Offshore Drilling Market by Service (Contract Drilling, Directional Drilling, Logging While Drilling, and Measurement While Drilling), by Application (Shallow, Deep, and Ultra-Deep Water) & by Region - Global Forecast to 2020

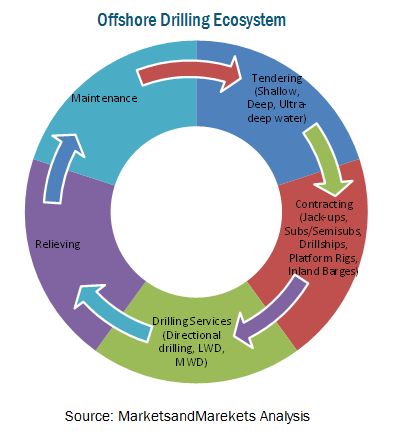

Offshore drilling includes services related to drilling wells including type of the rig required, depth and direction of well to be dug and services and expertise required to accomplish the desired goal. Offshore drilling market is estimated to be $78.57 Billion in 2014 and is projected to grow with a CAGR of 4.54% from 2015 to 2020. Crude oil prices which have witnessed a sharp decline in the last one year are expected to increase to USD 80/ barrel by 2018. This rebound in oil price will be spurred by the delay in capacity addition as the oil & gas companies are currently shelving new projects to reduce their capital expenditure. With the increase in the price of crude oil, the investments for E&P activities will also increase which will lead to new projects in regions that are looking to overturn their production decline such as Europe and Asia-Pacific. This will in turn create further demand for the offshore drilling in these regions.

Years considered for the study: 2013, 2014, 2015 and 2020

Base Year: 2014

Forecast years: 2015-estimated, 2020-predicted

Research Methodology:

- Major regions were identified along with countries contributing the maximum share

- Secondary research was conducted to find the depths (shallow, deep, ultra-deep water) of offshore oilfields in the regions and their contribution

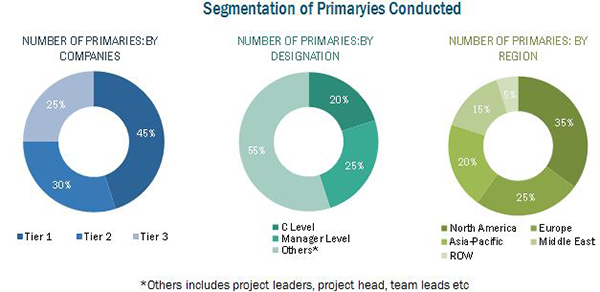

- Services were identified on the basis of rigs contracted in the region and the split was calculated by conducting primary’s with industry participants, subject matter experts, C-level executives of key market players, and industry consultants among other experts, which helped to obtain and verify critical qualitative and quantitative information as well as assess future market prospects

- Top companies revenues (regional/global), rig pricing, and industry trends along with top-down, bottom-up, and MnM KNOW were used to estimate market value

- This was further broken down into several segments and subsegments on the basis of information gathered

Study addresses several of the stakeholders which include OEMs, EPC companies, Utility service providers, Distributers & Suppliers, Consulting firms, Private Equity groups, investment houses, equity research firms and other stakeholders. It gives them information about market segments to focus in next two to five years for prioritizing the efforts and investments

Scope of the report:

- This study estimates the global market of offshore drilling, in terms of dollar value, till 2020

- It offers a detailed qualitative and quantitative analysis of this market

- It provides a comprehensive review of major market drivers, restraints, opportunities, challenges, winning imperatives, and key issues of the market

- It covers various important aspects of the market. These include analysis of value chain, Porter’s Five Forces model, competitive landscape, market dynamics, market estimates in terms of value, and future trends in the offshore drilling market.

