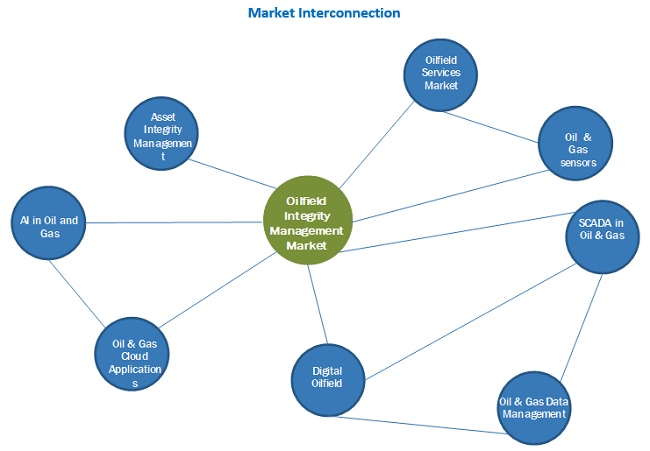

Oilfield Integrity Management Market by Management Type (Planning, Predictive Maintenance & Inspection, Corrosion Management, Data Management, and Monitoring System), Component (Hardware, Software, Services), Application, & Region - Global Forecast to 2025

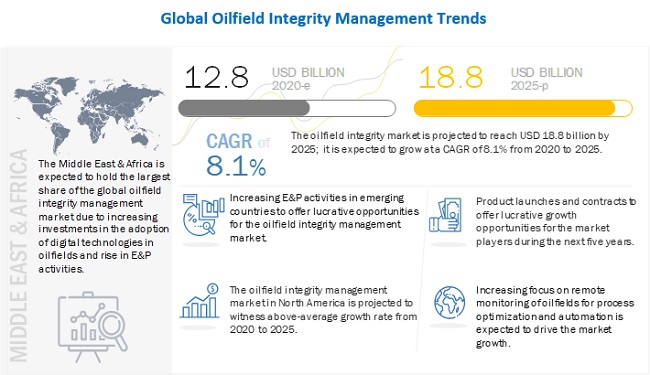

[246 Pages Report] The global oilfield integrity management market in terms of revenue was estimated to be worth $12.8 billion in 2020 and is poised to reach $18.8 billion by 2025, growing at a CAGR of 8.1% from 2020 to 2025. Increasing investments for adopting digital technologies in upstream oil & gas and stringent government regulations related to environmental safety are the key factors driving the oilfield integrity management market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Oilfield Integrity Management Market

The outbreak of the COVID-19 pandemic, which has led to a standstill in business activities in the oil & gas value chain, is projected to adversely impact the growth of the oilfield integrity management market in 2020. Also, the COVID-19 has led to a sharp decline in oil prices, and lockdown in countries has led to a halt in oil production activities. This has resulted in a decline in capital expenditures in the upstream sector, which has affected the willingness of the adoption of technology and services.

Oilfield integrity management Dynamics

Driver: Increasing focus on remote monitoring of oilfields for process optimization and automation

The oil & gas industry is transforming its traditional business models into smarter operations, which has increased the focus of industry players on remote monitoring of oilfields. Remote monitoring helps in reducing the need for human intervention, which consequently decreases the overall cost and chances of manual errors. It is a 24*7 monitoring system and assists operators to monitor real-time data, thereby improving the overall productivity and reliability of an oilfield.

Automation and digital transformation are emerging trends in the oil & gas industry. The industry faces many challenges, such as low oil prices, frequent budget, schedule overrun, and climate change. Digital transformation and process automation help to overcome these challenges and provide value to the shareholders. They also help in controlling operations from a centralized place, reduce downtime and the total cost of ownership, and increase productivity. Moreover, the major oil & gas companies are focusing on high-degree automation. Based on these trends, the adoption of oilfield integrity management services, which help in reducing risks and equipment failure in an oilfield, is expected to increase at a significant rate during the review period

Restraint: Fluctuation in oil prices are hampering operational spending on various oilfield services

Crude oil price is the ultimate influencer for the complete oil & gas value chain. The oil & gas industry is continuously witnessing fluctuations in crude oil prices owing to various factors such as changes in demand for crude oil, OPEC and non-OPEC supply, intense competition between the US and OPEC countries, and the shale gas revolution. Besides, with the declining prices, companies involved in oil and gas production are experiencing a drop in revenue, profits, and operating margins. This ultimately has led to a decline in capital investments in infrastructure projects and other oilfield services, as it lowers the return on investment.

