Subsea Systems Market by Subsea Production (Subsea Umbilicals, Risers, Flowlines (SURF), Trees, Manifolds, Control System), Subsea Processing (Boosting, Separation, Injection, Compression), and Region - Global Forecast to 2021

The global subsea systems market is expected to grow from an estimated USD 15.78 Billion in 2016 to USD 17.44 Billion by 2021, at a CAGR of 2.02% from 2016 to 2021. Increasing deepwater production and exploration activities and investments by emerging economies in offshore exploration are major factors driving the subsea system market.

The years considered for the study are as follows:

- Base Year: 2015

- Estimated Year: 2016

- Projected Year: 2021

- Forecast Period: 20162021

2015 has been considered as the base year for company profiles. Whenever information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the global subsea system market by type, component, technology, and region

- To provide detailed information regarding major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, future prospects, and contribution of each segment to the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments such as contracts & agreements, expansions, new product developments, and mergers & acquisitions in the market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for a technical, market-oriented, and commercial study of the global subsea system market. Primary sources are mainly industry experts from core and related industries, preferred suppliers, manufacturers, distributors, service providers, technology developers, standard and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The points given below explain the research methodology.

- Study of annual revenue and market developments of major players that provide subsea systems

- Analysis of major applications of and demand for subsea systems in oil & gas operations

- Assessment of future trends and growth of subsea production systems and subsea processing systems

- Study of market trends in various regions/countries with regards to the components of subsea production systems used

- Study of market trends in various regions with regards to the subsea processing technologies used

- Study of contracts and developments related to the market by key players across different regions

- Finalization of overall market sizes by triangulating the supply-side data, which includes product developments, supply chain, and annual revenues of companies manufacturing subsea systems across the globe

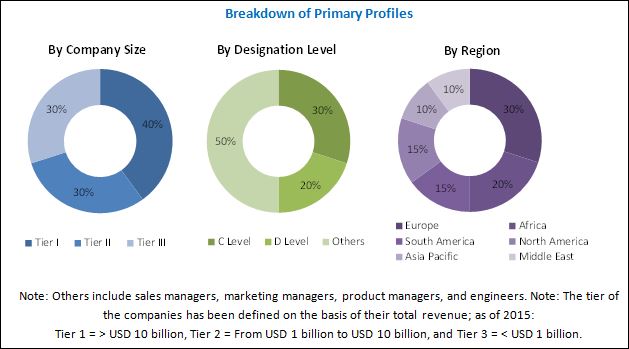

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure given below illustrates the breakdown of primaries conducted during the research study on the basis of company type, designation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem

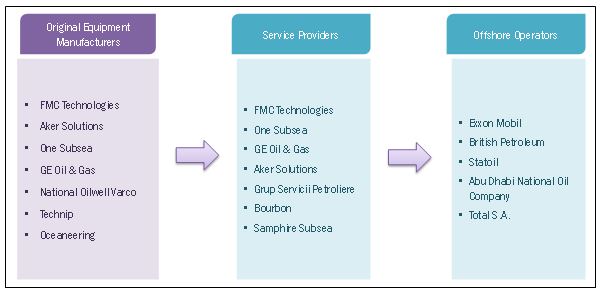

The ecosystem of the subsea system market consists of Original Equipment Manufacturers (OEMs), service providers, and oilfield operators. The figure given below shows the market ecosystem along with major companies.

OEMs include companies such as FMC Technologies (U.S.), GE Oil & Gas (U.S.), National Oilwell Varco (U.S.), Aker Solutions (Norway), Technip (France), and others who manufacture the tools and equipment required for subsea production & processing systems. Companies such as, FMC Technologies (U.S.), GE Oil & Gas (U.S.), and Aker Solutions (Norway) also provide subsea services, which are essential for the subsea system market. Oilfield exploration and production companies such as Exxon Mobil (U.S.), British Petroleum (U.K.), Statoil (Norway), and others use subsea production & processing system and act as end-users

Target Audience:

The reports target audience includes:

- Associations [Subsea UK, American Petroleum Institute and European Subsea Cables Association (ESCA) among others]

- Drilling contractors and production planning consultancies

- Government and research organizations

- Institutional investors

- National and local government organizations

- National Oil Companies (NOCs)

- Oilfield service companies

- Private E&P companies

- Subsea systems equipment manufacturers

Scope of the Report:

By Type

- Subsea Production System

- Subsea Processing System

By Subsea Production Component

- SURF (Subsea Umbilicals, Risers, Flowlines)

- Subsea Trees

- Subsea Control System

- Subsea manifolds

By Subsea Processing Technology

- Subsea Boosting System

- Subsea Separation System

- Subsea Injection System

- Subsea Compression System

By Region

- North America

- Europe

- Asia-Pacific

- Middle East

- South America

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

Further breakdown of region/country-specific analysis

Company Information

Detailed analysis and profiling of additional market players (Up to 5)

The global subsea systems market is projected to grow at a CAGR of 2.02% from 2016 to 2021, to reach a market size of USD 17.44 Billion by 2021. This growth is attributed to increasing focus on oil & gas production from offshore fields, particularly activities in deepwater reserves.

The report segments the subsea system market on the basis of type into subsea production system and subsea processing system. The subsea production system segment is projected to dominate the subsea system market throughout the forecast period.

The subsea production systems market is segmented based on components into SURF, subsea trees, control systems, and manifolds. The SURF subsegment accounted for the largest market share in 2015, driven by deepwater drilling and production demand.

The report segments the subsea processing system market based on technology into subsea boosting, subsea separation, subsea water injection, and subsea gas compression. Subsea processing system reduces dependence on costly topside facilities for offshore operations and is gaining importance as companies look to cut costs in a low oil price scenario. Boosting technology dominates the subsea processing system market owing to the growing usage of large application for improving recoveries from aging fields and enhancing production. Subsea gas compression technology is in the development stage when compared with the other technologies. Majority of the subsea compression system projects are in pipeline in the North Sea.

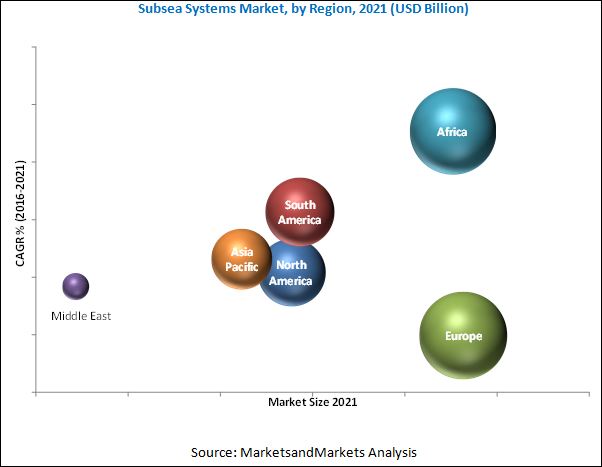

In this report, the subsea system market has been analyzed with respect to five regions, namely, North America, Europe, Asia-Pacific, the Middle East, South America, and Africa. The European region led the subsea system market with the largest market share in 2015, and the trend is projected to continue till 2021. This growth can be attributed to the subsea production activities in offshore Norway and the U.K. Major reforms have been done by both the governments for increasing oil production which would provide significant growth of the subsea system market.

Africa is the fastest growing market in the subsea production system during the forecast period. The growth is due to the rising investments in major oil producing African nations, namely, Angola, Ghana, Nigeria, and Equatorial Guinea, driven by large new offshore discoveries.

The low price of crude oil in the international market is a restraint for the subsea system market. The continuing downturn in oil prices has resulted in large-scale cut backs in exploration and production spending by major oil companies around the world. Costly offshore projects are being given a second thought keeping in mind the prevailing scenario. However, long-term projects are expected to remain on track with expectations of price recoveries in the closing years of the decade.