The market has been segmented into -

On the basis of Service Type

- Contract Drilling

- Directional Drilling

- Logging While Drilling

- Measurement While Drilling

On the basis of Application

- Shallow Water

- Deep Water

- Ultra-Deep Water

On the basis of Region

- North America

- South America

- Asia-Pacific

- Middle East

- Europe

- Africa

Available Customization

With the market data provided above, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (Up to 5)

- Country-wise analysis can be extended by one country for every region

The increase in the global oil and gas production in North America and the Middle East accompanied by the maturing onshore oilfields shifted the focus of operators towards offshore for new E&P activities. However, due to the recent crude oil price slump, offshore drilling companies will see weaker revenues over the next few quarters. This downfall is a result of the spending cuts and increase in demand for better pricing and terms of the contract negotiations and renewals. Offshore drilling companies are likely to face a dip in the demand and pricing for services. These companies are therefore trying to capitalize on scale, improve their operational efficiency and their cost bases.

Global offshore drilling market is expected to grow from USD 78.6 Billion in 2014 to USD 89.8 Billion by 2020, at a CAGR of 4.54% during 2015-2020. Asia-Pacific accounted for the largest market share in 2014 and is projected to grow at a CAGR of 4.49% during 2015-2020.

Offshore drilling market has been classified on the basis of applications such as shallow water, deepwater and ultra-deepwater based operations.

Nearly half of the offshore drilling market is covered by shallow water applications, but with the advent of advanced technology, the operators are entering into deepwater and ultra-deepwater zones. Moreover, due to decreasing production in shallow water basins, the large potential of untapped subsea hydrocarbon reserves is driving increased focus in deep water drilling. There have been increasing deep water oil discoveries in India, Africa, Australia, the U.S., Russia, and Norway. Oil discoveries in Africa especially in Ghana, Congo, Mozambique, and Angola are creating lucrative business opportunities where offshore drilling market players are trying to focus to enhance their revenue.

Offshore drilling market has also been classified on the basis of service type into offshore contract drilling, directional drilling, logging-while-drilling and measurement while drilling. More than half of the offshore drilling market is captured by offshore contract drilling services. The market is also witnessing an increase in directional drilling. However due to continuous decline of oil price since mid-2014, the market has witnessed a drastic setback leading to retirement/cold stacking of many of the rigs and delay in the delivery of new rigs. Several operators have either cancelled or postponed their contracts leading to lower day rates.

Asia-Pacific is the leading market in the offshore drilling owing to the offshore activities taking place in South China Sea. China, Thailand, India, Australia and Indonesia are mainly driving growth of the offshore drilling market in the region. Also, Liberalization of Mexican oil & gas industry is another key driver fueling the demand for offshore drilling market in South America. Mexico is one of the largest non-OPEC oil producers in the world. With the liberalization, state run monopoly has ended, paving way for foreign E&P companies.

The recent downturn in the crude oil prices has resulted in the decline of the exploration & production (E&P) activities all over the world. As offshore drilling is highly capital intensive industry, it was affected more as compared to onshore drilling industry. Many contracts were cancelled, postponed, or reworked by companies for rigs. Rigs still in operation are operating on very low dayrates compared to the rates in 2013-14.The current expenditure in E&P has fallen since 2014 but the current capacity reduction is expected to resolve the current demand and supply imbalance of oil and gas. Thus, the price of oil and gas is expected to rise in the future amounting to more capital expenditure on oil and gas E&P activities. As a result, the expected increase in the demand for energy in the future is expected to push the need for optimum exploration & production, thus boosting the demand for the offshore drilling across the globe.