Opportunity: Digitalization in oilfields

Fluctuating oil prices, combined with the ever-increasing demand for oil and increasing costs of exploration and production activities, is expected to result in a shift toward the adoption of oilfield integrity management services. Oilfield integrity management services help to automate workflows for maximizing productivity, reducing costs, and minimizing the overall risks associated with oilfield operations. It is possible by analyzing the real-time data received from connected devices and sensors, which help in maintenance, planning, and operation optimization.

Moreover, advancements in digital technology have increased the safety of employees, especially isolated workers, by making them more connected and giving them access to the information they require. Thus, the introduction of digital trends has helped in optimizing the upstream process and making effective decisions. Furthermore, it has been observed that the providers of oilfield integrity management solutions are increasing the R&D investments for innovating new technologies for the upliftment of oilfields.

Challenge: Impact of COVID-19 on upstream activities

The COVID-19 pandemic has slowed the growth of the oil & gas industry and disrupted the supply chain. In some cases, the production and delivery of material and machinery for projects have been affected due to lockdowns, which have disrupted transportation (e.g., port facilities). For instance, the Lombardy region of Italy, which was among the first areas of Europe to be locked down, is a major manufacturing center for specialized engineering equipment for the oil and gas industry.

Furthermore, the global expansion of this pandemic has declined the demand and prices of oil. As of 31 December 2019, West Texas Intermediate (WTI) oil future was valued at USD 61.1. By 23 March 2020, it was valued at USD 23.4, declining by more than 60%. As of 28 May 2020, 212 countries had been impacted by this pandemic, and the governments of the respective countries implemented nationwide lockdowns. This has resulted in a considerable decline in transportation and related activities and impacted the demand for oil and gas. As of April 2020, OPEC and other oil-producing countries have agreed to reduce oil production by 10 million BPD, which is about 23% of their production levels. The International Energy Agency (IEA) reported that oil demand is likely to decrease by 23.1 million barrels per day (BPD) in the second quarter of 2020.

To know about the assumptions considered for the study, download the pdf brochure

By management type, the monitoring system segment is the largest contributor in the oilfield integrity management during the forecast period.

The monitoring system includes machinery and equipment such as wireless sensors, analyzers, flow meters, smart well systems, SCADA systems, and DCS systems. The Middle East & Africa is projected to be the fastest-growing market for monitoring systems from 2020 to 2025. The growth of the market is driven by its multiple advantages, such as a reduction in manual intervention, monitoring of remote locations oilfields, and collection of real-time data from sensors to detect equipment health.

By component, the hardware segment is expected to grow at the fastest rate during the forecast period.

The hardware segment accounted for the highest share of the oilfield integrity management market, by component during the forecast period. The adoption of digital technologies for collecting significant volumes of data is increasing the demand for hardware equipment in oilfields. It is responsible for surveillance and communication data transfer in both onshore and offshore fields.

By application, the onshore segment is expected to be the largest contributor during the forecast period.

The onshore application segment held the largest share of the oilfield integrity management market in 2019. Onshore wells are widely drilled across the world, with more oil & gas production potential from regions such as the Middle East, North America, Africa, and Asia Pacific. The demand for oilfield integrity management is high in the onshore application segment as new well drilling activities are rising in onshore locations at a faster pace than in the offshore fields. In addition, the cost incurred in onshore oilfield activities is less compared to the offshore application.

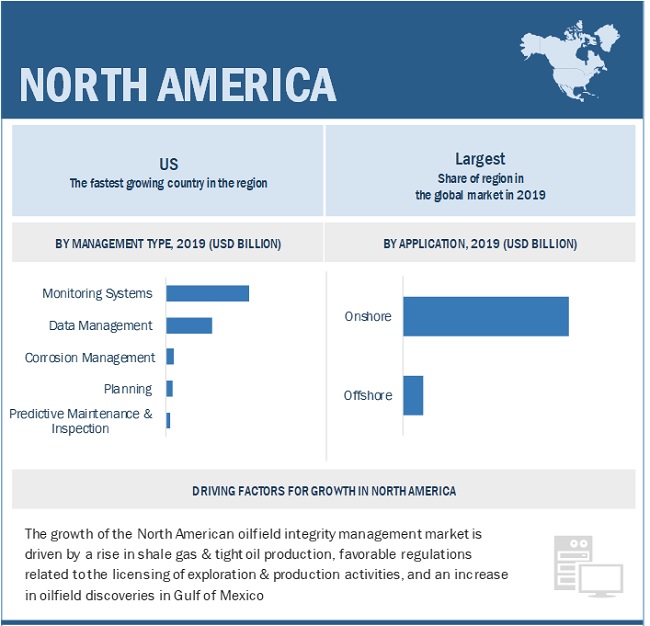

North America held the largest share of the oilfield integrity management market in 2019.