Leading players in the subsea systems market, based on their recent developments and other strategic industrial activities, include Subsea 7 (U.K.), FMC Technologies (U.S.), GE Oil & Gas (U.S.), Aker Solutions (Norway), One Subsea (U.S.), and Technip (France). In terms of growth strategies, market players have been focusing on winning large number of contracts & agreements to increase their market size and strengthen their market foothold in the regional market. New product launches are the second most commonly adopted strategy of the key market players in the industry. This shows a mix of both organic and inorganic growth strategies. The impending merger of FMC Technologies (U.S.) and Tehcnip (France) will alter the competitive dynamics of the market by creating a potentially market leading entity in the subsea industry.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered (Subsegments Including GEO Segmentation)

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 24)

3.1 Introduction

4 Premium Insights (Page No. - 29)

4.1 Attractive Market Opportunities in the Subsea Systems Market

4.2 Subsea System Market, By Subsea Production System

4.3 Subsea System Market in Europe

4.4 Europe Dominates the Subsea System Market

4.5 Life Cycle Analysis By Region

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Subsea Systems: Market Segmentation

5.2.1 By Subsea Production System

5.2.2 By Subsea Processing System

5.2.3 By Region

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growing Focus in Deep Water Drilling

5.3.1.2 Rising Investments in Emerging Economies

5.3.2 Restraints

5.3.2.1 Oil Price Volatility

5.3.3 Opportunities

5.3.3.1 Liberalization in Mexican Oil & Gas Industry

5.3.3.2 New Offshore Discoveries

5.3.4 Challenge

5.3.4.1 Stringent Environmental & Safety Regulations

6 Subsea System Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Subsea Production System

6.3 Subsea Processing System

7 Subsea Production System Market, By Component (Page No. - 45)

7.1 Introduction

7.2 Surf

7.3 Subsea Trees

7.4 Subsea Control Systems

7.5 Subsea Manifolds

8 Subsea Processing System Market, By Technology (Page No. - 52)

8.1 Introduction

8.2 Subsea Boosting

8.3 Subsea Separation

8.4 Subsea Injection

8.5 Subsea Compression System

9 Subsea Systems Market, By Region (Page No. - 59)

9.1 Introduction

9.2 Europe

9.2.1 Norway

9.2.2 U.K.

9.2.3 Denmark

9.2.4 Rest of Europe

9.3 Africa

9.3.1 Angola

9.3.2 Nigeria

9.3.3 Ghana

9.3.4 Equatorial Guinea

9.3.5 Rest of Africa

9.4 North America

9.4.1 U.S.

9.4.2 Canada

9.4.3 Mexico

9.5 South America

9.5.1 Brazil

9.5.2 Venezuela

9.5.3 Rest of South America

9.6 Asia-Pacific

9.6.1 China

9.6.2 India

9.6.3 Malaysia

9.6.4 Indonesia

9.6.5 Australia

9.6.6 Rest of Asia-Pacific

9.7 Middle East

9.7.1 Iran

9.7.2 UAE

9.7.3 Saudi Arabia

9.7.4 Qatar

9.7.5 Rest of the Middle East

10 Competitive Landscape (Page No. - 93)

10.1 Overview

10.2 Competitive Situation & Trends

10.2.1 Contracts & Agreements

10.2.2 New Product/Service/Technology Developments

10.2.3 Mergers & Acquisitions

10.2.4 Expansions

11 Company Profiles (Page No. - 101)

(Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments)*

11.1 Introduction

11.2 Subsea 7 SA

11.3 Technip

11.4 FMC Technologies

11.5 GE Oil & Gas

11.6 Aker Solutions

11.7 Dril-Quip Inc.

11.8 National Oilwell Varco

11.9 Oceaneering International, Inc.

11.10 Kongsberg Gruppen

11.11 Nexans SA

11.12 Parker Hannifin Corporation

11.13 Vallourec

11.14 Onesubsea

11.15 Twister BV

11.16 Proserv Group Inc.

*Details on Company at A Glance, Recent Financials, Products & Services, Strategies & Insights, & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 151)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (69 Tables)