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.3 Key Industry Insights

2.1.4 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Market Opportunities in the Offshore Drilling Services Market

4.2 Offshore Drilling Market , By Region

4.3 Offshore Drilling Market in the Asia_Pacific Region

4.4 Asia-Pacific, the Largest Offshore Drilling Market in 2014

4.5 Offshore Drilling Market: By Services

5 Industry Trends (Page No. - 39)

5.1 Introduction

5.2 Supply Chain Analysis

5.3 Porter’s Five Forces Analysis

5.3.1 Threat of New Entrants

5.3.2 Threat of Substitutes

5.3.3 Bargaining Power of Suppliers

5.3.4 Bargaining Power of Buyers

5.3.5 Intensity of Competitive Rivalry

6 Market Overview (Page No. - 44)

6.1 Introduction

6.2 Market Dynamics

6.2.1 Drivers

6.2.1.1 Rising Investments in Emerging Economies

6.2.1.2 Liberalization of Mexican Oil & Gas Industry

6.2.1.3 Rapid Technological Advancements

6.2.2 Restraints

6.2.2.1 Capital Intensive

6.2.2.2 Oil Price Slump

6.2.3 Opportunities

6.2.3.1 Arctic Discoveries

6.2.3.2 Growing Focus on Deep Water Drilling

6.2.4 Challenges

6.2.4.1 Rising Environmental Concerns

6.2.4.2 Strict Government Regulations

6.3 Impact of Market Dynamics

7 An Overview of the Offshore Oil & Gas Industry (Page No. - 57)

7.1 Introduction

7.2 Global Oil & Gas Reserves

7.2.1 Global Oil & Gas Reserves, By Regions

7.3 Global Offshore Oil & Gas Production

7.3.1 Global Offshore Oil Production

7.3.2 Global Offshore Gas Production

7.4 Offshore Drilling Activity

7.4.1 Global Offshore Drilling Activity

7.4.2 Asia-Pacific Offshore Drilling

7.4.3 Europe Offshore Drilling

7.4.4 Middle East Offshore Drilling

7.4.5 Africa Offshore Drilling

7.4.6 North America Offshore Drilling

7.4.7 South America Offshore Drilling

8 Offshore Drilling Rig Market (Page No. - 64)

8.1 Introduction

8.1.1 Drillships

8.1.2 Semi-Submersibles

8.1.3 Jackups

8.1.4 Platform Rigs

8.1.5 Tender Assist Rig

8.2 Offshore Rig Supply Overview

8.2.1 The U.S. Gulf of Mexico (US GOM)

8.2.2 West Africa/Mediterranean

8.2.3 North Sea

8.2.4 Middle East

8.2.5 South East Asia/India

8.2.6 South America

8.2.7 Mexico

8.2.8 Others

8.3 Offshore Driller’s Market

8.3.1 Offshore Rig Count, By Company and Type

8.3.2 Jackup Newbuilds, By Company

8.3.3 Floaters Newbuilds, By Company

8.4 Offshore Rigs Newbuilds

8.4.1 Jackup Newbuilds Deliveries

8.4.1.1 Jackups New Build Deliveries, 2014

8.4.1.2 Jackup New Build Deliveries, 2015

8.4.1.3 Jackup New Build Deliveries, 2016+

8.4.2 Drillships Newbuilds Deliveries

8.4.2.1 Drillships New Build Deliveries, 2014

8.4.2.2 Drillships New Build Deliveries, 2015

8.4.2.3 Drillships New Build Deliveries, 2016

8.4.2.4 Drillships New Build Deliveries, 2017+

8.4.3 Semi-Submersibles New Builds Deliveries

8.4.3.1 Semi-Submersibles New Build Deliveries, 2014

8.4.3.2 Semi-Submersibles New Build Deliveries, 2015

8.4.3.3 Semi-Submersibles New Build Deliveries, 2016

8.4.3.4 Semi-Submersibles New Build Deliveries, 2017+

8.5 Offshore Rig Utilization Rate

8.6 Offshore Rig Day Rates

8.6.1 Jackup Day Rate

8.6.2 Floater Day Rate

9 Global Offshore Drilling Market, By Service (Page No. - 92)