North America accounted for the largest share of the oilfield integrity management market in 2019. This region has been segmented by country into the US and Canada. The oil & gas industry is a major contributor to the North American economy. According to the Commerce Department’s Bureau of Economic Analysis (BEA), in 2018, the oil & gas sector contributed USD 1.3 trillion to the GDP of the US. Similarly, Natural Resource Canada declared that in 2018, the oil & gas industry contributed 2.8% to the nominal GDP of Canada. The high energy supply and demand from the region offer lucrative opportunities to the entire oil & gas value chain. The country houses some of the top service providers such as Schlumberger, Ltd. (US), Halliburton (US), and Baker Hughes Company (US), who continuously invest in developing innovative solutions for various segments of the oil & gas industry.

Key Market Players

Schlumberger (US), Halliburton (US), Baker Hughes Company (US), Siemens (Germany), Emerson (US), IBM (US), and Oracle (US).are the leading players in the oilfield integrity management market. Aker Solutions (Norway), Wood Group (UK), SGS (Switzerland), Oceaneering International (US), TechnipFMC (UK) are other players operating in the market are the leading players in the global digital oil field market.

Scope of the Report

|

Report Coverage |

Details |

|

Market size: |

USD 12.8 billion in 2020 to USD 18.8 billion by 2025 |

|

Growth Rate: |

8.1% |

|

Largest Market: |

North America |

|

Market Dynamics: |

Drivers, Restraints, Opportunities & Challenges |

|

Forecast Period: |

2020-2025 |

|

Forecast Units: |

Value (USD Billion) |

|

Report Coverage: |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered: |

Management Type, Component, Application, and Region |

|

Geographies Covered: |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Report Highlights:

|

Updated financial information / product portfolio of players |

|

Key Market Opportunities: |

Digitalization in oilfields |

|

Key Market Drivers: |

Increasing focus on remote monitoring of oilfields for process optimization and automation |

This research report categorizes the oilfield integrity management based on type, end-user, speed, and region.

Based on the management type:

- Planning

- Predictive Maintenance & Inspection

- Data Management

- Corrosion Management

- Monitoring System

Based on the component:

- Hardware

- Software

- Services

Based on the application:

- Onshore

- Offshore

Based on the region:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- In February 2020, Halliburton launched SPIDRlive Self-Powered Intelligent Data Retriever, an unconventional well testing and fracture interaction monitoring technology that acquires real-time well data without the need for intervention to reduce costs and improve fracture understanding for greater recovery.

- In May 2020, Emerson expanded its manufacturing space and inaugurated a new innovation center focused on research, product development, and industry training for its advanced flow measurement products in Colorado, US.

- In June 2019, Baker Hughes entered into a joint venture with C3.ai, an AI solution provider company. With this venture, Baker Hughes planned to increase digitalization and accelerate production in the oil & gas industry.

- In July 2019, Schlumberger was awarded a contract from Chevron for subsea development projects in the Gulf of Mexico. The scope of the contract was to provide subsea equipment, which will enable Chevron to reduce its operational costs.

Frequently Asked Questions (FAQ):

What is the current market size of the oilfield integrity management market?

The size of the global oilfield integrity management is USD 12.8 billion in 2019.

What are the major drivers for the oilfield integrity management market?

The oilfield integrity management is driven by major factors such as increasing focus on remote monitoring of oilfields for process optimization & automation and stringent government regulations regarding environmental safety

Which region dominates during the forecasted period in the oilfield integrity management market?

The Middle East & Africa is projected to be the fastest-growing market during the forecast period. The growth of the oilfield integrity management in Middle East & Africa can be attributed to the increasing number of drilling activities and the requirement for inspection and monitoring systems to optimize the production from mature fields

Which is the fastest-growing management type segment during the forecasted period in the oilfield integrity management market?

The data management segment is the fastest-growing during the forecasted period. The growth of the data management segment is driven by the increasing need for improving the production capacity of oilfields and analyzing the data gathered over a period of time to derive meaningful insights.

Who are the leading players in the global oilfield integrity management market?

Schlumberger (US), Halliburton (US), Baker Hughes Company (US), Siemens (Germany), Emerson (US), IBM (US), and Oracle (US).are the leading players in the oilfield integrity management market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 DEFINITION

1.2.1 OILFIELD INTEGRITY MANAGEMENT MARKET, BY SERVICE TYPE: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 OILFIELD INTEGRITY MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

TABLE 1 OILFIELD INTEGRITY MANAGEMENT MARKET: PLAYERS/COMPANIES CONNECTED

2.2 SCOPE

2.3 KEY INFLUENCING FACTORS/DRIVERS

2.3.1 OILFIELD COUNT

2.3.2 PRODUCTION TRENDS

FIGURE 2 OPERATIONAL WELL COUNT VS. CRUDE OIL PRODUCTION (2013–2019)

