA MARINE CONTRACTORS

TABLE 242 HEEREMA MARINE CONTRACTORS: BUSINESS OVERVIEW

TABLE 243 HEEREMA MARINE CONTRACTORS: DEALS

12.1.15 ALLSEAS GROUP

TABLE 244 ALLSEAS GROUP: BUSINESS OVERVIEW

TABLE 245 ALLSEAS GROUP: DEALS

12.2 OTHER COMPANIES

12.2.1 DEEPOCEAN GROUP

12.2.2 ACTEON GROUP

12.2.3 MAERSK DECOM

12.2.4 ABLE UK

12.2.5 MACTECH OFFSHORE

*Details on Business overview, Products offered, Recent Developments, SWOT Analysis, MNM view might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 246)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the offshore decommissioning market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as Oil & Gas data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and offshore decommissioning journal to identify and collect information useful for a technical, market-oriented, and commercial study of the offshore decommissioning market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The market comprises several stakeholders such as companies related to the industry, consulting companies in the oil & gas sector, oil companies, government & research organizations, organizations, forums, alliances & associations, offshore decommissioning service providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by the decommissioning expenditure across regions, investments by key oil & gas companies, and maturing of oilfields. Moreover, the demand is also driven by a change in rules and regulations and active participation from environmental bodies have pushed the market. The supply side is characterized by contracts & agreements and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global offshore decommissioning market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Offshore Decommissioning Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the offshore decommissioning activities.

Objectives of the Study

- To define, describe, segment, and forecast the offshore decommissioning market based on service, removal, structure, and depth

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to the main regions (Asia Pacific, Europe, North America, South America, and the Middle East & Africa)

- To provide detailed information regarding Porter’s five forces analysis, supply chain analysis, product pricing trade analysis, and revenue shift trend pertaining to the market

- To strategically profile the key players and comprehensively analyze their market rankings and core competencies*

- To analyze competitive developments such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures, and mergers & acquisitions in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Offshore Decommissioning Market