9.1 Introduction

9.2 Offshore Contract Drilling Market

9.3 Offshore Directional Drilling Market

9.4 Offshore Logging While Drilling Market (LWD)

9.5 Offshore Measurement While Drilling (MWD)

10 Global Offshore Drilling Market, By Application (Page No. - 100)

10.1 Introduction

10.2 Shallow Water Drilling Market

10.3 Deepwater Drilling Market

10.4 Ultra-Deepwater Drilling Market

11 Offshore Drilling Market, By Region (Page No. - 107)

11.1 Introduction

11.2 Asia-Pacific Offshore Drilling Market

11.2.1 Thailand Offshore Drilling Market

11.2.2 China Offshore Drilling Market

11.3 North America Offshore Drilling Market

11.3.1 U.S. Offshore Drilling Market

11.3.2 Mexico Offshore Drilling Market

11.4 Europe Offshore Drilling Market

11.4.1 Norway Offshore Drilling Market

11.4.2 U.K. Offshore Drilling Market

11.5 Middle East Offshore Drilling Market

11.5.1 Uae Offshore Drilling Market

11.5.2 Saudi Arabia Offshore Drilling Market

11.6 South America Offshore Drilling Market

11.6.1 Brazil Offshore Drilling Market

11.6.2 Venezuela Offshore Drilling Market

11.7 Africa Offshore Drilling Market

11.7.1 Angola Offshore Drilling Market

11.7.2 Nigeria Offshore Drilling Market

12 Competitive Landscape (Page No. - 134)

12.1 Overview

12.2 Competitive Situation & Trends

12.3 Contracts & Agreements

12.4 New Product/Service/Technology Launch

12.5 Mergers & Acquisitions

12.6 Expansion

12.7 Other Developments

13 Company Profiles (Page No. - 144)

13.1 Introduction

13.2 Halliburton Company

13.2.1 Business Overview

13.2.2 Products & Services

13.2.3 Developments, 2012-2015

13.2.4 SWOT Analysis

13.2.5 MnM View

13.3 Schlumberger Limited

13.3.1 Business Overview

13.3.2 Products & Services

13.3.3 Developments, 2012-2015

13.3.4 SWOT Analysis

13.3.5 MnM View

13.4 Seadrill Limited

13.4.1 Business Overview

13.4.2 Products & Services

13.4.3 Developments, 2012-2015

13.4.4 SWOT Analysis

13.4.5 MnM View

13.5 Transocean Ltd.

13.5.1 Business Overview

13.5.2 Products & Services

13.5.3 Developments, 2012-2015

13.5.4 SWOT Analysis

13.5.5 MnM View

13.6 Weatherford International Ltd

13.6.1 Business Overview

13.6.2 Products & Services

13.6.3 Developments, 2012-2015

13.6.4 SWOT Analysis

13.6.5 MnM View

13.7 Atwoods Oceanics

13.7.1 Business Overview

13.7.2 Products & Services

13.7.3 Developments, 2012-2014

13.8 Baker Hughes Incorporated

13.8.1 Business Overview

13.8.2 Products & Services

13.8.3 Developments, 2012-2014

13.9 China Oilfield Services Limited

13.9.1 Business Overview

13.9.2 Products & Services

13.9.3 Developments, 2012-2015

13.10 Diamond Offshore Drilling Inc.

13.10.1 Business Overview

13.10.2 Products & Services

13.10.3 Developments, 2012-2013

13.11 Dolphin Drilling

13.11.1 Business Overview

13.11.2 Products & Services

13.11.3 Developments, 2013

13.12 Ensco PLC.

13.12.1 Business Overview

13.12.2 Products & Services

13.12.3 Developments, 2012-2015

13.13 KCA Deutag

13.13.1 Business Overview

13.13.2 Products & Services

13.13.3 Developments, 2012-2014

13.14 Maersk Drilling

13.14.1 Business Overview

13.14.2 Products & Services

13.14.3 Developments, 2012-2015

13.15 Nabors Industries Ltd