2.3.3 CRUDE OIL PRICES

FIGURE 3 CRUDE OIL PRICE TREND

2.3.4 IMPACT OF COVID-19 ON OIL & GAS ACTIVITIES

2.4 MARKET SIZE ESTIMATION

2.4.1 IDEAL DEMAND-SIDE ANALYSIS

2.4.1.1 Assumptions

2.4.1.2 Limitations

2.4.1.3 Calculation

2.4.2 SUPPLY-SIDE ANALYSIS

2.4.2.1 Assumptions

2.4.2.2 Calculation

FIGURE 4 RESEARCH METHODOLOGY: ILLUSTRATION OF OILFIELD INTEGRITY MANAGEMENT COMPANY REVENUE ESTIMATION (2019)

FIGURE 5 KEY PLAYERS & INDUSTRY CONCENTRATION, 2019

2.4.3 FORECAST

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION METHODOLOGY

2.6 PRIMARY INSIGHTS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 7 SCENARIO ANALYSIS: OILFIELD INTEGRITY MANAGEMENT MARKET, 2018–2025

3.1 OPTIMISTIC SCENARIO

3.2 REALISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

TABLE 2 MARKET SNAPSHOT

FIGURE 8 NORTH AMERICA HELD LARGEST SHARE OF MARKET IN 2019

FIGURE 9 HARDWARE SEGMENT IS EXPECTED TO LEAD MARKET, BY COMPONENT, DURING FORECAST PERIOD

FIGURE 10 MONITORING SYSTEM SEGMENT IS EXPECTED TO LEAD MARKET, BY MANAGEMENT TYPE, DURING FORECAST PERIOD

FIGURE 11 ONSHORE SEGMENT IS EXPECTED TO LEAD MARKET, BY APPLICATION, DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 56)

4.1 ATTRACTIVE OPPORTUNITIES IN OILFIELD INTEGRITY MANAGEMENT MARKET

FIGURE 12 HIGH FOCUS ON DIGITALIZATION IN OILFIELDS TO SUPPLEMENT GROWTH OF MARKET, 2020–2025

4.2 MARKET, BY COMPONENT

FIGURE 13 HARDWARE SEGMENT IS EXPECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD, 2025

4.3 MARKET, BY MANAGEMENT

FIGURE 14 MONITORING SYSTEM IS EXPECTED TO ACCOUNT FOR THE HIGHEST SHARE, 2025

4.4 MARKET, BY APPLICATION

FIGURE 15 ONSHORE SEGMENT IS EXPECTED TO DOMINATE THE MARKET, 2025

4.5 MARKET, BY REGION

FIGURE 16 OILFIELD INTEGRITY MANAGEMENT SEGMENT IN THE MIDDLE EAST & AFRICA IS EXPECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.6 NORTH AMERICA MARKET, BY APPLICATION & COUNTRY

FIGURE 17 ONSHORE SEGMENT AND US DOMINATED NORTH AMERICA MARKET IN 2019

5 MARKET OVERVIEW (Page No. - 61)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 18 COVID-19 GLOBAL PROPAGATION

FIGURE 19 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 20 RECOVERY ROAD FOR 2020

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 21 REVISED GDP FORECAST FOR SELECTED G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 22 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increasing focus on remote monitoring of oilfields for process optimization and automation

5.5.1.2 Stringent government regulations regarding environmental safety

5.5.2 RESTRAINTS

5.5.2.1 Fluctuations in oil prices are hampering operational spending on various oilfield services

FIGURE 23 WEST TEXAS INTERMEDIATE (WTI) CRUDE OIL PRICES, 2015–2020

5.5.2.2 High initial cost and complex process of system installation

FIGURE 24 PDCA FRAMEWORK FOR OILFIELD INTEGRITY MANAGEMENT

5.5.3 OPPORTUNITIES

5.5.3.1 Digitalization in oilfields

5.5.3.2 Increasing exploration and production activities in emerging countries

FIGURE 25 CRUDE OIL - PROVED RESERVES OF 2019

5.5.4 CHALLENGES

5.5.4.1 Interoperability of multiple system components from different solution providers

5.5.4.2 Impact of COVID-19 on upstream activities

5.6 REGULATORY LANDSCAPE

TABLE 3 REGULATIONS ON E&P ACTIVITIES

5.7 MARKET MAP

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 26 OILFIELD INTEGRITY MANAGEMENT SUPPLY CHAIN

5.8.1 EQUIPMENT MANUFACTURERS

5.8.2 OILFIELD SERVICE PROVIDERS

5.8.3 SOFTWARE OPERATORS

5.8.4 OILFIELD OPERATORS

5.9 CASE STUDY ANALYSIS

5.9.1 INCREASE IN PRODUCTION FROM INTEGRATED SOLUTIONS

6 COVID-19 IMPACT ON OILFIELD INTEGRITY MANAGEMENT MARKET, SCENARIO ANALYSIS, BY REGION (Page No. - 77)

6.1 INTRODUCTION

6.1.1 IMPACT OF COVID-19 ON GDP

TABLE 4 GDP ANALYSIS (IN PERCENTAGE)