Table 1 Subsea Systems Market Size, By Type, 20142021 (USD Million)

Table 2 Subsea Production System: Market Size, By Region, 20142021 (USD Million)

Table 3 Subsea Processing System: Market Size, By Region, 20142021 (USD Million)

Table 4 Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 5 Subsea Production System: Surf Market Size, By Type, 20142021 (USD Million)

Table 6 Subsea Production System: Surf Market Size, By Region, 20142021 (USD Million)

Table 7 Subsea Production Systems: Subsea Trees Market Size, By Region, 20142021 (USD Million)

Table 8 Subsea Production System: Subsea Control System Market Size, By Region, 20142021 (USD Million)

Table 9 Subsea Production System: Subsea Manifolds Market Size, By Region, 20142021 (USD Million)

Table 10 Subsea Processing System Market Size, By Technology, 20142021 (USD Million)

Table 11 Subsea Boosting: Subsea Processing System Market Size, By Region, 20142021 (USD Million)

Table 12 Subsea Separation: Subsea Processing System Market Size, By Region, 20142021 (USD Million)

Table 13 Subsea Injection: Subsea Processing System Market Size, By Region, 20142021 (USD Million)

Table 14 Subsea Compression: Subsea Processing System Market Size, By Region, 20142021 (USD Million)

Table 15 Subsea System Market Size, By Region, 20142021 (USD Million)

Table 16 Europe: Subsea System Market Size, By Type, 20142021 (USD Million)

Table 17 Europe: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 18 Europe: Subsea Processing System Market Size, By Technology, 20142021 (USD Million)

Table 19 Europe: Subsea Production System Market Size, By Country, 20142021 (USD Million)

Table 20 Norway: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 21 U.K.: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 22 Denmark: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 23 Rest of Europe: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 24 Africa: Subsea System Market Size, By Type, 20142021 (USD Million)

Table 25 Africa: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 26 Africa: Subsea Processing System Market Size, By Technology, 20142021 (USD Million)

Table 27 Africa: Subsea Production System Market Size, By Country, 20142021 (USD Million)

Table 28 Angola: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 29 Nigeria: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 30 Ghana: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 31 Equatorial Guinea: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 32 Rest of Africa: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 33 North America: Subsea System Market Size, By Type, 20142021 (USD Million)

Table 34 North America: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 35 North America: Subsea Processing System Market Size, By Technology, 20142021 (USD Million)

Table 36 North America: Subsea Production System Market Size, By Country, 20142021 (USD Million)

Table 37 U.S.: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 38 Canada: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 39 Mexico: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 40 South America: Subsea System Market Size, By Type, 20142021 (USD Million)

Table 41 South America: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 42 South America: Subsea Processing System Market Size, By Technology, 20142021 (USD Million)

Table 43 South America: Subsea Production System Market Size, By Country, 20142021 (USD Million)

Table 44 Brazil: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 45 Venezuela: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 46 Rest of South America: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 47 Asia-Pacific: Subsea System Market Size, By Type, 20142021 (USD Million)

Table 48 Asia-Pacific: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 49 Asia-Pacific: Subsea Processing System Market Size, By Technology, 20142021 (USD Million)

Table 50 Asia-Pacific: Subsea Production System Market Size, By Country, 20142021 (USD Million)

Table 51 China: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 52 India: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 53 Malaysia: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 54 Indonesia: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 55 Australia: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 56 Rest of Asia-Pacific: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 57 Middle East: Subsea System Market Size, By Type, 20142021 (USD Million)

Table 58 Middle East: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 59 Middle East: Subsea Processing System Market Size, By Technology, 20142021 (USD Million)

Table 60 Middle East: Subsea Production System Market Size, By Country, 20142021 (USD Million)

Table 61 Iran: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 62 UAE: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 63 Saudi Arabia: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 64 Qatar: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 65 Rest of the Middle East: Subsea Production System Market Size, By Component, 20142021 (USD Million)