13.15.1 Business Overview

13.15.2 Products & Services

13.15.3 Developments, 2013-2014

13.16 Noble Corporation

13.16.1 Business Overview

13.16.2 Products & Services

13.16.3 Developments, 2012-2014

13.17 Paragon Offshore PLC.

13.17.1 Business Overview

13.17.2 Products & Services

13.17.3 Developments, 2014

13.18 Scientific Drilling International

13.18.1 Business Overview

13.18.2 Products & Services

13.18.3 Developments, 2013-2015

13.19 Superior Energy Services

13.19.1 Business Overview

13.19.2 Products & Services

13.19.3 Developments, 2012-2014

14 Appendix (Page No. - 193)

14.1 Insights of Industry Experts

14.2 Discussion Guide

14.3 Other Developments, 2012-2014

14.4 Introducing RT: Real Time Market Intelligence

14.5 Available Customizations

14.6 Related Reports

List of Tables (127 Tables)

Table 1 Consumption of Crude Oil, By Region , 2010-2014 (Million Tonnes)

Table 2 Production of Crude Oil, By Region , 2010-2014 ( Million Tonnes)

Table 3 Consumption of Natural Gas, By Region , 2010-2014 ( Million Tonnes)

Table 4 Production of Natural Gas, By Region , 2010-2014 ( Million Tonnes)

Table 5 Impact of Market Dynamics

Table 6 Offshore Wells Drilled, By Regions, 2012–2014

Table 7 Asia-Pacific: Offshore Wells Drilled, By Countries, 2012–2014

Table 8 Europe: Offshore Wells Drilled, By Countries, 2012–2014

Table 9 Middle East: Offshore Wells Drilled, By Countries, 2012–2014

Table 10 Africa: Offshore Wells Drilled, By Countries, 2012–2014

Table 11 North America: Offshore Wells Drilled, By Countries, 2012–2014

Table 12 South America: Offshore Wells Drilled, By Countries, 2012–2014

Table 13 Us Gulf of Mexico: Mobile Offshore Drilling Rig Count, 2012–2015

Table 14 West Africa/Mediterranean: Mobile Offshore Drilling Rig Count, 2012–2015

Table 15 North Sea: Mobile Offshore Drilling Rig Count, 2012–2015

Table 16 Middle East: Mobile Offshore Drilling Rig Count, 2012–2014

Table 17 South East Asia/India: Mobile Offshore Drilling Rig Count, 2012–2015

Table 18 South America: Mobile Offshore Drilling Rig Count, 2012–2015

Table 19 Mexico: Mobile Offshore Drilling Rig Count, 2012–2015

Table 20 Others: Mobile Offshore Drilling Rig Count, 2012–2015

Table 21 Offshore Rig Count, By Company and Type, 2015

Table 22 Jackup Newbuilds, By Company, 2014–2017+

Table 23 Floater Newbuilds, By Company, 2014–2017+

Table 24 Jackup Newbuild Deliveries, 2014–2017+

Table 25 Jackup Newbuild Deliveries, 2014

Table 26 Jackup Newbuild Deliveries, 2015

Table 27 Jackup Newbuild Deliveries, 2016+

Table 28 Global Drillship Newbuild Deliveries, 2014–2017+

Table 29 Drillship Newbuild Deliveries, 2014

Table 30 Drillship Newbuild Deliveries, 2015

Table 31 Drillship Newbuild Deliveries, 2016

Table 32 Drillship Newbuild Deliveries, 2017+

Table 33 Semi-Submersibles Newbuild Deliveries, 2014–2017+

Table 34 Semi-Submersibles Newbuild Deliveries, 2014

Table 35 Semisubmersibles Newbuild Deliveries, 2015

Table 36 Semi-Submersibles Newbuild Deliveries, 2016

Table 37 Semi-Submersibles Newbuild Deliveries, 2017

Table 38 Offshore Rig Utilization Rate, By Type, Aug 2015–Oct 2015

Table 39 Jackup Day Rate, Q2 2015–Q1 2017 (Thousand USD Per Day)