6.1.2 SCENARIO ANALYSIS OF OIL & GAS INDUSTRY

TABLE 5 MARKET SIZE, BY SCENARIO ANALYSIS, 2018–2025 (USD MILLION)

6.1.3 OPTIMISTIC SCENARIO

TABLE 6 OPTIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.1.4 REALISTIC SCENARIO

TABLE 7 REALISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

6.1.5 PESSIMISTIC SCENARIO

TABLE 8 PESSIMISTIC SCENARIO: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7 OILFIELD INTEGRITY MANAGEMENT MARKET, BY MANAGEMENT TYPE (Page No. - 82)

7.1 INTRODUCTION

FIGURE 27 MONITORING SYSTEM SEGMENT HELD LARGEST MARKET SHARE IN 2019

TABLE 9 MARKET, BY MANAGEMENT TYPE, 2018–2025 (USD MILLION)

7.2 PLANNING

7.2.1 NEED FOR DETERMINING THE LOCATION OF CRUDE OIL RESOURCES IS LIKELY TO DRIVE THE MARKET GROWTH

TABLE 10 PLANNING: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.3 PREDICTIVE MAINTENANCE & INSPECTION

7.3.1 NEED FOR INCREASING THE RELIABILITY OF OILFIELDS TO AVOID HIGH FINANCIAL LOSS IS LIKELY TO DRIVE MARKET GROWTH

TABLE 11 PREDICTIVE MAINTENANCE & INSPECTION: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.4 CORROSION MANAGEMENT

7.4.1 PREVENTION OF FAILURES TO REDUCE UNPLANNED DOWNTIME TO DRIVE MARKET GROWTH

TABLE 12 CORROSION MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.5 DATA MANAGEMENT

7.5.1 INCREASING NEED TO ORGANIZE AND ANALYSE DATA COLLECTED FROM OILFIELD OPERATIONS TO DRIVE MARKET GROWTH

TABLE 13 DATA MANAGEMENT: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

7.6 MONITORING SYSTEM

7.6.1 GROWING ADOPTION OF DIGITAL TECHNOLOGIES TO COLLECT LARGE VOLUMES OF DATA IS LIKELY TO BOOST DEMAND FOR MONITORING SYSTEM

TABLE 14 MONITORING SYSTEM: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8 OILFIELD INTEGRITY MANAGEMENT MARKET, BY COMPONENT (Page No. - 90)

8.1 INTRODUCTION

FIGURE 28 HARDWARE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 15 MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

8.2 HARDWARE

8.2.1 GROWING USE OF DATA ACQUISITION EQUIPMENT AND WIRELESS SENSORS TO INCREASE EFFICIENCY AND ACCURACY

TABLE 16 HARDWARE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.3 SOFTWARE

8.3.1 INCREASING MODIFICATION RATE OF CONVENTIONAL OILFIELDS TO BOOST DEMAND FOR SOFTWARE

TABLE 17 SOFTWARE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

8.4 SERVICES

8.4.1 INCREASING FOCUS ON FINANCIAL AND WELL PLANNING DURING INITIAL PHASES OF OILFIELD DEVELOPMENT

TABLE 18 SERVICES: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9 OILFIELD INTEGRITY MANAGEMENT, BY APPLICATION (Page No. - 95)

9.1 INTRODUCTION

FIGURE 29 ONSHORE SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

TABLE 19 MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

9.2 ONSHORE

9.2.1 INCREASING NUMBER OF ONSHORE OILFIELDS IS LIKELY TO DRIVE MARKET GROWTH

TABLE 20 ONSHORE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

9.3 OFFSHORE

9.3.1 INCREASING DEEPWATER DRILLING AND PRODUCTION ACTIVITIES IS LIKELY TO DRIVE MARKET GROWTH

TABLE 21 OFFSHORE: MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10 OILFIELD INTEGRITY MANAGEMENT MARKET, BY REGION (Page No. - 99)

10.1 INTRODUCTION

FIGURE 30 REGIONAL SNAPSHOT: MIDDLE EAST & AFRICA MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 31 MARKET SHARE, BY REGION, 2019

TABLE 22 MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 32 NORTH AMERICA: REGIONAL SNAPSHOT

10.2.1 BY MANAGEMENT TYPE

TABLE 23 NORTH AMERICA: MARKET SIZE, BY MANAGEMENT TYPE, 2018–2025 (USD MILLION)