Table 66 Contracts & Agreements, 20122016

Table 67 New Product Development, 20132016

Table 68 Mergers & Acquisitions, 20122016

Table 69 Expansions, 20122016

List of Figures (49 Figures)

Figure 1 Markets Segmentation: Subsea System Market

Figure 2 Subsea System Market: Country-Wise Scope

Figure 3 Subsea System Market: Research Design

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Europe Occupied the Largest Share in the Subsea System Market in 2015

Figure 7 Subsea Production System Would Be the Largest Segment, During the Forecast Period

Figure 8 Subsea System Market Snapshot (2016 vs 2021): Africa is Expected to Exhibit the Highest Growth Rate During the Forecast Period

Figure 9 Surf Segment is Expected to Dominate the Subsea Production System Market During the Forecast Period

Figure 10 Subsea Boosting Segment is Expected to Dominate the Subsea Processing System Market During the Forecast Period

Figure 11 Subsea 7 S.A. is the Most Active Company in Terms of Market Developments During the Forecast Period

Figure 12 Rising Deepwater Drilling is Expected to Boost the Subsea System Market During the Forecast Period

Figure 13 Surf Segment is Expected to Grow at the Fastest Pace in the Subsea Production System Market During the Forecast Period

Figure 14 Surf Segment Accounted for the Maximum Share in the Subsea System Market in 2015

Figure 15 Europe Held the Largest Market Share in 2015

Figure 16 Subsea System Market is Nearing Maturity in European Region

Figure 17 Subsea System Market Segmentation, By Subsea Production System, Processing System & Region

Figure 18 Growing Focus in Deep Water Drilling is Driving the Subsea System Market

Figure 19 Subsea System Market Share (Value), By Type, 2015

Figure 20 Subsea Processing System Market is Expected to Grow at A Higher Rate During the Forecast Period

Figure 21 Subsea Production System Market Share (Value), By Component, 2015

Figure 22 Surf Segment is Expected to Grow at the Fastest Rate During the Forecast Period

Figure 23 Surf Market Share (Value), By Type, 2015

Figure 24 Subsea Processing System Market Share (Value), By Technology, 2015

Figure 25 Subsea Compression Segment is Expected to Grow at the Fastest Pace Between 2016 and 2021

Figure 26 The Subsea Regional Snapshot of Subsea System Market (2015): Angola Would Lead Market During the Forecast Period

Figure 27 Global Subsea System Market Share (Value), By Region, 2015

Figure 28 Europe Subsea System Market Snapshot

Figure 29 Companies Adopted Contracts & Agreements and New Product/ Service/ Technology Developments to Capture The Market, 20122016

Figure 30 Company Market Share (Value), 2015

Figure 31 Market Evaluation Framework: New Product Launches, Contracts & Agreements, Mergers & Acquisitions Have Fuelled The Growth of Companies, 20122016

Figure 32 Regional Revenue Mix of The Top Five Players

Figure 33 Subsea 7 SA: Company Snapshot

Figure 34 Subsea 7 SA : SWOT Analysis

Figure 35 Technip: Company Snapshot

Figure 36 Technip: SWOT

Figure 37 FMC Technologies: Company Snapshot

Figure 38 SWOT: FMC Technologies

Figure 39 GE Oil & Gas: Company Snapshot

Figure 40 SWOT: GE Oil & Gas

Figure 41 Aker Solutions: Company Snapshot

Figure 42 SWOT: Aker Solutions

Figure 43 Dril-Quip: Company Snapshot

Figure 44 National Oilwell Varco: Company Snapshot

Figure 45 Oceaneering International, Inc.: Company Snapshot

Figure 46 Kongsberg Gruppen: Company Snapshot

Figure 47 Nexans SA: Company Snapshot

Figure 48 Parker Hannifin Corporation: Company Snapshot

Figure 49 Vallourec: Company Snapshot

Growth opportunities and latent adjacency in Subsea Systems Market