Table 40 Floater Day Rate, Q2 2015–Q1 2017 (Thousand USD Per Day)

Table 41 Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 42 Offshore Contract Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 43 Offshore Contract Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 44 Offshore Directional Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 45 Offshore Directional Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 46 Offshore Logging While Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 47 Offshore Logging While Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 48 Offshore Measurement While Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 49 Offshore Measurement While Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 50 Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 51 Shallow Water Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 52 Shallow Water Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 53 Deepwater Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 54 Deepwater Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 55 Ultra-Deepwater Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 56 Ultra-Deepwater Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 57 Offshore Drilling Market Size, By Region, 2013-2020 (USD Million)

Table 58 Asia-Pacific: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 59 Asia-Pacific: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 60 Asia-Pacific: Offshore Drilling Market Size, By Country, 2013-2020 (USD Million)

Table 61 Thailand: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 62 Thailand: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 63 China: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 64 China: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 65 North America: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 66 North America: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 67 North America: Offshore Drilling Market Size, By Country, 2013-2020 (USD Million)

Table 68 U.S.: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 69 U.S.: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 70 Mexico: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 71 Mexico: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 72 Europe: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 73 Europe: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 74 Europe: Offshore Drilling Market Size, By Country, 2013-2020 (USD Million)

Table 75 Norway: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 76 Norway: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 77 U.K.: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 78 U.K.: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 79 Middle East: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 80 Middle East: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 81 Middle East: Offshore Drilling Market Size, By Country, 2013-2020 (USD Million)

Table 82 Uae: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 83 Saudi Arabia: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 84 Saudi Arabia: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 85 Saudi Arabia: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 86 South America: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 87 South America: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 88 South America: Offshore Drilling Market Size, By Country, 2013-2020 (USD Million)

Table 89 Brazil: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 90 Brazil: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 91 Venezuela: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 92 Venezuela: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 93 Africa: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 94 Africa: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 95 Africa: Offshore Drilling Market Size, By Country, 2013-2020 (USD Million)

Table 96 Angola: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 97 Angola: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 98 Nigeria: Offshore Drilling Market Size, By Service, 2013-2020 (USD Million)

Table 99 Nigeria: Offshore Drilling Market Size, By Application, 2013-2020 (USD Million)

Table 100 Contracts & Agreements, 2012-2015

Table 101 New Product Developments, 2012-2015

Table 102 Mergers & Acquisitions, 2012-2015

Table 103 Expansions, 2012-2015

Table 104 Other Developments, 2012-2015

Table 105 Products & Services

Table 106 Products & Services

Table 107 Seadrill Limited.: Products & Services

Table 108 Transocean Limited: Products & Services

Table 109 Weatherford International Ltd.: Products & Services

Table 110 Atwoods Oceanics: Products & Services

Table 111 Baker Hughes: Products & Services

Table 112 China Oilfield Services Limited: Products & Services

Table 113 Diamond Offshore Drilling Inc.: Products & Services

Table 114 Dolphin Drilling: Products & Services

Table 115 Ensco PLC. : Products & Services

Table 116 KCA Deutag: Products & Services

Table 117 Maersk Drilling: Products & Services

Table 118 Nabors Industries Ltd: Products & Services

Table 119 Noble Corporation: Products & Services

Table 120 Paragon Offshore PLC..: Products & Services

Table 121 Scientific Drilling International: Products & Services

Table 122 Superior Energy Services: Products & Services

Table 123 Mergers & Acquisitions

Table 124 Contracts & Agreements

Table 125 Joint Ventures/Partnerships

Table 126 New Product/ Service Launch

Table 127 Expansions

List of Figures (51 Figures)