10.2.2 BY COMPONENT

TABLE 24 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.2.2.1 Component, by country

TABLE 25 HARDWARE: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 26 SOFTWARE: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 27 SERVICES: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.2.3 BY APPLICATION

TABLE 28 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.3.1 Application, by country

TABLE 29 ONSHORE: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 30 OFFSHORE: NORTH AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.2.4 BY COUNTRY

TABLE 31 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.2.4.1 US

10.2.4.1.1 Investments to integrate digital technologies in oilfield operations to drive market growth

TABLE 32 US: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 33 US: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.2.4.2 Canada

10.2.4.2.1 Growing onshore oil production to drive the growth of the market

TABLE 34 CANADA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 35 CANADA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3 ASIA PACIFIC

10.3.1 BY MANAGEMENT TYPE

TABLE 36 ASIA PACIFIC: MARKET SIZE, BY MANAGEMENT TYPE, 2018–2025 (USD MILLION)

10.3.2 BY COMPONENT

TABLE 37 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.3.2.1 Component, by country

TABLE 38 HARDWARE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 39 SOFTWARE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 40 SERVICES: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.3.3 BY APPLICATION

TABLE 41 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.3.1 Application, by country

TABLE 42 ONSHORE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 43 OFFSHORE: ASIA PACIFIC MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.3.4 BY COUNTRY

TABLE 44 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.3.4.1 China

10.3.4.1.1 Rise in shale exploration & production activities is likely to drive the market growth

TABLE 45 CHINA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 46 CHINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.4.2 India

10.3.4.2.1 Redevelopment of oilfields to drive the market growth in India

TABLE 47 INDIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 48 INDIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.4.3 Malaysia

10.3.4.3.1 Increasing capital expenditure on oilfields to drive the market growth

TABLE 49 MALAYSIA: OILFIELD INTEGRITY MANAGEMENT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 50 MALAYSIA: OILFIELD INTEGRITY MANAGEMENT MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.4.4 Indonesia

10.3.4.4.1 Increasing investments in mature wells to boost productivity is expected to drive the market growth

TABLE 51 INDONESIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 52 INDONESIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.4.5 Australia

10.3.4.5.1 Plans to redevelop mature oilfields are expected to drive the market growth

TABLE 53 AUSTRALIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 54 AUSTRALIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.3.4.6 Rest of Asia Pacific

TABLE 55 REST OF ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 56 REST OF ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4 EUROPE

10.4.1 BY MANAGEMENT TYPE

TABLE 57 EUROPE: MARKET SIZE, BY MANAGEMENT TYPE, 2018–2025 (USD MILLION)

10.4.2 BY COMPONENT

TABLE 58 EUROPE: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.4.2.1 Component, by country

TABLE 59 HARDWARE: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 SOFTWARE: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 61 SERVICES: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.4.3 BY APPLICATION

TABLE 62 EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.3.1 Application, by country

TABLE 63 ONSHORE: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 64 OFFSHORE: EUROPE MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.4.4 BY COUNTRY

TABLE 65 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.4.4.1 UK

10.4.4.1.1 Redevelopments in brownfields are expected to drive the market growth

TABLE 66 UK: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 67 UK: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.4.2 Russia

10.4.4.2.1 Increase in E&P activities in Russia far East region is expected to drive the market growth

TABLE 68 RUSSIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 69 RUSSIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.4.3 Norway

10.4.4.3.1 Fast depleting oil & gas fields in Norwegian Continental Shelf are offering growth opportunities for market

TABLE 70 NORWAY: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 71 NORWAY: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.4.4.4 Rest of Europe

TABLE 72 REST OF EUROPE: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 73 REST OF EUROPE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

FIGURE 33 MIDDLE EAST & AFRICA: REGIONAL SNAPSHOT

10.5.1 BY MANAGEMENT TYPE

TABLE 74 MIDDLE EAST & AFRICA: MARKET SIZE, BY MANAGEMENT TYPE, 2018–2025 (USD MILLION)

10.5.2 BY COMPONENT

TABLE 75 MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.5.2.1 Component by country

TABLE 76 HARDWARE: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 77 SOFTWARE: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 78 SERVICES: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.5.3 BY APPLICATION

TABLE 79 MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.3.1 Application, by country

TABLE 80 ONSHORE: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 81 OFFSHORE: MIDDLE EAST & AFRICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.5.4 BY COUNTRY

TABLE 82 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.5.4.1 Saudi Arabia

10.5.4.1.1 Increasing crude production from onshore fields and surge in offshore exploration are expected to drive the market growth

TABLE 83 SAUDI ARABIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 84 SAUDI ARABIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.2 Kuwait