Figure 1 Research Design: Offshore Drilling Market

Figure 2 Bottom-Up Approach

Figure 3 Top-Down Approach

Figure 4 Assumptions of the Research Study

Figure 5 Limitations of the Research Study

Figure 6 Shallow-Water Application Accounted for the Largest Market Share (Value) in Asia-Pacific in 2014

Figure 7 Offshore Drilling Market, By Application, During the Forecast Period

Figure 8 Europe & Asia-Pacific Expected to Dominate the Offshore Contract Drilling Services Market During the Forecast Period

Figure 9 Shallow Water Drilling Market, By Services, 2015-2020 (USD Million)

Figure 10 Increase in Oil & Gas Production From North America & Opec Nations to Create Growth in Offshore Drilling Market

Figure 11 Asia-Pacific is Expected to Account for A Major Share (By Value) of the Offshore Drilling Market During the Forecast Period

Figure 12 Shallow-Water Application Accounted for A Major Share (By Value) in the Offshore Drilling Market in 2014

Figure 13 Asia-Pacific Held Major Share in the Offshore Drilling Market, in 2014

Figure 14 Offshore Contract Drilling Services Estimated to Account for Largest Market Share (Value) in the Offshore Drilling Market By 2020

Figure 15 Offshore Drilling Market: Supply Chain Analysis

Figure 16 Porter’s Five Forces Analysis: Offshore Drilling Market

Figure 17 Brent Crude Oil Prices, (USD Per Barrel)

Figure 18 Regional Distribution of Undiscovered Arctic Region Oil Resources

Figure 19 Crude Oil & Natural Gas Reserves, By Regions, 2014

Figure 20 Offshore Oil Production, By Region, 2014 (Thousand Barrels Per Day)

Figure 21 Offshore Gas Production, By Region, 2014 (Billion Cubic Meters Per Day)

Figure 22 Offshore Drilling Market Share (Value), By Service, 2014

Figure 23 Offshore Drilling Market Share (Value), By Application, 2014

Figure 24 Offshore Drilling Market Share (Value), By Region, 2014

Figure 25 Companies Adopted Contracts & Agreements and New Product/Service/Technology Development to Capture the Markets

Figure 26 Market Evaluation Framework: Top Companies on the Basis of Market Share

Figure 27 Market Evaluation Framework: Top Companies on the Basis of Developments

Figure 28 Market Evaluation Framework: New Product Launches, Contracts & Agreements, and Mergers & Acquisitions Have Fuelled the Growth of Companies During 2012-2015

Figure 29 Region-Wise Revenue Mix of Top 5 Market Players

Figure 30 Halliburton Company: Company Snapshot

Figure 31 Halliburton Company: SWOT Analysis

Figure 32 Schlumberger Limited: Company Snapshot

Figure 33 Schlumberger: SWOT Analysis

Figure 34 Seadrill Limited: Company Snapshot

Figure 35 Transocean Ltd.: Company Snapshot

Figure 36 Transocean Ltd.: SWOT Analysis

Figure 37 Weatherford International Ltd.: Company Snapshot

Figure 38 Weatherford International Ltd.: SWOT Analysis

Figure 39 Atwoods Oceanics.: Company Snapshot

Figure 40 Baker Hughes Incorporated: Company Snapshot

Figure 41 China Oilfield Services Limited.: Company Snapshot

Figure 42 Diamond Offshore Drilling Inc.: Company Snapshot

Figure 43 Dolphin Drilling: Company Snapshot

Figure 44 Ensco PLC.: Company Snapshot

Figure 45 KCA Deutag: Company Snapshot

Figure 46 Maersk Drilling: Company Snapshot

Figure 47 Nabors Industries Ltd.: Company Snapshot

Figure 48 Noble Corporation: Company Snapshot

Figure 49 Paragon Offshore PLC.: Company Snapshot

Figure 50 Scientific Drilling International: Company Snapshot

Figure 51 Superior Energy Services Inc.: Company Snapshot

Growth opportunities and latent adjacency in Offshore Drilling Market