10.5.4.2.1 Plans to invest in oilfields are likely to drive the market growth

TABLE 85 KUWAIT MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 86 KUWAIT: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.3 UAE

10.5.4.3.1 Growing adoption of advanced techniques to boost oil production is expected to drive the market growth

TABLE 87 UAE: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 88 UAE: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.4 Iraq

10.5.4.4.1 Increase in onshore drilling activities is expected to drive the market growth

TABLE 89 IRAQ: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 90 IRAQ: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.5 Nigeria

10.5.4.5.1 Increasing investments in E&P activities to drive the market growth

TABLE 91 NIGERIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 92 NIGERIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.6 Algeria

10.5.4.6.1 Upcoming drilling activities and rising capital expenditure are expected to drive the market growth

TABLE 93 ALGERIA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 94 ALGERIA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.5.4.7 Rest of the Middle East & Africa

TABLE 95 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 96 REST OF THE MIDDLE EAST & AFRICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6 SOUTH & CENTRAL AMERICA

10.6.1 BY MANAGEMENT TYPE

TABLE 97 SOUTH & CENTRAL AMERICA: MARKET SIZE, BY MANAGEMENT TYPE, 2018–2025 (USD MILLION)

10.6.2 BY COMPONENT

TABLE 98 SOUTH & CENTRAL AMERICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

10.6.2.1 Component, by country

TABLE 99 HARDWARE: SOUTH & CENTRAL AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 100 SOFTWARE: SOUTH & CENTRAL AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 101 SERVICES: SOUTH & CENTRAL AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.6.3 BY APPLICATION

TABLE 102 SOUTH & CENTRAL AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.3.1 Application, by country

TABLE 103 ONSHORE: SOUTH & CENTRAL AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 104 OFFSHORE: SOUTH & CENTRAL AMERICA MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.6.4 BY COUNTRY

TABLE 105 SOUTH & CENTRAL AMERICA: MARKET SIZE, BY COUNTRY, 2018–2025 (USD MILLION)

10.6.4.1 Brazil

10.6.4.1.1 Increase in investments in offshore activities is expected to drive the market growth

TABLE 106 BRAZIL: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 107 BRAZIL: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.4.2 Mexico

10.6.4.2.1 Investments for expediting oil & gas production from existing reserves is expected to drive the growth of the market

TABLE 108 MEXICO: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 109 MEXICO: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.4.3 Argentina

10.6.4.3.1 Increase in drilling activities is expected to drive the market growth

TABLE 110 ARGENTINA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 111 ARGENTINA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

10.6.4.4 Rest of South & Central America

TABLE 112 REST OF SOUTH & CENTRAL AMERICA: MARKET SIZE, BY COMPONENT, 2018–2025 (USD MILLION)

TABLE 113 REST OF SOUTH & CENTRAL AMERICA: MARKET SIZE, BY APPLICATION, 2018–2025 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 160)

11.1 OVERVIEW

FIGURE 34 KEY DEVELOPMENTS IN MARKET, 2017–2020

11.2 MARKET EVALUATION FRAMEWORK

FIGURE 35 MARKET EVALUATION FRAMEWORK:

11.3 REVENUE ANALYSIS OF THE TOP 5 MARKET PLAYERS

FIGURE 36 TOP PLAYERS IN THE MARKET IN 2019

11.4 KEY MARKET DEVELOPMENTS

11.4.1 PRODUCT LAUNCH

11.4.2 EXPANSION

11.4.3 MERGER/ACQUISITION/JOINT VENTURE

11.4.4 CONTRACT/AGREEMENT

11.4.5 PARTNERSHIP

12 COMPANY EVALUATION MATRIX AND COMPANY PROFILES (Page No. - 167)

12.1 OVERVIEW

12.2 COMPANY EVALUATION MATRIX DEFINITIONS AND METHODOLOGY

12.2.1 STARS

12.2.2 EMERGING LEADERS

12.2.3 PERVASIVE

12.2.4 EMERGING COMPANIES

FIGURE 37 COMPANY EVALUATION MATRIX, 2019

12.3 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.3.1 BAKER HUGHES COMPANY

FIGURE 38 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

FIGURE 39 BAKER HUGHES: SWOT ANALYSIS

12.3.2 SCHLUMBERGER

FIGURE 40 SCHLUMBERGER: COMPANY SNAPSHOT

FIGURE 41 SCHLUMBERGER: SWOT ANALYSIS

12.3.3 HALLIBURTON

FIGURE 42 HALLIBURTON: COMPANY SNAPSHOT

FIGURE 43 HALLIBURTON: SWOT ANALYSIS

12.3.4 WOOD GROUP

FIGURE 44 WOOD GROUP: COMPANY SNAPSHOT

12.3.5 AKER SOLUTIONS

FIGURE 45 AKER SOLUTIONS: COMPANY SNAPSHOT

FIGURE 46 AKER SOLUTIONS: SWOT ANALYSIS

12.3.6 SGS

FIGURE 47 SGS: COMPANY SNAPSHOT

FIGURE 48 SGS: SWOT ANALYSIS

12.3.7 OCEANEERING INTERNATIONAL

FIGURE 49 OCEANEERING INTERNATIONAL: COMPANY SNAPSHOT

12.3.8 TECHNIPFMC

FIGURE 50 TECHNIPFMC: COMPANY SNAPSHOT

12.3.9 EMERSON

FIGURE 51 EMERSON: COMPANY SNAPSHOT

12.3.10 SAIPEM

FIGURE 52 SAIPEM: COMPANY SNAPSHOT

12.3.11 SUBSEA 7

FIGURE 53 SUBSEA 7: COMPANY SNAPSHOT

12.3.12 WEATHERFORD INTERNATIONAL

FIGURE 54 WEATHERFORD INTERNATIONAL: COMPANY SNAPSHOT

12.3.13 SIEMENS

FIGURE 55 SIEMENS: COMPANY SNAPSHOT

12.3.14 INTERTEK GROUP

FIGURE 56 INTERTEK GROUP: COMPANY SNAPSHOT

12.3.15 APPLUS+

FIGURE 57 APPLUS+: COMPANY SNAPSHOT

12.3.16 NATIONAL OILWELL VARCO

FIGURE 58 NATIONAL OILWELL VARCO: COMPANY SNAPSHOT

12.3.17 BUREAU VERITAS

FIGURE 59 BUREAU VERITAS: COMPANY SNAPSHOT

12.3.18 ORACLE

FIGURE 60 ORACLE: COMPANY SNAPSHOT

12.3.19 IBM

FIGURE 61 IBM: COMPANY SNAPSHOT

12.3.20 FLUOR

12.3.21 LIST OF OTHER MAJOR PLAYERS IN THE MARKET

12.3.21.1 Nalco Champion

12.3.21.2 China Oilfield Services

12.3.21.3 Archer

12.3.21.4 Expro Group

12.3.21.5 ABB

12.3.21.6 DNV GL

12.3.21.7 Microsoft

12.3.21.8 Accenture

12.3.21.9 SAP

12.3.21.10 Intel

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 238)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

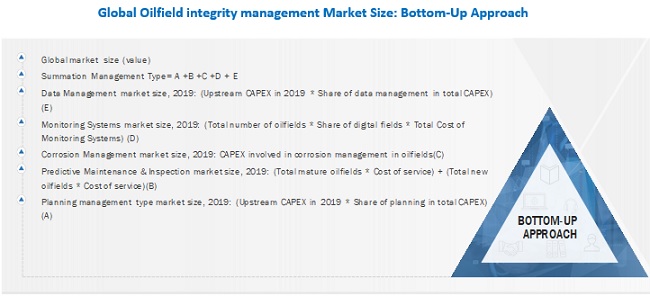

This study involved four major activities in estimating the current market size for oilfield integrity management. Exhaustive secondary research was done to collect information on the market and the peer market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global oilfield integrity management market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

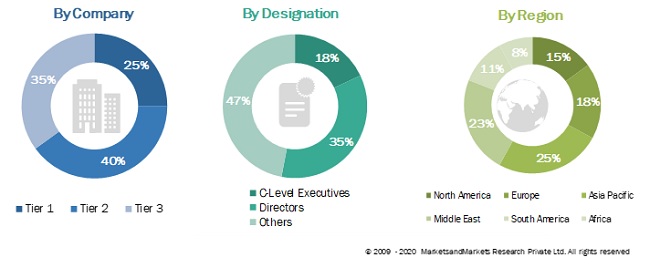

Primary Research

The oilfield integrity management market comprises several stakeholders, such as service providers, contractors, and third-party vendors. The demand side of this market is characterized by estimating the market size of induvial type of management, including planning, corrosion management, monitoring systems, predictive maintenance & inspection, and data management, through the contribution of each service to total upstream CAPEX. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as following—

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global oilfield integrity management market and its dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global oilfield integrity management market by management type, component, application, and region

- To provide detailed information on the major factors influencing the growth of the digital oil field market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the market with respect to individual growth trends, prospects, and contribution of each segment to the market

- To analyze the impact of COVID-19 on the market for the estimation of the market size

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the market with respect to the major regions (Asia Pacific, Europe, North America, South America, the Middle East, and Africa)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To track and analyze competitive developments, such as product launch, contract, agreement, investment, expansion, merger, acquisition, joint venture, and partnership in the oilfield integrity management market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Regional Analysis

- Further breakdown of region or country-specific analysis

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Oilfield Integrity Management Market